Colibri Samples 9.84 g/t Au on the Plomo Property at the EP Project, Caborca Gold Belt, Sonora

Colibri Resource Corporation (TSX-V: CBI) (OTC Pink: CRUCF) is very pleased to report the results of geological mapping and outcrop sampling at the Pavo Real target on the Plomo property, EP Gold Project, Caborca Gold Belt, northwestern Sonora. Results have confirmed and expanded the footprint of gold in tourmaline altered diorite at Pavo Real and include a high of 9.48 grams per tonne Au.

Ron Goguen, President & CEO of Colibri commented, “We are very encouraged by the results of our inaugural exploration work program on the Plomo property, which we acquired in March. This work represents the first steps in the evaluation of Plomo’s large and highly prospective land position within the EP Gold Project. Colibri will continue to aggressively advance towards a maiden drill program at Plomo”.

PAVO REAL HISTORY & RESULTS

Historical work at the Pavo Real target documents widespread tourmaline alteration including tourmaline in NW trending structures reported to be traced over a 600 m strike length and containing anomalous gold values including 5.82 g/t Au. Due diligence reconnaissance field work, conducted earlier in year, confirmed the presence of tourmaline-quartz alteration (commonly forming overprinting stock work and breccia textures) and sampling confirmed the presence of Au with several grab samples greater than 1 g/t Au and a high-grade grab sample of 9.94 g/t Au.

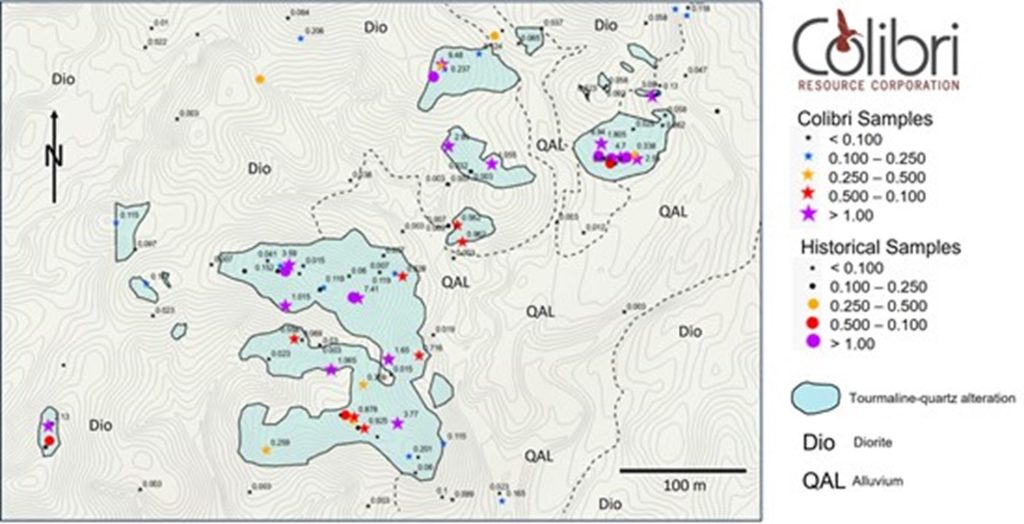

A selected area at Pavo Real, approximately ½ km x ½ km, was mapped and 90 grab samples were collected for Au analyses (see Map 1). Au was detected in all but 11 of the samples, 38 of the samples returned values greater than 0.1 g/t Au, 13 samples returned values greater than 1.0 g/t Au with the highest grade sample being 9.84 g/t Au. Mineralized samples (> 0.1 g/t Au) are characterized by quartz-tourmaline breccia matrix and stockwork overprinting a quartz, sericite, tourmaline, pyrite (Fe-oxide) altered felsic host rock. The higher-grade samples also commonly include veinlets mapped as jasperoid which in thin section was determined to be a very fine grained assemblage of limonite and hematite and interpreted to possibly be derived from a primary Fe-carbonate bearing vein assemblage. The mineralized tourmaline bearing breccia and stock work samples are massive to strongly foliated where foliation consistently has a north-northwest strike and moderate northeast dip. Northwest and northeast trending structures and associated apparent grade directional trends are evident on the Plomo property (as well as Evelyn). These structural orientations are important in the regional geological evolution and control the occurrence of major gold deposits in the Caborca Gold Belt.

Illustration 1: Grab samples and geology on topo contour map, Pavo Real Target area

EP PROJECT NEXT STEPS

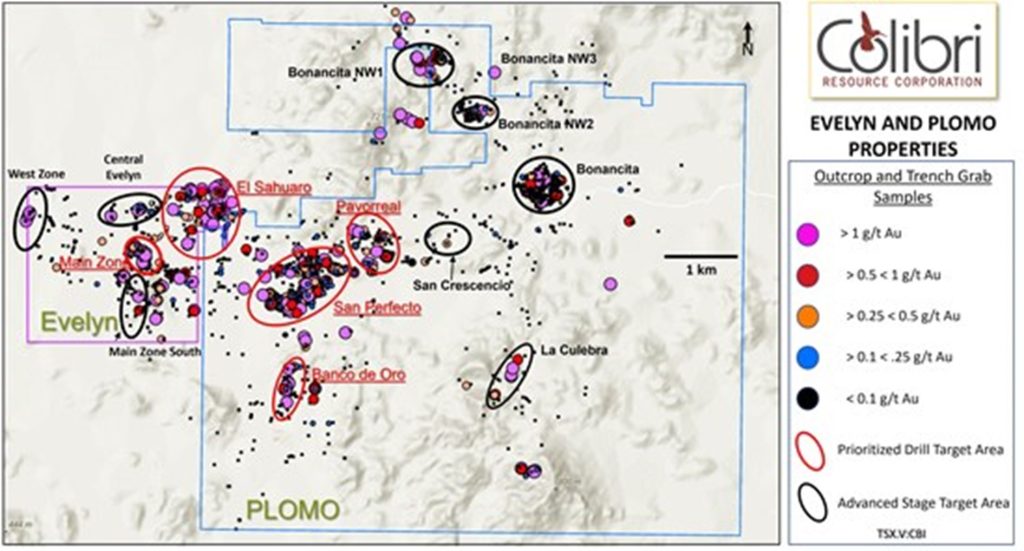

The Company continues to evaluate both the Evelyn and Plomo properties of the EP Gold Project with the objective of advancing prospects and prioritizing drill targets. The Company will continue to evaluate mineralized domains at the Pavo Real target, as indicated by mapping and sampling to date, and anticipates continued exploration to include geological mapping as well as trenching with a mechanical shovel. Assays are pending from geological mapping and sampling also recently completed at the Banco de Oro and La Bonancita targets. On the Evelyn side, the Company is currently planning a RC drilling program to follow up on positive soil geochemistry results north and south of the Main Zone a well as west of El Sahuaro

ABOUT PLOMO

The newly acquired Plomo property is contiguous with the Company’s Evelyn Property and collectively they comprise the Company’s EP Gold Project covering a total area of 4,766 Ha. The EP Gold Project is located in the 500 km long, northwest trending Caborca Gold belt which includes the > 15 million ounce La Herradura Mine, located 30 km west of Plomo, the > 2-million-ounce Noche Buena Mine located approximately 8 km southwest of Plomo, and the past producing Soledad-Dipolos Mine (> 3 Moz Au) located approximately 32 km to the northwest (see attached map 2).

Highlights of the Plomo Property include:

- The historical database, totaling 1,853 surface rock samples, includes 524 samples greater than 0.1 grams per tonne (“g/t”) Au, 132 samples greater than 1.0 g/t Au, and 15 high grade samples greater than 10 g/t Au. Surface exploration including prospecting, mapping, and rock sampling since 2007 has resulted in the identification of 9 target areas on the Plomo property (see Map 3)

- Underground sampling completed in the adit at the Banco de Oro prospect in 2008 are reported to have included 298.0 g/t Au over a chip length of 2.4 metres

- The Plomo property has been the subject of only very limited exploration drilling, completed in 2008, with a total of 1,570 meters completed in 10 holes. Highlights of the drilling are 0.66 g/t Au over an intersection length of 11.65 metres (“m”) and 0.92 g/t Au over an intersection length of 4 m.

- The Plomo property has had small scale artisanal mining including pits, adits, and placer mining dating back to the 18th century. The first recorded exploration was in 2006 and the property has been the subject of only episodic exploration since that time.

- Mapping completed by Colibri geologists confirmed vein style mineralization consisting of veins, veinlets, and vein stockworks, altered host rocks that include intense silicification, sericite, disseminated pyrite, and locally tourmaline bearing stockworks and breccias.

- Sampling by Colibri completed during its due diligence evaluation confirmed the historical distribution of high-grade samples at Plomo and included twenty-five grab samples with values > 1.0 g/t Au, including 6 samples with values > 5 g/t Au. A total of 62 grab samples taken by Colibri during due diligence sampling returned Au assay values > 0.1 g/t Au.

Illustration 2: Location of the Evelyn & Plomo (“EP”) properties within Caborca Gold Belt

Illustration 3: Evelyn & Plomo Outcrop & Trench Grab Samples

QAQC

Assays for the Plomo mapping and sampling program have been completed at ALS Laboratories (ALS) with sample preparation completed in Hermosillo, Sonora and Atomic Absorption and Fire Assay analyses completed in Vancouver, Canada. Colibri employs industry standard QAQC protocol including the use of control samples (Certified Standards and Blanks) and check assays. Jamie Lavigne, P. Geo has supervised the drilling program at Evelyn.

QUALIFIED PERSON

Jamie Lavigne, P. Geo and a Director for Colibri is a Qualified Person as defined in NI 43-101 and has reviewed and approved the technical information in this press release.

ABOUT COLIBRI RESOURCE CORPORATION:

Colibri is a Canadian-based mineral exploration company listed on the TSX-V and is focused on acquiring and exploring prospective gold & silver properties in Mexico. The Company holds seven high potential precious metal projects of which six have planned exploration programs for calendar 2023.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE