CUPANI doubles land within Extensions Zone

CUPANI Metals Corporation (CSE: CUPA) (OTCQB: CUPIF) is pleased to announce the execution of an option agreement with Prospector Metals Corp. a corporation incorporated under the laws of the province of British Columbia, and whereby Prospector granted CUPANI a right and option to purchase a 100% undivided interest in the Nemo Project (Figure 1) located in the southern Labrador Trough, Québec, located 80 km northeast of Schefferville. All dollar amounts disclosed herein are in Canadian dollars, unless stated otherwise.

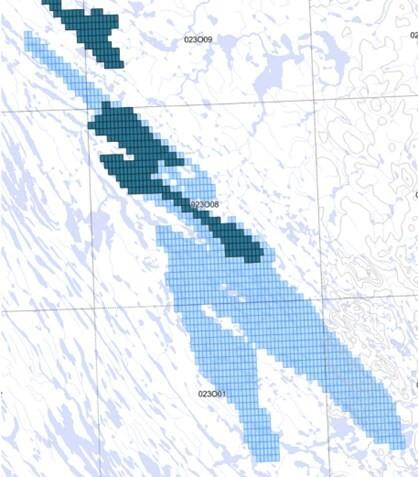

The Nemo Project comprises 321 exploration claims that interlock with CUPANI’s existing claims in the Extensions Zone. Similar to the broader Extensions Zone, these Claims cover poorly explored mafic-ultramafic rocks. To date, no drilling has been conducted on these Claims. The Claims contain the same peridotite sills that elsewhere hold the historic Blue Lake deposits of 2.3% copper equivalence. Figure 1 illustrates the newly controlled claims in dark blue, while the Company’s pre-existing claims are shown in light blue.

Brian Bosse, Chief Executive Officer of the Company, said: “This will be the final piece of land acquisition. I am happy to say Cupani is the only entity controlling exploration claims throughout the region. We locked up exploration rights of the peridotite sill since that hosts the historical 2.3% copper equivalent mineralization. That sill twists and turns across the surface for over 100 miles. Going forward we can apply learnings from exploration at one location to every other location without delay, getting smarter as we go. Cupani now controls 100% of all the exploration lands.”

Subject to the terms and conditions of the Option Agreement, Cupani agreed to pay the following consideration to Prospector for the acquisition of the 100% undivided interest in the Nemo Project:

| a) | on or before August 23, 2025, pay requisite renewal fees for the Claims forming part of the Property having a renewal deadline of August 23, 2025 (the “Block 1 Claims“) in the amount of $14,850 and complete a minimum of $12,150, in exploration work on the Block 1 Claims necessary to keep the Block 1 Claims in good standing; | ||

| b) | on or before September 18, 2025, pay requisite renewal fees for the Claims forming part of the Property having a renewal deadline of September 18, 2025 (the “Block 2 Claims“) in the amount of $38,115 and complete a minimum of $31,185, in exploration work on the Block 2 Claims necessary to keep the Block 2 Claims in good standing; | ||

| c) | upon the exercise of the Option by the Company, grant to Prospector a perpetual royalty in respect of the products derived from the Property equal to one-half of one percent (0.5%) of net smelter returns on all minerals produced from the Property, and which can be repurchased entirely for a one-time cash payment of $500,000; and | ||

| d) | issue 625,000 common share purchase warrants each entitling the holder to acquire one common share of Cupani at an exercise price of $0.16 per share, vesting on February 1, 2026, and expiring three years from issuance, exercisable only after the Vesting Date. |

The Option Agreement remains subject to the approval of the Canadian Securities Exchange.

About CUPANI

CUPANI Metals Corp. provides shareholders with long-term capital growth exposure by investing in mineral exploration properties and other assets. The Company is listed on the CSE under the symbol “CUPA”.

Figure 1. Nemo Project Location (dark blue) (CNW Group/Cupani Metals Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE