Fortuna Advances Diamba Sud Gold Project in Senegal with Updated Mineral Resources; PEA Completion Targeted for Q4 2025

Fortuna Mining Corp. (NYSE: FSM) (TSX: FVI) is pleased to report an updated Mineral Resource estimate as of July 7, 2025, for the Diamba Sud Gold Project located in Senegal. All dollar amounts in this news release are expressed in US dollars.

Highlights of the Inpit Mineral Resource Update

- Indicated Mineral Resource of 724,000 gold ounces, representing a 53 percent increase since year-end 2024

- Inferred Mineral Resource of 285,000 gold ounces, reflecting a 93 percent increase since year-end 2024

- Initial Inferred Mineral Resource estimates for the Southern Arc and Moungoundi deposits, containing 194,000 ounces and 31,000 ounces of gold, respectively

- Preliminary Economic Analysis (PEA) underway, with completion targeted for the fourth quarter of 2025

- Exploration drilling at Southern Arc continues focusing on:

- Infilling drilling to upgrade Inferred Resources

- Expansion drilling where mineralization remains open at shallow depths to the south and east of the defined deposit limits

Diamba Sud Gold Project, Senegal

Fortuna estimates that the Diamba Sud Gold Project comprises an Indicated Mineral Resource of 14.2 Mt at an average gold grade of 1.59 g/t, containing 724,000 ounces of gold, and an Inferred Mineral Resource of 6.2 Mt at an average gold grade of 1.44 g/t containing 285,000 ounces of gold.

The updated Mineral Resource estimate is based on new drilling completed between July 2024 to July 2025, comprising 243 holes totaling 31,652 meters. The data collected improved the geological interpretation and resource modelling for Area A, Area D, Karakara, Western Splay, and Kassassoko. It also contributed to the expansion of Diamba Sud´s pipeline of emerging deposits, with the first-time resource estimates for Southern Arc and Moungoundi. Expansion drilling at these deposits, along with the drilling of new targets, is planned for the fourth quarter of 2025.

Changes from the previous estimate are due to the following:

- Infill drilling at Area A, Area D, Karakara, Western Splay, and Kassassoko improved the geological interpretation and supported the conversion of Inferred Resources to Indicated Resources

- Exploration drilling at Southern Arc and Moungoundi resulted in the first-time estimation of Inferred Mineral Resources

- An increase in the long-term gold price assumption, now at $2,600/oz, along with refinements to projected mining and processing costs, contributed to updated pit shell optimization and cut-off grade determination

Diamba Sud Gold Project Mineral Resources by deposit

|

Mineral Resources – Indicated |

Contained Metal | |||

| Classification | Deposit | Tonnes (000) |

Au (g/t) |

Au (koz) |

| Indicated | Area A | 3,891 | 1.47 | 184 |

| Area D | 4,877 | 1.75 | 274 | |

| Karakara | 2,476 | 1.79 | 143 | |

| Western Splay | 1,615 | 1.65 | 86 | |

| Kassassoko | 1,294 | 0.90 | 38 | |

| Total Indicated | 14,153 | 1.59 | 724 | |

| Mineral Resources – Inferred | Contained Metal | |||

| Classification | Deposit | Tonnes (000) |

Au (g/t) |

Au (koz) |

| Inferred | Area A | 61 | 1.02 | 2 |

| Area D | 600 | 1.10 | 21 | |

| Karakara | 510 | 1.61 | 26 | |

| Western Splay | 101 | 2.11 | 7 | |

| Kassassoko | 123 | 0.85 | 3 | |

| Southern Arc | 3,854 | 1.57 | 194 | |

| Moungoundi | 922 | 1.06 | 31 | |

| Total Inferred | 6,171 | 1.44 | 285 | |

Notes:

- Mineral Reserves and Mineral Resources are as defined by the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves

- Mineral Resources are exclusive of Mineral Reserves.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Factors that could materially affect the reported Mineral Resources include changes in metal price and exchange rate assumptions; changes in local interpretations of mineralization; changes to assumed metallurgical recoveries, mining dilution and recovery; and assumptions as to the continued ability to access the site, extend and/or retain mineral and surface rights, titles and permits, maintain environmental and other regulatory permits, and maintain the social license to operate.

- Mineral Resources are reported as of July 7, 2025.

- Mineral Resources for Diamba Sud are reported pit constrained on a 100% ownership basis at selective mining unit block sizes and at an incremental gold cutoff grade for oxide/transitional material of 0.31 g/t Au, with fresh material reported based on a cutoff of 0.35 g/t Au for Area A, 0.42 g/t Au for Area D, 0.35 g/t Au for Karakara, 0.41 g/t Au for Western Splay, 0.35 g/t Au for Kassassoko, 0.37 g/t Au for Southern Arc, and 0.39 g/t Au for Moungoundi in accordance with the varying ore differential parameters and varying metallurgical recoveries for oxide, transitional and fresh rock within pit shell optimizations, assuming a long-term gold metal price of $2,600/oz and metallurgical recoveries based on metallurgical testwork.

- Eric Chapman, P. Geo. (EGBC #36328), is the Qualified Person responsible for Mineral Resources, being an employee of Fortuna Mining Corp.

- Totals may not add due to rounding

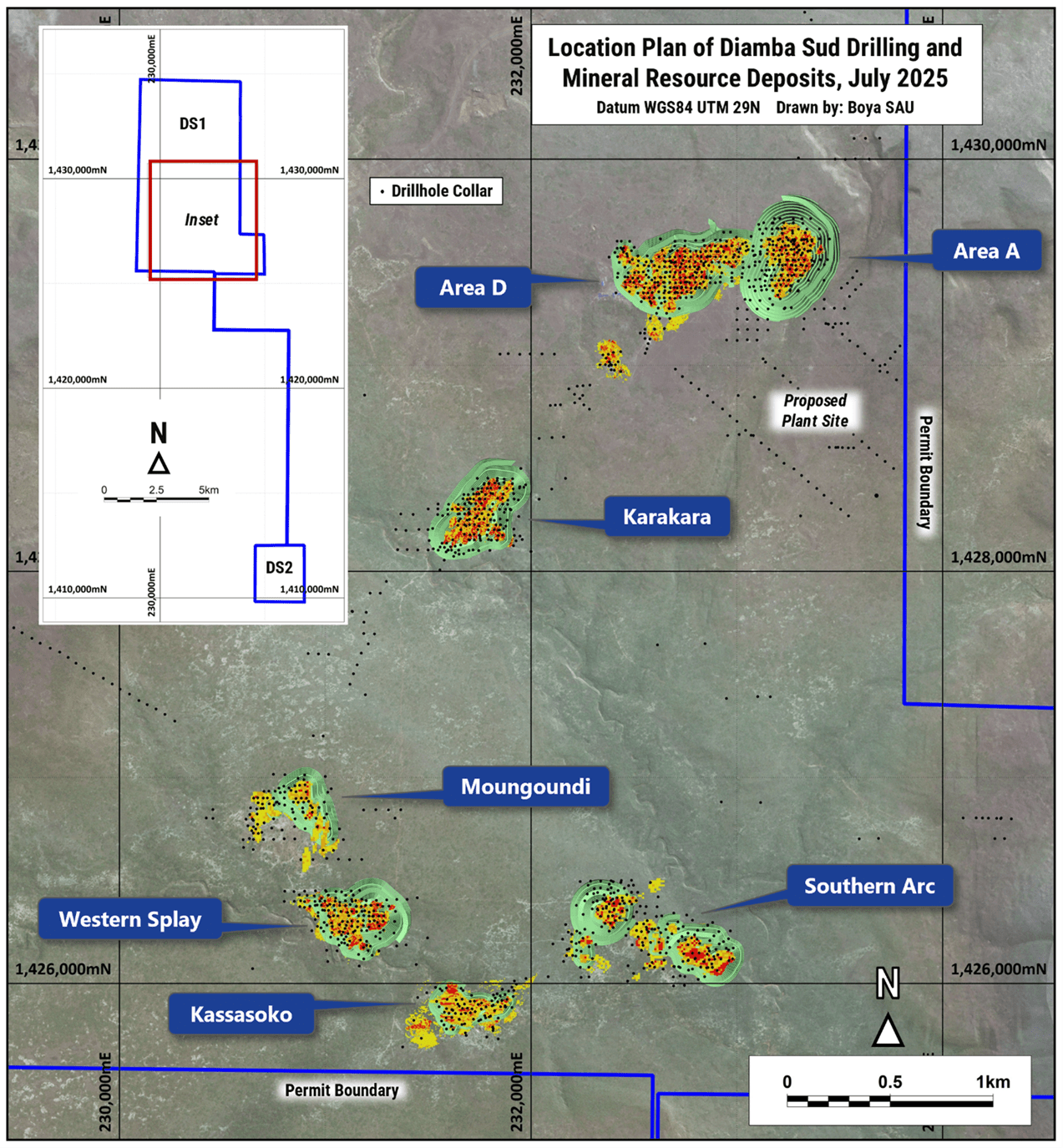

The Mineral Resource is comprised of seven deposits: Area A, Area D, Karakara, Western Splay, Kassassoko, Southern Arc, and Moungoundi. It incorporates data from a total of 1,178 diamond and reverse circulation (RC) drill holes, totaling 154,814 meters, completed at these deposits since 2019 (see Figure 1).

Figure 1: Location of Deposits Included in the Mineral Resource Estimate

All RC drilling at Diamba Sud was conducted using a 5.25-inch face sampling pneumatic hammer, with samples collected into 60-liter plastic bags. To maintain sample integrity, sufficient air pressure was used to keep samples dry and prevent groundwater inflow. If water ingress exceeded air pressure capacity, RC drilling was halted, and drilling converted to diamond core tails. Samples were collected at 1-meter intervals from an onboard cyclone and split on site to produce two 1.5-kilogram sub-samples. The first sample was submitted for laboratory analysis, while the second was retained at the core yard as a field duplicate.

The majority of diamond drill holes at Diamba Sud were drilled with either HQ or NQ sized diamond drill bits. Core was logged and marked for sampling using standard lengths of one meter or to geological boundaries as appropriate. Samples were cut into equal halves using a diamond saw. One half of the core was retained in the original core box and stored in a secure facility at the project site’s core yard. The other half was sampled, catalogued, and placed into sealed bags which were securely stored on site until shipment.

All RC and diamond core samples form Diamba Sud were shipped to ALS Global’s laboratory in Kedougou, Senegal, for preparation and then sent, via commercial courier, to ALS’s facility in Ouagadougou, Burkina Faso, for final analysis. Routine gold analysis was performed using a 50-gram charge with fire assay and atomic absorption finish. Quality control procedures included the systematic insertion of blanks, duplicates, and certified reference standards into the sample stream. Additionally, ALS implemented its own quality control protocols.

The Mineral Resource estimate for Diamba Sud was prepared using data with an effective cut-off date of July 7, 2025. Three-dimensional wireframes were constructed for the host lithologies, including the weathering profile, as well as for mineralized zones. The mineralized envelopes were defined using nominal cut-off grades of approximately 0.1 g/t and 0.3 g/t Au, respectively.

Wireframes for each mineralized envelope were used to select and flag drillhole samples. Samples were preferentially sampled at 1-meter intervals, regardless of drilling technique based on the deposit characteristics, and therefore composited to this length. Composites for each mineralized domain were evaluated both individually and collectively using histograms, log-probability plots, and box-and-whisker plots.

Input composite data for each domain were assessed for outliers, and grade capping was applied on a semi-quantitative basis. This process was guided by statistical tools, including histograms, log-probability plots, and mean-variance plots. Grade caps were generally applied at or above the

98th percentile.

Where sufficient data existed, experimental semi-variograms were generated for each domain and modelled accordingly. These were typically characterized by a moderate to high nugget effect and two nested spherical structures.

A block model was built for each of the Diamba Sud deposits. Models were aligned with the national UTM coordinate system used for the input data and were designed with block dimensions reflecting the likely selective mining unit.

Mineralized wireframes were treated as hard boundaries during grade interpolation, meaning only assay data within each domain was used to interpolate grades within that domain. Grade interpolation was performed using either inverse distance weighting or ordinary kriging, depending on the quality and robustness of the modeled variograms. The Qualified Person considers the interpolation methods appropriate for the style of mineralization at Diamba Sud.

All estimates were carried out on a parent block basis. Estimation search parameters were informed by Kriging Neighborhood Analysis (KNA), utilizing a single-block KNA approach within well-drilled areas. An oriented ellipsoid search was applied to select composites for interpolation, with orientations derived from variogram models. Gold grade estimation was completed using a three-pass search strategy within each mineralized domain, based on the respective variogram ranges.

Fixed bulk density values were assigned by lithology and weathering profile, based on more than 25,000 water immersion measurements of drill core collected across the Diamba Sud property.

Initial validation of the block models included checks for unestimated mineralized blocks, incorrect or missing density assignments, and verification that no mineralized blocks or blocks with density values were present above the topographic surface. Visual validation included comparing the estimated block model grades to the composite grades for a series of cross sections sliced through each of the deposits.

Following the initial validation checks, swath plots were generated along the three principal axes to assess the representativeness of the estimated grade profiles relative to the input composite grades. These plots were prepared on a per-domain basis for each mineralized solid and demonstrate a satisfactory correlation between the estimated grades and the underlying composite data, supporting the reliability of the grade interpolation.

Mineral Resource classification considered several aspects affecting confidence in the estimation including geological continuity; data density and orientation; data accuracy and precision; and grade continuity. Indicated Mineral Resources have relied on a drilling grid of approximately 25 meters, with Inferred Mineral Resources based on an approximate 50-meter grid.

Mineral Resources are reported on a 100 percent ownership basis, using block sizes consistent with the anticipated selective mining unit. Resources are constrained by optimized pit shells and reported at incremental gold cut-off grades that reflect varying metallurgical recoveries and projected mining, processing, and general costs. A long-term gold price of $2,600 per ounce was assumed for pit optimization and economic evaluation.

Qualified Person

Eric Chapman, Senior Vice President, Technical Services, is a Professional Geoscientist of the Association of Professional Engineers and Geoscientists of the Province of British Columbia (Registration Number 36328) and a Qualified Person as defined by National Instrument 43-101- Standards of Disclosure for Mineral Projects. Mr. Chapman has reviewed and approved the scientific and technical information contained in this news release and has verified the underlying data.

About Fortuna Mining Corp.

Fortuna Mining Corp. is a Canadian precious metals mining company with three operating mines and a portfolio of exploration projects in Argentina, Côte d’Ivoire, Mexico, and Peru, as well as the Diamba Sud Gold Project in Senegal. Sustainability is at the core of our operations and stakeholder relationships. We produce gold and silver while creating long-term shared value through efficient production, environmental stewardship, and social responsibility.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE