Collective Mining Expands the New Porphyry Discovery at San Antonio by Cutting 172.40 Metres at 1.40 g/t Au, 0.16% Cu, 17 g/t Ag and 68 ppm Mo with the Hole Bottoming in Strong Mineralization

Latest drill results at San Antonio into the Pound target have expanded the footprint of the recently discovered porphyry system and intersected multiple mineralized zones:

- Hole SAC-18, located two hundred and fifty metres south of previously announced discovery hole SAC-11, was drilled vertically into a mineralized porphyry system and intersected:

- 172.40 metres @ 1.88 g/t gold equivalent (1.40 g/t Au, 0.16% Cu, 17 g/t Ag, 68 ppm Mo) including:

- 28.50 metres @ 3.32 g/t AuEq (2.05 g/t Au, 0.20% Cu, 62 g/t Ag, 12 ppm Mo) and

- 60.75 metres @ 2.27 g/t AuEq (2.05 g/t Au, 0.17% Cu, 4 g/t Ag, 98 ppm Mo)

- The hole was terminated prematurely while in strong mineralization due to the limitation of the rig with the final 1.60 metres averaging 2.03 g/t AuEq

- 172.40 metres @ 1.88 g/t gold equivalent (1.40 g/t Au, 0.16% Cu, 17 g/t Ag, 68 ppm Mo) including:

- Hole SAC-15 was drilled to the south from the same pad as SAC-18 at a flatter angle and also intersected the same mineralized system returning:

- 154.20 metres @ 1.22 g/t gold equivalent (1.12 g/t Au, 0.03% Cu, 11 g/t Ag) including:

- 58.00 metres @ 2.15 g/t AuEq (1.95 g/t Au, 0.03% Cu, 21 g/t Ag)

- 16.05 metres @ 2.17 g/t AuEq (2.03 g/t Au, 0.08% Cu, 12 g/t Ag)

- SAC-15 also bottomed in strong mineralization due to the depth capacity limit of the rig with the final 9.90 meters averaging 3.18 g/t AuEq (2.99 g/t Au, 0.11% Cu, 17 g/t Ag).

- 154.20 metres @ 1.22 g/t gold equivalent (1.12 g/t Au, 0.03% Cu, 11 g/t Ag) including:

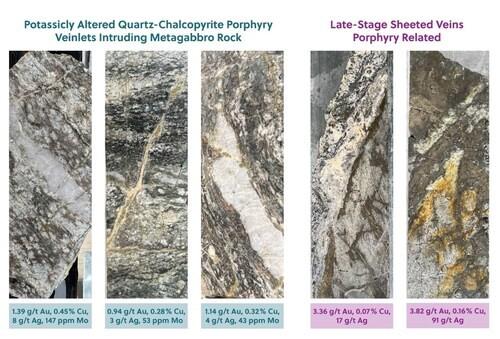

- Three porphyry related mineralized phases have now been identified at the Pound target as follows:

- Phase 1 is a large, three by three-kilometre area covering the entirety of the San Antonio project displaying a phyllic altered, porphyry halo zone, which hosts low grade gold (0.2 g/t Au-0.5 g/t Au), extends from surface to a minimum of 700 metres depth and is open in all directions.

- Phase 2 is a late-stage, gold and silver rich sheeted veinlet system (CBM Veins) beginning at surface but with more robust grades starting from 300 metres below surface (see Table 3). Phase 2 mineralization is found close to or in contact with the Phase 3 porphyry system.

- Phase 3 is a gold-copper-silver-molybdenum porphyry system with potassic alteration (secondary biotite). This system commences at approximately 400 metres below surface and displays an unusually high gold to copper ratio of up to 4:1 in grade. Both Phase 2 and Phase 3 mineralized zones are found within the large Phase 1 mineralized porphyry halo (See Table 2).

- Drill holes SAC-11 (see press release dated May 5, 2025), SAC-15 and SAC-18 have tested approximately 450 metres of north-to-south strike length with the system remaining open in all directions. Due to rig limitations, holes SAC-15, SAC-18 and SAC-20 (assay results pending) were stopped prematurely while still in strong mineralization. A higher capacity rig is now drilling hole SAC-21 and is progressing at a significantly improved rate.

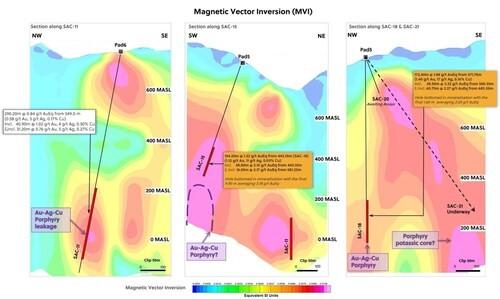

- Magnetic Vector Inversion (“MVI”) modelling of airborne geophysical data is proving to be quite useful at identifying Phase 2 and Phase 3 porphyry mineralization (see Figure 2) and as a result drill hole SAC-21 is currently being directed into an MVI high.

Collective Mining Ltd. (NYSE: CNL) (TSX: CNL) is pleased to announce that drilling assay results from the San Antonio Project’s Pound target have confirmed that the Company has discovered a high-grade porphyry system over a minimum strike length of 450 metres (open), which locates within a gold mineralized halo envelope measuring 3 kilometres x 3 kilometres and is open in all directions. The San Antonio Project is located between 2 kilometres and 5 kilometres to the east-northeast from the Company’s flagship Guayabales Project within the Caldas Department in Colombia.

The Company currently has eleven drill rigs operating as part of its fully funded 70,000-metre drill program for 2025 with three rigs at the San Antonio Project and eight rigs at the Guayabales Project. Drilling at the Guayabales Project is focused on multiple objectives which include defining shallow mineralization at the Apollo system, expanding and identifying new high-grade sub-zones at the Apollo system, expanding the high-grade Ramp Zone (“Ramp”) (located at the bottom of Apollo) at depth and along strike and testing new targets across the project. Two deep capacity drill rigs are at Apollo with the first rig now drilling a mother hole to test Ramp after successfully extending an earlier step-out hole for Ramp which failed to reach its intended depth (assays results pending). A second deep capacity rig has recently arrived at site and is expected to begin drilling a second mother hole to test the high-grade Ramp Zone discovery within the next two weeks.

Approximately 10,000 metres of diamond drilling has been completed to date at the San Antonio Project, including 6,500 metres at the Pound target. There are currently two drill holes awaiting assay results with three more holes currently being drilled at the San Antonio Project.

Ari Sussman, Executive Chairman commented: “Having just walked the entire San Antonio Project with the team, I am extremely impressed by the sheer scale of the system and its exciting potential. Although exploration is in its infancy, we are confident that aggressive drilling will prove fruitful as we advance our understanding of the system. It is important to note that the porphyry system discovered at the Pound target is approximately equal distance (3.5 kilometres) to the proposed infrastructure location for a future mine from our Apollo system at the neighbouring Guayabales Project. Equally important factors about the San Antonio Project are that the hydro-power lines run right across the project, the porphyry discovery at Pound is located less than a kilometre from the Pan American highway and there are no communities living on or near the area.”

To watch a video of Ari Sussman, Executive Chairman, explain today’s results please click on the link here.

Details (see Table 1-3 and Figures 1-5)

Pound Target

Results outlined in this press release have expanded the footprint of the porphyry discovery previously announced in SAC-11 (see press release dated May 5, 2025) southwards by over 450 metres and intersected multiple mineralized zones:

- SAC-18 was drilled vertically from Pad 5 and intersected a strong zone of late-stage porphyry related sheeted veins before entering an Au-Cu-Ag-Mo rich porphyry system with results as follows:

- 172.40 metres @ 1.88 g/t AuEq (1.40 g/t Au, 0.16% Cu, 17 g/t Ag, 68 ppm Mo) which includes higher density mineralized sub-zones of:

- 28.50 metres @ 3.32 g/t AuEq (2.05 g/t Au, 0.20% Cu, 62 g/t Ag, 12 ppm Mo) and

- 60.75 metres @ 2.27 g/t AuEq (2.05 g/t Au, 0.17% Cu, 4 g/t Ag, 98 ppm Mo)

- 172.40 metres @ 1.88 g/t AuEq (1.40 g/t Au, 0.16% Cu, 17 g/t Ag, 68 ppm Mo) which includes higher density mineralized sub-zones of:

SAC-18 was terminated early and bottomed in strong porphyry mineralization due to the depth capacity limit of the rig with the final sample averaging 1.60 metres @ 2.03 g/t AuEq (1.91 g/t Au, 0.07% Cu, 6 g/t Ag).

- SAC-15 was drilled from Pad 5 to the south-southwest and entered a gold rich zone of sheeted veinlet mineralization as follows:

- 154.20 metres @ 1.22 g/t AuEq (1.12 g/t Au, 0.03% Cu, 11 g/t Ag) from 443.10 metres downhole including:

- 58.00 metres @ 2.15 g/t AuEq (1.95 g/t Au, 0.03% Cu, 21 g/t Ag)

- 16.05 metres @ 2.17 g/t AuEq (2.03 g/t Au, 0.08% Cu, 12 g/t Ag)

- 154.20 metres @ 1.22 g/t AuEq (1.12 g/t Au, 0.03% Cu, 11 g/t Ag) from 443.10 metres downhole including:

SAC-15 also bottomed in the contact fault between the gold rich zone and what the Company believes would have been the main porphyry system due to the depth capacity limit of the rig with the final 9.90 metres averaging 3.18 g/t AuEq (2.99 g/t Au, 0.11% Cu, 17 g/t Ag).

- With holes SAC-15, SAC-18 and SAC-20 (awaiting assay results) bottoming in significant mineralization due to rig capacity limitations, all rigs at San Antonio have been upgraded with three rigs now operating at optimal performance parameters.

- SAC-16 was a short hole drilled from Pad 5 to the west at a shallow dip angle and is interpreted to have been drilled above the zones of strong mineralization. Still, some sections of late-stage porphyry related gold mineralization were encountered in the hole with results as follows:

- 25.40 metres @ 0.32 g/t AuEq from 14.00 metres downhole

- 11.90 metres @ 2.59 g/t AuEq from 144.00 metres downhole

- 14.55 metres @ 2.09 g/t AuEq from 179.85 metres downhole

- SAC-12 and SAC-14 were drilled steeply from Pad 6 to the northeast and southeast respectively, and intersected Phase 1 porphyry halo style gold dominant mineralization from shallow depths as follows:

- 642.25 metres @ 0.36 g/t gold equivalent from 23.40 metres downhole (SAC-12) including:

- 25.35 metres @ 0.71 g/t AuEq

- 21.15 metres @ 0.64 g/t gold equivalent from 51.05 metres downhole (SAC-14) and;

- 183.05 metres @ 0.32 g/t gold equivalent from 184.55 metres downhole and;

- 79.95 metres @ 0.32 g/t gold equivalent from 454.75 metres downhole

- 642.25 metres @ 0.36 g/t gold equivalent from 23.40 metres downhole (SAC-12) including:

- SAC-13 was drilled steeply from Pad 7 to the northeast and also cut Phase 1 shallow gold dominant mineralization associated to the porphyry pyrite halo zone with assay results as follows:

- 8.70 metres @ 2.26 g/t gold equivalent from 33.40 metres downhole

- 124.40 metres @ 0.35 g/t gold equivalent from 84.20 metres downhole

- 211.50 metres @ 0.51 g/t gold equivalent from 329.45 metres downhole

- Relogging of previous drilling and interpretation of these new results and more extensive surface mapping in the San Antonio Project have resulted in the identification of three mineralized phases which outline a very large porphyry footprint and are summarized below:

- Phase 1 is a large, three kilometre x three-kilometre area displaying a phyllic altered, porphyry halo zone, which hosts low grade gold (0.2 g/t Au-0.5 g/t Au), extends from surface to a minimum of 700 metres depth and is open in all directions. At surface it envelops and includes the Pound, COP, COP West, Euro and Euro West targets. The Company plans to drill test all of these targets in 2025.

- Phase 2 is a late-stage, gold and silver rich sheeted veinlet system (CBM Veins) beginning at surface but with more robust grades from 300 metres below surface.

- Phase 3 is a gold-copper-silver-molybdenum porphyry system with potassic alteration (secondary biotite). This system commences at approximately 400 metres below surface and displays an unusually high gold to copper ratio of up to 4:1 in grade.

- Phase 2 mineralization locates close to or in contact with the Phase 3 porphyry system. Both Phase 2 and Phase 3 mineralized zones are found within the large Phase 1 mineralized porphyry halo. Examples of Phase 2 and Phase 3 mineralization are provided in assay Table 2 and Table 3.

- SAC-17 was drilled as an exploratory hole into a greenfield target named Real. The hole failed to intersect any material mineralization and as a result the Real target has been downgraded with no further drilling planned in this area.

Table 1: Assays Results for Drill Holes SAC-12, SAC-13, SAC-14, SAC-15, SAC-16, SAC-17 and SAC-18

| Hole # | From (m) |

To (m) |

Length (m) |

Au g/t |

Ag g/t |

Cu % |

Mo % |

AuEq g/t* |

| SAC-12 | 23.40 | 665.65 | 642.25 | 0.23 | 6 | 0.05 | – | 0.36 |

| Incl. | 172.60 | 197.95 | 25.35 | 0.38 | 12 | 0.13 | – | 0.71 |

| SAC-13 | 33.40 | 42.10 | 8.70 | 1.60 | 57 | – | – | 2.26 |

| and | 84.20 | 208.60 | 124.40 | 0.32 | 3 | – | – | 0.35 |

| and | 329.45 | 540.95 | 211.50 | 0.45 | 3 | 0.02 | 0.001 | 0.51 |

| Incl. | 531.40 | 540.95 | 9.55 | 1.79 | 2 | – | – | 1.69 |

| SAC-14 | 51.05 | 72.20 | 21.15 | 0.27 | 25 | 0.03 | 0.001 | 0.64 |

| and | 184.55 | 367.60 | 183.05 | 0.17 | 6 | 0.05 | – | 0.32 |

| and | 454.75 | 534.70 | 79.95 | 0.23 | 4 | 0.04 | – | 0.32 |

| SAC-15 | 443.10 | 597.30 | 154.20 | 1.12 | 11 | 0.03 | 0.001 | 1.22 |

| Incl. | 443.10 | 501.10 | 58.00 | 1.95 | 21 | 0.03 | 0.001 | 2.15 |

| & Incl. | 581.25 | 597.30 | 16.05 | 2.03 | 12 | 0.08 | – | 2.17 |

| SAC-16 | 14.00 | 39.40 | 25.40 | 0.25 | 6 | – | – | 0.32 |

| and | 144.00 | 155.90 | 11.90 | 0.75 | 126 | 0.02 | 0.002 | 2.59 |

| and | 179.85 | 194.40 | 14.55 | 1.22 | 57 | 0.04 | – | 2.09 |

| SAC-17 | NSV *Drilled in a different Target (Real) | |||||||

| SAC-18 | 571.70 | 744.10 | 172.40 | 1.40 | 17 | 0.16 | 0.007 | 1.88 |

| Incl. | 580.35 | 608.85 | 28.50 | 2.05 | 62 | 0.20 | 0.001 | 3.32 |

| & Incl. | 683.35 | 744.10 | 60.75 | 2.05 | 4 | 0.17 | 0.010 | 2.27 |

*AuEq (g/t) is calculated as follows: (Au (g/t) x 0.93) + (Ag (g/t) x 0.016 x 0.85) + (Cu (%) x 1.71 x 0.90) + (Mo (%) x 6.86 x 0.70) + (Zn (%) x 0.43 x 0.85) + (Pb (%) x 0.38 x 0.85) utilizing metal prices of Au – US$2,000/oz, Ag – US$32/oz, Cu – US$5.0/lb, Mo – US$20/lb, Zn – US$1.25/lb and Pb – US$1.10/lb and recovery rates of 93% for Au, 85% for Ag, 90% for Cu, 70% for Mo, 85% for Zn and 85% for Pb. AuEq (g/t) calculation considers Zn or Pb values when Zn>0.1% or Pb>0.05% for each intercept. Recovery rate assumptions are speculative as limited metallurgical work has been completed to date but is based on other comparable deposits in neighboring South American countries. True widths are unknown, and grades are uncut.

Table 2: Select Section of Assays Results for SAC-18 Highlighting the Mineralization of the Porphyry Zone (Phase 3) Encountered at the End of the Hole (Bottomed in Mineralization)

| From (m) |

To (m) |

Length (m) |

Au g/t |

Ag g/t |

Cu % |

Mo % |

AuEq g/t* |

| 717.00 | 717.85 | 0.85 | 0.88 | 4 | 0.30 | 0.011 | 1.41 |

| 717.85 | 719.10 | 1.25 | 0.44 | 3 | 0.20 | 0.021 | 0.85 |

| 719.10 | 720.90 | 1.80 | 0.77 | 3 | 0.28 | 0.005 | 1.21 |

| 720.90 | 722.10 | 1.20 | 1.72 | 4 | 0.33 | 0.007 | 2.19 |

| 722.10 | 723.25 | 1.15 | 1.14 | 4 | 0.32 | 0.004 | 1.63 |

| 723.25 | 724.50 | 1.25 | 0.49 | 3 | 0.19 | 0.014 | 0.86 |

| 724.50 | 725.75 | 1.25 | 0.76 | 5 | 0.37 | 0.009 | 1.40 |

| 725.75 | 727.00 | 1.25 | 0.49 | 2 | 0.18 | 0.005 | 0.79 |

| 727.00 | 728.00 | 1.00 | 0.41 | 1 | 0.13 | 0.004 | 0.63 |

| 728.00 | 729.00 | 1.00 | 0.62 | 2 | 0.18 | 0.004 | 0.90 |

| 729.00 | 730.15 | 1.15 | 0.94 | 3 | 0.28 | 0.005 | 1.37 |

| 730.15 | 731.40 | 1.25 | 0.73 | 3 | 0.22 | 0.014 | 1.13 |

| 731.40 | 732.75 | 1.35 | 0.90 | 3 | 0.25 | 0.009 | 1.31 |

| 732.75 | 733.80 | 1.05 | 0.56 | 3 | 0.23 | 0.012 | 0.97 |

| 733.80 | 734.80 | 1.00 | 0.55 | 2 | 0.15 | 0.045 | 0.98 |

| 734.80 | 735.65 | 0.85 | 0.44 | 2 | 0.13 | 0.010 | 0.68 |

| 735.65 | 736.70 | 1.05 | 0.92 | 3 | 0.18 | 0.008 | 1.22 |

| 736.70 | 738.70 | 2.00 | 0.39 | 2 | 0.13 | 0.006 | 0.61 |

| 738.70 | 740.00 | 1.30 | 0.62 | 2 | 0.14 | 0.005 | 0.84 |

| 740.00 | 741.30 | 1.30 | 0.43 | 2 | 0.07 | 0.003 | 0.54 |

| 741.30 | 742.50 | 1.20 | 0.34 | 3 | 0.14 | 0.005 | 0.60 |

| 742.50 | 744.10 | 1.60 | 1.91 | 6 | 0.07 | 0.013 | 2.03 |

| Weighted Average | 27.10 | 0.76 | 3 | 0.20 | 0.010 | 1.10 | |

*AuEq (g/t) is calculated as follows: (Au (g/t) x 0.93) + (Ag (g/t) x 0.016 x 0.85) + (Cu (%) x 1.71 x 0.90) + (Mo (%) x 6.86 x 0.70) utilizing metal prices of Au – US$2,000/oz, Ag – US$32/oz, Cu – US$5.0/lb and Mo – US$20/lb and recovery rates of 93% for Au, 85% for Ag, 90% for Cu and 70% for Mo. Recovery rate assumptions are speculative as limited metallurgical work has been completed to date but is based on other comparable deposits in neighboring South American countries. True widths are unknown, and grades are uncut.

Table 3: Select Section of Assays Results for SAC-18 Highlighting the Porphyry Related, Late-Stage Sheeted Gold and Silver Rich Zone Located Above and Contiguous to the Porphyry Mineralization (Phase 2)

| From (m) |

To (m) |

Length (m) |

Au g/t |

Ag g/t |

Cu % |

Zn % |

Pb % |

AuEq g/t* |

| 582.50 | 583.75 | 1.25 | 1.35 | 17 | 0.65 | – | – | 2.51 |

| 583.75 | 584.60 | 0.85 | 1.07 | 9 | 0.20 | – | – | 1.43 |

| 584.60 | 585.60 | 1.00 | 0.58 | 2 | 0.08 | – | – | 0.68 |

| 585.60 | 586.60 | 1.00 | 0.55 | 2 | 0.10 | – | – | 0.69 |

| 586.60 | 587.70 | 1.10 | 1.31 | 9 | 0.14 | – | – | 1.56 |

| 587.70 | 589.00 | 1.30 | 0.26 | 1 | 0.04 | – | – | 0.32 |

| 589.00 | 589.90 | 0.90 | 1.26 | 4 | 0.32 | – | – | 1.71 |

| 589.90 | 590.80 | 0.90 | 0.81 | 2 | 0.15 | – | – | 1.00 |

| 590.80 | 591.70 | 0.90 | 0.73 | 2 | 0.17 | – | – | 0.97 |

| 591.70 | 592.70 | 1.00 | 3.82 | 91 | 0.16 | 0.43 | 0.28 | 5.29 |

| 592.70 | 593.70 | 1.00 | 1.28 | 425 | 0.59 | 6.23 | 2.84 | 11.06 |

| 593.70 | 595.00 | 1.30 | 4.86 | 56 | 0.12 | 0.27 | 0.16 | 5.62 |

| 595.00 | 596.00 | 1.00 | 1.44 | 28 | 0.13 | – | – | 1.92 |

| 596.00 | 597.10 | 1.10 | 5.81 | 400 | 0.62 | 4.25 | 2.86 | 14.27 |

| 597.10 | 598.25 | 1.15 | 4.19 | 257 | 0.38 | 1.26 | 0.59 | 8.63 |

| 598.25 | 599.10 | 0.85 | 7.57 | 33 | 0.11 | 0.29 | 0.13 | 7.82 |

| 599.10 | 600.00 | 0.90 | 0.89 | 10 | 0.18 | – | – | 1.26 |

| 600.00 | 601.30 | 1.30 | 6.54 | 13 | 0.08 | – | – | 6.39 |

| 601.30 | 602.50 | 1.20 | 1.75 | 170 | 0.11 | – | – | 4.12 |

| 602.50 | 603.80 | 1.30 | 1.51 | 12 | 0.06 | – | – | 1.66 |

| 603.80 | 605.20 | 1.40 | 1.75 | 27 | 0.13 | 0.16 | 0.06 | 2.28 |

| Weighted Average | 22.70 | 2.39 | 75 | 0.21 | 0.61 | 0.33 | 3.92 | |

*AuEq (g/t) is calculated as follows: (Au (g/t) x 0.93) + (Ag (g/t) x 0.016 x 0.85) + (Cu (%) x 1.71 x 0.90) + (Zn (%) x 0.43 x 0.85) + (Pb (%) x 0.38 x 0.85) utilizing metal prices of Au – US$2,000/oz, Ag – US$32/oz, Cu – US$5.0/lb, Zn – US$1.25/lb and Pb – US$1.10/lb and recovery rates of 93% for Au, 85% for Ag, 90% for Cu, 85% for Zn and 85% for Pb. AuEq (g/t) calculation considers Zn or Pb values when Zn>0.1% or Pb>0.05% for each intercept. Recovery rate assumptions are speculative as limited metallurgical work has been completed to date but is based on other comparable deposits in neighboring South American countries. True widths are unknown, and grades are uncut.

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective is a gold, silver, copper and tungsten exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interest in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo system, which hosts the large-scale, bulk-tonnage and high-grade gold-silver-copper-tungsten Apollo system. The Company’s objectives are to improve the overall grade of the Apollo system by systematically drill testing newly modeled potentially high-grade sub-zones, expand the newly discovered high-grade Ramp Zone along strike and to depth and drill a series of greenfield generated targets on the property.

Additionally, the Company has launched its largest drilling campaign in history at the San Antonio Project as it looks to the expand upon the newly discovered porphyry system. The San Antonio Project is located between two kilometres and five kilometers east-northeast of the Guayabales Project and could potentially share infrastructure given their close proximity to each other.

Management, insiders, a strategic investor and close family and friends own 44.5% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on both the NYSE and TSX under the trading symbol “CNL”.

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock, soils and core samples from the San Antonio Project have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru; and at Actlabs laboratory facilities in Medellin, Colombia and Toronto, Canada. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Figure 1: Plan View of the San Antonio Project Highlighting the Mineralized Corridor of the Pound Target and Significant Assay Results Announced Today and Previously (CNW Group/Collective Mining Ltd.)

Figure 2: Cross section along SAC-11, SAC-15, SAC-18 and SAC-21 Showing the High MVI Anomaly Correlated with Au-Ag-Cu-Mo Porphyry Mineralization at the Pound Target (CNW Group/Collective Mining Ltd.)

Figure 3: Drill Hole SAC-18 Split Core Highlighting the Gold-Copper-Silver-Molybdenum Porphyry Mineralization (Left) and the Late-Stage High-Grade Gold and Silver Sheeted Porphyry Veinlets (Right) Encountered from Drilling at the Pound Target (CNW Group/Collective Mining Ltd.)

Figure 4: Image of the San Antonio Project and its Targets (foreground) and the Guayabales Project (background) Highlighting the Potential for Shared Future Infrastructure. Note the Hydro Power and the Vastly Unpopulated Landscape (CNW Group/Collective Mining Ltd.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE