Equity Metals Announces Non-Brokered Flow-Through Private Placement

Equity Metals Corporation (TSX-V: EQTY) announces that it proposes to undertake a non-brokered private placement of securities to raise total gross proceeds of up to $550,000. The Offering will be comprised of 4,230,770 flow-through units to be sold at a price of $0.13 per FT Unit for gross proceeds of $550,000. Each FT Unit will be comprised of one flow-through common share and one-half of one non-flow-through warrant. Each whole warrant entitles the holder thereof to purchase one non-flow-through common share for a period of 3 years at a price of $0.20.

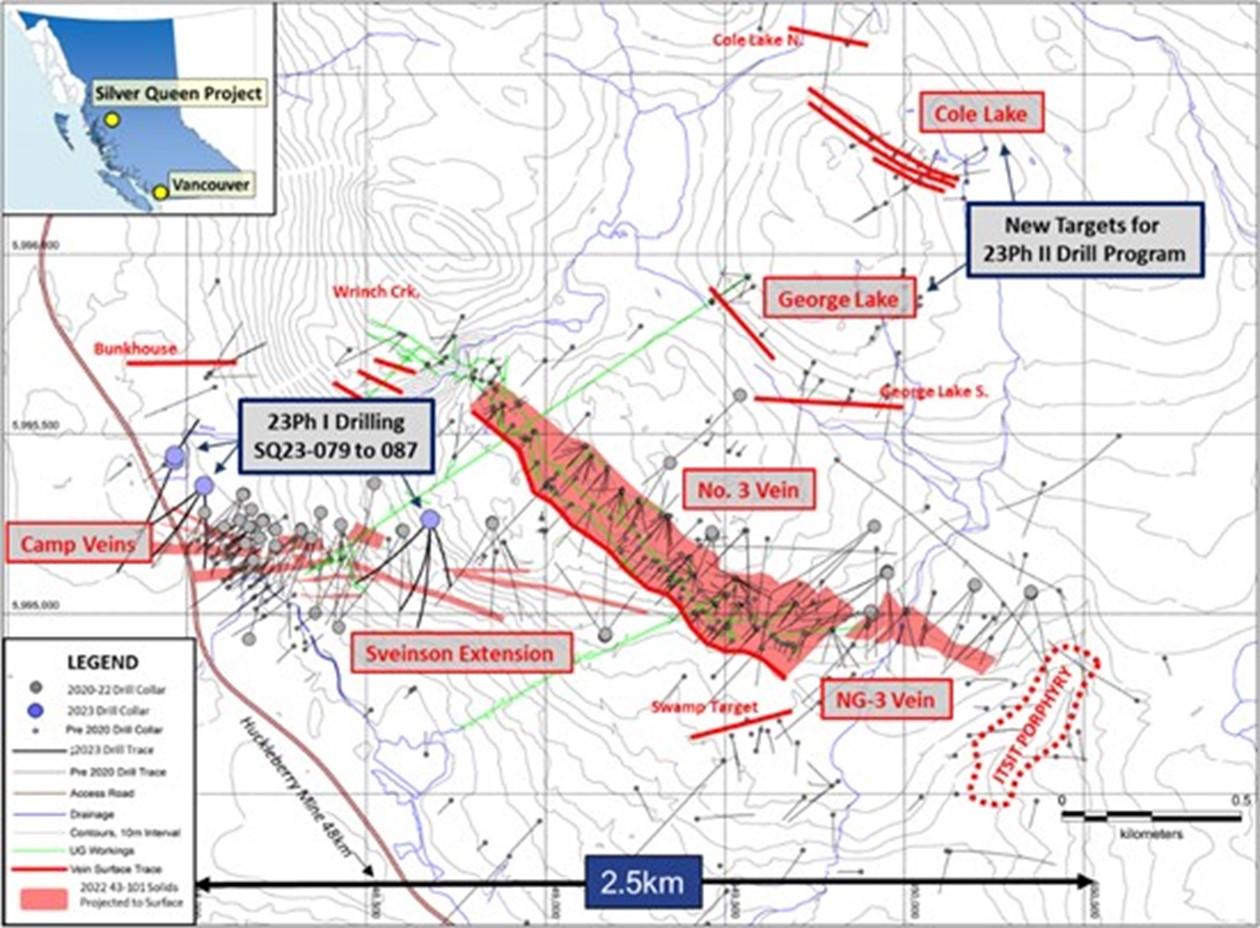

The proceeds received from the sale of the FT Units will be focused on the initial delineation of two new targets located to the northeast of, and not included in, the earlier 2022 updated Mineral Resource estimate on the Silver Queen, gold/silver project, in British Columbia. These additional funds allow for drilling to continue well into summer on the Cole and George Lake veins systems (Figure 1), which have been partially tested by historical drilling.

The Company may pay finders’ fees comprised of cash and non-transferable warrants in connection with the Offering, subject to compliance with the policies of the TSX Venture Exchange. All securities issued and sold under the Offering will be subject to a hold period expiring four months and one day from their date of issuance. Completion of the Offering and the payment of any finders’ fees remain subject to the receipt of all necessary regulatory approvals, including the approval of the TSX Venture Exchange.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration is available.

Figure 1: Plan Map of targets on the Silver Queen vein system, BC

About Silver Queen Project

The Silver Queen Project is a premier gold-silver property with over 100 years of historic exploration and development and is located adjacent to power, roads and rail with significant mining infrastructure that was developed under previous operators Bradina JV (Bralorne Mines) and Houston Metals Corp. (a Hunt Brothers company). The property contains an historic decline into the No. 3 Vein, the George Lake Vein, camp infrastructure, and a maintained Tailings Facility.

The Silver Queen Property consists of 45 mineral claims, 17 crown grants, and two surface crown grants totalling 18,852ha with no underlying royalties. Mineralization is hosted by a series of epithermal veins distributed over a 6 sq km area. An updated NI43-101 Mineral Resource Estimate with effective date December 1st, 2022 was detailed in a News Release issued on Jan 16, 2023, which can be found by clicking here and the full Technical Report can be found on SEDAR and the Company’s website.

More than 20 different veins have been identified on the property, forming an extensive network of zoned Cretaceous- to Tertiary-age epithermal veins. The property remains largely under explored.

About Equity Metals Corporation

Equity Metals Corporation is a Malaspina-Manex Group Company. The Company owns 100% interest, with no underlying royalty, in the Silver Queen project, located along the Skeena Arch in the Omineca Mining Division, British Columbia. The property hosts high-grade, precious- and base-metal veins related to a buried porphyry system, which has been only partially delineated. The Company also has a controlling JV interest (57.49%) in the Monument Diamond project, NWT, strategically located in the Lac De Gras district within 40 km of both the Ekati and Diavik diamond mines. The Company also has royalty and working interests in other Canadian properties, which are being evaluated further to determine their value to the Company.

Robert Macdonald, MSc. P.Geo, is VP Exploration of Equity Metals Corporation and a Qualified Person as defined by National Instrument 43-101. He is responsible for the supervision of the exploration on the Silver Queen project and for the preparation of the technical information in this disclosure.

MORE or "UNCATEGORIZED"

Antimony Resources Corp. (ATMY) (K8J0) Reports Massive Antimony Bearing Stibnite - Drills 4.17% Sb over 7.40 meters Including Three Zones of Massive Antimony Bearing Stibnite which returned 28.8% Sb, 21.9% Sb, and 17.9% Sb Respectively

Highlights Assays received High-grade assays returned for Drill H... READ MORE

Kenorland Minerals and Auranova Resources Report Drill Results at the South Uchi Project, Ontario; Auranova Completes Initial Earn-in

Kenorland Minerals Ltd. (TSX-V: KLD) (OTCQX: KLDCF) (FSE: 3WQ0) a... READ MORE

Wallbridge Exploration Drilling Continues to Intercept High-Grade Gold Mineralization at Martiniere

Wallbridge Mining Company Limited (TSX: WM) (OTCQB:WLBMF) announc... READ MORE

ValOre Reports Results from Successful 87 Hole Trado® Auger Drilling Campaign at Pedra Branca, Including 10.0 m at 12.95 g/t 2PGE+Au from Surface

Provides Update on Pedra Branca PGE Project and Strategic Growth ... READ MORE

Pasinex Announces 2024 Annual and 2025, Q1 Financial Results

Pasinex Resources Limited (CSE: PSE) (FSE: PNX) announced financi... READ MORE