Critical Investor – “Omai Gold Mines Drills 8.5m @ 5.0g/t Au and 17.1m @ 2.3g/t Au In Wenot Step-out Holes”

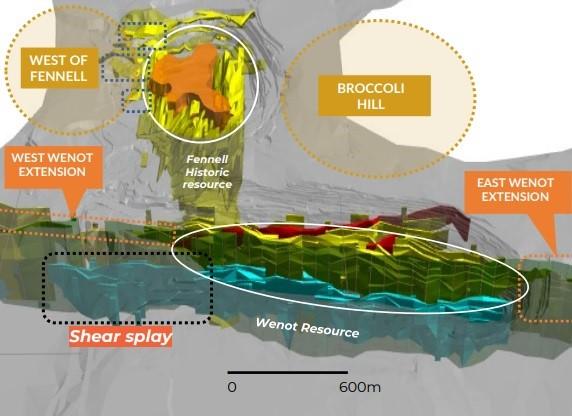

Although the US Dollar index recently broke through levels not seen since 2003, indicating great strength, caused by already announced and anticipated Fed rate hikes to counter the multi-decade high inflation levels, gold is still trading around US$1850/oz. As the Russia-Ukraine conflict is still far from over, and markets are frothy over a potential looming recession, gold as the ultimate fear trade appears to be holding its ground firmly. As an advanced gold explorer, Omai Gold Mines (TSX-V:OMG) seems to be looking at the right metal, as they are in the midst of an ongoing trenching and drill program at their Omai Gold project in Guyana, after raising C$2.6M, as a second and last tranche of C$600k was closed on April 27, 2022. Most of this financing came from a large UK gold fund that knows Guyana and recognizes the potential in this stock, jumping in at $0.12/share. New drill results were recently announced, stepping out 100m to the west at Wenot, and generated economic results, much to the delight of management. As a reminder, Omai Gold Mines already has delineated the Wenot deposit with a 2022 NI43-101 resource estimate (1.64Moz @ 1.5g/t Au, another adjacent mineralized envelope (Fennell) has a historic resource estimate of about 1.5Moz @ 1.5g/t Au, and Omai is now in the process of expanding Wenot.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Omai Gold Mines’ resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Omai or Omai’s management. Omai Gold Mines has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

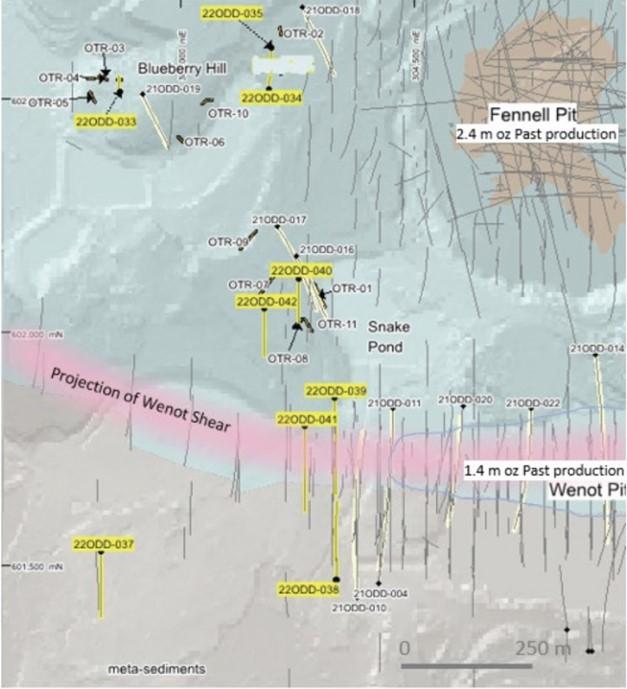

On May 27, 2022, Omai Gold Mines announced the first results of the ongoing exploration program at their Omai gold project in Guyana. The company already completed 5 diamond drill holes totaling 1,423m west of the Wenot deposit commencing at the end of March, and a sixth hole is underway. Eight drill holes west of the Fennell target for 1,213m and several trenches were also completed during February-April. An overall view of exploration can be seen on this map, with among others the highlight holes 220DD-033/038/039 being featured, also discussed in the May 27, 2022 news release (and this article):

The results of these drill holes were solid:

- Hole 22ODD-038 (West Wenot) 8.5m @ 5.01 g/t Au from 215m

- Hole 22ODD-039 (West Wenot) 17.1m @ 2.32 g/t Au from 264m

- Hole 22ODD-033 (Blueberry Hill) 0.9m @ 41.73 g/t Au from 151m

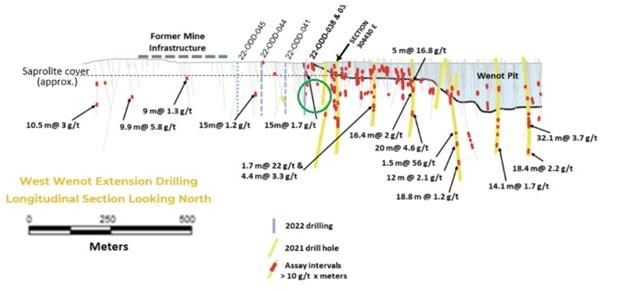

Although these results were intercepted from significant depths, especially hole 039, this could still be economic ore, as real depth is 110m for hole 038 and 140m for hole 039, due to the inclination of both holes. The drilling for the West extension of Wenot can also be viewed in this section:

CEO Elaine Ellingham was excited about these first two results at Wenot:

“We are very pleased that our drilling has established that the Wenot shear zone extends to the west and continues to host significant gold mineralization. The gold mineralization in these new holes is similar to the main zones at Wenot. We recently deployed the second drill to commence step out drilling on the eastern extension of the Wenot deposit, roughly two kilometers to the east. Our objective is to work towards a revised NI 43-101 Wenot resource, assuming favourable results continue as we explore both the east and west extensions of the Wenot shear. Expanding the Wenot resource into these un-mined areas is significant for an ultimate mine plan as these could contribute to lower-strip-ratio starter pits for the larger Wenot deposit.”

As these two results in itself are hitting gold at significant depth, and would have a substantial strip ratio related to the gold contents, and were drilled under a 50 degree inclination, I wondered if management anticipates more mineralization at lower depth, as part of vertical mineralized lenses as is the typical geological concept at Wenot:

For that, management would have to drill fences perpendicular on the strike direction of Wenot to the west. CEO Ellingham answered: “Not in the short term, as historic drilling tested shallow mineralization in the saprolite layer, and the necessary data for a resource update is available. We will also wait for assays of more holes before determining about fences etc, and the focus is on expanding the strike length of the deposit. We are drilling pretty deep to catch zones at depth, and most zones run upwards to the saprolite anyway.”

Some examples of more near surface historic holes can be seen here (in green):

The full results for holes 038 and 039 are represented in this table:

| Hole ID | From | To | Interval (m) | g/t Au | Gold grade (gams per tonne) |

| 22ODD-038 | 160.0 | 161.0 | 1.0 | 2.92 | |

| 171.0 | 176.0 | 5.0 | 0.48 | ||

| 215.0 | 223.5 | 8.5 | 5.01 | ||

| including | 221.8 | 223.5 | 1.7 | 17.80 | |

| 22ODD-039 | 52.3 | 53.0 | 0.7 | 3.81 | |

| 246.9 | 264.0 | 17.1 | 2.32 | ||

| including | 246.9 | 253.8 | 6.9 | 3.54 | |

| and | 262.9 | 264.0 | 1.1 | 5.58 | |

| 277.3 | 277.9 | 0.6 | 1.36 | ||

| 288.8 | 293.0 | 4.2 | 0.56 |

Despite the inclination, the drill bit obviously hit several mineralized layers, often very narrow but clearly indicating a stockwork of veins/lenses. Hole 038 was drilled more to the north, to seek mineralization below a sediment cover into volcanic fresh rock, which was successful. As the geologists put it: “the gold mineralization occurs within quartz-ankerite veinlets and stockworks, some with coarse visible gold and developed primarily in and along the sheared margins of variably silicified sub-vertical felsic dikes at or near the lithologic contact between the andesite-dominant lithologies to the north and lithic wacke sediments to the south.” It was nice to read that the West extension of Wenot was the former site of the mill, service buildings and other mine infrastructure. When asked if the former operator didn’t explore this area before building the mine, CEO Ellingham answered: “The former operators focused entirely on getting the known resource into production as soon as possible, and didn’t explore much after the mine came into production. The area where we are drilling now was covered with haul roads and all of the Omai buildings, so certainly no drilling could be done in this area. Our current exploration offices, core logging facilities and barracks are in this area, but we can drill right around them. In fact one of the next holes will be between our kitchen and laundry facilities.”

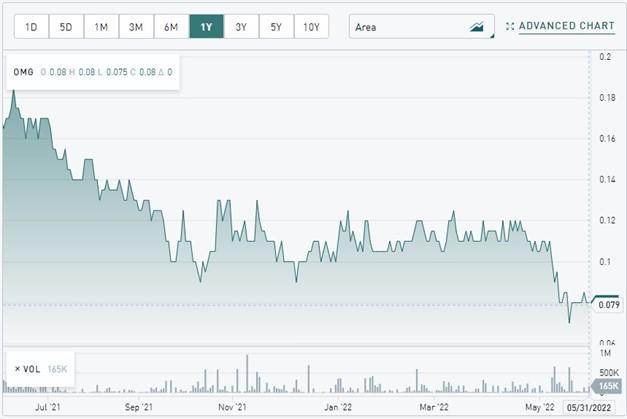

It is good to have solid drill results out right before PDAC, as investors were apparently looking at other opportunities it seems during the last difficult 2 weeks or so:

Share price 1 year timeframe (Source: tmxmoney.com)

Share price 1 year timeframe (Source: tmxmoney.com)

According to CEO Ellingham, they have more results from the Wenot west extension drilling coming out soon, probably within 2 weeks, and it is very likely they will adhere to this timeframe this time and make it before the upcoming PDAC, as most lab delays are solved now.

Omai Gold Mines has also completed drilling, trenching and sampling west of the Fennell pit and to the southwest of the Wenot pit. Eight holes have been drilled, and assays were returned for the first 5 holes totaling 1,213m. Drilling at the Blueberry Hill target provided the following results of 3 holes:

| 22ODD-033 | 150.6 | 151.5 | 0.9 | 41.73 |

| 22ODD-034 | 19.5 | 21.0 | 1.5 | 0.53 |

| Incl. | 58.0 | 59.0 | 1.0 | 0.81 |

| Incl. | 63.0 | 64.2 | 1.2 | 1.80 |

| Incl. | 69.5 | 71.0 | 1.5 | 1.71 |

| 22ODD-035 | 46.6 | 48.1 | 1.5 | 1.91 |

Hole 033 returned visible gold and a high grade intercept, hole 034 hit several low grade veins, and hole 035 hit just one low grade vein. All three holes tested high grade mineralization identified during trenching, where 6 of 11 samples assayed over 6g/t Au. Additional trenching is planned in order to find more vectors before more drill targets can be defined. As the strong trenching results created some expectations with me, I asked CEO Ellingham how she viewed and interpreted these drill results, also in connection to the trenching results and other geophysical data. She stated: “We did hit a very high grade vein, but were expecting additional mineralization. We knew from the trenching that the structural setting is complex, so we will continue to model the data before further drilling. Our Guyana expert Linda Heesterman was recently on site for 10 days and agreed that this area is complex but clearly has significant gold potential.”

At the Snake Pond target, trenching and sampling returned equally impressive results like 1m @ 5.2g/t Au, 5m @ 1.49g/t Au, 5m @ 4.5g/t Au, 5m @ 6.1g/t Au and 5m @ 7.68g/t Au. Two drill holes (040 and 042, which can be seen in the first map in this article) were completed, with assays pending.

The company also drill tested a target south of Wenot with two holes. Diamond drill hole 036 didn’t intercept anomalous gold, and hole 037 (which can be seen in the first map in this article) returned anomalous values like 6m @ 0.67g/t Au, 1m @ 0.77g/t Au and 1m @ 0.96g/t Au. According to CEO Ellingham, this was the first of tests of the key airborne geophysics targets identified by their consultants. There are a number of such targets, any one of which could host another Fennell or Wenot deposit and these would be game changers for the project. Hole 037 had a few intersections and some core loss around the quartz veining that had anomalous gold. They will likely do a follow up hole in this area as the geology was very favourable.

Last but not least, the historic Fennell resource would take just 4-5 holes to convert it into a NI43-101 compliant resource, so I wondered if this drilling and potentially maiden resource could be completed this year. CEO Ellingham stated: “We need to focus on creating value for our shareholders in the short-term and we see the best use of our funds in exploring the extensions of the Wenot shear, with the goal of advancing to an updated NI 43-101 resource. The Fennell deposit was well drilled with 46 holes totally 27,000 metres, so we are fairly confident that the ounces are there. These holes to upgrade the Fennell historic resource will be long holes that will be slow to complete and more expensive, so in the shorter term, we see more value in expanding into a new area. Also, the areas we are exploring along strike of Wenot have not been mined before and will therefore be near surface and ultimately cheaper to mine.”

Conclusion

It was good to see Omai Gold Mines closing the financing for C$2.6M, which enables them to keep exploring for the remainder of this year. The first step out drill results at Wenot were promising, but need more follow up drilling in order to add significant economic tonnage. Drilling at the Blueberry and Snake Pond targets did return significant gold mineralization as yet, but need a lot more follow up trenching and drilling before delineating eventual satellite deposits. Historic drilling indicated prospective targets, so the search for more gold continues at the former Omai Gold mining camp. Converting Fennell into a compliant resource could instantly double the existing gold resources, so this would be an interesting development as there aren’t too many juniors with over 3Moz Au with market caps hovering at just C$23M.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Omai Gold Mines is a sponsoring company. All facts are to be checked by the reader. For more information go to www.omaigoldmines.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE