Exceptional drilling results support high grade, large scale and continuity of FireFly’s Green Bay Copper-Gold Project

Consistently strong intersections extend known mineralisation ahead of December quarter Mineral Resource Estimate update; First results from economic studies due early next year

KEY POINTS

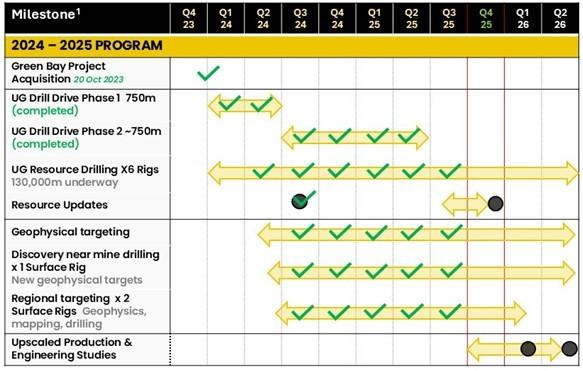

- FireFly made rapid progress during the quarter across the four key planks of its growth strategy; These comprise Mineral Resource growth, upgrading Inferred Resources to the Measured and Indicated (M&I) categories, new discoveries, and economic studies for an upscaled production restart at the Green Bay Project in Canada

- Growing global investor recognition of the strong outlook at Green Bay was reflected in FireFly’s addition to the S&P/ASX 300 Index

- Subsequent to the end of the quarter, FireFly announced assays from step-out drilling which extended the known mineralisation by another 650m (see ASX announcement dated 16 October 2025)

- The results included:

- 49.0m @ 6.1% copper equivalent (CuEq)1 (4.9% Cu & 1.3g/t Au) in hole MUG25-202 (~39.2m true thickness), including 14.3m @ 13.7% CuEq (10.6% Cu & 3.2% Au) (see ASX announcement dated 16 October 2025)

- Infill drilling of the Volcanogenic Massive Sulphide (VMS) lenses continued to generate outstanding assays including (see ASX announcement dated 17 July 2025):

- 11.6m @ 9.3% CuEq1 (6.0% Cu & 3.9g/t Au) in hole MUG24-128 (~ true thickness)

- 5.5m @ 7.1% CuEq (5.4% Cu & 2.0g/t Au) in hole MUG25-014 (~ true thickness)

- 14.6m @ 6.7% CuEq (5.4% Cu & 1.5g/t Au) in hole MUG25-032 (~ true thickness)

- Drilling of the broad Footwall Stringer Zone continued to demonstrate thick and consistent copper mineralisation, pointing to the potential for large-scale bulk mining. Intersections include (see ASX announcement dated 17 July 2025)

- 9.5m @ 6.4% CuEq (6.1% Cu & 0.4g/t Au) followed by a further zone of 24.9m @ 2.4% CuEq (2.2% Cu & 0.1g/t Au) in hole MUG25-073 (~ true thickness)

- 26.2m @ 5.3% CuEq (4.9% Cu & 0.4g/t Au) in hole MUG25-015 (~ true thickness)

- 24.1m @ 3.7% CuEq (3.5% Cu & 0.3g/t Au) in hole MUG25-042 (~ true thickness)

- The first modern geophysical programs were completed over the project area, resulting in numerous significant drill-ready targets being defined (see ASX announcement dated 24 July 2025)

- FireFly continued to lay the foundations at Green Bay with environmental approvals for an upscaled restart operation now secured,2 mining studies and construction permitting underway and metallurgical tests returning outstanding results (see ASX announcement dated 5 August 2025)

- Metallurgical tests on 1.5 tonnes of material from the Ming Mine showed that the mineralisation is metallurgically amenable to conventional low-cost processing, with copper recovery exceeding 98% and gold recovery exceeding 85% (see ASX announcement dated 5 August 2025)

- Exploration activities commenced at the prospective Tilt Cove Project that was acquired by the Company in late 2024; Historical mining at the Tilt Cove Mine, only ~30km east of the Ming Mine, produced ~170,000t of copper and 50,000oz of gold from a large-scale Volcanogenic Massive Sulphide (VMS) system (see ASX announcement dated 24 July 2025)

- Ground-based EM completed by FireFly at Tilt Cove confirmed an extensive untested conductive anomaly first identified by Newmont Exploration in the 1980s; Drill testing of the anomaly is planned for Q4 2025 (see ASX announcement dated 24 July 2025)

- FireFly successfully completed the second tranche of an equity raising and share purchase plan (SPP) (see ASX announcement dated 11 July 2025 and 3 September 2025)

- The Company emerged with ~A$129.7m3 in cash and liquid investments, ensuring it is well funded to execute the aggressive eight-rig drilling strategy and mining studies

| FireFly Managing Director Steve Parsons said: “The momentum at Green Bay continues to build, with exceptional drilling results and strong progress on upscaled production re-start studies.

“We are now seeing the benefits of our eight-rig drilling strategy, which continues to both extend and infill the known mineralisation. We are looking forward to feeding these results into the Mineral Resource Estimate update planned for later this year. “In parallel with the aggressive drilling campaign, we have identified numerous compelling targets which we will test early next year. These have the potential to make a significant impact on the project. “And our economic studies are progressing well, with metallurgical tests and engineering work among the activities underway on this front.” |

FireFly Metals Ltd (ASX:FFM) (TSX: FFM) is pleased to report on a highly productive quarter which saw the Company generate more outstanding drilling results ahead of its next Mineral Resource Estimate update and progress its studies on an upscaled production restart at Green Bay.

HIGH-GRADE INFILL DRILLING

During the quarter, FireFly announced outstanding assays from infill drilling which continue to show why Green Bay is a world-class copper-gold project with very high grades, continuous mineralisation, scale potential and existing infrastructure in a tier-one location.

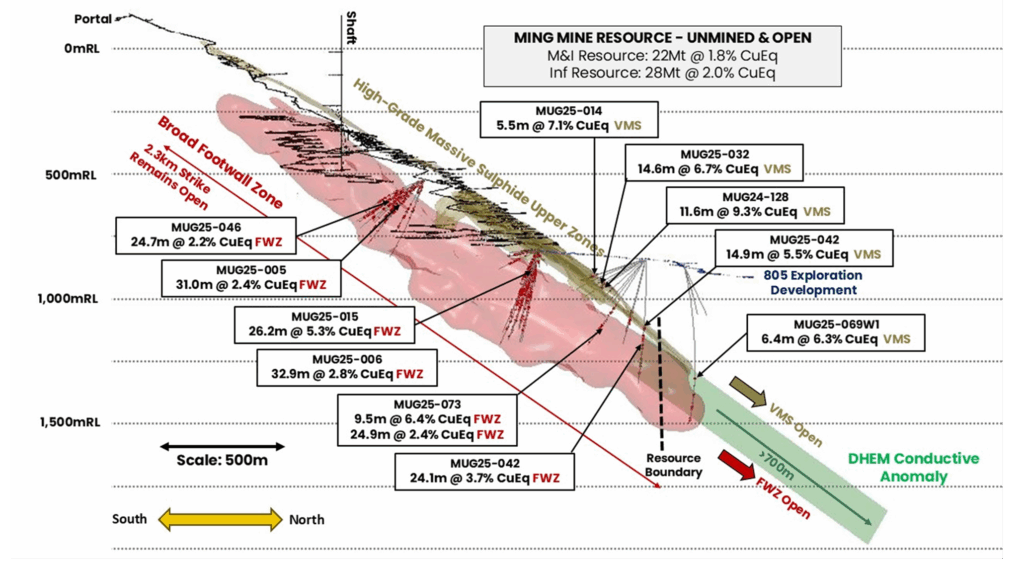

Figure 1: Long section through the Green Bay Ming underground mine showing the location of select drill results from ASX announcement dated 17 July 2025. Results from both the high-grade copper-gold VMS zone and broad copper Footwall Zone are shown. The green shape is a modelled DHEM anomaly (from hole MUG25-040 – see ASX announcement dated 7 May 2025 for further details). Drill assays >0.5% copper are shown in red.

The current Mineral Resource Estimate at the Green-Bay Copper-Gold Project stands at 24.4Mt @ 1.9% for 460Kt CuEq of M&I Resources and a further 34.5Mt @ 2.0% for 690Kt CuEq of Inferred Resources (see ASX announcement dated 29 October 2024).

An extensive six-rig underground drill campaign is underway with the dual objectives of growing the current Mineral Resource (four rigs) and upgrading more of the Inferred Resources to the higher-confidence Measured and Indicated categories (2 rigs).

The upcoming Mineral Resource Estimate (MRE) update, due later this year, will underpin upscaled mining and economic studies currently underway and scheduled for completion in early CY2026.

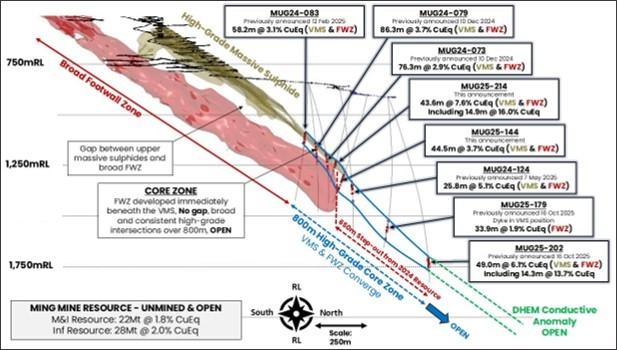

Figure 2: Long section through the Ming Mine highlighting the current ~800m strike of the extremely high-grade core zone and remains open. The FWZ stringer style mineralisation is developed directly beneath the upper high-grade VMS. Clipping +/- 30m

About the Drill Results

FireFly acquired the Green Bay Copper-Gold Project in October 2023 and began an extensive underground drilling campaign at Ming Mine. Since this time, the Company has completed approximately 123,064m of diamond core drilling to 30 September 2025. The diamond drilling is part of the extensive underground development program for the planned upscaling of the past-producing Ming Mine.

There are two distinct styles of mineralisation present at the Green Bay Ming Mine, consisting of a series of upper copper-gold rich Volcanogenic Massive Sulphide (VMS) lenses underlain by a broad copper stringer zone, known as the Footwall Zone (FWZ).

The Footwall Zone is extensive, with the stringer mineralisation observed over thicknesses of ~150m and widths exceeding 200m. The known strike of the mineralisation defined to date is 2.3km and it remains open down-plunge (see ASX announcement dated 16 October 2025).

Drilling continues to demonstrate continuity of the high-grade copper-gold rich VMS mineralisation, with key intersections including 11.6m @ 9.3% CuEq, 14.6m @ 6.7% CuEq, 14.9m @ 5.5% CuEq and 5.5m @ 7.1% CuEq (~true widths) (see ASX announcement dated 17 July 2025).

Infill drilling of the broader copper-rich footwall stringer zone repeatedly intersected thick and continuous mineralisation exceeding 2% copper. Highlights include 26.2m @ 5.3% CuEq, 24.1m @ 3.7% CuEq and 9.5m @ 6.4% CuEq (~ true widths) – supporting the possibility of bulk‐scale mining from the footwall domain (see ASX announcement dated 17 July 2025).

The development of phase two of the 805L exploration drive has now been completed. Two drill rigs have been mobilised to the northern extent of the platform and are testing mineralisation up to 650m beyond the current MRE. Subsequent to the quarter, on 16 October 2025, it was announced that results of such drilling extended the known mineralisation by 430m beyond previous drilling and more than 650m beyond the current MRE.

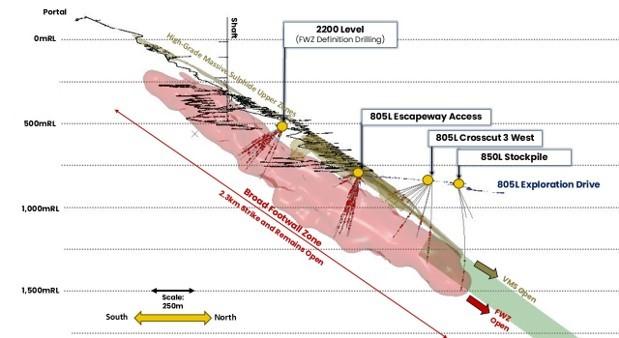

Figure 3: Long section through the Ming Mine showing the location of drill platforms and drilling reported in the ASX announcement dated 17 July 2025. Assay results greater than 0.5% Cu are shown in red.

Resource Conversion Drilling from the 805L Exploration Drive

Drilling from the 805L drill drive focused primarily on upgrading the data density in the high-grade copper-gold dominated VMS lenses defined by previously reported exploration drilling. The results demonstrate strong continuity and consistent high grades in the Ming North and South VMS lenses in addition to the FWZ (where targeted).

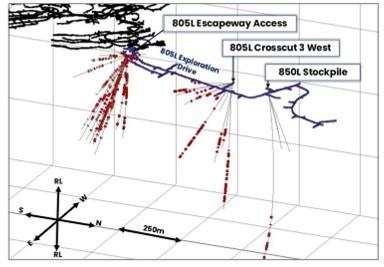

Drilling from the 805L was predominantly completed from the 805L Crosscut 3 West, 805 Escapeway Access and the 850L stockpile (Figure 3).

Figure 4: Isometric view of drill positions in the 805L Exploration drill drive. Drill results from the ASX announcement dated 17 July 2025 are shown with copper assays >0.5% shown in red.

Significant intersections4 announced on 17 July 2025 from resource definition drilling include, but are not limited to:

805L Crosscut 3 West

Hole MUG24-128 comprised of a thick copper and gold rich massive sulphide zone with local sericite altered stringers immediately beneath, delivering an intersection of:

- 11.6m @ 6.0% Cu, 3.9g/t Au, 11.4g/t Ag, 0.1% Zn (9.3% CuEq) from 187.4m (VMS-style)

Hole MUG25-032 contained an upper copper-gold massive sulphide zone grading into upper footwall style stringers:

- 14.6m @ 5.4% Cu, 1.5g/t Au, 11.6g/t Ag, 0.3% Zn (6.7% CuEq) from 214.7m (VMS-style)

Hole MUG25-014 intersected a massive sulphide zone with strong copper-gold mineralisation:

- 5.5m @ 5.4% Cu, 2g/t Au, 8.1g/t Ag, 0.4% Zn (7.1% CuEq) from 208m (VMS-style)

805L Escapeway Access

Hole MUG25-015 intersected a thick zone of very high-grade stringer-style mineralisation, with chalcopyrite routinely exceeding 10% of the zone:

- 26.2m @ 4.9% Cu, 0.4g/t Au, 7g/t Ag, 0.03% Zn (5.3% CuEq) from 167m (FW Stringer-style)

Hole MUG25-006 included numerous zones of copper stringer-style mineralisation, including:

- 32.9m @ 2.7% Cu, 0.1g/t Au, 2.9g/t Ag, 0.04% Zn (2.8% CuEq) from 154.2m (FW Stringer-style)

- 21.8m @ 2.0% Cu, 0.1g/t Au, 2.4g/t Ag, 0.01% Zn (2.1% CuEq) from 213m (FW Stringer-style)

Hole MUG25-009 intersected multiple thick zones of footwall stringer style mineralisation, including:

- 8.0m @ 2.1% Cu, 0.2g/t Au, 2.6g/t Ag, 0.01% Zn (2.3% CuEq) from 120m (FW Stringer-style)

- 4.3m @ 1.5% Cu, 0.1g/t Au, 2.4g/t Ag, 0.01% Zn (1.7% CuEq) from 155m (FW Stringer-style)

Hole MUG25-001 contained multiple zones of copper-dominated footwall stringer style mineralisation, including:

- 14.0m @ 1.8% Cu, 0.3g/t Au, 2.7g/t Ag, 0.04% Zn (2.1% CuEq) from 86m (FW Stringer-style)

- 15.6m @ 1.4% Cu, 0.1g/t Au, 2g/t Ag, 0.02% Zn (1.5% CuEq) from 150.9m (FW Stringer-style)

805L Stockpile

Hole MUG25-069W1 from the 850L Stockpile, the northernmost drilling completed to date, confirmed the presence of strong VMS-style mineralisation underlain by a broad footwall stringer zone. This stringer zone is at the projected margins of the lower footwall zone. Key intersections included:

- 6.4m @ 3.0% Cu, 3.6g/t Au, 25.6g/t Ag, 0.9% Zn (6.3% CuEq) from 458.7m (VMS-style)

- 20m @ 1.3% Cu, 0.1g/t Au, 1.3g/t Ag, 0.06% Zn (1.4% CuEq) from 572m (FW Stringer-style)

Resource Conversion Drilling from the 2200L Exploration Drive

Resource conversion drilling from the historical 2200 level of the Ming Mine is targeting an area of low drill density higher up in the mine, down-plunge of the historical shaft. (~500m RL).

Significant intersections5 announced on 17 July 2025 include, but are not limited to:

Hole MUG25-046 contained numerous mineralised zones throughout the hole, headlined by the broad intersection of:

- 24.7m @ 2.1% Cu, 0.2g/t Au, 2.3g/t Ag, 0.02% Zn (2.2% CuEq) from 201m (FW Stringer-style), including:

- 9.7m @ 2.8% Cu, 0.2g/t Au, 3.2g/t Ag, 0.02% Zn (3.0% CuEq) from 216m

Hole MUG25-005 intersected multiple zones of stringer-style copper dominated mineralisation, including:

- 5.4m @ 1.8% Cu, 0.1g/t Au, 2.0g/t Ag, 0.04% Zn (2.0% CuEq) from 130m (FW Stringer-style)

- 31.0m @ 2.2% Cu, 0.3g/t Au, 2.3g/t Ag, 0.02% Zn (2.4% CuEq) from 156m (FW Stringer-style)

Hole MUG25-034 drilled multiple zones of stringer-style chalcopyrite rich veins, with key intersections including:

- 8m @ 2.0% Cu, 0.2g/t Au, 2.5g/t Ag, 0.01% Zn (2.2% CuEq) from 138.7m (FW Stringer-style)

- 6.4m @ 1.8% Cu, 0.1g/t Au, 1.7g/t Ag, 0.01% Zn (1.9% CuEq) from 154.7m (FW Stringer-style)

STEP-OUT DRILLING FOR MINERAL RESOURCE GROWTH

During the quarter, FireFly conducted step-out drilling from the end of the Ming Mine exploration drive. Subsequent to the quarter, on 16 October 2025, it was announced that the results of such drilling extended the known mineralisation by 430m beyond previous drilling and more than 650m beyond the current MRE.

METALLURGICAL RESULTS

On 5 August 2025, FireFly announced results from a comprehensive metallurgical test program completed on ~1,500 kg of bulk samples of mineralisation from the Ming Mine at Green Bay, undertaken at the SGS Canada Inc. metallurgical facility in Lakefield, Ontario.

The bulk samples for metallurgical testing incorporated representative samples of both the high-grade VMS lenses and the broader FWZ, and included numerous blend ratios to inform the economic studies.

The metallurgical test work is a key component of the economic studies currently underway, which will be incorporated into the Scoping Study6 due for completion in the March quarter of 2026.

Using an optimised flowsheet, metal recoveries to final copper concentrate from all samples averaged +98% for Copper, +75% for Gold and +78% for Silver. Subsequent gravity and conventional leach testing of the pyrite flotation tails improved precious metals recoveries, with gold recovery rising to +85% and silver to +84%.

These results are a significant improvement in comparison to recoveries attained by the previous operator through the small-scale 500ktpa Nugget Pond processing plant.

The improved gold recovery has the potential to enhance the economics of the upscaled restart, with the current MRE containing a total of 550koz of gold7 across all Mineral Resource categories, making it a significant contributor to potential future cash flow.

The ore proved metallurgically simple and amenable to conventional, low-cost processing, backed by favourable grindability (Bond Work Index of 10.4-11.4 kWh/t) and low abrasive index (0.1-0.18 g), suggesting lower than average power, maintenance and consumable costs.

These positive results will feed directly into refining processing design, cost models, and revenue assumptions in the upcoming economic and scoping studies.

ENVIRONMENTAL APPROVAL

FireFly is rapidly laying the foundations for a staged upscaled production restart at Green Bay.

As announced on 5 August 2025, FireFly has obtained a conditional environmental release (Environmental Release) from the Province of Newfoundland and Labrador that permits an initial upscaled restart of operations at Green Bay, with a processing plant throughput capacity of 1.8 Mtpa.8

As a result of this decision, no further detailed environmental and socio-economic assessments are required for that scale of restart, enabling FireFly to proceed toward construction permit applications and early works.

Applications for construction permits are underway, and early seasonal site preparation works are planned to begin in late 2025.

Ongoing environmental monitoring and closure planning are in progress, supported by external consultants to ensure compliance, including with the conditions of the Environmental Release.

The plant capacity is a technical specification forming part of the environmental submission and not a forecast of the estimated production of the mining operation. The mining operation’s forecast production will not be estimated until such time as the Company has prepared and announced its Scoping Study. Should a larger scale case be adopted than contemplated by the Environmental Release, further assessment may be required by government agencies.

ENGINEERING STUDY UPDATES

FireFly has engaged leading consultants to progress optimal mining and processing designs.

Conceptual mining studies by Entech recommend Transverse Long Hole Open Stoping for the broader footwall zones and conventional Long Hole Open Stoping for the high-grade VMS zones, both utilising full backfill strategies to optimise extraction.

The Company is designing a paste backfill system that can encapsulate over 50% of tailings underground, offering both operational and environmental benefits.

Process engineering progress is also being advanced. Ausenco is refining the process flowsheet, incorporating the recent metallurgical testwork to guide design choices.

Preliminary design and trade-off studies for the tailings storage facility (TSF) have been completed by Knight Piesold, with final designs to be delivered in the coming months. Sterilisation and geotechnical drilling in the proposed TSF and processing plant areas have confirmed favourable rock conditions and did not intersect mineralisation.

Newfoundland and Labrador Hydro is conducting the power supply studies which are due for completion before the end of the year. Existing high voltage hydro transmission lines traverse the property and are expected to play an important role in the future development of the upscaled production at the Ming Mine.

In March 2025, Natural Resources Canada announced conditional approval of contribution funding of the Green Bay Power Assessment Project through the Critical Minerals Infrastructure Fund. Subsequent to the quarter, on 2 October 2025, NRCan and FireFly signed a non-repayable contribution agreement for up to C$613,775 in funding to support the Project. This project will advance electrification studies to support the development of infrastructure required to expand critical minerals production in the Province of Newfoundland and Labrador.

The overall study timeline suggests completion of a Scoping Study9 in the March quarter of 2026. The Scoping Study will integrate the mining, processing, infrastructure and permitting elements into one cohesive economic assessment.

REGIONAL EXPLORATION AND GREENFIELDS COPPER-GOLD TARGETS

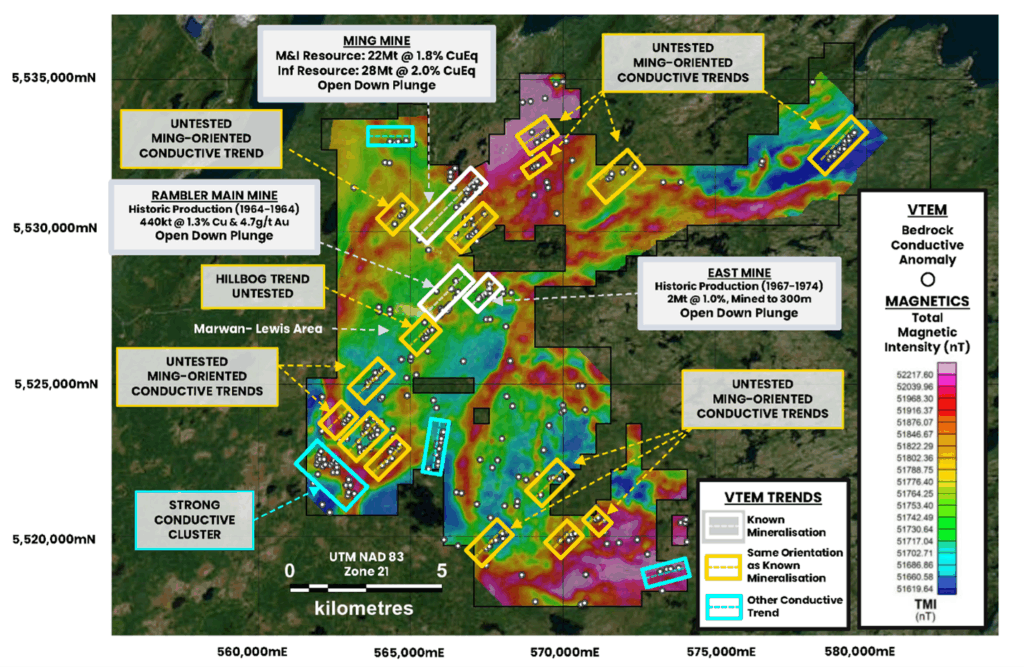

On 24 July 2025, the Company announced the results of a modern geophysical campaign over the central Green Bay Copper-Gold Project claims, which has identified 325 conductive anomalies potentially caused by copper-gold bearing sulphide mineralisation considered to be look-alikes to the known deposits (e.g. Ming, Rambler Main, East Mine). The surveys, comprising airborne electrical and magnetic data plus localised ground electromagnetic follow-up, represent the first modern regional geophysics over the area and strengthen the case for significant discovery upside.

Geophysics is a key exploration tool at Green Bay, with the mineralisation at the Ming deposit and other known deposits exhibiting strong responses to electromagnetic surveys due to the conductive nature of the chalcopyrite-rich sulphide mineralisation.

Many of the 325 anomalies occur as coherent trends that exhibit strong resemblance to known mineralisation in the district. Similarities include geological setting, orientation of the trends (North-East, similar to Ming), and magnitude of the conductive responses.

Due to the significant number of high priority new geophysical targets, FireFly has mobilised a second surface diamond drill rig and plans to accelerate surface exploration, particularly in prospective zones such as the Hillbog and Southwest areas adjacent to the Ming, Rambler, and East Mines. The Company plans to systematically drill test the high-priority anomalies beyond the known deposits to confirm the cause of the anomalous response, which could include copper and gold bearing sulphides.

Based on the strength of the targets generated, the Company intends to fast-track the surface discovery program with part of the proceeds of the recent capital raising. A total of ~C$10 million raised via the issue of Canadian flow-through shares as part of the June 2025 equity raising (see ASX announcement dated 5 and 10 June 2025) has been allocated to discovery, targeting and testing of greenfields areas at Green Bay through to December 2026.

Recently, surface drilling has been focused on testing mineralisation proximal to historical deposits such as the Rambler Main and East Mines. Results previously announced from drilling at Main Mine included 10m @ 6.4% CuEq and 12.9m @ 4.3% CuEq (see ASX announcement dated 15 May 2025).

Figure 5: Multiple significant new targets from the recent airborne VTEM and magnetic geophysical surveys. The white dots represent bedrock conductive anomalies. There are numerous untested conductive trends in a similar orientation (yellow boxes) to the known mineralisation at the Ming, Rambler Main and East Mines (white boxes). So far, a total of 325 conductive responses have been identified which are significant and potentially caused by copper-gold bearing sulphide mineralisation.

Initial Targets

TILT COVE PROJECT

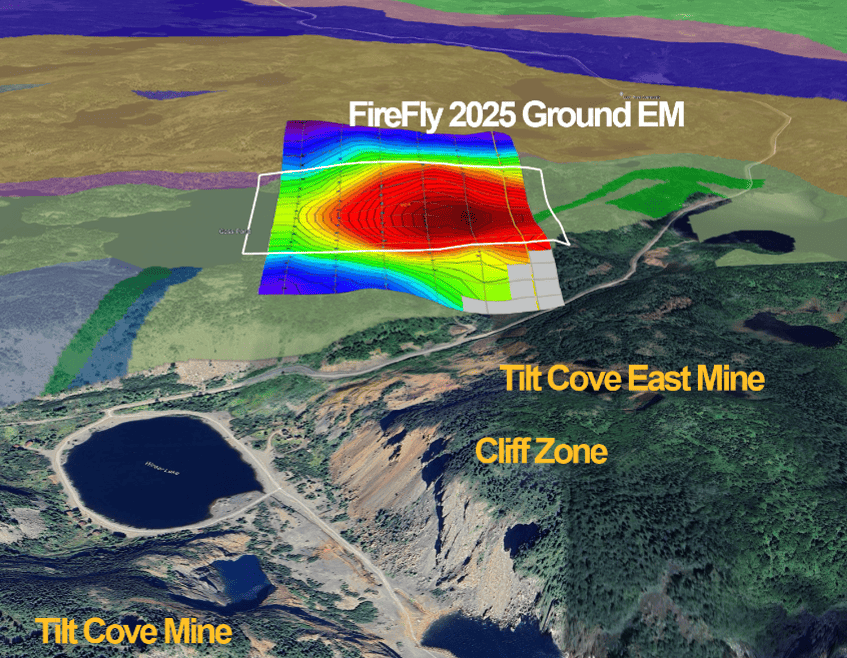

FireFly has commenced exploration at the recently acquired Tilt Cove Project, located approximately 30 km east of the Ming Mine. Tilt Cove is a large-scale copper-gold VMS system that historically produced around 170,000 t of copper and 50,000 oz of gold between 1864 and 1967, with limited modern exploration completed since.

Ground EM surveys have confirmed a strong, large-scale conductive anomaly (Figure 6) at the project, which is scheduled for drill testing later in 2025 (see ASX announcement dated 24 July 2025).

In addition, FireFly is completing a lease-wide airborne VTEM and magnetic survey over the project area, the first of its kind at Tilt Cove, with results to be reported as they become available (see ASX announcement dated 27 October 2025).

RAMBLER MAIN MINE AND EAST MINE AREA: HILLBOG TARGET

In addition to identifying the surface expression of both historical Rambler Main and East Mines, the airborne VTEM survey identified a large previously unknown look-alike anomaly 300m to the south of Rambler Main Mine, known as Hillbog (see ASX announcement dated 24 July 2025).

Drilling of this target has commenced.

SOUTHWEST TARGET AREA

In the Southwest portion of the Green Bay Project, approximately 8 km SW of Ming Mine, a series of large untested EM anomalies have been defined in prospective volcanic rocks (Figure 6). The area is covered by glacial sediments and boulders with very little outcropping exposures. The EM response is similar to known mineralisation within past producing copper mines on FireFly’s land package.

Figure 6: Tilt Cove Copper-Gold Project area showing the large-scale conductor (red) identified by FireFly’s ground-based EM survey. This conductor is significant and potentially caused by copper-gold bearing sulphide mineralisation. These results confirm an anomaly earlier identified in a 1983 EM survey completed by Newmont Exploration. The anomaly has yet to be drill tested and will be the subject of maiden drilling later in 2025.

FORWARD WORK PLANS

Near-term drilling activities at the Green Bay Copper-Gold Project will continue to focus on three key areas: Mineral Resource Growth, Upgrading the Mineral Resource (with infill drilling results) and New Discoveries from both underground and surface. At 30 September 2025, the Company had completed 251 drill holes for ~123,064 metres of underground diamond drilling. A total of six underground rigs will continue to advance the underground Mineral Resource growth and development activities. Additionally, a second surface drill rig has been mobilised to fast-track surface regional discovery.

Green Bay (Ming Mine) Mineral Resource Growth and Development

The low-cost Mineral Resource growth strategy is underpinned by the 805L exploration drill drive at the Ming Mine. The Company has invested in 2,335 metres of underground exploration and ancillary development since acquisition of the project in October 2023 to provide drill platforms to accelerate growth and discovery from underground. The second phase of 805L Exploration drive has been completed, providing locations for both infill drilling and further down-plunge Mineral Resource extension. Underground drilling from the drill drive is currently underway to test the Ming mineralisation up to 650m beyond the current Mineral Resource boundary. Subsequent to the quarter, on 16 October 2025, it was announced that initial results of such drilling extended the known mineralisation by 430m beyond previous drilling and more than 650m beyond the current MRE. The relevant results included:

- 49.0m @ 6.1% CuEq (4.9% Cu & 1.3g/t Au) in hole MUG25-202 (~39.2m true thickness), including 14.3m @ 13.7% CuEq (10.6% Cu & 3.2% Au) (see ASX announcement dated 16 October 2025).

Development of additional platforms for further ongoing exploration and infill drilling will continue at Ming throughout 2025.

Upgrading the MRE remains a key priority for the Company’s plans to resume upscaled mining at Green Bay. Infill drilling is expected to upgrade the Inferred Resource (34.5Mt @ 2.0% CuEq) at Ming to the higher quality M&I Resource categories which currently stand at 24.4Mt @ 1.9% CuEq10.

Based on results to date, it is likely that the amount of mineralisation classified as M&I will increase in the MRE update currently planned by year-end 2025.11 This will be important for future economic studies.

Economic evaluation of the proposed upscaled resumption of production at Green Bay is in full-swing. Key consultants have been appointed to complete the economic studies, including Entech, Ausenco, Stantec and Knight Piesold. SGS have completed comprehensive metallurgical test work on samples of both VMS and footwall stringer-style mineralisation. The results have demonstrated considerable improvement (see ASX announcement dated 5 August 2025). Such results are expected to be a catalyst for ongoing discussions with potential offtake groups interested in securing the high-quality copper-gold concentrate expected to be produced from the Ming Mine. Various scenarios for an upscaled restart to operations are being evaluated. With the huge success of the drilling programs to date, the Company wishes to avoid unnecessarily limiting the size of any future potential upscaled mining operation until it has completed the next phase of growth drilling.

The first economic studies are currently planned for completion in Q1 2026.10

Having received from the Environmental Release from the Newfoundland and Labrador Department of Environment and Climate Change, FireFly will has now commenced applying for early works and construction permits.

Green Bay (Ming Mine) Regional Discovery

Based on the quality of targets identified, the Company is accelerating the regional discovery program at Green Bay over the next 6-12 months.

Surface drilling during 2025 has focused on extensions of mineralisation at Rambler Main Mine. Further assay results from this program are expected in the coming weeks. The second surface rig is testing targets beyond the known deposits. Key priority areas to be tested include the Hillbog prospect and Southwest target area.

Geophysics is a key exploration tool at Green Bay, with the mineralisation at Ming and other known deposits exhibiting strong responses to electromagnetic surveys due to the conductive nature of the chalcopyrite-rich sulphide mineralisation.

Targets identified by recent VTEM surveys are scheduled to be systematically drill tested in upcoming exploration drilling campaigns through to December 2026.

Exploration will also ramp up at the Company’s Tilt Cove Project. Follow-up drill testing of the conductive anomaly, that was confirmed by ground-based EM, is scheduled before the end of 2025.

Figure 7: Key 2024-2025 milestones for the Green Bay Copper-Gold Project.

- Timelines are indicative and may be subject to change.

PICKLE CROW GOLD PROJECT

No field activities were undertaken by the Company at the Pickle Crow Gold Project during the quarter due to the team’s focus on the development and exploration activities at the Green Bay Copper-Gold Project.

As announced on 30 April 2025, the Company appointed BMO Capital Markets to assist with a strategic review with respect to the Company’s 70% interest in the high-grade Pickle Crow Gold Project. The objective of the Strategic Review is to evaluate options to maximise value for shareholders and allow the Company to focus on progressing the Green Bay Copper-Gold Project. The BMO-led Strategic Review, including a thorough evaluation of strategic alternatives and recommendations to maximise shareholder value, is being evaluated and finalised. A conclusion is expected to be completed and released to the market by the end of 2025.

Investors are cautioned that there is no guarantee that the Strategic Review will result in the divestment of all or any part of the Company’s interest in the Pickle Crow Gold Project and the Company will otherwise keep the market updated in accordance with its continuous disclosure obligations.

CORPORATE

S&P/ASX 300 Index

On 5 September 2025, the Company was announced by S&P Dow Jones Indices as an addition to the S&P/ASX 300 Index, effective prior to the open of trading on 22 September 2025, as a result of the September quarterly review.

FINANCIAL OVERVIEW

Share Purchase Plan (SPP)

On 11 July 2025, FireFly announced that due to strong investor demand it had doubled its SPP from A$5.0 million to A$10.0 million. The SPP was completed on 14 July 2025, with the issue of 10,416,666 ordinary fully paid shares in the Company (New Shares).

The SPP was undertaken concurrently with the Company’s broader equity raising of ~A$98.1 million comprising the following components (together, the Equity Raising):

- ~A$11.2 million (~C$10.0 million) charity flow-through placement to Canadian investors at a price of approximately A$1.49 per share (Charity Flow-Through Placement) which completed on 13 June 2025 with the issue of 7,559,539 New Shares;

- ~A$54.9 million two-tranche institutional placement at a price of A$0.96 per share (Institutional Placement) of which the first tranche completed on 16 June 2025 with the issue of 28,064,281 New Shares and second tranche completed on 3 September 2025 with the issue of 29,166,667 New Shares; and

- ~A$32 million (C$28.4 million) fully underwritten Canadian bought deal offering with BMO Capital Markets at a price of C$0.86 per share (Canadian Offering) which completed on 23 June 2025 with the issue of 33,000,000 New Shares.

The net proceeds from the Equity Raising and SPP are primarily allocated to exploration and development expenditures at the Green Bay Copper-Gold Project, including underground development, resource extension and infill drilling, regional and near mine exploration and drill testing, and pre-construction and study works. The net proceeds were also be used to cover transaction costs of conducing the Equity Raising and will also be used for working capital.

CASH FLOW

At 30 September 2025, FireFly had a cash balance of A$114.3 million. During the quarter, the Company incurred net cash outflows from operating activities of A$2.8 million and investing activities of $17.8 million. The Company received net cash inflows from financing activities of A$35.3 million. Key movements by activity classification are provided below.

Operating Activities

The net cash outflow from operating activities for the quarter of A$2.8 million comprised:

- A$0.6 million payments for care and maintenance and site costs associated with the Green Bay Copper-Gold Project;

- A$0.9 million for payments of annual insurance premiums, payroll tax (for the prior financial year) and prepaid expenses;

- A$2.3 million payments for staff, administration and corporate costs in both Australia and Canada; and

- A$1.0 million receipts of interest and other income.

Investing Activities

The net cash outflow from investing activities for the quarter of A$17.8 million comprised:

- A$18.1 million for payments associated with the underground development drive, exploration drilling, and project and engineering studies expenditure at the Green Bay Copper-Gold Project;

- A$0.1 million for acquisition of plant and equipment; and

- A$0.4 million of proceeds received from the sale of plant and equipment.

Financing Activities

Net cash inflows from financing activities for the quarter of A$35.3 million comprised:

- A$10.0 million of gross proceeds from completion of the SPP on 14 July 2025;

- A$28.0 million of gross proceeds from completion of tranche two of the Institutional Placement on 3 September 2025, offset by:

- payment of A$2.5 million for transaction costs associated with the Equity Raising; and

- A$0.2 million for payments associated with the lease of equipment for the Green Bay Copper-Gold Project and office space.

PAYMENTS TO RELATED PARTIES

During the quarter, the Company made payments to related parties of A$380,000 which comprised executive directors’ salaries and superannuation, non-executive directors’ fees, and payments to Exia-IT Pty Ltd for IT support services and IT equipment.12

ABOUT FIREFLY METALS

FireFly Metals Ltd is an emerging copper-gold company focused on advancing the high-grade Green Bay Copper-Gold Project in Newfoundland, Canada. The Green Bay Copper-Gold Project currently hosts a Mineral Resource prepared and disclosed in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code 2012) and Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects of 24.4Mt of Measured and Indicated Resources at 1.9% for 460Kt CuEq and 34.5Mt of Inferred Resources at 2% for 690Kt CuEq. The Company has a clear strategy to rapidly grow the copper-gold Mineral Resource to demonstrate a globally significant copper-gold asset. FireFly has commenced a 130,000m diamond drilling program.

FireFly holds a 70% interest in the high-grade Pickle Crow Gold Project in Ontario. The current Inferred Resource stands at 11.9Mt at 7.2g/t for 2.8Moz gold, with exceptional discovery potential on the 500km2 tenement holding.

The Company also holds a 90% interest in the Limestone Well Vanadium-Titanium Project in Western Australia.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE