G2 Drilling Significantly Expands Mineralized Envelope at Oko Project; Guyana

- New high grade shoot discovered between Ghanie and Oko gold zones

– 13.5m @ 5.7 g/t Au & 4m @ 36.8 g/t Au

- Ghanie Main Zone extended to depth with high grade intercepts

– 4m @ 11.6 g/t Au & 3m @ 12.1 g/t Au + 4.5m @ 5.7 g/t Au + 4.5m @ 9.1 g/t Au

- Oko Main Zone Shear 3 extensions drilled

– 18m @ 3.1 g/t Au & 5.6m @ 2.0 g/t Au

- Infill drilling hits additional high grade at OMZ deposit

– 11m @ 4.9 g/t Au (Shear 1)

G2 Goldfields Inc. (TSX: GTWO) (OTCQX: GUYGF) is pleased to provide an update on its ongoing exploration program at the Company’s 58,000-acre OKO-AREMU gold project, Guyana. In April 2024, G2 announced a mineral resource estimate comprised of 922,000 ounces of gold and 1,099,000 ounces of gold [see press release dated April 03, 2024]. To date, G2 has drilled a total of 509 diamond drill holes totalling 139,180 meters at the 2.2 km long OKO-GHANIE gold system. Subsequent to the April MRE, the Company has completed an additional 200 drill holes totalling 56,887 meters which will provide additional data for the updated MRE to be announced in Q1 of 2025.

G2’s OKO gold resource lies along a prominent 2.5 km long north-south structure which is defined by the high grade OMZ resource to the north [688,000 ounces Au @ 9.03 g/t Au (Indicated) and 495,000 ounces Au at 6.38 g/t Au (Inferred)] and the Ghanie open pit and underground resource to the south. In the latter half of 2024, the Company’s exploration program focused on the southern portion of this regional trend, in doing so it targeted:

- i) Expansion of the Ghanie open pit along strike and to depth,

ii) Possible new gold zones in between the Ghanie and Oko deposits,

iii) Strike extensions to the OMZ high grade deposit to the south, and

iv) Depth extensions to the Ghanie central deposit.

The exploration program was successful in achieving each of the four stated objectives.

Assay results from a total of 54 diamond drill holes are reported in this release. A complete set of drill results is available here and on the Company’s website.

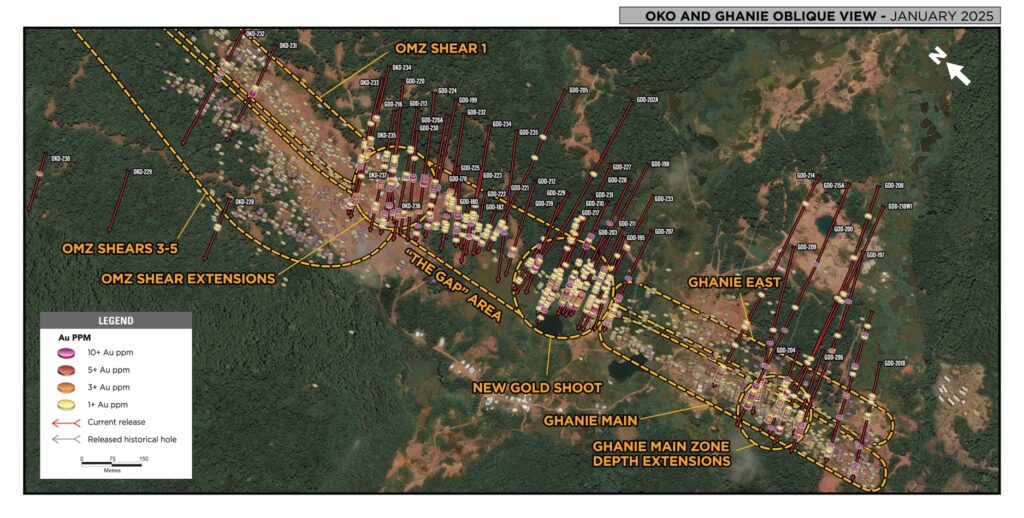

A drill plan in the oblique view is included as Figure 1 and on the Company’s website here.

Figure 1

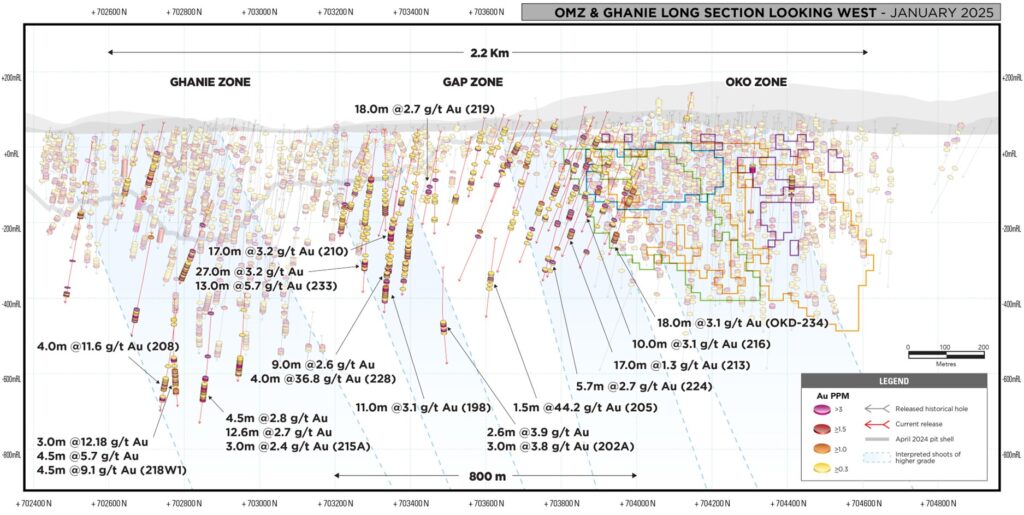

New High-Grade Zone Discovered in ‘Gap’

Drilling has defined a parallel high-grade shoot, partially closing the 800m gap between the April 2024 Ghanie and OMZ resources. Highlights of the drilling include hole GDD-228 which returned 9m @ 2.6 g/t Au and 4m @ 36.8 g/t Au as well as GDD-233 which assayed 5.7 g/t Au over a core length of 13.5m, and GDD-210 which assayed 3.2 g/t Au over 17.7m. Table 1 displays the highlights of intercepts from this new zone.

TABLE 1

| HOLE ID | FROM | TO | INT. (M) | AU G/T |

| GDD-198 | 463.0 | 507.0 | 44.0 | 1.4 |

| Incl. | 463.0 | 474.0 | 11.0 | 3.1 |

| GDD-204 | 140.3 | 199.0 | 58.7 | 1.1 |

| Incl. | 182.5 | 193.0 | 10.5 | 3.8 |

| GDD-205 | 442.5 | 467.5 | 25.0 | 2.9 |

| Incl. | 458.5 | 460.0 | 1.5 | 44.2 |

| GDD-210 | 294.0 | 298.0 | 4.0 | 1.6 |

| GDD-210 | 308.0 | 325.7 | 17.7 | 3.2 |

| Incl. | 309.0 | 315.0 | 6.0 | 7.2 |

| GDD-219 | 175.0 | 193.0 | 18.0 | 2.7 |

| Incl. | 175.0 | 176.5 | 1.5 | 11.5 |

| And | 187.0 | 188.5 | 1.5 | 10.3 |

| And | 191.5 | 193.0 | 1.5 | 9.5 |

| GDD-228 | 156.0 | 157.0 | 1.0 | 10.6 |

| GDD-228 | 397.5 | 428.0 | 30.5 | 1.3 |

| Incl. | 419.0 | 428.0 | 9.0 | 2.6 |

| GDD-228 | 446.0 | 454.5 | 8.5 | 17.4 |

| Incl. | 446.0 | 450.0 | 4.0 | 36.8 |

| GDD-233 | 382.5 | 410.0 | 27.5 | 3.2 |

| Incl. | 388.5 | 402.0 | 13.5 | 5.7 |

The intercepts reported are down-hole widths. True widths are estimated between 75% and 85% of reported down-hole widths. Gold grades are uncapped.

A long section illustrating the new discovery zone is included below as Figure 2 or available on the Company’s website here.

Figure 2

Central Ghanie Zone Depth Extensions

G2 successfully targeted the down plunge extensions of holes GDD-192 and GDD-194 which returned 51.8m @ 2.1 g/t Au and 51.4m @ 5.3 g/t Au, respectively [see press release dated November 18, 2024]. Hole GDD-208 returned 4m @ 11.6 g/t Au and hole GDD-218W1 (which has three intersections) returned 3m @ 12.1 g/t Au, 4.5m @ 5.7 g/t Au, and 4.5m @ 9.1 g/t Au. GDD-208 and GDD-218W1 intercepted the structure at vertical depths approximately 100m below the GDD-192 and GDD-194 intercepts.

OMZ Extensions to Shear 3

Boaz Wade, VP Exploration, stated “Some encouraging drilling intercepts, which included zones of visible gold, confirm that high grade mineralization occurs down-plunge of the existing OMZ resource. This program demonstrates growth potential at the OMZ deposit by targeting well-defined structural geometries.”

The most successful holes included OKD-234 and GDD-213 which returned 18m @ 3.1 g/t Au and 5.6m @ 2.0 g/t Au, respectively.

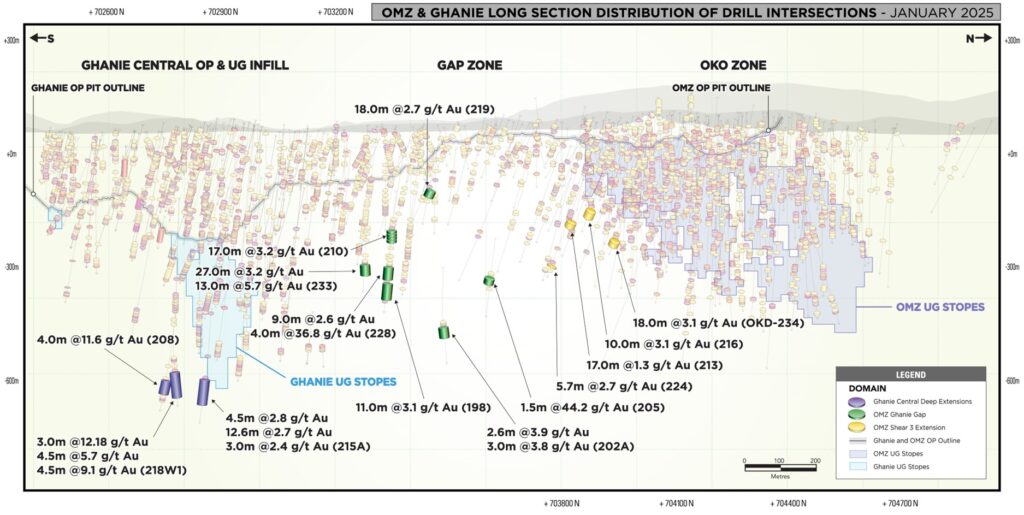

OMZ Infill Drilling

Infill drilling continued to further define the Oko Main Zone deposit. Drilling has intersected a high-grade zone in the Shear 1 part of the OMZ structure which returned 4.9 g/t Au over 11m, illustrating the prospectivity of the OMZ Shear 1 structure which was omitted from the April MRE.

Dan Noone, G2 CEO, stated, “These new results definitively demonstrate that, despite almost five hundred holes being completed to date, the OKO project remains very much a growth story. In 2025 we will continue to aggressively explore this emerging gold district.”

A long section illustrating the distribution of drill intersections is included below as Figure 3 and available on the Company’s website here.

Figure 3

QA/QC

Drill core is logged and sampled in a secure core storage facility located on the OKO project site, Guyana. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to MSALABS Guyana, in Georgetown, Guyana, which is an accredited mineral analysis laboratory, for analysis. Samples from sections of core with obvious gold mineralisation are analysed for total gold using an industry-standard 500g metallic screen fire assay (MSALABS method MSC 550). All other samples are analysed for gold using standard Fire Assay-AA with atomic absorption finish (MSALABS method; FAS- 121). Samples returning over 10.0 g/t gold are analysed utilizing standard fire assay gravimetric methods (MSALABS method; FAS-425). Certified gold reference standards, blanks, and field duplicates are routinely inserted into the sample stream, as part of G2 Goldfields’ quality control/quality assurance program (QAQC). No QA/QC issues were noted with the results reported herein.

About G2 Goldfields Inc.

The G2 Goldfields team is comprised of professionals who have been directly responsible for the discovery of millions of ounces of gold in Guyana as well as the financing and development of the Aurora Gold Mine, Guyana’s largest gold mine [RPA, 43-101, Technical Report on the Aurora Gold Mine, March 31, 2020].

In April 2024, G2 announced an Updated Mineral Resource Estimate for the Oko property in Guyana [see press release dated April 03, 2024]. Highlights of the Updated MRE include:

Total combined open pit and underground Resource for the Oko Main Zone:

- 495,000 oz. Au – Inferred contained within 2,413,000 tonnes @ 6.38 g/t Au

- 686,000 oz. Au – Indicated contained within 2,368,000 tonnes @ 9.03 g/t Au

Total combined open pit and underground Resource for the Ghanie Zone:

- 604,000 oz. Au – Inferred contained within 12,216,000 tonnes @ 1.54 g/t Au

- 236,000 oz. Au – Indicated contained within 3,344,000 tonnes @ 2.20 g/t Au

The MRE was prepared by Micon International Limited with an effective date of March 27, 2024. Significantly, the updated mineral resources lie within 500 meters of surface. The Oko district has been a prolific alluvial goldfield since its initial discovery in the 1870s, and modern exploration techniques continue to reveal the considerable potential of the district.

Anglo Gold Ashanti (NYSE:AU) currently holds 35,948,965 shares representing 14.99% of the issued and outstanding shares of G2. G2 currently has cash holdings exceeding (Cad) $38 million and is well financed to execute on this regional exploration program.

All scientific and technical information in this news release has been reviewed and approved by Dan Noone (CEO of G2 Goldfields Inc.), a “qualified person” within the meaning of National Instrument 43-101. Mr. Noone (B.Sc. Geology, MBA) is a Fellow of the Australian Institute of Geoscientists.

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE