Dolly Varden Silver Intersects 93.95 m of 357 g/t AgEq including 9,422 g/t AgEq over 1.02m expanding Homestake Silver High-Grade Trend

Dolly Varden Silver Corporation (TSX-V: DV) (OTC: DOLLF) is pleased to announce drill results from its 2023 program at the Homestake Silver deposit in BC’s Golden Triangle. The 23 drillholes reported total 12,150m of drilling targeting priority zones within the deposit and have significantly expanded the width and extent of the reinterpreted high-grade silver and gold mineralized plunge.

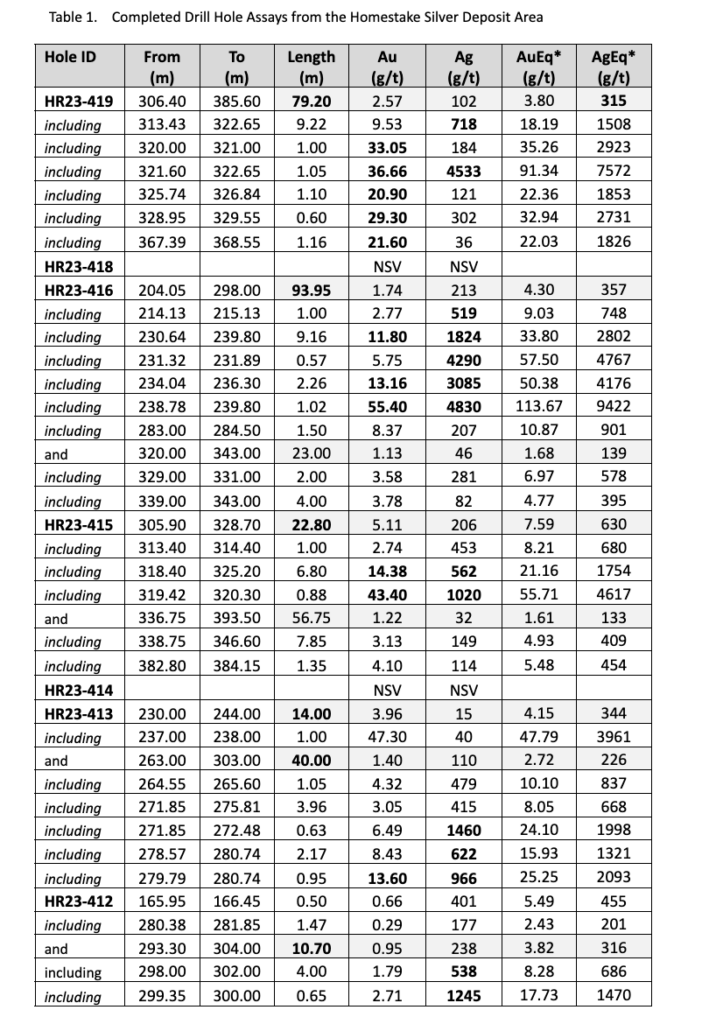

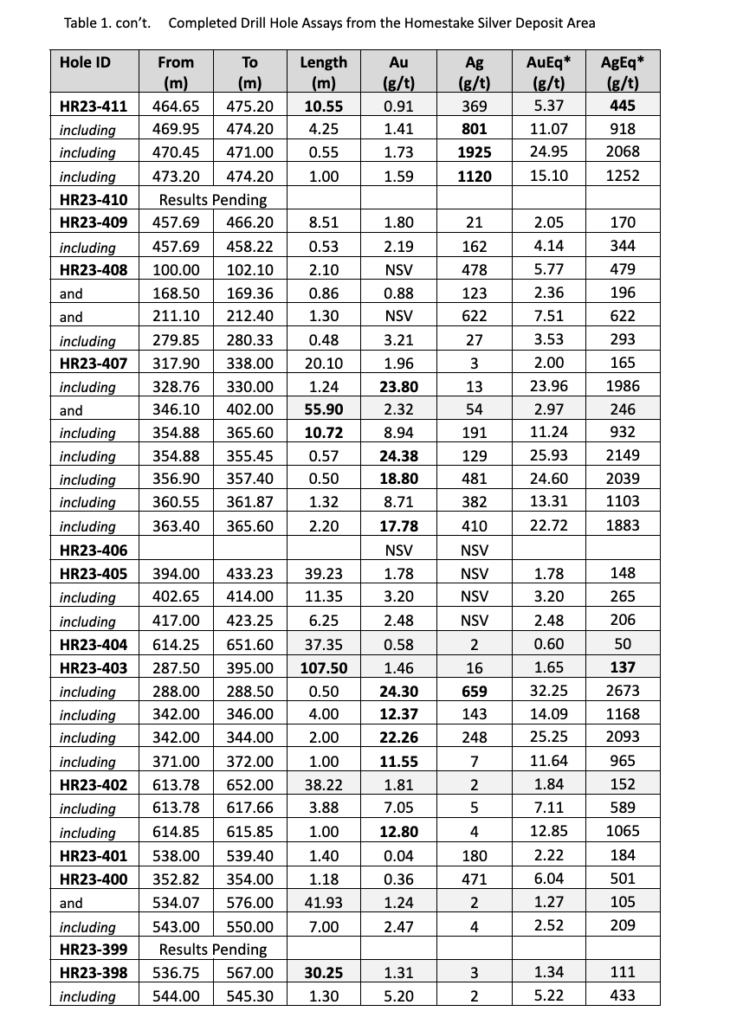

Highlights from Homestake Silver (intervals shown are core length**):

- HR23-419: Mineralized envelope: 315 g/t AgEq (2.57 g/t Au and 102 g/t Ag) over 79.20 meters, including internal breccia vein intervals grading 1,508 g/t AgEq (9.53 g/t Au and 718 g/t Ag) over 9.22 meters length, 7,572 g/t AgEq (36.66 g/t Au and 4,533 g/t Ag) over 1.05 meters.

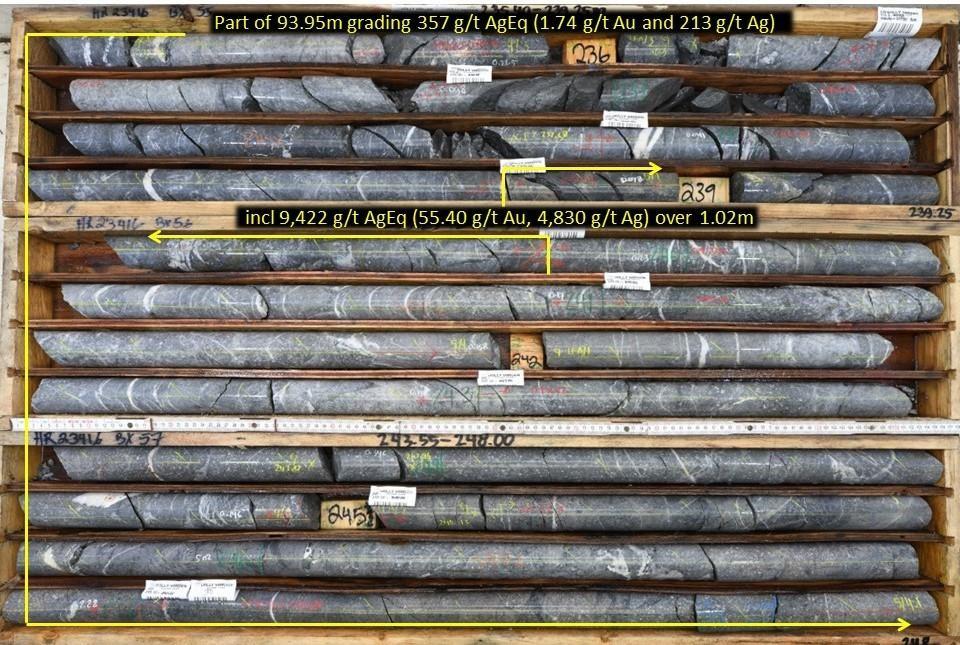

- HR23-416 Mineralized envelope: 357 g/t AgEq (1.74 g/t Au, 213 g/t Ag) over 93.95 meters length, including internal breccia vein intervals grading 2,802 g/t AgEq (11.80 g/t Au and 1,824 g/t Ag) over 9.16 meters length, 4,176 g/t AgEq (13.16 g/t Au and 3,085 g/t Ag) over 2.26 meters and 9,422 g/t AgEq (55.40 g/t Au and 4,830 g/t Ag) over 1.02 meters.

- HR23-415: Mineralized envelope: 630 g/t AgEq (5.11 g/t Au and 206 g/t Ag) over 22.80 meters, including internal breccia vein intervals grading 1,754 g/t AgEq (14.38 g/t Au and 562 g/t Ag) over 6.80 meters length, 4,617 g/t AgEq (43.40 g/t Au and 1,020 g/t Ag) over 0.88 meters.

- HR23-413: Mineralized envelope: 226 g/t AgEq (1.40 g/t Au and 110 g/t Ag) over 40.00 meters, including internal breccia vein intervals grading 668 g/t AgEq (3.05 g/t Au and 415 g/t Ag) over 3.96 meters, 1,998 g/t AgEq (6.49 g/t Au and 1,460 g/t Ag) over 0.63 meters.

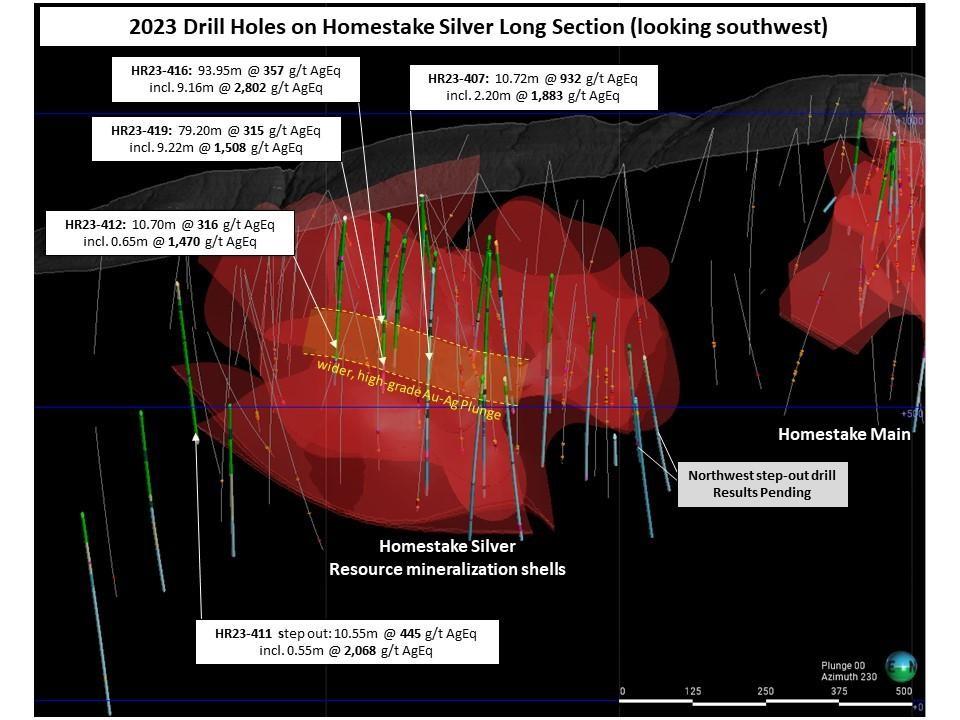

- HR23-407: Mineralized envelope: 246 g/t AgEq (2.32 g/t Au and 54 g/t Ag) over 55.90 meters length, including internal breccia vein intervals grading 932 g/t AgEq (8.94 g/t Au and 191 g/t Ag) over 10.72 meters length, 2,149 g/t AgEq (24.38 g/t Au and 129 g/t Ag) over 0.57 meters and 1,883 g/t AgEq (17.78 g/t Au and 410 g/t Ag) over 2.20 meters.

- HR23-411: Expansion step out hole to the southeast; 445 g/t AgEq (0.91 g/t Au and 369 g/t Ag) over 10.55 meters including 2,068 g/t AgEq (1.73 g/t Au and 1,925 g/t Ag) over 0.55 meters.

*AuEq and AgEq are calculated using only the two precious metal components at $US1650/oz Au, $US20/oz Ag, Assays are not capped

**Estimated true widths vary depending on intersection angles and range from 65% to 85% of core lengths, further modelling of the new interpretation is needed before true widths can be calculated

“The 2023 drilling at Homestake Silver has identified a substantial zone of exceptional precious metal grades, often typified by multiple phases of silver and gold mineralization, over wide, continuous intervals that are potentially amendable to bulk underground mining methods,” said Shawn Khunkhun, CEO of Dolly Varden Silver. “Results from additional step-out holes to the north of these intercepts are being finalized and are expected to be announced shortly.”

“Applying what was learned from the structural reinterpretation work at the Homestake Main gold zone to the existing wider spaced drilling at Homestake Silver Zone has led to the discovery of high-grade pathways within a continuous mineralized envelope with average precious metal grades above the average resource grades and over much wider intervals than expected”, states Rob Van Egmond, P.Geo, Vice President of Exploration.

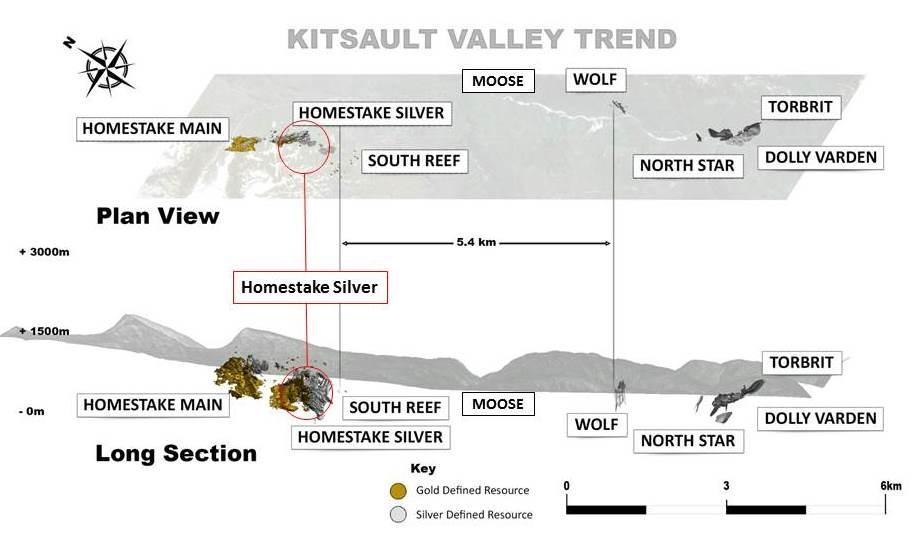

Figure 1. Location along Dolly Varden’s Kitsault Valley trend of Deposits

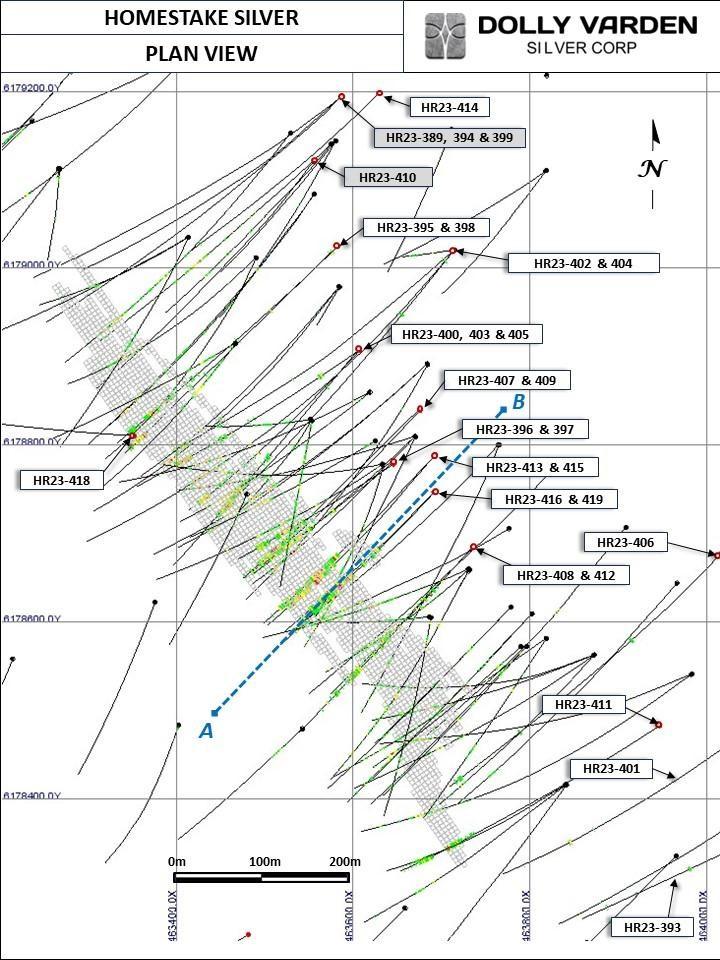

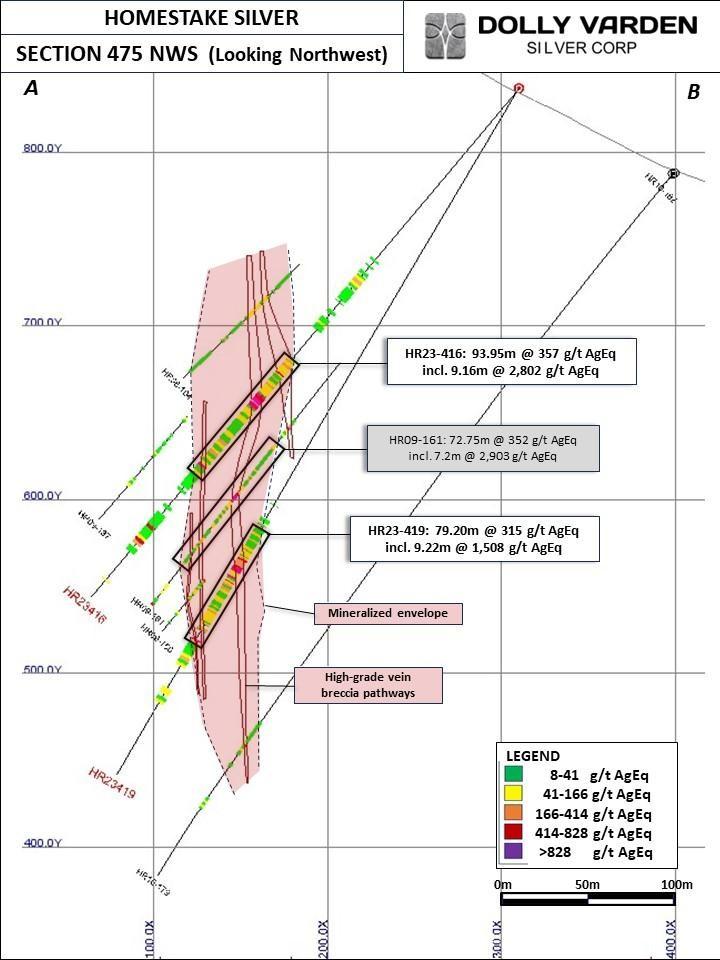

Drill holes HR23-416 and HR23-419 have a down dip spacing of 105 meters on the same vertical cross-section. The holes were up and down dip, respectively, from historic drill hole HR09-161 which graded 352 AgEq (2.89 g/t Au and 112 g/t Ag) over 72.75 meters over the width of the mineralized envelope (see figure 2 section). Drill holes HR23-413 and HR23-415 are located on section 25m to the north-northwest and HR23-407 is 100m along strike from HR23-416/419.

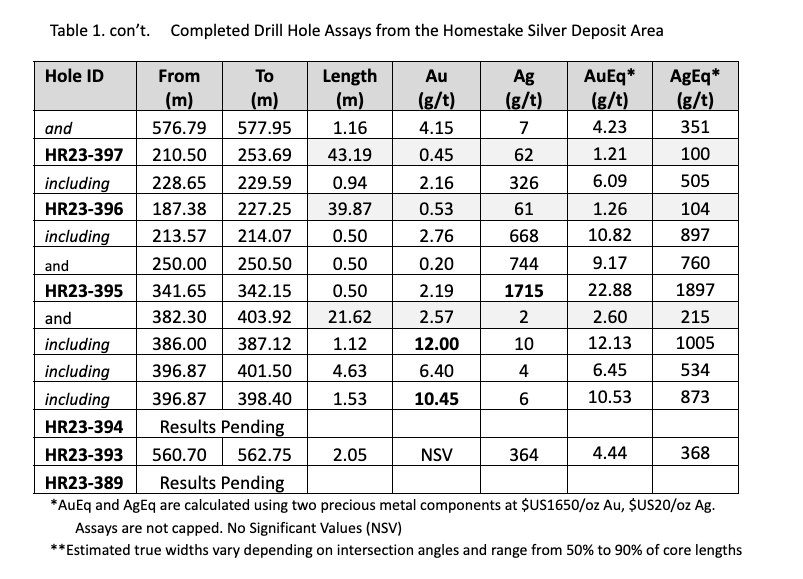

Drill holes HR23-396 and 397 were drilled up dip of the wide, higher-grade plunge intersecting individual higher-grade vein breccias extending above the mineralized envelope.

Drilling targeted the high-grade plunge within the Homestake Silver deposit. These holes focused on defining and expanding the wide gold and silver (+/- lead and zinc) mineralized zone along the low angle, northerly plunge of the high-grade mineralization. The reinterpretation concluded that the wider mineralization zone at Homestake Silver is at a similar plunge orientation as that of the Homestake Main deposit, located 300m to the northwest. The average grades are higher, on a precious metal silver equivalent basis, than the average grade of the silver deposits at the Dolly Varden property to the south due to the increased gold content at the Homestake Ridge deposits.

Figure 2. Drill hole HR23-416 from the Homestake Silver deposit. A 12.60-meter section from the 93.95-meter mineralized envelope highlighting the 1.02-meter high-grade multi-pulse vein breccia pathway. Strong alteration and stockwork with local multi-pulse vein and vein breccias can be seen throughout the interval.

Drill hole HR23-411 is a 50m step out (down dip) from the southeastern end of Homestake Silver showing that the gold and silver mineralization remains open in that direction. Drill hole HR23-414 was drilled in the unmineralized footwall to Homestake Silver.

Finalized results remain to be released for 47 of the 115 drill hole, 51,454.90 meter, 2023 Kitsault Valley Project exploration drill program. These include 25 drill holes at Homestake Main (11,054.90m), 4 drill holes (2,478.00m) from Homestake Silver northern extension and 6 drill holes (1,627m) from Homestake Ridge property exploration drill holes. Plus 12 drill holes (7,400m) from the southern Dolly Varden property.

Figure 3. Homestake Silver Long section looking southwest with 2023 drill hole highlights. 100m wide window.

Homestake Ridge

The Homestake Ridge deposits are interpreted as structurally controlled, multi-phase epithermal vein stockwork and vein breccia system hosted in Jurassic aged Hazelton volcanic rocks. Mineralization consists of pyrite, +/-galena and sphalerite in a breccia matrix within a silica breccia vein system (see Figure 2). The northwest orientation of the main Homestake structural trend appears to have numerous subparallel internal structures that are interpreted to form the controls for higher grade gold and silver shoots within a broader Mineralized envelope at the Homestake Silver deposit. The main structural corridor dips steeply to the northeast at Homestake Main and rolls to vertical or steeply southwest at Homestake Silver (see Figure 5).

Figure 4. Homestake Silver Plan View with Current Mineral Resource block model, primarily of Inferred resource classification with 2023 drill collar locations highlighted.

Figure 5. Homestake Silver Cross Section (A-B) with 2023 and historic drill holes.

Quality Assurance and Quality Control

The Company adheres to CIM Best Practices Guidelines for exploration related activities conducted on its property. Quality Assurance and Quality Control (QA/QC) procedures are overseen by the Qualified Person.

Dolly Varden QA/QC protocols are maintained through the insertion of certified reference material (standards), blanks and field duplicates within the sample stream. Drill core is cut in-half with a diamond saw, with one-half placed in sealed bags and shipped to the laboratory and the other half retained on site. Third party laboratory checks on 5% of the samples are carried out as well. Chain of custody is maintained from the drill to the submittal into the laboratory preparation facility.

Analytical testing was performed by ALS Canada Ltd. in North Vancouver, British Columbia. The entire sample is crushed to 70% minus 2mm (10 mesh), of which a 500 gram split is pulverized to minus 200 mesh. Multi-element analyses were determined by Inductively Coupled Plasma Mass Spectrometry (ICP-MS) for 48 elements following a 4-acid digestion process. High grade silver testing was determined by Fire Assay with either an atomic absorption, or a gravimetric finish, depending on grade range. Au is also determined by fire assay on a 30g split with either atomic absorption, or gravimetric finish, depending on grade range. Metallic screen assays may be completed on very high grade samples.

Qualified Person

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this news release and supervises the ongoing exploration program at the Dolly Varden Project.

Dolly Varden Announces New Investor Relations Services Providers

The Company has entered into an agreement with Triomphe Holdings Ltd. (dba Capital Analytica) for investor relations and communication services. The Consulting Agreement has an initial term of six months, commencing January 1 , 2024 under which the Company will pay to Capital Analytica an aggregate of $120,000 at a rate of $20,000 per month, and has an option to renew the Consulting Agreement for an additional 6 months at a rate of $10,000 per month, unless terminated earlier in accordance with the Consulting Agreement.

Pursuant to the terms of the Consulting Agreement, Capital Analytica will provide ongoing capital markets consultation, ongoing social media consultation regarding engagement and enhancement, social sentiment reporting, social engagement reporting, discussion forum monitoring and reporting, corporate video dissemination, and other related investor relations services.

Capital Analytica is a Nanaimo based company owned and operated by Jeff French who is arm’s length to the Company and holds no securities, directly or indirectly of the Company.

The Company is also pleased to announce the engagement of Zoppa Media Group to provide additional investor relations services beginning effective January 12, 2024. Dolly Varden has entered into a consulting agreement with Zoppa Media Group (the “Services Agreement”), pursuant to which Zoppa Media Group will provide certain investor relations services including investor outreach and management of the Company’s social media accounts in order to increase awareness regarding Dolly Varden. Pursuant to the Services Agreement, the Zoppa Media Group will provide such services on a month-to-month basis for a renewable one year term for a fee of $10,000 per month.

Zoppa Media Group is a Vancouver based company, owned by Diana Zoppa. Diana Zoppa has previously served Dolly Varden in an executive assistant role prior to gaining investor relations experience with a number of publicly trading companies. The Zoppa Media Group and Diana Zoppa hold 25,200 common shares of the Company.

About Dolly Varden Silver Corporation

Dolly Varden Silver Corporation is a mineral exploration company focused on advancing its 100% held Kitsault Valley Project (which combines the Dolly Varden Project and the Homestake Ridge Project) located in the Golden Triangle of British Columbia, Canada, 25kms by road to tide water. The 163 sq. km. project hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge along with the past producing Dolly Varden and Torbrit silver mines. It is considered to be prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other, on-trend, high-grade deposits, such as Eskay Creek and Brucejack. The Kitsault Valley Project also contains the Big Bulk property which is prospective for porphyry and skarn style copper and gold mineralization, similar to other such deposits in the region (Red Mountain, KSM, Red Chris).

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE