Elemental Altus Expands Royalty Portfolio with Cornerstone Laverton Acquisition and Dugbe Development Asset

Elemental Altus Royalties Corp. (TSX-V: ELE) (OTCQX: ELEMF) is pleased to announce the creation of a cornerstone gold royalty at Laverton in Western Australia. The Laverton royalty acquisition builds on the Company’s existing coverage to create a cornerstone gold royalty in a Tier 1 jurisdiction. Elemental Altus has signed binding agreements to acquire an existing uncapped 2% Gross Revenue Royalty over Genesis Minerals’ (ASX: GMD) Focus Laverton Project in Western Australia, alongside an existing 2% GRR on Brightstar Resources’ (ASX: BTR) producing Jasper Hills Project.

In parallel, the Company is acquiring an existing uncapped 2.0-2.5% Net Smelter Return Royalty on Pasofino Gold’s (TSX-V: VEIN) feasibility-stage Dugbe Project in Liberia.

Highlights:

- Focus Laverton Royalty (Western Australia)

- ~US$52 million acquisition of an uncapped 2% GRR over Genesis’ recently acquired multi-million-ounce Focus Laverton Project to create third cornerstone asset alongside Karlawinda and Caserones

- The Focus Laverton Royalty covers ~2.1Moz of Measured and Indicated Resources and 1.5Moz of Inferred Resources adjacent to Genesis’ operating Laverton mill, 99% on granted mining leases and positioned for rapid inclusion into Genesis’ mine plan

- The Focus Laverton 2% GRR overlaps the Company’s existing 2% GRR covering approximately 0.75Moz of Measured and Indicated Resources and 1.1Moz of Inferred Resources at the same project

- The combination of Elemental Altus’ existing Laverton royalty and the Focus Laverton Royalty create a cornerstone 2-4% GRR for the Company in a Tier 1 jurisdiction with a proven mid-tier operator in Genesis Minerals

- Royalty tenure has been near-dormant for over a decade with Genesis highlighting the compelling exploration upside across ~300km² of highly prospective licences

- Genesis have also announced studies are ongoing into staged processing plant expansions at their Laverton mill

- As part of the same transaction, the Company acquired an uncapped 2% GRR on Brightstar’s producing Jasper Hills Project in the same Laverton district

- The Jasper Hills Royalty is currently in production with mineralised materials being toll treated through Genesis’ Laverton mill while Brightstar advance standalone development plans

- Dugbe (Liberia)

- Initial US$16.5 million acquisition of an uncapped 2.0% NSR royalty over the 3.3Moz Measured and Indicated Resource at the Dugbe Project, increasing to 2.5% under certain production and gold price conditions

- Pasofino’s 2022 Feasibility Study outlined a 14-year mine life producing ~162koz gold per annum at US$1,700/oz assumptions

- An updated Feasibility Study is underway and the Project is expected to be reinvigorated with the support of the new indirect majority owner, Coris Bank International

- Mineral Reserves of 2.8Moz gold and significant exploration upside across up to 1,257km² of royalty coverage

- Pasofino well placed to accelerate the development of the project over 2026 and updated studies will de-risk the asset going forwards

Frederick Bell, CEO of Elemental Altus, commented:

“These multi-million-ounce acquisitions highlight our strategy of securing both cornerstone and growth-stage gold royalties in quality jurisdictions. Laverton enhances our near-term cash flow profile through exposure to one of Western Australia’s most well-known gold districts, while Dugbe adds a large-scale feasibility-stage project with long-life, multi-million-ounce potential. Together, they expand our near-term revenues and reinforce our long-term pipeline, positioning Elemental Altus as the most compelling royalty growth story in the sector. We continue to demonstrate our ability to transact on value-accretive opportunities that deliver both scale and diversification for our shareholders”.

Terms of the Acquisitions

The Laverton acquisition is structured as an agreement to acquire a private Australian company which holds the Laverton and Jasper Hills royalties for cash consideration of A$80 million (approximately US$52 million).

The Dugbe acquisition is structured as an agreement to acquire a wholly owned subsidiary of Ecora Resources PLC, which holds the Dugbe Royalty, for an initial consideration of US$16.5 million in cash, plus a contingent payment of up to US$3.5 million in cash, payable on the earlier of:

- US$700,000 upon the commencement of project construction; and

- US$2,800,000 upon the commencement of commercial production; or,

- A cumulative 150,000 ounces of royalty-linked gold production at Dugbe

As at September 1, 2025, Elemental Altus has over US$32 million in cash and an undrawn credit facility of up to US$50 million with National Bank of Canada, Canadian Imperial Bank of Commerce, and Royal Bank of Canada.

The Dugbe acquisition is expected to close shortly with the Laverton acquisition closing prior to the end of Q4 2025. Royalty revenue from the Jasper Hill royalties, part of the Laverton acquisition, will be attributable to the Company from completion of the transaction.

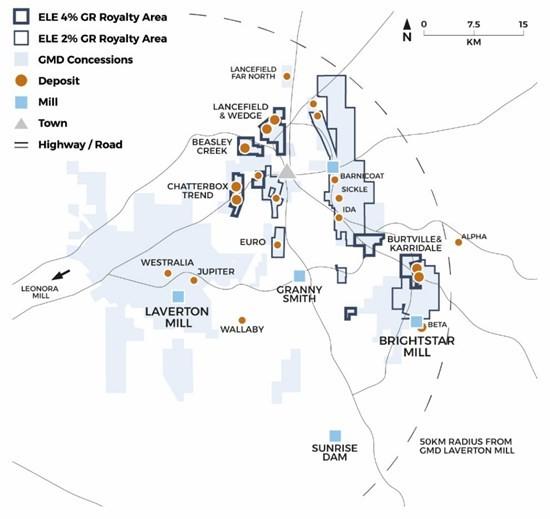

Laverton – 2% Gross Revenue Royalty

The Laverton Project covers several Archaean greenstone belts north-northeast of Kalgoorlie which host a range of orogenic lode gold deposits, typical of the Western Australian Yilgarn Eastern Goldfields. The Laverton district is one of the best endowed gold regions in Australia, hosting a number of major deposits, such as Gold Fields’ Granny Smith and AngloGold Ashanti’s Sunrise Dam.

Following the acquisition, Elemental Altus will hold a total 4% GRR over 67km2 of the project, and a further 2% GRR over an additional 240km2.

Elemental Altus’ to be acquired royalty covers a total of 307 km2 of the Laverton Project, encompassing the following deposits:

- Beasley Creek and Beasley Creek South

- The Chatterbox Trend, including Apollo, Eclipse, Innuendo, Rumor

- The Gladiator Trend, including Gladiator and Murrays

- The Lancefield-Wedge Trend, including Telegraph, Wedge-Lancefield North

- The historic underground Lancefield Gold Mine

- The Karridale-Burtville Project

- The Euro Trend, comprising both North and South deposits

- The Cragiemore-Mary Mac Trend, including the Golden Pinnacles, Mary Mac and Craigiemore

- The West Laverton-Bulldog Trend

- The Barnicoat Project, including Barnicoat, Admiral Hill, Bells, Castaway, Grouse and Sickle

The wider Laverton project has the following JORC 2012 compliant Mineral Resource and Ore Reserve Estimates, over which Elemental Altus has significant coverage:

- Indicated Mineral Resource Estimate of 45.0 Mt @ 1.5 g/t Au for 2,100,000 ounces

- Inferred Mineral Resource Estimate of 23.0 Mt @ 2.1 g/t Au for 1,600,000 ounces

Including:

- Probable Ore Reserve Estimate of 13.0 Mt @ 1.3 g/t Au for 546,000 ounces

The newly acquired royalty area also includes an additional combined 240,000 ounces of historical gold resources at the Barnicoat Project and South Lancefield, reported to a JORC-2004 Compliant standard only.

Genesis notes the clear potential for Laverton to supply open pit and underground ore to Genesis’ operating 3 Mtpa Laverton mill approximately 30 km away. The mill is currently designed for standard CIL/CIP processing of free milling ores, comprising a jaw crusher and ball mill, leach tanks and an elution circuit. Genesis is investigating staged expansion opportunities, including an additional ball mill, increased leaching capacity and a crushing circuit upgrade. The new operator is also investigating the possible inclusion of refractory gold deposits, and these studies could potentially include restarting the Lancefield underground mine, with an Inferred Resource of 790,000 ounces at 6.3 g/t Au within Elemental Altus’ royalty area, which could be used to supplement future mill feed.

Figure 1 – Elemental Altus royalty coverage over the Laverton Project

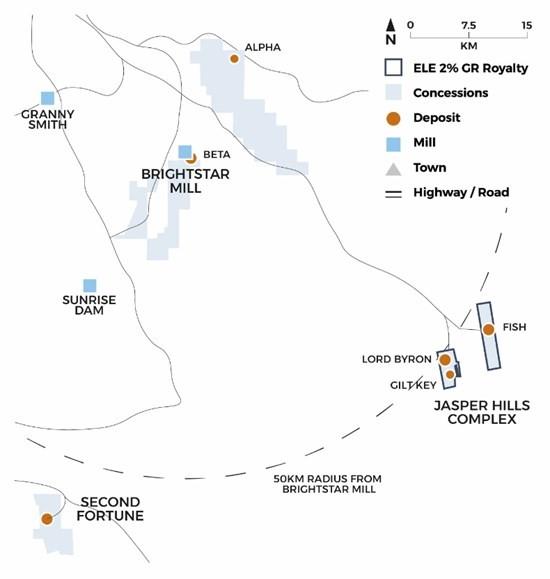

Jasper Hills – 2% Gross Revenue Royalty

The Jasper Hills Project consists of the Lord Byron, Fish and Gilt Key gold deposits approximately 100 km southeast of Laverton, Western Australia. The Mineral Resources lie in an underexplored greenstone belt SE of Laverton approximately 70km southeast of Brightstar’s processing plant, itself located ~30km southeast of Laverton, WA. Mining has previously occurred at Jasper Hills, with Crescent Gold Limited extracting 350,000t @ 3.83 g/t Au from the Fish open pit from 2011 to 2012, with ore being processed at Granny Smith. Crescent also mined 280,150t @ 1.5g/t Au for 13,510 oz gold produced from two shallow laterite pits at Lord Byron in 2012. Post 2012, Blue Cap Mining completed a further cutback at Lord Byron, with 190,400t @ 2.04g/t sold for processing at Sunrise Dam.

Elemental Altus’ royalty covers 32 km2 of the Jasper Hills Project, encompassing the following JORC 2012 compliant Mineral Resource and Ore Reserve Estimates:

- Measured and Indicated Mineral Resource Estimate of 2.5 Mt @ 1.8 g/t Au for 147,000 ounces

- Inferred Mineral Resource Estimate of 3.2 Mt @ 1.6 g/t Au for 160,000 ounces

Including:

- Proven and Probable Ore Reserve Estimate of 1.5Mt @ 1.6 g/t Au for 77,000 ounces

Brightstar are actively developing the underground mine at Fish, with portal access established in April 2025, and first ore intersected in late June. Stoping is on track to commence in the September quarter, with ore to be hauled to Genesis’ Laverton Mill, where a tolling agreement is in place to treat Brightstar material until Q1 2026. Two underground diamond drilling platforms have been established ahead of an exploration drill campaign this quarter. Inferred Resources are present beneath the currently planned development, with exploration targets identified at depth. The company believes that there is significant potential for reserve replacement, and for the life of mine to be extended beyond the current plan.

The Lord Byron open pit is scheduled to commence mining in Q3 2026, with ore to be treated at the Brightstar Mill, which is planned to be refurbished and restarted in H2 2026. It is expected that Lord Byron will provide the initial baseload feed to the expanded 1.0 Mtpa mill up to and including 2030. The current Reserve pit shell at Lord Byron is modelled using a A$3,500/oz gold price, which is significantly below consensus forecasts, increasing the likelihood for further reserve conversion, pushbacks and depth extensions to the current Resource, which is open at depth. Brightstar report ore from existing low-grade stockpiles at Lord Byron have been processed at Laverton for additional near-term production.

Elemental Altus note clear intent from Brightstar to maximise efficiencies and productivity at the Jasper Hills complex, with the construction of a new camp and associated infrastructure being progressed to enhance synergies across the two operations. The Jasper Hills tenements are central to Brightstar’s early production plan, using initial near-term revenue to fund exploration and develop the wider Laverton package, including at Second Fortune, Alpha and Cork Tree Well to the North.

Figure 2 – Elemental Altus royalty coverage over the Jasper Hills Project

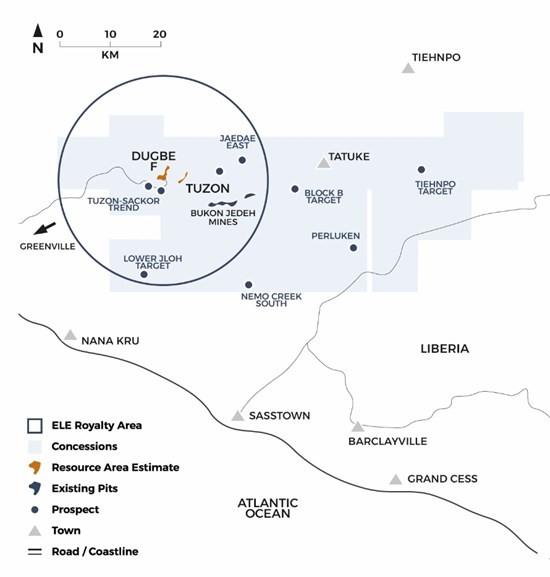

Dugbe – 2.0-2.5% Net Smelter Return Royalty

Liberia is considered highly prospective for gold and is a geologically similar, yet underexplored jurisdiction compared to the neighbouring gold producing countries Côte d’Ivoire, Mali, Burkino Faso and Ghana. The 2,078km2 project area is situated in an established mining region – with Bonikro, Yaoure, Ity and Abujar gold deposits all present to the northeast. The royalty covers a circular area with a 20km radius from a defined point at the southern edge of current Dugbe F pit design. The royalty area covers 1,257km2, with approximately 850km2 overlapping with the current project area.

DRA Global completed a Feasibility Study for Dugbe in June 2022, and more recently, Pasofino announced that they have engaged MineScope Services to complete a gap analysis and trade-off studies to update the 2022 Feasibility Study. ‘Phase One’ of this process has now been completed, and improvement workstreams have been outlined for the next 12 months, leading to the planned release of an updated study next year.

The proposed greenfield project is a multi-pit mine, utilising truck-shovel open pit mining methods with a single processing plant. The 2022 Dugbe Feasibility Study proposed a 5 Mtpa mill throughput with a 14-year mine life, producing ~162,000 ounces of gold per annum, averaging ~200,000 ounces of gold per annum over the first ten years of full production. All project infrastructure to be constructed is included in the study, as well as upgrades at the nearby port facility at Greenville, and the 75km access route. The royalty area also contains a number of encouraging exploration prospects, including the very promising Sackor and Bukon Jedeh areas.

Figure 3 – Elemental Altus royalty coverage over the Dugbe Project

About Elemental Altus Royalties Corp.

Elemental Altus is an income generating precious metals royalty company with 10 producing royalties and a diversified portfolio of pre-production and discovery stage assets. The Company is focused on acquiring uncapped royalties and streams over producing, or near-producing, mines operated by established counterparties. The vision of Elemental Altus is to build a global gold royalty company, offering investors superior exposure to gold with reduced risk and a strong growth profile.

Qualified Person

Richard Evans, FAusIMM, is Senior Vice President Technical for Elemental Altus, and a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical disclosure contained in this press release.

Notes

- Genesis Minerals Limited ASX release titled “Genesis eyes further growth in production and cashflow with the acquisition of Laverton Gold Project”, dated May 25, 2025, at https://genesisminerals.com.au/

- Brightstar Resources Limited ASX release titled “Compelling Scoping Study for Jasper Hills Gold Project”, dated March 25, 2024, at https://brightstarresources.com.au/

- Brightstar Resources Limited ASX release titled “Menzies & Laverton Gold Projects Feasibility Study Outlines $461m Free Cash Flow”, dated June 30, 2025, at https://brightstarresources.com.au/

- Dugbe Gold Project NI 43-101 Technical Report – Feasibility Study, effective June 13, 2022, and dated July 28, 2022, at https://www.pasofinogold.com/

- Elemental Altus notes that for historical deposits, the tonnages and grades stated were not prepared or disclosed consistent or compliant with NI 43-101 or an acceptable foreign code. No qualified person has completed sufficient work to classify the estimate as current mineral resources or mineral reserves.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE