Falco Completes a Private Placement of $10.8 Million With Strategic Quebec Investors

Falco Resources Ltd. (TSX-V:FPC) is pleased to announce that it has closed its non-brokered private placement of units, previously announced in November 2016, with three strategic Québec investors, namely Ressources Québec inc., acting as a mandatary for the government of Québec, Capital Croissance PME II, s.e.c. and SIDEX, s.e.c., pursuant to which the Company has issued 10,093,083 units of the Company (“Units”) at a price of $1.07 per Unit, for aggregate gross proceeds of $10,799,600.

Each Unit consists of one common share in the capital of the Company and one-half of one common share purchase warrant. Each Warrant is exercisable to acquire one additional common share of the Company for a period of 18 months from the closing date of the Offering at an exercise price of $1.45 per Warrant Share.

The expiry date of the Warrants may be accelerated by the Company at any time following the six-month anniversary of the closing of the Offering and prior to the expiry date of the Warrants if the volume-weighted average trading price of the Company’s common shares is greater than $1.75 for any 20 consecutive trading days, by issuing a press release announcing the reduced warrant term whereupon the Warrants will expire on the 20th calendar day after the date of such press release.

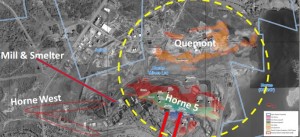

The net proceeds of the Offering will be used by the Company to advance the dewatering program related to the development of the Horne 5 Deposit, for regional exploration and for general working capital.

The Offering was conditionally approved by the TSX Venture Exchange (the “TSXV”) in November 2016, and the TSXV has agreed to extend the timeframe for closing of the Offering in order to allow the Company to complete the Offering.

Securities issued under the Offering are subject to a four month hold period expiring on May 27, 2017.

The Offering was completed on a private placement basis pursuant to prospectus exemptions of applicable securities laws and is subject to final acceptance by the TSXV.

As a result of the Offering, 156,776,406 common shares of Falco are issued and outstanding.

Luc Lessard, President and Chief Executive Officer of Falco, stated: “We are very pleased to have a strong base of Québec shareholders, including Ressources Québec. We look forward to working with these financial partners to advance the Horne 5 Project.”

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws and may not be offered or sold within the United States or to or for the account or benefit of a U.S. person (as defined in Regulation S under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

About Ressources Québec

Ressources Québec is a wholly owned subsidiary of Investissement Québec. Investissement Québec’s mission is to foster the growth of investment in Québec, thereby contributing to economic development and job creation in every region. The Corporation offers businesses a full range of financial solutions, including loans, loan guarantees and equity investments, to support them at all stages of their development. It is also responsible for administering tax measures and prospecting for foreign investment.

About SIDEX, s.e.c.

The mission of SIDEX is to invest in companies engaged in mineral exploration in Quebec in order to diversify Quebec’s mineral base and open new territories to exploration and investment.

About Capital Croissance PME II, s.e.c.

Capital croissance PME, the combined strength of Capital régional et coopératif Desjardins et de la Caisse de dépôt et placement du Québec, is an investment fund with the primary mission of providing patient capital to Québec SMEs to carry out a variety of expansion projects. Managed by Desjardins Business Capital régional et coopératif, CCPME is designed to meet the financing needs of Québec companies, primarily in the form of subordinated loans of less than $5 million.

About Falco

Falco Resources Ltd. is one of the largest mineral claim holders in the Province of Québec, with extensive land holdings in the Abitibi Greenstone Belt. Falco owns 74,000 hectares of land in the Rouyn-Noranda mining camp, which represents 70% of the entire camp and includes 13 former gold and base metal mine sites. Falco’s principal property is the Horne 5 project located in the former Horne Mine that was operated by Noranda from 1927 to 1976 and produced 11.6 million ounces of gold and 2.5 billion pounds of copper. Osisko Gold Royalties is the largest shareholder of the Company and currently owns 13.2% of the outstanding shares of the Company.

MORE or "UNCATEGORIZED"

PPX Mining Announces Closing Of $1.35 Million Private Placement

PPX Mining Corp. is pleased to announce that it has closed its fu... READ MORE

Elevation Gold Reports Financial Results for Year Ended December 31, 2023, including $66.4M in Total Revenue

Elevation Gold Mining Corporation (TSX-V: ELVT) (OTCQB: EVGDF) i... READ MORE

Reunion Gold Announces the Signing of a Mineral Agreement With the Government of Guyana for Its Oko West Project

Reunion Gold Corporation (TSX-V: RGD; OTCQX: RGDFF) is pleased to announ... READ MORE

Drilling Confirms 4 km of Favourable Corridor at Lynx Gold Trend

Puma Exploration Inc. (TSX-V: PUMA) (OTCQB: PUMXF) is thrilled to... READ MORE

Grid Metals Intersects 7 m at 1.28% Li2O at over 125 m Below the Previously Deepest Drill Holes at Donner Lake; Provides Project Update

Grid Metals Corp. (TSX-V:GRDM) (OTCQB:MSMGF) is pleased to announ... READ MORE