GFG Discovers New Gold Zone in Footwall and Extends Mineralization to Near-Surface at Aljo Gold Project, Timmins, ON

KEY HIGHLIGHTS:

- ALJ-24-019 intersected multiple high-grade intervals relating to the Hangingwall Main and newly expanded Footwall Zones.

- HW Zone returned 4.39 grams of gold per tonne over 3.4 metres, 7.76 g/t Au over 1.5 m and 5.24 g/t over 1.0 m extending the zone to near-surface.

- Main Zone returned numerous visible-gold bearing, stacked vein sets, confirming continuity.

- New FW Zone hosted in strongly-altered basalt associated with porphyry dyking with assays of 7.26 g/t Au over 0.6 m, 4.20 g/t Au over 0.7 m and 2.17 g/t Au over 1.5 m.

- ALJ-24-021 and 22 confirmed a high-grade, near-surface western extension to the Main Zone intersecting 4.24 g/t Au over 3.0 m including 12.00 g/t Au over 1.0 m and 4.38 g/t Au over 1.3 m including 8.21 g/t Au over 0.7 m.

- Pending results from an additional 5 drill holes at Aljo to be released as they become available.

- Drilling at Aljo to resume in July 2025 with an aggressive 3,000 drill program focused on targeting the depth and strike extensions of the HW, Main and FW Zones.

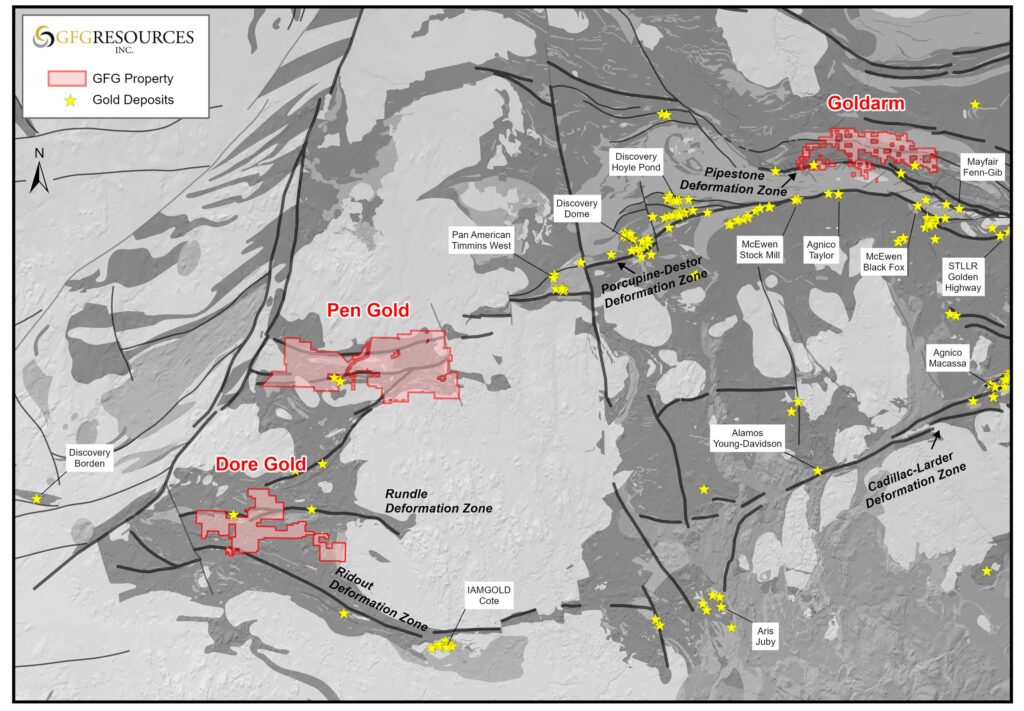

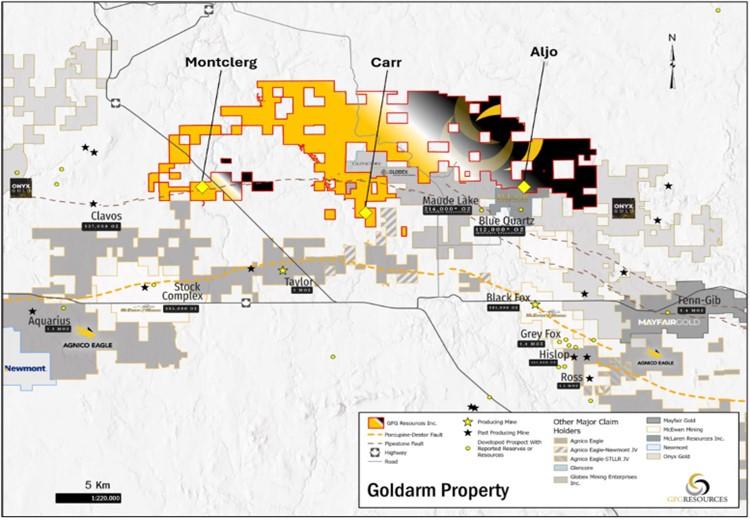

GFG Resources Inc. (TSX-V: GFG) (OTCQB: GFGSF) reports the latest assay results from its 100% owned Aljo Mine Target located on the Goldarm Property in the world-class Timmins Gold District of Ontario, Canada. The Aljo project is strategically positioned north of the Porcupine Destor Deformation Zone, surrounded by key infrastructure and operating mines and mills (See Figures 1-2).

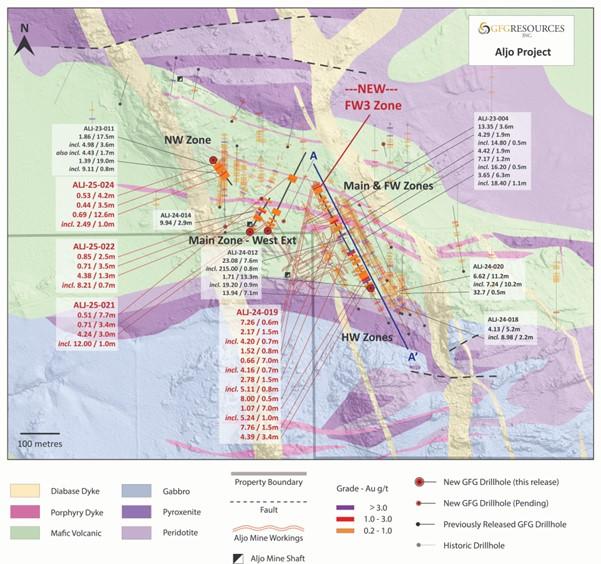

Today’s results are related to the Company’s 12-hole (2,600 m) drill program completed in late 2024 and early 2025 which focused on testing the downdip and lateral extensions at the historic Aljo Mine as well as step-out holes testing the western extensions and the North West target (See Figures 2-4 and Table 1).

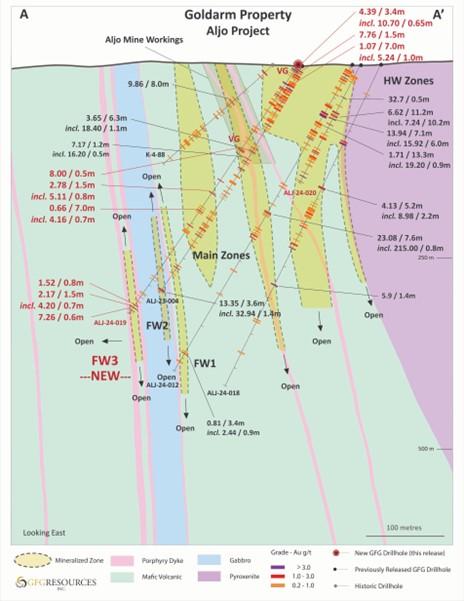

Drilling expanded known mineralized zones and identified new zones of mineralization that host significant visible gold. Holes 019, 021, 022 and 024 successfully intersected near-surface mineralization, confirming continuity in the HW and Main Zones at Aljo. Also of particular significance is the discovery of a new FW Zone, termed FW3, characterized by strongly-altered basalt and porphyry dyking with moderate to high-grade veining and sulphidation hosting up to 7.26 g/t Au. The 45 m thick panel of strongly altered basalts and porphyry remains open in all directions, and the hole was terminated in strong alteration and mineralization. Previous drill holes had not tested to this depth into the footwall and the setting and alteration is considered highly prospective (see news release dated March 17, 2025). Follow-up drilling at Aljo is planned to start in the second half of 2025 with approximately 3,000 m.

Brian Skanderbeg, CEO and President of GFG stated, “We are pleased to announce the discovery of FW3, a new footwall porphyry-associated zone with high-grade gold at our Aljo project. The continuity of these footwall porphyry dykes across the E-W corridor and linking to the North West target demonstrates continuity of the system and potential for further discoveries. The extension of the HW and Main Zones to near surface with high-grade gold is a significant development. Our updated geological and structural model highlights the importance of key lithologies and litho-contacts as well as fertile vein orientations across the region. The nature of the stacked veining, complex and prospective structural settings and abundance of visible gold associated with high grades lenses, give us confidence for future expansion of the system and discovery of additional gold zones.”

Assay Results Commentary

ALJ-24-019: This hole intersected near-surface mineralization in the HW and Main Zones, with a significant 45 m footwall interval dominated by strongly altered basalt and porphyry associated with moderate to high-grade gold up to 7.26 g/t Au over 0.6 m.

HW Zone: Located at the northern edge of the HW Zone, the hole intersected 4.39 g/t Au over 3.4 m with visible gold starting at 5.3 m down-hole. Additional intercepts include 7.76 g/t Au over 1.5 m with visible gold from 27.0 m and 1.07 g/t Au over 7.0 m including 5.24 g/t Au over 1.0 m from 42.3 m. These near-surface intercepts extend the system 50 m up-dip from previously reported high-grade intercepts.

Main Zone: Further down-hole, the Main Zone returned moderate to high-grade intercepts including 8.00 g/t Au over 0.5 m from 140.0 m, 5.11 g/t Au over 0.8 m from 203.0 m, and 4.16 g/t Au over 0.7 m. These intercepts correlate to Main Zone results from ALJ-23-004 that yielded 3.65 g/t Au over 6.3 m (see release dated February 15, 2024) and historic(1) drilling that returned 9.86 g/t over 8.0 m, confirming the stacked nature of veins within the Main Zone.

FW3 Zone: The footwall environment to the Aljo gold system is characterized by a gabbroic unit in contact with basalt flows intruded by feldspar porphyry sills. Significant grade occurs within an altered basalt flow defining this new FW3 Zone over a 10 m interval, including 1.52 g/t Au over 0.8 m from 383.3 m, 4.20 g/t Au over 0.7 m, and 7.26 g/t Au over 0.6 m from 391.5 m. These intercepts represent a 60 m step-out from previously reported high-grade gold in the FW2 zone of 13.35 g/t Au over 3.6 m in ALJ-23-004 (see release dated February 15, 2024).

ALJ-24-021: This hole intersected near-surface mineralization with visible gold approximately 150 m northwest of the Aljo mine workings, yielding a peak intercept of 4.24 g/t Au over 3.0 m including 12.00 g/t Au over 1.0 m from 12.3 m. This intercept represents a 60 m step-out from previously reported high-grade gold of 9.94 g/t Au over 2.9 m in ALJ-24-014 (see release dated November 28, 2024).

ALJ-24-022: This hole also intersected near-surface mineralization with visible gold approximately 200 m northwest of the Aljo Mine workings, stepping out 50 m west of hole ALJ-24-021. The hole intersected high-grade gold correlating to the mineralized zone in ALJ-24-021, yielding an intercept of 4.38 g/t Au over 1.3 m including 8.21 g/t Au over 0.7 m from 15.2 m. This zone is hosted within an altered basalt sequence, similar to the zone in ALJ-24-021.

ALJ-25-024: This hole was drilled to test the lateral thickness of gold mineralization of the Aljo West Zone approximately 300 m northwest of the Aljo Mine workings hosted in a variolitic and amygdaloidal basalt. The hole intersected approximately 55.0 m of anomalous gold mineralization with peak intercepts of 0.69 g/t Au over 12.6 m including 2.49 g/t Au over 1.0 m from 37.1 m, correlating with previous drill intercepts from the zone that graded 1.39 g/t Au over 19.0 m and 1.86 g/t Au over 17.5 m including 4.98 g/t Au over 3.6 m (see release dated February 15, 2024).

Anders Carlson, Vice President, Exploration commented, “We are very excited to see the Aljo gold system continue to grow with the discovery of the FW3. With fewer than 30 drillholes completed to-date on the project, GFG has rapidly expanded the HW and Main Zones while generating the best drill results ever reported at Aljo. The new FW3 Zone is an exciting opportunity at Aljo and underscores why we’ve chosen to be aggressive. The new FW3 Zone provides a great opportunity to potentially add ounces at Aljo through expanded drill programs directly from surface to 300+ vertical metres in an area that has seen virtually no drilling to-date. Most importantly, we are expanding our exploration pipeline at Aljo in a region of the Abitibi that continues to garner more attention.”

Table 1: Aljo Mine Project Assay Results (2)

| Hole ID | From (m) | To (m) | Length (m) | Au (g/t) | Zone | Visible Gold |

| ALJ-24-019 | 5.3 | 8.7 | 3.4 | 4.39 | HW | VG |

| incl. | 8.0 | 8.7 | 0.7 | 10.70 | HW | VG |

| and | 27.0 | 28.5 | 1.5 | 7.76 | HW | VG |

| and | 34.5 | 38.0 | 3.5 | 1.01 | HW | |

| and | 42.3 | 49.3 | 7.0 | 1.07 | HW | |

| incl. | 45.8 | 46.8 | 1.0 | 5.24 | HW | |

| and | 58.3 | 61.7 | 3.5 | 0.76 | HW | |

| and | 97.4 | 104.4 | 7.0 | 0.48 | Main | |

| and | 133.3 | 135.5 | 2.2 | 1.94 | Main | VG |

| and | 140.0 | 140.5 | 0.5 | 8.00 | Main | VG |

| and | 182.5 | 183.5 | 1.0 | 1.27 | Main | |

| and | 202.2 | 203.7 | 1.5 | 2.78 | Main | |

| incl. | 203.0 | 203.7 | 0.8 | 5.11 | Main | |

| and | 228.0 | 235.0 | 7.0 | 0.66 | Main | |

| incl. | 231.2 | 231.9 | 0.7 | 4.16 | Main | |

| and | 254.7 | 255.8 | 1.1 | 1.21 | Main | |

| and | 364.0 | 366.6 | 2.6 | 0.55 | FW3 | |

| and | 383.3 | 384.2 | 0.8 | 1.52 | FW3 | |

| and | 387.0 | 388.5 | 1.5 | 2.17 | FW3 | |

| incl. | 387.0 | 387.7 | 0.7 | 4.20 | FW3 | |

| and | 391.5 | 392.1 | 0.6 | 7.26 | FW3 | |

| ALJ-25-021 | 12.3 | 15.3 | 3.0 | 4.24 | Main – West Ext | VG |

| incl. | 13.3 | 14.3 | 1.0 | 12.00 | Main – West Ext | VG |

| and | 23.0 | 26.4 | 3.4 | 0.71 | Main – West Ext | |

| and | 178.3 | 186.0 | 7.7 | 0.51 | Main – West Ext | |

| ALJ-25-022 | 15.2 | 16.5 | 1.3 | 4.38 | Main – West Ext | VG |

| incl. | 15.2 | 15.8 | 0.7 | 8.21 | Main – West Ext | VG |

| and | 43.3 | 46.8 | 3.5 | 0.71 | Main – West Ext | |

| and | 61.5 | 64.0 | 2.5 | 0.85 | Main – West Ext | |

| ALJ-25-024 | 4.8 | 9.0 | 4.2 | 0.53 | NW | |

| and | 21.5 | 25.0 | 3.5 | 0.44 | NW | |

| and | 37.1 | 49.6 | 12.6 | 0.69 | NW | |

| incl. | 41.0 | 42.0 | 1.0 | 2.49 | NW |

*Drill intercepts are presented using a 0.20 g/t Au cut-off and as drilled length with a minimum 1 gram-metre product. Composites include internal dilution of up to 3 m at grades less than 0.20 g/t Au. Included intervals are calculated using a 3 g/t cut-off at a minimum 1 gram-metre product unless otherwise stated. True width is estimated to be 30 to 90% drilled length.

Muskego Update

In February, the Company launched its inaugural drill program to test several greenfield targets across the 30 square kilometre Muskego target area. The Company tested 5 targets with 10 holes totaling 2,685 m. All assay results remain pending and will be announced once received.

In addition to the drilling program, GFG completed a sonic drill program focused on the western portion of the Muskego target area. The purpose of the sonic drill program is to gain till and bedrock samples to generate additional drill targets in this underexplored region. Further, the Company completed a 54 line-kilometre IP survey over the main portion of the Muskego target. The IP survey will support exploration efforts by refining current targets and potentially outline new targets.

Other Matters

The Company also wishes to correct its earlier press release dated May 2, 2025 concerning its private placement of 11,041,591 premium flow-through units of the Company at C$0.2717 per unit. The Company had reported that it had paid finders’ fees of C$12,540 in connection with the Offering, however finders’ fees totalling only C$11,400 were paid. With respect to the insider participation in the Offering, the Company relied upon the exemptions from the formal valuation and minority shareholder approval requirements of Multilateral Instrument 61-101 contained in sections 5.5(a) and 5.7(1)(a) therein as neither the fair market value of the subject matter of, nor the fair market value of the consideration for, the Offering, insofar as it involved interested parties, exceeded 25% of the Company’s market capitalization.

Figure 1: Regional Map of GFG Gold Projects in the Timmins Gold District

Figure 2: Goldarm Property Plan View Map

Figure 3: Aljo Gold Project Plan View Map(2)

Figure 4: Aljo Project Cross Section(1) (2)

About GFG Resources Inc.

GFG is a North American precious metals exploration company focused on district scale gold projects in tier one mining jurisdictions. The Company operates three gold projects, each hosting large and highly prospective gold properties within the prolific gold district of Timmins, Ontario, Canada. The projects have similar geological settings that host most of the gold deposits found in the Timmins Gold Camp which have produced over 70 million ounces of gold.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE