Galiano Gold Advances Towards a Maiden Underground Resource at Abore with Additional High-Grade Results Encountered Including 4.7 g/t Au over 28m and 3.5 g/t Au over 17m

Galiano Gold Inc. (TSX: GAU) (NYSE American: GAU) is pleased to provide an update on the 2025 Abore drilling program, currently underway at the Asanko Gold Mine, in Ghana, West Africa. The latest drilling results continue to confirm multiple significant high-grade intercepts, demonstrating continuity of mineralization within new ore shoots identified in 2025 that lie below the existing Mineral Reserve and Mineral Resource. Continued drilling success has prompted an expansion of the 2025 Abore drilling program by a further 11,000 meters demonstrating the Company’s strategic focus on increasing Abore’s Mineral Resource.

Selected Drill Highlights (see notes 4,5,6 from Table 1):

Main Pit:

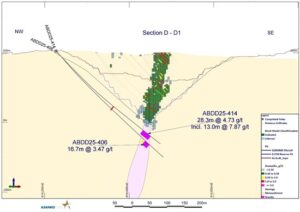

- 4.7 grams per tonne (“g/t”) gold (“Au”) over 28m from 339m, and 3.3 g/t Au over 3m from 236m (Hole ABDD25-414)

- 2.6 g/t Au over 25.5 from 344m (Hole ABDD25-410)

- 3.5 g/t Au over 17m from 364m (Hole ABPC25-406)

South Pit:

- 3.5 g/t Au over 20m from 233m (Hole ABPC25-419)

- 3.1 g/t Au over 16m from 223m, and 2.7 g/t Au over 5m from 243m (Hole ABPC25-418)

- 3.4 g/t Au over 14m from 347m (Hole ABDD25-403)

- 2.3 g/t Au over 14m from 335m (Hole ABPC25-397)

- 3.6 g/t Au over 20m from 178m (Hole ABDD25-425)

Saddle Zone:

- 2.2 g/t Au over 28m from 158m, and 2.3 g/t Au over 4.6m from 192m (Hole ABDD25-426)

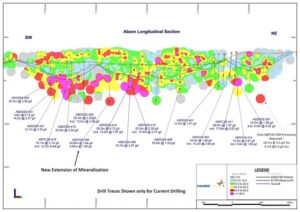

Figure 1: Long section through the Abore deposit showing gram meter contours of Au intercepts with highlights of current drilling labelled.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_001full.jpg

Chris Pettman, Galiano Gold’s Vice President of Exploration, stated: “We are very pleased with the progress at Abore as we continue to intercept high-grade mineralization across the deposit. These latest drill results further confirm the potential for Abore to host meaningful underground Mineral Resources and therefore redefine the long-term future of the AGM. These results, along with the expanded infill and step out drilling program, will be used to define a maiden Mineral Resource, expected in February 2026.”

Current Results

The most recent results are part of the ongoing Abore drilling campaign that began in Q2 2025 and will now continue through the end of Q4 2025 and into 2026.

Based on the positive drilling results to date1,2,3 the current Abore drill program is focused on rapidly infilling areas immediately below the Abore Mineral Reserve and Mineral Resource to expand the Inferred and Indicated Mineral Resource, as well as to test for further continuations of mineralization down plunge and below known mineralized zones.

- Continuity of High Grades below Main and South Pits and within the saddle zone

-

- The most recent drilling at Abore is focused on infilling gaps within the recently discovered ore-shoots below the Mineral Resource. Current results have confirmed high-grade mineralization has excellent continuity within the north plunging ore shoots below both the South pit and Main pit, as well as within the saddle zone between the two pits where a conjugate south plunging structure also carries high grade mineralization. These zones combined have been confirmed to span approximately 800m in strike length and carry grades expected to support underground mining.

- North High Grade Zone

-

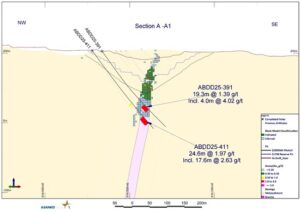

- Step out drilling in the vicinity of previously announced hole ABDD25-388 which intercepted high grade mineralization at North pit has also intercepted additional high-grade mineralization in hole ABDD25-411 returning 24.6m @ 2.0 g/t, including 17.6m @ 2.63 g/t and providing valuable structural information which will help inform further drilling designed to expand this high-grade zone.

- Extension at Depth

-

- In addition to infill drilling within the known mineralized zones, the current program aims to test for extensions of mineralization below these zones. Hole ABDD25-398 was designed to test the area below the Main pit ore shoot and successfully intercepted 60.5m of granite with strong mineralization returning 18.6m @ 1.6 g/t Au from 409m and 5m @ 1.6 g/t Au from 361m at the granite-sediment contact along with strong alteration and quartz veining known to accompany high-grade mineralization at Abore. This mineralization remains open in all directions and is very encouraging as the current drilling continues to test deeper underground Resource targets.

Next Steps

The Board of Directors has approved an additional budget of $3.1M for a further 11,000m of drilling to be completed at Abore by the end of 2025. Key objectives of the increased budget include:

-

- Further delineate continuity of high-grade mineralized zones identified in Q3 2025.

- Increase drilling density to convert zones of Inferred Resources to the Indicated category.

- Test for further extensions of mineralization along strike and plunge of known ore zones below the Mineral Resource.

- Step-out drilling below known mineralization to test for further expansions of the Abore mineralizing system.

- Resource Expansion:

- Cut-off date of January 5,2026 has been set for delivery of new exploration data to support updated Mineral Resource and Mineral Reserve statement to be released in February 2026.

- Maiden Underground Resource:

- Drilling completed ahead of MRMR cut-off date will be incorporated into a maiden underground Mineral Resource at Abore to be released as part of the updated MRMR in February 2026.

Abore 2025 Drilling Overview

Since January 2025, over 22,000m of drilling has been completed at Abore and includes:

- Phase 1: consisted of 5,543m and was completed in May 2025, designed to test for extensions of mineralization immediately below the existing Mineral Resource. This initial drilling resulted in the discovery of a new high-grade zone under Main pit as well as multiple new high-grade intercepts under South pit.1

- First Deep Test: An initial test for deeper mineralization consisting of 1,907m was completed in July, 2025. These four holes all intersected mineralized granite with three holes returning significant widths and grades.2

- Phase 2: Following positive results from Phase 1, a Phase 2 program commenced in June 2025 consisting of 10,000m of drilling designed to test for extensions of mineralization identified in Phase 1 and expand drilling across the entire 1,800m strike length. This drilling returned exceptional results, identifying multiple high-grade ore shoots under South and Main pits, as well as the discovery of a new high-grade zone under North pit. The initial drill plan for this phase was subsequently expanded to a total of 14,687m drilled.3

Background

Abore is located approximately 13 kilometers north of the AGM’s processing plant, directly along the haul road, and has current Measured and Indicated Mineral Resources of 638,000 ounces at 1.24 g/t Au and Inferred Mineral Resources of 78,000 ounces at 1.17 g/t Au, as published in the Company’s most recent Mineral Reserve and Mineral Resource estimates effective December 31, 20244.

The Abore deposit sits along the Esaase shear corridor, which also hosts the Esaase deposit, and forms part of the northeast striking Asankrangwa gold belt. The geology of Abore is characterized by a sedimentary sequence composed primarily of siltstones, shales and thickly bedded sandstones that has been intruded by a granite, which lies parallel to the shear and dipping steeply to the northwest. The majority of mineralization is constrained to the granite, hosted in west dipping quartz vein areas developed primarily along the eastern margin of the granite/sediment contact.

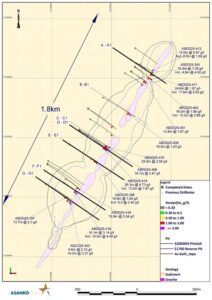

Figure 2: Abore plan map showing current drilling locations and highlighted intercepts. Select cross sections (A,D,E,F,G shown with black lines above) are included in this press release. Additional cross sections available on Galiano’s website: https://galianogold.com/operations/exploration/

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_002full.jpg

Step-out at Abore North

Figure 3: Cross Section A-A1 showing holes ABDD25-391 and ABDD25-411 at Abore North pit below the Mineral Resource with high-grade mineralization open at depth.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_003full.jpg

High-Grade Continuity at Abore Main Pit

Figure 4: Cross section D-D1 showing holes ABDD25-414 and ABDD25-406 within the high-grade ore shoot under Abore Main pit showing the continuity of high-grade mineralization within this portion of the mineralized zone which remains open at depth.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_004full.jpg

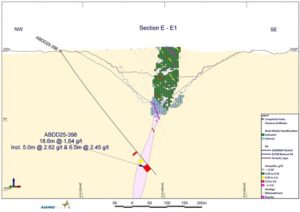

Step-out at Depth at Abore Main Pit

Figure 5: Cross section E-E1 showing hole ABDD25-398 illustrating the presence of high-grade mineralization 150m below the Mineral Resource and 80m below known mineralization at Abore Main pit.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_005full.jpg

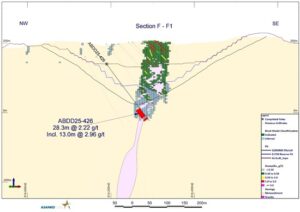

South Pit Ore shoot

Figure 6: Cross section F-F1 showing hole ABDD25-426 located within the saddle zone between Abore Main and South pits which has confirmed good continuity of high grades within this mineralized zone.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_006full.jpg

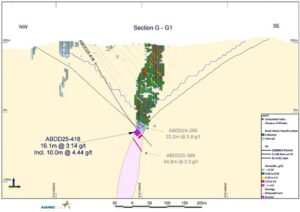

Continuity of High Grades

Figure 7: Cross section G-G1 showing hole ABDD25-418 drilled as an infill within the high-grade ore shoot below South pit showing an example of continuity of high-grade mineralization between previous drill holes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_007full.jpg

Table 1: Current Abore Drilling Intercepts Table4,5,6

| Hole ID | From (m) | To (m) | Width (m) | Grade (g/t Au) |

Intercept Description |

| ABDD25-390 | 242.8 | 247.0 | 4.2 | 1.2 | 4.2m @ 1.2 g/t |

| ABDD25-391 | 196.0 | 215.3 | 19.3 | 1.4 | 19.3m @ 1.4 g/t |

| ABDD25-392 | 418.0 | 431.2 | 13.2 | 1.2 | 13.23m @ 1.2 g/t |

| ABDD25-393 | 200.0 | 204.0 | 4.0 | 0.9 | 4.0m @ 0.9 g/t |

| and | 237.0 | 242.0 | 5.0 | 0.6 | 4.95m @ 0.6 g/t |

| ABDD25-396 | 274.0 | 285.0 | 11.0 | 1.4 | 10.97m @ 1.4 g/t |

| ABDD25-397 | 335.3 | 349.0 | 13.7 | 2.3 | 13.67m @ 2.3 g/t |

| and | 379.0 | 388.6 | 9.6 | 0.6 | 9.6m @ 0.6 g/t |

| ABDD25-398 | 361.1 | 366.0 | 4.9 | 1.6 | 4.94m @ 1.6 g/t |

| and | 377.0 | 382.4 | 5.4 | 0.4 | 5.40m @ 0.4 g/t |

| and | 388.0 | 397.0 | 9.0 | 0.6 | 9.0m @ 0.6 g/t |

| and | 408.9 | 427.5 | 18.6 | 1.6 | 18.6m @ 1.6 g/t |

| ABDD25-399 | 429.0 | 442.0 | 13.0 | 1.0 | 13.0m @ 1.0 g/t |

| ABDD25-400 | 324.3 | 341.0 | 16.7 | 0.9 | 16.7m @ 0.9 g/t |

| ABDD25-401 | 191.9 | 205.7 | 13.8 | 1.7 | 13.8m @ 1.7 g/t |

| ABDD25-402 | 189.0 | 193.0 | 4.0 | 1.3 | 4.0m @ 1.3 g/t |

| and | 203.0 | 219.0 | 16.0 | 1.9 | 16.0m @ 1.9 g/t |

| ABDD25-403 | 314.3 | 323.9 | 9.6 | 2.2 | 9.6m @ 2.2 g/t |

| and | 329.8 | 335.0 | 5.2 | 1.8 | 5.2 m @ 1.8 g/t |

| and | 347.0 | 361.2 | 14.2 | 3.4 | 14.2m @ 3.4 g/t |

| ABDD25-404 | 381.9 | 390.0 | 8.1 | 0.7 | 8.1m @ 0.7 g/t |

| ABDD25-406 | 356.0 | 360.5 | 4.5 | 0.9 | 4.5m @ 0.9 g/t |

| and | 364.0 | 380.7 | 16.7 | 3.5 | 16.7m @ 3.5 g/t |

| ABDD25-408 | 307.0 | 322.8 | 15.8 | 1.0 | 15.8m @ 1.0 g/t |

| and | 350.0 | 368.0 | 18.0 | 1.0 | 18.0m @ 1.0 g/t |

| ABDD25-410 | 228.0 | 231.0 | 3.0 | 0.6 | 3.0m @ 0.6 g/t |

| and | 237.0 | 242.0 | 5.0 | 0.4 | 5.0m @ 0.4 g/t |

| and | 344.0 | 369.5 | 25.5 | 2.6 | 25.5m @ 2.6 g/t |

| ABDD25-411 | 188.0 | 192.7 | 4.7 | 0.9 | 4.7m @ 0.9 g/t |

| and | 239.4 | 264.0 | 24.6 | 2.0 | 24.6m @ 2.0 g/t |

| ABDD25-412 | 441.0 | 446.0 | 5.0 | 0.9 | 5.0m @ 0.9 g/t |

| ABDD25-414 | 229.0 | 232.1 | 3.1 | 1.4 | 3.1m @ 1.4 g/t |

| and | 236.0 | 239.0 | 3.0 | 3.3 | 3.0m @ 3.3 g/t |

| and | 339.0 | 367.3 | 28.3 | 4.7 | 28.3m @ 4.7 g/t |

| ABDD25-417 | 252.0 | 255.0 | 3.0 | 1.2 | 3.0m @ 1.2 g/t |

| and | 321.0 | 332.0 | 11.0 | 1.5 | 11.0m @ 1.5 g/t |

| and | 337.0 | 341.1 | 4.1 | 1.0 | 4.12m @ 1.0 g/t |

| ABDD25-418 | 223.6 | 239.6 | 16.1 | 3.1 | 16.05m @ 3.14g/t |

| and | 243.0 | 248.0 | 5.0 | 2.7 | 5.0m @ 2.7 g/t |

| ABDD25-419 | 233.0 | 252.9 | 19.9 | 3.5 | 19.9m @ 3.5 g/t |

| ABDD25-422 | 168.9 | 175.2 | 6.3 | 1.9 | 6.3m @ 1.9 g/t |

| and | 211.0 | 219.0 | 8.0 | 0.6 | 8.0m @ 0.6 g/t |

| ABDD25-425 | 165.5 | 170.0 | 4.5 | 1.1 | 4.5m @ 1.0 g/t |

| and | 178.0 | 198.0 | 20.0 | 3.6 | 20.0m @ 3.6 g/t |

| and | 201.5 | 206.8 | 5.3 | 1.6 | 5.3m @ 1.6 g/t |

| ABDD25-426 | 158.0 | 186.3 | 28.3 | 2.2 | 28.3m @ 2.2 g/t |

| and | 192.1 | 196.7 | 4.6 | 2.3 | 4.6m @ 2.3 g/t |

Notes:

- Intervals reported are hole lengths with true width estimated to be 80%-90%.

5. Intervals are not top cut and are calculated with the assumptions of > 0.5 g/t and < 3m of internal waste.

6. All samples are taken from diamond core.

Qualified Person and QA/QC

Chris Pettman, P. Geo, Vice President Exploration of Galiano, is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has supervised the preparation of the scientific and technical information that forms the basis for this news release. Mr. Pettman is responsible for all aspects of the work, including the Data Verification and Quality Control/Quality Assurance programs and has verified the data disclosed, by reviewing all data and supervising its compilation. There are no known factors that could materially affect the reliability of data collected and verified under his supervision. No quality assurance/quality control issues have been identified to date. Mr. Pettman is not independent of Galiano.

Certified Reference Materials and Blanks are inserted by Galiano into the sample stream at the rate of 1:14 samples. Field duplicates are collected at the rate of 1:30 samples. All samples have been analyzed by Photon assay by Intertek Minerals Ltd. in Tarkwa, Ghana with standard preparation methods. ChrysosTM Photon assay uses high energy X-ray to activate gold nuclei in a large sample ca. 500g. Photon assay uses a larger sample, thus the variance on the sampling error is less. Crushing the sample to 2-3mm is required in many cases. Photon assay tends to have a higher detection limit than fire assay (0.02ppm). Intertek does its own introduction of QA/QC samples into the sample stream and reports them to Galiano for double checking. Higher grade samples are re-analyzed from pulp or reject material or both. Intertek is an international company operating in 100 countries and is independent of Galiano. It provides testing for a wide range of industries including the mining, metals, and oil sectors.

Contact Information

Krista Muhr

Toll-Free (N. America): 1-855-246-7341

Telephone: 1-778-239-0446

Email: info@galianogold.com

About Galiano Gold Inc.

Galiano is focused on creating a sustainable business capable of value creation for all stakeholders through production, exploration and disciplined deployment of its financial resources. The Company owns and operates the Asanko Gold Mine, which is located in Ghana, West Africa. Galiano is committed to the highest standards for environmental management, social responsibility, and the health and safety of its employees and neighbouring communities. For more information, please visit www.galianogold.com.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE