Fury Announces Initial Mineral Resource Estimate for the Sakami Gold Project in Quebec

Fury Gold Mines Limited (TSX: FURY) (NYSE: FURY) is pleased to announce an initial inferred mineral resource estimate for the La Pointe Extension target on its wholly owned Sakami gold project, located in the Eeyou Istchee Territory in the James Bay region of Northern Quebec.

Highlights:

- Inferred Mineral Resource: 23.9 million tonnes (Mt) grading 1.07 grams per tonne (g/t) gold (Au), for 825,000 ounces (oz) (see Table 1).

- Near Surface: All of these ounces are projected to be in-pit within 400 metres (m) of surface.

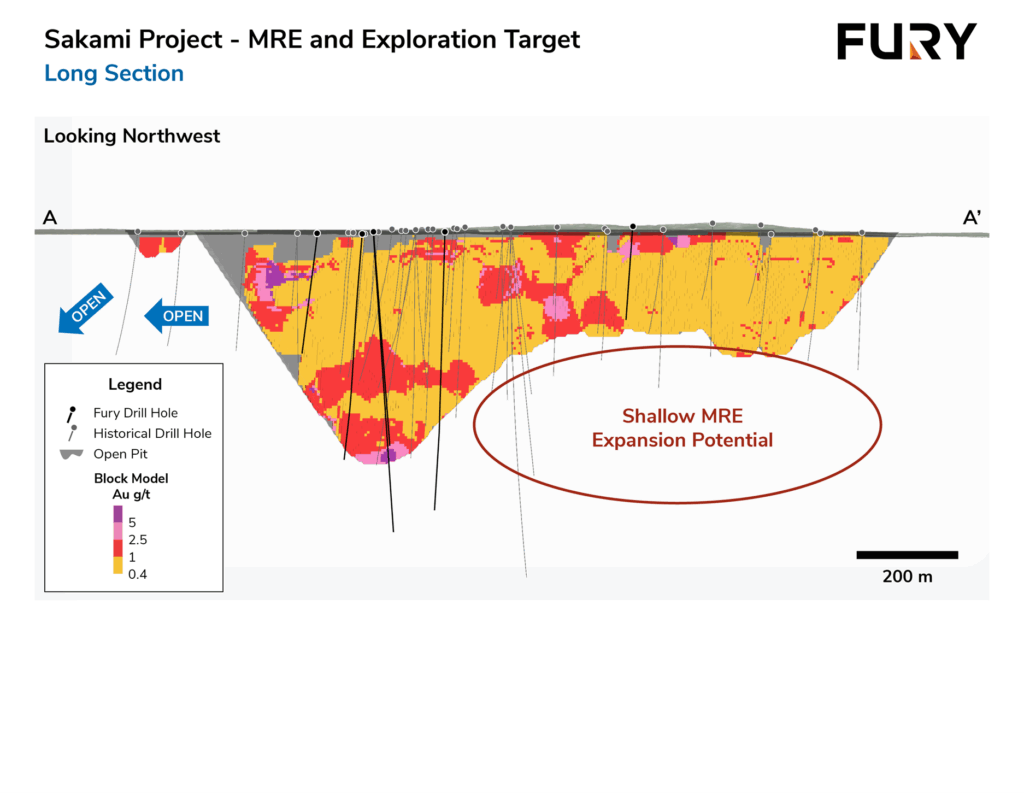

- MRE Expansion Potential: Resource remains open in all directions. Immediate opportunity to expand the MRE to the northeast and southwest as well as below the current open pit extents where drilling is limited to within 175m of surface (see Figure 1).

Considerable upside to expand beyond the existing in-pit resources with an initial Mineral Exploration Target at La Pointe ranging between 8.1Mt and 14.7Mt grading 1.57 g/t Au to 1.11 g/t Au (see Table 3).

- Industry-Low Discovery Cost: The La Pointe Extension discovery cost of less than C$9/oz, which includes both Fury’s acquisition cost of Quebec Precious Metals Corporation (QPM) (see news release dated April 28, 2025) and the cost of the 2025 Sakami drill program.

“The Sakami mineral resource estimate is an exciting portfolio milestone and starting point for the project,” commented Tim Clark, CEO of Fury Gold Mines. “Less than a year from acquiring Sakami from Quebec Precious Metals, the Fury team identified a path to growing portfolio ounces, leveraging this quality asset situated in an established mining region with excellent access to infrastructure. These 825,000 ounces are a solid base from which we can grow, demonstrating significant expansion potential and paves the way to growing our ounces within the Eeyou Istchee James Bay region.”

”The summer 2025 drill program at Sakami expanded upon and confirmed the continuity and grades encountered in historical drilling to the stage where we can release this initial resource. The broad widths of moderate grade gold with a higher-grade gold core encountered in the 2025 drilling campaign all remain open to further expand on this inferred resource. In fact, the current optimized pit encompasses all the drilling completed to date at La Pointe Extension,” commented Bryan Atkinson, P.Geo., SVP Exploration of Fury.

Initial MRE Overview

The initial MRE (Table 1) was prepared by Olivier Vadnais-Leblanc, Geologist with SGS Geological Services in accordance with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards and Canadian National Instrument 43-101. SGS is independent of Fury and the Project.

The following is the current Mineral Resource Estimate as at November 11, 2025 (the “Effective Date”), which incorporates 17,719m of total drilling conducted by Quebec Precious Metals (14,754m) and Fury (2,965m).

Table 1: La Pointe Extension, Sakami Project MRE Summary, effective as of November 11, 2025

| Mineral Resource Category |

Tonnes | Grade (Au g/t) |

Contained Ounces |

| Inferred | 23,887,000 | 1.07 | 825,000 |

Notes:

- The effective date of the Sakami project Mineral Resource Estimates (“MREs”), is November 11, 2025.

- The Mineral Resource Estimates were estimated by Olivier Vadnais-Leblanc, P. Geo. of SGS Geological Services who is an independent Qualified Person as defined by NI 43-101.

- The classification of the current Mineral Resource Estimates as Inferred mineral resources is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves.

- All figures are rounded to reflect the relative accuracy of the estimate.

- The mineral resources are presented undiluted and in situ, constrained by continuous 3D wireframe models, and are considered by the Qualified Person to have reasonable prospects for eventual economic extraction.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It can be reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The Project mineral resource estimates (Sakami Extension) are based on a validated database which includes data from 54 surface diamond drill holes totalling 18,233.72 m. The Project resource database totals 13,147 drill hole assay intervals representing 17455.62 m of data.

- The MRE for the Sakami deposit is based on 44 three-dimensional (“3D”) resource models.

- Grades for Au were estimated for each mineralization domain using 1.0 metre capped composites assigned to that domain. To generate grade within the blocks, the inverse distance square (ID2) interpolation method was used for all domains of the Sakami deposit. An average density value of 2.76 g/cm3 was assigned to each domain.

- Based on the location, surface exposure, size, shape, general true thickness, and orientation, it is envisioned that parts of the Sakami deposit may be mined using open-pit mining methods. In-pit mineral resources are reported at a base case cut-off grade of 0.4 g/t Au. The in-pit resource grade blocks are quantified above the base case cut-off grade, above the constraining pit shell, below topography and within the constraining mineralized domains (the constraining volumes).

- The pit optimization and base-case cut-off grade consider a gold price of $2,600/oz and considers a gold recovery of 92%. The pit optimization and base case cut-off grade also considers a mining cost of US$2.80/t mined, pit slope of 55⁰ degrees, and processing, treatment, refining, G&A and transportation cost of USD$19.00/t of mineralized material.

- The results from the pit optimization, using the pseudoflow optimization method in Whittle.20.22, are used solely for the purpose of testing the “reasonable prospects for economic extraction” by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Property. The results are used as a guide to assist in the preparation of a Mineral Resource statement and to select an appropriate resource reporting cut-off grade. A Whittle pit shell at a revenue factor of 1.00 was selected as the ultimate pit shell for the purposes of this mineral resource estimate.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other such relevant issues.

Table 2: La Pointe Extension MRE Sensitivity to Gold Cut-Off Grade

| Cutoff Au (g/t) |

Grade Au (g/t) |

Tonnes | Contained Ounces |

| 0.3 | 0.98 | 27,615,000 | 867,000 |

| 0.4 | 1.07 | 23,887,000 | 825,000 |

| 0.5 | 1.18 | 20,393,000 | 775,000 |

| 0.6 | 1.29 | 17,327,000 | 721,000 |

| 0.7 | 1.41 | 14,740,000 | 667,000 |

| 0.8 | 1.53 | 12,390,000 | 610,000 |

Notes:

- Bolded row represents the base case for the MRE.

- Cut-off grades as low as 0.2 g/t Au are considered by the Qualified Person to meet NI 43-101 guidelines for Reasonable Prospects for Eventual Economic Extraction.

Expansion Potential

The La Pointe Extension resource remains open in all directions (Figure 1) with near-term opportunity to expand the MRE to the northeast and southwest as well as beneath the optimized open pit where it is limited to 175m below surface (Figure 1).

Figure 1: La Pointe Extension, Sakami Project Long Section

Considerable upside to expand beyond the existing in-pit resources to add 8.1Mt to 14.7Mt grading between 1.57 g/t Au and 1.11 g/t Au (see Table 3), of which 35,487m of historical drilling has been completed. The potential quantity and grade are conceptual in nature, that there has been insufficient exploration to define a mineral resource and that it is uncertain if further exploration will result in the target being delineated as a mineral resource.

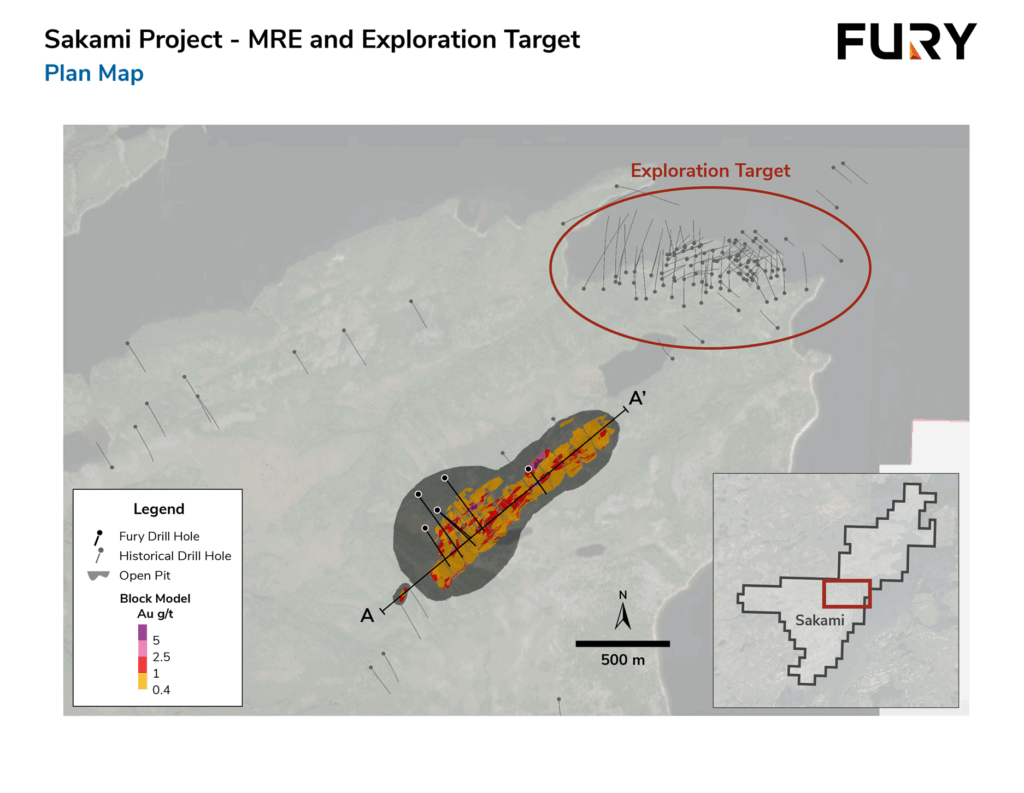

Figure 2 shows the location of the outlined La Pointe Extension MRE (green) and the outlined exploration expansion target opportunity, which lays within the Sakami Reservoir (between peninsulas), approximately 300m from surface. More work needs to be completed to confirm the resource potential.

Table 3: Exploration Target (in-pit) for La Pointe

| Cutoff Au (g/t) |

Grade Au (g/t) |

Tonnage (Million Tonnes) |

| 0.3 – 0.8 | 1.10 – 1.55 | 8 – 14 |

- The deposit, located along the shoreline of the Sakami Reservoir, would require a dam to be mined. The costs to build this dam is not consider in this Exploration Target. Engineering studies and permits are required.

- The interpretation of the 3d solids and the interpolation of the block model follow the same procedures used for the MRE on Lapointe extension.

- The pit optimization is considering a gold value of 2,300$ using a gold recovery of 92%. The pit optimization and base case cut-off grade also considers a mining cost of US$2.80/t mined, pit slope of 55⁰ degrees.

- No classification as been applied on this Exploration Target.

- All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

- The Exploration Target is based on a validated database which includes data from 129 surface diamond drill holes totalling 35487.24 m.

- The exploration target is based on 46 three-dimensional resource models.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues

Figure 2: Sakami Initial MRE and Location of Exploration Target

About the Sakami Project

The 100% owned Sakami project covers approximately 14,250 hectares (ha) or 142.5 square kilometres (km), located 30km to the east of the paved Billy Diamond Highway. The Project straddles the prospective structural corridor marking the contact between the Opinaca and La Grande Geological sub-provinces, where gold mineralization has been identified over a distance of more than 23km. Gold mineralization is located at the base of a sulphide-rich horizon within a zone of intense pervasive silicification located along a regional shear zone, marking the contact between the two geological sub-provinces.

A total of seven diamond drill holes totaling approximately 3,685m were completed during the 2025 campaign. Six holes targeted the down plunge and along strike extensions of previously identified gold mineralization across 650m of strike length at the La Pointe Extension target. Historical drilling has intercepted gold mineralization across widths of up to 75m and to a depth of up to 500m below surface. All 2025 drill holes completed at La Pointe Extension intercepted zones of intense silicification with sulphide mineralization containing broad zones of gold mineralization in two sub-parallel zones with higher grade cores.

A technical report will be prepared by Qualified Persons in accordance with the requirements of NI 43-101 and will be filed on SEDAR+ (sedarplus.ca) within 45 days of this press release.

Qualified Person

Valerie Doyon, P.Geo, Senior Project Geologist at Fury, is a “qualified person” within the meaning of Canadian mineral projects disclosure standards instrument 43-101 and has reviewed and approved the technical disclosures in this press release.

The November 11, 2025 Mineral Resource Estimate has been prepared by Olivier Vadnai-Leblanc, P. Geo., Geologist with SGS Geological Services, a “qualified person” within the meaning of Canadian mineral projects disclosure standards instrument 43-101

About Fury Gold Mines Limited

Fury Gold Mines Limited is a well-financed Canadian-focused exploration company positioned in two prolific mining regions across Canada and holds an 11.3 million common share position in Dolly Varden Silver Corp (12.9% of issued shares). Led by a management team and board of directors with proven success in financing and advancing exploration assets, Fury intends to grow its multi-million-ounce gold platform through rigorous project evaluation and exploration excellence. Fury is committed to upholding the highest industry standards for corporate governance, environmental stewardship, community engagement and sustainable mining

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE