Equity Metals Reports 431g/t AgEq over 7.6 Metres and 710g/t AgEq over 3.3 Metres from Fall Drill Program on the Silver Queen Property, BC

Equity Metals Corporation (TSX-V: EQTY) reports initial assay results from the Fall ’24 drill program on its 100% owned Silver Queen Au-Ag project, British Columbia and includes new assays from the No. 3 North target.

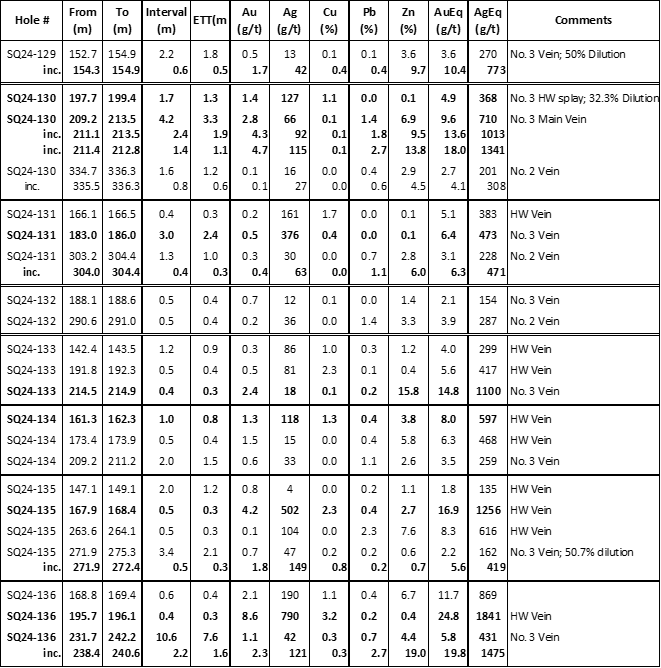

Sixteen core holes totaling 5,952 metres were completed on the No. 3 North Target from two setups as part of the Fall ’24 drill program. Assay highlights from the first eight holes include:

- A 7.6 metre (Est. TT) interval grading 1.1g/t Au , 42g/t Ag, 0.7% Pb and 4.4% Zn (431g/t AgEq or 5.8g/t AuEq) including a 1.6 metre (est. TT) interval averaging 2.3g/t Au, 121g/t Ag, 2.7% Pb and 19.0% Zn (1,475g/t AgEq or 19.8g/t AuEq) from SQ24-136;

- A 3.3 metre (Est. TT) interval grading 2.8g/t Au, 66g/t Ag , 1.4% Pb and 6.9% Zn (710g/t AgEq or 9.6g/t AuEq) including a 1.1 metre (est. TT) interval averaging 4.7g/t Au, 115g/t Ag, 2.7% Pb and 13.8% Zn (1,341g/t AgEq or 18.0g/t AuEq) from SQ24-130; and

- A 2.4 metre (Est. TT) interval grading 0.5g/t Au, 376g/t Ag , 0.4% Cu and 0.1% Zn (473g/t AgEq or 6.4g/t AuEq) from SQ24-131.

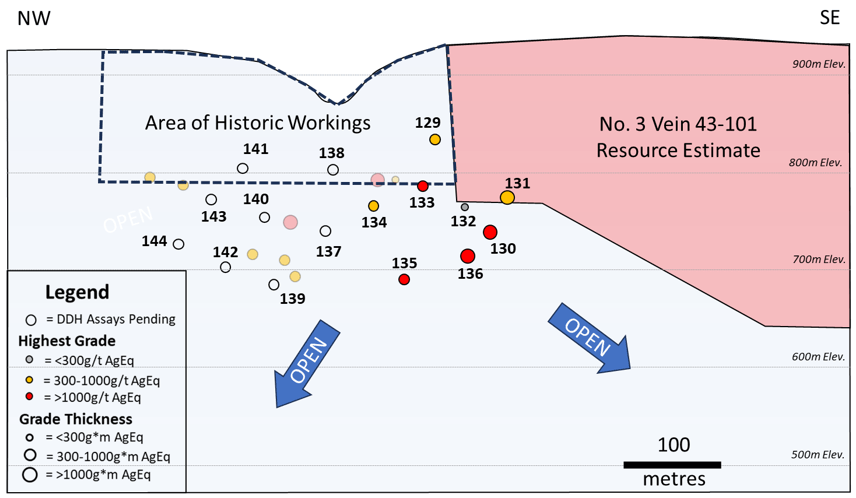

These latest assay results have successfully confirmed both the grade and tenor of mineralization beyond the northern end of the No. 3 Vein resource model. Drilling has identified higher grade gold- and silver-enriched intercepts both 100 metres below the modelled resource and a further 100 metres laterally to the northwest (see Figure 2). Intercepts of the No. 3 Vein demonstrate strong continuity in this latest drilling and several high-grade copper-enriched hangingwall intercepts also show promise and include 8.6g/t Au, 790g/t Ag and 3.2% Cu (1,841g/t AgEq or 24.8g/t AuEq) over 0.3m (ETT) from SQ24-136 . The historic No. 2 Vein was intersected in several holes (see Table 1) and sits in the footwall of the main No. 3 Vein intercepts. All of the veins remain open for further delineation and extension.

The No. 3 Vein is the single largest deposit currently identified on the Silver Queen property and with its southern extension, the NG-3 Vein, account for 65% of the currently modelled mineral resources on a AgEq basis. Any extensions to the No. 3 Vein remain highly accretive to the current mineral resource. The updated NI43-101 Mineral Resource Estimate with an effective date of December 1st, 2022 is detailed in a News Release issued on Jan 16, 2023, which can be found by clicking here and the full Technical Report can be found on SEDAR and the Company’s website.

VP Exploration Rob Macdonald commented, “This northern extension of the No. 3 Vein is a new target area for the Company and drilling from 2024 could potentially extend the projection of the vein system a further +300 metres to the northwest from what is currently modelled. Mineralization remains open both laterally and at depth and is immediately adjacent to, and down dip from, existing historic underground workings, which would likely reduce development costs in an underground mining scenario. Further assays from the drilling are pending and are anticipated in the coming weeks. ”

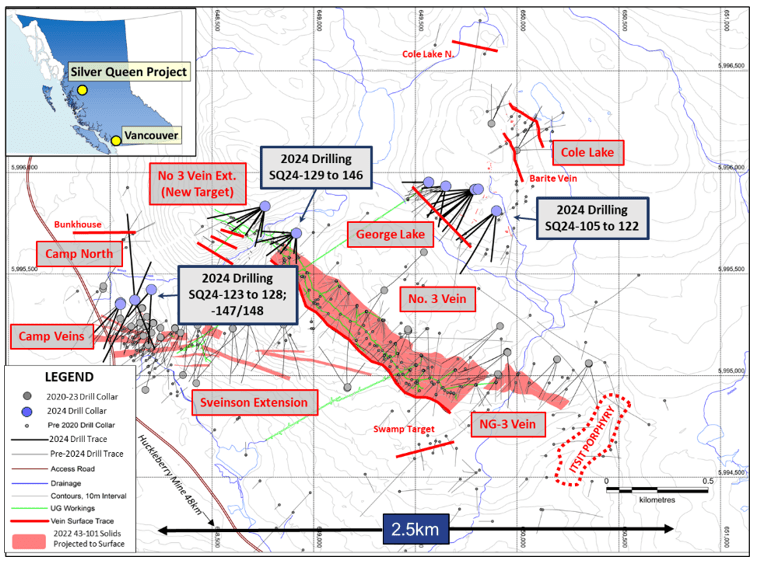

Figure 1: Plan of Silver Queen project area

Figure 2: No.3 North Longitudinal Section showing historical and 2024 drill intercepts. Historical Intercepts are semi-transparent.

2024 Drilling

Forty-two core holes totalling 17,209 metres were completed as part of Equity’s 2024 exploration program. Drilling resulted in the delineation of a 550-metre strike-length for mineralization in the George Lake target and 400-metre strike-length for mineralization in the No. 3 North target, as well as several extensions of earlier identified veins in the Camp Deposit and a new discovery in the Camp North target. Assays are pending from the final 10 drill holes from the 2024 exploration season which will be reported in the coming weeks.

Work in 2025 will continue to incorporate the 2024 drill data into revised exploration and resource models toward a Mineral Resource update to be prepared in 2025 and further exploration drilling on the ever-expanding Silver Queen vein system.

Table 1: Select Composites from 2024 Drilling on the No. 3 North Target

Notes: drill core samples were analyzed by FA/AAS for gold and 48 element ICP-MS by MS Analytical, Langley, BC. Silver (>100ppm), copper, lead and zinc (>1%) overlimits assayed by ore grade ICP-ES analysis, High silver overlimits (>1000g/t Ag) and gold overlimits (>10g/t Au) re-assayed with FA-Grav. Silver >10,000g/t re-assayed by concentrate analysis, where a FA-Grav analysis is performed in triplicate and a weighed average reported. Downhole composites calculated using a 80g/t AgEq (1g/t AuEq) cut-off and <20% internal dilution, except where noted. Accuracy of results is tested through the systematic inclusion of QA/QC standards, blanks and duplicates into the sample stream. AuEq and AgEq were calculated using prices of $1,800/oz Au, $22/oz Ag, $3.50/lb Cu, $0.95/lb Pb and $1.30/lb Zn. AuEq and AgEq calculations utilized relative metallurgical recoveries of Au 70%, Ag 80%, Cu 80%, Pb 81% and Zn 90%.

About Silver Queen Project

The Silver Queen Project is a premier gold-silver property with over 100 years of historic exploration and development and is located adjacent to power, roads and rail with significant mining infrastructure that was developed under previous operators Bradina JV (Bralorne Mines) and Houston Metals Corp. (a Hunt Brothers company). The property contains an historic decline into the No. 3 Vein and the George Lake Vein, camp infrastructure, and a maintained Tailings Facility.

The Silver Queen Property consists of 46 mineral claims, 17 crown grants, and two surface crown grants totalling 18,871ha with no underlying royalties. Mineralization is hosted by a series of epithermal veins distributed over a 6 sq km area. More than 20 different veins have been identified on the property, forming an extensive network of zoned Cretaceous- to Tertiary-age epithermal veins. The property remains largely under-explored.

About Equity Metals Corporation

Equity Metals Corporation is a member of the Malaspina-Manex Group. The Company owns 100% interest, with no underlying royalty, in the Silver Queen project, located along the Skeena Arch in the Omineca Mining Division, British Columbia. The property hosts high-grade, precious- and base-metal veins related to a buried porphyry system, which has been only partially delineated. The Company also has a controlling JV interest (57.49%) in the Monument Diamond project, NWT, strategically located in the Lac De Gras district within 40 km of both the Ekati and Diavik diamond mines. As well, the Company has an option to acquire a 100% interest in the Arlington Property, located within the Boundary District of south-central British Columbia where 2025 exploration work is planned to consist of geophysics and diamond drilling designed to identify and delineate an apparent gold system. The Company is fully funded to undertake proposed 2025 exploration and development at Silver Queen and Arlington.

Robert Macdonald, MSc. P.Geo, is VP Exploration of Equity Metals Corporation and a Qualified Person as defined by National Instrument 43-101. He is responsible for the supervision of the exploration on the Silver Queen project and for the preparation of the technical information in this disclosure.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE