Critical Investor – “Adriatic Metals: A Polymetallic Explorer With Significant Potential”

Drilling at Rupice

Drilling at Rupice

Introduction

This time Kees Dekker analyzes Adriatic Metals, an Australian junior exploring a very high grade polymetallic project called Rupice in Bosnia Herzegovina. Kees and I had our doubts as the last drill results at the border of the drill permitted area took a very long time until release, but when they did came in, the results appeared to be pretty good again. Kees does a good job calculating metal value including recovery and payability, basing his cash margin on this, and hereby maintaining a conservative stance which seems healthy for an early stage exploration play.

With the corporate tax in Bosnia Herzegovina standing at a very cheap 10%, and a potential operation dealing with very small tonnage and thus low capex, there is no doubt in my mind that this could be a very profitable mine somedays. If I would take a 2Mt resource for the entire mineralized envelope (Kees takes 1.58Mt for the deeper part only), a decent 10y LOM would deliver a 570tpd (350 days per annum) operation, and using an average small scale underground capex/tpd of US$80,000/tpd, the total capex would come in at US$45.6M. Let’s use some margin of error and take US$50M and add 50% of capex as sustaining capital to opex as underground development seems relatively limited. Using the calculated cash margin of US$290M (without sustaining capital) of Kees as a base, this would result in a NPV8 of US$80M, and the calculated cash margin of US$370M would result in a NPV8 of US$120M. This is all very conservative, and considering the current market cap of about US$40M and exploration ongoing there is a lot of upside. This could be a small gem.

Next up is the analysis itself by Kees Dekker.

All presented charts/tables are provided by Kees Dekker, unless stated otherwise.

All pictures are company material, unless stated otherwise.

- Executive Summary

Adriatic Metals (ASX.ADT) (FSE:3FN) is a recently listed Australian company with two complex base metal – precious metal deposits in Bosnia Herzegovina. Its share price has shown a spectacular appreciation over the past few weeks. However, at its current share price Adriatic has an Enterprise Value of approx. US$37 million, assuming full dilution, which must be considered modest compared to the value of the deposits in its portfolio.

This study concludes that the company is still vary good value based on the cash operating margin one can expect from mining the resources of one deposit (called Veovaca) and the volume of the deeper portions of an ore shoot at another deposit (Rupice), derived from published drill results.

The deeper, very high-grade portion of the shoot at Rupice, defined over an estimated 200 m plunge, 40 m width and 55 height, has the potential to generate a total operating cash of US$370 million (assuming that its BaSO4 content can be upgraded to a drill mud additive product) and US$290 million (without BaSO4 sales). Each 50 m additional plunge extent established from further drilling would increase the cash margin by US$90 million (incl. BaSO4 sales), or US$70 million (without BaSO4 sales).

This study arrives at prospective at-mine revenue from Indicated Resources at Veovaca of at least US$260 million based on at-mine revenue of US$56/t in-situ, which as an open pit mine could well generate cash from operations of at least US$130 million. This assuming that the BaSO4 content in the resources can be concentrated to a marketable product. If not, this deposit is of little to no value.

There are a number of upsides to Adriatic apart from adding to the deposits dimensions, being the value of the shallower portion of the Rupice shoot, exploring targets in the vicinity and at the same stratigraphic level, and upgrading the BaSO4 concentrate to a higher grade product for which the sales price is a multiple higher than the drill mud additive product.

The main risks are related to testwork showing poor metallurgical performance for the mineralisation and the difficult and ambiguous legislative environment in the jurisdiction, which complicates obtaining the necessary rights and permits to advance projects and securing the rights to new discoveries.

This share being an exploration play is definitely not for widows and orphans, but, for the less risk adverse, constitutes an attractive opportunity on a risk/return basis

- Introduction

Adriatic Metals is an Australian company with a number of complex base metal – precious metal deposits in Bosnia Herzegovina. The company was listed on the Australian stock exchange in May 2018 and its price has since risen spectacularly from A$0.20 to peak at A$0.585 on 29 June 2018. On that day it announced a parallel listing on the Frankfurt Stock Exchange (under the code FSE:3FN).

According to an announcement dated 23 May 2018 the company has 82.95 million shares currently quoted and another 47.85 million shares in escrow for 18 months. Total shares therefore amount to 130.80 million to which must be added 19.5 million share options, of which 18.5 million are currently in the money. Fully diluted the market capitalisation is A$65.6 million at the share price on 19 October of A$0.44. When deducting the A$5.4 million cash raised from exercising the options and the cash balance of A$8.5 million in October, the Enterprise Value on a diluted basis is A$51.7 million, or US$37 million.

The following sections will show that this valuation is very low for what the company has already proven by drilling and the prospects for additional discoveries.

- Review of the Mineral Prospects

3.1 Background

The information, wording and illustrations presented in this section are derived from:

- A prospectus dated 27 April 2018.

- Press releases with drill results dated 12 June, 22 June, 16 July, 17 July, 29 August, 28 September and 19 October 2018.

- A press release dated 22 June 2018 with drill results.

The Adriatic key asset is the Vares Polymetallic Project, comprising the Veovaca and Rupice deposits, which is situated in Bosnia and Herzegovina. The projects were acquired from Balkan Mining Pty Ltd in 2017 while Adriatic was a private company. The project is located near the town of Vareš, which was a historic mining and industrial centre with infrastructure including sealed roads, grid (coal / hydro) power, heavy duty rail and blast furnaces. Figure 3.1_1 extracted from the prospectus shows a map putting the two deposits into a regional context.

| Figure 3.1_1

Location of the Rupice and Veovaca Deposits Within the Balkan Region

|

The two deposits are located in approx. 17 km apart (refer to Figure 3.1_2 which has also been extracted from the prospectus).

| Figure 3.1_2

Regional Geological Map for the Area Around Rupice and Veovaca |

The above map also identifies the mineral rights areas secured by Adriatic, which cover the two deposits proper, and the numerous other targets, their names identified in green. The concessions acquired through the acquisition of a bankrupt entity are of very limited size: 83 hectares (“ha”) at Rupice and 191 ha at Veovaca.

Geologically the deposits are situated in a block of ground that has been thrust on top of much younger rocks. Polymetallic mineralisation is predominately hosted in the matrix of a polymictic breccia of banded shale, siltstone or sandstone clasts, both overlain and underlain by a succession of sandstone, siltstone, shale or limestone. The mineralisation seems to be semi-comfortable with the lithology.

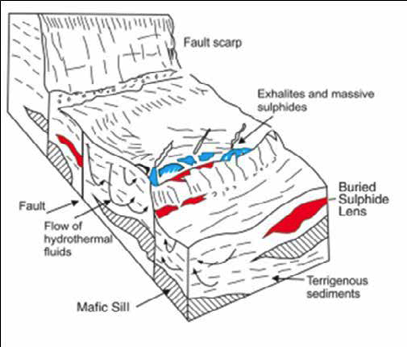

The technical report postulates that the mineral field is of the Besshi-style type, which implies that the metals are of sedimentary exhalative origin. Figure 3.1_3 from the Adriatic Metals prospectus shows schematically the setting for Besshi-type deposits.

| Figure 3.1_3

Geological Setting of Besshi-type Deposits |

Getting a handle on what specific type of deposits Adriatic is dealing with has implications for regional prospecting. For example, Besshi-type deposits form in clusters along stratigraphic horizons and can be restricted in aerial extent. This means that there could be many more Rupice and Veovaca type deposits at the same stratigraphic level in the project area.

3.2 The Rupice Deposit

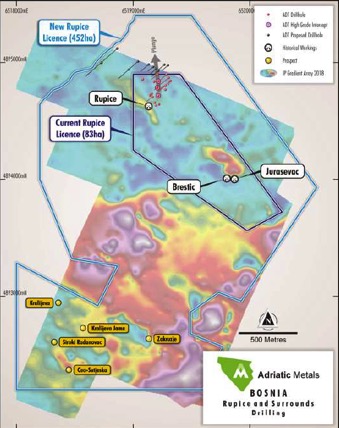

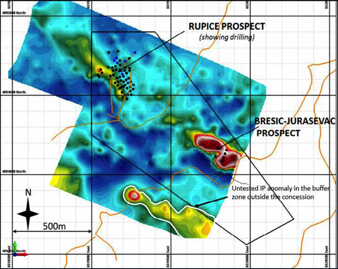

The Rupice deposit is known from exploration activities, which commenced in 1952 and continued intermittently until 1990, initially focusing on barite (= the mineral with chemical formula BaSO4) mineralisation and later on the polymetallic mineralisation. The change is understandable in the light of very high BaSO4 grades at shallow levels with low base metal values, but with deeper drilling encountering much higher base metal and precious metal values. Mineralisation at Rupice, and Jurasevac-Brestic almost one kilometre to the southeast, have induced polarisation (“IP”) geophysical anomalies associated with them (see Figure 3.2_1, extracted from the prospectus).

| Figure 3.2_1

Plan of IP Anomalies Over the Rupice Tenement Area |

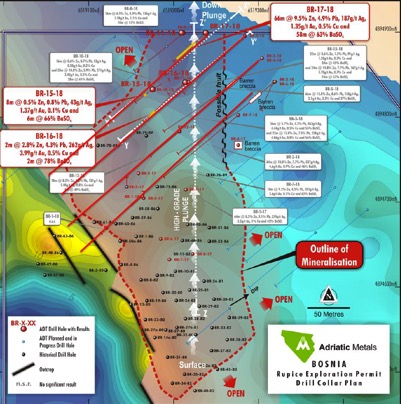

Interpretation of drill results Rupice concluded that the mineralisation appears to be dominantly strata-bound and hosted within brecciated sediments in a shoot dipping approximately 50 degrees to the east. Whereas the prospectus still suggested the shoot to plunge to the northeast, in later press releases the interpretation of the plunge direction was changed to north (see Figure 3.2_2)

| Figure 3.2_2

Drill Location Map Showing Interpreted Dip and Plunge Directions of Mineralisation |

The red traces show the direction of the dip and the arrows the direction of the plunge, which is due north.

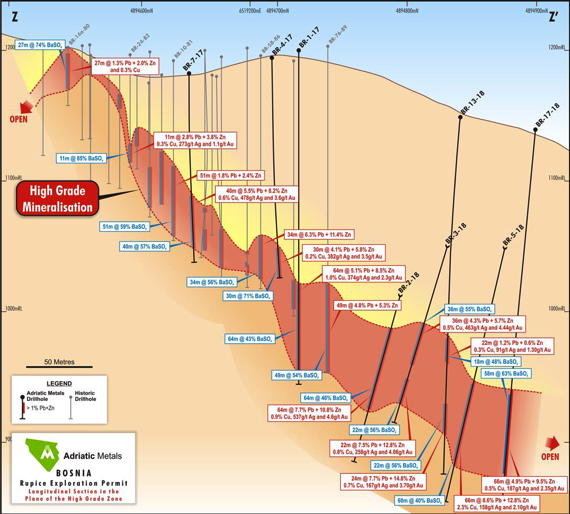

Whereas drill results from June 2018 onwards have successfully tracked the plunge over considerable vertical extent all the way up to the northern concession border, successive cross section interpretations show a considerable reduction in the dimensions perpendicular to the plunge direction. As one example, figure 3.2_3 illustrates the progressive reduction in interpreted horizontal dimension of the high-grade shoot oblique to the plunge as extracted from the various press releases.

| Figure 3.2_3

SE-NW Cross Section Over Borehole BR 5-18 – 17 July 2018 Press Release SE-NW Cross Section Over Borehole BR 5-18 – 28 September Press Release SE-NW Cross Section Over Borehole BR 5-18 – 18 October 2018 Press Release |

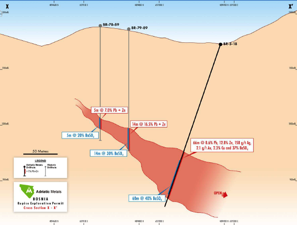

The development over time of the cross sections would have been cause for concern about the continuity of the mineralisation, but on the other hand consistent intersections along plunge of the deposit, where it is developed widest, give much comfort. Figure 3.2_4 shows the geological interpretation along the interpreted plunge of the high-grade shoot, extracted from the October press release.

| Figure 3.2_4

Geological Interpretation Along Plunge Direction of the Rupice Shoot |

According to this interpretation the shoot plunges at 60 degrees from surface for approx. 150 m after which it abruptly levels off to 30 degrees and shows a considerable increase in dimension vertically.

This illustration also clearly shows the dramatically improving base and precious metals grades with depth whereas the BaSO4 grade remains high, but with a declining trend.

According to the 22 June news release, mineralisation in holes BR-2-18 and BR-3-18 is very visible and consists of galena (PbS), sphalerite (ZnS), chalcopyrite (CuFeS2) and barite. There is no mention of tetrahedrite ({Cu,Fe}12Sb4S13), which according to the prospectus is present in minor quantities. As tetrahedrite is a copper mineral containing some antimony, appreciable quantities of the mineral could result in penalties imposed by off-takers of the copper concentrate.

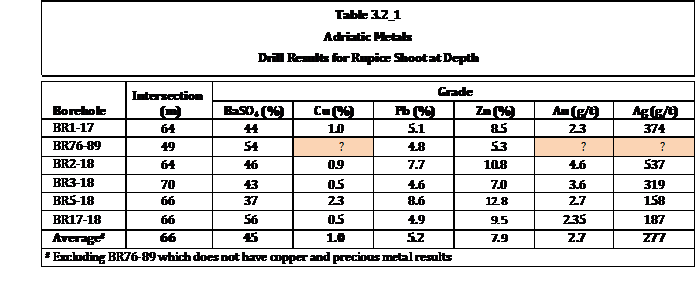

Table 3.2_1 summarises the drill results for this deeper, higher-grade portion of the shoot with the holes listed in the order from shallower to deeper down plunge.

Hole BR76-89 was drilled before Adriatic’s involvement and was not assayed for copper and precious metals. The holes are over a plunge distance of 200 m, define the deposit over a vertical height of 55 m (see Figure 3.2_4) and in cross section at least 40 m wide (see Figure 3.2_3). This amounts to a volume of at least 0.44 million cubic metres.

With the high specific gravity of 4.5 for barite and at a content of BaSO4 in the middle forties an average density of at least 3.6 can be expected, especially considering the density contribution of the sulphide minerals. The defined deeper portion of the shoot would therefore contain at least 1.58 million tonnes.

3.3 The Veovaca Deposit

Similar to Rupice, Veovaca is a sediment-hosted deposit with mineralisation present in a brecciated zone within a folded sediment package. This sediment package and the breccia zone appear to be steeply dipping to the northwest and plunging to the northeast.

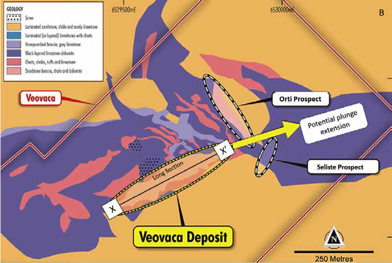

Figure 3.3_1 shows a geological map of the immediate surroundings of the deposit and indicating interpreted potential down plunge, extracted from the prospectus.

| Figure 3.3_1

Geological Map for the Veovaca Deposit |

According to the technical report in the prospectus 19 holes at the Orti prospect over an area of 500 m x 150 m indicated potential for resources there grading 1.2%-1.4% Pb, 1.7%-2.1% Zn and 21%-26% BaSO4.

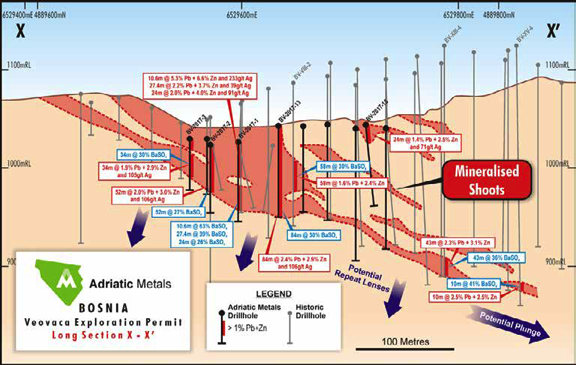

Figure 3.3_2, also extracted from the prospectus, shows a longitudinal section along trace X-X’ on Figure 3.3_1 to illustrate the deposit outline and potential at depth and down plunge.

| Figure 3.3_2

Longitudinal Section Through the Veovaca Deposit |

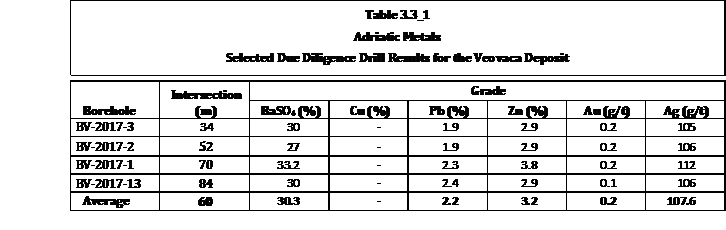

On the longitudinal section are also indicated due diligence boreholes drilled by Adriatic in 2017. Table 3.3_1 summarises the results of these holes over a strike length of 100 m listed in sequence from west to east. The deeper holes further east, with spotty intersections, have been ignored.

The results are attractive for an open pittable deposit with low strip ratio, but the holes were clearly sited along a favourable drill fence in the centre of the deposit as the grades for many of the other 11 holes are clearly lower. This is also evident from the average grades of a resource estimation carried out by CSA Global in February 2018 based on 48 historical drill holes and the 16 drill holes drilled in 2017 by Adriatic, some of which twinned historical holes.

According to CSA Global, the combined drillhole density of approximately 30 m x 30 m closing in places to 20 m x 20 m, provided sufficient data points to model the polymetallic (lead, zinc, silver, gold and barite) lenses over a strike length of approximately 550 m, and the silver and gold over 250 m of the 550 m strike.

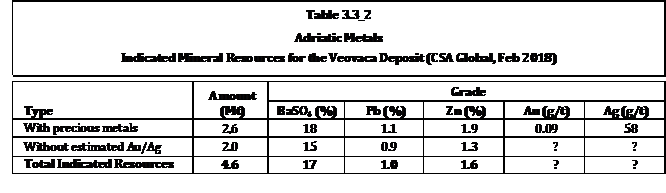

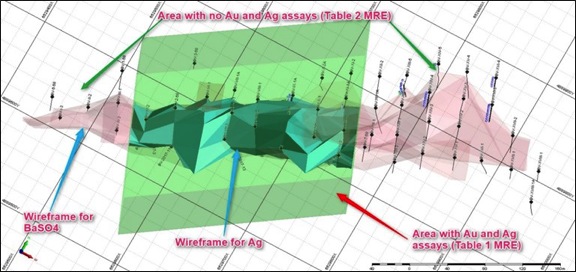

Mineral Resources were reported using cut-off grade of 0.5% ZnEq, and separately for the deposit area where gold and silver assays were taken and used, and outside of the area where there are no assays for gold and silver (see Figure 3.3_3, extracted from the prospectus, for relative location of the two resources).

| Figure 3.3_3

Relative Location of the Areas With and Without Resources With Precious Metal Grades |

Table 3.3_2 gives the resources reported as of Indicated category confidence level, ignoring 2.6 million tonnes Inferred resources, because these have grades that will unlikely be economical. The cut-off grade of 0.5% ZnEq is probably too low given the low net payability of zinc, which is usually between 50% and 60%, which converts the 0.5% threshold to approx. US$15/t.

- Economic Potential

4.1 Introduction

The projects are still at a very early stage and no economical value can be “calculated”, but at best estimated using broad-brush assumptions. This section will apply such to the estimated deposit sizes to give an indication what can safely be assumed as established to place the current Enterprise Value in perspective and the sensitivity of the deposit values to success in extending their dimensions.

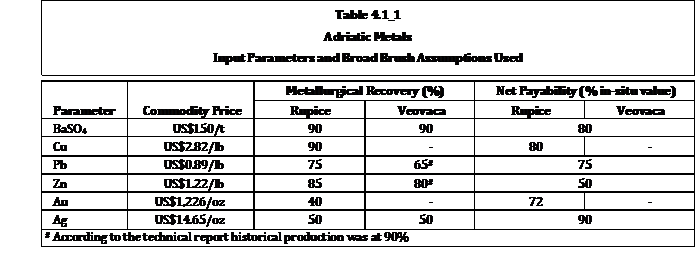

Table 4.1_1 shows the spot metal prices at 19 October and broad brush assumptions used for metallurgical recovery and net payability after off-take terms and all realisation charges.

The assumptions have been purposefully kept conservative. For example, according to the technical report all elements at Veovaca had a historical recovery of 90%. Given the low grades for Pb and Zn and the absence of numbers presented (elsewhere in the prospectus it is mentioned that there are no historical production statistics), much lower recoveries have been assumed. The net gold payability reflects the relatively low gold grade, which can be expected for the Cu-concentrate.

The spot price for BaSO4 is not generally available and reference was made to press release of Mountain Boy Minerals Ltd dated 18 April 2018, which states “barite is currently selling from US$120 to US$180 per ton depending on the location”. It should be noted that low grade barite concentrate that is used as an additive to oil drilling mud has certain maximum criteria for mercury (i.e. 1 ppm), cadmium (3 ppm) and lead (1,000 ppm) content. Given the association of the barite with lead mineralisation, it still has to be proven that lead minerals can be sufficiently separated to yield a marketable product. However, the Veovaca mine has reportedly sold BaSO4 when in operation.

4.2 The Potential of the Rupice Deposit

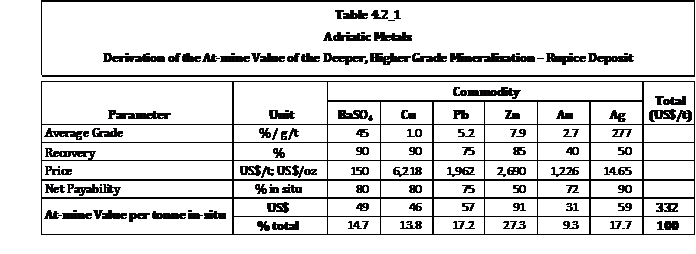

The approach to gauge the potential of the Rupice Deposit is to calculate the at-mine value of the material that has until now been delineated. Table 4.2_1 gives the derivation of this.

The calculation above indicates that the value of the deeper higher-grade portion of Rupice is US$332/t, assuming that the barite can be concentrated to a marketable product. Zinc, silver and lead are the products of most economical interest, accounting for more than 62% of the total value.

Even without barite the calculated value amounts to US$283/t.

Based on the minimum amount of 1.58 million tonnes in the deeper, higher-grade portion of the shoot, as derived at the end of Section 3.2, prospective at-mine revenue is US$525 million with barite as a saleable product and US$448 million without. This revenue would be earned at a very high cash operating profit margin, because the deposit would lend itself for bulk underground mining and total cost per tonne treated would probably be lower than US$100/t – US$125/t, with the higher number accounting for very complex metallurgical processing. If applicable the cash margin would therefore be US$290 million (without barite sales) and US$370 million (with barite sales).

The above values are for the dimensions 200 m plunge direction, 40 m width and 55 m height. It is unlikely that further drilling will affect the height much, but width and especially plunge length can be extended from additional drill results. Each 50 m additional plunge extent would increase the cash margin by US$90 million (incl. barite sales), of US$70 million (without barite sales).

In conclusion, only little exploration success from what is currently known will have a dramatic impact on the value of Rupice.

4.3 The Potential of the Veovaca Deposit

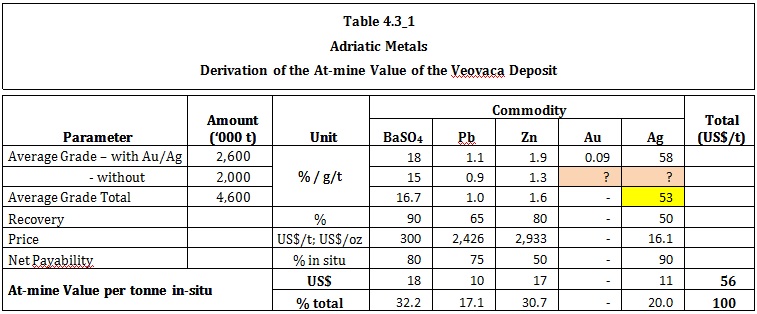

The approach to gauge the potential of the Veovaca Deposit is similar to that for the Rupice Deposit. Table 4.3_1 gives the derivation of this.

To also arrive at a more realistic value for the Indicated Resources that were reported without precious metal grades the average silver grade was estimated based on the relative lead grades, as the silver is most probably included in the mineral galena (PbS). The gold grades has been ignored as it may well be associated with pyrite (FeS2) and therefore of no value.

The table shows that the at-mine value per tonne of Veovaca resources is US$56 assuming that barite concentrates can be sold. It would be only US$38/t without barite as a marketable product. For an open pit operation a value of US$56/t is attractive. Unfortunately no information is available about the prospective strip ratio associated with the resources. As long as the strip ratio is below 4.3 the cash operating profit margin will be 50% or more, assuming mining cost of US$3/t, processing cost of US$15/t and G&A cost of US$5/t treated.

Given the illustrations in Section 3.2.3 it seems highly likely that the strip ratio is moderate. Therefore, assuming barite can be concentrated to a marketable product, the at-mine revenue of the Indicated Resources at current prices would be approx. US$260 million and generate operating cash of US$130 million.

Should it not be possible to sell barite the Veovaca deposit has no to little value.

- Upsides and Risks

5.1 Upsides

In addition to adding to the delineated Rupice and Veovaca deposits there are a number of other upsides, being:

Proving up the high-grade Rupice shoot down plunge after obtaining expansion of the concession, which has been approved by the municipal authority and the Ministry of Mining, subject to a public review process, which is expected completed in November 2018. Figure 5.1_1, extracted from the October 2018 corporate presentation, shows the proposed new concession area.

| Figure 5.5_1

Proposed Extension of the Concession Area Around Rupice

|

The above assumptions have erred on the conservative and ignored any value for the shallower portion of the Rupice deposit which has very high BaSO4 grades and grades for Pb and Zn in percentages and material precious metal credits.

The numerous other targets, shown in Figure 3.1_2, along the same stratigraphic horizon as Rupice and Veovaca and with historical exploration results showing Pb-Zn mineralisation. In particular Bresic-Jurasevic at close proximity to Rupice is of interest with Adriatic having sampled dumps there, assaying high base metal and precious metal values.

Given the substantial BaSO4 content and grades Adriatic may well explore a processing route to concentrate the mineral to a high grade (i.e. +98%) instead to a product for drilling grade barite which must have a density above 4.1 (therefore >78% BaSO4), and selling at prices that are a multiple of the product price assumed in the above estimations.

5.2 Risks

The main risk associated to the value of Adriatic are:

The lack of information on the metallurgical performance of the mineralisation. Whereas polymetallic deposit can be of very high grade such as indicated at Rupice, they are usually also metallurgically complex with relatively low recoveries and deleterious elements that find their way in concentrates resulting in penalties. One of the obvious metallurgical risks is inability to keep mercury, cadmium and lead contents in barite concentrate below maximum thresholds for marketing purposes.

- The high-grade plunge may well be off-set by a major fault just north of the current concession border.

Any application for adjacent areas and other new mineral rights is complex, requires involvement of many stakeholders and is uncertain to be granted. Mineral rights are regulated at all legislative levels, at national government level and the level of 10 Cantons composing Bosnia Herzegovina. The project area falls in the Zenica-Doboj Canton.

* * *

This ends the full analysis of Adriatic Metals by Kees Dekker. If you have an interest in contacting Kees Dekker, this is possible through using the contact form on my website www.criticalinvestor.eu. Stay tuned for more analysis by Kees coming soon.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Adriatic Metals. Kees Dekker is also not a registered investment advisor, and currently has a long position in Adriatic Metals as well. All facts are to be checked by the reader. For more information go to the websites of the mentioned companies and read the available company information and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

MORE or "UNCATEGORIZED"

PPX Mining Announces Closing Of $1.35 Million Private Placement

PPX Mining Corp. is pleased to announce that it has closed its fu... READ MORE

Elevation Gold Reports Financial Results for Year Ended December 31, 2023, including $66.4M in Total Revenue

Elevation Gold Mining Corporation (TSX-V: ELVT) (OTCQB: EVGDF) i... READ MORE

Reunion Gold Announces the Signing of a Mineral Agreement With the Government of Guyana for Its Oko West Project

Reunion Gold Corporation (TSX-V: RGD; OTCQX: RGDFF) is pleased to announ... READ MORE

Drilling Confirms 4 km of Favourable Corridor at Lynx Gold Trend

Puma Exploration Inc. (TSX-V: PUMA) (OTCQB: PUMXF) is thrilled to... READ MORE

Grid Metals Intersects 7 m at 1.28% Li2O at over 125 m Below the Previously Deepest Drill Holes at Donner Lake; Provides Project Update

Grid Metals Corp. (TSX-V:GRDM) (OTCQB:MSMGF) is pleased to announ... READ MORE