Critical Mineral Resource at Falchani Exceeds 400,000 t Cesium (M+Ind) Within Existing Lithium Resource

Major Process Improvements Provide Additional Pilot Plant Optimization Input

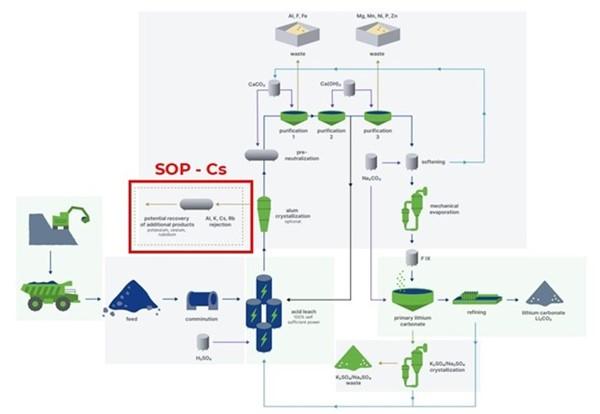

American Lithium Corp. (TSX-V:LI) (OTCQX:AMLIF) (Frankfurt:5LA1) is pleased to highlight the globally significant cesium resource contained within the Falchani Lithium deposit and announce results of recent optimization work on the processing flowsheet, including the potential recovery of cesium by-products.

Cesium is officially recognized as a critical mineral in both the U.S. and Canada due to its rarity, strategic importance, and limited global supply. With the U.S. entirely reliant on imports, Falchani’s scale positions it as one of the world’s largest cesium resources, with potential to strengthen North American supply chains.

Test work was completed at the Australian Nuclear Science and Technology Organization laboratories in Sydney, Australia. In parallel, TECMMINE in Lima, Peru, is currently testing newly acquired component equipment for the pilot plant phase, which is expected to commence within a few months.

Falchani’s volcanic-style lithium mineralization, with naturally low impurities, supports a straightforward flowsheet that produces high-purity lithium carbonate (>99.5%), meeting battery-grade specifications. Falchani mineralization is enriched in cesium, potassium, and rubidium alongside lithium. Recent test work results demonstrate production of a saleable mixed cesium sulphate product (~18% Cs) and high-quality sulphate of potash, with strong recoveries at low additional cost. Additional work is planned to increase the cesium content of the sulfate by-product above 18% Cs.

The deposit contains a large-scale cesium resource within the lithium resource base (effective October 30, 2023):

- Measured: 69 Mt at 631 ppm Cs (43,539 t Cs)

- Indicated: 378 Mt at 1,039 ppm Cs (392,742 t Cs)

- Inferred: 506 Mt at 778 ppm Cs (393,668 t Cs)

Test work highlights and meaningful cost improvements include:

- Recycling 50% of acid streams maintains recoveries (Li 88%, Cs 85%, K 35%).

- Counter-current leaching reduces sulfuric acid use to ~240 kg/t acid consumption, nearly 50% lower than outlined in the February 2024 PEA.

- Additional savings are expected from reduced reagent demand, smaller gypsum waste volumes, and lower tailings costs.

- Soluble high purity crystalline SOP containing 45% K is produced at low temperatures after the cesium sulphate precipitation.

Alex Tsakumis, Interim CEO of American Lithium stated: “The proven ability to process Falchani’s volcanic lithium rocks into battery-grade lithium carbonate, cesium sulfate, and SOP demonstrates extensive technical progress. Flowsheet improvements that lower costs and enhance project economics show we have advanced well beyond simple resource endowment. Importantly, Peru is a net importer of SOP, and future Falchani operations could help meet domestic demand while also supporting exports.”

Table 1 – Falchani Mineral Resource Estimate – updated October 30, 2023

| Cutoff | Volume | Tonnes | Li | Million Tonnes (Mt) | Cs | K | Rb | ||

| Li (ppm) | (Mm^3) | (Mt) | (ppm) | Li | Li2CO3 | LiOH*H2O | (ppm) | (%) | ppm |

| Measured | |||||||||

| 600 | 29 | 69 | 2792 | 0.19 | 1.01 | 1.15 | 631 | 2.74 | 1171 |

| 1000 | 27 | 65 | 2915 | 0.19 | 1.01 | 1.15 | 647 | 2.71 | 1208 |

| 1200 | 25 | 61 | 3142 | 0.18 | 0.96 | 1.09 | 616 | 2.74 | 1228 |

| Indicated | |||||||||

| 600 | 156 | 378 | 2251 | 0.85 | 4.52 | 5.14 | 1039 | 2.92 | 1055 |

| 1000 | 136 | 327 | 2472 | 0.81 | 4.31 | 4.9 | 1095 | 2.87 | 1104 |

| 1200 | 129 | 310 | 2549 | 0.79 | 4.20 | 4.78 | 1069 | 2.86 | 1146 |

| Measured + Indicated | |||||||||

| 600 | 185 | 447 | 2327 | 1.04 | 5.53 | 6.29 | 976 | 2.90 | 1072 |

| 1000 | 163 | 392 | 2551 | 1.00 | 5.32 | 6.05 | 1021 | 2.84 | 1121 |

| 1200 | 154 | 371 | 2615 | 0.97 | 5.16 | 5.87 | 1009 | 2.84 | 1130 |

| Inferred | |||||||||

| 600 | 198 | 506 | 1481 | 0.75 | 3.99 | 4.54 | 778 | 3.31 | 736 |

| 1000 | 138 | 348 | 1785 | 0.6 | 3.3 | 3.75 | 886 | 3.18 | 796 |

| 1200 | 110 | 276 | 1961 | 0.54 | 2.87 | 3.27 | 942 | 3.10 | 850 |

- CIM definitions are followed for classification of Mineral Resource.

- Mineral Resource surface pit extent has been estimated using a lithium carbonate price of US$20,000 per tonne and mining cost of US$3.00 per tonne, a lithium recovery of 80%, fixed density of 2.40 g/cm3 for the mineralized Upper Breccia, Lithium Rich Tuff and Lower Breccia Geological Units and a fixed density of 2.70 g/cm3 for the mineralized Coarse Felsic Intrusion.

- Tonnes are metric.

- Conversions: Li2CO3:Li ratio = 5.32, LiOH.H2O:Li ratio =6.05

- Totals may not represent the sum of the parts due to rounding.

- The Mineral Resource estimate has been prepared by Mariea Kartick, P. Geo., and Derek Loveday, P. Geo. Of Stantec Consulting Services Inc. in conformity with CIM “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and are reported in accordance with the Canadian Securities Administrators NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. The effective date of the Mineral Resource Estimate is October 30, 2023. There is no certainty that any mineral resource will be converted into mineral reserve.

Figure 1 – Schematic Falchani Lithium Carbonate Processing Flowsheet highlighting SOP-Cs Stage

Qualified Person

Mr. Ted O’Connor, P.Geo., a Director of American Lithium, and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this news release.

About ANSTO Minerals

ANSTO Minerals is an international mining consultancy group located in Sydney, Australia, with an experienced team of 60+ engineers, metallurgists, chemists, and scientists who have been providing consulting services and process development services to the mining and minerals processing industries for well over 35 years. ANSTO Minerals has world-leading expertise in uranium ore processing, rare earth processing, zirconium/niobium/hafnium processing, base metals processing, lithium processing (brines and hardrock), and radioactivity control and management.

About TECMMINE

TECMMINE E.I.R.L. is a Peruvian metallurgical consulting company based in Lima, Peru with mineral processing and metallurgical testing laboratory facilities and experienced metallurgical personnel led by Eng. Jose Malqui.

About American Lithium

American Lithium is developing two of the world’s largest, advanced-stage lithium projects, along with the largest undeveloped uranium project in Latin America. They include the TLC claystone lithium project in Nevada, the Falchani hard rock lithium project and the Macusani uranium deposit, both in southern Peru. All three projects have been through robust preliminary economic assessments, exhibit significant expansion potential and enjoy strong community support.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE