David Smith – “Newfoundland’s Area Gold Play: A 21st Century Klondike Gold Rush Analog?”

Between 1896 and 1899, in and around the Klondike region of Yukon, in north-western Canada, what was perhaps the greatest and most heavily covered gold rush in history took place. Other “rushes” may have logged more participants, but arguably, none evinced more energy, pathos and tribulation. More than 100,000 prospectors started out and about 30,000 made it. Half who got there never even turned a pick and shovel. And most of the relative few who “scored” frittered the winnings away soon thereafter. Pierre Berton captured the magic in his timeless work, “The Klondike Fever: The Life and Death of the Last Great Gold Rush.”

Then as now, those who’ve long been in the markets, worked in exploration companies, or prospected on their own can be weighted down by “knowing too much”. As Berton writes,

“It was the old-timers who were skeptical of Bonanza. The valley was too wide, they said and the willows didn’t lean the right way, and the water didn’t taste right. It was on the wrong side of the Yukon. It was moose pasture. Only the cheechakos were too green to realize that it could not contain gold, and this naivete made some of them rich. The men who staked were men who saw the Klondike as a last chance, men in poor luck, with nothing better to do than follow the siren call of a new stampede…

Now they stared into the first pan…they had no way of knowing it, but this was the richest creek in the world. Each of the claims they staked that day eventually produced one million dollars or more.

Today, in the same country but on opposite ends of the continent, another gold rush is in play. Informed by near-instant 21st Century internet connections and research capabilities which “everyman” (and woman) can easily access, off-the-charts gold results from a miner’s drill campaign is igniting a “gold frenzy” by investors around the globe. In certain respects, this evolving story is unique to the times in which we live. But in other ways it’s arguably close enough to the zeitgeist – and potential results – of the Klondike Rush, to be considered an analog of what took place in and around Dawson City, Yukon many decades ago. Though this essay is by no means a comprehensive build out of the idea, it can help the reader get a handle on what’s taken place in the past, view what’s going on now, and offer hints of what might be in store going forward.

The key thing to keep in mind is that over time, human nature – and its emotional response to stimulus – does not change.

In August 1896, the story has it that a prospector on a small creek noticed gold nuggets dropping out of a brush he had uprooted from the stream bank for building a fire. Another variation recounts that “color” appeared in a cup being washed out. Whatever happened, it didn’t take long for word to get around.

Taking a gander with “The Keats.” When thinking about this ongoing Newfoundland area gold rush, the quaint phrase, “taking a gander” comes to mind. Whether (seldom now) used as a noun or a verb, it means to stick one’s neck out inquisitively like a goose. And sometimes it can lead to “flying high” – like the Bar-Headed geese at 30,000 feet, as they migrate over the Himalayas.

Few important things in this world come to those who don’t “stick out their neck”. Who aren’t curious. Who won’t spend the energy to challenge the prevailing narrative. And – if no narrative exists – won’t create one of their own! Even if it takes a long time and maybe they can’t see where they’re going or even if they’re going to get there at all. But that’s exactly what a disparate set of characters in and around Newfoundland did – some of them over a forty year period – and in many ways what they’re still doing today.

Looking at the sum total of their efforts, it’s easy to see the connective personality threads running directly from the prospectors and assorted players of the Klondike Gold Rush with their picks, shovels and gold pans, right through to today’s diamond core drills, halo spectrometers and geologists’ rock hammers.

Over several decades, a couple of majors and a number of small prospectors staked and worked parts of Newfoundland, mostly via trenching, grab sample studies and shallow drill holes, finding a substantial number of showings, but no one it seems, was able to put together a mental or physical picture of the potential that might lie just below the surface. Generally declining gold prices into the early 2000’s didn’t help either.

But things were beginning to change. One of several early sparks was the discovery by Fred Keats, of an 1,869 g/t gold boulder. Known to geologists as a “float boulder” it had come from somewhere else – at a location that probably held even more gold -and not just in some boulders…

His brother, Al, spent the next ten years searching the area, and finally located “the dome” – a mineralized outcrop 3 km from where the boulder had come to rest -This protuberance, as Kevin Keats says, “made the rush happen – in Newfoundland.”

The Dome showing. (Courtesy New Found Gold Corp.)

“It’s unbelievable. There’s no words that can describe it.” – Al Keats.

Evincing the same motivation that drove prospectors in the Klondike valley almost one and a-half centuries ago, Al Keats explains that, “We do that other people don’t do – because they just give up…you never give up. You never give up!”

During its first attempt in 2019, New Found Gold Corp https://newfoundgold.ca/ (at the time a private company), drilled what was to be one of the highest-grade holes in Canadian history, retrieved a stunning 93 g/t Au over 19.0 meters, including 285.2 g/t Au over 6.0 meters, starting at only 96 meters down hole. After further drilling, this would lead to planning and eventual execution of a 100,000, then doubling to a 200,000-meter drill program, focusing on two corridors along the Appleton fault, starting at bedrock surface and extending 350m down plunge and open, along with step-out drilling.

This path-making discovery helped build a “kindling pile of information-to-ignition phase”, that would ramp up a staking rush by other miners in the area, as each sought to acquire land “on trend” like what seemed to have favored the teams at New Found Gold.

A series of news release drill core results built anticipation in New Found Gold’s stated 200,000 meter drill program, but what may have provided the near-term breakout impetus – as well as two way volatility for many of the area’s company shares took place. On Friday May 21, 2021 a news release stated “New Found Intercepts 146.2G/T AU over 25.6M in 65M Step-Out to South Keas, Extends High-Grade Zone to 425M Down-Plunge.” Attention-getting to say the least!

Though it may feel now like the current level of discovery happened almost overnight, it was actually, as Exploits Discovery terms it, a culmination of sorts, “40 years of incremental advancements in the understanding of gold mineralization in the camp. The sum of this knowledge is now coming together in discrete and effective exploration models…”

Close to 30 companies now jostle for position (and land) in share acquisition ripples spreading interest out from Canadian investors “in the know”, to the U.S. with ten times the population and just as much desire to “strike it rich”.

A premise of this essay is that New Found Gold Corp, along with several others of the close to thirty exploration plays in the area, could be in the process of “proving up” what may become the largest gold discovery and build out in recent decades. This, in one of the world’s most conducive environments for exploration and eventual development of a district-sized gold project, with low country risk, informed by the high standards which today’s Environmental, Social, and Governance (ESG) protocols demand.

(Yes, we know that Russia’s Sukhoi Log is a gold monster, but it’s essentially owned by one person, the (low grade) recovery rates are around 75%, its financials lack a certain transparency…and it’s over there, not here.) Not to mention that other mega-projects like Pascua Lama, straddling Argentina – Chile, and Bristol Bay’s Pebble, at least during the current secular cycle, – to put it mildly – face daunting odds of ever seeing the first turn of pick and shovel recoveries.

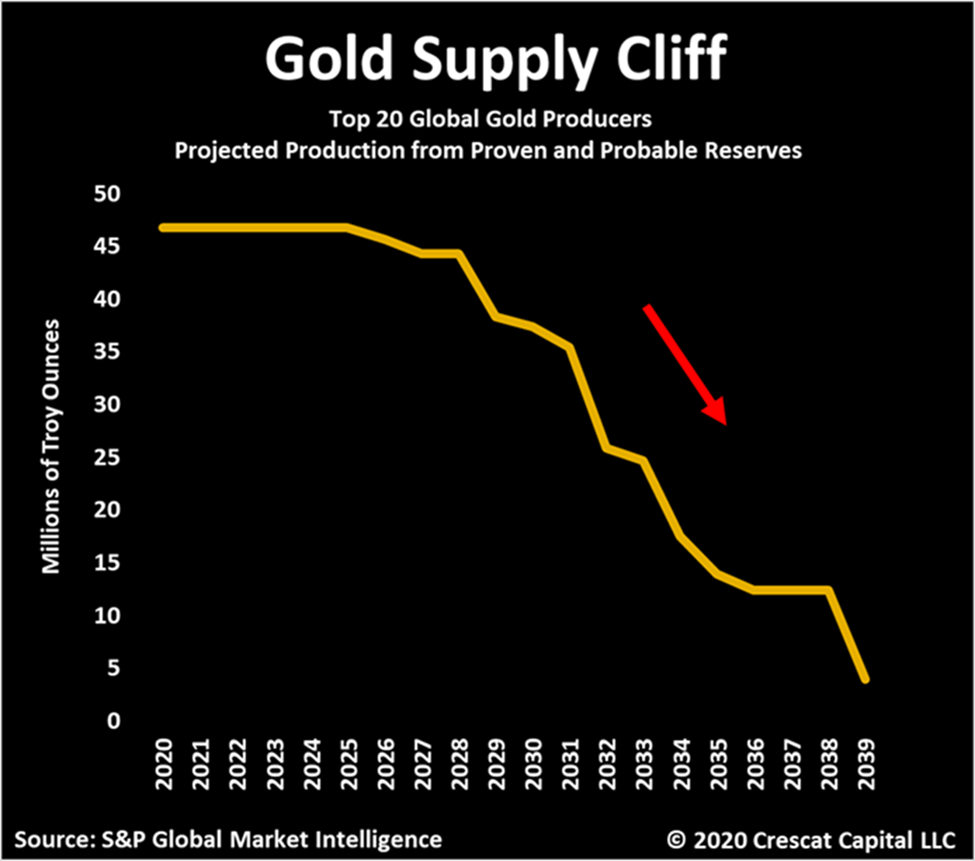

“Replacement urgency.”

Right now, there’s an element of “replacement urgency” that was not so apparent when the secular bull run got underway around 2000. The run up in gold’s price from under $300 to over $1,900 the ounce in 2011 didn’t help all that much to bring new ounces out of the ground to counteract the increase in investor demand. This took place concomitant with declining yields, increased country risk and a dearth of major discoveries. As Frank Giustra recently stated, “All the gold discovered in the last ten years is less than half the amount of gold that was discovered in just one year – 1990 – when gold was under $400/ounce.”

Every “gold rush” seems to elevate one or two companies and/or locations that catch the publics’ eye, driving a level of investor and speculator participation that can ignite “the animal spirits” residing in just about all of us. Sometimes it can set an entire sector on fire. At this writing, possibly most who know about and hold company shares in New Found Gold and other area explorers are Canadian, but with a population south of the border that’s 10x larger, if drill results keep looking good, they’re likely to face stiff competitive interest.

At this stage, it remains to be seen if this is The One – but it’s worth considering. And maybe even worth putting together and acting upon a personal action plan. At the present time, the “pathfinder company” appears to be New Found Gold as it follows the epizonal orogenic system at its Keats and Lotto Zone discoveries, which as Geologist Quinton Hennigh says, “is formed at relatively shallow depths within the earth’s crust”.

Of course, who knows? If you study Burton’s recounting of the Klondike Gold Rush, the “leader’s mantle” can always be bestowed on another contender. At first, everyone was working placer gold in the streambeds and nearby banks. Then someone discovered it along the hillsides…

Why are so many who either take positions in mining stocks, or who simply follow the news on such happenings so intrigued by these events? Why has a recent book on another gold discovery in Australia gleaned so much attention? Will an intriguing volume like Bob Moriarty’s “What Became of the Crow: The Inside Story of the Greatest Gold Discovery in History” someday be written about this gold rush? It’s hard to say. But it would be unwise to bet against it.

From start to finish, the Klondike Gold Rush largely played itself out in less than two years, even though to this day the area is still putting out substantial gold values.

Now, with sophisticated soil geochemistry, magnetic geophysics, structural settings, halo spectrometers, and assay drill core analysis, things in Newfoundland could proceed faster. Or slower, if you add in forming up a resource, writing a PEA, building one or more mills and fully reaping the results of such a large and seemingly rich find. Perhaps something akin to the Red Lake District, which has been the site of high-grade gold production.

But what if instead of just finding solid gold values at relatively shallow depths, the yellow metal still shows one or two thousand meters below surface? After all, the Red Lake District, has, at least since 1922 and at depths to 2,500 meters, yielded close to 30 million ounces, and is still one of the world’s most prolific, conclusively and consistently demonstrated just that.

One of the “Names” paying attention to Newfoundland right now. In a recent Sprott Money News Weekly, Bob Thompson of Raymond James in Vancouver was interviewed by Craig Hemke. He commented about his friend Eric Sprott’s interest in the area, saying,

“I talked to him extensively (this week) about what he’s doing, and so I’d like to share that with you (‘about his thesis and what he’s looking to do’)…you know, Eric spreads his ideas around – he holds lots of different companies. But when he finds something he really likes, he concentrates on it, and it is the complete focus of his intention.

“So right at this particular time, his entire focus is on Newfoundland and the Central Newfoundland Gold Belt…. he pays attention, based on the research of a few people…one (of which) is Shawn Ryan. You take what these people have been saying, and how they think Newfoundland can be very, very similar to the Abitibi region (with historic production of 150-200 moz gold) – and by the way Newfoundland has hardly been explored at all. It’s incredible. It’s been there for millions of years…and they only came up with the idea that something might be there, less than a decade ago…

“So Shawn Ryan, who got his notoriety through exploring in the Yukon, actually said a few years ago, he said, ‘If I had known about Newfoundland 25 years ago instead of the Yukon, I would have focused on Newfoundland instead…

“When you look at these companies, Eric has paid attention to their research – and has done a tremendous amount of research himself. He’s found 10-15 companies… that he wants to take positions in up to 20%…including some of the biggest companies in the area.

Eric’s “Secret Sauce”?

Craig Hemke: “You know what he’s always taught me, and it’s contrary to what I thought was right, back when I was a stock broker 30 years ago; when he finds one that’s obviously working, he (Eric) puts more money in – a lot of people are tempted to get their seed money out – but when he finds one that goes, he presses his bets in a sense…

Bob Thompson: You’ve got to be willing to believe your thesis, you’ve got to be willing to have conviction; and you’ve got to be willing to hold your winners. Because all it takes is a few stocks to make up for a lot of stocks that didn’t win. But most people will chop their winners, and hold onto their losers – well mathematically you end up with a whole portfolio of losers. You’ve got to hold onto your winners; and add to them as the rate of change gets better…

Maybe you made it but, can you hold onto it? Most investors, present company included, tend to spend the majority of their time and effort planning how to make a lot of money, and not so much work – if any – reflecting on how they might keep it. The sad reality for any number of reasons, is that only a small minority will make significant profits from the entirety of a secular bull run, and fewer yet will be able to avoid giving them back. It was thus in the 1890’s, it remains true today, and will continue to be so going forward.

But it does not have to be this way! The key is to approach this conundrum now, not after all is said and done, and the market has completed its bull run.

How much of a profit in your personal campaign is enough? Can you lower the cost of a core position by careful partial selling on wildly-strong up days? Are you willing to depart a trade with the majority of your position without being absolutely certain (in truth, only knowable some time after the event) that the top is really in?

Second Chance

If so, we propose a viable solution. This writer and David Morgan have co-authored a book titled, Second Chance: How to Make and Keep Big Money from the (in play now) Gold and Silver Shock-Wave. In part, it involves deciding beforehand if this becomes a “rush”- that you will do your best not to overstay your welcome – risking becoming what Rick Rule refers to as “road kill”. Not to mention the much wider trend underlying this arena – the secular bull run in gold, silver, copper, EV metals and their associated mining stocks.

Then, with the criteria you’ve established for yourself, make plans to layer out (in tranches) into the kind of strength that often characterizes blow off tops. But what if, as in the case of palladium a few years ago, the price run fools you, continues upward for hundred(s) of percent more, and even stays there for awhile?

Well, if you had set aside some of your holdings – what we refer to as a “Sacrifice Throw Position (STP) to remain in the market, then you could continue being involved and not obsess about being left behind – or worse – jumping back in at much higher and possibly topping prices. There is one key metric you must accept if you intend to allow this plan – for better or worse – to play itself out. And it is possible that you won’t be able, emotionally or in terms of your own strategic planning, to accept our thesis. But if so, we believe that in several years, you could very well find yourself, along with a relatively few others, seated at the Winners’ Table.

“Color” isn’t just found in a gold mine. Lest the reader get caught up in the white hot pitch of the moment, crowding out all other considerations as most players jockey to place bets on one or more miners seeking outsized results in a given drill hole – or a series of them – consider attempting to keep at least some perspective on things that really matter in life, beyond the profit of holding a mining stock that might go up sharply in value. Maybe take a different more balanced approach than Henry Ford had when asked “How much is enough?” His answer: “Just a little bit more!”

After all, gold isn’t only found in the ground. “Color” can be seen on the flanks of a Sea-run Brown Trout in Argentina, Arctic Char in Alaska or Brook Trout in Spawning dress in Newfoundland itself.

Finding “gold” the Jim Teeny way. A few years ago, this writer penned an essay titled “More than Making Money: Living, Fishing and Investing the Jim Teeny Way.” Any reader interested can request a free pdf copy by simply writing to support@themorganreport.com Whether in fishing or investing, it just might help you to spot “the Real Deal.”

Coda: Pierre Burton began his book with an intriguing “old tale” of a prospector. It goes:

“All my life,” he said, “I have searched for the treasure. I have sought it in the high places, and in the narrow. I have sought it in the deep jungles, and at the ends of rivers, and in dark caverns – and yet have not found it.

“Instead, at the end of every trail, I have found you awaiting me. And you have become familiar to me, though I cannot say I know you well. Who are you?”

And the stranger answered: “Thyself.”

……………………………………………………………..

Disclaimer: This writer, David H. Smith, has a position in New Found Gold, built over several months in the open market, and added shares of Exploits Discovery, Matador Mining, and Labrador Gold Corp.

……………………………………………………………..

Bio Brief: David H. Smith: Senior Analyst, The Morgan Report ; Contributor, Money Metals.com ; LODE Cryptographic Silver project ambassador at https://ag.lode.one/ ; Co-Author with David Morgan of Second Chance: How to Make (and Keep) Big Money from the Coming Gold and Silver Shock-Wave; Tours/Writes about Miners and presents globally at Virtual/ F2F Conference venues.

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE