Bob Moriarty & Richard Mills – “Mrs. Lincoln Other Than That.”

Rick Mills, Editor/ Publisher, Ahead of the Herd:

I’m going to ask you straight out: Has Trump got anything right in this second administration? I look at Iran, I look at Israel, Syria, Russia, Ukraine, the Qatar gift, the crypto crooks. I look at China, Taiwan, tariffs, diplomacy, the Big Beautiful Bill, taxes, debt, deficit, and now we have this complete diplomatic failure on the part of the United States in that they can’t control Israel and now they’re bombing Iran. It’s so obvious Israel did not want a nuclear deal done between the US and Iran. Is there anything going right for the Trump administration over the last four-five months?

Bob Moriarty, Founder, 321gold

Other than that, Mrs. Lincoln, how was the play?

RM: Great response. It doesn’t seem like anything is going right.

BM: Well, I will say you could make a list of about 15 things that Donald Trump was elected on. I approve of his nomination of Acting Assistant Secretary in the Bureau of Economic and Business Affairs Amy Holman, I approve of his nomination of Robert F. Kennedy Jr., but the Trump administration is owned and operated on behalf of Israel and that could destroy both Israel and the United States.

RM: After the attack on Iran by Israel, I looked at the charts right after the first attack, stocks are tumbling, oil’s going up, gold is up, silver’s flat, copper’s going down, gasoline is going up, natural gas is going up, long-term bond yields are up, and the US dollar is up, so the US dollar I guess is being considered a safe haven again, although it wasn’t up that much.

Funding the debt is going to get much more difficult but I’ve got no problems believing that the Big Beautiful Bill is going to get passed in the Senate.

Do you see a large inflation surge happening in the US over the summer because what’s been keeping the inflation numbers reasonable is the low price of gas and oil.

BM: The probability of Iran closing the Strait of Hormuz is as close to 100% as you could possibly imagine. That would destroy the US economy and the world economy.

We’ve got things going on that are scary to me, and you and I have predicted a lot of this stuff for weeks. Who would’ve predicted a revolution in LA and spreading all over the United States? Trump’s Triumph could easily have turned into the Battle of Bunker Hill. We could have serious legal issues, military issues starting.

RM: Well, I have serious doubts about 700 US marines being on the streets of LA, I posted they’d be better off learning a little bit more about the Middle East and desert warfare. On the other hand, it’s usually just brown nations that get to see that much US military equipment up so close and personal.

While there are US marines in the streets and plans for more, I find the idea of a military parade to celebrate Donald Trump’s birthday, I find it all just a little bit ironic, what do you think?

BM: Do you remember the triumphs under the Roman emperors?

RM: Yes, but please explain.

BM: When a general or an emperor had won an important battle there would be a celebration in Rome. It was a holiday, free food for all the peasants and the general would parade through Rome, it was called a triumph, and the parade is Trump’s triumph, but the difference between Donald Trump and how the emperors did it, during back in Roman times the slave who was helping the emperor in the chariot would be whispering in the emperor’s ear, do you have an idea what the slave was saying?

RM: Melania, sitting on his left was whispering how turned on she was, Pete Hegseth Defense Secretary, sitting on Trump’s right was whispering the same thing. But the slave said “Memento mori”, remember you will die.

Do you think there could be regime change in Iran over this battle; do you think Iranians are going to be sick and tired of the mullahs and the Ayatollah?

BM: They’re going to fight. If you go back to World War II and you compare the effects of the British and American bombing of Germany after the war, the British did a study and they found out the bombing increased the length of the war, and more people died because of the bombing. If you think there’s going to be regime change, the place there’s going to be regime change is going to be in Israel, it’s not going to be in Iran.

RM: Did you know that China is supplying Iran with the precursors, ammonium perchlorate which is used to make the solid fuel for Iranian ballistic missiles? In early January 2025 two Iranian ships sailed to China, and they loaded up with this precursor and the two tankers sailed back with enough solid rocket fuel to fuel 260 of Iran’s ballistic missiles. And they’ve got a deal with China to supply fuel for a total of well over 800 ballistic missiles.

China is Iran’s largest trading partner particularly in oil exports, the two countries signed a strategic partnership plan in 2021 concerning security ties, joint military exercises and weapons systems development. Beijing has also supplied the Iranian military with satellite imaging so they can target their ballistic missiles. China’s involved in this war more than most people know.

BM: No, that’s not true. Both Russia and China have said publicly that they’re not going to allow Israel to destroy Iran, and as far as supplying the necessary ingredients for ballistic missiles the real question has to be, does Iran have the inherent right of self-defence and I think the answer is so obvious — of course they do. Here’s what’s crazy. Let me ask you a question: Does Iran have a nuclear weapons program?

RM: Does Iran have the right to produce civilian nuclear power? Absolutely. But why would any country insist they were going to buy uranium, and than enrich it and face, go thru, all this destruction that has been visited on them?

The Nuclear Energy Institute reports that fuel costs are around 17% of the total generating cost. The cost of nuclear fuel is the cheapest part of overall operating expenses in producing civilian nuclear energy, compared to other costs like labor, maintenance, and capital expenditures.

Iran could trade oil for uranium-235 to a lot of countries; they do have trade agreements with China who already buys a lot of Iran’s sanctioned oil. Trade oil for reactor grade uranium, why do they have to be the ones to enrich it?

BM: Well, would you like to believe the head of US intelligence who came out two weeks ago and said all 18 US intelligence agencies have concluded Iran has not had a weapons program since 2003 and have no plans whatsoever for making nuclear weapons. There is one nuclear-armed state that threatens the entire world in the Middle East and it’s not Iran.

RM: How does Israel manage to fly all the way to Iran and the way it comes across on the news is that they’re running around unimpeded, bombing whatever, whenever they want. They’ve made several sorties from Israel. What happened to defence systems in Iran, why aren’t we hearing about planes being shot down, and the Israeli Air Force having a bit more of a tougher time than they are?

BM: Who controls the media?

RM: Well, it’s certainly not Iran.

BM: Thank you. We’ve had this conversation before. 100% of what you’re told by US governments, Western governments is a lie. And 100% of what you’re being told by mainstream media is a lie.

We’re not being told the truth, we know that, so we don’t know what Iran has done. I will say as a former F-4 pilot; the attack was effective from a tactical POV but it’s a total failure from a strategic point of view. I posted an article; I believe we just started World War III.

RM: Iran is not going to back down, they’ve already said, “Screw the UN, we’ll just walk away from the nuclear treaty.” Iran just came straight out and said, “We’re going to continue our enrichment program for civilian purposes.”

BM: Well, they’ve got all the right in the world to do that. Iran has signed the Nuclear Non-Proliferation Treaty and has abided by the provisions of the Nuclear Non-Proliferation Treaty. Israel has not. We’ve got a situation in which there is a rogue state in the Middle East that is in conflict with Gaza, is in conflict with the West Bank, is in conflict with Syria, is in conflict with Lebanon, is in conflict with Iran, is in conflict with Yemen, and we’re supposed to pretend they’re the victim. They’re not the victim, they’re the aggressors.

RM: Brad Aelicks is one of the smartest trader’s that I know, and I listen to him when he talks about taking a punt. He’s been buying a company called Mogotes Metals, the symbol is MOG, it trades on the Toronto exchange.

Now this is just a punt, I have no relationship with this company. I’m going to put some money towards getting a handful of shares, 80,000 to 100,000 shares and the reason I’m doing it is because I want to see the drill results.

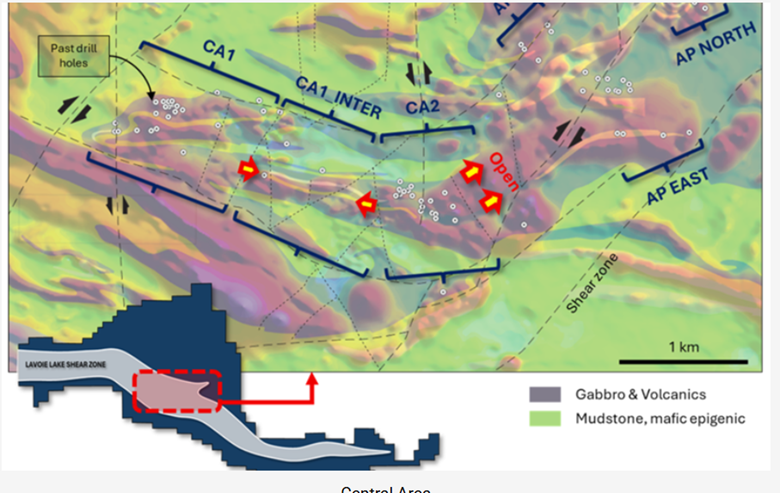

This project, they’re exploring for copper and gold next to the large Filo discovery, and it’s on the same fault as three other copper discoveries. So Mogotes Metals’ Filo Sur project is immediately south of Filo Corp’s flagship Filo del Sol project which is BHP and Lundin Mining who have formed a 50/50 joint venture, Vicuña Corp. to hold the Filo del Sol and the Josemaria project.

It’s on strike with the world-class, brand new sulfide discovery in the Vicuña Copper District, and NGEx Minerals recently discovered Lunahuasi and Los Helados exploration projects are nearby.

So, I think that throwing some money at this stock, picking up some shares in the market might pay off bigly for me. They’re doing a financing right now at $0.20, there’s a billionaire family from Argentina, the Braun family, coming in for $9m, one of them is taking a seat on the board.

So, every now and then, maybe two three times a year I get the urge to gamble and I’m taking a punt on decent drill results. I believe that if they come back with even one hole that looks anything similar to any of these other huge discoveries where they’re trading at $15, $30 I think the stock is going to have a lot of legs. This is a straight out roll of the dice and I am definitely not recommending anyone follow me.

BM: Well, you are picking up a stock that I’ve owned for years, and they’re on the same trend as three other major deposits. It would take one drill hole to move that stock up five to 10-fold. The stock is obscenely cheap, I own it, I like the stock, I like the management, I think they’re okay, but we need to talk about Harvest Gold too.

RM: You want to talk about Harvest Gold (HVG) warrants.

BM: Here’s the deal, it’s very important for our readers to understand, the mining industry is capital-intensive, they always need money, and the reason the juniors have been creamed so bad over the last year or two is because nobody’s got any money to advance. Now that’s starting to change and it’s starting to get better but Harvest Gold we were talking about it when it was 2.5 cents a share and think it’s $0.09 now.

That has been a home run over the last month or two but here’s what’s important: They have 17 million warrants at $0.07 that are in the money, so as time goes by people will be selling shares to exercise their warrants and that’s a good thing for both the investor and it’s a good thing for potential investors. It will keep the price from running away and it will bring money to the company.

Now in addition to that, there’s another 25 million warrants at $0.05 that will be exercisable in August. So, all the warrants are in the money, 17 million of them can be exercised now, another 25 million will be able to be exercised in August, so the companies in good shape for money and now all they have to do is deliver some results.

RM: I was looking at that. My calculator says that money is over $2.4 million and that is a very nice pot to have sitting there. I think that the last set of results – their survey results from last year came out and they were nothing short of spectacular – and then earlier in the week they had a targeting release. They have an enormous number of high-quality targets to drill, they’ve got their drill permits, they have their driller. I’m talking to HVG’s CEO Rick Mark Monday morning about those targets, drilling etc.

I think they’re going to need to raise some more money to actually drill, but good results from the drill bit will propel the share price higher, and those warrants will get exercised, putting $2.4 million into the kitty, funding the company and saving more dilution.

BM: Absolutely correct.

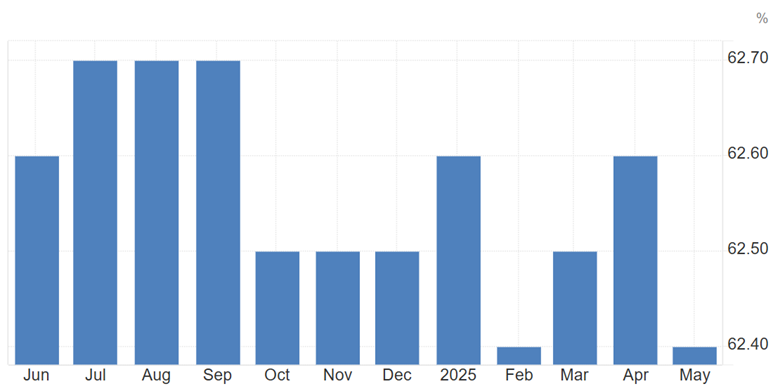

RM: Let’s look at something that I was doing some research on, and what I found was that we always have known that inflation is undercounted, under-represented, it’s always higher than the print. If the Fed says it’s 3% you can pretty much bet that it isn’t 3%, it’s much higher. But here’s something that absolutely is going to floor most people.

When you look at tariffs, and let’s just use a basic rate of 10% tariffs on imports coming into the United States. Walmart and others are going to start increasing their pricing this month. Let’s say that they pass through the full 10% of the tariff and that’s what settles out of all this chaos. Imports into the US make up a third of consumer goods purchased, okay, so a third of your imports are going to have 10% tariffs on them. It’s clear that that’s a 3.3% rise in prices. Are you following my math on this one?

BM: Yes.

RM: Okay, so now you’ve got tariffs causing a 3.3% rise in prices, plus you’ve got the Fed telling you that the inflation rate already is, before tariffs start to bite, 2.4% in May. So, just going this far you’re going to potentially have inflation at 5.7%.

But we’re not done. What about the dollar’s drop from early January’s 110 to yesterdays peg of 97 before the attack on Iran? That’s a drop of 13 points.

Trading Economics

I’m telling you; you must include that in your calculations of inflation because the US consumer, on those one-third of imports into the country, has lost 10% of their purchasing power so far this year. That’s got to be counted, and they are not.

What’s the difference between a 10% rise on one third of import prices from tariffs and a 10% loss of purchasing power on one third of imports? Nada, zip, zilch.

Play with the numbers all you want, what’s important is the inflation prints you are reading today, the way they are calculated will not include what’s coming and never will. They have never included shrink inflation, aka greed inflation, and they won’t include the US dollar’s coming loss of purchasing power and further shrink inflation.

BM: Right, everybody else is missing it. I went through all the inflation of the ‘60s, ‘70s and ‘80s and inflation is very sticky and it’s going to go a lot higher, and this World War III is going to make things bad so quickly that everybody’s going to say, “Why weren’t we warned?”

RM: There’s something else to this too, in that all the predictions by the world’s biggest money managers, like Paul Tudor Jones, who manages the macro hedge fund Tudor investment Corp, said the dollar could very well be +10% lower a year from now than it is.

You’ve got all kinds of things dragging the dollar down, one that very few are talking about is foreign investors, they hedge their bond exposure, and their dollar hedge ratios are 70-100%, okay, because currency moves can wipe out bond returns, they hedge.

Foreign equity investors have never been fans of hedging, never had to be, so their dollar hedge ratios were usually between 10 and 30%, well not anymore. The dollar is under such pressure that these guys, the Danes, the rest of the Scandinavians, the Eurozone and Canada, everywhere dollar exposure is high, what they’re doing now is their US asset dollar hedge ratios surged to 75%.

I don’t think they’re going to continue hedging their dollar exposure for long.

Why not jump ship and go with other currencies if they think the dollar is going to weaken further? The question we must think about is ‘will the dollar gain back lost safe haven status because of the Middle East war, or do things settle down and we go back to that status weakening?

BM: Well, we have gone from the world being in a dangerous place to literally World War III overnight. There’s another thing that I wanted to talk to you about, I mean you’re absolutely correct but again because it’s impossible to predict what’s going to happen, the closing the Strait of Hormuz is a very easy prediction, but beyond that it’s almost impossible to predict what Russia will do, China will do, what Iran will do, we know we’re being lied to by the media, we know that the media is incredibly biased towards Israel and we’re not being told the truth.

But there is something that you raised in the past, I’m not sure I sent it to you, did I send the article about the farmers complaining about not getting farm equipment from Mexico?

RM: I read the article.

BM: Well, the strange thing is we had alluded to it. A lot of US farmers have ordered farm machinery that’s made in Mexico and when Trump started swinging his baseball bat at Canada and Mexico, the Mexicans on the border went into the slow-down phase and they’re holding up shipping the farming equipment to the farmers until planting season has passed.

So, it’s one of those things that they can have a remarkable effect by doing nothing and not allowing the equipment through. The equipment will eventually come into the United States, but it’ll come into the United States when it doesn’t do the farmer any good.

We’re going to have a farming crisis, we’ve got a beef crisis right now because of the screw worm, but we’re going to have a farming crisis this year no matter what the weather does, and a lot of it is self-inflected.

RM: Your right, and farmers have another self-inflicted worry. Every year what happens is you get a swell of legal temporary workers come into the States and I’m not denying there’s going to be some illegals in there as well, but basically the agricultural industry relies on this yearly influx of migrant workers coming in from Mexico to pick the fruit and work the fields.

The report I read is that they’re scared to come across the border and it’s not that they’re scared of getting returned home, they’re literally scared to death of being sent, like picked up off the street when they go get their paycheck or they line up and the farmers come pick them up to go to work, or even ICE going out to the farms and going through the bunkhouses, they’re very concerned about being picked up and shipped to El Salvador’s prison, they’ve been talking about using Libya, and now they’re talking about sending them to Rwanda, and the farmers are complaining that they just can’t get workers.

BM: Let me explain something to you that you wouldn’t know about me because I’ve never discussed it before. When I was in Vietnam I was flying the F-4, and the F-4 in the Marine Corps is a two-man aircraft. You’ve got a pilot in the front and a radar intercept operator in the back.

Now the Air Force version of the F-4 had pilots in both cockpits, but the Navy and Marine Corps had a pilot up front and a radar intercept operator in the back. There was one person that I flew dozens of missions with the F-4 in Vietnam in 1968 and he came back. He was a veterinarian, he raised Christmas trees in North Carolina, which is a very important part of the North Carolina’s economy.

A hundred percent of the trees in the United States are being raised by migrant labor that comes up from Mexico, they work for six months, when the trees are cut in November they go back to Mexico, and they come back in the spring. There will be no Christmas trees harvested in the United States if Trump continues what he’s doing.

Nobody wants to admit it, but the cheap Mexican labor has always been a foundation of the American agricultural scene. So, there are some unintended consequences that Americans cannot see now, but the increase in inflation is simply cooked into the cake already, it’s going to get bad.

RM: I agree, you know it’s funny how similar that is to a situation in British Columbia on transient workers. Our forest industry is of course doing replanting, and the replanting happens certain months of the year. What happens is there’s a lot of French men and women come out from Quebec every year, and it’s funny how reliant the industry is on these French tree planters. If they were to suddenly be barred or for some reason will not come out to British Columbia to plant our trees, our forest industry would be in serious trouble.

And it goes a little bit further into our agricultural industry in the Okanagan Valley and our lower mainland. I’m sure you’ve heard of the Okanagan, it’s semi-desert all the way down to Osoyoos from Vernon and it’s just a huge, rich agricultural area – grapes and vegetables and all kinds of fruits grow there – and a lot of it is picked by migrant workers.

The agricultural industry in BC is the Okanagan and the lower mainland. The industry would be decimated if for some reason these migrant workers didn’t come in and work. They come in, they work, they’re good workers, they’re there every day, they’re there for a reason, they go home, they collect unemployment and then they come back when it’s picking season or planting season, and they do the work.

And it is work that nobody else wants, you start to magnify that by 1,000 times with the workers in the US coming in, and yes, they’re heading for a crisis without those migrant workers.

BM: Well things were bad prior to yesterday but it’s gone super critical now and no one can predict how bad it’s going to get, but there’s a lot of bad things happening and a lot more coming up.

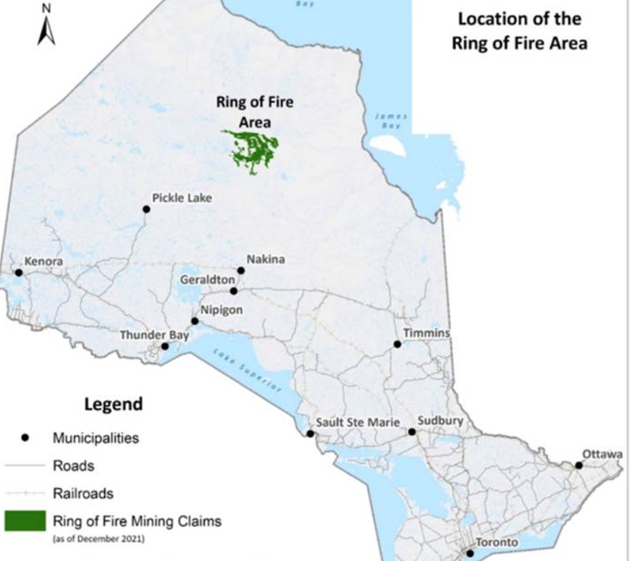

RM: I sent you a couple things on the Ring of Fire and PTX Metals.

BM: I’m exceptionally familiar with the Ring of Fire and you made a very good point – there are not that many junior companies operating there.

RM: You’re a PGE, a platinum group element fan, are you still high on platinum and palladium?

BM: Absolutely.

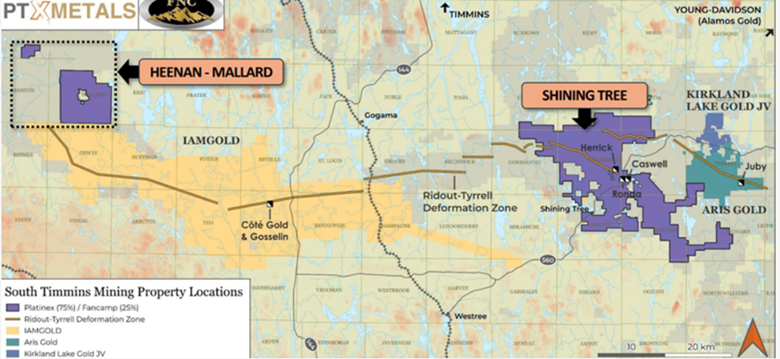

RM: What I like about PTX Metals is they have the Shining Tree gold project, and it’s got some nice properties, they’ve got some nice discoveries down in the right area, Cote’s gold mine is 20 million ounces, they’ve got Aris, they’ve got the Kirkland Lake joint venture in that area.

I believe they might be looking at spinning the project out into a separate company; they’re good projects, people are interested in them, that’ll be a nice little bonus for shareholders if they do it.

But what’s really fascinating about this company is the size and the richness of their other land package. They’re a PGE-nickel-copper-cobalt project, they own 100%, most of the mineralization is at surface and it is in the Ring of Fire.

Now the Ring of Fire is a very underexplored camp, and it’s potentially one of the more interesting copper-nickel-PGE camps in the world. It’s underexplored mostly because of a lack of access, but with what’s going on with the federal government in Canada – Prime Minister “one way forward” Carney’s programs and promises – and what’s going on with the premier of Ontario, Doug Ford, he’s committed a billion dollars for development.

The First Nations in the Ring of Fire, 16 nations last year got electricity and 10 more this year, they’re all going to be hooked up to the Ontario power grid. You’ve got roadbuilding going on, you’ve got a billion dollars going into the area and Ontario also says it’s going to put in a concentrator.

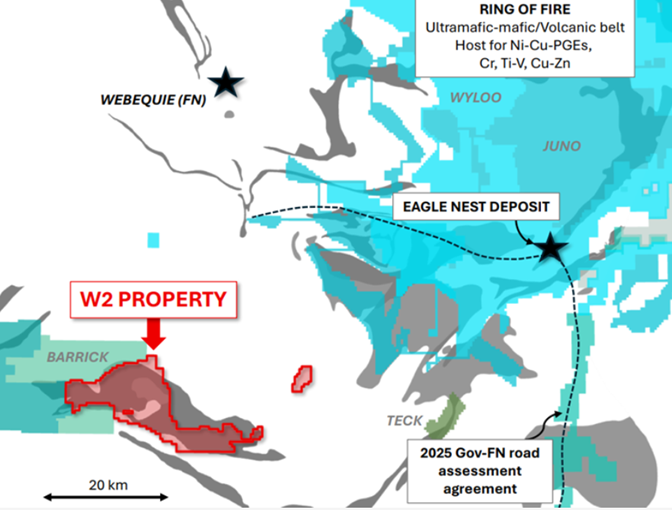

You’ve got major miners moving in, locking up the camp. Fortescue Metals owns Wyloo Metals which owns the Eagle’s Nest, the deposit that started it all. Teck’s in there, Barrick’s there, there’s private Juno which owns a mega amount of acreage.

The mine closest to PTX’s W2 project is Fortescue Metals’ Eagle’s Nest mine, they have a base metal company called Wyloo Metals that acquired it for $600 million and W2’s mineralization is very similar, except for it’s up on surface, it’s not a 1.5-kilometer-deep pipe. It’s not as high grade obviously but it is up on surface, and these ultramafic systems are very common; the metallurgy is well understood.

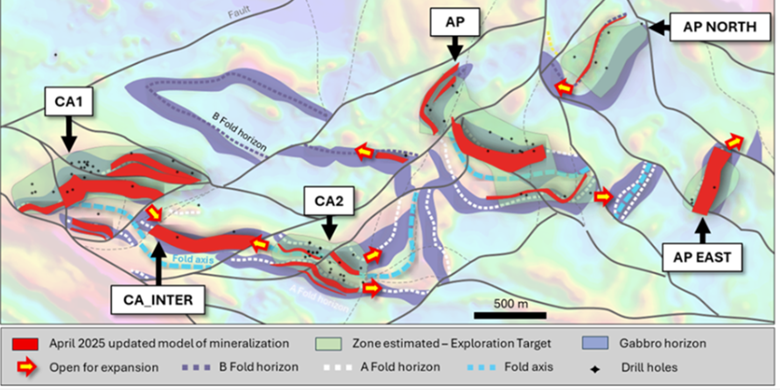

The Eagle’s Nest did kickstart the whole Ring of Fire story, but the difference in the two is W2 lies flat, spanning over 8 kilometers, open at depth, while as I said Eagle’s Nest is a pipe. At Eagle Nest they drilled through lower-grade mineralization, and they got into a higher-grade second layer and they kept going and they got into an even higher-grade third layer, it goes down 1.5 kilometers and the interesting thing about W2, as they drill, and you can see this in the drill results, they get better grades the deeper they go.

They’ve done an estimate on all the historical drilling, and so far, they have built a lot of tonnage, currently it’s 135 million tonnes and that grades 0.8% copper equivalent using a half percent Cu eq cut-off, it’s of course a combination of the copper, the nickel and the PGEs. It is important to point out that it doesn’t take into account any losses through metallurgical processing.

If you look at everything that they’ve done, you realize that this is from a very small area of the known mineralized area. Aurora Platinum was there and there’s an area where you get much higher PGEs that they’re going to be drilling that this year.

The platinum-palladium-gold component is about 25% of the economics. The copper is going to be about 50%, and you’ve got the nickel sulpfides coming in around 25%, so at a reasonable cut-off like the 0.5% you get 2 million ounces of platinum-palladium and the biggest weight of those would be the palladium.

I like this one, the Ring of Fire is going to be developed and there’s very few juniors to pick from in that area play, most of the land’s tied up by major mining companies and I’ve never really heard of a major area play before but I think that’s what we got developing and that makes any junior with large, shallow deposits very valuable.

The Ontario government is going to spring for a concentrator in the area, and Sudbury has the smelters, so it’s a great thing for the province. I like the idea of having a junior in that play.

BM: You raised a really good point. I have a lot of people contact me because I’ve been a big fan of both silver and platinum for the last six months to a year, because relative to gold they’re especially cheap.

People kept asking me for a platinum play and frankly I told them go buy the Sprott Platinum ETF, because I don’t know what the choice is. I know you didn’t spend a lot of time thinking about their market cap, but with 135 million tonnes of potential ore, a $12-million market cap is pretty damn cheap.

RM: Yes, your right. They just need more drilling and building ROF excitement.

BM: Majors don’t like projects of 2-3-5 million tonnes because it’s not worth their investment. When you go over 100 million tonnes, they start taking it seriously because their processing costs can be so low. I have shares in San Cristobal Mining in Bolivia, and it costs them about $4.50 a tonne for mining and milling, and they’re doing 50,000 tonnes a day; that’s what majors want to see.

RM: I want to get into another thing that people really aren’t paying attention to, now we’ve talked about the job situation before. The last jobs report showed a modest increase in jobs, you know it’s kind of a “meh” report.

The BLS publishes something called birth-death assumptions and this is about the formation of new businesses alright? It’s the biggest pile of bull crap I’ve ever seen coming from an organization that’s supported by your tax dollars. So, they published the data behind their birth-death assumptions, and they assumed, in May, there was 200,000 jobs created.

Now there’s no facts backing this up, it’s just based on their magical formula, so 200,000 jobs were assumed into existence in May, and in April they had assumed 400,000 more jobs into existence based solely on the idea that new companies are always starting.

There’s another way of calculating jobs and that is taking a household survey. People should pay attention and read the previous link. This is where thousands of people across the US are called and asked, “Are you working? Is this person working? Has this person lost a job? Are they on unemployment, how long they been looking, how long have they quit looking?” This kind of direct survey paints a clearer picture of what’s happening across the country as it relates to the economy and jobs.

United States Labor Force Participation Rate,

Trading Economics. Link to Forbes must read household survey.

They talk to households and the numbers just don’t match up. The difference is 700,000 jobs. Can you imagine that? There’s obviously something wrong in the US employment market that isn’t being reported.

BM: Well, I don’t believe anything the government says, I don’t believe any of the statistics, and the private agencies and the non-mainstream media is the only source of some accurate information. I think the US economy is balanced on a cliff and it’s about to fall over.

We could not only have World War III, but we could also have a revolution or a civil war in the United States and that’s pretty scary.

RM: Yet here we are.

BM: Remember Kent State in 1970?

RM: Well, I was 12 years old, I was thinking about other things, but I know what you’re talking about.

BM: The problem with the military is they are taught not to think and just to obey orders. The same people who are out of control in Iraq and Afghanistan are quite willing to be out of control in the United States. Somebody’s backing it, it’s organized, it’s paid for, and it could get ugly quick. Donald Trump would love to be dictator of the world and he’s getting played by Netanyahu.

RM: Would you believe me if I told you the US Justice Department’s team dedicated to investigating allegations of foreign bribery is pretty much non-existent under Donald Trump’s admin? They fired most of them.

BM: Well, here’s the deal, he doesn’t even hide it. He goes to Qatar, and he says, “Okay you’ve got this nice $400 million airplane I’d like to have that” and to show that it’s corrupt he said, “And we’ll fix it up and I’ll use it as a presidential limo while I’m president for the next two terms, and then I’ll donate it to my library.” The crypto thing which we’ve never even really got into, his outright bribery on behalf of the crypto people, so it’s a dangerous time in the US.

RM: I want to end on a positive note and just to say that we’re not just ‘doom and gloom – buy gold.’ We had some very good news, the headline read, ‘Doctors hail potential cure for a common cancer’ and I’m going to read it to you, it’s brilliant: “A group of 97 patients had longstanding multiple myeloma, a common blood cancer that doctors consider incurable.”

These patients were facing a long slow extremely painful death within about a year. Now they had all gone through a series of treatments, each of which controlled their disease for awhile, but it came back as it always does; there’s just no hope.

They reached the stage where they were out of options and they were looking at a hospice, but they got involved in a study, it was a last-ditch effort, and they all got immunotherapy.

A third of them responded so well that they got what was an astonishing reprieve and after five years the cancer has not returned for those patients, and this is a result that has never before been seen in this disease. How great is that?

BM: That’s a great story; there have been a lot of good medical advances in the last 50 years.

RM: We’re going to leave it here. As always, great talking to you Bob.

BM: Okay good deal, bye.

Subscribe to AOTH’s free newsletter

Richard does not own shares of PTX Metals (TSX.V:PTX). PTX is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of PTX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE