Equity Reports 2.3 Metres Averaging 604g/t AgEq in the Western Step-out Drilling at the Camp Vein Target, Silver Queen Project, BC

Equity Metals Corporation (TSX-V: EQTY) reports further High-grade Silver drill intercepts in western and down dip step-outs of the Camp Vein target, Silver Queen Project, BC.

New highlight intercepts include:

- a 0.5 metre interval grading 1,659g/t Ag, 0.1g/t Cu, 1.6% Pb and 0.36% Zn (1,761g /t AgEq) within a 2.3 metre interval averaging 554g/t Ag, 0.7% Pb and 0.6% Zn (604g/t AgEq) from drill hole SQ21-035; and

- a 2.0 metre interval averaging 226g/t Ag, 0.1% Pb and 0.4% Zn (248g/t AgEq) from drill hole SQ21-036.

Drilling has now extended the western margin of the Camp Vein system along strike and down dip of previously released assays from holes SQ20-010 and SQ21-030 to -034, which include:

- a 0.3 metre interval grading 56,291g/t AgEq within a 4.4 metre interval averaging 4,718g/t AgEq from drill hole SQ20-010 (NR-12-20; October 19, 2020);

- a 0.3 metre interval grading 10,117g/t AgEq within a 3.7 metre interval averaging 1,148g/t AgEq from drill hole SQ21-034 (NR-13-21; November 23, 2021);

- a 2.0 metre interval averaging 2,358g/t AgEq from drill hole SQ21-030 (NR-08-21; May 25, 2020);

- a 3.5 metre interval averaging 752g/t AgEq from drill hole SQ21-032 (NR-13-21; November 23, 2021); and

- a 2.1 metre interval averaging 537g/t AgEq from drill hole SQ21-033 (NR-13-21; November 23, 2021);

Multiple veins have been identified in each hole with mineralization in drill hole SQ21-035 extending the vein system a further 50 metres to the west of Equity’s previous drilling at the Camp Vein target. Drilling has also extended the veins to depths of up to 195 metres below surface, which is significantly deeper than historic drilling and will provide continuity with mineralized intercepts in drill holes SQ21-010, SQ21-030 and SQ21-032 to -034.

Drilling as now confirmed broad continuity in all four of the modelled veins identified on the northwestern margin of the Camp Vein target. Mineralization is open and untested to the west and projects eastward into previously identified vein intercepts. Assays from a single hole on this portion of the Camp Vein, SQ21-049, are pending.

Eighteen new core holes and an extension of an earlier hole, totalling 4,636 metres, were completed on a 280 metre strike-length of the Camp Vein Target as part of the September 2021 program.

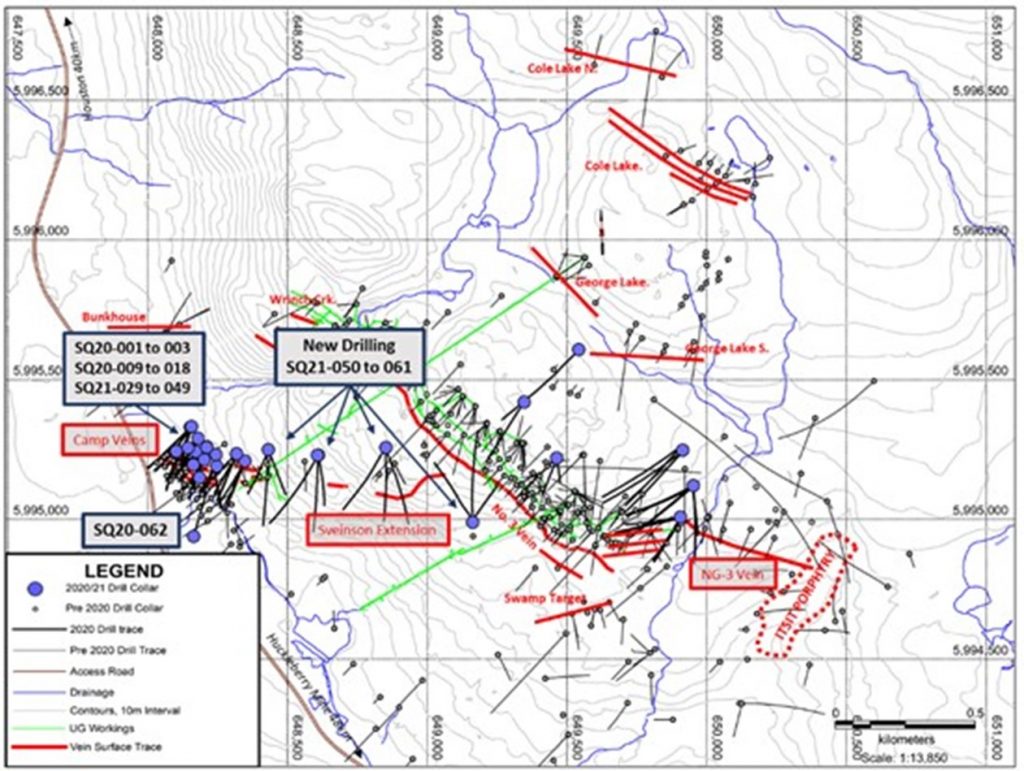

In October through December 2021, 14 holes totaling 5,024 metres tested the 1,000 metre-long region between the Camp veins and the No. 3 Vein with wide-spaced drilling, as an initial test of the area now referred to as the Sveinson Extension (includes the No. 5 and Switchback veins; see Figure 1). A final hole, SQ21-049, has tested the footwall of the Camp Vein target. Full assays from 26 of these holes are pending with further assay results expected over the coming weeks and extending into the New Year.

A total of 63 drill holes for 19,645 metres has now been completed by Equity Metals on the Silver Queen property in five successive phases of exploration drilling starting in late 2020. Five separate target areas have been tested and thick intervals of high-grade gold, silver and base-metal mineralization have been identified in each of the Camp Vein, No. 5/switchback, No. 3, and NG-3 Vein systems.

Figure 1: Plan Map of targets on the Silver Queen vein system, BC

Table 1: Summary Composites from September2021 Drilling on the Camp Vein Target.

| Hole # | From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

Cu (%) |

Pb (%) |

Zn (%) |

AuEq (g/t) |

AgEq (g/t) |

Comments |

| SQ21-035 | 53.0 | 53.3 | 0.3 | 0.2 | 191 | 0.1 | 0.1 | 0.3 | 3.0 | 225 | |

| SQ21-035 | 221.0 | 223.0 | 2.0 | 0.3 | 48 | 0.0 | 0.7 | 1.4 | 1.9 | 143 | |

| SQ21-035 | 248.8 | 251.1 | 2.3 | 0.1 | 544 | 0.0 | 0.7 | 0.6 | 8.1 | 604 | 23% dilution |

| inc. | 249.6 | 250.1 | 0.5 | 0.2 | 1659 | 0.1 | 1.6 | 0.6 | 23.5 | 1761 | |

| SQ21-036 | 32.8 | 34.6 | 1.8 | 0.1 | 126 | 0.1 | 0.1 | 0.5 | 2.2 | 166 | |

| inc. | 32.8 | 33.7 | 0.9 | 0.1 | 212 | 0.0 | 0.1 | 0.3 | 3.1 | 236 | |

| SQ21-036 | 59.2 | 61.2 | 2.0 | 0.0 | 226 | 0.0 | 0.1 | 0.4 | 3.3 | 248 | |

| inc. | 60.2 | 61.2 | 1.0 | 0.0 | 356 | 0.0 | 0.1 | 0.6 | 5.1 | 384 | |

| SQ21-036 | 135.9 | 136.2 | 0.3 | 0.6 | 284 | 0.0 | 0.2 | 0.7 | 4.8 | 364 | |

| SQ21-036 | 254.2 | 255.3 | 1.1 | 0.0 | 250 | 0.0 | 0.1 | 0.2 | 3.5 | 261 |

Samples were analyzed by FA/AAS for gold and 48 element ICP-MS by MS Analytical, Langley, BC. Silver (>100ppm), copper, lead and zinc (>1%) overlimits assayed by ore grade ICP-ES analysis, High silver overlimits (>1000g/t Ag) and gold overlimits (>10g/t Au) re-assayed with FA-Grav. Silver >10,000g/t re-assayed by concentrate analysis, where a FA-Grav analysis is performed in triplicate and a weighed average reported. Composites calculated using a 80g/t AgEq (1g/t AuEq) cut-off and <20% internal dilution, except where noted. Reported intervals are core lengths, true widths undetermined or estimated. Accuracy of results is tested through the systematic inclusion of QA/QC standards, blanks and duplicates into the sample stream. AuEq and AgEq were calculated using prices of $1,500/oz Au, $20/oz Ag, $2.75/lb Cu, $1.00/lb Pb and $1.10/lb Zn. AuEq and AgEq calculations did not account for relative metallurgical recoveries of the metals.

About Silver Queen Project

The Silver Queen Project is a premier gold-silver property with over 100 years of historic exploration and development and is located adjacent to power, roads and rail with significant mining infrastructure that was developed under previous operators Bradina JV (Bralorne Mines) and Houston Metals Corp. (a Hunt Brothers company). The property contains an historic decline into the No. 3 Vein, camp infrastructure, and a maintained Tailings Facility.

The Silver Queen Property consists of 45 mineral claims, 17 crown grants, and two surface crown grants totalling 18,852ha with no underlying royalties. Mineralization is hosted by a series of epithermal veins distributed over a 6 sq km area. Most of the existing resource is hosted by the No. 3 Vein, which is traced by drilling for approximately 1.2km and to the southeast transitions into the NG-3 Vein close to the buried Itsit copper-molybdenum porphyry.

An initial NI43-101 Mineral Resource Estimate (see Note 1 below) was detailed in a News Release issued on July 16th, 2019, and using a CDN$100 NSR cut-off, reported a resource of:

- Indicated – 244,000ozs AuEq: 85,000ozs Au, 5.2Mozs Ag, 5Mlbs Cu, 17Mlbs Pb and 114Mlbs Zn; and

- Inferred – 193,000ozs AuEq: 64,000ozs Au, 4.7Mozs Ag, 5Mlbs Cu, 16Mlbs Pb and 92Mlbs Zn.

More than 20 different veins have been identified on the property, forming an extensive network of zoned Cretaceous-to Tertiary-age epithermal veins. The property remains largely under explored.

About Equity Metals Corporation

Equity Metals Corporation is a Manex Resource Group Company. Manex provides exploration, administration, and corporate development services for Equity Metals’ two major mineral properties, the Silver Queen Au-Ag-Zn-Cu project, located in central B.C., and the Monument Diamond project, located in Lac De Gras, NWT.

The Company owns 100% interest, with no underlying royalty, in the Silver Queen project, located along the Skeena Arch in the Omineca Mining Division, British Columbia. The property hosts high-grade, precious-and base-metal veins related to a buried porphyry system, which has been only partially delineated. The Company also has a controlling JV interest in the Monument Diamond project, NWT, strategically located in the Lac De Gras district within 40 km of both the Ekati and Diavik diamond mines. The project owners are Equity Metals Corporation (57.49%), Chris and Jeanne Jennings (22.11%); and Archon Minerals Ltd. (20.4%). Equity Metals is the operator of the project.

The Company also has royalty and working interests in other Canadian properties, which are being evaluated further to determine their value to the Company.

- The 2019 Silver Queen Resource Estimate was prepared following CIM definitions for classification of Mineral Resources and identified at a CDN$100/NSR cut-off, an indicated resource of 815Kt averaging 3.2g/t Au, 201g/t Ag, 1.0% Pb, 6.4% Zn and 0.26% Cu and an inferred resource of 801Kt averaging 2.5g/t Au, 184g/t Ag, 0.9% Pb, 5.2% Zn and 0.31% Cu. Grade capping on Ag and Zn was performed on 0.75m to 1.24m length composites. Au, Cu and Pb required no capping. ID3 was utilized for grade interpolation for Au and Ag while ID2 was utilized for Cu, Pb and Zn. Grade blocks were interpreted within constraining mineralized domains using and array of 3m x 1m x 3m blocks in the model. A bulk density of 3.56 t/m³ was used for all tonnage calculations. Approximate US$ two-year trailing average metal prices as follows were used: Au $1,300/oz, Ag $17/oz, Cu $3/lb, Pb $1.05/lb and Zn $1.35/lb with an exchange rate of US$0.77=C$1.00.

The C$100/tonne NSR cut-off grade value for the underground Mineral Resource was derived from mining costs of C$70/t, with process costs of C$20/t and G&A of C$10/t. Process recoveries used were Au 79%, Ag 80%, Cu 81%, Pb 75% and Zn 94%. AuEq and AgEq are based on the formula: NSR (CDN) = (Cu% * $57.58) + (Pb% * $19.16) + (Zn% * $30.88) +(Au g/t * $39.40) + (Ag g/t * $0.44) – $78.76.

Mineral Resources are not Mineral Reserves, do not have demonstrated economic viability and may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. Inferred Mineral Resources have a lower level of confidence than Indicated Mineral Resources and may not be converted to a Mineral Reserve but may be upgraded to an Indicated Mineral Resource with continued exploration. The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines.

The Mineral Resource Estimate was prepared by Eugene Puritch, P.Eng., FEC, CET and Yungang Wu, P.Geo., of P&E Mining Consultants Inc. of Brampton, Ontario, Independent Qualified Persons, as defined by National Instrument 43-101. P&E Mining suggests that an underground mining scenario is appropriate for the project at this stage and has recommended a CDN$100/tonne NSR cut-off value for the base-case resource estimate.

Robert Macdonald, MSc. P.Geo, is VP Exploration of Equity Metals Corporation and a Qualified Person as defined by National Instrument 43-101. He is responsible for the supervision of the exploration on the Silver Queen project and for the preparation of the technical information in this disclosure.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE