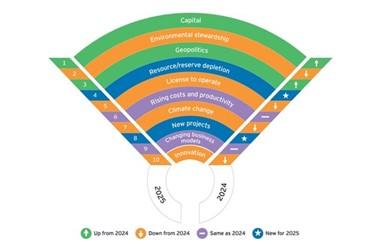

Capital is King as Miners Respond to Energy Transition

- The energy transition needs the Mining & Metals sector to accelerate growth and build additional capacity.

This trend along with the need to maintain capital discipline has elevated capital to the #1 risk for 2025 - Environmental stewardship, a key priority, has become the standout ESG issue

- Resource depletion debuts at #4 and new projects at #8 amid soaring minerals and metals demand, rising exploration costs and a lack of new discoveries

Traditional territory of the Mississaugas of the Credit, the Anishnabeg, the Chippewa, the Haudenosaunee and the Wendat peoples – The energy transition continues to disrupt the mining and metals sector and drive the leadership agenda, according to the EY top 10 business risks and opportunities survey for 2025.

“Companies are grappling with the challenge of meeting demand for minerals and metals while addressing a trifecta of pressures: maintaining capital discipline, achieving sustainable mining and meeting elevated stakeholder expectations,” says Theo Yameogo, EY Americas Mining & Metals Leader. “These competing priorities highlight the urgent need for mining and metals companies to rethink their strategy and operations to thrive in the future.”

Capital emerges as the top risk

Mining companies are under increasing pressure to manage capital effectively while making strategic investments in future growth. The continuing focus of miners on M&A needs to shift to building new mines, which will inevitably reduce returns in the short term.

“This year’s study reveals that capital access is now the top risk for mining companies, signaling a shift from short-term focus to long-term value,” says Yameogo. “While miners are known for capital discipline, they must now invest strategically to ensure sustainable growth.”

Environmental stewardship has become the standout ESG issue

Mining companies are continuing to prioritize nature-positive initiatives to meet growing investor expectations. This shift reflects a broader industry focus on environmental concerns, with almost half of respondents (46%) expressing confidence in meeting their nature-positive obligations.

Waste management has become a key area of scrutiny from investors. This year, the focus on waste is broader than just tailings, with progressive miners capturing value through improving mining performance, implementing closed-loop processes to minimize waste and reprocessing mining waste.

The commitment by International Council on Mining and Metals (ICMM) members to nature-positive goals has also driven greater attention to biodiversity, water management and other critical ESG issues across the sector.

Resource depletion and new projects become key concerns amid rising demand

Resource depletion, ranked fourth, and new projects, ranked eighth, are new risks identified in this year’s study, driven by soaring demand for critical minerals and rising exploration costs. Achieving global decarbonization targets by 2050 will require a significant increase in the number of mines and volumes produced. in fact, the next 30 years will require more mining than over the last 70,000 years. However, capital raised for exploration has declined by 4% year-on-year, with budgets favouring gold over critical minerals like copper. Lack of new discoveries and long permitting times add further complexity to the situation and put the energy transition at real risk.

“With few major copper discoveries in the last decade and an average of 15.7 years to bring a new mine online, we’re facing a critical supply gap,” says Yameogo. “Copper is essential to the energy transition, yet exploration budgets have been slow to shift towards critical minerals. Without accelerated investment and innovation in exploration, the world’s decarbonization goals are at serious risk.”

For more information on the latest mining and metals developments and to view the full report, visit

https://www.ey.com/en_ca/mining-metals/risks-opportunities-2025.

About EY

EY exists to build a better working world, helping create long-term value for clients, people and society and build trust in the capital markets.

Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform and operate.

Working across assurance, consulting, law, strategy, tax and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses personal data and a description of the rights individuals have under data protection legislation are available via ey.com/privacy. EY member firms do not practice law where prohibited by local laws.

Capital is king as miners respond to energy transition (CNW Group/EY (Ernst & Young))

MORE or "UNCATEGORIZED"

Doubleview Gold Corp. Reports Updated Mineral Resource Estimate as of February 25, 2026 Including a Copper Equivalent Mineral Resource: 609 (Mt) of Measured and Indicated Resources at 0.43% CuEq containing CuEq 5.82 Billion lbs. 503 (Mt) of Inferred Resources at 0.41% CuEq containing CuEq 4.57 Billion lbs

Doubleview Gold Corp (TSX-V: DBG) (OTCQB: DBLVF) (FSE: 1D4) is pleased to announce the update... READ MORE

NexGold Intersects 9.30 g/t Gold Over 11.0 Metres and 2.31 g/t Gold Over 21.5 Metres at the Goldlund Deposit, Ontario

NexGold Mining Corp. (TSX-V: NEXG) (OTCQX: NXGCF) is pleased to provide additional results f... READ MORE

Canterra Minerals Extends Lundberg Deposit with 86m of 0.91% CuEq at Buchans Project, Newfoundland

Canterra Minerals Corporation (TSX-V:CTM) (OTCQB: CTMCF) (FSE:DXZB) is pleased to announce drill re... READ MORE

Osisko Intersects 694 Metres Averaging 0.31% Cu at Gaspé

Osisko Metals Incorporated (TSX: OM) (OTCQX:OMZNF) (FRANKFURT: 0B51) is pleased to announce new dri... READ MORE

West Red Lake Gold Reports 219.73 g/t Au over 4.8m, 148.36 g/t Au over 3m and 133.13 g/t Au over 2.5m in Austin 904 Complex – Madsen Mine

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is pleased to report drill results from i... READ MORE