Bunker Hill Mining Receives Letter of Intent for Up to $150m in Potential Low-Cost Funding From EXIM Bank

Bunker Hill Mining Corp. (TSX-V:BNKR) (OTCQX:BHLL) is pleased to announce that it has received a non-binding Letter of Interest from the Export-Import Bank of the United States for a debt funding package of up to $150M with a loan term of up to 15 years.

The funding will enable the Company to expedite the development of the 2500tpd Bunker 2.0 expansion project coincident with restarting the mine and strengthening the balance sheet.

“We are thrilled to announce this first step in a potential partnership with EXIM to rapidly expand Bunker Hill’s contribution to US domestic production of critical zinc and silver,” said President and CEO, Sam Ash. “In the face of competition from China, Bunker Hill is proud to play its part in strengthening the US metals supply chain and creating new US mining jobs within the disadvantaged Shoshone County of Northern Idaho.”

Figure 1 – Bunker Hill Staff and Contractors standing inside the 1800tpd processing plant in Kellogg, Idaho

BUNKER HILL 2.0 EXPANSION PROJECT

Coincident with the planned restart of the operations at 1800tpd in the first half of next year, the company intends to conduct extensive drilling from the underground and surface of previously identified exploration targets. This will be complemented by detailed engineering studies designed to support a ramp-up to 2500tpd operations under the previously announced Bunker Hill 2.0 Concept.

The first step on this path will be to issue an updated resource and reserve report in Q1|25, followed by further exploration conducted underground and at the surface. As key milestones are completed, the Company will update the market and its strategic partner on the evolution of this concept and its supporting resources.

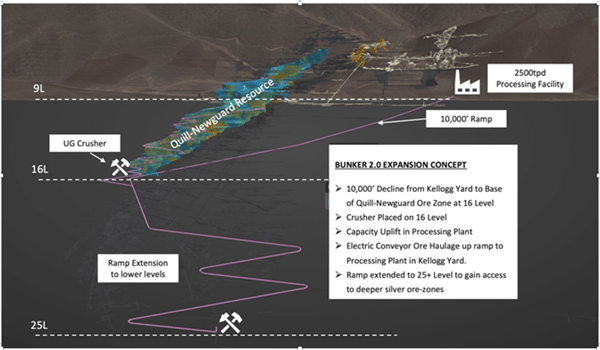

Figure 2 – Bunker Hill 2.0 Expansion Concept

The Bunker Hill 2.0 expansion concept is designed to significantly increase the rate and efficiency of the mining and processing of the Quill-Newgard ore zones and subsequently enable access to the deeper, higher-grade silver galena veins being mined from the lower levels of the mine when the mine closed in 1981.

The LOI from EXIM does not represent a financing commitment and is a preliminary step in the formal EXIM application process. The debt financing is subject to the satisfactory completion of due diligence, the negotiation and settlement of final terms, and the negotiation of definitive documentation. There can be no assurance that the debt financing will be completed on the terms described above. The Company will update the market upon reaching a definitive agreement with EXIM for funding support.

The Company expects to submit a formal application to EXIM by the end of 2024.

ZINC, SILVER AND THE US CRITICAL METALS LIST

Zinc has been included in the US Critical Metals list since 2022, while silver is being reviewed now for the 2025 list by the United States Geological Survey. Both are metal inputs to the energy transition, the ongoing upgrade to critical national infrastructure and to domestic re-industrialization. Zinc for its ability to galvanize steel, and silver for its reflective and electrical and thermal conductive properties.

The 2022 list was created based on directives from the Energy Act of 2020, which indicates that at least every three years, the Department of the Interior must review and update the list of critical minerals, update the methodology used to identify potential critical minerals, take interagency feedback and public comment through the Federal Register, and ultimately finalize the list of critical minerals.

The Energy Act of 2020 defines a “critical mineral” as a non-fuel mineral or mineral material essential to the economic or national security of the U.S. and with a supply chain vulnerable to disruption. Critical minerals are also characterized as serving a necessary function in manufacturing a product, the absence of which would have significant consequences for the economy or national security.

ABOUT THE EXPORT-IMPORT BANK OF THE UNITED STATES

EXIM is the official export credit agency of the United States of America. EXIM is an independent Executive Branch agency with a mission of supporting American jobs by facilitating the export of US goods and services.

As published in its 2023 Annual Report, EXIM currently has exposure to US$1,476.7B in lending across 148 countries worldwide. The default rate across the portfolio is 0.98%, reflecting the high standards of credit required to obtain EXIM financing. Furthermore, EXIM’s charter requires that it supplement and encourage, not displace, private capital.

The EXIM Make More in America Initiative was developed in response to President of the United States Executive Order 14017 on American Supply Chains and provides U.S. manufacturers new access to capital to fill critical supply chain gaps, and was approved by EXIM’s Board of Directors in April 2022. MMIA’s objective is to unlock financing for U.S. manufacturing and close critical supply chain gaps, especially in sectors critical to national security. Under MMIA, EXIM can make the agency’s existing medium- and long-term loans, loan guarantees, and insurance programs available to export-oriented domestic projects such as Bunker Hill.

The China and Transformational Exports Program was established through a December 2019 Congressional reauthorization of EXIM’s charter. Under CTEP’s mandate, EXIM is authorized to help US exporters facing competition from China and to ensure that the US continues to lead in crucial strategic areas critical to national security, including renewable energy, storage and efficiency. CTEP supports the extension of EXIM loans, guarantees and insurance at rates and on terms and other conditions, to the extent practicable, that are fully competitive with rates, terms and other conditions established by China.

ABOUT BUNKER HILL MINING CORP.

Under Idaho-based leadership, Bunker Hill intends to restart and develop the Bunker Hill Mine sustainably to consolidate and optimize several mining assets into a high-value portfolio of operations centered initially in North America. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

MORE or "UNCATEGORIZED"

Hudbay Delivers Record Fourth Quarter and Full Year 2025 Results; Achieves 2025 Consolidated Copper and Gold Production and Cost Guidance

Hudbay Minerals Inc. (TSX:HBM) (NYSE: HBM) released its fourth ... READ MORE

Argo to Acquire the Hurdman Silver-Zinc Project

Argo Gold Inc. (CSE: ARQ) (OTC: ARBTF) entered into an agreement ... READ MORE

Centerra Gold Announces 2025 Year-End Mineral Reserves and Resources and Provides Exploration Update; Gold and Copper Reserves Increased 58% and 49%

Centerra Gold Inc. (TSX: CG) (NYSE: CGAU) announces its 2025 year... READ MORE

Eldorado Gold Delivers Strong 2025 Full Year and Fourth Quarter Financial and Operational Results; Significant Free Cash Flow Excluding Skouries and Increased Cash Generated From Operating Activities

Eldorado Gold Corporation (TSX: ELD) (NYSE: EGO) reports the Comp... READ MORE

Centerra Gold Reports Fourth Quarter and Full Year 2025 Results; Delivered Robust Annual Production and Beat Cost Guidance; 2026 Outlook Remains Strong as Centerra Executes its Self-Funded Growth Strategy

Centerra Gold Inc. (TSX: CG) (NYSE: CGAU) reported its fourth qua... READ MORE