Doubleview Extends High-Grade Domains at Hat: H099 Returns 438m of 0.40% CuEq Including 52m of 1.02% CuEq, Expanding Mineralization Envelope Around Conceptual Pit Vertically and Laterally

Doubleview Gold Corp. (TSX-V: DBG) (OTCQB: DBLVF) (FSE: 1D4) is pleased to announce assay results from drill holes H097, H098, and H099 from its 2025 drill program at the Hat Polymetallic Deposit in northwestern British Columbia. Drill holes H097, H098 and H099 were collared from the same platform as drill holes H093-H096 and were drilled into previously untested potential extensions of the deposit and have successfully expanded the mineralized footprint approximately 100m laterally and 200 meters vertically and strengthened confidence in continuity in part of the Lisle Zone.

Highlights

- H099 returned 438.0 metres of 0.40% CuEq, including 52.0 metres of 1.02% CuEq, representing one of the strongest continuous mineralized intervals drilled at the Hat deposit to date.

- H097 and H098 confirm mineralization in previously undrilled sections and extend data approximately 200-300 metres down-dip and up to 100 metres laterally and fill important gaps in the geological exploration model. Drill holes H097, H098 and H099 when integrated into the database potentially will extend the 2024 conceptual open-pit shell by ~200 metres down-dip and up to 100 metres laterally, and demonstrate strong expansion potential that may be realized in the revised version of the 2024 Mineral Resource Estimate (MRE-2) and the Preliminary Economic Assessment (PEA).

- Drill hole analyses reported in this News Release show continuity of copper-gold-cobalt-scandium domains [scandium is an emerging critical metal and an important component of the Hat deposit], across broad intervals of the system.

- These drill holes support the Company’s objective to complete an up-dated Mineral Resource Estimate (MRE-2) and a Preliminary Economic Assessment (PEA) and improve confidence in the exploration model all of which will be incorporated in the current and future engineering studies *Copper Equivalent (CuEq) values exclude scandium (Sc2O3).*

Table 1: Summary of Significant % CuEq Drill Core Intercepts

Summary of Significant Drill Core Intercepts

| DDH | From (m) | To (m) | Length (m) | CuEq (%) Excl. Sc2O3 | Ag (g/t) | Au (g/t) | Co (g/t) | Cu (%) | Sc (g/t) | |

| H097 | 30.8 | 476.0 | 445.3 | 0.20 | 0.18 | 0.09 | 62.1 | 0.10 | 28.1 | |

| H097 | Including | 112.8 | 258.0 | 145.2 | 0.25 | 0.24 | 0.12 | 85.3 | 0.12 | 25.5 |

| Including | 209.0 | 279.0 | 70.0 | 0.29 | 0.34 | 0.10 | 89.8 | 0.17 | 25.3 | |

| Including | 387.0 | 422.0 | 35.0 | 0.36 | 0.21 | 0.14 | 60.5 | 0.22 | 21.6 | |

| H098 | 45.0 | 438.0 | 393.0 | 0.27 | 0.25 | 0.10 | 77.5 | 0.16 | 27.9 | |

| Including | 288.0 | 436.0 | 148.0 | 0.41 | 0.34 | 0.12 | 73.2 | 0.28 | 30.9 | |

| Including | 290.0 | 433.0 | 143.0 | 0.42 | 0.34 | 0.12 | 73.7 | 0.28 | 31.0 | |

| H099 | 72.0 | 715.0 | 643.0 | 0.34 | 0.21 | 0.16 | 62.6 | 0.18 | 29.9 | |

| Including | 210.0 | 648.0 | 438.0 | 0.40 | 0.25 | 0.17 | 67.5 | 0.23 | 30.4 | |

| Including | 312.0 | 648.0 | 336.0 | 0.47 | 0.29 | 0.20 | 67.9 | 0.27 | 31.5 | |

| Including | 362.0 | 457.3 | 95.3 | 0.61 | 0.51 | 0.18 | 91.0 | 0.42 | 30.6 | |

| Including | 586.0 | 687.0 | 101.0 | 0.64 | 0.25 | 0.35 | 49.9 | 0.31 | 32.4 | |

| Including | 586.0 | 676.7 | 90.7 | 0.68 | 0.24 | 0.38 | 52.2 | 0.33 | 31.5 | |

| Including | 586.0 | 638.0 | 52.0 | 1.02 | 0.34 | 0.58 | 67.2 | 0.48 | 28.3 |

Notes:

1 – Copper Equivalent (CuEq) currently does not include Scandium

2 – The intervals presented in this table are not true widths. The true width of mineralized sections has not been determined.

3 - Metal equivalents should not be relied upon for future evaluations. Drill hole intercepts included in this news release are core lengths that may or may not represent true widths of mineralization. It is not possible to determine true widths.

4 – Parameters used to calculate Copper Equivalent: Au price (US$/oz): 2365.09; Ag price (US$/oz): 27.43; Cu price (US$/lb): 4.17; Co price (US$/lb): 14.76. Au recovery: 89.0%; Ag recovery: 68.0%; Cu recovery: 84.0%; Co recovery: 78.0%. * Copper Equivalent Calculation CuEq in % = ([Ag grade in ppm] *27.43*0.68/31.1035 + [Au grade in ppm] *2365.09*.89/31.1035 + 0.0001* [Co grade in ppm] *14.76*0.78*22.0462 + 0.0001* [Cu grade in ppm] *4.17*0.84*22.0462)/(4.17*22.0462*0.84).

| Drill intercept overview: | |

| H099 |

In 643 m at 0.34% CuEq |

| H098 |

|

| H097 |

|

These long intercepts continue to demonstrate and explore the dimensions of the horizontal and vertical porphyry-style Hat deposit mineralization enriched in copper, gold, cobalt, silver, and scandium.

Geological Interpretation

Step-Out Drilling Adds Increased Volumes

H097-H099 were planned to intersect previously undrilled areas between and beneath the trace of previously released drill holes (H093-H096). Although collared from the same surface location, the drill holes highlighted in this News Release extended the dimensions of the deposit 200-300 metres at depth and up to 100 metres laterally, successfully fulfilling the objective of characterizing untested volumes of the deposit.

Expansion of Conceptual Pit Potential

The strong continuity and grade distribution observed in drill hole H099, together with similar results from H097 and H098, extend the interpreted geometry of the mineralized body and potentially allow major extensions of the conceptual pit by approximately 200 metres vertically and ~100 metres laterally. Note: the current exploration model and conceptual pit design are based on available information and may not be supported by future drilling and engineering studies.

Continuity & Resource Confidence

The drill holes included in this News Release were planned to improve the interpretation of deposit geology and strengthen the block model used for resource estimates. The results confirm both lateral and vertical continuity of the system and will contribute to higher confidence resource categories as the model is updated.

High-Grade Domains and Depth Potential

Drill hole H099 is particularly important as it highlights a strongly mineralized area of copper, et al. metals, including more than 50 metres exceeding 1.0% CuEq, and demonstrates that high-grade zones continue to depth. The extent of such high-grade zones has not been determined.

Critical Metals: Scandium & Cobalt

While scandium (Sc2O3) is not included in CuEq calculations, scandium grades remain consistent with prior drill campaigns and continue to frame the Hat Deposit as a potentially significant North American source of critical metals.

CEO Comments

Farshad Shirvani, President and CEO, commented:

“These new step-out holes continue to validate and strengthen our geological model of the Hat Deposit. H099, in particular, delivered exceptional continuity with long and high-grade sections, confirming that the Lisle Zone remains robust at depth. The drilling extended mineralization into untested areas and demonstrated expansion potential for the conceptual pit by approximately 200 metres down-dip and 100 metres laterally.

These results reaffirm our confidence in the Hat model, highlight the presence of high-grade domains, and demonstrate meaningful depth potential. Importantly, the new holes help us improve resource confidence and will be incorporated into the upcoming resource estimation work. We are very encouraged by the consistent scandium and cobalt values across the system, strengthening Hat’s profile as a strategic critical-metals project in British Columbia. Our team is already planning follow-up drilling into several newly opened areas.”

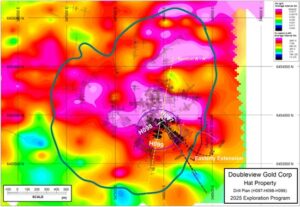

A surface plan map showing locations of H097, H098, and H099 relative to earlier holes (H090-H096), plotted on top of the 3D Induced Polarization (IP) chargeability model. The map illustrates the central Lisle Zone, the 2024 conceptual pit outline, and the new volumetric extensions identified through the 2025 drilling.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8003/276907_7723e6e3145a690d_001full.jpg

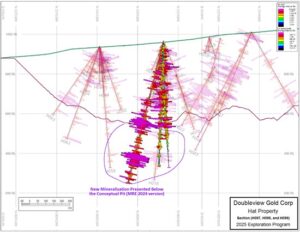

Figure 2 – Section View Through H099

A north-south vertical cross-section through H099 showing down-hole CuEq grades, highlighting the 438 m mineralized interval and the high-grade 52m zone exceeding 1.0% CuEq. The section illustrates how the reported drill holes extend mineralization 200-300 m below prior interpretation and opens new areas for follow-up.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8003/276907_7723e6e3145a690d_002full.jpg

Other notes:

Details of the algorithm used to estimate %CuEq are presented in the notes above. The metal values used in our current algorithm are average trailing three years commodity prices, and do not reflect recent dramatic increases in prices of mineral commodities. Scandium recovery has been announced in the news release dated 25th of November 2025 with an overall pre-optimized 82%.

Core samples are delivered securely to a fully accredited commercial laboratory and processed by industry-standard methods and include insertion of standard samples, duplicate core samples and blank samples to ensure confidence. Assays are received from the analytical laboratory at irregular intervals, verified by reference to notes provided by our field crew, added to our database, and disseminated publicly by News Release.

“The scandium resource potential is based on the drill holes on the property drilled for (July 25, 2024) maiden resource estimate for other metal content than scandium. The potential quantity and grade are conceptual in nature, there has been insufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Table 2: Drill hole locations

| DDH ID | UTM-East (m) | UTM-North (m) | Elevation (m) | Azimuth (°) | Dip (°) | Max-Depth (m) | Year |

| H097 | 347963 | 6453927 | 966 | 348.0 | -86.2 | 639 | 2025 |

| H098 | 347963 | 6453927 | 966 | 251.0 | -87.4 | 633 | 2025 |

| H099 | 347963 | 6453927 | 966 | 190.0 | -76.0 | 738 | 2025 |

About Doubleview Gold Corp

Doubleview Gold Corp. is mineral resource exploration and development company headquartered in Vancouver, British Columbia, Canada. It is publicly traded on the TSX-Venture Exchange (TSX-V: DBG), (OTCQB: DBLVF), (WKN: LA1W038), and (FSE: 1D4). Doubleview focuses on identifying, acquiring, and financing precious and base metal exploration projects across North America, with a strong emphasis on British Columbia. The company enhances shareholder value through the acquisition and exploration of high-quality gold, copper, cobalt, scandium, and silver projects-collectively critical minerals utilizing cutting-edge exploration techniques.

Doubleview’s success is deeply rooted in the unwavering support of its long-term shareholders, supporters, and institutional investors. Their ongoing commitment has been instrumental in advancing the company’s strategic initiatives. Doubleview looks forward to further collaborative growth and development and continues to welcome active participation from its valued stakeholders as the company expands its portfolio and strengthens its position in the critical minerals sector.

About the Hat Polymetallic Deposit

The Hat Deposit, located in northwestern British Columbia, is a polymetallic porphyry project with major resources of copper, gold, cobalt, and the potential for scandium. As one of the region’s significant sources of critical minerals, the Hat deposit has undergone targeted exploration and development. The 0.2% CuEq cut-off resource estimate, as of the recently completed Mineral Resource Estimate and the Company’s July 25, 2024, news release, is summarized below:

| Average Grade | Metal Content | |||||||||||

| Open Pit Model Hat | Resource Category | Tonnage | CuEq | Cu | Co | Au | Ag | CuEq | Cu | Co | Au | Ag |

| Mt | % | % | % | g/t | g/t | million lb | million lb | million lb | thousand oz | thousand oz | ||

| In Pit | Indicated | 150 | 0.408 | 0.221 | 0.008 | 0.19 | 0.42 | 1,353 | 733 | 28 | 929 | 2,045 |

| Inferred | 477 | 0.344 | 0.185 | 0.009 | 0.15 | 0.49 | 3,619 | 1,945 | 91 | 2,328 | 7,575 | |

Scandium potential for the Hat Deposit is estimated to be 300 to 500 million tonnes at an average grade of 40 ppm (0.004%) Sc2O3.

For further details of the MRE, please refer to the Company’s July 25, 2024 news release.

On behalf of the Board of Directors,

Farshad Shirvani, President & Chief Executive Officer

For further information please contact:

Doubleview Gold Corp

Vancouver, BC Farshad Shirvani

President & CEO

T: (604) 678-9587

E: corporate@doubleview.ca

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE