Capitan Drills 35.1m of 0.42 G/T Aueq Incl. 4.6m of 1.1 G/T Aueq and Entered an Agreement to Buyback All Outstanding Royalties at the Penoles Project

Capitan Mining Inc. (TSX-V: CAPT) is pleased to report results for six reverse-circulation drill holes from the Capitan Hill oxide-gold deposit, at its 100%-owned Peñoles project in Durango, Mexico. In addition, management is also pleased to report that after several months of negotiation they have entered into a purchase agreement to acquire a portfolio of royalties including a 2% royalty on the Capitan Gold oxide deposit from Exploraciones Altiplano.

Highlights:

- Drillhole CARC 21-48: returned 35.1m of 0.42 g/t Aueq including 4.6m of 1.1 g/t Aueq

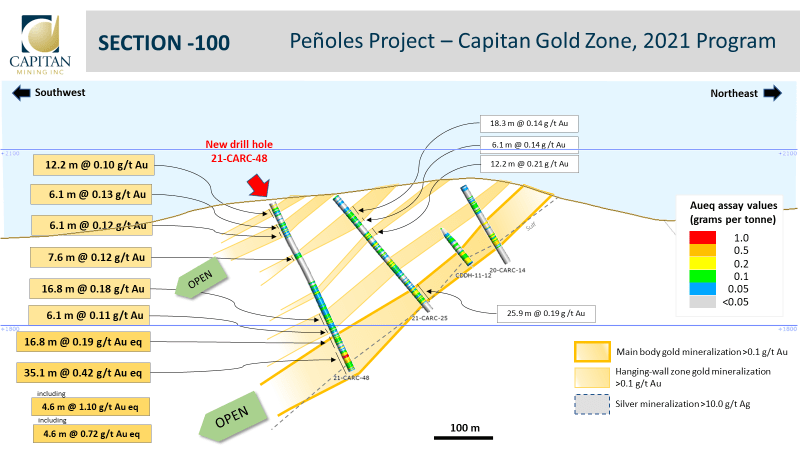

- Extends mineralization 170m down-dip from hole 21-CARC-25 on cross section -100

- Royalty Buyback: Total purchase price of royalty portfolio is US $1.0M over two years, payable in cash and shares

- The Altiplano royalty portfolio included a 2% net smelter royalty (NSR) on the Capitan Hill oxide-gold deposit

- Any shares issued to Altiplano are subject to right of first refusal (ROFR) allowing Capitan to market and place shares with investors if Altiplano elects to sell

- This transaction with Altiplano in combination with Capitan’s contractual option to retire Riverside Resources 1% royalty for C$250,000 will leave the Peñoles project royalty free and will enhance overall project economics for investors

- Drilling to resume in late January following holiday break

- Assays for 11 drill holes are pending

Royalty Purchase Agreement

Capitan Mining has entered into a purchase agreement to acquire all outstanding net smelter royalties (NSR’s) on mining claims in the Peñoles project from Exploraciones del Altiplano, a private Mexican exploration company. The royalties covered a number of targets including the current gold-silver resource areas of Capitan and Jesús María. This included a 2% NSR on the Capitan Hill claims, 0.75% on claims covering the Jesús María, San Rafael, Pinchazo and Capitan 2 targets and 0.5% on third-party claims surrounding these targets. The total consideration for the transaction is US$1.0M, which will be paid 50% in cash and 50% in Capitan shares over a staged 2-year payment schedule. Capitan will also retain a right of first refusal (ROFR) on any shares distributed to Altiplano as consideration for the royalty purchase; allowing the company the opportunity to place Altiplano’s shares, upon written notice from Altiplano of their intentions to sell.

In addition to the royalties held by Altiplano, the Peñoles project has a 1% royalty owned by Riverside Resources which was created as part of the asset spinout in 2020. Capitan has the contractual option to purchase and retire the Riverside royalty for C$250,000 at any time.

Capitan’s CEO, Alberto Orozco, stated: “We are very happy to have completed the purchase of the Peñoles project royalty portfolio from Exploraciones Altiplano. This agreement paves the way for the project to be royalty-free and will benefit all shareholders going forward, as we evaluate the economics of the Capitan Hill oxide-gold deposit.”

Exploration update: Capitan Hill Oxide-Gold Deposit

The results for the final 6 holes of the 2021 Phase 2 drill program at the Capitan Hill oxide-gold deposit are presented below. These drillholes consisted of both step-out drill holes located in the central and southeastern portion of the deposit as well as one infill hole located in the western portion of the deposit.

Central and Southeast Step-out Holes

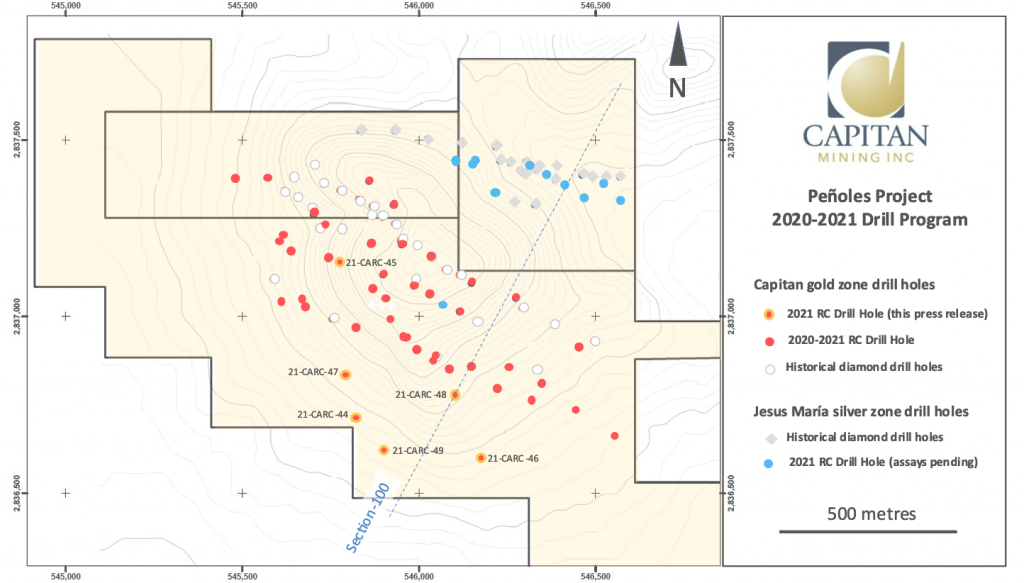

Holes 21-CARC-44, 46, 47, 48 and 49 tested the down-dip extension of the Capitan zone in the central and southeast portion of the deposit, to extend both the Capitan main and Hanging wall zones to the south.

Hole-21-CARC 48, was a 170m step-out on section -100, and was successful in extending mineralization on that respective section. The hole returned several, narrow, low-grade intervals over the first 200m of the hole, similar to adjacent holes that are on-strike and up-dip. Of particular significance, the hole returned the highest-grade interval to date in the southeastern portion of the Capitan deposit returning 35.1m of 0.42 g/t Aueq, including 4.6m of 1.1g/t Aueq. This interval occurred just before the hole terminated and is the deepest intersection of higher-grade mineralization to date at Capitan Hill. This intersection also supports the hypothesis that the holes above, may not have been drilled deep enough (zone was displaced to depth), given the position of mineralized interval in hole 21-CARC-48. (See Figures 1 & 2)

Holes 21-CARC-44, 46, 47, and 49 were large step-out holes located on sections 100, -250, 200, and 000 respectively. These step-out holes were drilled between 75 and 175m down-dip from the previous holes on their respective sections. In general, these holes returned relatively narrow, low-grade intercepts that did not correlate well with mineralization returned in previous drilling located up-dip (see Table 1 below). Given that the holes above were all drilled in the same vicinity as one another, it is interpreted that there may be some displacement of the main zone down-dip, possibly related to the Santa Theresa fault, which the holes crossed before they reached their target depth. Of note: the above holes were terminated due to the depth capacity of the rig, and ground conditions.

Figure 1: 2020-2021 Drill Hole Map at Capitan Hill Oxide-Gold Deposit

Figure 2: Cross Section

Strategic Infill

Hole 21-CARC-45 is located on section 350 and was designed to twin a historic diamond drill hole that was not sampled adequately. The hole intersected both the Hanging Wall and Capitan Main zone and returned width and grades typical of the mineralization in that area. In total, 74.7m of gold mineralization was encountered at the Capitan Main Zone in two separate intervals, with the best interval returning 44.2m at 0.28 g/t Aueq.

Summary of Phase 2 Program

The 2021 Phase 2 drill program was focused on testing and expanding the continuity of oxide gold mineralization at the Capitan Hill deposit, to better define the boundaries of both the Capitan Main Zone, and the more poorly defined Hanging Wall Zone.

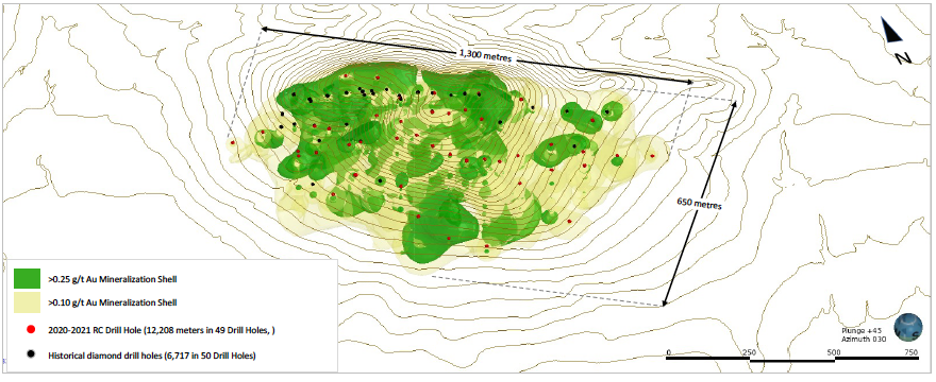

Step-out drilling during the 2021 Phase 2 program, has significantly expanded the footprint of both the Hanging Wall and Capitan Main zone compared to the 2020 envelope (See Figure 3). Additionally, infill drilling has helped to define higher-grade shoots within the lower grade envelope in the central and western portions of the deposit.

The Phase 2 program totals include 6,036m of drilling completed in 21 RC drillholes, bringing the total amount of drilling by Capitan to 12,208m. Drilling continues at Capitan’s Penoles project and management will provide guidance in a separate press release in the coming week.

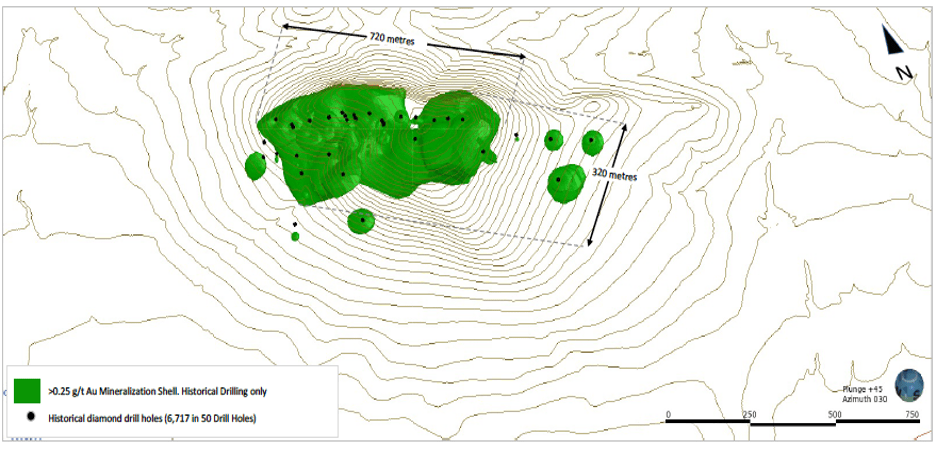

Figure 3a: Expansion of mineralization at the Capitan Hill oxide-gold deposit (3D View)

Figure 3b: Expansion of mineralization at the Capitan Hill oxide-gold deposit (3D View)

Top Image (3a): Historic (Pre-2020) Drillhole Locations, showing >0.25 g/t Au Isosurface Outline and Dimensions.

Bottom image (3b): Historic and 2020-21 Drillhole Locations, with current >0.25 g/t Au Isosurface Outline and Dimensions.

Table 1. Table of Drill Results (Holes 44-49)

| Hole Name | Az. | Dip | Section | Zone | From (m) | To (m) | Interval (m) | AuEq (g/t) * | Au (g/t) | Ag (g/t) | OX-SUL |

| 21-CARC-44 | |||||||||||

| Interval | 28 | 65 | 100 | Capitan Main | 79.2 | 82.3 | 3.0 | 0.11 | 0.11 | NSV** | OX |

| 21-CARC-45 | |||||||||||

| Interval | 28 | 55 | 350 | Hanging Wall | 7.6 | 21.3 | 13.7 | 0.14 | 0.14 | NSV** | OX |

| Interval | Hanging Wall | 25.9 | 44.2 | 18.3 | 0.17 | 0.17 | NSV** | OX | |||

| Interval | Capitan Main | 114.3 | 144.8 | 30.5 | 0.22 | 0.18 | 2.73 | OX | |||

| Interval | Capitan Main | 155.4 | 199.6 | 44.2 | 0.28 | 0.21 | 5.79 | MIX | |||

| 21-CARC-46 | |||||||||||

| Interval | 28 | 60 | -250 | Hanging Wall | 0.0 | 13.7 | 13.7 | 0.16 | 0.16 | NSV** | OX |

| Interval | Hanging Wall | 19.8 | 22.9 | 3.0 | 0.11 | 0.11 | NSV** | OX | |||

| 21-CARC-47 | |||||||||||

| Interval | 28 | 65 | 200 | Capitan Main | 236.2 | 239.3 | 3.0 | 0.25 | 0.24 | 1.15 | OX |

| Interval | Capitan Main | 254.5 | 271.3 | 16.8 | 0.28 | 0.25 | 2.46 | OX | |||

| 21-CARC-48 | |||||||||||

| Interval | 28 | 65 | -100 | Hanging Wall | 38.1 | 44.2 | 6.1 | 0.13 | 0.13 | NSV** | OX |

| Interval | Hanging Wall | 48.8 | 54.9 | 6.1 | 0.12 | 0.12 | NSV** | OX | |||

| Interval | Hanging Wall | 97.5 | 105.2 | 7.6 | 0.12 | 0.12 | NSV** | OX | |||

| Interval | Capitan Main | 157.0 | 160.0 | 3.0 | 0.12 | 0.12 | NSV** | OX | |||

| Interval | Capitan Main | 169.2 | 173.7 | 4.6 | 0.19 | 0.19 | NSV** | OX | |||

| Interval | Capitan Main | 198.1 | 202.7 | 4.6 | 0.12 | 0.12 | NSV** | OX | |||

| Interval | Capitan Main | 211.8 | 228.6 | 16.8 | 0.17 | 0.17 | NSV** | OX | |||

| Interval | Capitan Main | 249.9 | 266.7 | 16.8 | 0.19 | 0.16 | 2.04 | OX | |||

| Interval | Capitan Main | 280.4 | 315.5 | 35.1 | 0.42 | 0.39 | 2.58 | MIX | |||

| including | Capitan Main | 288.0 | 292.6 | 4.6 | 1.10 | 1.08 | 1.83 | OX | |||

| including | Capitan Main | 297.2 | 301.8 | 4.6 | 0.72 | 0.70 | 1.90 | OX | |||

| 21-CARC-49 | |||||||||||

| Interval | 28 | 65 | 00 | Hanging Wall | 42.7 | 45.7 | 3.0 | 0.29 | 0.29 | NSV** | OX |

Note: Only drill intercept lengths are reported in the table. Drill holes are designed to cut the mineralized zones as close to true width as possible, with true widths ranging from 70-95% of the reported drilled length.

* Gold equivalent calculated at 80:1 ratio

**No significant values.

Qualified Person & QA/QC:

The scientific and technical data contained in this news release pertaining to the Peñoles Project was reviewed and approved by Marc Idziszek, P.Geo, a non-independent qualified person to Capitan Mining, who is responsible for ensuring that the technical information provided in this news release is accurate and who acts as a “qualified person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Capitan Mining Inc. has a Quality Assurance/Quality Control program that includes insertion and verification of control samples including standard reference material, blanks and duplicates consistent with industry standards.

RC drill samples from the Peñoles Project are collected and split at the drill site using a Gilson Universal Splitter. The samples are stored in either plastic bags (dry) or micropore bags (wet) and secured with plastic zip-ties and then transported to the preparation laboratory of Bureau Veritas in Hermosillo, Sonora. The sample pulps are then transported to the Bureau Veritas’ laboratory in Vancouver, where they are assayed for gold by fire assay with atomic absorption finish (FA430 assay method code; 0.005 to 10 ppm detection limit). Samples over 10 ppm Au are assayed with gravimetric finish (Assay code FA530). All samples are also assayed by ICP-ES (code AQ300) for a suite of 33 elements.

All summarized intervals reported in this press release were calculated using a 0.10 ppm Au cut-off grade. Intervals contain no more than 3 metres of internal dilution. High grades have not been capped.

About Capitan Mining Inc.

Capitan Mining is a well-funded junior exploration company focused on its 100% owned gold and silver Peñoles Project in Durango, Mexico. The company is led by a management team that has successfully advanced and developed several heap leach operations in Mexico over the past 16 years.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE