Canterra Minerals Intersects 68 metres of 1.0% CuEq from Surface at the Buchans Project, Newfoundland

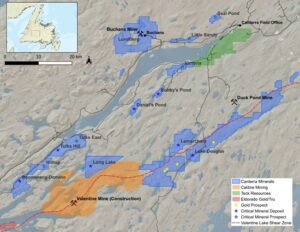

Canterra Minerals Corporation (TSX-V: CTM) (OTCQB: CTMCF) (FSE: DXZB) is pleased to announce additional drilling results from its ongoing 10,000 metre drill program at its 100% owned Buchans Project in the Central Newfoundland Mining District, located 50 kilometres north of Equinox Gold’s Valentine Gold Mine and 34 km northwest of Teck’s past producing Duck Pond Mine (Figures 1 & 2).

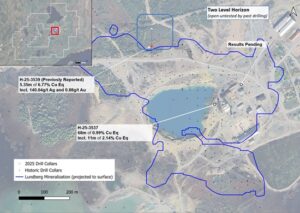

Drill Highlights and Insights from Drillhole H-25-3537 (1&2):

- 68.0m of 1.0% CuEq (0.50% Cu, 1.00 % Zn, 0.43% Pb, 3.5 g/t Ag & 0.06 g/t Au), from surface

- including 11.0m of 2.14% CuEq (0.63% Cu, 3.22% Zn, 1.62% Pb, 6.9 g/t Ag & 0.14 g/t Au) from surface

- Broad intersections of stockwork semi-massive sulfide mineralization that are expected to expand current open pit mineral resource

- Further demonstration of continuity of the Lundberg deposit, an open pit resource favourably situated on a brownfields site with excellent infrastructure

- Builds upon the Company’s successful expansion of the high-grade Two Level discovery announced on May 20, 2025, validating the exploration model targeting extensions of high-grade mineralization historically mined at Buchans Mine

- Additional drilling results from the current program, including the Pumphouse Target, will be released as assays are received and compiled

Chris Pennimpede, President and CEO of Canterra commented: “This exceptional 68-metre intersection from surface demonstrates robust, continuous mineralization that has the potential to grow existing open pit mineral resources at Buchans. The consistency and grade of this intersection reinforces our belief that Buchans represents one of the most compelling undeveloped critical minerals opportunities in Atlantic Canada.”

Table 1. Assay Highlights. Copper Equivalents (CuEq%) as per metal prices of April 11, 2025 (see notes 2 & 3 at end of release for additional explanation).

| Hole | From (m) | To (m) | Width (m) |

Cu% | Zn% | Pb% | Ag g/t | Au g/t | *CuEq (%) | Comments |

| H-25-3537 | 8.00 | 76.00 | 68.00 | 0.50 | 1.00 | 0.43 | 3.5 | 0.06 | 0.99 | Lundberg |

| incl. | 8.00 | 19.00 | 11.00 | 0.63 | 3.22 | 1.62 | 6.9 | 0.14 | 2.14 | ” “ |

| incl. | 29.00 | 37.00 | 8.00 | 1.47 | 0.39 | 0.14 | 4.8 | 0.06 | 1.74 | ” “ |

| incl. | 65.00 | 76.00 | 11.00 | 0.45 | 0.41 | 0.12 | 2.2 | 0.02 | 0.64 | ” “ |

| and | 93.00 | 108.00 | 15.00 | 0.18 | 1.75 | 1.19 | 2.8 | 0.03 | 1.01 | ” “ |

Figure 1. Buchans 2025 drilling collars and assay highlights to date.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8054/254195_690088f95480e9ae_001full.jpg

Buchans Project

Canterra’s Buchans Project hosts the world-renowned, past producing Buchans Mine as well as the undeveloped Lundberg open pit resource. This brownfield project covers 95 km2 near the town of Buchans and includes the past producing Buchans Mine operated by Asarco from 1928 to 1984.

The undeveloped Lundberg deposit comprises VMS stockwork sulphide mineralization composing a large, near-surface open pit resource proximal to the previously mined, high-grade Lucky Strike massive sulphide orebody. At the former Lucky Strike orebody, Asarco is reported to have mined 5.6 million tonnes1 of high-grade ore averaging 18.4% Zn, 8.6% Pb, 1.6% Cu, 112 g/t Ag & 1.7 g/t Au. Lucky Strike’s past production is a significant portion of the former Buchans Mine’s past production that is reported to have totaled 16.2 million tonnes1 at an average grade of 14.5% Zn, 7.6% Pb, 1.3% Cu, 1.37 g/t Au & 126 g/t Ag mined from five orebodies.

Table 2: Lundberg Deposit Mineral Resource Estimate – Effective Date: February 28, 2019

| NSR Cut-off ($US/t) | Category | Tonnes | Cu % | Zn % | Pb % | Ag g/t | Au g/t | NSR ($US/t) | |

| 20 | Indicated | 16,790,000 | 0.42 | 1.53 | 0.64 | 5.69 | 0.07 | 54.98 | |

| Inferred | 380,000 | 0.36 | 2.03 | 1.01 | 22.35 | 0.31 | 72.95 |

- Mineral Resources were prepared in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (MRMR) (2014) and CIM MRMR Best Practice Guidelines (2019).

- Mineral Resources are defined within an optimized pit shell with pit slope angles of 45⁰ and an overall 2.9:1 strip ratio (waste: mineralized material)

- Price assumptions used were US$1.20 /lb Zn, US$1.00 /lb Pb, US$3.00 /lb Cu, US$1250 /oz Au, and US$17 /oz Ag.

- Metallurgical recoveries to concentrates are based on the “Centralized Milling of Newfoundland Base Metal Deposits – Bench Scale DMS and Flotation Test Program” (Thibault & Associates Inc., 2017). Metal recoveries are 83.0% Cu, 13.3% Au, and 7.84% Ag in the copper concentrate, 84.3% Pb, 10.5% Au, and 50.3% Ag in the lead concentrate, and 87.2% Zn, 8.28% Au, and 14.8% Ag in the zinc concentrate.

- Net Smelter Return $US/t values were determined by calculating the value of each Mineral Resource model block using an NSR calculator. The NSR calculator uses the stated metal pricing, metallurgical recoveries to concentrates, concentrate payable factors and current shipping and smelting terms for similar concentrates.

- Pit optimization parameters include: mining at $3 US per tonne, processing at $15 US per tonne, and G&A at $2 US per tonne (total $20 US per tonne).

- Mineral Resources are reported at a cut-off value of $20 US/t NSR within the optimized pit shell and is considered to reflect reasonable prospects for economic extraction by open pit mining methods.

- Mineral Resources were interpolated using Inverse Distance Squared methods applied to 1.5 m downhole assay composites.

- Results of an interpolated Inverse Distance Squared bulk density model (g/cm3) were applied.

- Mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resource tonnages have been rounded to the nearest 10,000. Totals may vary due to rounding.

Figure 2. Canterra’s Central Newfoundland Mining District properties.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8054/254195_690088f95480e9ae_002full.jpg

Notes:

(1) Past production figures from Kirkham, R.V., ed., 1987, Buchans Geology, Newfoundland. Geological Survey of Canada, Paper 86-24, 288 p.

(2) True widths estimated to be a ~90% of reported core lengths. Copper equivalents (CuEq) based on total contained copper, zinc, lead, silver and gold and metal prices as of April 11, 2025 (Cu – US$4.06/lb, Zn – US$1.19/lb, Pb – US$0.85/lb, Ag – US$32.23/oz and Au – US$3,236.00/oz).

(3) Copper Equivalent % = Cu% + (Pb% * 22.046 * Pb Rec.* Pb price) + (Zn% * 22.046 * Zn Rec. * Zn price) + (Ag g/t/31.10348 * Ag Rec. * Ag price) + (Au g/t/31.10348 * Au Rec. * Au Price))/(Cu Price * 22.046 * Cu Rec.). Metal recoveries are assumed to be 100% (Rec.)

Table 3. Drill collar locations

| Hole | Length (m) | Azimuth | Dip | Northing (UTM NAD83 Zone 21) |

Easting (UTM NAD83 Zone 21) |

| H-25-3537 | 121 | 0 | -90 | 5,407,849 | 509,973 |

Newfoundland and Labrador Junior Exploration Assistance

Canterra would like to acknowledge financial support it may receive from the government of Newfoundland and Labrador’s Junior Exploration Assistance Program related to completion of its 2025 exploration programs at Buchans.

About Canterra Minerals

Canterra is a diversified minerals exploration company focused on critical minerals and gold in central Newfoundland. Canterra holds Newfoundland’s second-largest combined critical minerals inventory with seven resource-stage deposits. The Buchans Project hosts the Lundberg Copper-Zinc-Lead deposit, the largest and most advanced critical minerals deposit within the Central Newfoundland Mining District. The Company’s projects are near the world-renowned, past-producing Buchans Mine and Teck Resources’ Duck Pond Mine, which collectively produced copper, zinc, lead, silver and gold. Canterra’s gold project is located on-trend of Equinox Gold’s Valentine mine currently under construction and cover a ~60 km extension of the same structural corridor that hosts mineralization within Equinox Gold’s mine. Past drilling by Canterra within the Company’s gold projects intersected multiple occurrences of orogenic-style gold mineralization within a large land position that remains underexplored.

Additional information about the Company is available at www.canterraminerals.com

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE