EXCELLON ANNOUNCES AGREEMENT TO ACQUIRE PAST PRODUCING LA NEGRA MINE IN MEXICO

ACQUISITION OF THE LA NEGRA MINE IN ALL SHARE TRANSACTION

COMPANY PLANS TO RESTRUCTURE CONVERTIBLE DEBENTURES ADDING FINANCIAL FLEXIBILITY

COMPANY PLANS SUBSCRIPTION RECEIPT PRIVATE PLACEMENT TO FINANCE PROJECT DEVELOPMENT

Excellon Resources Inc. (TSX: EXN) (NYSE: EXN) (FRA: E4X2) is pleased to announce that it has entered into a definitive acquisition agreement to acquire the permitted, past-producing La Negra Mine located in Querétaro State, Mexico from Dalu S. à r.l. an entity owned by an investment fund managed by Orion Resource Partners for aggregate consideration of US$50 million paid through upfront payments totalling US$20m, payable in common shares of the Company, and a further US$30m of deferred, contingent consideration payable in common shares of the Company or in cash at the Company’s option, following the restart of commercial production.

Concurrent with the execution of the Agreement, Excellon has entered into a binding term sheet with holders representing approximately 66 2/3% of the principal amount of outstanding convertible debentures to convert 25% of the Debentures into equity and reprice and extend maturity of remaining principal outstanding upon closing the Acquisition, providing greater flexibility to the Company.

La Negra Highlights:

- La Negra, a past producing mine with historical production averaging +3.0 million silver-equivalent ounces annually1

- Brownfields site with permits to restart production, existing infrastructure including a 3,000 tonne per day mill, mine development, camp facilities, all-season highway access and existing workforce

- Completed Preliminary Economic Assessment with an effective date of March 31, 2022 supported by an NI 43-101 technical report (the “La Negra Technical Report”)2

- Indicated Mineral Resources of approximately 15.1 million oz AgEq and Inferred Mineral Resources of approximately 41.8 million oz AgEq3

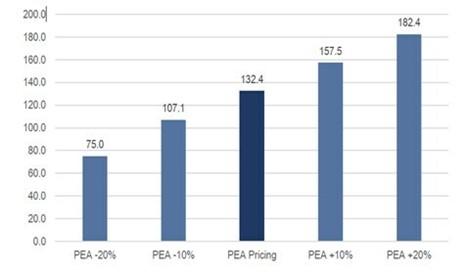

- PEA demonstrates a Post-tax NPV5% of US$132.4 million4

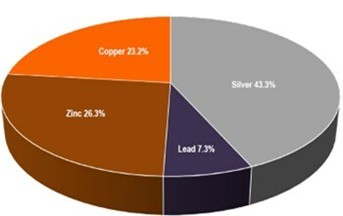

- Polymetallic production mix: 43% Ag, 26% Zn, 23% Cu, 7% Pb by NSR contribution3,4

- Near-term restart of La Negra: 12-18 month development plan de-risking mine restart

- New labour agreement in place, local workforce and communities strongly support a restart

- Local partner, Grupo Desarrollador Migo, S.A.P.I. de C.V. (“M Grupo”) to become key shareholder in Excellon

- Located in Querétaro, one of the most stable states to operate in Mexico

- Opportunities to expand current Mineral Resource estimates with multiple untested near-mine exploration target areas

- Significant exploration potential along the regional structures controlling mineralization and below unconstrained skarn bodies

| _________________________________________ |

| 1 Average annual production from 2013 to 2015 at throughput of approximately 2,500 tpd. |

| 2 See Cautionary Statements regarding “Preliminary Economic Assessments” at the end of this news release. Refer also to the La Negra Technical Report, which will be filed within 45 days of the date of this news release. |

| 3 Mineral Resource Estimate effective as at March 31, 2022 prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101“) of the Canadian Securities Administrators (“CSA“). See also Cautionary Statements on “Mineral Resources” and to “U.S. Readers” at the end of this news release. Once filed, refer also to the La Negra Technial Report which, as noted, the Company expects to file under its profile at www.sedar.com within 45 days, and will announce by news release upon such filing. |

| 4 Long-term commodity price estimates used in analysis: US$22.00/oz Ag, US$1.15/lb Zn, US$3.60/lb Cu, US$0.95/lb Pb |

Shawn Howarth, President and CEO commented, “Excellon has a long history of operational excellence in Mexico. The acquisition of La Negra will be transformational for Excellon, with the goal of returning the Company to producer status on an accelerated timeline. La Negra stands out as a permitted, near-term restart opportunity capable of generating significant value. Our strategy is to restart the mine following a 12-18 month de-risking process that we believe will position the Company for operational readiness by early 2024. We also see significant upside potential in the currently defined Mineral Resource estimates, which despite La Negra’s 50-year production history, remains relatively under-explored, and the system remains open along strike and at depth. An infill drill program has been budgeted for and is considered to be a critical component of longer-term success.”

Mr. Howarth added “The transaction further highlights the strengths each party is delivering in an all-share deal. At Excellon, we believe that we have the management experience and operational know-how to successfully restart La Negra. We are pleased that M Grupo, who has the in-country relationships at the community, labour and government levels to support a seamless transition, will become a new significant shareholder of the Company and a continuing local resource for La Negra. We are also excited to be partnering with Orion as another new, significant shareholder and expected long-term strategic supporter of the asset and the Company.”

A presentation on the Acquistion and La Negra is available on the Company’s website under https://excellonresources.com/investors/presentations under a link entitled La Negra Acquisition. In addition, the Company plans to file the La Negra Technical Report within 45 days of the date of this news release and will announce such filing by news release.

Acquisition and Debenture Restructuring Highlights

- All-Share Acquisition of the La Negra Mine

- Up to US$50 million aggregate consideration, of which 60% will be paid to the Seller in respect of the acquisition of all of the outstanding shares of the holding company of La Negra, and 40% will be paid to M Grupo in satisfaction of the termination of existing joint venture arrangements regarding La Negra.

- Orion previously entered into an agreement with its local joint venture partner, M Grupo, a privately held, Querétaro-based infrastructure and construction company with a more than 30 year track record and long-standing in-state and national relationships, that specified that 40% of the proceeds from a sale of La Negra would be for the account of M Grupo.

- Up front US$20 million payment will be paid 60% to the Seller in respect of the purchase of the shares and 40% to M Grupo in satisfaction of the termination of the joint venture arrangements.

- Deferred payments of US$30m in the aggregate (payable in two tranches, as described below), contingent on successfully achieving commercial production, payable to Orion and M Grupo on the same 60% / 40% basis.

- Restructuring of the Debentures

- Conversion of C$4.5 million, or 25%, of the Debentures principal to equity upon closing the Acquisition at a conversion price of C$0.48 per Excellon Share

- Adjustment of conversion price for the remaining principal to C$0.535 per share

- Extension of maturity of remaining principal from July 30, 2023 to April 30, 2027

- Private placement for a minimum of US$10 million (the “Closing Private Placement”)

- Planned subscription receipt financing to provide development capital

- Proceeds to fund 12-18 month development plan and general corporate purposes

Excellon Restart Strategy for La Negra: 12 to 18-month Timeline

Excellon is targeting a restart timeline of 12 to 18 months for La Negra. While the Company believes there is potential to optimize this timeline, critical work streams need to be completed prior to reassessing restart timing.

La Negra is a prior producer that has historically operated at 2,500+ tpd throughput. A Preliminary Economic Assessment was completed for the asset, with an effective date of March 31, 20222. The PEA concluded there was adequate detail and information to support a positive economic outcome and recommended restart of La Negra, particularly as this is a brownfields site with existing infrastructure, equipment, development, operating permits and labour force.

A summary of the PEA conceptual life-of-mine statistics is provided in the following table (and additional detail is set out below under the heading “Summary of the PEA for La Negra”)2:

| La Negra PEA Summary – LOM Statistics | ||

| Unit | Value | |

| Mine Life5 | Years | 7.4 |

| LOM Tonnage | kt | 6,223 |

| LOM Average Silver (Ag) Grade | g/t | 63 |

| LOM Average Lead (Pb) Grade | % | 0.4 |

| LOM Average Zinc (Zn) Grade | % | 1.5 |

| LOM Average Copper (Cu) Grade | % | 0.4 |

| LOM Process Rate | tpd | 2,500 |

| Average Annual Payable Metal | ||

| Silver | 000 oz | 1,227 |

| Lead | 000 lbs | 5,521 |

| Zinc | 000 lbs | 19,126 |

| Copper | 000 lbs | 4,262 |

| Economics6 | ||

| Restart Capital | US$m | $20.9 |

| AISC7 | US$/oz AgEq | $12.95 |

| Post-Tax NPV 5% | US$m | $132.4 |

| Post-Tax NPV 7.5% | US$m | $119.0 |

| __________________________________________ | ||

| 5 Based on current Mineral Resource Estimate | ||

| 6 AgEq calculated utilizing the metals price assumptions in the PEA and provided in the table under Economic Analysis below | ||

| 7All-in sustaining cost, or AISC, is a non-GAAP financial measures with no standardized meaning under IFRS and therefore, may not be comparable to similar measures presented by other issuers. AISC for La Negra is a forward-looking non-GAAP financial measure without historical equivalents given the lack of recent operations at La Negra. | ||

The following key areas need to be assessed to further advance the PEA and de-risk restart planning:

- Tailings management: The PEA contemplates construction of a filtered tailings facility to replace historical hydraulic tailings deposition. Approximately 50% of the restart capital is allocated to filtered tailings and conveyance.

- Infill drilling: The Company plans to undertake an infill drill program aimed to better define mineralization scheduled for the initial three years of the current conceptual Life of Mine production plan.

- Mine plan and equipment review: Explore opportunities for planning optimization, based on information gathered during infill drilling and further assessment of mining equipment and infrastructure at site.

- Processing analysis and metallurgical test work: The historical mill requires refurbishment to return it to operational status. During this refurbishment period the Company will also undertake metallurgical test work to explore opportunities to optimize metallurgical recoveries.

La Negra Mineral Resource Estimate3

The Mineral Resource estimate presented in the following table is derived from the La Negra Technical Report and is effective as at March 31, 2022 and is reported at a base case cut-off grade of US$28/t net smelter return accounting for value from Ag, Pb, Zn and Cu, treatment and refining charges, and penalties from arsenic (As) and iron (Fe).

A drill program was completed in 2021 consisting of 35 underground diamond drill holes totaling 9,800 metres. The global database contains 47,000 underground and surface drill hole assays.

The mineral resources have been estimated using Ordinary Kriging with assay data collected from diamond drilling, channel sampling, and long-hole production sampling. Samples have been selected and the block model has been defined by 35 mineral zone solids constructed via implicit modelling using a mineral domain spatial cut-off of US$20/t as a general guide.

| La Negra Mineral Resource Estimate3 | |||||||||

| Grade | Contained Metal | ||||||||

| Classification | Tonnes (m) |

Ag (g/t) |

Zn (%) |

Cu (%) |

Pb (%) |

Ag (m oz) |

Zn (m lbs) |

Cu (m lbs) |

Pb (m lbs) |

| Indicated | 2.46 | 64.0 | 1.95 % | 0.50 % | 0.27 % | 5.1 | 105.8 | 27.1 | 14.6 |

| Inferred | 6.42 | 80.0 | 1.80 % | 0.40 % | 0.65 % | 16.5 | 254.8 | 56.6 | 92.0 |

| See Cautionary Statements on “Mineral Resources” at the end of this news release. Mineral Resources are stated as undiluted. Quantity and grades are estimates and are rounded to reflect the fact that the resource estimate is an approximation. NSR includes the following price assumptions: Ag US$20.0/oz, Pb US$0.90/lb, Zn US$1.10/lb and Cu US$3.30/lb based on the Q3 2021 Q3 long-term forecasts provided by Duff & Phelps (D&P). NSR includes varying recovery with the averages of 80% Ag, 68% Pb, 80% Zn, and 66% Cu | |||||||||

Detailed Terms of the Acquisition

Excellon has agreed to acquire all of the issued and outstanding shares of Minera La Negra, S.A de C.V. the Mexican company that holds title to La Negra. Excellon has agreed to pay an aggregate of up to US$50,000,000 in connection with the purchase of MLN. Upon closing of the Acquisition, Excellon will issue the Seller and M Grupo an aggregate of 56,191,666 common shares of Excellon at a price of C$0.48 per Excellon Share (33,715,000 Excellon Shares to be issued to the Seller and 22,476,666 to be issued to a subsidiary of M Grupo), for a deemed value of US$20,000,000 upon closing of the Acquisition.

In addition, Excellon has agreed that it will pay aggregate deferred, consideration of US$30,000,000 through two payments to the Seller and M Grupo:

| (a) | within three days after the declaration of commercial production at the La Negra Mine, Excellon will pay an aggregate of US$15,000,000 to the Seller and M Grupo; and | |

| (b) | twelve months after the declaration of commercial production at the La Negra Mine, Excellon will make a further aggregate payment of US$15,000,000 to the Seller and M Grupo. | |

With respect to the Deferred Consideration Payments, 60% of such payments will be made to the Seller and 40% will be made to M Grupo. The Agreement provides that commercial production at the La Negra Mine will be achieved upon the restart of the La Negra mine and the associated plant and the production of saleable concentrate for three consecutive months at 75% of the nameplate capacity of the plant.

Excellon may, at its sole election, satisfy either or both Deferred Consideration Payments by issuing Excellon Shares at a price equal to the 20-day volume-weighted average trading price for the Excellon Shares on the Toronto Stock Exchange ending on the day prior to the issuance of such Excellon Shares, or in cash.

In connection with the Acquisition, Excellon, the Seller and M Grupo have agreed to terminate the Joint Venture Agreement between the Seller and M Grupo upon M Grupo’s (or a subsidiary thereof) receipt of 40% of the Closing Date Consideration Shares and as mentioned above, M Grupo will thereafter be entitled to similarly receive 40% of the Deferred Consideration Payments. As a result of the Acquisiton, it is expected that Orion and M Grupo will become significant shareholders of Excellon. Upon completion of the issuance of the Closing Date Consideration Shares, it is expected that the Seller and M Grupo will hold approximately 26% and 17%, respectively, of Excellon’s then issued and outstanding common shares, depending on the aggregate number of Excellon Shares issued pursuant to the Company’s anticipated Closing Private Placement.

In recognition of their significant anticipated holdings, the Company has agreed to enter into an investor rights agreement with Orion and M Grupo upon closing of the Acquisition. The investor rights agreement will, among other things, provide each of Orion and M Grupo with the right to nominate one qualifying individual to the Board of Directors of the Company. The Company currently anticipates that Victor Flores, a nominee of Orion, and Pablo Reynoso, a nominee of M Grupo, will be proposed for addition to the Board of Directors of the Company at the special meeting of shareholders of Excellon to be called in connection with the Acquisition (as further discussed below).

In addition, each of Orion and M Grupo will be provided with customary registration rights, participation rights and the right to participate in a technical committee regarding La Negra. The investor rights agreement will require that Orion and M Grupo vote in accordance with management proposals to Excellon shareholders that are approved by the Company’s independent directors, other than in respect of matters requiring supermajority approval, for a period of 18 months following closing of the Acquisition.

The Excellon Shares issuable to Orion and M Grupo will also be subject to contractual restrictions on transfer pursuant to the investor rights agreement. The Closing Date Consideration Shares will be subject to the following restrictions on resale: (i) 25% will be restricted for a period of twelve months from closing of the Acquisition, (ii) an additional 25% will be restricted for a period of fifteen months from closing of the Acquisition, and (iii) 50% will be restricted for a period of eighteen months from closing of the Acquisition. Concurrent with the execution of the Agreement, the La Negra JV Termination will be completed.

Completion of the Acquisition is subject to approval of the TSX. As the Excellon Shares to be issued in connection with the Acquisition will exceed 25% of the issued and outstanding Excellon Shares and as the Acquisition will result in Orion holding sufficient shares to materially affect control of Excellon (within the meaning of applicable requirements of the TSX), approval by at least 50.1% of Excellon shareholders is required under the TSX listing rules. Excellon expects to convene a special meeting of Excellon shareholders to consider and approve the issuance of Excellon Shares in connection with the Acquisition and related matters by April 15, 2023. Completion of the Acquisition is expected to occur on or before April 30, 2023. Additional information regarding the Acquisition will be provided in the Company’s management information circular in connection with the special meeting.

The Agreement and the transactions contemplated therein are subject to customary conditions for transactions of similar size including receipt of Excellon shareholder approval, conditional listing approval of the TSX, as well as the La Negra JV Termination, completion of the Debenture restructuring, and delisting of Excellon Shares from the NYSE American and deregistration with the U.S. Securities and Exchange Commission which the Company has concurrently announced by separate news release.

The Board of Directors of Excellon has considered and unanimously approved the entering into the Agreement and the completion of the transactions contemplated by the Agreement. Cormark Securities Inc. has provided an independent fairness opinion to the Board of Directors of Excellon stating that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications stated in such opinion, the consideration to be paid under the Acquisition is fair, from a financial point of view, to Excellon.

Debenture Restructuring

The Company has entered into a binding term sheet with holders representing approximately 66 2/3% of the aggregate principal amount of the Debentures outstanding, to restructure the Debentures based on the following key terms:

- Conversion of C$4.5 million (25%) of the aggregate principal amount of the Debentures upon closing of the Acquisition at a price of C$0.48 per Excellon Share

- Extension of the maturity date from July 30, 2023 to April 30, 2027

- Reprice the conversion price of the remaining principal to C$0.535 per share

- Interest rate of 6.5% (payable semi-annual in cash to maturity) or 10.0% payable in Excellon Shares, at the Company’s election

- Option to call the Debentures at the Company’s election after 12 months if the trading price of the Excellon Shares is above C$1.50 for at least 20 consecutive trading days

- Option for the Debentureholders to put the Debentures to the Company for repayment in cash, on or after December 31, 2025

- Issuance to current Debentureholders of 6.7 million warrants to purchase Excellon Shares, exercisable at C$0.85 per share within 48 months

In consideration for the Debenture amendments, Debentureholders will also receive one special warrant per Debenture. The special warrants will, for a period of 60 months, entitle the holders to 22.5% (in the aggregate) of the issued and outstanding common shares of the Excellon subsidiary holding the Company’s Silver City project, which will be deemed to be automatically exercised for no additional consideration, with no further action required by the holder upon a spin-out of such project by public offering or other prescribed disposition or dissolution of such subsidiary or the project. Consent of the holders of the special warrants will be required prior to any sale, transfer or other disposition of the company holding the Silver City project or any sale, transfer or other disposition of all or substantially all of its property or assets.

Completion of the Debenture restructuring is subject to approval of the TSX and approval of at least 66 2/3% of holders of the aggregate principal amount of Debentures outstanding, which is expected to be obtained based on such percentage having signed the binding term sheet.

Planned Financing

Prior to closing of the Acquisition, Excellon intends to complete the Closing Private Placement for gross proceeds of at least US$10 million. The Closing Private Placement is expected to be an offering of subscription receipts, with proceeds being placed into escrow pending closing of the Acquisition. Proceeds from the Closing Private Placement would be expected to be released from the subscription receipt escrow upon closing of the Acquisition. Proceeds of the financing will be used to fund development activities for the planned restart of mining operations at La Negra and for general corporate purposes. Further details regarding the financing will be announced in due course once final terms have been determined.

Summary of the PEA for La Negra2

The PEA was completed by an independent consultant with an effective date of March 31, 2022 and prepared in accordance with NI 43-101.

La Negra Location and Background:

The La Negra Mine is located in the State of Querétaro, in Central Mexico. La Negra was first developed by Industrias Peñoles S.A. de C.V. in the 1960s and achieved commercial production in 1971. Mining and processing at La Negra proceeded to operate almost continuously since then as other deposits have been discovered and developed.

The mine was closed in March 2020 due to the COVID-19 shutdown. During this period of care-and-maintenance, a new labour contract was negotiated with the union and went into effect in April 2021, a 15-year extension to the land-use agreement was signed in July 2021 and a 9,800 metre drill program was completed that formed the basis of an updated Mineral Resource Estimate.

La Negra has all the permits required to restart operations as contemplated by the PEA. An amendment is required to the environmental impact statement in order to support filtered tailings deposition at the primary tailings storage facility. It is expected the amendment will be completed prior to the restart of the mine.

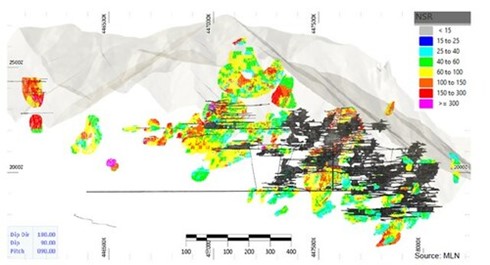

Geology and Mineralization:

The La Negra property is located in the Sierra Gorda range, belonging to the Sierra Madre Occidental physiographic province. The main sedimentary host rocks consist of late Jurassic – Cretaceous carbonates which were intruded by Eocene granodiorites along favourable structural corridors leading to the formation of skarn bodies.

The principal minerals at La Negra consist of sphalerite (marmatite), galena, and chalcopyrite, with silver present in association with galena and as argentite and pyrargyrite.

Conceptual Mine Plan:

Mining is expected to be completed by way of long-hole open stoping, using a top-down approach. Mineralized zones will be mined using existing mine infrastructure, supplemented by new drift and ramp development, water handling and ventilation, as needed. Mine production is based on 2,500 tonnes per operating day, or 842,500 tonnes per annum. All phases of mining, with the exception of haulage to surface, will be carried out by experienced La Negra personnel, with haulage to the surface portal anticipated to be managed by a local contractor.

Recommended stope geometry is 20 metres long by 20 metres high and 6 metres wide.

The mineral resource model3 was adjusted to account for expected mining dilution as historically achieved.

Process Plant:

The existing process facility at La Negra consists of standard crushing, grinding, flotation and filtration circuits producing a lead-silver, copper-silver and zinc concentrates. The concentrator has a designed (or nameplate) capacity of 3,000 tonnes per day.

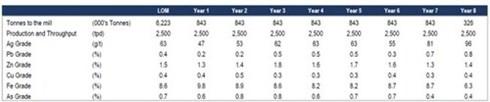

Set out below is a summary of the life of mine production schedule based on the PEA2.

The process plant is currently not operational and capital for refurbishment is required to ensure a successful restart.

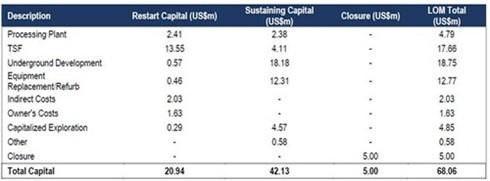

Capital Cost:

Estimated restart capital based on the PEA is US$20.9 million. The cost estimate includes refurbishing the process plant, upgrading the existing mining fleet, mine development, purchasing additional equipment and constructing a new tailings facility to support filtered tailings deposition.

Of the restart capital, approximately US$13.5 million was estimated for construction of the tailings filter, tailings conveyor, and engineering of the tailings storage facility.

Operating Cost:

LOM operating cost estimates for La Negra average approximately US$28.00/tonne and include mining, processing, tailings, geotechnical services and G&A. The cost per tonne milled is based on an annual processing rate of 842,500 tonnes (2,500 tonnes per day).

The LOM operating cost excludes offsite costs such as treatment charges, refining charges, other concentrate penalties/losses and concentrate transportation.

The all-in sustaining cost is estimated to average US$12.95 per ounce AgEq, based on commodity price assumptions as summarized below in the Economic Analysis section.7

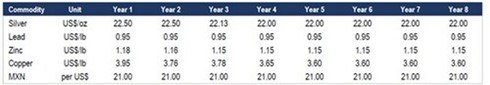

Economic Analysis2:

The following table outlines metals prices and foreign exchange assumptions used in the economic analysis.

The PEA returned an after-tax NPV5% of US$132.4 million at base case commodity price and FX assumptions. The NPV was sensitized to metals prices of -20%, -10%, +10% and +20% relative to the base case, as summarized in the following table.

The NSR contribution is primarily silver, zinc, copper and lead. The distribution by metal is provided in the following table:

Advisors

Osler, Hoskin & Harcourt LLP is acting as legal counsel to Excellon on the Acquisition. Bennett Jones LLP is acting as legal counsel on the Debenture restructuring. Canaccord Genuity is acting as financial advisor to Excellon. Cormark provided an independent fairness opinion to the Excellon Board of Directors.

None of the securities to be issued pursuant to the Acquisition have been or will be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act“), or any state securities laws, and any securities issuable in the Acquisition are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. news press release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

About Excellon

Excellon’s vision is to realize opportunities through the acquisition of advanced development or producing assets with further potential to gain from an experienced operational management team for the benefit of our employees, communities and shareholders. The Company is advancing a portfolio of silver, base metals and precious metals assets including Kilgore, an advanced gold exploration project in Idaho; and Silver City, a high-grade epithermal silver district in Saxony, Germany with 750 years of mining history and no modern exploration. As discussed above, the Company has also entered into an agreement to acquire La Negra, a past-producing Ag-Zn-Cu-Pb mine with exploration potential, located in Mexico.

About Orion

Orion Mine Finance Group is one of the world’s leading mining-focused private equity businesses. In addition, the Orion team has experience in the physical metals markets, such as facilitating the purchase, metal financing, transporting, processing and selling of a mine’s output to end customers.

About M Grupo

Grupo Desarrollador Migo, S.A.P.I. de C.V. is a Querétaro-based infrastructure company. M Grupo has business interests in real estate, infrastructure construction and in mining, through La Negra. M Grupo’s focus is labour relations, community support and social responsibility.

Technical Information

Mr. Paul Keller, P. Eng., Chief Operating Officer of the Company and a Qualified Person as defined in NI 43–101, reviewed, verified and approved the scientific and technical information in this news release relating to operations and production. Mr. Jorge Ortega, M.Sc., P.Geo., Vice President Exploration of the Company and a QP, reviewed, verified and approved any scientific and technical information relating to geological interpretation and results contained in this news release.

Overview of the La Negra Mineralization (CNW Group/Excellon Resources Inc.)

LOM Production Schedule (CNW Group/Excellon Resources Inc.)

LOM Capital Cost Estimate (CNW Group/Excellon Resources Inc.)

Commodity Price and FX Assumptions (CNW Group/Excellon Resources Inc.)

NPV5% and Metals Price Sensitivity (Figures in US$m) (CNW Group/Excellon Resources Inc.)

NSR Distribution by Metal (CNW Group/Excellon Resources Inc.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE