Defense Metals – Robust Economics from Wicheeda Rare Earth Deposit PFS

Defense Metals Corp. (TSX-V: DEFN) (OTCQB: DFMTF) (FSE:35D) is pleased to release the results of its independent Pre-Feasibility Study concerning the on-going development of its 100%-owned Wicheeda Rare Earth Element deposit located in British Columbia (BC), Canada.

All amounts herein are in United States dollars, unless otherwise stated.

Guy de Selliers, Executive Chairman, stated: “The positive results of our Pre-Feasibility Study confirm the strategic importance of the Wicheeda Project at a time when North America and Europe are prioritizing economic resilience and supply chain security for critical minerals.

“With NdPr being essential to electric vehicles, renewable energy, and advanced defense technologies, the Wicheeda Project represents a unique opportunity to establish a reliable, Western-aligned supply of these vital materials, reducing reliance on foreign sources and importantly helping to secure economic security.

“Our Wicheeda rare earth project is one of the most advanced in either North America or Europe that is not yet in production, positioning it as a leading, near-term solution to meet the growing demands for Western-aligned supply chains.

“As we move forward, we remain committed to responsible development policies and practices, along with strong partnerships that collectively will unlock the full economic and strategic value of this asset for all stakeholders and rightsholders.”

Wicheeda Project PFS Highlights

Robust Economics

- Pre-tax net present value (NPV) of $1.8 billion and after-tax NPV of $1.0 billion, at an 8% discount rate.

- After-tax payback period of 3.7 years from the start of production.

- Pre-tax internal rate of return (IRR) of 24.6%, and after-tax IRR of 18.9%.

- Initial Capital Cost (CAPEX) of $1.4 billion.

- Open-pit production of 15 years (excluding pre-production) feeding a 5,000 tonne per day (tpd) flotation concentrator.

- Cash operating costs average $37.42/kg NdPrO (equivalent contained1) recovered.

- Average operating margin of 71% (EBITDA / Revenue).

High-Grade REE Mineral Deposit Advantage

- Defense Metals’ Wicheeda REE deposit is located in a Tier 1 mining jurisdiction.

- The Wicheeda Project has logistical and infrastructure advantages.

- The project’s reserves support a 15-year Life-of-Mine (LOM) with an average annual production of 31,900 tonnes (t) of Total Rare Earth Oxide (TREO)2 in concentrate, yielding approximately 5,200 t of TREO in a high-value mixed rare earth carbonate (MREC) after the removal of cerium (Ce) and lanthanum (La).

- Unique mineralogy of the Wicheeda REE deposit allows for the production of one of the highest-grade flotation REE mineral concentrates in the world at exceptional recovery levels.

High-Grade Mineral Concentrate Advantage

- LOM production of a high-grade flotation mineral concentrate, containing an average 50% TREO (dry basis) at 81% recovery over the initial 8 years.

- The mineral concentrate will be processed at Defense Metals’ own hydrometallurgical and solvent extraction (SX) separation process facilities.

High-Value Saleable Mixed Rare Earth Carbonate Product

- All of the La and most of the Ce will be removed during the SX process, creating a value-added final MREC product.

- The basket value of the MREC is derived from rare earth elements critical to high-growth permanent magnet applications; neodymium and praseodymium (87.3 wt%), dysprosium, (0.6 wt%), and terbium (0.2 wt%) of contained TREO. Other minor REE constituents are not considered in the basket value.

Defense Metals has taken a focused and conservative approach to all costs and inputs to deliver a realistic and compelling PFS that it believes maximizes the scope and scale of its Wicheeda Project over the long term.

The PFS incorporates an initial proven and probable mineral reserve estimate that supports a 15-year, open-pit mining operation (excluding pre-production) that will produce ore feed for a 5,000 tpd flotation plant. The flotation plant will produce a high-grade REE mineral concentrate that will feed hydrometallurgical and SX process facilities to produce a value-added MREC product.

Mark Tory, President and CEO of Defense Metals, commented: “We are thrilled to announce the successful completion of an independent Pre-Feasibility Study for our Wicheeda Rare Earth Deposit, marking a major milestone in its development. The PFS, conducted in collaboration with renowned global experts Hatch and SRK, demonstrates the strong potential of the Wicheeda Project as a reliable and sustainable source of critical rare earth elements that are essential to advance energy technologies, manufacturing, and defence applications.

“The high-grade mineral concentrate produced by the Wicheeda Project will undergo hydrometallurgical and solvent extraction processing, and according to our flowsheet design will enable us to produce a high-value Mixed Rare Earth Carbonate product, due to the substantial removal of lanthanum and cerium.

“With a pre-tax IRR of 24.6% and a pre-tax NPV of US$1.8 billion, our PFS confirms the robust economics this project has to offer. These results position the Wicheeda Project as one of the most compelling rare earth projects in North America or Europe. Given the increasing geopolitical tensions affecting rare earth supply chains, there is significant potential for rare earth prices to rise, further enhancing Wicheeda’s value and maximizing returns for our shareholders.

“Looking ahead, we will focus on optimizing the project’s design to maximize operational efficiency and ultimately shareholder returns. Additionally, we will engage with potential strategic partners to support the project’s growth and development.

“Now is the ideal time for a North American rare earth company to advance toward building a new mine and processing facilities. We are moving forward with our regulatory engagement and continue to work closely with the project’s Indigenous rightsholders to expedite the approval process and bring this critical project to fruition.”

________________________________________________________________________

1 Neodymium-Praseodymium oxide (NdPrO) and Total rare earth oxide (TREO) equivalents are reported in this document by convention. In the final MREC product, the rare earths will be present as carbonates (RE2(CO3)3), and in the feed and flotation concentrate they will be present in a variety of species. For reporting purposes, the rare earth content is converted to the oxide equivalent.

2 TREO accounts for all 15 rare earth oxides within the deposit; however, for financial modeling purposes only Nd, Pr, Tb and Dy are assigned economic value.

Wicheeda Project – Key Parameters

The project level financial analysis was performed on a 2025-dollar basis without inflation.

Table 1 – Base Case Economics

| Financial Metrics | Units | Base Case |

| Pre-tax NPV @ 8% | $M | 1,803 |

| After-tax NPV @ 8% | $M | 992 |

| Pre-tax IRR | % | 24.6 |

| After-tax IRR | % | 18.9 |

| Undiscounted After-tax Project Cashflow (LOM) | $M | 2,672 |

| After-tax payback period from start of production | Years | 3.7 |

| Costs and Profit | ||

| Initial capital expenditure | $M | 1,440 |

| Average annual operating cost | $M per annum | 165 |

| Average annual operating cost | $/kg NdPrO equivalent in MREC | 37.42 |

| MREC average price | $/kg NdPrO equivalent content in MREC | 136.30 |

| Life of mine gross revenue | $M | 9,030 |

| Operating (EBITDA) margin | % | 71 |

| Production Metrics | ||

| Mine life (excluding pre-production) | Years | 15 |

| Maximum mining production rate | Mtpa | 8.7 |

| Life of mine strip ratio | Waste: Ore | 3.3:1 |

| Life of mine TREO grade | % TREO in mill feed | 2.4 |

| Life of mine flotation concentrate | Thousand tonnes per annum (ktpa) dry | 62.5 |

| Concentrate grade | % TREO (dry) | 50 |

| Life of mine NdPrO contained in MREC | ktpa NdPrO equivalent | 4.4 |

| Life of mine NdPrO % of TREO in MREC | % NdPrO equivalent | 87 |

The PFS was conducted by Hatch Ltd. (Hatch) and SRK Consulting (Canada) Inc. (SRK). The Hatch and SRK Qualified Person (QP) authors confirm that the Wicheeda Project PFS disclosure meets the standards established by the Canadian Securities Administrators’ National Instrument 43-101 – Standard of Disclosure for Mineral Projects (NI 43-101).

The effective date of the PFS is February 7, 2025, and the Company expects to file a NI 43-101 technical report relating to the PFS on SEDAR+ within 45 days of this news release.

Wicheeda Project Overview

Favourable Mineralogy Leading to Favourable Metallurgy

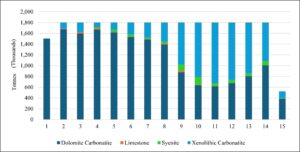

The Wicheeda REE deposit is characterized by three main REE-bearing lithologies: dolomite carbonatite (DC), which is the dominant lithology, xenolithic carbonatite, and syenite. Limestone is the major waste rock lithology.

The predominant REE-bearing minerals are bastnäsite, monazite, synchysite and parisite. The coarse grain size of Wicheeda’s REE mineralization provides significant metallurgical advantages, allowing for enhanced mineral liberation and improved separation from gangue minerals during comminution and increased flotation efficiency. These factors all support efficient and cost-effective REE recovery and collectively lead to the production of a LOM high-grade REE concentrate (averaging 50% TREO) that contributes to the Wicheeda Project’s economic viability.

Mine Planning

Table 2 – PFS Mine Plan Summary

| Mine Production Metrics | Unit | Pre-prod | Yrs 1-8 | Yrs 9-15 | LOM |

| Target Annual Throughput | Mt/a | – | 1.8 | 1.8 | 1.8 |

| Total Material Movement | Mt | 11.2 | 65.2 | 33.3 | 109.7 |

| Total Ore | Mt | 0.1 | 14.6 | 10.8 | 25.5 |

| Total Waste | Mt | 11.0 | 50.0 | 21.6 | 84.2 |

| Strip Ratio | waste: ore | 77.0:1 | 3.5:1 | 2.1:1 | 3.3:1 |

| Average Ore Grade | % TREO | 2.32 | 2.80 | 1.92 | 2.43 |

| Total Flotation Concentrate Produced | Mt dry | – | 0.632 | 0.306 | 0.94 |

| Design Flotation Concentrate Grade | % TREO | 50 | 50 | 50 | 50 |

| Average Flotation Plant Recovery | % | – | 80.9 | 69.3 | 76.7 |

The Wicheeda Project will be developed as an open-pit mining operation. In the first eight years of ore production, near-surface, mostly high-grade DC mineralization will be mined as indicated in the Figure 1 showing ore lithology over time. Mining rates will range from 4 to 9 million-tonnes per annum (Mtpa) over the 15-year mine life (excluding pre-production).

Mined ore will be crushed at a facility near the pit and transported via conveyor to sustain a 1.8 Mtpa mill feed to the on-site flotation plant. Waste rock will be placed in a waste rock storage facility (WRSF) adjacent to the pit.

The flotation plant will produce a high-grade rare earth mineral concentrate averaging 50% TREO. The flotation plant flowsheet includes crushing, semi-autogenous and ball mill grinding, rougher and scavenger flotation and three stages of cleaner flotation at elevated temperatures to produce a final flotation concentrate.

The Wicheeda Project envisages dewatering tailings using filter press technology and storing the filtered material in a filtered tailings storage facility (FTSF) located west of Wichcika Creek. It will store both flotation tailings and hydrometallurgical residue, with a liner system and water management pond to manage environmental impact.

The high-grade, filtered mineral concentrate will be transported off-site, approximately 45 kilometers (km) by truck, to Bear Lake for hydrometallurgical and SX processing to produce a high-quality MREC product.

Hydrometallurgy with Lanthanum and Cerium Removal by Solvent Extraction

During hydrometallurgical processing, the flotation mineral concentrate will first undergo acid baking with concentrated sulphuric acid (1.1 t/t concentrate) at about 300˚C, converting the rare earths into water-soluble sulphates, which readily dissolve during a subsequent water leach process. The resulting leachate will then be purified before being sent to the SX unit for the removal of La and Ce to allow production of MREC with enhanced economic value.

The SX operations will employ a single, standard solvent extraction circuit using an acidic extractant in a kerosene-based diluent: to separate La and Ce from the other REEs.

The low-value La and Ce will largely be eliminated and separately precipitated and disposed of in a waste storage facility provided for the hydrometallurgical process (with potential to be recovered should a market develop for these elements). The more valuable REEs will be retained, including the magnet-metal REEs: praseodymium (Pr), neodymium (Nd), terbium (Tb) and dysprosium (Dy).

Table 3 – Hydrometallurgical Plant Metrics

| Item | Unit | Yrs 1-8 | Yrs 9-15 | LOM |

| Flotation concentrate feed | ktpa | 80.4 | 44.7 | 63.7 |

| MREC production (TREO equivalent) | ktpa | 6.3 | 3.8 | 5.2 |

| NdPrO (equivalent) | ktpa | 5.4 | 3.2 | 4.4 |

| Heavy REO (equivalent)3 | ktpa | 0.8 | 0.5 | 0.7 |

| Hydrometallurgical Plant Recovery | % NdPrO | 93.4 | 93.4 | 93.4 |

After the La and Ce are removed, the remaining REEs are precipitated as a MREC.

The advantage of the SX process is that a higher-quality, higher-value MREC product is produced, containing 87% NdPr oxide and 11% heavy rare earth oxides including valuable Dy and Tb. Elimination of the La and Ce reduces the mass of MREC to be produced by a factor of six without any loss of the valuable NdPr. This not only allows for transportation and separation cost savings but also creates a more desirable product for downstream end users and REE separators.

____________________________________________________________________

3 For the purposes of this document, Heavy REO refers to the oxides of samarium (Sm), europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu), and yttrium (Y). Only Tb and Dy contributions were considered in the product value calculations.

Proximity to Existing Infrastructure

The Wicheeda REE deposit is approximately 80 km northeast of the nearby city of Prince George, British Columbia. The deposit location provides excellent access to infrastructure, as the site is accessible via an all-weather gravel road that connects to British Columbia Highway 97. Proximity to major B.C. Hydro hydroelectric power lines, a natural gas pipeline, and the Canadian National Railway line further enhance the project’s logistical advantages.

Prince George (agglomerated population ~ 95,000) serves as a regional hub, supporting oil and gas, forestry, hydropower and mining industries and offers a skilled workforce and essential services. Daily commercial air service is available between Prince George and major Canadian international airports. Moreover, the port of Prince Rupert, the closest major North American port to Asia is located about 500 km to the west and accessible by rail and road.

Power

The Wicheeda Project’s power supply is expected to come from a new high-voltage transmission line (1L 365) located west of the project site which connects to the B.C. Hydro 500 kV line. Cost estimates used in the PFS are based on industry benchmarks.

Transportation

Upgrading the existing forestry road from Bear Lake will facilitate access to the project site.

The Canadian National Railway (CNR) will be important in the supply of Wicheeda Project process plant reagents and consumables. The CNR handles over 50% of all Canadian chemicals production and is the only rail carrier servicing three major petrochemical centers in North America: the Alberta Heartland, the U.S. Gulf Coast and southwestern Ontario. The CNR line that passes through Bear Lake is high-capacity rail line that also services the port facilities at Prince Rupert, BC.

Project Infrastructure

The mining project area exhibits a topography and geography ideally suited for development. The varied terrain provides opportunities to minimize earthwork requirements and facilitates the development of a water management plan which maintains natural drainage patterns.

Water Supply

All excess water at the mine site will be directed to the contact water pond at the processing plant for process water recirculation or treatment and discharge.

Table 4 – Wicheeda Project Capital Expenditure Estimates

| Category | Capital Costs ($M) | ||||

| Initial | Sustaining | Closure | Post Closure | Total | |

| Mining | 99.2 | 57.9 | – | – | 157.2 |

| Flotation Plant and Infrastructure | 450.9 | – | – | – | 450.9 |

| Hydrometallurgical and SX Plants | 614.5 | – | – | – | 614.5 |

| Mine Tailings | 19.8 | 45.7 | – | – | 66.5 |

| Hydrometallurgical Waste | 10.7 | 14.0 | – | – | 24.7 |

| Contact Water Pond | 11.8 | – | – | 11.8 | |

| Mine Site Water Management | 1.6 | – | – | – | 1.6 |

| Mine Site Water Treatment | 10.0 | – | – | – | 10.0 |

| Hydrometallurgical Water Treatment | 6.6 | – | – | – | 6.6 |

| Closure | – | – | 57.4 | 325.1 | 382.5 |

| Contingency | 214.8 | 15.3 | 7.2 | 40.6 | 277.9 |

| Total | 1,439.8 | 133.0 | 64.5 | 365.8 | 2,003.0 |

Cost estimates do not consider cost escalation resulting from the imposition of new tariffs, counter-tariffs, import and/or export duties or other similar charges applicable to raw, semi-finished or finished materials and/or other products.

Table 5 – Wicheeda Project Operating Costs Estimates

| Category | LOM ($M) | LOM avg ($M/y) | LOM ($/kg NdPrO equivalent in MREC) |

| Mining | 537 | 35.8 | 8.09 |

| Flotation Plant | 724 | 48.3 | 10.91 |

| Hydrometallurgical Facility | 995 | 66.3 | 15.02 |

| Concentrator & Hydrometallurgical Facility General & Administration | 88 | 5.8 | 1.32 |

| Mine Site Tailings | 94 | 6.3 | 1.42 |

| Hydrometallurgical Waste | 20 | 1.4 | 0.31 |

| Contact Water Pond | 2 | 0.2 | 0.04 |

| Mine Site Water Treatment | 11 | 0.7 | 0.16 |

| Hydrometallurgical Water Treatment | 8 | 0.5 | 0.12 |

| Total | 2,479 | 165.3 | 37.42 |

Rare Earth Markets and Price Forecast

The Rare Earth Market

According to Adamas Intelligence Inc. (Adamas), global Neodymium-Iron-Boron (NdFeB) magnet consumption grew by 13% in 2023, and projects demand will rise by 12% in 2024 to 231,371 t. This growth has been largely driven by passenger and commercial electric vehicles (EV) traction motors, wind power generators and consumer electronics.

Adamas reports that the magnet industry, which relies on Nd, Pr, and, for high-end applications, Dy and Tb, is the largest consumer of rare earths by volume, accounting for 49% of global demand in 2023. However, in value terms, rare earth permanent magnets have long been the dominant market. In 2023, magnet applications represented over 95% of the total rare earth market value.

Looking ahead, Adamas projects that global demand for NdFeB magnets will increase at a compound annual growth rate of 8.7% to reach 606,792 t by 2035 and 881,396 t in 2040. The expected greatest demands driving growth come from robotics, advanced air mobility, commercial EV traction motors and passenger EV traction motors, reinforcing their critical role in advanced technologies and the energy transition.

Rare Earth Prices

Rare earth prices have been highly volatile in recent years, driven by growing demand for energy and mobility technologies, the COVID pandemic, as well as geopolitical factors.

Adamas has developed a Base Case pricing scenario that accounts for supply-demand modeling and expects that the future of rare earths demand (at least in the case of, Nd, Pr, Dy and Tb) will be more robust, more resilient and less sensitive to price than demand of the past and present, which is still largely driven by consumer and legacy automotive applications.

Adamas believes that from 2032 through 2040 Defense Metals could expect to receive a price for its MREC equal to 95% of the rare earth oxide value it contains (value based on China domestic prices, excluding VAT).

Adamas expects the price of NdPr oxide to increase from an average of $63/kg this year to $70-110/kg in the late-2020s. In a rational market, it would expect these price increases to induce investment in new production capacity. However, owing to the long lead times to develop new rare earth supplies and the lack of advanced, financially committed projects in the pipeline today, Adamas sees potential for pervasive deficits to push prices above required inducement levels (estimated at $100-150/kg in the long term).

Given the high amounts of NdPr in the final MREC after removing Ce and La, the average MREC price per kg for the Wicheeda Project is $70.4/kg of MREC, which is the equivalent of $116.5/kg of contained TREO and the equivalent of $136.3/kg of contained NdPrO.

Financial Analysis

The expected project cashflows were modelled using a simple discounted cash-flow model. A discount rate of 8% was used. The model uses nominal cashflows and costs and is configured for annual periods. An exchange rate of 1.40 CAD/USD was used for reporting any CAD values used in the PFS. A constant price of $133/kg NdPrO was applied and is based on the Adamas long term forecast.

Table 6 – Cash Flow Summary

| Item | Undiscounted LOM ($M) | Undiscounted Unit Average ($/kg NdPrO equivalent in MREC) |

Discounted LOM ($M) |

| Gross Revenue | 9,030 | 136.33 | 4,536 |

| Operating Costs | (2,479) | (37.42) | (1,208) |

| Product Transportation | (26) | (0.39) | (13) |

| Royalties | (90) | (1.36) | (45) |

| EBITDA | 6,435 | 97.15 | 3,269 |

| Changes in Net Working Capital | – | – | (80) |

| Initial Capital Cost | (1,440) | (21.74) | (1,275) |

| Sustaining Capital Cost | (133) | (2.01) | (70) |

| Closure and Reclamation Bond Cost | (430) | (6.50) | (41) |

| Royalty buy-out | (1) | (0.01) | (1) |

| Pre-Tax Cash Flow | 4,431 | 66.90 | 1,803 |

| BC Mineral Tax | (604) | (9.12) | (269) |

| Corporate Tax | (1,155) | (17.44) | (542) |

| After-Tax Cash Flow | 2,672 | 40.33 | 992 |

The PFS estimates total LOM taxes paid of $1.8 billion including $604 million to the Province of British Columbia and $1.2 billion to the Government of Canada, implying an estimated tax rate on taxable income of approximately 40%.

Sensitivity Analysis

NPV @ different discount rates

Table 7: NPV sensitivity to discount rate

| Discount rate (%) | 5 % | 8% (base) | 10 % | 15 % |

| Pre-tax NPV ($M) | 2,582 | 1,803 | 1,403 | 694 |

| After-tax NPV ($M) | 1,514 | 992 | 722 | 242 |

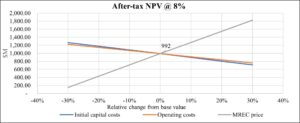

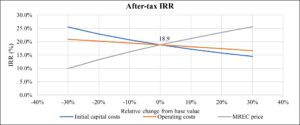

NPV and IRR sensitivity to the itemized factors are illustrated in the graphs which follow:

- MREC price (substantially NdPr)

- CAPEX

- OPEX

Defense Metals evaluated pricing reports from Adamas and Argus Media (Argus). The Company believes it was more appropriate to use Adamas for comparability with peers who have used the same pricing methodology. This includes MP Materials Corp. which reference the Adamas pricing in their February 22, 2024, EDGAR filing in relation to technical report for their Mountain Pass mine. Argus had two scenarios, the incentive price scenario was 6.8% higher than Adamas base case pricing and the conservative case was 18.3% lower than the Adamas base case pricing.

Environmental, Social, and Regulatory Engagement

Defense Metals is committed to maintaining high environmental, social, and governance standards while responsibly progressing the development of the Wicheeda Project. The regulatory jurisdiction has embedded standards relating to the environmental assessment and permitting processes that align with ESG principles, including the consideration of climate change in project planning and impact assessment, biodiversity assessments, social impact evaluation and stakeholder engagement and rightsholder consultation. Many critical baseline studies have been initiated to ensure a background understanding of environmental, social and cultural values. Additional environmental, social and cultural studies will be completed to provide project design refinements and advance environmental assessment and permitting processes.

Defense Metals and the McLeod Lake Indian Band (MLIB) have signed a Co-Design Agreement, formalizing their partnership to integrate MLIB’s perspectives into all project phases, from technical and engineering considerations to social and environmental planning. Defense Metals is committed to ongoing collaboration with rightsholders and stakeholders, prioritizing their interests and working towards consensus.

The Wicheeda Project is vital to British Columbia’s transition to clean energy. Defense Metals maintains close communication with the BC Critical Minerals Office, a government body that fosters the province’s critical mineral sector. Through this relationship, Defense Metals is provided with dedicated regulatory process assistance and possible funding support.

Mineral Reserves and Resources Estimates

Mineral Reserves

The mineral reserve estimate for the Wicheeda Rare Earth Element Deposit has been prepared for Defense Metals as part of the 2025 Pre-Feasibility Study (PFS). This mineral reserve estimate has been prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards on Mineral Resources and Mineral Reserves adopted by CIM Council in May 2014.

The mineral reserves respective of the open pit are based on Measured and Indicated mineral resources that have been identified as being economically extractable and which incorporate mining losses and mining waste dilution. The mineral reserves include 25.5 million tonnes (Mt) of mineable ore from one open pit at an average grade of 2.43% TREO. The mineral reserve includes variable mining dilution, and it is calculated after 1% ore loss.

A summary of the surface mineable mineral reserves by rock type and reserve classification is shown in Table 8.

Table 8 – Summary of the Mineral Reserves (as of February 7, 2025)

| Mineral Reserve | Rock Type | Tonnes | TREO | Pr6O11 | Nd2O3 | Tb4O7 | Dy2O3 |

| kt | % | ppm | ppm | ppm | ppm | ||

| Proven | Dolomite Carbonatite | 5,377 | 2.97 | 1,152 | 3,135 | 12 | 35 |

| Limestone | 11 | 2.01 | 858 | 2,359 | 12 | 40 | |

| Syenite | 42 | 1.45 | 582 | 1,681 | 11 | 39 | |

| Xenolithic Carbonatite | 258 | 1.74 | 700 | 2,060 | 11 | 37 | |

| Total | 5,688 | 2.90 | 1,127 | 3,074 | 12 | 35 | |

| Probable | Dolomite Carbonatite | 12,178 | 2.86 | 1,122 | 3,071 | 12 | 34 |

| Limestone | 139 | 1.39 | 563 | 1,600 | 10 | 38 | |

| Syenite | 639 | 1.25 | 503 | 1,483 | 8 | 26 | |

| Xenolithic Carbonatite | 6,820 | 1.42 | 585 | 1,717 | 9 | 30 | |

| Total | 19,775 | 2.30 | 913 | 2,543 | 10 | 32 | |

| Total | Dolomite Carbonatite | 17,554 | 2.89 | 1,131 | 3,091 | 12 | 34 |

| Limestone | 150 | 1.44 | 585 | 1,655 | 10 | 38 | |

| Syenite | 681 | 1.26 | 508 | 1,495 | 8 | 27 | |

| Xenolithic Carbonatite | 7,078 | 1.44 | 589 | 1,730 | 9 | 30 | |

| Total | 25,462 | 2.43 | 961 | 2,661 | 11 | 33 |

Mineral Reserves Notes:

- The effective date of the Wicheeda Rare Earth Element Deposit Mineral Reserve is February 7, 2025.

- Dollar values herein stated are United States Dollars (US$)

- Mineral Reserves are reported assuming the prices provided from Adamas listed below:

- NdPr Oxide 132.70 $/kg REO

- Tb4O71362.83 $/kg REO

- Dy2O3442.48 $/kg REO

- Mineral Reserves are defined within the final pit design guided by pit shells derived from the optimization software, GEOVIA Whittle™

- Cut-off grade is based on the value factors generated in each block. The revenue and related costs vary based on the composition of different elements in each block. Value of a block is the revenue generated in that block minus the related processing and G&A operating costs.

- The base mining costs are assumed to be $5.00/t. The mining costs vary based by the bench and depth of the pit. The average mining costs for the life of mine is calculated to be $5.26/t mined.

- Processing costs consist of flotation plant cost at the mine site and a hydrometallurgical/solvent extraction (hydrometallurgical) plant that is off the mine property. The operating cost of the flotation plant is $27.60/t milled and the hydrometallurgical plant operating cost is $1,164.4/t of concentrate treated.

- General and administration costs of the mine site is $3.67/t for ore milled.

- Tailings management and storage cost is $6.55/t of ore.

- Off-site cost (transportation) is $87.76/t of precipitate products produced.

- Processing recovery is calculated using the following formula:

- Flotation recovery for TREO = -11.183*TREO^2 + 67.831*TREO – 20.42194%. For ore above 3% TREO, the flotation recovery is set to 82.4%. For grade less than 0.32% TREO, the flotation recovery is set to 0.0%.

- Flotation recovery for TREO then is multiplied by 0.995, 0.996, 0.734, 0.636 for Pr, Nd, Tb, Dy respectively to calculate the respective flotation recovery for each element.

- Hydrometallurgical recovery for Pr, Nd, Tb, Dy are 0.932, 0.935, 0.802, 0.734 respectively.

- A 95% payability has been applied to the final hydrometallurgical product.

- Mining dilution varies based on the mining zone. The average mining dilution is calculated to be 2.9%, for the ore delivered to the mill. Tonnages reported as ore includes dilution.

- A 1% ore loss has been applied to the total reserve in each bench.

- Figures are rounded to the appropriate level of precision for the reporting of mineral reserves. Due to rounding, some columns or rows may not sum as shown.

- The overall strip ratio (Waste:Ore – the amount of waste mined for each tonne of ore) is 3.34.

- The mineral reserve is stated as diluted dry metric tonnes.

- The mine plan underpinning the mineral reserves has been prepared by SRK Consulting (Canada) Inc.

- The TREO grade encompasses 15 rare earth elements present in the deposit

- The estimate of Mineral Reserves may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

The Qualified Person, Dr. Anoush Ebrahimi, does not know of any legal, political, environmental, or other risks that could materially affect the potential development of the mineral reserves. Dr. Ebrahimi personally inspected the Wicheeda Project on October 26, 2021.

Mineral Resources

The Mineral Resource estimate for the Wicheeda Rare Earth Element Deposit has been prepared for Defense Metals as part of the 2025 Pre-Feasibility Study (PFS). This Mineral Resource estimate has been prepared in accordance with the CIM Definition Standards adopted May 2014.

The Mineral Resources stated below are constrained within an optimized pit shell to satisfy Reasonable Prospects of Eventual Economic Extraction (RPEEE) requirements. The Mineral Resources include 29.2 Mt of Measured + Indicated resource at an average grade of 2.27% TREO and 5.5 Mt of Inferred resource at an average grade of 1.42% TREO. No mining dilution has been incorporated into the Mineral Resources stated below. The Mineral Resources are stated inclusive of Mineral Reserves.

A summary of the surface mineable Mineral Resources by rock type and Resource classification is shown in Table 9.

Table 9 – Summary of the Mineral Resources (as of February 7, 2025)

| Mineral Resource | Rock Type | Tonnes | TREO | Pr6O11 | Nd2O3 | Tb4O7 | Dy2O3 |

| kt | % | ppm | ppm | ppm | ppm | ||

| Measured | Dolomite Carbonatite | 5,350 | 2.99 | 1161 | 3158 | 12 | 35 |

| Limestone | 10 | 1.99 | 851 | 2347 | 13 | 42 | |

| Syenite | 50 | 1.41 | 561 | 1635 | 11 | 40 | |

| Xenolithic Carbonatite | 300 | 1.64 | 662 | 1952 | 11 | 36 | |

| Total | 5,720 | 2.90 | 1128 | 3079 | 12 | 35 | |

| Indicated | Dolomite Carbonatite | 12,020 | 2.90 | 1139 | 3117 | 12 | 34 |

| Limestone | 160 | 1.41 | 573 | 1639 | 11 | 43 | |

| Syenite | 1,280 | 1.08 | 445 | 1340 | 8 | 29 | |

| Xenolithic Carbonatite | 9,980 | 1.32 | 549 | 1623 | 9 | 30 | |

| Total | 23,430 | 2.12 | 846 | 2374 | 10 | 32 | |

| Measured + Indicated | Dolomite Carbonatite | 17,370 | 2.93 | 1146 | 3129 | 12 | 34 |

| Limestone | 170 | 1.46 | 593 | 1688 | 11 | 43 | |

| Syenite | 1,330 | 1.09 | 450 | 1352 | 8 | 29 | |

| Xenolithic Carbonatite | 10,270 | 1.33 | 552 | 1633 | 9 | 30 | |

| Total | 29,150 | 2.27 | 901 | 2512 | 11 | 33 | |

| Inferred | Dolomite Carbonatite | 570 | 2.67 | 1072 | 2883 | 12 | 37 |

| Limestone | 210 | 1.51 | 603 | 1650 | 9 | 33 | |

| Syenite | 1,480 | 0.92 | 408 | 1251 | 9 | 33 | |

| Xenolithic Carbonatite | 3,240 | 1.43 | 589 | 1717 | 9 | 32 | |

| Total | 5,500 | 1.42 | 590 | 1709 | 9 | 33 |

Mineral Resources Notes:

- CIM (2014) definitions were followed for Mineral Resources.

- The Qualified Person for the MRE is Doug Reid, P.Eng., EGBC (23347), an SRK employee.

- The effective date of the Mineral Resource is February 7, 2025

- Dollar values herein stated are United States Dollars (US$)

- Mineral Resources are reported assuming the prices listed below (a 15% uplift was applied to the Reserve prices):

- NdPr Oxide 132.70 $/kg REO

- Tb4O71567.26 $/kg REO

- Dy2O3508.85 $/kg REO

- Mineral Resources are defined within a pit shell derived from the optimization software, GEOVIA Whittle™

- Cut-off grade is based on the value factors generated in each block. The revenue and related costs vary based on the composition of different elements in each block. Value of a block is the revenue generated in that block minus the related processing and G&A operating costs.

- The base mining costs are assumed to be $4.50/t. The mining costs vary based by the bench and depth of the pit. The average mining costs for the life of mine is calculated to be $4.74/t mined.

- Processing costs consist of flotation plant cost at the mine site and a hydrometallurgical/solvent extraction (hydrometallurgical) plant that is off the mine property. The operating cost of the flotation plant is $27.60/t milled and the hydrometallurgical plant operating cost is $1,164.4/t of concentrate treated.

- General and administration costs of the mine site is $3.67/t for ore milled.

- Tailings management and storage cost is $6.55/t of ore.

- Off-site cost (transportation) is $87.76/t of precipitate products produced.

- Processing recovery is calculated using the following formula:

- Flotation recovery for TREO = -11.183*TREO^2 + 67.831*TREO – 20.421940%. For ore above 3% TREO the flotation recovery is set to 82.4%. For grade less than 0.32% TREO the flotation recovery is set to 0.0%.

- Flotation recovery for TREO then is multiplied by 0.995, 0.996, 0.734, 0.636 for Pr, Nd, Tb, Dy respectively to calculate the respective flotation recovery for each element.

- Hydrometallurgical recovery for Pr, Nd, Tb, Dy are 0.932, 0.935, 0.802, 0.734 respectively

- A 95% payability has been applied to the final hydrometallurgical product.

- Bulk density is assigned by lithology.

- No mining dilution has been applied.

- Mineral Resources are reported inclusive of those Mineral Resources converted to Mineral Reserves.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Figures are rounded to the appropriate level of precision for the reporting of mineral Resources. Due to rounding, some columns or rows may not sum as shown.

- The TREO grade encompasses 15 rare earth elements present in the deposit

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

The Qualified Person, Douglas Reid, does not know of any legal, political, environmental, or other risks that could materially affect the potential development of the mineral Resources. Mr. Reid personally inspected the Wicheeda Project on October 31 and November 1, 2024.

Pre–Feasibility Study Review Webinar

Defense Metals will be hosting a webinar to discuss the results of the Wicheeda Project PFS during which members of the Defense Metals’ leadership team will be on the call. Participants will be able to submit questions or e-mail them in advance to info@defensemetals.com.

Date: February 19, 2025

Time: 1:00 p.m. ET/10:00 a.m. PT

Link: https://us02web.zoom.us/webinar/register/WN_BLHdzFqsSyufX1r2jYrFhQ

Qualified Persons – PFS Contributors

The Wicheeda Project PFS was conducted by independent representatives of Hatch and SRK (the PFS Contributors), each of whom is a Qualified Person (QP) as defined by the Canadian Securities Administrators’ National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

The PFS contributors prepared or supervised the preparation of information that forms the basis of the PFS disclosure in this news release.

Each of the QPs is independent of Defense Metals and has reviewed and confirmed that this news release fairly and accurately reflects, in the form and context in which it appears, the information contained in the respective sections of the Wicheeda Project PFS report for which they are responsible. The affiliation and areas of responsibility for each QP involved in preparing the PFS are provided as follows:

Hatch QPs:

- Metallurgical review, process design and operating cost estimates:

- Jeff Adams for Hydrometallurgical

- Joe Paventi for mine site flotation plant

- Process plant and associated infrastructure cost estimates – Gerry Schwab

- Financial analysis and market study – Stefan Hlouschko

SRK QPs:

- Mineral resources estimate – Doug Reid

- Mineral reserves, mine design and scheduling – Anoush Ebrahimi

- Mine costing – Bob McCarthy

- Tailings storage facilities – Ignacio Garcia

J.R. Goode, P.Eng., a consultant to the Company and a QP as defined in NI 43-101, reviewed and approved the metallurgical and process design information in this news release.

About Defense Metals Corp. and its Wicheeda REE Deposit

Defense Metals Corp. is focused on the development of its 100% owned, 11,800-hectare (~29,158-acre) Wicheeda REE deposit that is located on the traditional territory of the McLeod Lake Indian Band in British Columbia, Canada.

The Wicheeda Project, approximately 80 kilometres (~50 miles) northeast of the city of Prince George, is readily accessible by a paved highway and all-weather gravel roads and is close to infrastructure, including hydro power transmission lines and gas pipelines. The nearby Canadian National Railway and major highways allow easy access to the port facilities at Prince Rupert, the closest major North American port to Asia.

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE