Critical Investor – “Goldshore Resources Finally Finds Strategic Partner, Raises Up To C$3.75M”

Just as the Federal Reserve decided to pause their record-breaking rate hiking streak, with gold hovering around US$2,000/oz on a weaker US Dollar and fear for escalating Middle East tensions, Goldshore Resources (TSX-V:GSHR) (OTCQB:GSHRF)(FWB:8X00) finally found their strategic partner they were looking for all year. The company couldn’t disclose names yet, but assured me this will be the case at a later stage, when the partner increases its holdings in other future financings. For now, they will enter a starter position of 30M shares @ C$0.10 for gross proceeds of C$3M. Additional participants will likely take this non-brokered financing to C$3.75M, and this will provide Goldshore with a much needed cash infusion, in a low cash burning scenario lasting even into 2025.

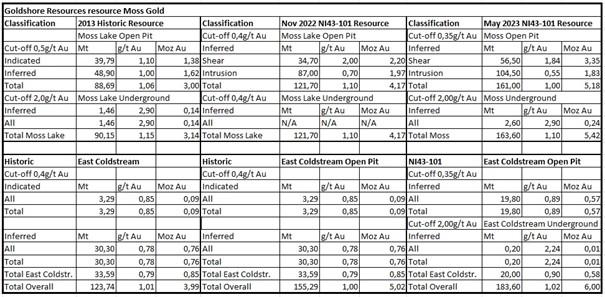

The NI43-101 compliant 6.00Moz @ 1.02g/t Au Inferred resource will serve as a baseline for an updated resource, to be expected in Q1 2024, and a PEA later next year. Goldshore isn’t exactly experiencing an easy walk in the park this year, and this will be discussed as well, so investors can get a complete picture of the company.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Goldshore Resources’ resource potential/economics are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Goldshore or Goldshore’s management. Goldshore Resources has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

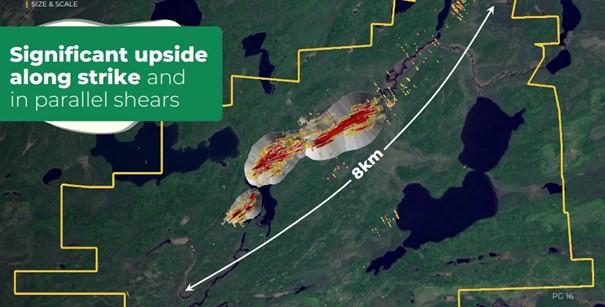

Although general sentiment for junior miners isn’t positive, and hasn’t been positive for quite some time now, it has probably dawned on interested investors by now that sentiment wasn’t the only thing Goldshore management had to deal with for the last year or so. As the potential size of Moss is huge (management was discussing 10Moz+ Au targets a year ago), corresponding drill programs to delineate such a resource would be equally huge and very dilutive.

Since opex and capex were steadily rising since last year due to high inflation, economics combined with the existing net profits interest (NPI) of 8.75% weren’t a no-brainer anymore, causing management to accept less favorable PP terms in December 2022 and January 2023. As the total PP amount was also relatively limited, although good for keeping dilution in check, the company was forced to let go the big exploration 10Moz Au scenario, and look into smaller scenarios, made possible by the new interpretation of the existing resource geology (separation of high and low grade domains, providing smaller scale mining scenarios).

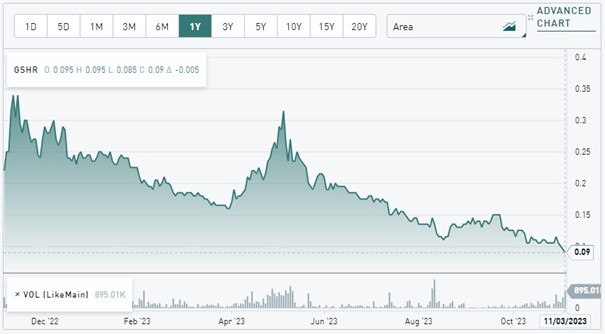

Share price 1 year timeframe (Source: tmxmoney.com)

The eventual updated resource estimate came out in May and marketing leading up to it supported the share price, but this milestone was eventually used as a considerable liquidity event in the coming weeks unfortunately. This was further exacerbated by the engineering firm that compiled the resource report, CSA. What happened was they filed the wrong, not finalized version on SEDAR, still containing some very negative comments of the geologist QP. This version was removed within a day, but social media got a hold of it and the stock suffered because of this blatant mistake.

The geologists of Goldshore had a much more specific approach in mind for the resource estimate, but CSA apparently had issues with this, and came under pressure because of time limits. The result wasn’t just a very global resource in order to meet CIM standards, but also lots of negativity in social media about the negative QP comments, which is of course understandable if you are no insider. As a reminder I’m quoting VP Ex Flindell extensively on the matter:

“The high-grade wireframes referred to in the CSA comment are manually-derived rather computer-generated wireframes of the shears that utilizes oriented core data, logging of shear intensity and pathfinder analyses. Many would consider it superior to implicit modeling processes, as it applies the geologist’s judgement when the latter depends only on data points and therefore requires a lot of data over the entire deposit. Our manual wireframes were always intended as a check of the computer-generated wireframes that CSA had proposed. It became the accepted basis for the resource model after four months when CSA recognized that it was not possible to create the computer-generated wireframes over the full volume of the resource. This decision was made by their resource team in order to meet the deadline.

For this reason, and concerns over historical drilling data, the resource was categorized as Inferred. This is consistent with the guidelines of National Instrument 43-101. Consequently, the current Inferred MRE is a reasonable estimate of the contained gold at Moss and is sufficient for our PEA. An updated resource model, following a proposed infill drill program, will likely utilize implicit modeling techniques but will also be validated by our manually modeled wireframes.”

About the process: “We commenced the modelling process in January of this year when we completed the last drillholes and demobilised the rigs. In the proposal we received from CSA, they wanted to utilise implicit modelling techniques to define the high-grade shears and low-grade alteration domain. This would be done with Leapfrog algorithms that can be fully described and reproduced. We were happy with this approach. In parallel, we developed manual wireframes of the shear zones using oriented core data, logging of shear intensity and pathfinder analyses. For the historical drill core where these data are not available, we used gold grade as a proxy. These models were created to test/validate the Leapfrog models we expected to receive from CSA. Unfortunately, CSA made little or no progress on the proposed modelling in February and March, citing an incomplete drill database. In fact, they had more than 95% of the drill data and we were waiting on final QAQC data on the last few holes before releasing these data. Once we got into April, I reminded CSA that the deadline for the MRE update was the end of April. At this stage, they said they could not complete the Leapfrog models as proposed. As a result, they elected to use our manual shear wireframes and to create a rough low-grade domain.

The author who made the unfortunate comment was the Geology QP who, because of his relocating back to Australia from Canada, was not up to speed on the decisions made by their resource team. We share his disappointment that the proposed work was not completed and agreed that the entire MRE should be categorized as Inferred. So, in a nutshell, we are all disappointed that the proposed implicit modelling of shears and alteration haloes was not completed. Fortunately, we had modelled the shears manually based on solid geological and geochemical data as a check of the proposed models; and this enabled CSA to meet the end of April deadline almost four months after the MRE project began.”

CSA were also concerned about a lack of documented QA/QC in the historical drillhole data, despite there being laboratory certificates and evidence that QA/QC protocols were applied. Unfortunately, routine reporting of QA/QC performance is something that did not come in until NI 43-101. This is another reason why CSA categorized the resource as Inferred.

Both Gilles Arseneaux at SRK and Mike Dufresne at APEX voiced opinions that the historical data was in far better shape than implied in CSA’s Technical Report. As a result, Goldshore selected APEX to conduct a more rigorous study of the historical drill data and its suitability for use in Indicated Mineral Resources. This work has been ongoing for the last two months with favourable results. The company decided to extend this work into a resource update that is due in Q1 2024.

The incoming strategic investor agreed with this, and also would like to see a much more detailed resource estimate, incorporating more historical data which according to APEX has more quality and credibility than CSA wanted to acknowledge. Another thing the incoming strategic investor would like to see is a smaller capex, as during these days of inflated capex (and opex) it is easier to finance and build a smaller (starter) operation. For this they agreed with Goldshore to focus on the higher grade shears (3.35Moz @ 1.84g/t Au), and explore the possibilities for a much cheaper (compared to conventional whole ore leach) heap leach operation for the lower grade intrusion zones (2.65Moz @ 0.66g/t Au). It would also give Goldshore options, as it could construct Moss in phases starting with a smaller mill circuit for the higher grade ore, and for example stockpile the lower grade ore until the HL facility is completed.

As a consequence, Goldshore had to rescope the project and timelines for the upcoming resource estimate and PEA (initially expected before year end). This time, management anticipates to convert about an estimated 1/3 of the high grade Inferred resource into Indicated, which would be great. The tonnage of the lower grade part may reduce in areas where volumes may be excluded because of limited drilling, but these would come back into the resource with further drilling. Overall, the ounces will probably not differ meaningfully. When looking at the previous resource estimates, it might be realistic to aim at an estimated 1-1.2Moz @ 1.90g/t Au Indicated, 2.3-2.5Moz @ 1.80g/t Au Inferred for the shears, and maybe a 1.7-1.8Moz @ 0.65-0.70g/t Au Inferred for the intrusions, with East Coldstream likely unchanged.

The result going into the PEA engineering will be a (much) higher quality resource, expected in January/February of next year, which will provide a more solid base combined with met work results involving all scenarios including heap leach, which are expected in March/April. The PEA is being scheduled to be complete before Beaver Creek next year (usually around mid-September), so Moss can be properly marketed to financiers.

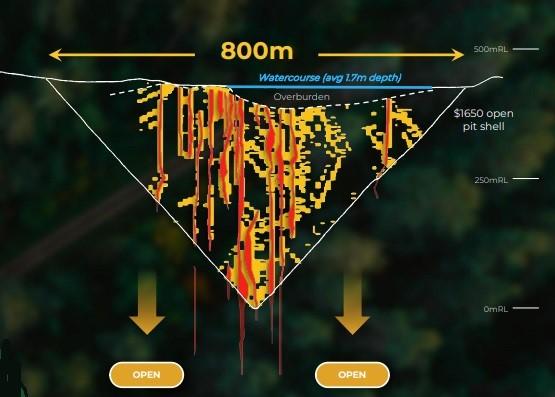

The CSA blunder wasn’t the last thing Goldshore had to deal with. On top of this, rumours about water issues kept swirling around, focusing on unforeseen problems regarding permits. In reality, just a small local river needs to be diverted, a river that widened at the project and formed a shallow lake, without any protected fish species in it or others that could cause problems. Again Flindell:

“Our independent environmental consultants, CSL, have re-evaluated the bathymetric data for inclusion in the upcoming Technical Report. In the process they found errors in the previous statements but noted that measurements of depth assume surface elevations that can change by meters over the seasons. This is what they have written into the Technical Report: Moss Lake and Kawawiagamak Lake occur in the vicinity of the Moss Gold Deposit. Bathymetric surveys show these to average 4.6m and 2.7m, respectively, with maximum depths of 15m and 16m, respectively. The Wawiag River runs along the axis of the Moss Gold Deposit and widens over the Main Zone to form Snodgrass Lake, which averages 1.7m deep and reaches a maximum depth of 4m. This explains why the Ministry of Environment considers the “lake” a river for the purpose of defining water limits for our Permit to Take Water (required for drilling).”

After management explained all this to worried investors and the dust settled, they went on the road, in order to look for a strategic partner, as this would be the preferred strategy to combat future, ongoing, heavy dilution, as such a partner would be able to provide capital exactly when it was needed, in the right amounts against favorable terms.

Unfortunately, this didn’t work out, and as the bottom of the treasury came more and more in sight, Jeff Zicherman of Eventus Capital, a loyal backer, came up with the idea of approaching a significant player in mine/project financings he was familiar with. They apparently liked what they saw, and decided to put C$3M @ 10c in the company, with a full 3 year warrant @ 13c. Goldshore couldn’t name names yet, but if we take a quick look at the incoming board member Kyle Hickey, who is a principal at SAF Group, a capital provider with offices in Calgary and Vancouver, it seems Goldshore has found their strategic investor after all. Goldshore is looking to raise another C$750k under the same terms, which means potential dilution could account for 75M additional fully diluted shares.

Raising at lows with no premium and a full warrant aren’t of course favorable terms, and investors weren’t exactly happy considering the price action following the news, but when you are in the position of Goldshore you don’t have many options unfortunately. When money is offered, you simply take it, as is the golden rule in junior mining. Since the strategic investor will enter with a position exceeding 10% ownership, they exercised their right to have a board seat, and Hickey will replace Michael Michaud, the representative for Wesdome Gold, the vendor of Moss. Wesdome giving up their board seat is actually a good sign as it was already clear that Wesdome wasn’t looking to invest more into Goldshore, and might for example put blocks of shares up for sale with cross trades in the near future, hereby limiting their potential influence which in turn provides Goldshore with more room to manoeuvre. I don’t rule out that this new strategic investor sits front row to take these blocks from the hands of Wesdome, but only time will tell.

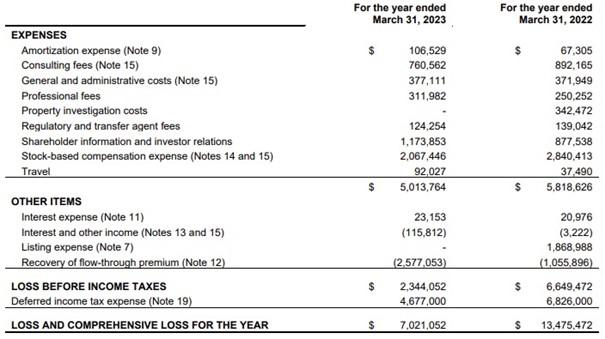

One more item that has also been bothering investors to a degree is the high burning rate of the company. To get an idea about this, here is a table taken from the FY 2023 financials:

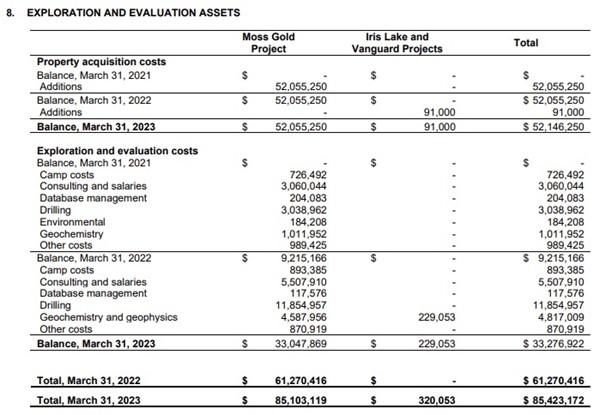

G&A of C$5M with substantial spending on marketing and IR but also a significant amount of salaries, fees and stock-based compensation racks up a number that wouldn’t be misplaced at an advanced developer. As Goldshore was set up as a powerplay with big numbers (the acquisition consideration of Moss project was C$57M to begin with), with a huge exploration budget as well, the resulting percentage of exploration was already bordering on acceptable in my view:

The company burned through C$33M in exploration costs, and C$11M in G&A is 33%, meaning 66.6% was spent on the project. Usually my threshold for healthy G&A/exploration expenditures is 25/75 or 20/80. This is all fine when the stock performs well, but this isn’t the case with Goldshore this year. When talking to management about this, CEO Richards agreed that G&A will come down sharply from now on. He elaborated a bit more what he has in mind on the various expenses: “In 2024, Goldshore will focus on 3 value drivers: the updated MRE, the met test work (heap leach testing) and a re-scoped PEA. To that end, we will be on a care and maintenance budget until the point in time we have a share price / market cap that supports raising money for the next drilling campaign, and this gives us enough working capital until the end of 2025”.

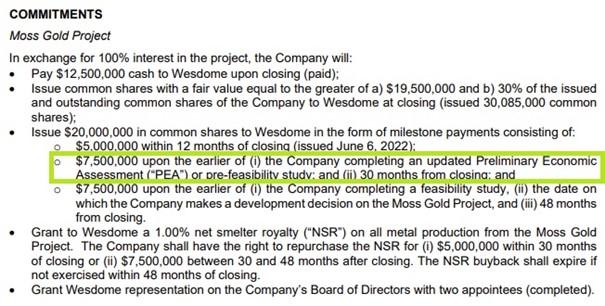

This is good to hear, as the current burn rate is of course unsustainable. When looking into upcoming commitments, Goldshore still has C$15M in shares for milestone payments coming up to Wesdome, with the first one being a C$7.5M in shares when completing the PEA:

30 months from closing would be December 4, 2023, so the intended date for the PEA (September) will likely come first. Dilution for these payments would be relatively limited, as the agreed base price for them was set at C$0.60 or 12.5M shares per C$7.5M payment. As Wesdome isn’t looking to participate in financings because of this already massive amount of paper (going to 40-45% ownership after the PEA if they don’t cross out before then with the strategic investor), I was wondering about their plans. CEO Richards had this to say: “we are working collaboratively with Wesdome to find large block buyers of their stock, but they have no intention of putting this into the market.”

Talking about the PEA, I discussed the intended change of scope with Richards and Flindell. In my last article I used a staged development scenario of much larger size (20,000tpd going up to 50,000tpd), using a blended ore approach (high grade and low grade combined). Management has other plans now, and is contemplating a 5,000tpd high grade operation for starters, with either stockpiling the low grade ore and blending this in later, or constructing a significant heap leach operation (estimated 40,000-50,000ktpd) at the same time or later on, with the aim of achieving the lowest capex possible. Contract mining is a viable option in this regard as well.

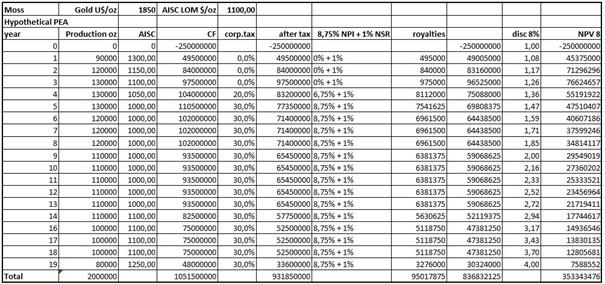

Considering the amount of infrastructure and power that needs to be constructed, together with the diversion of the small river etc, management expects to start up with a 5,000tpd operation, producing 100-110koz Au per annum, with ballpark capex numbers around US$250-300M. This would mean US$50-60k/tpd which is extremely conservative. For example Nighthawk Gold used US$29k/tpd for their 17ktpd combined open pit/underground operation in their 2023 Colomac PEA. Using an average head grade of 1.75g/t Au, recovery of 94%, strip ratio of 10 : 1 (treating the low grade ore as waste in the operation without the HL part), a total high grade production of 2Moz Au for a life of mine of 18 years, and a conservative average AISC of US$1100/oz because of high strip ratio, stockpiling (Nighthawk used a strip ratio of 9 : 1 and AISC of US$828/oz), my discounted cash flow model (DCF) generated an after-tax NPV8 of US$353M, and an after-tax IRR of 27.3%:

These numbers indicate a robust, decent operation, with a relatively low capex. My AISC number seems high compared to Nighthawk, but if you look at the major producers they sometimes end up even higher so I’m comfortable with this for now. When looking at the 40-50ktpd heap leach part, this would be a major expansion. When looking at the recent Freeman Gold PEA for Lemhi, their capex/tpd figure comes in at US$28k/tpd, with a smaller operation of 6.8ktpd. Without economies of scale, this would mean a US$1.1B capex for the HL part of Moss. My estimate is as Moss HL would be 6-7 times larger, that the capex/tpd number could come down to US$20k/tpd > capex of US$800M. This could easily add 300koz Au annual production, so we are talking a 400koz Au giant now. I have no idea if the higher grade material could be heap leached as well to increase grade, so economics would be very much armwaving here. Depending on recoveries (and if HL is feasible at all), it wouldn’t be too unrealistic to estimate an after tax NPV8 in the range of US$800M-1,000M in my view with such a combined operation.

Keep in mind, Goldshore Resources is trading at a market cap of just C$18.8M, which would be about 5% of the NPV8 for the small operation, and 2% of NPV8 for the large, combined operation, both of which are extremely low compared to peers for a project in a top jurisdiction with all the necessary infra nearby or at site (power). It will be clear that not just on a P/NAV basis but also on a EV/oz basis Goldshore is extremely cheap.

There is, at least in my view, no reason to think of as a fatal flaw for this project, like First Nations involvement or permitting, which could justify such a low valuation. In my view the company is suffering from negative sentiment in the markets, combined with the amount of drilling needed to advance this large project, no obvious stellar economics and a few hickups along the way. Investors might just like to see actual proof, defined by a robust and conservative PEA in Q3, 2024, based on a scenario that has a fundable capex. In that case, a subsequent re-rating seems to be inevitable for this project, managed by minebuilders although they want to set it up for a buyout within a few years, supported by the strategic partner they have found now.

Conclusion

Goldshore Resources has become a pretty complex story for investors in 2023. Notwithstanding the fact that Moss contains a substantial 6Moz Au open pit resource with a significant part of it higher grade and a lot of expansion potential through exploration, it isn’t obvious economics will come out positive as well, due to factors like the high royalty, necessary infrastructure, high strip ratio and low grade material recoveries which need to be tested for heap leach potential. As a consequence, the share price dropped more than was justified by the negative market sentiment in my view, hampering the ability of management to do financings or find a strategic investor. Fortunately they did found one, and although I hoped this party would show more support via better terms in the private placement (premium and no warrants for example), acknowledging that Goldshore could use all the help they could get, and mobilizing investor confidence that way, this could be a turning point.

Assuming the strategic investor could be willing to buy big blocks from Wesdome, and also participate in future financings, Goldshore could have landed another Greenstone or Waterton. The rescoping of the upcoming resource estimate and PEA is a good thing in my view, as nobody is looking for billion dollar capex gold projects at the moment. The potential is still there for a Tier I monster, but being a C$18.8M market cap, a more modest 100koz Au production scenario should be able to generate positive economics as well and function as a building block for potential expansions. Above all, better sentiment is needed. One step at the time. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Goldshore Resources. Goldshore Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldshoreresources.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE