Equity Metals

“BUILDING ON 100 YEARS OF GOLD & SILVER EXPLORATION IN THE SKEENA ARCH, BC”

Equity Metals Corporation (TSX-V:EQTY) is focused on creating shareholder value through fast tracking exploration of the company’s flagship 100% Owned Silver Queen Gold-Silver Property, British Columbia, Canada. With data from over a century of exploration on the property, including a historically producing mine, as well as excellent infrastructure close to the property, the property provides an excellent investment opportunity to create near to mid-term shareholder value through aggressive advancement and expansion of the current NI 43-101 Mineral Resource Estimate. The company also holds interests in two highly prospective diamond properties in the Lac de Gras area, one of Canada’s most prolific diamond producing areas.

Silver Queen Commencement Crew, August 2020

Projects

Silver Queen Project

Overview

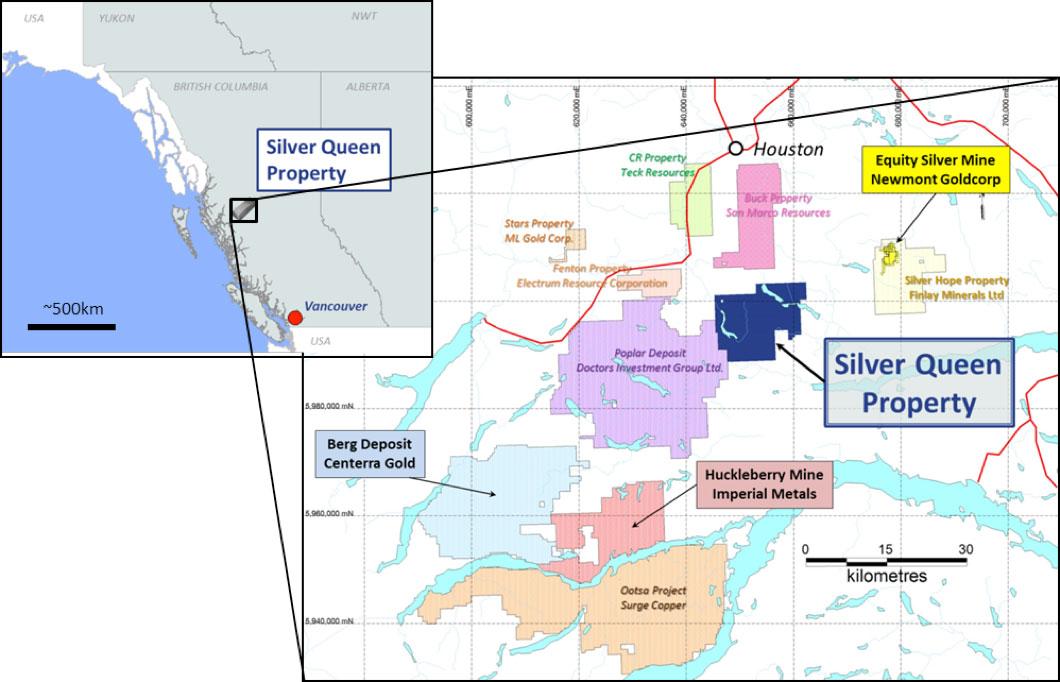

The Silver Queen gold-silver property consists of 17 crown-granted and 45 tenure claims covering 18,851.76 hectares in the Omineca Mining Division, south of Houston, British Columbia. The property is located on the all season maintained road to Huckleberry mine at Owen Lake – 43 km south of Houston BC. Located in the heart of the Skeena Arch and surrounded by current and past producing mines as well as advanced exploration projects for large mining companies, there is excellent potential for discovery and delineation of a productive deposit.

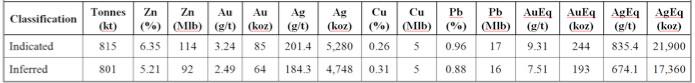

On July 16th, 2019, the company released a maiden NI 43-101 Resource Estimate of 85Kozs Au, 5.2Mozs Ag, 5Mlbs Cu, 17Mlbs Pb and 114Mlbs Zn (244,000oz AuEq) Indicated and 64Kozs Au, 4.7Mozs Ag, 5Mlbs Cu, 16Mlbs Pb and 92Mlbs Zn (193,000oz AuEq) Inferred(1-8). Click here for a summary table of the resource and click here for the full technical report. The company plans to aggressively expand this resource with the goal of producing an update of the NI 43-101 Resource Estimate by the end of 2020.

Figure 1 – Location and Infrastructure of the Silver Queen Property along with Nearby Deposits and Mines

History: 1912 – Present

Mineralization on the property was discovered in 1912. Since then, over 500 drillholes as well as >9km of underground workings have been conducted on the property. Since discovery, more than $20 million has been spent on the property. Table 1 is a brief summary of the historic work. For a more detailed description of historical work, see the technical report filed on SEDAR or on the company’s website.

Table 1 – Summary of Historic Exploration on the Silver Queen Property

| Year | Summary of Work |

| 1912 | Mineralization discovered on the property |

| 1912-1947 | 1,000m of underground workings developed, 38 tons of mineralization shipped |

| 1963-1971 | Property explored by Nadina Explorations limited, intermittently optioned to partners, 2500m of underground workings and >4,500m of drilling conducted |

| 1972-1974 | Property put into production by the Bradina Joint Venture, 200kt milled; ~10,000m of drilling |

| 1977-1985 | Nadina (reorganized as New Nadina in 1980) and various partners conducted trenching, metallurgy and >5,000m of drilling |

| 1985-1990 | Pacific Houston optioned the property and conducted metallurgy, 2500m of underground workings and ~10,600m of drilling |

| 1990-2018 | New Nadina surface exploration, surface and airborne geophysics and ~20,000m of drilling |

| 2019- | Equity Metals Corporation: New Management, New Name, New Direction |

Although the property has been extensively explored in the past, previous exploration programs mostly focussed on either large scale grass-roots discovery drilling or small-scale expansion of resources with closely spaced drilling to “feed the mill.” Current management plans to evaluate the data in a much more systematic manner with a new focus on prioritizing property wide targets and aggressively offsetting the primary targets with the goal of very quickly expanding on the initial NI 43-101 Mineral Resource Estimate.

Regional Geology

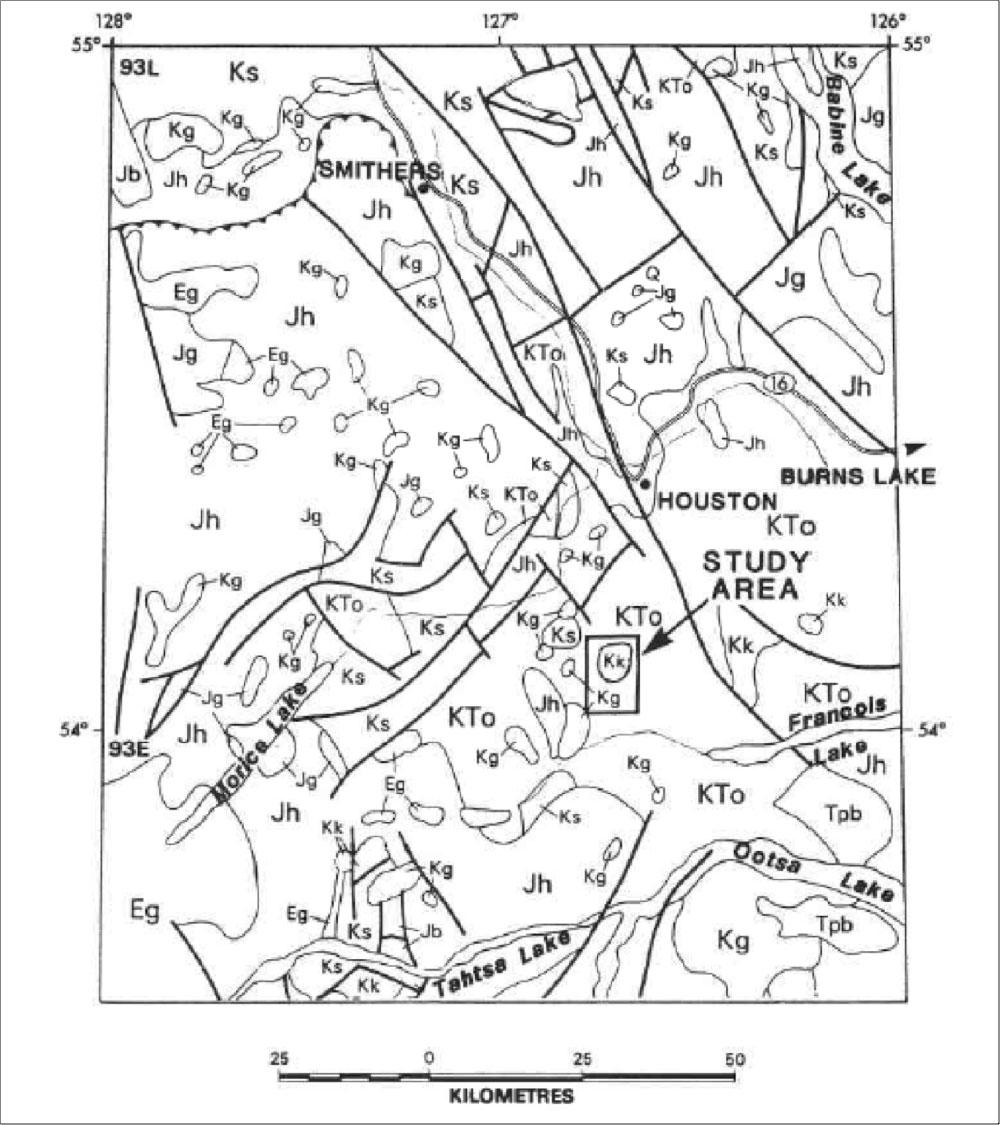

West-central British Columbia lies within the Stikine Terrane, that includes: Late Triassic Takla Group submarine calc-alkaline to alkaline, immature, volcanic-arc rocks; Early to Middle Jurassic Hazelton Group sub-aerial to submarine, calc-alkaline volcanic, volcaniclastic and sedimentary rocks; Late Jurassic and Cretaceous successor basin sedimentary rocks of the Bowser Lake, Skeena and Sustut groups; and Cretaceous to Tertiary calc-alkaline continental volcanic arc rocks of the Kasalka, Ootsa Lake and Endako groups (MacIntyre and Desjardins, 1988), shown in Figure 2. Plutonic rocks of Jurassic, Cretaceous and Tertiary age form distinct intrusive belts (Carter. 1981), with associated porphyry copper, stockwork molybdenum and mesothermal and epithermal base and precious metal veins.

Stratified Cretaceous rocks hosting the polymetallic epithermal veins on the Silver Queen Property and the Equity Silver Deposit are considered to be correlative with the Cretaceous Kasalka Group rocks (Church 1971).

The Kasalka Group is a late-Early Cretaceous (Armstrong, 1988) or early-Late Cretaceous (MacIntyre, 1985) continental volcanic succession that is predominantly porphyritic andesite and associated volcaniclastic rocks. It is well exposed in the Kasalka Range type section near Tahtsa Lake. In the type area, it includes a basal polymictic conglomerate with lenses of sandstone that lies in angular unconformity on older rocks. The conglomerate is overlain by a felsic fragmental unit over 100 m thick, consisting of variably welded siliceous pyroclastic rocks (lithic lapilli tuff, crystal and ash-flow tuff, minor breccia) with interbedded porphyritic flows. The fragmental rocks are in turn overlain by columnar jointed, massive, greenish grey flows or sills of hornblende-feldspar-porphyritic andesite to dacite that are at least 100 m thick. The andesite flows are conformably overlain by a 200 m thick assemblage of volcanic debris flows (lahars). Rhyolite flows and tuffs and columnar jointed basalt flows, together more than 100 m thick, cap the succession.

The Silver Queen Property is located on the western perimeter of the Buck Creek basin that is delineated by a number of rhyolite outliers and semicircular alignment of Upper Cretaceous and Eocene volcanic centres scattered between Francois Lake, Houston and Burns Lake. The Buck Creek basin is interpreted as a resurgent caldera (Leitch et al. 1992). The past-producing Equity Silver Mine is located within a window eroded into the central uplifted area (Church, 1985). A prominent lineament 30 km long trends east-northeast from the Silver Queen Property towards the central uplift hosting the past-producing Equity Silver Mine and appears to be a radial fracture coinciding with the eruptive axis of the Tip Top Hill (Kasalka Group) volcanics and a line of syeno-monzonite stocks and feeder dykes to an assemblage of “moat” volcanics (Church, 1985; Leitch et al. 1992). Block faulting is common in the basin, locally juxtaposing the various ages of volcanic rocks found within it.

Within the basin, a Mesozoic volcanic assemblage is overlain by a Tertiary volcanic succession. The oldest rocks exposed within the basin are at the Equity Silver and Silver Queen properties. The sequence at the Equity mine has been characterized by Church (1984) as the Lower Jurassic Telkwa Formation of the Hazelton Group, however, Wetherell et al. (1979) and Cyr et al. (1984) correlate the sequence hosting the Equity orebodies with the Upper Cretaceous Kasalka Group.

Upper Cretaceous rocks with similarities to the Kasalka Group are exposed westwards from the Equity Silver Mine to the Owen Lake area, where they host the Silver Queen Deposit (Church, 1984). These rocks have been dated at 75-80 Ma by K-Ar whole rock (Church, 1973).

The Upper Cretaceous rocks are overlain by the Eocene Ootsa Lake Group which includes the Goosly Lake and Buck Creek Formations of Church (1984). The Goosly Lake andesitic to trachyandesitic volcanic rocks are dated at 48.8 ± 1.8 Ma by K-Ar whole rock, and this is supported by dates of 49.6 ± 3.0 to 50.2 ± 1.5 Ma for related syenomonzonite to gabbro stocks with distinctive bladed plagioclase crystals (Church, 1973) at Goosly and Parrot lakes. The Buck Creek andesitic to dacitic volcanic rocks, which directly overlie the Goosly Lake Formation, are dated at 48.1 ± 1.6 Ma by K-Ar whole rock. Basalts of the upper part of the Buck Creek Formation (Swans Lake member: Church, 1984) may correlate with the Endako Group of Eocene-Oligocene age. These rocks give whole rock K-Ar ages of 41.7 ± 1.5 to 31.3 ± 1.2 Ma on samples from the Whitesail Lake map area (Diakow and Koyanagi, 1988). The youngest rocks in the Buck Creek basin are Miocene columnar olivine basalt, called the Poplar Buttes Formation by Church (1984) and dated at 21.4 ± 1.1 Ma by K-Ar whole rock (Church, 1973).

Figure 2 – Regional Geology of the Silver Queen Property Area (Source: Leitch et al. 1992)

Legend

| Tpb, Tertiary plateau basalt; | Eg, Eocene granite; |

| KTo, Ootsa Lake Group; | Kg, Cretaceous granite; |

| Kk, Kasalka Group; | Ks, Skeena Group; |

| Jg, Jurassic granite; | Jh, Hazelton Group. |

| Source: Leitch et al. (1992). | |

Property Geology

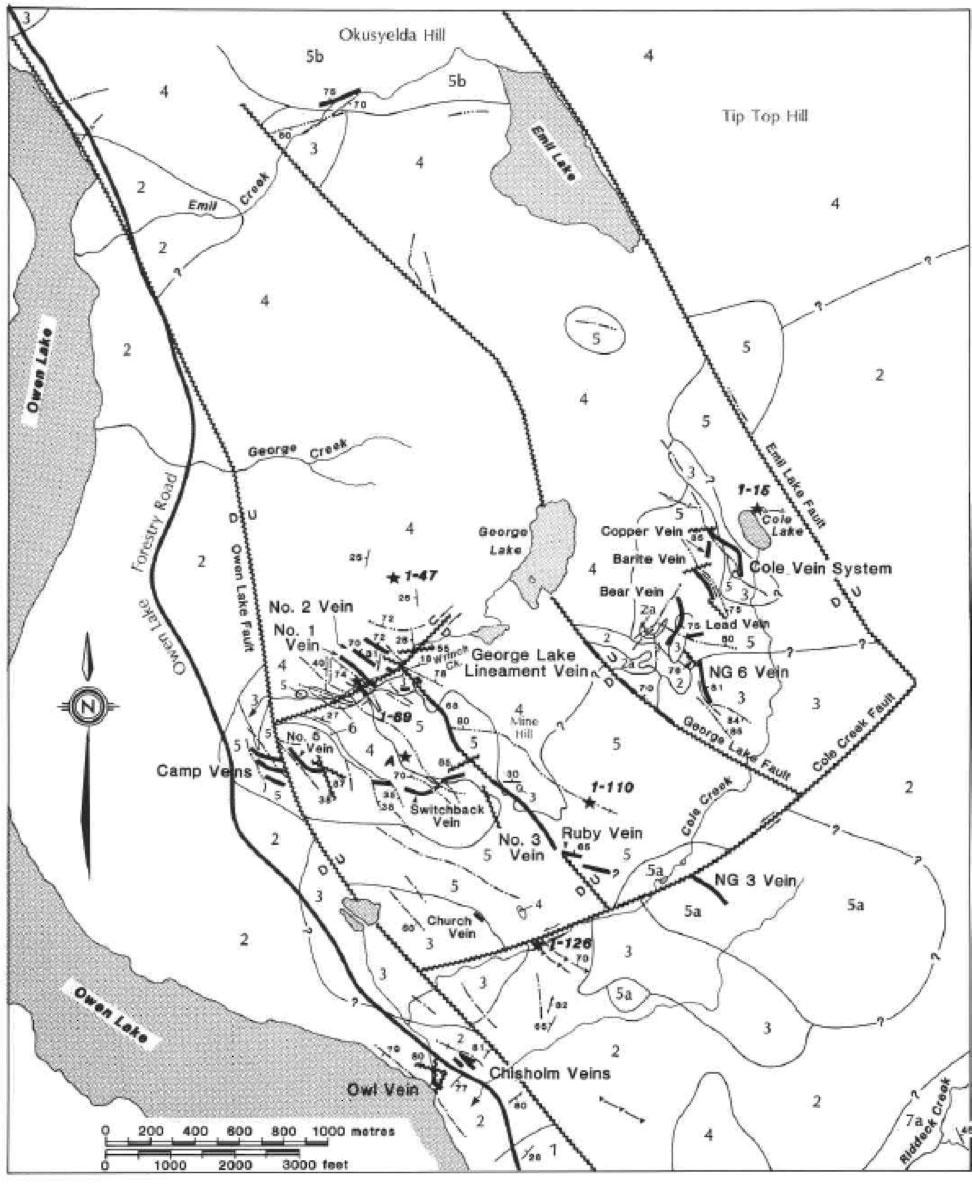

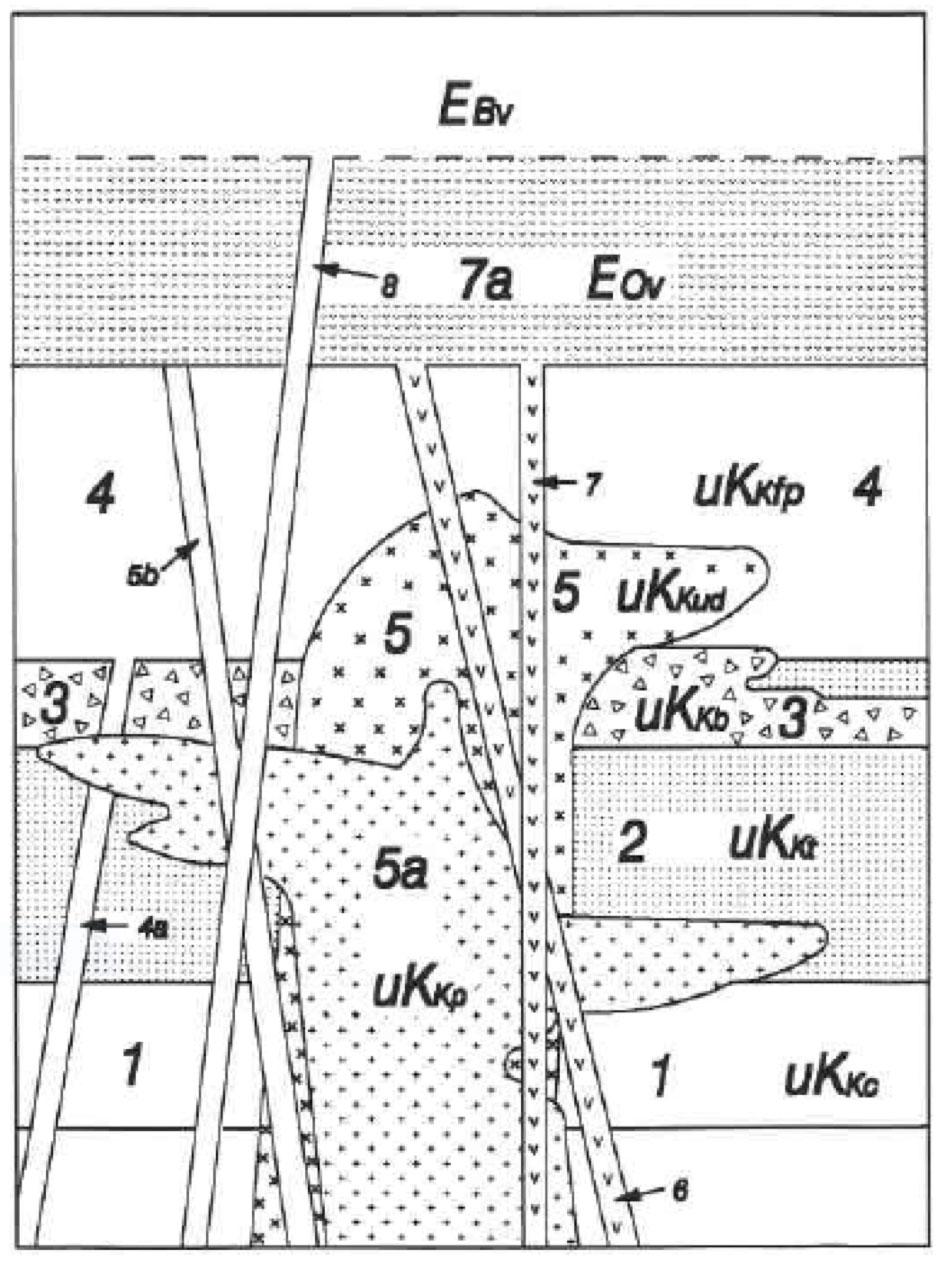

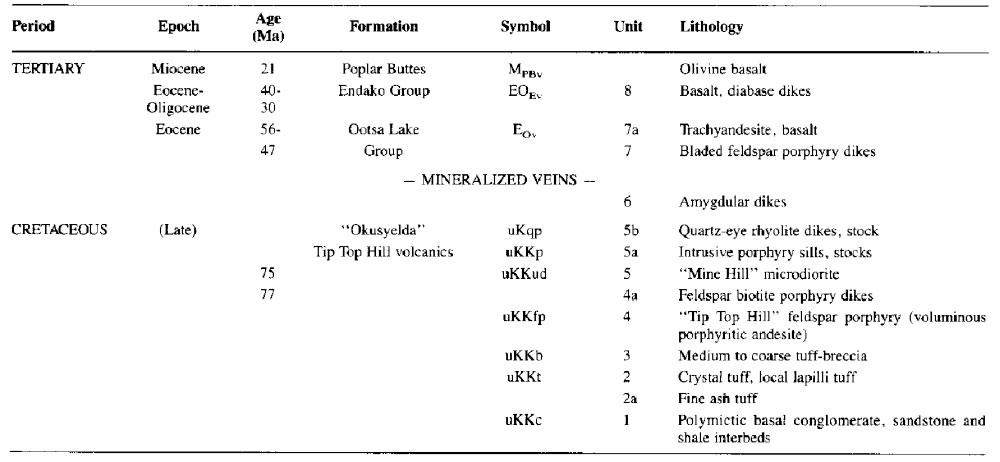

The stratigraphy of the area surrounding the Silver Queen Mine shows a stratigraphic succession that is similar to that observed in the Kasalka Range (Leitch et al. 1992). Leitch et al. (1992) subdivides the rocks on the Silver Queen Property into five major stratified units plus three types of dykes (Figure 5). The following descriptions taken are from Leitch et al. (1992).

Note: Numbers correspond to units described in text.

Source: Leitch et al. (1992)

A basal reddish purple polymictic conglomerate (Unit 1), is overlain by fragmental rocks ranging from thick crystal tuff (Unit 2) to coarse lapilli tuff and breccia (Unit 3), and this is succeeded upwards by a thick feldspar-porphyritic andesite flow unit (Unit 4), intruded by micro-diorite sills and other small intrusions (Unit 5). Coarsely porphyritic feldspar porphyry (Unit 5A) outcrops to the south which appears to be the subvolcanic source of the rocks of Unit 4 and of Unit 5. The stratified rocks form a gently northwest-dipping succession, with the oldest rocks exposed near Riddeck Creek to the south and the youngest exposed in Emil Creek to the north.

All of the stratified units are cut by dykes that can be divided into three groups: amygdaloidal dykes (Unit 6), bladed feldspar porphyry dykes (Unit 7), and diabase dykes (Unit 8). The relationships between units 1 through 8 are shown in Figure 4. Epithermal vein mineralization at Silver Queen occurs between unit 6 and unit 7. The age of the porphyry mineralization is as yet undetermined, although it occurs predominantly within unit 5a.

Figure 4 – Schematic relationships between geological units on the Silver Queen Property

Note: Unit numbers correspond with units described in text.

Source: Leitch et al. (1992)

Figure 5 – Legend for Figures 2 and 3

Deposit Types

Two different deposit types have been identified on the property. The “Itsit Porphyry” contains Chalcopyrite and Molybdenite in a quartz-stockwork zone with up to 4 phases of veining, within feldspar porphyry, tentatively correlated with Unit 5a.

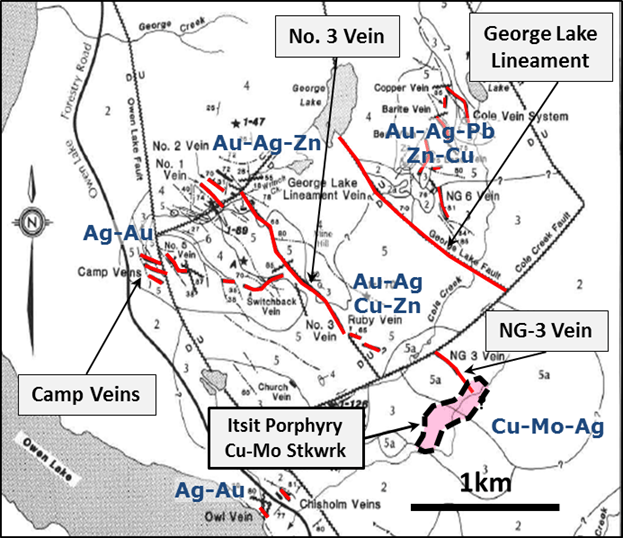

High-grade epithermal Au-Ag veins with varying abundances of base metals (Cu-Pb-Zn) cut the Late Cretaceous volcanic sequence. Over 20 individual veins have been identified on the property to date which display a regional-scale zoning ranging from Au-Ag-enriched in the western part of the property to more base metal-enriched in the eastern part of the property. These veins have been dated at approximately 51.5Ma old.

Primary Target High-grade Au-Ag-Zn Epithermal Vein system

The Epithermal Vein system on the Silver Queen Property was the first mineralization discovered and has been the target of the majority of exploration since. Of the more than 20 veins discovered on the property, three targets have been identified that have the potential to achieve the near term conceptual exploration target of resource expansion to +1Moz AuEq(i).Figure 6 is a map showing the location of the main targets for the 2019-20 exploration program.

Figure 6 – Location of some of the main targets on the Silver Queen Property

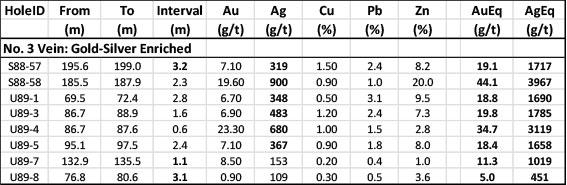

No. 3 Vein

Much of the historic exploration on the property targeted the No. 3 Vein system, which contains much of the recently announced NI 43-101 Mineral Resource Estimate on the property of:

Indicated: 85Kozs Au, 5.2Mozs Ag, 5Mlbs Cu, 17Mlbs Pb and 114Mlbs Zn (244,000oz AuEq); and

Inferred: 64Kozs Au, 4.7Mozs Ag, 5Mlbs Cu, 16Mlbs Pb and 92Mlbs Zn (193,000oz AuEq) (1-8).

Over 9km of underground workings have been developed and 200,000 tonnes of material have been mined resulting in historic production of 3,000oz Au, 400,000oz Ag, 0.9Mlbs Cu, 1.5Mlbs Pb and 11Mbls Zn.

Advanced metallurgical test work carried out by Cominco Engineering Services Ltd. in 1988 produced zinc, copper-lead and Au-Ag-pyrite concentrates with total recoveries from pilot plant testing of up to 83% Au, 95% Ag, 93% Cu, 91% Pb and 98% Zn.

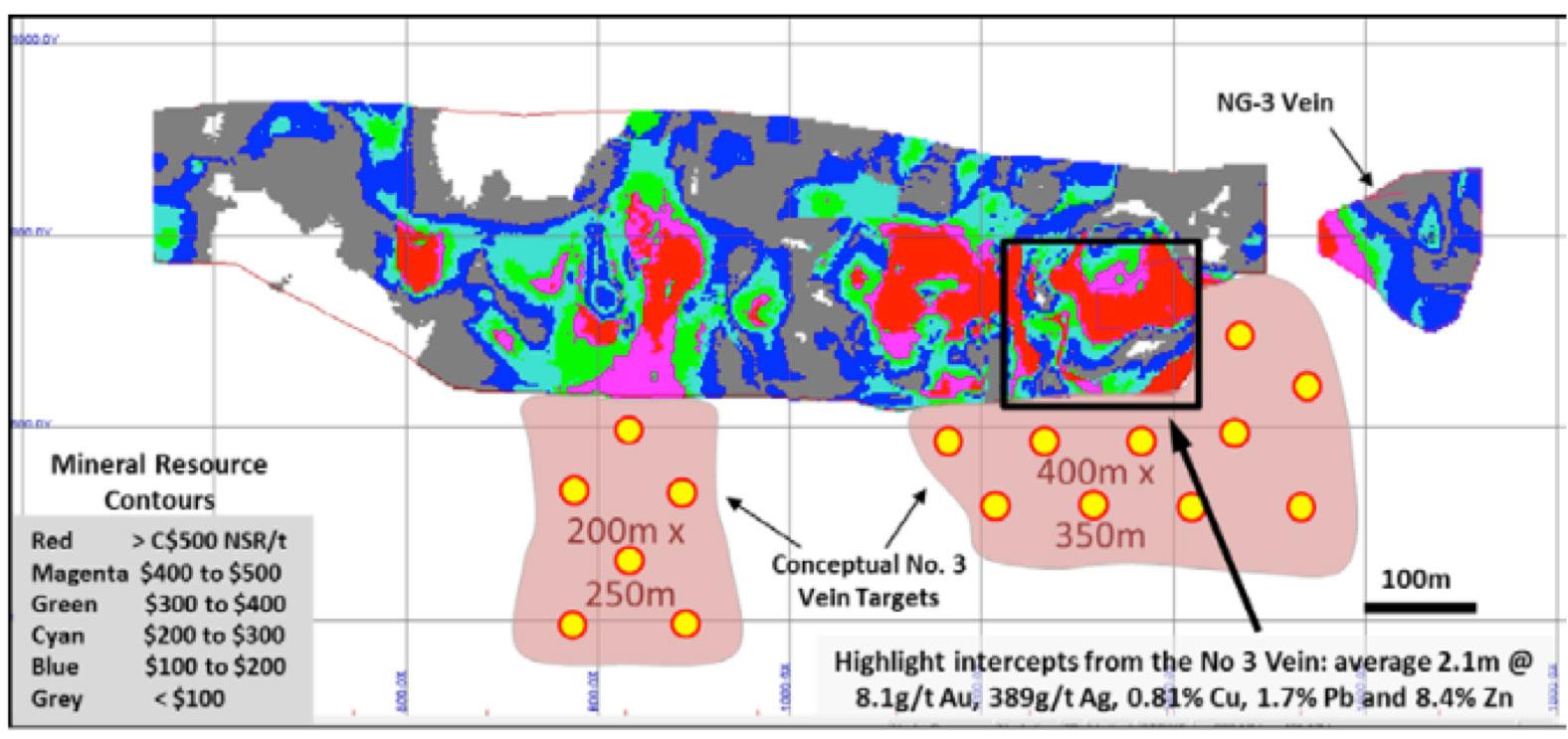

High-grade mineralization has been outlined over a strike length of 1km and a depth of approximately 300m. 2019/20 drilling will offset the resource solids at approximate 80-100m intervals within two areas immediately down dip of the higher grade “ore-shoots” within the block model including an area on the southeastern extent of the No. 3 Vein which previously returned eight holes averaging 2.1 metres of 8.1g/t Au, 389g/t Ag, 0.81% Cu, 1.7% Pb, 8.4% Zn on the southeastern of the No. 3 Vein which remains open both down-dip and along strike (Table 2).

Equity Metals’ initial objective is to increase the mineral resource from the current 1.6Mt to a conceptual target of 2.5-3.5Mt with a target grade of 10g/t AuEq for a total of +1Moz Au(i) See figure 7 for a long section outlining the No. 3 Vein target.

Table 2: Select Assays from the No. 3 Vein

Figure 7 – Long section showing the grade distribution within the resource estimate at the No. 3 Vein with 2019-20 target areas outlined

Camp Vein

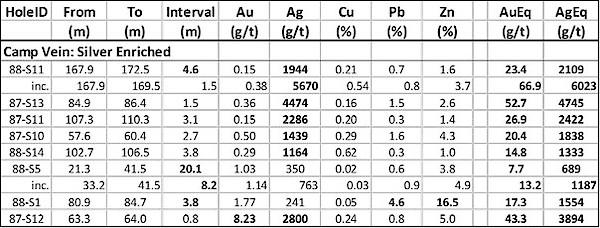

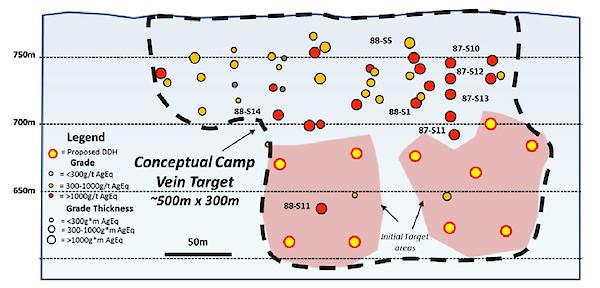

The camp vein is an area of highly silver enriched veins that were discovered in 1987 in the vicinity of the mine camp. Over 50 drillholes have tested the Camp vein, but, despite this, it has not been subject to a NI 43-101 mineral resource estimate however, an historic “inferred reserve” of 205kt grading 1.0g/t Au, 829.5g/t Ag and 4% Zinc is reported in BC Minfile (#093L 002). This resource is historic in nature and provided for information purposes only. It is based on drill data from the 1980s and is considered reliable, but should not be used as a mineral resource estimate. Management intends to conduct data verification and additional drilling in the future to produce a NI 43-101 resource estimate for this area.

Historic drilling targeted a strike length of ~300m, but only drilled to a depth of 150m. Initial drilling in the area of the Camp Vein will target underneath the high-grade silver at 50m to 75m depth with the goal of delineating a 500m x 300m area of high-grade silver mineralization.

The conceptual exploration target for this area is +500,000 tonnes at a grade of +1000g/t AgEq(ii), which is based on review of the historic drilling in the area (Table 3). It is conceptual in nature and there is no guarantee that further exploration will result in delineation of a mineral resource estimate. See figure 8 for a long section of the Camp Vein targeting.

Table 3: Select Assays from the Camp Vein

Figure 8 – Long section showing the drill targeting in the Camp Vein area

NG-3 Vein

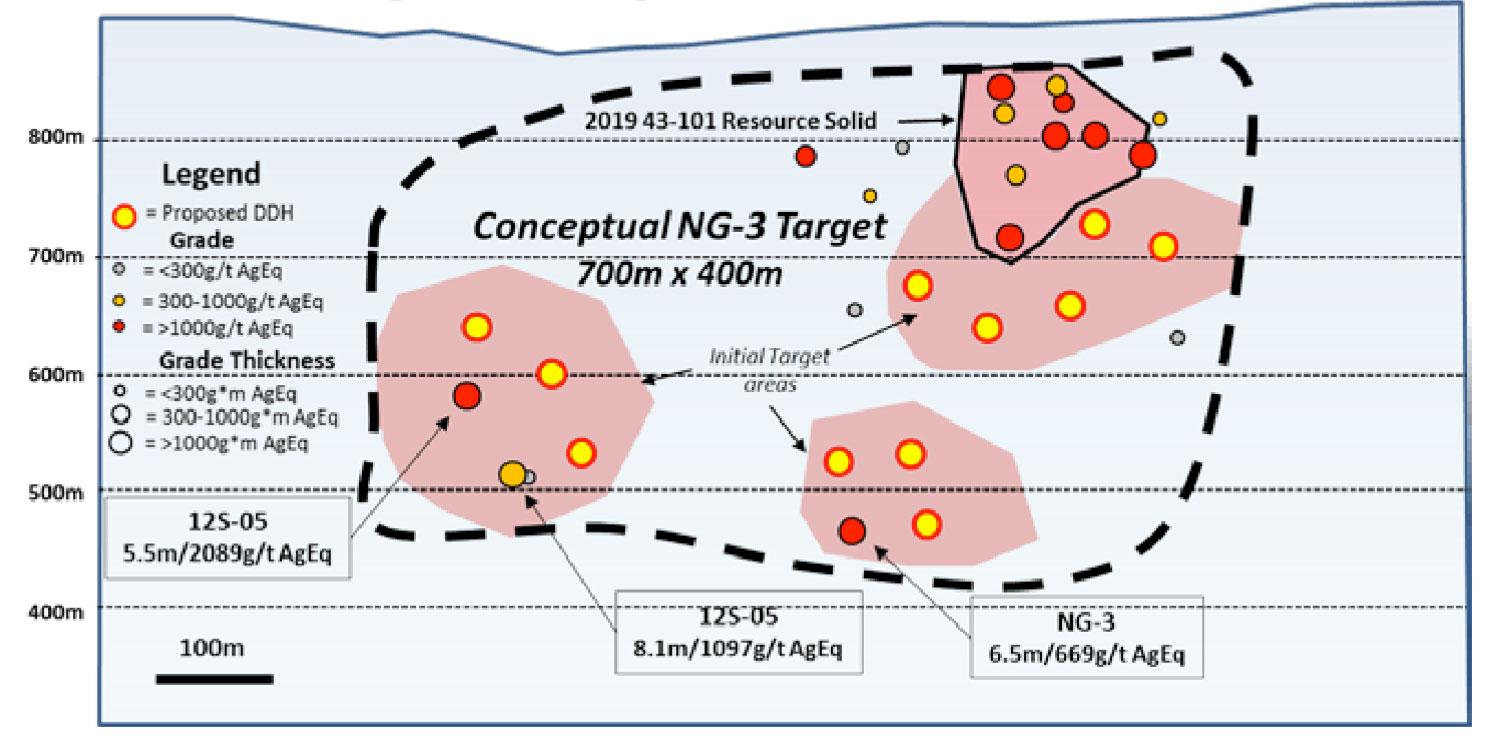

The NG-3 Vein forms the faulted southeast extension of the No. 3 Vein and is comprised of three segments which are variably defined by historical drilling. A small portion of this target area (approximately 150m x 150m) has been incorporated into the current NI43-101 Mineral Resource Estimate which was defined largely by drilling conducted in 2010.

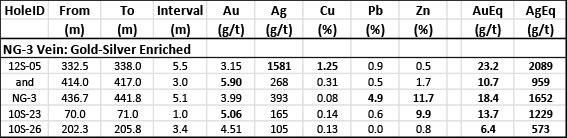

The vein is named after the intercept in drillhole NG-3 which tested a faulted panel of the vein approximately 300 metres from area of the estimated resource and contained a 5.1m intercept averaging 3.99g/t Au, 393g/t Ag, 4.9% Pb and 11.7% Zn

Drill hole 12S-05 tested a further 300m along strike and returned two higher grade intercepts including 5.5m averaging 3.15g/t Au, 1,581g/t Ag, 1.25% Cu, 0.9% Pb and 0.5% Zn. This high-grade intercept occurs within an area where the vein intersects a Cu-Mo quartz-stockwork hosted by feldspar porphyry within the Itsit porphyry target, discovered by drilling in 2011, and highlights the potential for thicker zones of higher grade mineralization with this target area. See the section on the Itsit porphyry for details.

Table 4: Select Assays from the NG-3 Vein

The NG-3 vein encompasses a 700m x 400m target area. Successful drilling would result in a significant addition to the current Mineral Resource Estimate. A conceptual resource target for this area is 1-3Mt @ 10g/t AuEq(ii). See figure 9 for a long section outlining the targeting in this area.

Figure 9 – Long section showing drill targeting for the NG-3 Vein area

Secondary Target – Itsit Porphyry Cu-Mo-Ag-Au Deposit

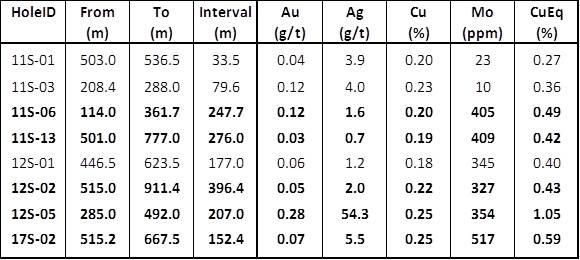

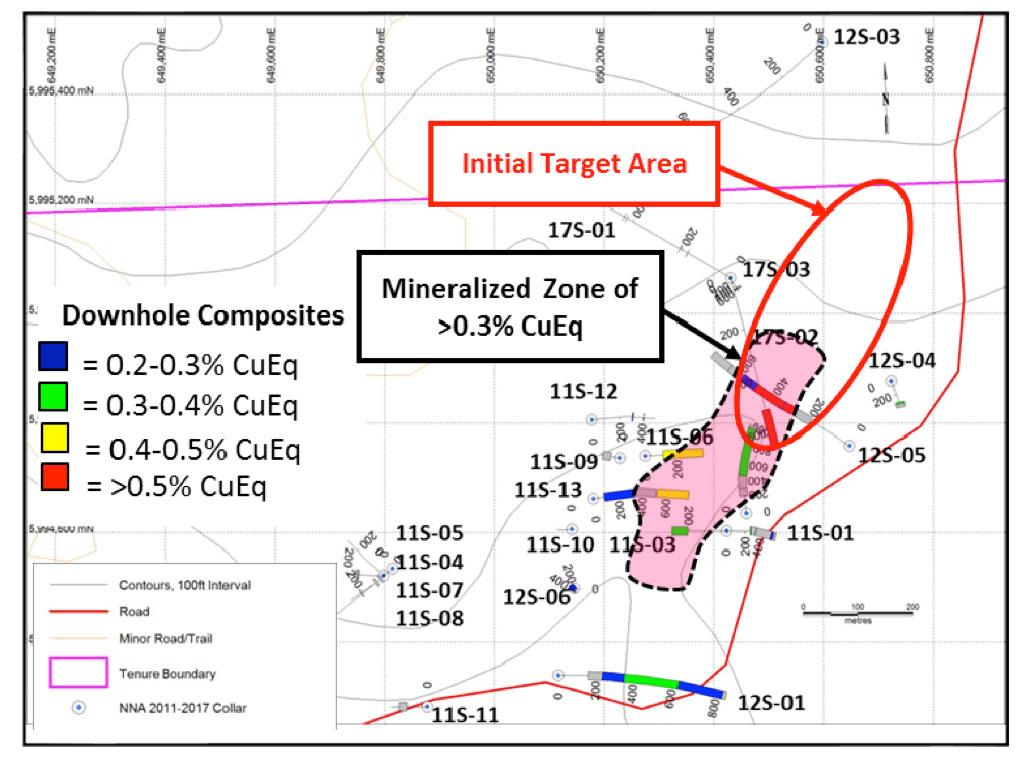

The Itsit Porphyry deposit was discovered in drilling following the identification a large chargeability anomaly in a Titan 24 DCIP geophysical survey in 2011-12. The current deposit is defined as a Cu-Mo quartz stockwork zone located several hundred metres to the southeast of the No. 3 Vein and is intersected in seven drill holes over a 300 metre strike-length. The stockwork zone occurs along the northwestern margin of a large 1000m x 500m x 300m chargeability anomaly which has been only partially tested with roughly 600 metres of strike-length, along this specific, trend remaining to be tested. Similar Cu-Mo quartz stockwork mineralization was also intersected in drill hole 12S-01 approximately 300 metres to the south of the main stockwork area and within the main part of the chargeability anomaly suggesting a much more widespread mineral potential in the Cu-Mo porphyry target.

Four generations of veining have been identified in the quartz stockwork which is strongly Cu and Mo enriched with generally >1g/t Ag values. Mineralization was tested to over 800 metres depth and most holes ended in strongly elevated to anomalous Cu-Mo-Ag mineralization. Higher Au-Ag mineralization was identified in drill hole 12S-05 which returned a 126m interval averaging 0.43g/t Au, 87.8g/t Ag, 0.29% Cu and 0.05% Mo and included two higher-grade vein intercepts of 5.5m averaging 3.15g/t Au, 1,581g/t Ag and 1.25% Cu and 3m averaging 5.9g/t Au, 268g/t Ag and 0.31% Cu.

Two target concepts have been identified within the porphyry system including the immediate lateral extensions of the main porphyry Cu-Mo stockwork zone and a sub-target developed around the intersection of the Cu-Mo stockwork with the Au-Ag epithermal vein system:

Porphyry Target: 400 – 500Mt @ 0.3% Cu, 0.04%Mo with Au and Ag credits (iii)

Sub-target: 25-50Mt @ 0.4g/t Au, 80g/t Ag, 0.3% Cu and % 0.05% Mo

Much more drilling is required on the Itsit Cu-Mo Prophyry Target which remains at this time a secondary target objective of the Company.

Table 5: Select Mineral intercepts from the Itsit Porphyry target

Figure 10 – Plan map of the “Itsit Porphyry” area with CuEq grades and drillholes labelled

- The exploration target consists of 3.0-5.0Mt grading 2-4g/t Au, 150-200g/t Ag, 0.2-0.4% Cu, 0.8-1.0% Pb and 5-7% Zn, is based on data from >500 drillholes drilled on the property, is conceptual in nature and relies on projections of mineralization that are beyond the standard CIM classification of mineral resources and should not be relied on as a mineral resource estimate. It is uncertain whether additional exploration will result in the target being delineated as a mineral resource.

- This exploration target is contained within the property wide exploration target, which consists of 3-5Mt grading 2-4g/t Au, 150-200g/t Ag, 0.2-0.4% Cu, 0.8-1.0% Pb and 5-7% Zn, is based on data from >500 drillholes drilled on the property, is conceptual in nature and relies on projections of mineralization that are beyond the standard CIM classification of mineral resources and should not be relied on as a Mineral Resource Estimate. It is uncertain whether additional exploration will result in the target being delineated as a mineral resource.

- The exploration target consists of 400-500Mt grading 0.2-0.3% Cu, 0.03-0.05% Mo, 1-3g/t Ag and 0.05-0.15g/t Au, is conceptual in nature and relies on projections of mineralization that are beyond the standard CIM classification of mineral resources and should not be relied on as a mineral resource estimate. The target is based on wide intercepts (>100m) of Cu-Mo-Ag-Au mineralization intersected in 2011-2017 drilling. It is uncertain whether additional exploration will result in the target being delineated as a mineral resource.

Environmental and Permitting

The Silver Queen Property is within the Wet’suwet’en territory and the First Nation is included in the Notice of Work and permitting consultation process. Equity Metals will actively encourage First Nation involvement and will use qualified First Nations’ employees and contractors in all activities when available.

The Silver Queen site is considered a “brownfield” site as a result of previous mining and mineral processing activity during 1972-1973 and extensive exploration over many decades. The British Columbia environmental assessment and permitting processes are well defined and are expected to proceed smoothly. A Best Practices Mine Closure Plan will be outlined and implemented that will result in minimal site long-term liabilities.

2019 Resource Estimate

The following section is taken from the July 2019 Technical Report:

The Mineral Resource Estimate at an NSR C$100/t cut-off (C$70/t mining, C$20/t processing and C$10/t G&A,) as of the effective date of July 15th, 2019, is tabulated in Table 6.

Table 6 – Silver Queen Mineral Resource Estimate at a CDN$100/t NSR cutoff as of July 15th, 2019

Notes:

- The Mineral Resource Estimate was prepared by Eugene Puritch, P.Eng., FEC, CET and Yungang Wu, P.Geo., of P&E Mining Consultants Inc. (“P&E”) of Brampton, Ontario, Independent Qualified Persons (“QP”), as defined by National Instrument 43-101.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

- The Mineral Resource Estimate was based on metal prices of US$1,300/oz gold, US$17/oz silver, US$1.35/lb zinc, US$3.00/lb copper and US$1.05/lb lead.

- The historical mined areas were depleted from the Mineral Resource.

- AuEq and AgEq are based on the formula: NSR (CDN) = (Cu% * $57.58) + (Pb% * $19.16) + (Zn% * $30.88) +(Au g/t * $39.40) + (Ag g/t * $0.44) – $78.76. See details in Sections 14.10 and 14.12 of the technical report.

The Mineral Resource Estimate presented in the current Technical Report has been prepared following the guidelines of the Canadian Securities Administrators’ National Instrument 43-101 and Form 43-101F1 and in conformity with generally accepted “CIM Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines. Mineral Resources have been classified in accordance with the “CIM Standards on Mineral Resources and Reserves: Definition and Guidelines” as adopted by CIM Council on May 10, 2014. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no guarantee that all or any part of the Mineral Resource will be converted into a Mineral Reserve. Confidence in the estimate of Inferred Mineral Resources is insufficient to allow the meaningful application of technical and economic parameters or to enable an evaluation of economic viability worthy of public disclosure.

All drilling and assay data for Au, Ag, Zn, Cu and Pb were provided in the form of Excel data files by New Nadina (Equity Metals.) The Geovia Gems V6.8 database for this Mineral Resource Estimate, compiled by P&E, consisted of 535 drill holes totalling 66,045 m, of which a total of 194 drill holes intersected the mineralization wireframes used for the Mineral Resource Estimate. In the database, 75 drill holes totalling 7,688 m did not have any assays and were not utilized for the Mineral Resource Estimate. The assay records for these 75 drill holes were not located. Industry standard validation checks were carried out on the supplied databases, and minor corrections made where necessary. P&E considers that the drill hole database supplied is suitable for Mineral Resource estimation. The supplied drill hole database contains 21 bulk density measurements with values ranging from 3.56 to 4.34 t/m3 and an average bulk density within the defined mineralized domains of 3.56 t/m3.

Four mineralization wireframes representing Vein No. 3, Vein No. 3HW (hanging wall), Vein No. 3FW (footwall) and Vein No. 3EX (extension) were constructed for the Mineral Resource Estimate. The wireframes were created from successive cross-sectional polylines on northwest-facing vertical sections with a 25 m spacing. The main mineralization domain, Vein No. 3, is modeled proximately 1,150 m long, 300 m deep, average true width 2.1 m, with a general strike azimuth of 130°, dipping 55°–60° to the northeast. The resulting Mineral Resource domains were utilized as constraining boundaries for Mineral Resource estimation. A topographic surface was provided by New Nadina (Equity Metals.) P&E created an overburden surface using drill hole logs, and digitized shapes of mined out voids and non-mineralized dykes based on a vertical longitudinal projection drawing provided by New Nadina (Equity Metals.)

Approximately 63% of the constrained sample lengths were less than 1 m in length, and a 1.0 m compositing length was used in order to regularize the assay sampling intervals for grade interpolation. Grade capping was investigated on the 1.0 m composite values in the database within the constraining domains to ensure that the possible influence of erratic high values did not bias the database. In the main part of Vein 3, Au and Ag were capped at 15 g/t and 900 g/t respectively. Vein 3 FW and Vein 3 EX were not capped.

An NSR C$100/t cut-off value was applied to the mineralization wireframes. The NSR was calculated with the formula:

NSR (CDN) = (Cu% * $57.58) + (Pb% * $19.16) + (Zn% * $30.88) +(Au g/t * $39.40) + (Ag g/t * $0.44) – $78.76

This cut off reflects underground mining costs of potentially economic portions of the mineralization. In some cases, mineralization below the NSR cut-off value was included for the purpose of maintaining zonal continuity. The NSR model uses approximate 2-year trailing average commodity prices, estimated process recoveries, plus estimated smelter and refining charges. Au, Ag, Cu, Pb, and Zn prices used were US$1,300/oz, US$17/oz, US$3.00/lb, US$1.05/lb and US$1.35/lb respectively.

The Silver Queen block model was constructed using Geovia Gems V6.8 modelling software. The block model consists of separate model attributes for estimated grade of Au, Ag, Cu, Zn and Pb, rock type, volume percent, bulk density, NSR value and classification. A rotated block model was established to cover the extent of the mineralized domains and reflect the generally tabular nature of the mineralization. The block size was 1 x 3 x 3 m. A volume percent block model was set up to accurately represent the volume and subsequent tonnage that was occupied by each block inside the constraining domains. The Au and Ag grade blocks were interpolated with Inverse Distance Cubed (“ID3”), while Zn, Cu and Pb were interpolated with Inverse Distance Squared (“ID2”).

In P&E’s opinion, the drilling, assaying and exploration work on the Silver Queen Project supports this Mineral Resource Estimate and are sufficient to indicate a reasonable potential for economic extraction and thus qualify it as a Mineral Resource under the CIM definition standards. The Mineral Resource was classified as Indicated and Inferred based on the geological interpretation, semi-variogram performance and drill hole spacing. The Indicated Mineral Resource was classified within the blocks of Vein No. 3 interpolation Pass 1 and II which used at least three composites from a minimum of two holes. Inferred Mineral Resources were categorized for all remaining grade populated blocks within all mineralized domains.

The resulting Mineral Resource Estimate at an NSR C$100/t cut-off (C$70/t mining, C$20/t processing and C$10/t G&A) as of July 15th, 2019, is tabulated in Table 6.

The current surface disturbance resulting from historical mining activity can be considered limited. The principal current liabilities include: surface hazards from unsecured portals, raises and open trenches; metal leaching from tailings and development rock; and mine drainage. The Silver Queen Project can be developed as a relatively small-scale underground mining project (<1,000 tpd), and will be designed and operated to have no discernable off-site impacts during development, operations and closure. No hazardous chemicals will be used to process (on surface) the mineralised feed material. While the mineralized material and waste rock may be mildly acid generating and metal leaching, measures will be taken to minimise occurrence and effects.

P&E considers that the Silver Queen Property hosts significant high-grade mineralization that may potentially be amenable to underground economic extraction and warrants further exploration. P&E recommends that the next exploration phase focus on the No. 3 Vein. The program should also include metallurgical, environmental and permitting work and is budgeted at $1,960,000.

2019/20 Exploration Plans

Based on the targeting described in the previous section, the following budget is proposed for exploration in 2019-20:

- Phase I (Q4 – 2019): $75,000

- Complete data compilation and interpretation.

- Phase II (Q1/Q2 – 2020): $1.5 – $2.0 million

- Drill program: To include testing three initial targets in the vein system and surface exploration on future target areas.

- Phase III (Q2-Q4 – 2020): $1.5 – $2.0 million

- Drill program: Follow-up drilling to infill or extend specific targets in order to finalize a NI43-101 Mineral Resource Update on the project

Click here for the Equity Metals Corporation Silver Queen Property COVID-19 Protocol

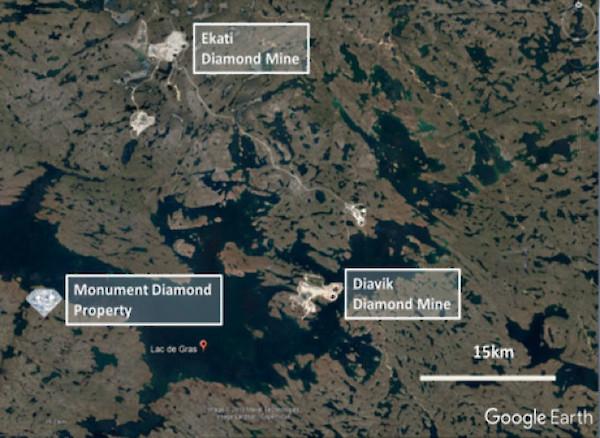

Monument Diamond Project

Lac de Gras, NWT

The Monument Property is strategically located on the south shore of Lac De Gras, NWT. Kimberlites of the Monument Property form part of the Lac de Gras cluster and occur within 40 km of both the Ekati Diamond Mine and Diavik Diamond Mines Ltd., which together produce a noteworthy percentage of the world’s diamond production.

The property operates under a joint venture with Equity Metals Corporation acting as operator. The Monument project JV owners are: 57.49% Equity Metals Corporation, 22.11% Chris and Jeanne Jennings and 20.4% Archon Minerals Ltd. (Stu Blusson). 1% NSR is payable to each DHK Diamonds Inc. and International Royalty Corp

Figure 1 – Location of the Monument Diamond Property

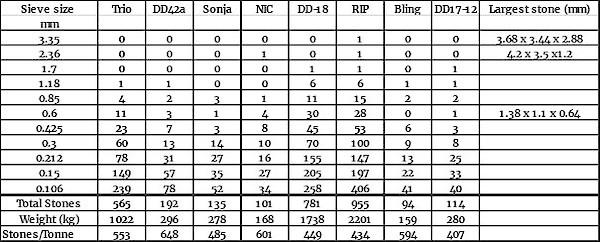

The Monument property has twelve known kimberlites. Drilling on land based targets during recent programs found several new kimberlites including Genie, Bling and most recently the Trio, Gemini and Sparky kimberlites. Drill sampling in 2007 of RIP extracted larger samples where 2,201.7 kg of kimberlite produced 955 diamonds including the largest diamond found to date from the Monument property weighing 0.445 carats. On the DD17 kimberlite, 2,137.6 kg of kimberlite produced 964 diamonds.

In Q4 2019, Equity Metal updated its 5 year Land Use Permit on the property which will allow continued exploration of the project.

Figure 2 – Location of discovered kimberlite clusters on the Monument Property

HISTORY RECAP

The Monument Property is located in the Lac de Gras district, 300 km north of Yellowknife and is accessible by float and ski plane and winter ice road. It was staked in 1992 by DHK Diamonds Inc. and worked from 1992 to 2003 by Kennecott Canada Exploration Inc. New Nadina (now Equity Metals Corporation) acquired the property in 2004 at which time there were five known diamond bearing kimberlites on the property (DD17, DD39, DD42, DD2002, DD17-11). In 2004, the Company and partners took the three claims, DHK 16, 17, and 18 to lease, acquired a Land Use Type A Permit and commenced active exploration in 2005.

The Monument Joint Venture has since discovered eight diamond bearing kimberlites: Sonja, Nic, Rip, Bling, Genie, Trio, Sparky, and Gemini. There are currently four reference zones or strings, the northern, central, southern and eastern, of kimberlite clusters. Along with diamond drilling, various types of geophysics have been conducted as well as closer spaced till sampling searching for kimberlite indicator minerals. An all season camp is positioned on the south shore of Lac de Gras.

Northern Zone: The Trio and DD42 string are in the north on the south shore of Lac de Gras. The DD42a is the most westerly and most recent under water target tested of the DD42 string of geophysical targets. A further winter program is necessary to test the remaining targets and acquire kimberlite for diamond content and analyses.

Central Zone: The largest kimberlite within the string is DD17 and is just over a hectare in size. It is located in the middle of the central zone in close proximity to two pipes to the west and three to the east. There are component similarities of the kimberlites in this string with diamond recovery ranging between 434 to 594 stones per tonne. The central zone is the most tested to date and consists of Sonja, Nic, DD17, RIP, Bling and DD17-11.

South Zone: The south zone contains kimberlites DD39, Sparky and Gemini. Within this zone remain at least two untested targets. The core samples from these pipes have produced samples of 473, 458 and 422 stones per tonne.

East Zone: There is also a cluster of small targets in the zone near the east boundary where the Genie kimberlite is located.

Table 1 – Monument property: Microdiamond recovery from core samples to date:

The largest diamond recovered from the RIP kimberlite measures 3.68 x 3.44 x 2.88 mm, weighs 89.129 mg. which is 0.445 carats.

For additional information, click here for a detailed report on the property.

In conclusion, Equity Metals management believes there is sufficient historical data to indicate that further exploration is warranted. The Company will discuss with its JV partners the next steps to advance the project and then plan a budget for a systematic exploration program to test the various targets and acquire further kimberlite for diamond content and analyses.

WO Project

Introduction

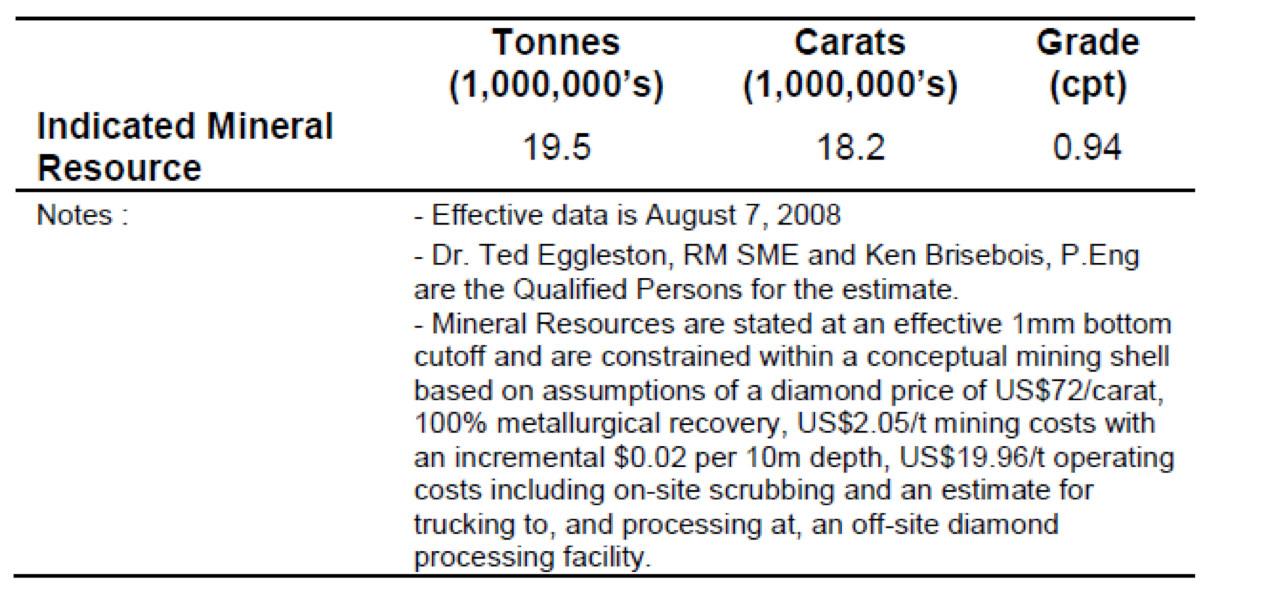

The WO Project is an advanced exploration diamond project where several diamondiferous kimberlites have been discovered. It is a joint venture, majority owned by De Beers Canada Inc. who is the operator of the project. The project contains an Indicated NI 43-101 resource of 19.5Mt at a grade of 0.94cpt for a total of 18.2 million carats of diamonds. For detailed resource parameters, see the section “Mineral Resource Estimates” Bulk sampling in 2007 produced rough diamonds up to 9.45 carats in size. The majority of the information in the following sections has been taken directly from the Peregrine Diamonds technical reports filed on SEDAR dated 15th July, 2014 and January 9th, 2009.

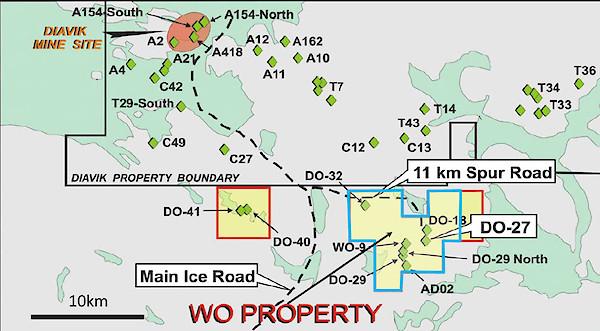

Property Description and Location

The WO Project is located in the Lac de Gras area, approximately 300 km north-northeast of the city of Yellowknife in the Northwest Territories, Canada to the southeast of the Diavik diamond mine centred at approximately 64o 20’ N latitude and 109o 50’ W longitude

The property consists of 8 leases for a total of 5,816.55ha which are owned by De Beers Canada Inc. (after takeover of Peregrine Diamonds Ltd.), (72.13%), Archon Minerals Limited (17.57%) and DHK Diamonds Inc. (10.30%). EQTY has a 43.37% interest in DHK Diamonds Inc. Royalties payable of 0.25% gross overriding royalty (GOR) to Mantle Diamonds Canada Inc.; 0.55% GOR to Aberex Minerals Ltd.; 1.0% GOR to 824567 Canada Limited – De Beers (Peregrine) holds 97.92% of the diamond marketing rights from any WO Property diamond production and is the operator of the Joint Venture.

Figure 1 – Location of WO Diamond Property (blue outline) with respect to Diavik Diamond Mine (Modified from Peregrine Diamonds January 2009 Technical Report to reflect updated WO Property)

Access and Infrastructure

Access to the area is from Yellowknife, which is the main staging area for all operations in this region. Most necessary services can be obtained in Yellowknife. Access is commonly via fixed wing aircraft equipped with wheels, floats, or skis, depending on the season. From approximately mid-January to mid-April access is provided via a winter ice road which connects Yellowknife with the Diavik and Ekati Diamond Mines. This road passes within 11 km of the DO-27 kimberlite.

History

Claims comprising the Project were originally part of the WO claim block staked by representatives of DHK consortium in February of 1992 following the announcement, by BHP Billiton (BHPB) and DiaMet Minerals Ltd. (Diamet), in the fall of 1991, of the diamond discovery at Point Lake. DHK shareholders were Dentonia Resources Ltd (Dentonia, 33%), Horseshoe Gold Ltd. (Horseshoe Gold, 33%) and Kettle River Resources (Kettle River, 33%). The claims were then optioned to Kennecott Canada Exploration Inc. (Kennecott), SouthernEra Resources Ltd (SouthernEra), and Aber Resources Inc. (Aber), who exercised the option, leaving DHK with a carried interest. Kennecott was operator and completed exploration work on the property discovering six kimberlites: DO-18, DO-27, DO-29N, DO-29S, DO-32 & AD-02 (Doyle, 1994; 1995; 1996; 1997). Between 2000 and 2004, some of the original claims were allowed to lapse and were acquired by other operators, including Thelon Ventures Ltd. (Thelon) and Dunsmuir Ventures Ltd. (Dunsmuir). In 2004, Peregrine acquired BHPB’s interest in the remaining claims from the original WO block (which contained the OW 19, OW 20 and TT 1 to 3 claims and SAS 1 to 3 leases). Dunsmuir entered into options to earn 100% interest in the MLT 1 to 6 and MLT 8 claims from a private prospecting syndicate and to earn a 65% interest in the CRW 5, and OKI 1 to 3 claims from Thelon. In 2006, Dunsmuir and Peregrine merged and the claims were re-united. In 2000, BHPB signed an option to earn an interest in part of the Project area by flying a FalconTM gravity survey and drilling targets. Kennecott agreed to exchange their 40% working interest in the property for a 9.9% interest in DHK. In 2004, Peregrine acquired BHPB’s interest in the Project. Peregrine was bought out by De Beers in September of 2018.

Geological Setting and Mineralization

The Project lies within the Slave Structural Province of the Northwest Territories, northern Canada, which is an Archean segment of the North American Craton. The Slave Province is subdivided isotopically into an eastern and a western domain. Kimberlites intrude granites, supracrustal rocks and, in some cases, diabase dykes (Pell, 1995, 1997) in both the eastern and western domains of the Slave Province. To date, all economic and near economic kimberlites, including those at Ekati, Diavik, Snap Lake, Gahcho Kue, and Jericho are located in the eastern Slave Province. Subsequent to kimberlite emplacement, the area was covered by the Laurentide ice sheet during the Late Wisconsinan glaciation, which climaxed about 20,000 years before present (B.P.). Till is the most prominent surficial sediment type in the Slave Geological Province. Glaciofluvial deposits, eskers, and outwash plains, are present in the Slave Province. In the Lac de Gras area, eskers are mainly west and northwest trending.

Two-mica post-deformational granite is the only major rock type on the properties. Medium- and high-grade Archean metaturbidites occur both east and west of the property. All of the kimberlites discovered on the properties, including DO-27 and DO- 18, which lies 800 m north of DO-27, intrude the granite. DO-27 does not crop out; it is overlain by 23-50 metres of till consisting of angular granitic boulders, gravel, sand, silt and clay and is mostly covered by Tli Kwi Cho Lake with an average depth of approximately 4 m and area of 1 km2. Till thickness at DO-18 is between five and 20 metres.

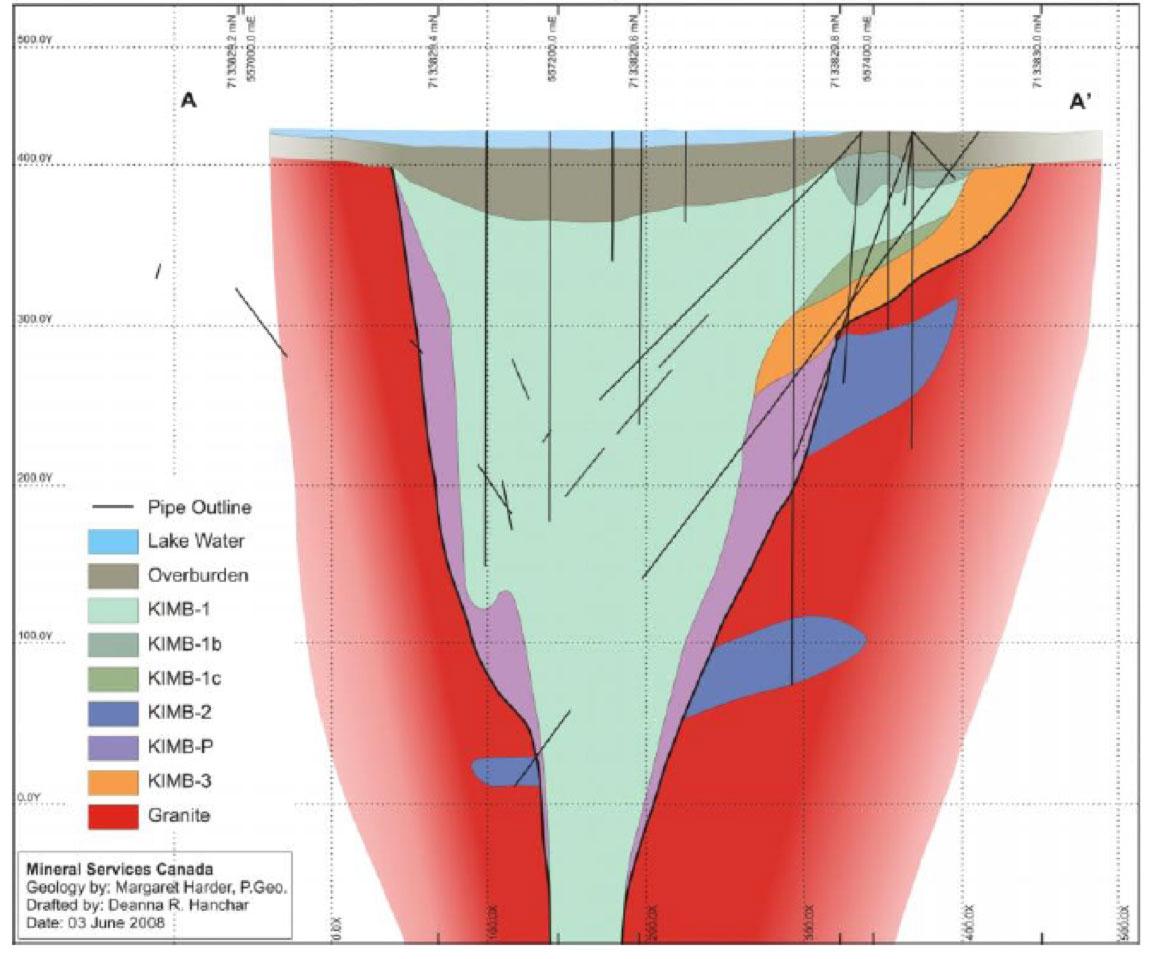

The main DO-27 pipe is asymmetrical in shape, with a steep western margin and a shallower eastern margin in the northeastern part of the pipe. The irregular shape of the pipe and complex geology in the northeastern zone suggests that two separate, but related eruptions may have been involved in pipe formation (Doyle et al., 1999). DO-27 consists primarily of KIMB-1, a pyroclastic kimberlite (PK). KIMB-1 is commonly light to medium green in colour. It is extremely altered and the upper 100 m generally displays extremely poor mineral and textural preservation. This lack of preservation is most notable towards the centre of the pipe, with preservation improving towards the margins. KIMB-1 is clast-supported, moderately well-packed, and is dominated by single olivine grains over juvenile lapilli, comprising approximately 60-70% olivine. KIMB-2 is volumetrically the second most important kimberlite. KIMB-2 is interpreted to be magmatic in origin and may be related to the magmatic sheets (dikes and sills) common immediately north of the DO-27 pipe. KIMB-2, where intersected in the vicinity of the northeastern lobe, is granite-rich (>25%), with a brownish to greenish kimberlite matrix with white to light green altered granitic clasts.

KIMB-3 is a complex unit of volcaniclastic kimberlite that contains several sub-divisions that cannot always be correlated between drill holes. To date, it has been observed only in the northeastern lobe of DO-27 where it comprises approximately 20% of the kimberlite (approximately 2% of the whole body), locally underlying KIMB-1. It is variable in colour from green to black and highly variable in grain size, sorting and xenolith content, with some units (KGB – kimberlite-granite breccia) containing > 30% granite boulders up to 2 m in size. KIMB-P is volcaniclastic, possibly re-sedimented, kimberlite infilling the DO-27 pipe which cannot be further subdivided into KIMB-1 or KIMB-3. It is present in small volumes at the pipe margins in many areas of the kimberlite. It contains variable amounts of dilution, and contains as much as 15% mud as xenoliths and within the matrix. Mineralization within the Project consists of kimberlite intrusions containing diamonds.

Figure 2 – Geological Cross-Section through the DO-27 Kimberlite Pipe

Exploration

Since the claims were first staked, exploration has consisted of geophysical studies, core and reverse circulation (RC) drilling, and underground developments. Peregrine exploration at DO-27 consists of core and large diameter reverse circulation drilling (LDD) in 2005, 2006, and 2007.

Mineral Processing and Metallurgical Testing

DO-27 Macrodiamond Sample Processing

Sample processing protocols were developed specifically for Peregrine’s requirements and the use of the Ekati sample plant. The Ekati sample plant was used by Peregrine for the 2005, 2006 and 2007 sample processing. AMEC visited the sample plant in 2005 to observe operations during DO-27 sample processing, and reported on their findings and recommendations (AMEC Americas, 2005). Howard Coopersmith was present at the Ekati plant for the processing of several complete DO-27 samples and audits, and to assess protocol compliance, metallurgical operations, efficiency, and security. A complete processing report was provided by BHPB (Fortin, 2007). The Ekati sample plant recovered diamonds down to a minus 1.0 mm bottom cut off, using primarily 1 mm x 14 mm slotted screens.

After the concentrate was produced, final diamond recovery operations were performed by Howard Coopersmith assisted by Jennifer Pell and Jim Crawford of Peregrine. Sorting procedures and protocols are presented in Appendix 5 of Coopersmith and Pell (2007). Ekati personnel performed all sample processing and recovery operations until the final product (X-ray diamond recovery machine and grease table products). These products were labelled and securely stored for Peregrine personnel who performed all final concentrate handling and sorting. Ekati personnel were not party to any final recovery operations or results; however, all operations were conducted in view of security cameras monitored by Ekati security personnel.

Mineral Resource Estimates

Table 1 contains the NI 43-101 mineral resource estimate on the property as of August 7, 2008. The tonnage reported in Table 1 lies within the Whittle™ resource shell and the modelled KIMB-1 boundary and is reported as undiluted kimberlite only (or partial block tonnes). The tabulation does not include mixed kimberlitic material that occurs between the KIMB-1 and KIMB-P boundary.

Table 1 – NI 43-101 Mineral Resource Estimate on the WO Diamond Property as of August 7th, 2008

AMEC identified an additional 6.5-8.5 Mt of material grading in the range of 0.8-1.0 cpt beneath the Indicated Mineral Resource that represents a target for additional exploration. The potential quantity and grade of the DO-27 target is conceptual in nature and there has been insufficient exploration to define a mineral resource. It is uncertain whether additional exploration will result in the target being delineated as a mineral resource.

The three-dimensional model of the DO-27 kimberlite and the tonnage and resource estimates are based on data from 66 core holes (17,300 m) and 46 LDD (35-61 cm) holes totalling 8,800 m and sample results for a cumulative 3,200 dry tonnes of bulk sample material collected from the LDD holes. The tonnage for each block was calculated by multiplying the interpreted volume by density determined from a three-dimensional density model developed by AMEC. The density model was based on 507 density measurements on drill core from throughout the body performed by Global Discovery Laboratories in Vancouver. Recovered macrodiamond results at a 1 mm lower cutoff were used to interpolate grades into 25 x 25 x 15 m blocks. Ordinary kriging was used to estimate the block grades. The Vulcan™ mine modelling software system was used to create the resource model.

Detailed analysis of diamond size distributions led to an adjustment process to account for known differences in diamond recovery regimes between drill campaigns. Study of these data showed that the distributions were affected by year-to-year treatment plant recovery differences. AMEC used factors derived from industry-standard recovery studies to adjust the distributions before their use in the resource estimation. Adjustments derived from these analyses for conversion of individual sample cpht values were 1.33 for 2007 data (addresses deficiency of small stones due to treatment plant differences) and 1.11 for 2006 data (adjusts for a small degree of deficiency of large stones).

AMEC used a base case from the various Lerchs-Grossman (LG) sensitivity runs to establish reasonable prospects for eventual economic extraction. The shell was used to restrict the estimated block model for tabulation and reporting. AMEC has used the Scrub-only, ‘high’ diamond price, LG case discussed below. This case uses the ‘high’ diamond value from the WWW International Diamond Consultants Ltd (WWW) diamond valuation. Based on project and resource modelling work to date, AMEC considers the kimberlitic material contained within the resulting resource shell to be an Indicated Mineral Resource (Table 1). The base elevation of the Indicated Mineral Resource lies within adequate proximity of the RC drilling where macrodiamond sampling has occurred. These data have been used to estimate and value the diamond resource. While the effective date of the estimation and tabulation is some six years older than this Technical Report, AMEC is of the opinion that diamond price escalation exceeds mining and operating cost escalation over the intervening time period. Application of escalated parameters would not result in a decreased resource shell. From this, AMEC concludes that DO-27 has reasonable prospects for eventual economic extraction.

Sampling issues with the RC drilling (refer Sections 13.4, 14.2.2) resulted in a resource model where local variations in block grades may not be fully reflected in the resource block estimates. The Indicated Mineral Resource classification must therefore carry the important caveat that it can only be converted to a Mineral Reserve without the use of cutoffs or mining selectivity assumptions. Any future Mineral Reserve conversion process must treat the Indicated Mineral Resource from this long range resource model as a bulk-mining target with no opportunity for selective mining alternatives.

There has been no Inferred Mineral Resource declared at this time given the results of the resource shell runs. It is clear from the resource shell results; however, that changing conditions may result in a declaration of an Inferred Mineral Resource in the future.

Reasonable Prospects for Eventual Economic Extraction

AMEC reviewed the technical and economic aspects of a conceptual mine on DO-27 as well as current diamond prices (WWW, 2014) and concluded that diamond price escalation likely more than offset any escalation of the assumed mining costs used in the resource estimates during the 2007-2014 period and that the Whittle™ resource shell used to constrain the Mineral Resource estimate in 2007 was still valid. The legal path forward for permitting of mines in the Northwest Territories is clearly defined. A number of mines have been successfully permitted in recent years. AMEC believes that there is a reasonable expectation that a mine could be permitted at DO-27.

Mineral tenure appears to be secure. Sufficient land for mining and infrastructure are available to support a mine on DO-27. Agreement with local First Nations will be required for surface use, but there is a reasonable expectation that those agreements can be reached. Local water resources are adequate to support mining but will require proper permits from local authorities. Based on the resource shell generated within Whittle™ and other factors discussed above, AMEC concludes that the DO-27 Resource has reasonable prospects for eventual economic extraction, but cautions that several factors could adversely impact that conclusion. Those factors include:

- Inability to secure mining permits.

- Inability to secure water rights.

- Significant decreases in diamond prices.

- Significant increases in operating or capital costs.

Other Relevant Data and Information – Diamond Valuation and Price Modelling

Peregrine contracted WWW to value the diamond parcels and perform price modelling.

WWW are recognized international leaders in this field. M.M. Oosterveld, a professional mining engineer and recognized expert in diamond evaluations was contracted to give an independent review.

The 2007 individual sample goods were combined on the basis of geology to give four parcels for valuation: Parcels PDL07-03 and 04 from KIMB-1 in the main lobe of DO-27; Parcel PDL07-01 from KIMB-1 in the northeast lobe of DO-27; and Parcel PDL07-02 from other lithologies mixed with KIMB-1, at the base of the northeast lobe of DO-27. Results of the valuation are summarized in Table 1-2.

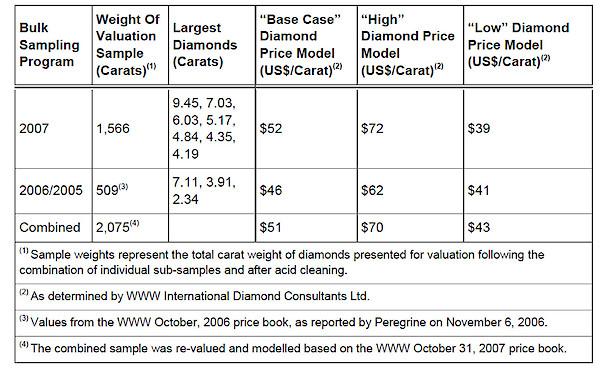

Table 2 – Summary of WWW Diamond Valuations for DO-27

WWW believes it is highly unlikely that the modelled average price will be lower than the minimum values and that the high values should not be considered maximum values. The modelled average price is extremely sensitive to the value of large diamonds so there is a high degree of uncertainty in the modelled value of the larger stones that would be expected in a production scenario.

AMEC was provided with a copy of a WWW report dated 14 July 2014 that shows changes to the diamond price index since the October 2007 DO-27 valuation. The WWW report shows a general upward trend to diamond prices since the valuation of the DO-27 diamond parcel.

AMEC relied on the WWW work to establish valuations for the diamonds. The valuations were applied to the estimated resource model grades models and became the basis for the development of LG resource shells within which resources have been declared. The valuation process performed by WWW and others is partially analytical (in the way that a gold assay process can be termed analytical) in that the diamonds are studied and classified. The dollar per carat determinations for various stones however, is ultimately governed by the valuators price-book. This part of the process is proprietary, governed by a given valuator’s view of the marketplace and can vary from valuator to valuator, particularly for larger stones. Even in larger parcels valuators must then ‘model’ or extrapolate values in the larger stone size classes where there may be few representatives. The methodology for modelling is also proprietary. The culmination of the process is the average prices for given zones, lobes or pipes. The heavy dependence of the process on economic market assessments, and the proprietary nature of the valuators assumptions and methods, materially affects the quality of, and confidence in, the mineral resource estimate. In this way, the valuations used in the resource assessments are quite different than the concept of analytical mineral assays in, for instance, a precious metal project. The proprietary nature of the processes employed for valuations limit any quantitative assessment of the added risk to the Project.

Conclusions

DO-27 is a diamondiferous kimberlite pipe in the Northwest Territories of Canada. It has been explored in detail to a depth of about 350 m by a combination of core and large diameter reverse circulation drilling. Drilling employed industry-standard procedures and protocols. Large diameter reverse circulation drilling was used to produce bulk samples that were then processed at the Ekati sample plant using standard procedures and protocols. Diamond valuation was performed by WWW and reviewed by M.M. Oosterveld, a recognized expert in diamond evaluations. AMEC has been involved with, and reviewed all aspects of the exploration and is of the opinion that it has been performed to industry standards. These data are the basis for an estimation of the mineral resource at DO-27. The DO-27 Mineral Resource estimates with an effective date of August 7, 2008 remain valid and relevant. Exploration discovered a number of other kimberlites that are diamondiferous. DO-18 was explored a number of core holes that outlined the shape of the kimberlite. Other kimberlites were drilled and sampled for microdiamonds. Additional work was not done on those kimberlites because the focus of the Project was DO-27 and later, other, higher priority Peregrine projects.

Management and Directors

Joseph A. Kizis, Jr.

Director & President

Mr. Kizis is a Registered Geologist and a Certified Professional Geologist with a B.S. in Geology from Kent State University and an M.S. in Geology from the University of Colorado. He has 40 years of experience in exploration for gold, silver, copper, molybdenum, lead, zinc, and uranium in the U.S., Canada and abroad. He is the President and a director of Bravada Gold Corporation and Equity Metals Corporation and previously of Homestake Resource Corporation as well as Fortune River Resource Corp. (which amalgamated with Bravada Gold Corporation in 2011). Mr. Kizis has held previous executive positions and directorships with Fairmile GoldTech, Sierra Geothermal, the Geological Society of Nevada, and the GSN Foundation.

Robert W.J. Macdonald, MSc., PGeo

Vice President of Exploration

Mr. Macdonald is the Vice President of Geological Services for the Manex Resource Group of Companies and in such capacity has been the Exploration Manager for several publicly listed companies including Homestake Resource Corporation (formerly Bravo Gold Corp.), Southern Silver Exploration Corp., Valterra Resource Corporation, Duncastle Gold Corp. and Fortune River Resource Corp. Mr. Macdonald has overseen the exploration of many projects throughout North America including the discovery and delineation of the high-grade 1.2 million ounce Homestake Ridge Au-Ag deposit in northern British Columbia and is currently advancing Southern Silver’s 12million tonne Cerro Las Minitas Ag-Pb-Zn project, Durango State, Mexico. Mr. Macdonald graduated with a B.Sc. (Hons) from Memorial University of Newfoundland in 1990 and earned a MSc. from the University of British Columbia in 1999. Over his career in the geosciences Mr. Macdonald’s work has focused on vein and intrusion-related gold systems and VMS environments. Prior to joining Manex, Mr. Macdonald worked as a geologist with the British Columbia Geological Survey and Teck Exploration on projects in Alaska, Peru and British Columbia.

Lawrence Page, B.A., LL.B., Q.C.

Director & Chairman

Lawrence Page obtained his law degree from the University of British Columbia in 1964 and was called to the Bar of British Columbia in 1965 where he has practiced in the areas of natural resource law and corporate and securities law to the present date. Through his experience with natural resource companies and, in particular, precious metals development, Mr. Page has established a unique relationship with financiers, geologists and consultants and has been counsel for public Companies which have discovered and developed producing mines in North America. Specifically, he has been a Director and Officer of Companies which have discovered and brought into production the David Bell and Page Williams mines in Ontario, the Snip, Calpine/Eskay Creek and Mascot Gold Mines in British Columbia, as well as the discovery of the Penasquito Mine in Mexico.

Mr. Page is the principal of the Manex Resource Group of Vancouver which provides administrative, financial, corporate, corporate finance and geological services to a number of public companies in the mineral resource sector. He currently serves as a director of four public companies, including Bravada Gold Corporation, Equity Metals Corporation, Southern Silver Exploration Corp. and Valterra Resource Corporation.

Killian Ruby, CPA, CA

Director & Chief Financial Officer

Mr. Ruby is the President & CEO of Malaspina Consultants Inc. in Vancouver and focuses on clients in the resource and junior public sector. Mr. Ruby advises clients on matters related to financial management and public company reporting and is particularly adept at handling complex issues and multiple stakeholders with a collaborative, team-based approach.

Prior to joining Malaspina, Mr. Ruby was an Assurance Partner at Wolrige Mahon LLP (now Baker Tilly Canada) working predominantly with resource and other junior public companies, and formerly was a Senior Manager with KPMG LLP working on a range of public companies and reporting issuers. He holds a BSc. (Accounting) from University College Cork, Ireland, a Post-Graduate Diploma in Corporate Treasury from Dublin City University, Ireland, and received his Chartered Accountant designations from Canada and Ireland in 2010 and 2002, respectively.

Arie Page, B.A., LL.B.

Corporate Secretary

Arie Page obtained her law degree in 2004 and was called to the Bar of British Columbia in 2005. Ms. Page currently serves as corporate secretary to several public resource companies in the minerals sector including Bravada Gold Corporation, Equity Metals Corporation, Pacific Ridge Exploration Ltd., Southern Silver Exploration Corp. and Valterra Resource Corporation.

Courtney Shearer, B.Sc (Eng.), MBA, CPA, CMA

Director

Mr. Shearer has been an entrepreneur all his working career. After working in the BC timber industry and in a junior silver producer in the Canadian Arctic, he co-founded and ran a private oilfield service company in Alberta for a decade and successfully sold it to a large, multi-national corporation.

He was involved in several junior Canadian exploration and production companies for 15-years as a board member and in the C-suite, including being CFO for Merit Mining Corp. when they opened the Greenwood Gold Project in 2008.

He was also a director and consultant for San Gold Corporation when they opened the Rice Lake, Manitoba gold mine and grew from a market capitalization of $18 million to over $1.1 billion in 6 years. He worked on the business development team that raised over $120 million to finance that growth and conversion from the TSX Venture Exchange to the TSX.

He is currently a partner in a private company that provides implementation of land development, funding and financial strategies to private, public and not-for-profit organizations.

John R. Kerr, P. Eng

Director

Mr. Kerr graduated from the University of British Columbia in 1964 with a BASc degree in Geological Engineering. He has participated continuously in the mining industry since graduation as an exploration geologist, representing Canadian Johns-Manville Co. Ltd. in all areas of Canada during his early career in the 1960s. During the 1970s and early 1980s, he initiated a consulting business out of Kamloops, British Columbia, participating in exploration programs in all areas of North America, moving to Vancouver in 1984 to assume the role of managing director of several junior mining companies. As a consultant, John specialized in supervising remote projects in the High Arctic regions of northern Canada and Greenland.

John has gained experience in recognition and identification of mineral potential in a diversified field of geological environments. His expertise is epithermal and sedex-hosted precious metal deposits in the southwest United States, strata controlled gold deposits and porphyry copper/gold/molybdenum deposits of the western Cordillera, and VMS deposits in all areas of North America. Successful ventures include:

- Recognition and discovery of the Santa Fe gold mine in Nevada;

- Identification of the Calvada gold mine in Nevada;

- Discovery of the Mindora gold/silver deposit in Nevada;

- Early identification of two VMS deposits in Newfoundland;

- Recognition of several copper porphyry deposits in British Columbia;

- Discovery of the Frasergold strata controlled gold deposit in British Columbia; and

- Development of the Malmbjerg molybdenum deposit in Greenland.

John maintains a geological consulting practice out of Vancouver, B.C. with projects located in all areas of North America. He is currently a director of Quaterra Resources Inc. (QTA), Bravada Gold Corporation (BVA), Searchlight Resources Inc. (SCLT), and Equity Metals Corporation (EQTY) listed on the TSX Venture Exchange.

Corporate Info

Head Office

Suite 1100, 1199 West Hastings St.

Vancouver, BC, V6E 3T5 Canada

Tel: +1 (604) 684-9384

Fax: +1 (604) 688-4670

Email: info@mnxltd.com

IR Contact

Tel: +1 (604) 641-2759

Email: ir@mnxltd.com

Shares Outstanding

73 million

Fully Diluted

121 million

RELATED COMPANY ARTICLES

Prospector News Podcast - Joe Kizis "We Have Been Able to Add to the Resource at Very Low Cost per Ounce"

Prospector News Publisher Michael Fox is joined on location at AME BC’... READ MORE

Equity Metals Provides Corporate Update

Equity Metals Corporation (TSX-V: EQTY) (OTCQB: EQMEF) announces... READ MORE

Equity Reports Final Drill Results from the Cole Lake Target, Including 2.5 metres (est TT) of 220g/t AgEq in Hole SQ23-099 and 2.6 metres (est TT) of 223g/t AgEq in Hole SQ23-103, Silver Queen Project, BC

Equity Metals Corporation (TSX-V: EQTY) reports assays from the f... READ MORE

Equity Metals Grants Stock Options

Equity Metals Corporation (TSX-V:EQTY) has granted incentive stoc... READ MORE

Equity Reports Initial 2023 Drill Results from the Cole Lake Target, Including 3.8 metres (est TT) of 328g/t AgEq in Hole SQ23- 096 and a thicker interval of 8.9 metres (est TT) of 157g/t AgEq in Hole SQ23-095, Silver Queen Project, BC

Equity Metals Corporation (TSX-V: EQTY) reports encouraging assay... READ MORE

Equity Expands George Lake with Thicker Intercepts, Including 3.6 metres (est TT) of 333 g/t AgEq in Hole SQ23- 094 and 3.0 metres (est TT) of 394g/t AgEq in Hole SQ23-093, Silver Queen Project, BC; Provides Corporate Update

Equity Metals Corporation (TSX-V: EQTY) reports encouraging assay... READ MORE

Equity Receives Encouraging Drill Results from the George Lake Target, Intersects 1.5 metres (est TT) of 1.3g/t Au, 226g/t Ag, 1.0% Cu, 1.7% Pb and 6.6% Zn (9.2g/t AuEq or 755g/t AgEq) at the Silver Queen Project, BC

Equity Metals Corporation (TSX-V: EQTY) reports encouraging assay... READ MORE

Equity Metals Returns 55.2g/t Gold and 5,049g/t Silver from Outcrop Sampling on the Cole Lake Target, Silver Queen Project, BC; Crews Mobilizing to Resume Drill program; Corporate Update

Equity Metals Corporation (TSX-V: EQTY) reports results from its ... READ MORE

NOVA ROYALTY REPORTS FINANCIAL RESULTS FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND PROVIDES ASSET UPDATE

Nova Royalty Corp. has reported its financial results for the sec... READ MORE

Erdene Announces Positive Updated Feasibility Study for the Bayan Khundii Gold Project

NI 43-101 Technical Report Highlights (US$1,800/oz Gold Price) Ba... READ MORE

Wheaton Precious Metals Announces Solid Second Quarter Results for 2023

“Wheaton delivered solid operational results during the qua... READ MORE

SILVERCORP REPORTS ADJUSTED NET INCOME OF $12.4 MILLION, $0.07 PER SHARE, AND CASH FLOW FROM OPERATION OF $28.9 MILLION FOR Q1 FISCAL 2024

Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) reported i... READ MORE

Jordan Roy-Byrne – “Why Precious Metals Remain in a Funk”

The technicals for precious metals were looking positive at the e... READ MORE

Pan American Silver reports second quarter 2023 results, demonstrating the transformative impact of the Yamana acquisition

Production up 55% for silver and 102% for gold compared with Q1 2... READ MORE

Osisko Reports Q2 2023 Results

Osisko Gold Royalties Ltd (TSX:OR) (NYSE:OR) announced its consol... READ MORE

Equity Extends New Mineralization; Including 7.7 metres (est TT) of 0.9g/t Au, 57g/t Ag, 1.4% Pb and 6.5% Zn (11.2g/t AuEq or 445g/t AgEq) at the Sveinson Deposit, Silver Queen Project, BC

Equity Metals Corporation (TSX-V: EQTY) reports final assays from... READ MORE

Golden Minerals Reports Second Quarter 2023 Financial Results

Golden Minerals Company (TSX: AUMN) (NYSE-A: AUMN) has released f... READ MORE

Hudbay Announces Second Quarter 2023 Results

Hudbay Minerals Inc. (TSX:HBM) (NYSE:HBM) released its second qua... READ MORE

MAG Silver Reports Second Quarter Financial Results

MAG Silver Corp. (TSX:MAG) (NYSE American: MAG) announces the Com... READ MORE

Critical Investor – “Platinex Commences Exploration At Shining Tree and Mallard Gold Projects”

After raising C$2.7M in March and closing the South Timmins JV with Fanc... READ MORE

SILVERCORP TO ACQUIRE ORECORP, CREATING A DIVERSIFIED, HIGH GROWTH PRECIOUS METALS COMPANY

Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) and OreCor... READ MORE

Sandstorm Gold Royalties Announces Record Revenue and Strong Operating Results in Second Quarter 2023

Sandstorm Gold Ltd. (TSX: SSL) (NYSE: SAND), has released its res... READ MORE

Patriot Battery Metals Announces a C$109 Million Strategic Investment and Memorandum of Understanding with Albemarle Corporation

Patriot Battery Metals Inc. (TSX-V: PMET) (ASX: PMT) (OTCQX: PMET... READ MORE

Eldorado Gold Reports Q2 2023 Financial and Operational Results; Well Positioned to Meet 2023 Guidance

Eldorado Gold Corporation (TSX: ELD) (NYSE: EGO) reports the Company’s... READ MORE

AGNICO EAGLE REPORTS SECOND QUARTER 2023 RESULTS - RECORD QUARTERLY GOLD PRODUCTION AND SOLID COST PERFORMANCE DRIVE STRONG QUARTERLY EARNINGS AND OPERATING CASH FLOW; WELL POSITIONED TO ACHIEVE ANNUAL PRODUCTION AND COST GUIDANCE

Agnico Eagle Mines Limited (TSX: AEM) (NYSE: AEM) reported financ... READ MORE

SIGMA LITHIUM SHIPS 30,000 TONNES OF BATTERY GRADE LITHIUM AND BY-PRODUCTS; ACHIEVES NET ZERO CARBON, OPERATING PROFITABILITY AND PREMIUM PRICING

NET ZERO Sigma Lithium achieves operational net zero (carbon neut... READ MORE

1911 Gold Enters into Agreement with Grid Metals for Lithium Spodumene Concentrate Production at True North Mill

1911 Gold Corporation (TSX-V: AUMB) (OTC: AUMBF) is pleased to an... READ MORE

Osisko Metals Announces Successful Closing of Previously-Announced Acquisition of the Gaspé Copper Project

Osisko Metals Incorporated (TSX-V: OM) (OTCQX: OMZNF) (FRANKFURT:... READ MORE

Trilogy Metals Reports Second Quarter Fiscal 2023 Financial Results

Trilogy Metals Inc. (TSX: TMQ) (NYSE: TMQ) announces its financi... READ MORE

Steppe Gold Signs Binding Term Sheet for US$150 Million to Fully Fund the Phase 2 Expansion at the ATO Gold Mine

Steppe Gold Ltd. (TSX: STGO) (OTCQX: STPGF) (FSE: 2J9) is very pl... READ MORE

Osisko Announces Preliminary Q2 2023 Deliveries and Provides Company Update

Osisko Gold Royalties Ltd (TSX:OR) (NYSE:OR) is pleased to provid... READ MORE

First Mining Gold Intersects 0.92 g/t Au Over 114 Metres and 0.75 g/t Au Over 58 Metres at its Saddle Target in the Birch-Uchi Greenstone Belt Project

First Mining Gold Corp. (TSX: FF) (OTCQX: FFMGF) (FRANKFURT: FMG)... READ MORE

Gold & Special Minerals Fund Holdings Update - June 2023 and Attribution Analysis

This report details the most recent portfolio holdings for Gold &... READ MORE

Equity Metals Announces Non-Brokered Flow-Through Private Placement

Equity Metals Corporation (TSX-V: EQTY) announces that it propose... READ MORE

Premium Nickel Resources Ltd. Announces Closing of Financing Transactions Totalling Approximately CAD$34 Million

Premium Nickel Resources Ltd. (TSX-V: PNRL) (OTCQX: PNRLF) is ple... READ MORE

Guanajuato Silver Provides Updated PEA for the El Cubo Mines Complex

Guanajuato Silver Company Ltd. (TSX-V:GSVR) (AQUIS:GSVR) (... READ MORE

First Mining Completes $5 Million Flow-Through Financing

First Mining Gold Corp. (TSX: FF) (OTCQX: FFMGF) (FRANKFURT: FMG)... READ MORE

Canada's Mining Sector Commits to World-Leading EDI Standards

New Towards Sustainable Mining Protocols Will Drive Industry Perf... READ MORE

Marimaca Announces C$20 Million Strategic Investment from Mitsubishi Corporation

Marimaca Copper Corp. (TSX: MARI) is pleased to announce a C$20 m... READ MORE

Equity Resumes Drill Program at the Silver Queen Project, BC

Equity Metals Corporation (TSX-V: EQTY) reports that crews have m... READ MORE

Electric Metals (USA) Limited ("EML") Announces First Closing of Non-Brokered Financing

Issued 10,744,680 Units at a price of $0.235 per Unit for gross p... READ MORE

Transition Metals Corp. Closes $1,000,000 Private Placement

Transition Metals Corp. (TSX-V: XTM) is pleased to announce that it has closed ... READ MORE

Osisko Announces Closing of CSA Stream Transactions

Osisko Gold Royalties Ltd (TSX:OR) (NYSE:OR) is pleased to repo... READ MORE

CIB to Invest in Critical Minerals Infrastructure

Facilitating enabling and supporting mining infrastructure across... READ MORE

Goldmoney Inc. Reports Financial Results for Fourth Quarter and Fiscal Year 2023, Announces Proposed Share Consolidation, and Publishes Annual Letter to Shareholders

Goldmoney Inc. (TSX: XAU) (US: XAUMF) a precious metal financial ... READ MORE

Eldorado Gold Announces Closing of C$135 Million Bought Deal Financing

Eldorado Gold Corporation (TSX: ELD) (NYSE: EGO) announced the cl... READ MORE

Equity Expands the Western Camp Vein with Intercepts Including 0.8 Metres of 1,952g/t Ag, 0.1% Pb and 0.2% Zn (24.1g/t AuEq or 1,971g/t AgEq) Within a Wider Interval at the Silver Queen Project, BC

Equity Metals Corporation (TSX-V: EQTY) reports new assays from i... READ MORE

enCore Energy Enters Definitive Agreement for the Sale of the Marquez-Juan Tafoya Uranium Project

enCore Energy Corp. (NYSE American: EU) (TSXV: EU) announced it h... READ MORE

Benchmark Metals and Thesis Gold Announce Merger to Create Premier Precious Metals Project

Benchmark Metals Inc. (TSX-V: BNCH) (OTCQX: BNCHF) (WKN: A2JM2X) ... READ MORE

Gold and Special Minerals Fund Holdings Monthly Update - May 2023 and Attribution Analysis

This report details the most recent portfolio holdings for Gold &... READ MORE