Critical Investor – “Gamechanger Deal For Kenorland Minerals: Converts 20% Frotet Interest Into 4.0% NSR Royalty”

Ice drilling at Regnault target, Frotet project, Quebec

At a time where markets are weighing Federal Reserve comments about being hawkish towards rate cuts as inflation remains persistent, two major conflicts deepen (Russia-Ukraine) or seem to spread out (Israel-Hamas), the BRICS expand with new members, and recession fears are looming large in the background, gold remains trading above US$2,000/oz. In this market with mixed sentiments for juniors, and I was frankly waiting for drill results for their flagship Regnault, Kenorland Minerals (TSX-V:KLD) (FSE:3WQO) didn’t hesitate and felt the time was right to convert their 20% interest in their Frotet project, located in Quebec, into a 4.0% NSR royalty, which in turn also terminated their 20/80 JV with Sumitomo Metal Mining Canada (SMM). For additional context, a NSR is the value of the free cash flow after capex payback of the total amount of gold produced, not a net profit royalty. This transaction appears to be a pretty advantageous one, and I will explain in the following article why I believe this is a positive gamechanger for the company.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Kenorland’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Kenorland or Kenorland’s management. Kenorland Minerals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

Since Kenorland Minerals completed a 11,918m drill program at the end of last year, drill results are expected around the end of January, and the upcoming 2024 winter drill program is about to start around the same time, I didn’t really see the royalty news coming to be honest. For now, it seemed Sumitomo was happy with the results of the ongoing drill programs so far, and even seemed inclined to shift towards completing a NI43-101 resource estimate, as the estimated 3Moz Au target appeared to be well within reach. Kenorland is also well funded with C$23M in the treasury, so the 20% Regnault exploration expenditures weren’t really an issue in the near future. However, CEO Zach Flood had good reasons to do the conversion at this point.

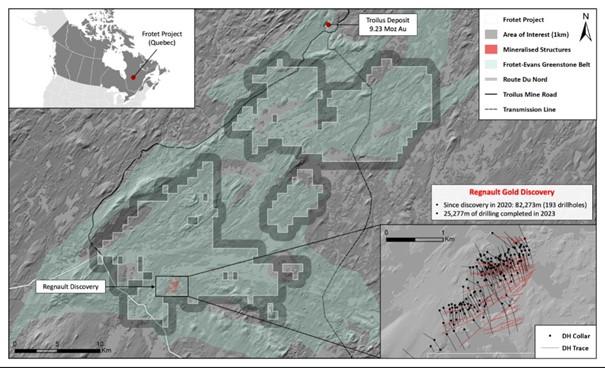

The entire Frotet project, covered by the 4% NSR

He felt that they had arrived at a point, where the recently commenced conversion from predominantly exploration drilling to more and more infill drilling would need lots of their own cash, which wouldn’t directly attribute or translate equally into more value, and would be also harder to recoup later on. Most of the new discoveries at Regnault were made at depth anyway, up to a 1,000m deep, so ongoing exploration at depth would have been costly anyway, and better preserved to continue as underground drilling during production. Besides this, Kenorland’s strength is early stage exploration and as they have acquired other projects recently, their resources are probably better used elsewhere.

On the macro side of things, with gold a bit on a plateau right now, but with rate cuts anticipated somewhere in 2024, an arranged royalty would gain lots of value when the gold price starts rising, likely having no trouble fetching a buyer in a mature royalty and streaming market these days.

The 4% NSR royalty isn’t really typical, as usually a 2-2.5% NSR is created for such a minority stake, or even less. The reasoning for Sumitomo to agree on this number was pretty simple. It not only consolidates the entire project for them, but the 4% appeared to be comparable with the 20% of the economics, so it was basically equal to the 20% interest, and on top of this, Kenorland already invested C$7M of their own money in the project, so for both parties it seemed a fair deal. When looking at the buy down terms, we get an impression of the actual worth of the NSR:

“The Frotet Royalty is subject to the following buy down rights in favour of Sumitomo:

- A 0.25% royalty interest may be purchased for a C$3,000,000 cash payment to the Company within five years of the grant of the Frotet Royalty upon the closing of the transaction.

- A 0.50% royalty interest may be purchased for a C$10,000,000 cash payment to the Company within ten years of the grant of the Frotet Royalty upon the closing of the transaction, provided Sumitomo has exercised the first buy down right.

In the event Sumitomo exercises the foregoing buy down rights, the Frotet Royalty would be reduced to an uncapped 3.25% net smelter return royalty on all minerals extracted from the Project.”

A 0.5% NSR being purchased for C$10M equals C$80M for the entire 4% NSR on paper, but this seems a bit rich at this point, where quite a bit of drilling is needed to generate a maiden Inferred resource. Since CEO Flood estimates that Sumitomo would need at least another 1.5-2 years of drilling for this, this could entail 45,000-60,000m of drilling, costing about C$23-30M. Since royalties typically sell for C$10M per 1Moz per 1% NSR at FS/permitting stage, and my estimate for the deposit stands at about 3Moz Au at the moment (more about this later), this would mean a value of C$120M at FS/permitting stage, which is many years out from now. How to discount to today I have no clue, but taking the buy down rights into account, it seems the 4% NSR could be worth C$30-40M today.

It is not just the current worth of the NSR, it also means saving 20% of all upcoming Frotet project costs, ranging from drilling to studies to construction packages, which could easily run into the hundreds of millions for Kenorland, generating lots of dilution as a significant amount of capital needs to be raised. This 4% NSR is completely dilution-free. Besides this, a NSR only starts to generate cash for the owner after the first years of production, which could be 7-8 years out from now. Theoretically one could assume the payback of capex debt at a maximum in the first 3-5 years, but normally payback schedules are spread out over 8-10 years, so free cash flow probably commences earlier, but with a very fast development scenario for Regnault, 7-8 years doesn’t seem unrealistic and even fast. Therefore this 4% NSR is much more value accretive and provides much more room to manoeuvre for Kenorland in terms of monetization.

Another advantage, and maybe the biggest advantage of all, is the termination of the first right of refusal that Sumitomo had on the 20% interest of Kenorland until production. It meant that Kenorland couldn’t sell its interest to just anyone, but always had to go to Sumitomo first, which could then offer a very low price, or not buy at all. With the NSR in hand, Kenorland can sell it at any point in time to whoever it wants.

After talking to CEO Flood it appears that it is possible for Sumitomo to develop a mine at Regnault, and this is what makes this 4% NSR so attractive, as these are rare and coveted by all the royalty companies. The value of this royalty will only grow over time, as Sumitomo likely keeps advancing Regnault, and hopefully the gold price will print new highs as well in the coming years. He also thinks that because of the extensions at depth of the current deposit, the strategy may be to define a resource in the shallower part of the mineralized system (less than 500m depth) as infill drilling at greater depths would be very expensive, and could be done better from underground, when producing.

The flipside of this could be that if resources at depth aren’t included in a resource, it would be harder to negotiate value for this when selling the 4% NSR, as future value at depth would only show when it is actually drilled many years later during production. CEO Flood had this to say about this: “The Great Bear royalty sold for C$200M with no resource, so no I don’t think that matters too much, as long as there’s exploration results showing obvious scale and upside. The value will be determined by what a large sophisticated royalty company is willing to pay for it.” Fair point, although I believe Kinross overpaid for Great Bear, and the royalty price got more or less extrapolated from that hype. Time will tell.

Another issue I wanted to ask Flood was this: although Kenorland remains the operator for another year, it made me wonder about access to drill data after that point, as I have seen many royalty holders being kept in the dark after conversion. CEO Flood had a surprisingly confident answer to this matter: “We have fairly comprehensive data rights and can still disclose material results on the project. Definitely, it’s very important these days to get data rights.…. It makes the royalty much more marketable.” This is a very important aspect of this deal, as Kenorland will have very close tabs on results, developments and value appreciation estimates this way. CEO Flood continues to impress me, and a grand exit would only be well deserved. Let’s see where this royalty, and his numerous other projects will bring him.

This actually lead to another question: what is the endgame he has in mind for Kenorland? Is he aiming at continuing this way, discovering and selling minority interests, in the meantime growing the portfolio, receiving management fees to cover G&A, and grow it into a business like GMX? Or is he looking to find that one big Tier I asset and drill it on his own, generating the big payday like Great Bear? Or could he be looking at a transformation into a royalty company like EMX after their $65M interest sale? CEO Flood had this to say: “Our biggest strength at Kenorland is early-stage exploration – we are experts in that environment. Incredible value is created through discoveries and we will continue to focus there. In the meantime, we have incredible upside through the royalty alone and downside is very limited. At the same time, we have this vast exploration portfolio with a massive amount of blue-sky potential. It’s the best of both worlds when it comes to an investment in this space. We won’t be changing our strategy any time soon.”

To finalize, as promised, and since it has been a while, here is a reminder of my 3Moz Au estimate of the mineralized potential of Regnault.

So far, Regnault seems to be following the concept of a large intrusive Lamaque like plug with series of stacked, (semi) parallel veins extending to great depths. The latest results also indicate further extensions of many known veins, and especially R2 and R3 appear to be quite long, almost 2km:

The veins R10 and R11 seem to be multiple stacked vein sets, consisting of 3 separate veins each. The R11 length is estimated at about 800m, the width 100m, and the R10 length about 800m and the width 50m. Lots of intercepts were extremely narrow, below 50cm but high grade (25-36g/t Au).

The R1 zone is in fact a set of layered veins, but for guesstimating purposes this will be simplified as one zone. The latest reported results didn’t appear to extend R1, so we still arrive for R1 at 1100 x 300 x 5 x 2.75 = 4.5Mt, at an average guesstimated grade of 6g/t Au, this would mean a hypothetical 870koz Au.

The R2 vein has been connected to the R5-R8 structures, so R2 is estimated at 1800 x 200 x 2 x 2.75 = 1980kt, at an average guesstimated grade of 8g/t Au this remains a hypothetical 509koz Au. For the R3 structure we have more visual information now, so the envelope could be estimated at 1500 x 100 x 2 x 2.75 = 825kt, at an average estimated grade of 7g/t this results in a hypothetical 186koz Au. The R4 structure appears to be unchanged, so this mineralized envelope is guesstimated at 200 x 100 x 2 x 2.75 = 110kt, at an average guesstimated grade of 10g/t Au this could imply a hypothetical 36koz Au. This results in a total hypothetical estimate for R1-R4 of 1.60Moz Au.

For the R5-R8 veins a link between R2-R3 and R5-R8 has been established through the summer program, so I’m inclined to extend the R5-R8 veins by 100m each. For the R5 vein, the envelope is estimated at 800 x 75 x 5 x 2.75 = 825kt, at an average estimated grade of 10g/t this results in a hypothetical 265koz Au.

For the R6 vein (including a second vein in between R5 and R6), the envelope is estimated now at 1100 x 75 x 6 x 2.75 = 1361kt, at an average estimated grade of 8g/t this results in a hypothetical 350koz Au. For the R7 vein (including a second vein in between R7 and R8), the envelope is estimated at 950 x 50 x 7 x 2.75 = 914kt, at an average estimated grade of 8g/t this results in a hypothetical 235koz Au. For the R8 vein, the envelope is estimated at 950 x 80 x 3 x 2.75 = 627kt, at an average estimated grade of 8g/t this results in a hypothetical 161koz Au.

The envelope for R9 appears to be pretty long as shown on the first map, at least 1250m long, and is therefore estimated conservatively at 1250 x 50 x 3 x 2.75 = 516.5kt, at an average grade of 8g/t this results in a hypothetical 133koz Au. New triple vein sets were also discovered at depth as discussed, which were called R10 and R11, and each has a minimum length of 450m per the news release. This would result in 3 x 450 x 50 x 1 x 2.75 = 185kt @ 10g/t = 60koz Au for R10, and 3 x 450 x 50 x 2 x 2.75 = 371kt @ 15g/t = 179koz Au for R11.

These R5-R11 veins result in a total, hypothetical number of 1.38Moz Au.

Adding those two sub totals together, my overall estimate for Regnault would come in at an hypothetical 2.98Moz Au for now. For average grade I maintain an estimated 7-8g/t Au.

This is it for now, Kenorland will come up with an exploration update on all other projects around later this quarter which I will discuss together with the drill results for Regnault, which are scheduled to be announced in 3 weeks from now, and the new winter drill program at this project will commence around the same time as well.

Conclusion

It is time for Kenorland Minerals to be valued appropriately, since everything they are doing is top notch and Tier I. The latest conversion of their 20% interest in the Frotet project into a 4% NSR speaks volumes again in this regard, and should be considered a gamechanger, as the advantages definitely outscore the current situation, and immediately generates a value accretive asset for the company, easy to monetize at anytime to anyone. I’m looking forward to Sumitomo’s plans with the project, as clearly visible advancement towards a mine is the catalyst that would create real value from the NSR. And let’s not forget Kenorland is well funded, and has a portfolio full of potential Tier I discoveries, which will see exploration plans for 2024 very soon. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Kenorland Minerals. Kenorland Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kenorlandminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

MORE or "UNCATEGORIZED"

Great Pacific Gold Announces Closing of Upsized $16.9 Million Private Placement Financing Led by Canaccord Genuity Corp

Great Pacific Gold Corp. (TSX-V: GPAC) (OTCQX: FSXLF) (FSE: V3H)... READ MORE

Ridgeline Minerals Provides Assay Results and Drill Program Updates for the Big Blue and Atlas Projects

Big Blue highlights: 0.6 meters grading 0.7% Cu, 3,194 g/t Ag and... READ MORE

Goldshore Intersects 42.7m of 1.09 g/t Au at the Eastern QES Zone of the Moss Deposit

Goldshore Resources Inc. (TSX-V: GSHR) (OTCQB: GSHRF) (FSE: 8X00)... READ MORE

Dios Sells K2 to Azimut

Dios Exploration Inc. (TSX-V: DOS) is pleased to report it has e... READ MORE

Northisle Announces Near Surface Intercepts and Higher-Grade Intercepts at Depth at West Goodspeed on its North Island Project

Highlights: Recent drilling at West Goodspeed supports the presen... READ MORE