Fremont Closes $2.0 Million Financing with a Lead Order from Palisades Goldcorp; to Drill North Carlin Later this Month

Fremont Gold Ltd. (TSX-V: FRE) (FSE: FR2) (OTCQB: FRERF) is pleased to announce that it has closed the previously announced non-brokered private placement through the issuance of 40,000,000 units at a price of $0.05 per Unit for gross proceeds of $2,000,000. Palisades Goldcorp Ltd. was the lead order in the Private Placement. Net proceeds of the Private Placement will be used for a drill program at the North Carlin gold project later this month, an exploration program at the Cobb Creek gold project this spring, and for general working capital.

“I’d like to thank everyone that participated in the financing, especially Palisades,” said Blaine Monaghan, CEO of Fremont. “The financing was well received and has provided Fremont with the resources required to drill North Carlin and to advance Cobb Creek. Permitting is well underway at North Carlin and drilling should be underway later this month. We are excited to get started as we have developed a number of untested drill targets located in the right geological setting for the discovery of a major gold deposit.”

North Carlin highlights:

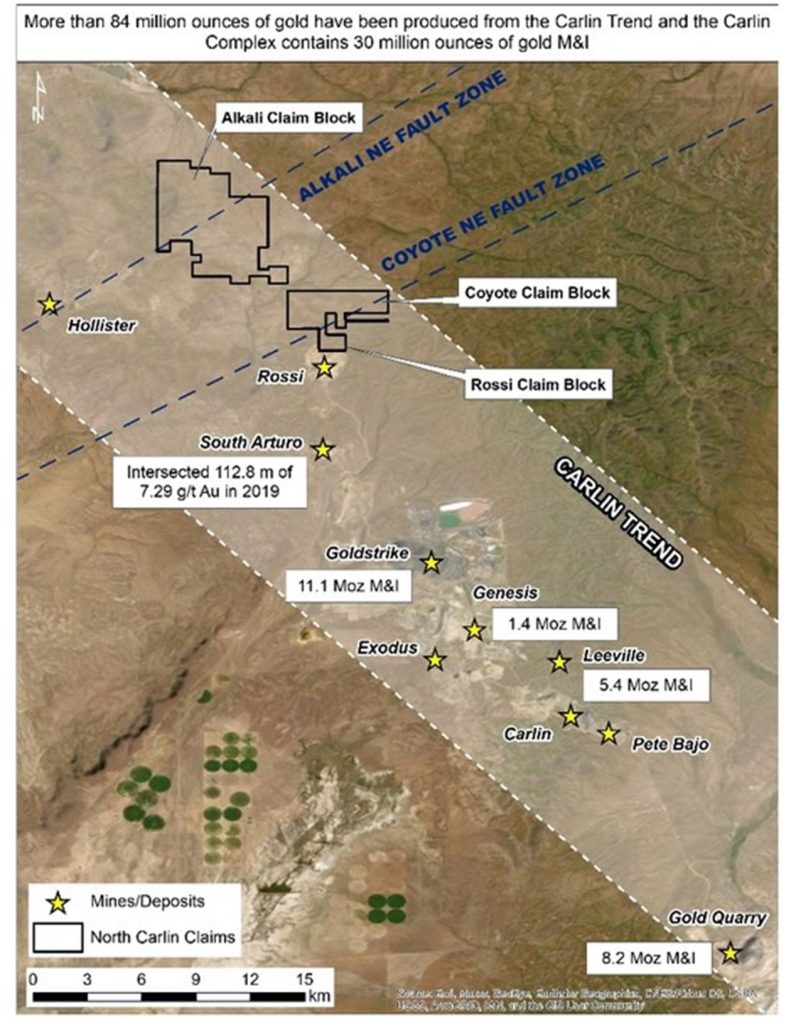

- Over 42 km2 in size, North Carlin is a large, underexplored gold project located at the northern end of the Carlin Trend (see Figure 1).

- The Carlin Trend is one of the richest gold mining districts in the world having produced over 84 million ounces of gold since the early 1960s1; Nevada Gold Mines’ Carlin Complex hosts 30 million ounces of gold in the measured and indicated category2.

- North Carlin is approximately 6 km north of and on-strike of Nevada Gold Mines/Premier Gold Mines’ South Arturo mine, where recent drilling intersected 39.6 metres of 17.11 g/t gold3, and 12 km north of Nevada Gold Mines’ Goldstrike mine, which hosts 11.1 million ounces gold in the measured and indicated category2. The western edge of North Carlin is approximately 6 km east of Hecla Mining Company’s Hollister mine.

- Situated in the right geological setting for the discovery of a major gold deposit, Fremont has developed several drill targets based on soil geochemistry, gravity and geomagnetic surveys, and the projection of key faults that control gold mineralization in the Carlin Trend.

- The Company is permitting ten drill sites at North Carlin and plans to drill a minimum of three holes, totaling 1,500 metres, in a reverse circulation program commencing later this month.

Figure 1: The Carlin Trend

Cobb Creek highlights:

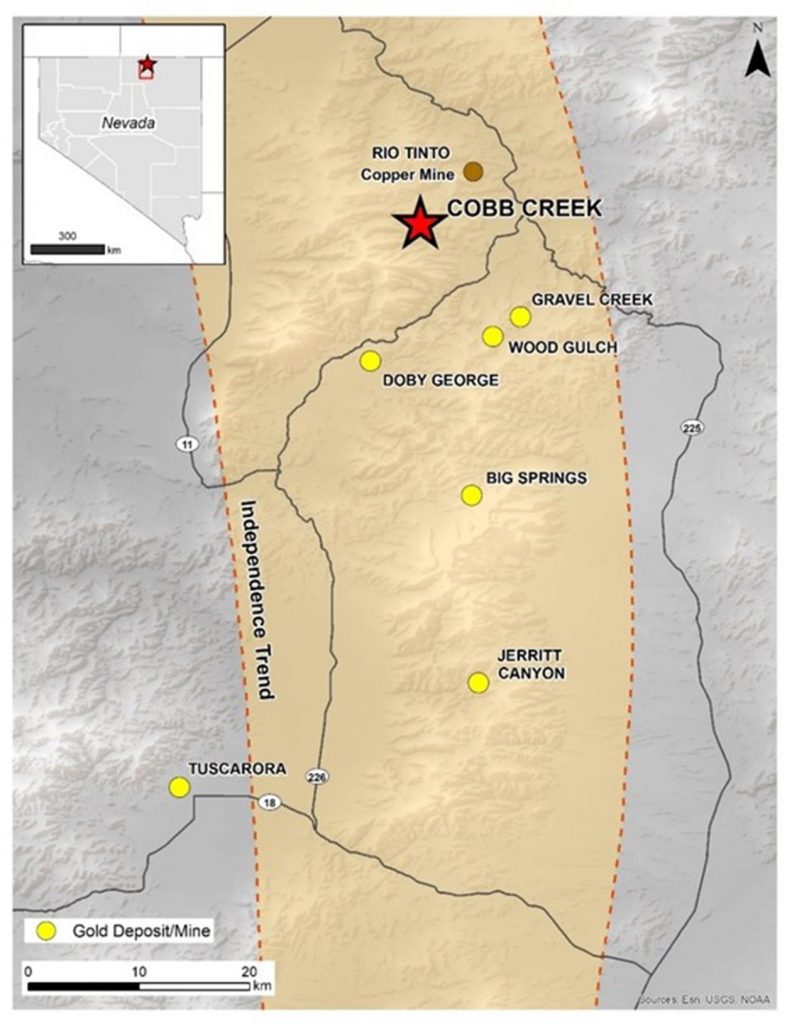

- Cobb Creek is comprised of 167 unpatented mining claims and is located at the northern end of the Independence Trend (see Figure 2). Western Exploration’s new gold discovery, Gravel Creek, is located approximately 6 km to the southeast. It has been reported that Gravel Creek “contains an in-place unclassified mineral inventory of 1.4 million ounces of gold and 21 million ounces of silver…“. (Muntean, Davis, and Ayling, 2017, p. 22)4.

- Historical mineral resource estimate: The McCall deposit, one target area within Cobb Creek, contains a historical mineral resource estimate (not NI 43-101 compliant) which is set out in the table below.

| Resource | Mineralized | Cut-Off | Grade | Ounces | |

| Classification | Zone | (opt) | Tons | (opt) | Gold |

| Indicated | Oxide | 0.01 | 1,362,233 | 0.04 | 54,864 |

| Indicated | Sulphide | 0.01 | 2,378,000 | 0.05 | 118,134 |

The historical mineral resource estimate (“Historical Estimate”) was performed by and reported in a technical report prepared by Michael R. Pawlowski for Stacatto Gold Resources Ltd. and dated October 30, 20045. The Historical Estimate is based on a total of 72 drill holes with continuous zones of gold assays above 0.01 opt gold that could be reasonably interpreted to be continuous in three dimensions based on the construction of nine cross sections, 200 feet apart. The methodology employed in the Historical Estimate is detailed in the 2004 technical report by Pawlowski1. A qualified person has not done sufficient work to classify the Historical Estimate as a current mineral resource or mineral reserve and Fremont is not treating the Historical Estimate as a current mineral resource or mineral reserve. In order to consider the Historical Estimate as current mineral resources or mineral reserves, Fremont needs to retain a qualified person to verify historical drilling and assaying methods and validate historical results, add any drilling and assaying or other pertinent geological information generated since the last estimation, and complete an updated resource estimate and a new technical report.

- Cobb Creek has not been drilled since 1992 and most of the historical drilling (over 140 drill holes) was very shallow. Some of the better drill results include drill hole COBRC-3, which returned 15.3 metres of 2.86 g/t gold (from 13.7 metres to 29.0 metres), and COBRC-84, which returned 33.5 metres of 1.92 g/t gold (from 18.3 metres to 51.8 metres), including 12.2 metres of 4.09 g/t gold.

- Cobb Creek is underexplored. Fremont believes that there is good potential to expand the Historical Estimate at McCall and for the discovery of a Carlin-type deposit. Additionally, a number of exploration targets have not been drilled or were not followed up despite returning very anomalous gold values.

Figure 2: Cobb Creek location

Private placement

Each Unit is comprised of a common share of Fremont and one share purchase warrant. Each share purchase warrant will entitle the holder to purchase one common share at a purchase price of $0.10 for a period of 36 months following the closing of the Private Placement.

The Company paid aggregate cash finders’ fees of $55,560 and issued an aggregate of 1,051,200 share purchase warrants to certain finders in connection with the Private Placement. Each Finder’s Warrant entitles the holder to purchase one common share of Fremont at a purchase price of $0.10 for a period of 36 months following closing of the Private Placement.

Officers and directors of the Company subscribed for a total of 1,200,000 Units of the Private Placement. The participation of officers and directors of Fremont in the Private Placement constitutes a “related party transaction” within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The transaction is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to section 5.5(b) and section 5.7(1)(b) as the fair market value of the officers’ and directors’ participation is not more than 25% of the Company’s market capitalization.

All securities issued in connection with the Private Placement are subject to a statutory hold period of four months plus a day from the date of issuance in accordance with applicable securities legislation and the policies of the TSX Venture Exchange, pursuant to which they may not be sold or transferred until March 3, 2021.

About Palisades Goldcorp

Palisades Goldcorp is Canada’s resource focused merchant bank. Palisades’ management team has a demonstrated track record of making money and is backed by many of the industry’s most notable financiers. With junior resource equities valued at generational lows, management believes the sector is on the cusp of a major bull market move. Palisades is positioning itself with significant stakes in undervalued companies and assets with the goal of generating superior returns.

About Fremont Gold

Founded by geologists that have a track record of making multi-million-ounce gold discoveries, Fremont has assembled a portfolio of quality gold projects located in Nevada’s most prolific gold trends. The Company’s property portfolio includes North Carlin, a new discovery opportunity, Cobb Creek, which hosts a historic resource, Griffon, a past producing gold mine, and Hurricane, which has returned significant gold intercepts in past drilling.

Qualified person

The content of this news release was reviewed by Dennis Moore, Fremont’s President, a P.G. and a qualified person as defined by National Instrument 43-101.

MORE or "UNCATEGORIZED"

Silver Mountain Announces Closing of Prospectus Offering

Silver Mountain Resources Inc. (TSX-V: AGMR) (OTCQB: AGMRF) is ... READ MORE

Mandalay Extends the Storheden Gold Deposit Adjacent to the Operating Björkdal Mine

Mandalay Resources Corporation (TSX: MND) (OTCQB: MNDJF) announce... READ MORE

Collective Mining Intercepts 632.25 Metres at 1.10 g/t Gold Equivalent in a 200 Metre Step-Out Hole to the South at Trap

Collective Mining Ltd. (TSX: CNL) (OTCQX: CNLMF) (FSE: GG1) is pl... READ MORE

Koryx Copper Intersects 207 Meters at 0.49% and 116 Meters at 0.54% Copper Equivalent

Significant copper and molybdenum intersections include: HM19: 11... READ MORE

Red Pine Intercepts Significant Mineralization at the Wawa Gold Project, including 5.34 g/t over 13.39 metres including 16.50 g/t gold over 0.97 metre and 13.62 g/t gold over 2.13 metres

Red Pine Exploration Inc. (TSX-V: RPX) (OTCQB: RDEXF) is pleased ... READ MORE