The Prospector News

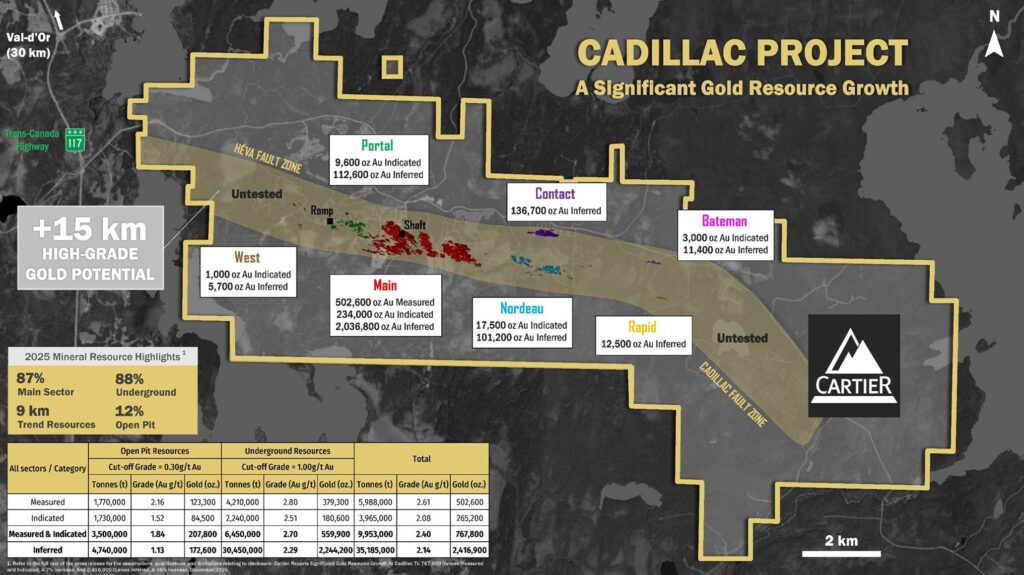

Cartier Reports Significant Gold Resource Growth At Cadillac With 9,953,000 tonnes at a grade of 2.40g/t Au for 767,800 Ounces Measured and Indicated, a 7% Increase and 35,185,000 tonnes at a grade of 2.14g/t Au for 2,416,900 Ounces Inferred, a 48% Increase

You have opened a direct link to the current edition PDF

Open PDF CloseCartier Reports Significant Gold Resource Growth At Cadillac With 9,953,000 tonnes at a grade of 2.40g/t Au for 767,800 Ounces Measured and Indicated, a 7% Increase and 35,185,000 tonnes at a grade of 2.14g/t Au for 2,416,900 Ounces Inferred, a 48% Increase

Cartier Resources Inc. (TSX-V: ECR) (FSE: 6CA) is pleased to announce the results of the Updated Mineral Resource Estimate on its 100% owned flagship Cadillac Project, located in Val-d’Or. The updated estimates include approximately 110,000 metres of drilling completed by Cartier from 2016 to 2024 as well as 420,000 metres drilling completed by previous mining companies. The MRE was independently prepared by PLR Resources Inc. and Evomine, specialists in mineral resource estimates and project evaluations, in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects and is dated December 17, 2025.

Strategic & Investment Significance Highlights of the Updated Mineral Resource Estimate

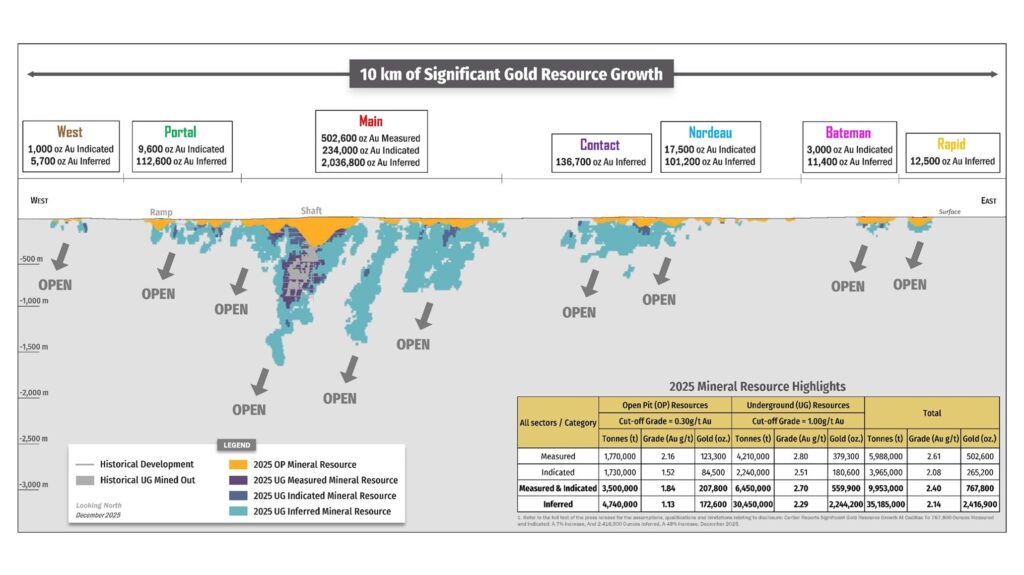

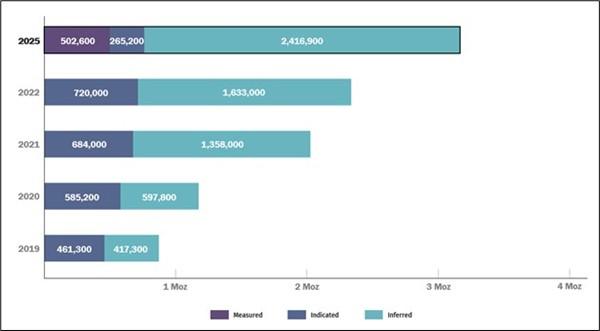

- Growing gold resource: Compared to the 2023 Preliminary Economic Assessment, total gold resources now contains 9,953,000 tonnes at a grade of 2.40g/t Au for 767,800 ounces Measured & Indicated (a 7% increase) and 35,185,000 tonnes at a grade of 2.14g/t Au for 2,416,900 ounces Inferred (a 48% increase), following the first-ever consolidation (2022) of all gold sectors across the entire Cadillac project.

- Increasing confidence & de-risking: M&I resources represent 25% of total resources, including 5,988,000 tonnes at a grade of 2.61g/t Au for 502,600 ounces Measured, strengthening the project’s development profile.

- Flexible development pathways: 12% of total gold resources are pit-constrained, offering near-term optionality with 3,500,000 tonnes at a grade of 1.84g/t Au for 207,800 ounces M&I and 4,740,000 tonnes at a grade of 1.13g/t Au for 172,600 ounces Inferred.

- Large underground resource & existing infrastructure advantages: Over 88% of total gold resources are underground-constrained with 6,450,000 tonnes at a grade of 2.70g/t Au for 559,900 ounces M&I and 30,450,000 tonnes at a grade of 2.29g/t Au for 2,244,200 ounces Inferred. This large resource is supported by valuable historical infrastructure including a 920 m shaft, 500 m ramp and 7 km of drifts, these could significantly reduce future capital requirements and allow management to adapt development strategies.

- Camp-scale upside potential: Gold sectors extend over 9 km along the Cadillac and Héva Fault Zones, covering 66% of a 15 km highly prospective gold corridor, leaving 6 km of strike with strong upside potential to be fully explored for resource expansion.

- High-quality core sector: The Main Sector (Chimo, East Chimo and West Nordeau deposits) hosts 87% of total resources within a 3 km mineralized trend and remains open at depth and along strike, providing strong leverage to further drilling success.

- Significant exploration target: A conceptual exploration target of 8 to 12 Mt of mineralization grading between 2.2 to 2.8 g/t Au, representing 600,000 to 1,100,000 ounces of gold, highlights the project’s potential to materially grow beyond the current resource base.

“The updated gold resource, incorporating both pit-constrained and underground scenarios, represents a new achievement and positions Cartier with a high degree of development flexibility at the Cadillac Project. This optionality enhances the project’s strategic value and will be further assessed through an updated PEA. Cadillac stands out as one of the few large-scale Quebec gold projects still delivering rapid resource growth, situated in a top-tier, pro-mining jurisdiction with established infrastructure and workforce. We look forward to advancing key value-creation milestones in 2026.” – Philippe Cloutier, President and CEO of Cartier.

“Since acquiring the project in 2016 and consolidating the east–west extensions in 2022, the Cartier team has systematically de-risked and enhanced the asset’s gold potential through consistent exploration success and a robust, standardized geological model. The ongoing 100,000-m drilling program is designed to test the property at a mining camp scale, support continued resource growth, and deliver meaningful exploration and blue-sky upside, positioning the project for further value-accretive discoveries.” – Ronan Deroff, Vice President Exploration of Cartier.

Upcoming Milestones

100,000 m drilling program (Q3 2025 to Q2 2027)

The ambitious 600-hole drilling program will both expand known gold zones (0 to 300 m deep) and test new shallow surface high-potential targets. The Company has implemented VRIFY’s AI-Assisted Mineral Discovery Platform (DORA) to guide exploration priorities and optimize drill targeting across the land package. The objective is to unlock the camp-scale, high-grade gold potential along the 15 km Cadillac and Héva Fault Zones.

Environmental baseline studies & economic evaluation of Chimo mine tailings (Q3 2025 to Q3 2026)

The studies will provide a comprehensive understanding of the current environmental conditions and implement operations that minimize environmental impact while optimizing the economic potential of the project. These studies will be supplemented by an initial assessment of the past-producing Chimo mine tailings to determine whether a quantity of gold can be extracted economically.

Metallurgical sampling and testwork program (Q4 2025 to Q1 2026)

The comprehensive program will characterize the mineralized material, gold recovery potential and validate optimal grind size defining the most efficient and cost-effective flowsheet. The data generated will directly support optimized project development and have the potential to significantly reduce both capital and operating costs, while also improving revenue generation and reducing the environmental footprint.

Preliminary economic assessment (2026)

Internal engineering studies have been initiated to validate a multitude of development scenarios that consider the updated MRE and current market environment. Following the selection of the most optimal scenario, a PEA will be completed which will also build upon the results of the metallurgical testwork program and the environmental baseline studies to unveil the updated development strategy and vision of the project.

Table 1: Results of the Updated Mineral Resource Estimate

| All sectors / Category |

Open Pit Resources | Underground Resources | Total | ||||||

| Cut-off Grade = 0.30g/t Au | Cut-off Grade = 1.00g/t Au | ||||||||

| Tonnes (t) | Grade (Au g/t) |

Gold (oz) | Tonnes (t) | Grade (Au g/t) | Gold (oz) | Tonnes (t) | Grade (Au g/t) |

Gold (oz) | |

| Measured | 1,770,000 | 2.16 | 123,300 | 4,210,000 | 2.80 | 379,300 | 5,988,000 | 2.61 | 502,600 |

| Indicated | 1,730,000 | 1.52 | 84,500 | 2,240,000 | 2.51 | 180,600 | 3,965,000 | 2.08 | 265,200 |

| Measured & Indicated | 3,500,000 | 1.84 | 207,800 | 6,450,000 | 2.70 | 559,900 | 9,953,000 | 2.40 | 767,800 |

| Inferred | 4,740,000 | 1.13 | 172,600 | 30,450,000 | 2.29 | 2,244,200 | 35,185,000 | 2.14 | 2,416,900 |

- The independent qualified persons for the MRE, as defined by National Instrument (“NI”) 43-101 guidelines, is Pierre Luc Richard, P.Geo., of PLR Resources Inc., with contributions from Stephen Coates, P.Eng., of Evomine Consulting for cut-off grade estimation and open pit and underground stope optimization solids.

- These Mineral Resources are not mineral reserves as they have no demonstrated economic viability. No economic evaluation of these Mineral Resource has been produced. The quantity and grade of reported Inferred Resources in this MRE are uncertain in nature and there has been insufficient drilling to define these Inferred Resources as Indicated. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated category with continued drilling.

- The Qualified Persons are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issues that could materially affect the Mineral Resource Estimate.

- Calculations used metric units (metres, tonnes). Metal contents in the above table are presented in gram per tonne and troy ounces. Metric tonnages and ounces were rounded, and any discrepancies in total amounts are due to rounding errors.

- CIM definitions and guidelines for Mineral Resource Estimates have been followed.

Table 2: Sensitivity analysis with different gold price assumptions

| Measured | Indicated | Inferred | |||||||||

| Gold Price Assumption ($/oz.) |

Cut-off Grade (Au g/t) |

Method | Tonnes (t) | Grade (Au g/t) |

Gold (oz) |

Tonnes (t) | Grade (Au g/t) |

Gold (oz) |

Tonnes (t) | Grade (Au g/t) |

Gold (oz) |

| 4,000 | 0.75 | Underground | 4,010,000 | 2.64 | 339,600 | 1,580,000 | 2.18 | 110,700 | 33,970,000 | 1.99 | 2,169,200 |

| 0.20 | Open pit | 2,600,000 | 2.02 | 169,300 | 3,500,000 | 1.29 | 144,900 | 15,600,000 | 0.98 | 491,300 | |

| – | Total | 6,607,000 | 2.40 | 508,900 | 5,084,000 | 1.56 | 255,600 | 49,576,000 | 1.67 | 2,660,500 | |

| 3,500 | 0.85 | Underground | 4,250,000 | 2.72 | 371,500 | 1,890,000 | 2.28 | 138,300 | 34,080,000 | 2.12 | 2,319,900 |

| 0.25 | Open pit | 2,130,000 | 2.02 | 138,500 | 2,740,000 | 1.42 | 124,900 | 7,490,000 | 1.05 | 251,900 | |

| – | Total | 6,382,000 | 2.49 | 509,900 | 4,627,000 | 1.77 | 263,200 | 41,571,000 | 1.92 | 2,571,800 | |

| 3,000 (base case) |

1.00 | Underground | 4,210,000 | 2.80 | 379,300 | 2,240,000 | 2.51 | 180,600 | 30,450,000 | 2.29 | 2,244,200 |

| 0.30 | Open pit | 1,770,000 | 2.16 | 123,300 | 1,730,000 | 1.52 | 84,500 | 4,740,000 | 1.13 | 172,600 | |

| – | Total | 5,988,000 | 2.61 | 502,600 | 3,965,000 | 2.08 | 265,200 | 35,185,000 | 2.14 | 2,416,900 | |

| 2,500 | 1.20 | Underground | 4,230,000 | 2.91 | 394,900 | 2,250,000 | 2.79 | 201,500 | 25,940,000 | 2.50 | 2,088,000 |

| 0.35 | Open pit | 1,190,000 | 2.43 | 93,300 | 1,050,000 | 1.68 | 56,700 | 2,810,000 | 1.28 | 115,400 | |

| – | Total | 5,421,000 | 2.80 | 488,200 | 3,296,000 | 2.44 | 258,200 | 28,746,000 | 2.38 | 2,203,400 | |

| 2,000 | 1.50 | Underground | 4,120,000 | 3.21 | 425,500 | 1,940,000 | 3.27 | 203,900 | 19,990,000 | 2.81 | 1,807,400 |

| 0.45 | Open pit | 370,000 | 2.92 | 34,800 | 530,000 | 1.86 | 31,600 | 1,470,000 | 1.58 | 74,600 | |

| – | Total | 4,494,000 | 3.19 | 460,300 | 2,472,000 | 2.96 | 235,500 | 21,461,000 | 2.73 | 1,882,000 | |

Figure 1: Plan View of Gold Resources by Gold Sectors

Figure 2: Long Section of Gold Resources by Category

Figure 3: Significant Gold Resource Growth

Table 3: General stope parameters used of the Mineral Resource Estimate

| Parameter | Unit | Value | ||||

| Selling | Base Case | |||||

| Gold price | USD/oz | 2,000.00 | 2,500.00 | 3,000.00 | 3,500.00 | 4,000.00 |

| Exchange Rate | CAD/USD | 1.40 | 1.40 | 1.40 | 1.40 | 1.40 |

| Royalty | % | 1.50 | 1.50 | 1.50 | 1.50 | 1.50 |

| Selling cost | USD/oz | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 |

| Payability | % | 99.90 | 99.90 | 99.90 | 99.90 | 99.90 |

| Net selling price | CAD/oz | 2,748.35 | 3,437.16 | 4,125.97 | 4,814.79 | 5,503.60 |

| Operating costs | ||||||

| Mining cost | CAD/t mined | 90.00 | 90.00 | 90.00 | 90.00 | 90.00 |

| Process cost | CAD/t milled | 25.00 | 25.00 | 25.00 | 25.00 | 25.00 |

| General & administration cost | CAD/t milled | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 |

| Total ore-based cost | CAD/t milled | 125.00 | 125.00 | 125.00 | 125.00 | 125.00 |

| Processing | ||||||

| Throughput (range) | tpd | 4,500.00 | 4,500.00 | 4,500.00 | 4,500.00 | 4,500.00 |

| Mill recovery | % | 93.10 | 93.10 | 93.10 | 93.10 | 93.10 |

| Mining | ||||||

| Block size | m | Sub-blocked | Sub-blocked | Sub-blocked | Sub-blocked | Sub-blocked |

| Minimum mining width Longhole | m | 2.50 | 2.50 | 2.50 | 2.50 | 2.50 |

| Dilution (HW & FW) | m | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Stope height | m | 25.00 | 25.00 | 25.00 | 25.00 | 25.00 |

| Strike length | m | 8.25 | 8.25 | 8.25 | 8.25 | 8.25 |

| Cut-off grade | ||||||

| Marginal cut-off grade calculated | g/t | 1.52 | 1.21 | 1.01 | 0.87 | 0.76 |

| Marginal cut-off grade rounded | g/t | 1.50 | 1.20 | 1.00 | 0.85 | 0.75 |

Table 4: General pit parameters used of the Mineral Resource Estimate

| Parameter | Unit | Value | ||||

| Selling | Base Case | |||||

| Gold price | USD/oz | 2,000.00 | 2,500.00 | 3,000.00 | 3,500.00 | 4,000.00 |

| Exchange Rate | CAD/USD | 1.40 | 1.40 | 1.40 | 1.40 | 1.40 |

| Royalty | % | 1.50 | 1.50 | 1.50 | 1.50 | 1.50 |

| Selling cost | USD/oz | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 |

| Payability | % | 99.90 | 99.90 | 99.90 | 99.90 | 99.90 |

| Net selling price | CAD/oz | 2,748.35 | 3,437.16 | 4,125.97 | 4,814.79 | 5,503.60 |

| Operating costs | ||||||

| Mining cost | CAD/t mined | 6.00 | 6.00 | 6.00 | 6.00 | 6.00 |

| Process cost | CAD/t milled | 25.00 | 25.00 | 25.00 | 25.00 | 25.00 |

| General & administration cost | CAD/t milled | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 |

| Total ore-based cost | CAD/t milled | 35.00 | 35.00 | 35.00 | 35.00 | 35.00 |

| Processing | ||||||

| Throughput (range) | tpd | 4,500.00 | 4,500.00 | 4,500.00 | 4,500.00 | 4,500.00 |

| Mill recovery | % | 93.1 | 93.1 | 93.1 | 93.1 | 93.1 |

| Mining | ||||||

| Block size | m | 5x5x5 | 5x5x5 | 5x5x5 | 5x5x5 | 5x5x5 |

| Slope angle | ° | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 |

| Cut-off grade | ||||||

| Marginal cut-off grade calculated | g/t | 0.43 | 0.34 | 0.28 | 0.24 | 0.21 |

| Marginal cut-off grade rounded | g/t | 0.45 | 0.35 | 0.30 | 0.25 | 0.20 |

Notes Accompanying the Mineral Resource Estimate

- Resources are presented as undiluted and in situ for the open-pit scenario within 5m x 5m x 5m blocks and include internal dilution for the underground scenario and are considered to have reasonable prospects for economic extraction. The constraining pit shell was developed using overall pit slopes of 50 degrees. The pit optimization to develop the mineral resource-constraining pit shells was done using the pseudoflow algorithm in Deswik software. The stope optimization to develop the underground mineral resource was done using Deswik.SO software.

- The MRE wireframe was prepared using Leapfrog Edge v.2025.1.1 and is based on 4,477 drill holes, totalling 535,360 meters drilled and 167,978 assays. The cut-off date for the drill hole database was February 17, 2025.

- Composites of 1.0 metre were created inside the mineralization domains. High-grade capping was done on the composited assay data. Based on individual statistical study for each zone, composites were capped between 5.0 g/t Au and 110.0 g/t Au for the high-grade zones, and between 1.0 g/t Au and 5.0 g/t Au for the low-grade zones.

- Pit constrained Mineral Resources for the base case are reported at a cut-off grade of 0.30 g/t Au; DSO-constrained Mineral Resources for the base case are reported at a cut-off grade of 1.00 g/t Au and include internal dilution (must-take). The cut-off grades will be re-evaluated in light of future prevailing market conditions and costs.

- Specific gravity values were estimated using data available in the drill hole database. Density values between 2.80 and 2.88 were applied to the model for hard rock and 2.00 for overburden.

- Grade model resource estimation was calculated from drill hole data using an Ordinary Kriging interpolation method in a sub-blocked model using blocks measuring 5 m x 5 m x 5 m in size and sub-blocks down to 0.625m x 0.625m x 0.625m. Ordinary kriging (OK), inverse square distance (ID2), Nearest neighbour (NN) interpolation methods were tested, resulting in no material difference in the Mineral Resource Estimates.

- The Measured, Indicated and Inferred Mineral Resource categories are constrained to areas where drill spacing is less than 12.5m, 25m and 100 metres respectively and show reasonable geological and grade continuity. An additional requirement for the Measured category is the close proximity of underground infrastructure. Cookie cutters were used to define categories based on the above parameters. Based on historical mining and geological knowledge of the deposit, drill spacing was increased up to 140m in the shoot direction to define inferred resources for some zones.

Conceptual Exploration Target

A significant Exploration Target was identified during the preparation of the MRE. This conceptual Exploration Target is integrated into the model used for the MRE, with the aim of facilitating future targeting and drill hole planning.

Highlights of the Exploration Target

- Estimated total of 8 to 12 million tonnes of mineralization grading between 2.2 to 2.8 g/t Au, representing 600,000 to 1,100,000 million ounces of gold.

Disclosure warnings in respect to an exploration target review

- An exploration target is not a National Instrument 43-101 compliant resource or reserve.

- The Exploration Target is confirmed only as a target for further exploration.

- Potential quantity and grades are conceptual in nature only.

- There has not been sufficient drilling to define any mineral resource on this Exploration Target; drilling intercepts crosscut the Exploration Target but drill spacing is too scarce to classify these blocks as Inferred Mineral Resources.

- There is no certainty that further drilling will result in the target being delineated as a mineral resource.

- The assessment of the target for further exploration was completed by PLR Resources, a consultant independent of the company. The estimation of the potential quantity and grade of the exploration target was based on the same drill hole database used for the Mineral Resource Estimate. With the available drilling information, PLR developed conceptual mineralized zones. Core samples were composited, and the composited gold assays were capped (similarly to the Mineral Resource Estimate). The gold values were interpolated into a three-dimensional block model using Ordinary Kriging. To estimate a tonnage, PLR used the same specific gravity values used for the Mineral Resource Estimate.

- Underground DSO stopes were run to constrain the Exploration Target.

Qualified Person

The scientific and technical content of this press release has been prepared, reviewed and approved by Mr. Ronan Déroff, P.Geo., M.Sc., Vice President Exploration, who is a ″Qualified Person″ as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

The independent qualified persons for the MRE, as defined by National Instrument 43-101 guidelines, is Pierre-Luc Richard, P.Geo., of PLR Resources Inc., with contributions from Stephen Coates, P.Eng., of Evomine Consulting for cut-off grade estimation and open pit and underground stope optimization solids.

About Cadillac Project

The Cadillac Project, covering 14,000 hectares along a 15-kilometre stretch of the Cadillac Fault, is one of the largest consolidated land packages in the Val-d’Or mining camp. Cartier’s flagship asset integrates the historic Chimo Mine and East Cadillac projects, creating a dominant position in a world class gold mining district. With excellent road access, year-round infrastructure and nearby milling capacity, the project is ideally positioned for rapid advancement and value creation.

About Cartier Resources Inc.

Cartier Resources Inc., founded in 2006 and headquartered in Val-d’Or (Quebec) is a gold exploration company focused on building shareholder value through discovery and development in one of Canada’s most prolific mining camps. The Company combines strong technical expertise, a track record of successful exploration, and a fully funded program to advance its flagship Cadillac Project. Cartier’s strategy is clear: unlock the full potential of one of the largest undeveloped gold landholdings in Quebec.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE