Chris Temple – “Thankful for Cascabel – Now officially a “Tier One” asset”

(From Nov. 22, 2018–Thanksgiving Day in the U.S.)

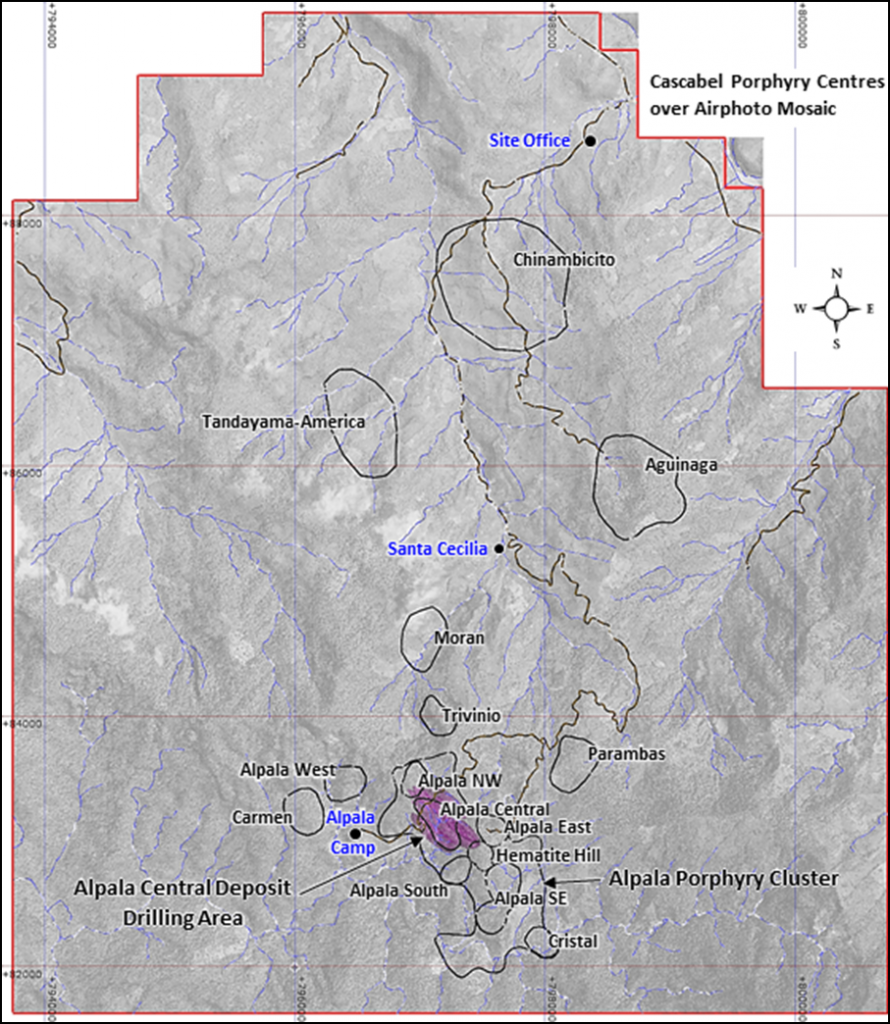

Aerial view of the main drilling camp targeting in/around

the main Alpala Prospect at Cascabel

It was only a week and a half ago that I passed along the latest impressive assay results from SolGold’s ongoing aggressive drilling campaign at the monstrous Cascabel concession in Ecuador.

A bit ahead of expectations, SolGold this week released the eagerly-awaited upgrade to the initial resource estimate on the Alpala prospect area. And suffice it to say, it was the latest big step in the evolution of this world-class asset; now, to official “Tier One” status.

Keep in mind that the HUGE resource at this now Tier One asset continues to grow; yet is just one central target of many at what should be a multi-generational producer of Cascabel.

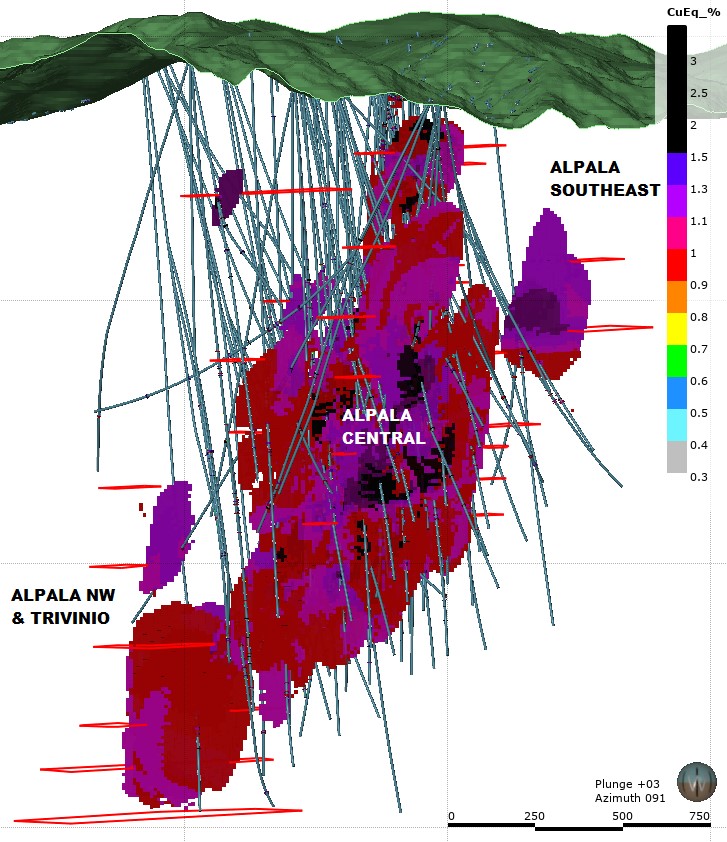

The biggest takeaway of this week’s news (see RIGHT HERE for all the details at junior partner Cornerstone Capital Resources‘ web site) was the growth of the high-grade “core” area at Alpala.

Now, the overall, growing resource is anchored by a larger high-grade indicated resource of 400 million tonnes of 1.49% copper equivalent. That breaks down to what will likely be an initial development target (as of now) containing 3.6 million tonnes of copper and 11.9 million ounces of gold.

Said President and C.E.O. Brooke Macdonald of Cornerstone (the initial discoverer and concession owner at Cascabel), “We are pleased that the increase in high grade resources has been added within or adjacent to the previous high grade envelope suggesting a robust target for early extraction of higher grade material. We are also confident that continued exploration on other Cascabel targets will add to the total mineral inventory.” (Emphasis added.)

That the core is now far larger is a step in the overall de-risking of the project, and revealing it as one that could be developed at an acceptable cost given these high grades. Further, with the entire resource (albeit some of the rest right now at lower grades and still inferred) now totaling 10.9 million tonnes of copper and 23.2 million ounces of gold, it is additionally the “Tier One”-sized asset that majors will want to have. (NOTE: For a broader look at the resource breakdown and more of SolGold’s exploration plans to augment it further, I encourage you to check out THEIR OWN NEWS of the past week.)

RECOGNITION GROWING ELSEWHERE

Happily, our Members got in on the ground floor here, when both SolGold, plc (TSX-SOLG; LSE-SOLG) and Cornerstone (TSXV-CGP; OTC-CTNXF) were selling for a fraction of their present valuations.

Now, with Ecuador generally and Cascabel particularly bursting to the front of the line of the consciousness of the world’s mining industry, belated coverage is appearing elsewhere at an increasing rate. And that’s especially true following this week’s resource upgrade!

For those who would like further color to this, check out the following:

* THIS ARTICLE from Financial Review, now characterizing the project as a Tier One copper discovery.

* THIS ITEM from Forbes contributor Tim Treadgold. Though he seems somewhat a Rip Van Winkle only now awake to Ecuador’s emergence as the planet’s most important new jurisdiction, etc., it’s noteworthy that this publication now contains coverage of the story!

* My own Twitter feed — https://twitter.com/NatInvestor and Facebook pages — https://www.facebook.com/TheNationalInvestor/ — where this past few days I have highlighted and passed along several other coverages.

WHAT’S NEXT?

It’s universally expected that the many outstanding assays still here from 2018’s drilling will ultimately add further to the overall resource, as well as converting still more of it from the inferred to indicated categories. It’s uncertain as of now whether that all will manifest itself in yet another upgrade, or maybe first in what is an expected upcoming PEA in the first half of 2019.

Aside from that, I’m especially interested in two possible looming developments:

- Any new satellite discoveries away from Alpala, especially any that are nearer surface. Such a thing would provide further attraction to the idea that the overall Cascabel concession is its own bona fide mining camp in the making; one that could produce for generations.

- The next moves by BHP Billiton, Newcrest (and/or others?) to get their own bigger piece of this monster. These latest numbers have prompted analysts covering SOLG to significantly up their price targets on that company; on average to more than doubleits current market price. And no doubt chatter will be increasing as we move toward the day when one or more of these global mining giants steps up in a bigger way to make sure IT will at least have a major hand in developing this deposit some day soon.

In the case of Cornerstone, it’s overly simplistic to expect that its shares, too, should merely keep up with SOLG, given that CGP owns–both directly and indirectly–some 23% of Cascabel. As I have explained previously, it conceivably could be the key to eventual majority control of Cascabel for another company.

Already, some were speculating that either Newcrest (which presently owns 14.5% of SolGold) or BHP (now up to over 11%) could just as easily buy Cornerstone as anything else to increase their stakes. Now that the growth of this world-class resource into a Tier One asset is confirmed, this talk may well increase.

I’ll repeat what I said the other day: Things should continue to get ever more interesting here!

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE