First Majestic Reports Positive Exploration Results at Los Gatos

Expansionary Drilling at Los Gatos Intersects Significant Silver and Base Metal Mineralization

First Majestic Silver Corp. (NYSE: AG) (TSX: AG) (FSE: FMV) is pleased to announce positive drilling results from its 2024/2025 exploration programs at the Los Gatos Silver Mine in Chihuahua, Mexico. The drilling programs were designed to expand silver, zinc, lead, copper and gold mineralization in the South-East Deeps, Central Deeps and North-West Deeps zones. None of the reported drill results were included in the Company’s year-end Mineral Reserve and Mineral Resource Estimates.

“Following the acquisition of Gatos Silver, the exploration program has advanced smoothly alongside all other aspects of the operation,” stated Keith Neumeyer, President & CEO of First Majestic. “A major driver for acquiring Los Gatos was the district’s significant exploration upside, and the latest drilling results reinforce that potential. Ongoing drilling continues to expand mineralization across multiple zones, supporting our expectation for meaningful Mineral Resource growth at Los Gatos.”

KEY DRILLING HIGHLIGHTS:

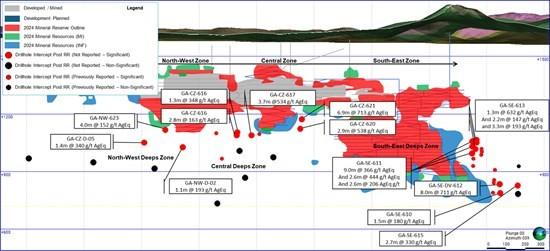

Ongoing exploration drilling intersected significant silver and base metals mineralization across all three zones tested: South-East Deeps, Central Deeps and North-West Deeps. A selection of significant drill hole intercepts from these zones (Figure 1) are highlighted in Tables 1 and 2 below:

South-East Deeps Drilling Highlights

Table 1: South-East Deeps Significant Intercepts

| Drill Hole | Significant Intercept | |||

| From (m) |

To (m) |

True Length (m) |

Metal Grades | |

| GA-SE-611 | 929.3 | 931.3 | 9.0 | 366 g/t AgEq – 196 g/t Ag, 5.43% Zn, 1.67% Pb, 0.23 g/t Au and 0.04% Cu |

| Include 1 | 697.0 | 698.5 | 1.2 | 589 g/t AgEq – 353 g/t Ag, 6.65% Zn, 3.03% Pb, 0.24 g/t Au and 0.08% Cu |

| Include 2 | 704.0 | 705.3 | 1.0 | 742 g/t AgEq – 365 g/t Ag, 9.89% Zn, 5.50% Pb, 0.32 g/t Au and 0.06% Cu |

| And | 735.0 | 738.0 | 2.6 | 444 g/t AgEq – 97 g/t Ag, 11.58% Zn, 2.90% Pb, 0.59 g/t Au and 0.09% Cu |

| And | 784.0 | 787.0 | 2.6 | 206 g/t AgEq – 105 g/t Ag, 1.48% Zn, 0.81% Pb, 0.44 g/t Au and 0.33% Cu |

| GA-SE-DV-612 | 893.0 | 903.0 | 8.0 | 711 g/t AgEq – 130 g/t Ag, 18.16% Zn, 6.31% Pb, 0.14 g/t Au and 0.22% Cu |

| Include 1 | 899.0 | 901.0 | 1.6 | 1080 g/t AgEq – 224 g/t Ag, 23.20% Zn, 12.35% Pb, 0.09 g/t Au and 0.20% |

| GA-SE-615 | 926.0 | 929.5 | 2.7 | 330 g/t AgEq – 173 g/t Ag, 4.32% Zn, 1.95% Pb, 0.38 g/t Au and 0.04% Cu |

Central Deeps Drilling Highlights

Table 2: Central Deeps Significant Intercepts

| Drill Hole | Significant Intercept | |||

| From (m) |

To (m) |

True Length (m) |

Metal Grades | |

| GA-CZ-617 | 706.0 | 710.0 | 3.7 | 534 AgEq g/t – 106 g/t Ag, 10.83% Zn, 2.75% Pb, 0.07 g/t Au and 1.01% Cu |

| Include 1 | 708.0 | 710.0 | 1.3 | 713 AgEq g/t – 154 g/t Ag, 10.65%Zn, 4.58% Pb, 0.06 g/t Au and 1.77% Cu |

| GA-CZ-620 | 630.0 | 633.0 | 2.9 | 538 AgEq g/t – 126 g/t Ag, 13.43% Zn, 1.73% Pb, 0.16 g/t Au and 0.60% Cu |

| Include 1 | 630.0 | 631.5 | 1.4 | 694 AgEq g/t – 216 g/t Ag, 14.05% Zn, 2.34% Pb, 0.10 g/t Au and 0.92% Cu |

| GA-CZ-620 | 561.5 | 568.5 | 6.9 | 713 AgEq g/t – 167 g/t Ag, 17.11% Zn, 4.99% Pb, 0.33 g/t Au and 0.42% Cu |

| Include 1 | 561.5 | 563.0 | 1.4 | 657 AgEq g/t – 165 g/t Ag, 12.45% Zn, 4.82% Pb, 0.03 g/t Au and 0.77% Cu |

| Include 2 | 563.0 | 565.0 | 1.9 | 545 AgEq g/t – 237 g/t Ag, 6.86% Zn, 4.97% Pb, 0.08 g/t Au and 0.48% Cu |

| Include 3 | 565.0 | 567.0 | 1.9 | 1013 AgEq g/t – 154 g/t Ag, 30.09% Zn, 6.66% Pb, 0.62 g/t Au and 0.27% Cu |

| Include 4 | 567.0 | 568.6 | 1.4 | 593 AgEq g/t – 92 g/t Ag, 18.15% Zn, 2.97% Pb, 0.57 g/t Au and 0.21% Cu |

Figure 1: Los Gatos Long Section with Drill Hole Intersections Looking to the Northeast (See Table 3 for all Assay Results used in the AgEq Calculation)

EXPLORATION RESULTS

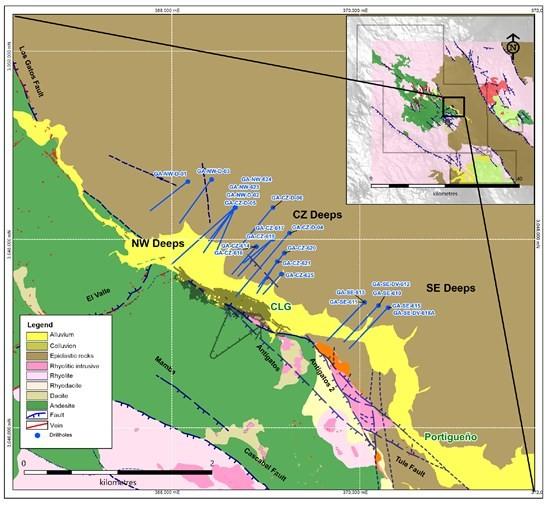

Exploration drilling designed to expand near-mine mineralization intersected significant silver and base metal mineralization while targeting the extension of the South-East Deeps orebody, along with exploration of the recently identified Central and North-West Deeps mineralization zones. Results from the program are summarized below (Figure 2).

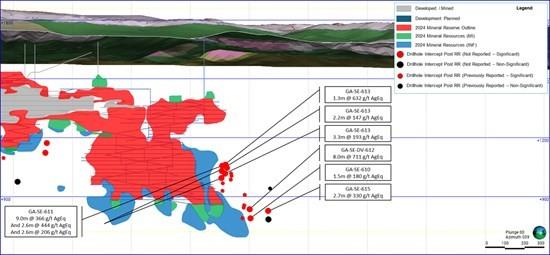

South-East Deeps Zone

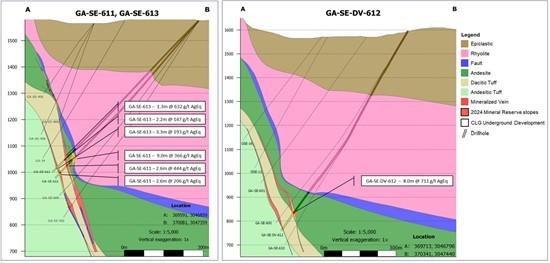

Exploration drilling of the South-East Deeps zone extended silver and base metals mineralization along plunge in the southeast portion of the vein system (Figure 3). The drilling continues to target an Inferred drill spacing, as the extensions of the system are tested. Results of the drilling program confirm the continuity of the South-East Deeps, as the known limits to the mineralization are extended. Future drilling will target the down-plunge potential at a wider spacing to test the geological limits of the system. Infill and Resource conversion drilling will be executed from the underground mine, once ramp and level access is established. Select significant drill hole intervals are shown below in Figure 4.

Figure 2: Los Gatos Near Mine Exploration Targets and Drill Hole Traces

Figure 3: South-East Deeps Long Section and Drill Hole Intersections Looking Northeast (See Table 3 for all Assay Results used in the AgEq Calculation)

Figure 4: South-East Deeps Cross Sections for Drill Holes GA-SE-611 / 613, and GA-SE-DV-612, Section Thickness +/- 25m Looking Northwest (See Table 3 for all Assay Results used in the AgEq Calculation)

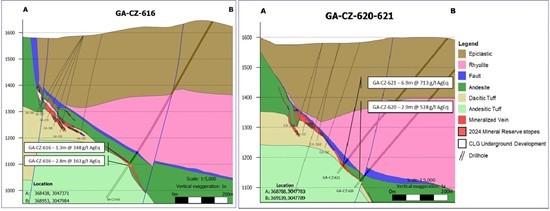

Central and North-West Deeps Zones

Drilling at the exploration targets in the Central and North-West Deeps zones confirmed the presence of silver and base metals mineralization at depth and identified a faulted offset from the main Los Gatos deposit (See Figure 5). Ongoing drilling is testing the lithological-structural model in these zones, to determine accurate mineralization controls. Drilling was conducted at a widely spaced exploration stage, targeting areas of interest, and will tighten to Inferred drill hole spacing throughout the remainder of 2025. All drilling has intersected the geological target as projected, with grade variability controlled by geological criteria.

The significant intervals returned from this drill program continue to grow and refine the areas of interest, with recent results indicating that the system remains open along strike to the northwest. Select significant drill hole intervals are shown in cross sections below in Figure 5.

Figure 5: Central Deeps Cross Sections for Drill Holes GA-CZ-616, and GA-CZ-620 / 621, Section Thickness +/- 25m looking Northwest (See Table 3 for all Assay Results used in the AgEq Calculation)

Table 3: Summary of Significant Gold and Silver Drill Hole Intercepts at Los Gatos

| Drill Hole | Target | Target Type | Actual | |||||||||

| From (m) |

To (m) |

Length (m) |

True Length (m) |

Ag (g/t) |

Zn (%) |

Pb (%) |

Au (g/t) |

Cu (%) |

AgEq (g/t) |

|||

| GA-SE-610 | South-East Deeps | Resource Addition | 929.3 | 931.3 | 2.0 | 1.5 | 45 | 2.92 | 2.18 | 0.06 | 0.24 | 180 |

| GA-SE-611 | South-East Deeps | Resource Addition | 695.2 | 705.3 | 10.1 | 9.0 | 196 | 5.43 | 1.67 | 0.23 | 0.04 | 366 |

| Include 1 | 697.0 | 698.5 | 1.5 | 1.2 | 353 | 6.65 | 3.03 | 0.24 | 0.08 | 589 | ||

| Include 2 | 704.0 | 705.3 | 1.3 | 1.0 | 365 | 9.89 | 5.50 | 0.32 | 0.06 | 742 | ||

| Include 3 | 735.0 | 738.0 | 3.0 | 2.6 | 97 | 11.58 | 2.90 | 0.59 | 0.09 | 444 | ||

| Include 4 | 784.0 | 787.0 | 3.0 | 2.6 | 105 | 1.48 | 0.81 | 0.44 | 0.33 | 206 | ||

| GA-SE-DV-612 | South-East Deeps | Resource Addition | 893.0 | 903.0 | 10.0 | 8.0 | 130 | 18.16 | 6.31 | 0.14 | 0.22 | 711 |

| Include 1 | 899.0 | 901.0 | 2.0 | 1.6 | 224 | 23.20 | 12.35 | 0.09 | 0.20 | 1080 | ||

| GA-SE-613 | South-East Deeps | Resource Addition | 713.0 | 714.5 | 1.5 | 1.3 | 151 | 15.90 | 4.51 | 0.26 | 0.12 | 632 |

| And | 720.5 | 723.0 | 2.5 | 2.2 | 26 | 3.92 | 1.06 | 0.26 | 0.03 | 147 | ||

| And | 772.5 | 776.0 | 3.5 | 3.3 | 23 | 4.48 | 1.20 | 0.10 | 0.36 | 193 | ||

| GA-SE-615 | Central Deeps | Resource Addition | 926.0 | 929.5 | 3.5 | 2.7 | 173 | 4.32 | 1.95 | 0.38 | 0.04 | 330 |

| GA-CZ-616 | Central Deeps | Resource Addition | 622.5 | 624.0 | 1.5 | 1.3 | 173 | 5.41 | 0.58 | 0.02 | 0.36 | 348 |

| And | 628.5 | 631.5 | 3.0 | 2.8 | 104 | 0.74 | 0.23 | 0.03 | 0.32 | 163 | ||

| GA-CZ-617 | Central Deeps | Resource Addition | 706.0 | 710.0 | 4.0 | 3.7 | 106 | 10.83 | 2.75 | 0.07 | 1.01 | 534 |

| Include 1 | 708.0 | 710.0 | 1.5 | 1.3 | 154 | 10.65 | 4.58 | 0.06 | 1.77 | 713 | ||

| GA-CZ-620 | Central Deeps | Resource Addition | 630.0 | 633.0 | 3.0 | 2.9 | 126 | 13.43 | 1.73 | 0.16 | 0.60 | 538 |

| Include 1 | 630.0 | 631.5 | 1.5 | 1.4 | 216 | 14.05 | 2.34 | 0.10 | 0.92 | 694 | ||

| GA-CZ-621 | Central Deeps | Resource Addition | 561.5 | 568.5 | 7.0 | 6.9 | 167 | 17.11 | 4.99 | 0.33 | 0.42 | 713 |

| Include 1 | 561.5 | 563.0 | 1.5 | 1.4 | 165 | 12.45 | 4.82 | 0.03 | 0.77 | 657 | ||

| Include 2 | 563.0 | 565.0 | 2.0 | 1.9 | 237 | 6.86 | 4.97 | 0.08 | 0.48 | 545 | ||

| Include 3 | 565.0 | 567.0 | 2.0 | 1.9 | 154 | 30.09 | 6.66 | 0.62 | 0.27 | 1013 | ||

| Include 4 | 567.0 | 568.6 | 1.5 | 1.4 | 92 | 18.15 | 2.97 | 0.57 | 0.21 | 593 | ||

| GA-CZ-D-05 | Exploration | 791.1 | 793.0 | 1.9 | 1.4 | 26 | 9.87 | 3.46 | 0.03 | 0.05 | 340 | |

| GA-NW-623 | Resource Addition | 791.0 | 795.0 | 4.0 | 4.0 | 33 | 3.06 | 0.39 | 0.06 | 0.35 | 152 | |

| GA-NW-D-02 | Exploration | 802.9 | 804.5 | 1.6 | 1.1 | 36 | 3.90 | 0.63 | 0.05 | 0.48 | 193 | |

Notes:

- All holes are Diamond Drill Core; AgEq grade = Ag grade (g/t) + [Au grade (g/t) * 20.5] + [Zn grade (%) * 21.9] + [Pb grade (%) * 27.3 to 28.0] + [Cu grade (%) * 0 to 112.6)

- Note – AgEq grade formula considers process plant recoveries and concentrate payable and deductible terms. Recovery, Payable and Deductible terms are variable by concentrate product. For further details, see the Company’s most recently filed AIF available under the Company’s SEDAR+ profile at www.sedarplus.ca.

- Process Plant recoveries range from:

- Ag = 88.2%, Au = 54.2%, Zn = 63.4%, Pb = 87.2% – 89.4%, Cu = 0 to 82.0% (Pb and Cu recoveries vary depending on Pb to Cu ratios. See the Company’s most recently filed AIF.)

- Payable terms range from:

- Ag = 95%, Au = 39%, Zn = 85%, Pb = 95%, Cu = 0 to 97% (Cu payable terms vary depending on concentrate. See the Company’s most recently filed AIF)

- “From” and “To” lengths indicated in metres, true width of the intercept is calculated per drill hole and vein angles.

- See Appendix to this news release for details regarding drill hole locations, sample type, azimuth, dip and total depth.

- Where present, single samples or intercepts with assay results higher than 500 g/t AgEq are highlighted as “Include” in each intercept.

At Los Gatos, silver, zinc, lead, gold and copper drill hole intercepts were composited using the length weighted averages of uncapped sample assays, a 140 g/t AgEq minimum grade, and a minimum composite length of 0.7 m (true width). A maximum one metre below the minimum grade was allowed as internal dilution and a single sample below the minimum AgEq grade was allowed in the hanging or footwall to achieve minimum true width in select cases. True width of intercepts is calculated based on current understanding of drill hole and vein angle geometry. All individual samples or intercepts higher than 500 g/t AgEq are reported as “include”.

First Majestic’s Los Gatos drilling programs follow established Quality Assurance / Quality Control insertion protocols with standards, blanks and duplicates introduced to the sample stream and submission of check duplicates to an independent third-party laboratory. After geological logging, all drill core samples are cut in half. One half of the core is submitted to the laboratory for analysis, and the remaining half is retained on-site for verification and reference purposes.

Core samples were submitted to the ALS preparation facilities in Chihuahua City, Mexico for pulp preparation and subsequently to the ALS laboratory in Vancouver, British Columbia, Canada for analysis (ISO/IEC 17025:2017). At ALS, silver, zinc, lead and copper are analyzed by 4-acid digestion with Inductively Coupled Plasma Atomic Emission Spectrometry finish (ME-ICP61). Samples with overlimit results are analyzed using ore grade 4-acid digestion and ICP finish analysis (OG62). Gold is analyzed by 30 g fire assay atomic absorption finish (Au-AA23).

For further information concerning QA/QC and data verification matters, key assumptions, parameters, and methods used by the Company to estimate Mineral Reserves and Mineral Resources, and for a detailed description of known legal, political, environmental, and other risks that could materially affect the Company’s business and the potential development of Mineral Reserves and Mineral Resources, see the Company’s most recently filed Annual Information Form available under the Company’s SEDAR+ profile at www.sedarplus.ca and the Company’s Annual Report on Form 40-F for the year ended December 31, 2024 filed with the United States Securities and Exchange Commission on EDGAR at www.sec.gov/edgar.

QUALIFIED PERSON

Gonzalo Mercado, P. Geo., the Company’s Vice President of Exploration and Technical Services and a “Qualified Person” as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), has reviewed and approved the scientific and technical information contained in this news release. Mr. Mercado has verified the exploration data contained in this news release, including the sampling, analytical and test data underlying such information.

ABOUT FIRST MAJESTIC

First Majestic is a publicly traded mining company focused on silver and gold production in Mexico and the United States. The Company presently owns and operates four producing underground mines in Mexico: the Los Gatos Silver Mine (the Company holds a 70% interest in the Los Gatos Joint Venture that owns and operates the mine), the Santa Elena Silver/Gold Mine, the San Dimas Silver/Gold Mine, and the La Encantada Silver Mine, as well as a portfolio of development and exploration assets, including the Jerritt Canyon Gold project located in northeastern Nevada, U.S.A.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE