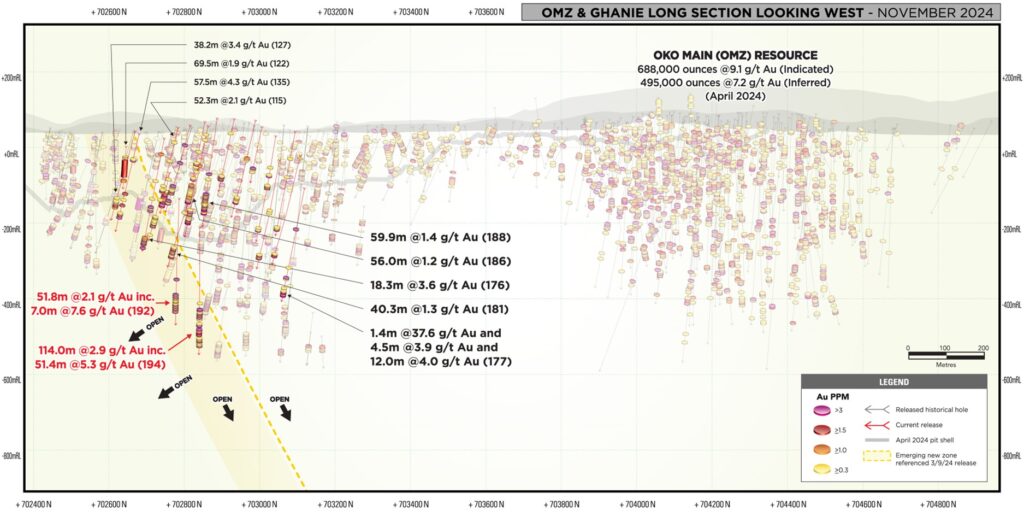

G2 Drills 114m @ 2.9 g/t Au & 51.8m @ 2.1 g/t Au Significantly Expanding New Gold Zone

G2 Goldfields Inc. (TSX: GTWO) (OTCQX: GUYGF) is pleased to provide an update on its ongoing exploration program at the Company’s 58,000-acre OKO-Aremu gold project, Guyana. G2 currently has six rigs operating at the project, building on the Company’s current mineral resource which is comprised of 922,00 ounces of gold (Indicated) and 1,099,000 ounces (Inferred) [see press release dated April 03, 2024]. G2 continues to expand and define existing gold zones whilst discovering new high grade parallel zones of gold mineralization. The Company intends to issue an updated mineral resource estimate (MRE) for the OKO project in Q1 of 2025.

Subsequent to the April 3rd MRE, to date G2 has completed an additional 124 holes totalling 42,853 meters. This drilling campaign has led to the discovery of new zones of gold mineralization along strike and down plunge of the previously defined resource [see press release of September 03, 2024]. One of the more promising new discoveries was announced on September 03, 2024. It described a new mineralized structure starting from near surface and running parallel to the central Ghanie zone. Select intercepts from the initial discovery are highlighted in Table 1.

|

TABLE 1 |

||||

| HOLE ID | FROM | TO | INT. (M) | AU G/T |

| GDD-122 | 74.0 | 143.4 | 69.5 | 1.9 |

| Incl. | 123.3 | 129.5 | 6.2 | 16.3 |

| GDD-127 | 223.0 | 261.2 | 38.2 | 3.4 |

| Incl. | 250.5 | 258.0 | 7.5 | 14.7 |

| GDD-135 | 271.0 | 328.5 | 57.5 | 4.3 |

| Incl. | 311.0 | 326.0 | 15.0 | 15.3 |

Subsequent drilling has encountered the most expansive zone of gold mineralization discovered to date at Ghanie and has extended mineralization a further 200m down plunge. Highlights from the latest eighteen drill holes are tabulated in Table 2 below.

| TABLE 2 | ||||

| HOLE ID | FROM | TO | INT. (M) | AU G/T |

| GDD-176 | 330.0 | 348.3 | 18.3 | 3.6 |

| Incl. | 342.0 | 348.3 | 6.3 | 8.6 |

| GDD-181 | 383.0 | 423.3 | 40.3 | 1.3 |

| Incl. | 390.5 | 393.5 | 3.0 | 4.8 |

| GDD-192 | 479.3 | 531.0 | 51.8 | 2.1 |

| Incl. | 513.0 | 520.0 | 7.0 | 7.6 |

| GDD-194 | 518.0 | 632.0 | 114.0 | 2.9 |

| Incl. | 580.6 | 632.0 | 51.4 | 5.3 |

The intercepts reported are down-hole widths. True widths are estimated between 75% and 85% of reported down-hole widths. Gold grades are uncapped.

A complete table of drill results is available here.

FIGURE 1

FIGURE 2

Dan Noone, G2 Goldfields CEO, stated, “We are eager to continue this intensive exploration campaign across the Ghanie district, where multiple discoveries have demonstrated that the district has been extensively mineralized.”

QA/QC

Drill core is logged and sampled in a secure core storage facility located on the OKO project site, Guyana. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to MSALABS Guyana, in Georgetown, Guyana, which is an accredited mineral analysis laboratory, for analysis. Samples from sections of core with obvious gold mineralisation are analysed for total gold using an industry-standard 500g metallic screen fire assay (MSALABS method MSC 550). All other samples are analysed for gold using standard Fire Assay-AA with atomic absorption finish (MSALABS method; FAS- 121). Samples returning over 10.0 g/t gold are analysed utilizing standard fire assay gravimetric methods (MSALABS method; FAS-425). Certified gold reference standards, blanks, and field duplicates are routinely inserted into the sample stream, as part of G2 Goldfields’ quality control/quality assurance program (QAQC). No QA/QC issues were noted with the results reported herein.

About G2 Goldfields Inc.

The G2 Goldfields team is comprised of professionals who have been directly responsible for the discovery of millions of ounces of gold in Guyana as well as the financing and development of the Aurora Gold Mine, Guyana’s largest gold mine [RPA, 43-101, Technical Report on the Aurora Gold Mine, March 31, 2020].

In April 2024, G2 announced an Updated Mineral Resource Estimate for the Oko property in Guyana [see press release dated April 03, 2024]. Highlights of the Updated MRE include:

Total combined open pit and underground Resource for the Oko Main Zone:

- 495,000 oz. Au – Inferred contained within 2,413,000 tonnes @ 6.38 g/t Au

- 686,000 oz. Au – Indicated contained within 2,368,000 tonnes @ 9.03 g/t Au

Total combined open pit and underground Resource for the Ghanie Zone:

- 604,000 oz. Au – Inferred contained within 12,216,000 tonnes @ 1.54 g/t Au

- 236,000 oz. Au – Indicated contained within 3,344,000 tonnes @ 2.20 g/t Au

The MRE was prepared by Micon International Limited with an effective date of March 27, 2024. Significantly, the updated mineral resources lie within 500 meters of surface. The Oko district has been a prolific alluvial goldfield since its initial discovery in the 1870s, and modern exploration techniques continue to reveal the considerable potential of the district.

Anglo Gold Ashanti (NYSE:AU) currently holds 35,948,965 shares representing 15.03% of the issued and outstanding shares of G2. G2 currently has cash holdings exceeding (Cad) $49 million and is well financed to execute on this regional exploration program.

All scientific and technical information in this news release has been reviewed and approved by Dan Noone (CEO of G2 Goldfields Inc.), a “qualified person” within the meaning of National Instrument 43-101. Mr. Noone (B.Sc. Geology, MBA) is a Fellow of the Australian Institute of Geoscientists.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE