Blackrock Silver Announces Positive Preliminary Economic Assessment for Its Tonopah West Project in Nevada; 8.6 Million Annual Production at AISC $11.96 AgEq Per Ounce; After-Tax IRR 39%

After-tax NPV (5%) $326-million on an initial capex of $178-million with an after-tax IRR of 39% producing at $11.96 AISC over 7.8 year mine life at head grade of 570 g/t AgEq

Blackrock Silver Corp. (TSX-V: BRC) (OTCQX: BKRRF) (FSE: AHZ0) is pleased to announce the results of a Preliminary Economic Assessment for its 100%-owned Tonopah West Project, in one of the largest historic silver districts in North America, located on private land in Nye and Esmeralda counties, Nevada, United States, approximately 1 kilometre (km) northwest of Tonopah.

The PEA was prepared by Minetech, LLC in accordance with Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards – For Mineral Resources and Mineral Reserves adopted May 19, 2014 and in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects with an effective date of September 4, 2024.

Highlights of the Tonopah West PEA

(All amounts are in United States Dollars unless otherwise indicated)

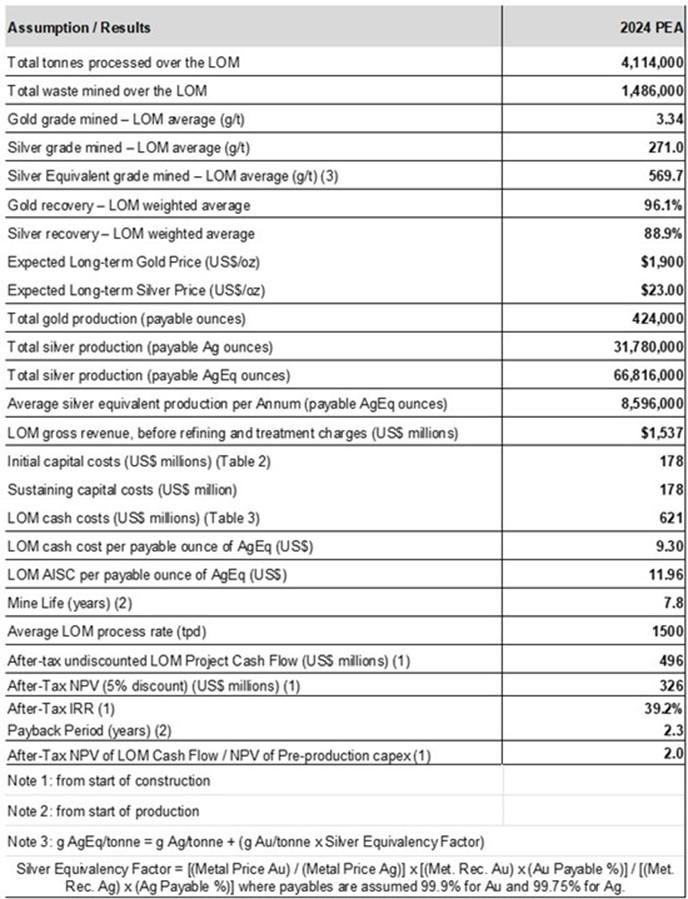

- At the base case gold price of $1,900 per ounce and silver price of $23 per ounce, the Project commands an after-tax net present value discounted at 5% of $326-million on a low initial capex of $178-million (including $22-million contingency) with a payback of 2.3 years and an after-tax internal rate of return of 39.2%

- At a gold price of $2,280 per ounce and a silver price of $27.60 per ounce (base case +20%), the economic profile of the Project escalates to an after-tax NPV5% of $495-million and an after-tax IRR of 54.0%.

- All-in Sustaining Costs1 of $11.96 per silver equivalent ounce basis.

- Over the approximately 8-year life of mine, production from the mining and processing of approximately 4.1 million diluted tonnes of material containing 75.4 million silver equivalent ounces (silver/gold ratio of 90/1) which equates to 66.8 payable AgEq ounces. The mine is expected to deliver 424,000 payable gold ounces and approximately 31.8 million payable silver ounces generating $496-million after-tax LOM cash flow.

- Tonopah West is situated on patented mineral claims (private land) and benefits from a stream-lined permitting process with only State and County regulators involved.

- The PEA is based on an updated Mineral Resource Estimate with an effective date of August 23, 2024, comprising 6.35 million tonnes grading 2.82 grams per tonne gold and 237.8 g/t silver totaling 577,000 ounces of gold and 48.5 million ounces of silver. At a AgEq grade of 492.5 g/t AgEq, the Inferred Resources in the updated MRE represent a total of 100.56 million AgEq ounces.

- Recoveries of 96.1% for gold and 88.9% for silver from a 3-stage crushing circuit and processing plant.

- Significant expansion potential: PEA excludes NW step out deposit (12 million AgEq ounces) from the mine plan. 3 drills are at site on a 20,000 metre resource expansion and conversion program aimed at de-risking an initial 3 years of production and bridging a one kilometre mineralized strike potential to NW step-out zone that could bring additional ounces online.

- The Project incorporates local contract mining and is expected to stimulate the local economy, benefitting the municipality of Tonopah and surrounding communities through direct and indirect employment at the Project, local sourcing of services and supplies and community programs funded by the Company.

Andrew Pollard, President & CEO of the Company, commented: “Four years on from our initial discovery at Tonopah West, completion of this PEA is an important achievement for Blackrock as it outlines the potential for it to be a key driver of domestic growth, increasing America’s annual silver production by over 12%2, while doing so at some of the lowest AISC in the world3 at $11.96 per silver equivalent ounce. With a lot more drilling in front of us, our Project already demonstrates a highly positive economic profile with an estimated after-tax NPV5% of $326 million, an after-tax IRR of 39% and a payback period of 2.3 years on a low initial capex of $178-million at a base case of $23 per ounce of silver and $1,900 per ounce of gold. At higher metals prices, the Project exhibits an estimated after-tax NPV5% of $495 million and an after-tax IRR of 54% at a price of $27.60 per ounces of silver and $2,280 per ounce of gold (base case +20%). The PEA outlines substantial silver-gold production of 66.8 million silver equivalent ounces over an initial 7.8-year mine life, averaging 8.6 million silver equivalent ounces annually (averaging 4.1 million ounces of silver and 54.6 thousand ounces of gold) providing for exceptional free cash flow. This PEA represents just this moment in time, with near-mine expansion potential identified to our NW step out deposit (12 million AgEq ounces) that was omitted from this mine plan, and with a 20,000 metre drill program currently underway, the Company aims to link up that mineralization while de-risking our ounces for the early years of the operation. Situated entirely on patented mineral claims adjacent to the town of Tonopah, Nevada, right along US highway 95, Tonopah West benefits from existing infrastructure and a stream-lined permitting process, of which findings from this PEA will be used as a roadmap to kickstart.”

A technical report prepared in accordance with NI 43-101 on the Project which includes the PEA and the updated MRE will be filed with the applicable Canadian securities regulators within 45 days of this news release. The technical report will be available under the Company’s profile on SEDAR+ (www.sedarplus.ca) and on the Company’s website (www.blackrocksilver.com). The results of the PEA are preliminary in nature and include inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them to be classified as mineral reserves. There is no certainty that the results of the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Table 1: Key Economic Parameters of the PEA

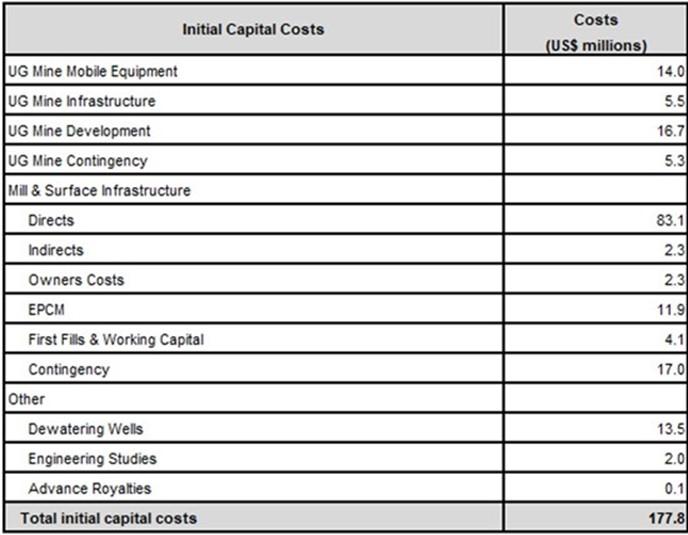

Capital Costs

The estimated capital costs to bring Tonopah West into operation are based on utilizing local and regional personnel and select contractors. Initially, an underground development contractor will be employed to establish the portal and initiate development. As the mine develops, the Company will transition to owner mining. Contractors will be sourced to construct all surface facilities including the process plant. After an initial ramp up period, mineralized material will be processed at a rate of 547,500 tonnes per year in a conventional three-stage crushing and milling plant including a refinery which will produce saleable gold and silver doré bars.

The initial capital expenditure is estimated at $177.8 million for the construction period which includes $22.3 million in contingency costs. An additional $178 million is estimated for sustaining capital, principally associated with underground mining development, additional underground mobile equipment and infrastructure, delineation drilling and accrued reclamation expense over the LOM. The Company has also included $11.7 million of expenditures for exploration access ramps to extend the current mineralization.

Capital cost estimates are based on industry standards and were developed using quotes and estimates provided by mining contractors and vendors.

Table 2: Capital Costs

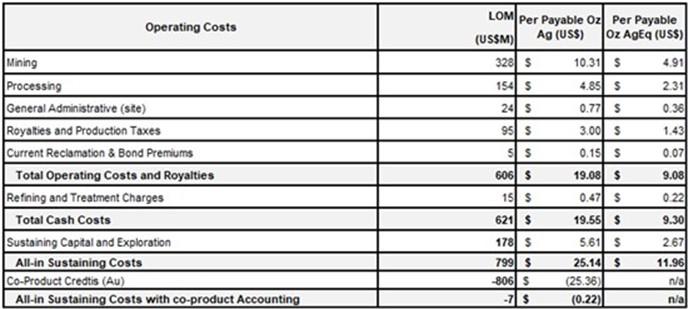

Operating Costs

The minable resource is accessed via a newly developed ramp system incorporating existing vertical shafts (rehabilitated) for ventilation and secondary escapeways. The minable resource will be extracted utilizing two mining methods, Sublevel Extraction and Cut and Fill mining techniques. Cemented Rock Fill (CRF) and Hydraulic Fill are intended to be utilized as backfill. CRF media is sourced from the development waste rock, whereas Hydraulic Fill will be obtained from segregated tailings material. The minable resource will be transferred to surface via underground haul trucks.

The study considers a processing plant with a design capacity to treat 1,500 metric tonnes per day. Extraction of gold and silver will be carried out by agitated cyanide leaching to produce a pregnant leach solution. The precious metal pregnant leach solution is separated from the solid material in counter-current decantation thickeners. Process tailings will be dewatered by pressure filtration. Solid tailings waste material from pressure filtration will be transported by dump truck to a lined dry-stack tailings storage area. For this evaluation, 20% of the tails were assumed to be used for backfill in the underground mine. Precious metal values will be recovered from the pregnant solution by Merrill-Crowe zinc precipitation, followed by precipitate smelting. Precipitate smelting will produce gold and silver doré bars.

Table 3: Operating Costs

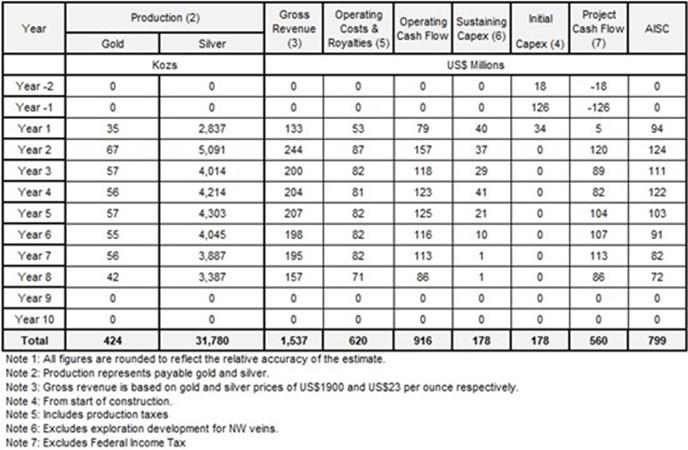

A summary of the key operating and financial metrics over the approximately 8-year LOM of the Project according to the PEA is as follows:

Table 4: LOM Operating and Financial Data

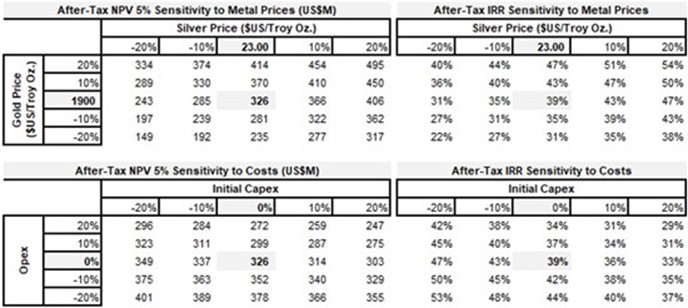

Table 5: Sensitivity to Metal Price, Opex and Capex Variations

Mineral Resources

The updated MRE was prepared in accordance with the CIM Definition Standards and NI 43-101. The effective date of the updated MRE prepared by RESPEC is August 23, 2024.

Table 6: Tonopah West Inferred Mineral Resource – Effective date August 23, 2024

| Cut-off Grade (AgEq g/t) (1) |

Tonnes (kt) |

Grade | Contained Metal | Classification(4) | ||||

| Au (g/t) | Ag (g/t) | AuEq (g/t)(2) |

Au (koz) |

Ag (koz) | AuEq (koz)(3) |

|||

| 190 | 6,351 | 2.82 | 237.8 | 492.5 | 577 | 48,550 | 100,560 | Inferred |

1 AgEq cutoff grade is based on total mining, processing and G&A costs of $128.6/tonne and a silver price of $25/ounce.

2 Silver Equivalent grade ratio used is 90:1 based on silver and gold prices of $23/ounce and $1,900/ounce, respectively, and recoveries for silver and gold of 87% and 95%, respectively. AgEq Factor= (Ag Price / Au Price) x (Ag Rec / Au Rec); g AgEq/t = g Ag/t + (g Au/t / AgEq Factor).

3 Rounding as required by reporting guidelines may result in apparent discrepancies between tonnes, grade, and contained metal content.

4 Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources estimated will be converted into mineral reserves. The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred mineral resources as indicated mineral resources. It is uncertain if further exploration will result in upgrading them to the Indicated mineral resources category.

The MRE encompasses the spatial areas known as Victor, DP, Bermuda and the Northwest Step Out areas. The Victor area is approximately 500-metres by 250-metres while the DPB area is 800-metres by 800-metres. The Bermuda area is a high-grade vein within the DPB area, and the NW step out represents a new extension of the vein zones to west-northwest. The spatial areas are not considered to be significantly different geologically but have been separated for logistical purposes in future mining scenarios. Table 7 presents the mineral resources subdivided by spatial area.

Table 7: Tonopah West Inferred Mineral Resources by Area

| Area | AgEq cutoff g/t (1) | Tonnes | Silver g/t | Gold g/t | AgEq g/t (2) | Ounces of Silver | Ounces of Gold | Ounces of Silver Equivalent(3) | Classification(4) |

| Victor | 190 | 2,255,000 | 258 | 3.05 | 532.8 | 18,698,000 | 221,000 | 38,621,000 | Inferred |

| DP | 190 | 1,652,000 | 191.5 | 2.57 | 423 | 10,167,000 | 136,000 | 22,462,000 | Inferred |

| Bermuda | 190 | 1,409,000 | 292 | 3.44 | 602.7 | 13,233,000 | 156,000 | 27,310,000 | Inferred |

| NW Step Out | 190 | 1,035,000 | 193.8 | 1.9 | 365.5 | 6,452,000 | 63,000 | 12,168,000 | Inferred |

| TOTAL | 6,351,000 | 237.8 | 2.82 | 492.5 | 48,550,000 | 577,000 | 100,560,000 | Inferred | |

1 AgEq cutoff grade is based on total mining, processing and G&A costs of $129.3/tonne and a silver price of $25/ounce.

2 Silver Equivalent grade ratio is 90:1 is based on silver and gold prices of $23/ounce and $1,900/ounce, respectively, and recoveries for silver and gold of 87% and 95%, respectively. AgEq Factor= (Ag Price / Au Price) x (Ag Rec / Au Rec); g AgEq/t = g Ag/t + (g Au/t / AgEq Factor).

3Rounding as required by reporting guidelines may result in apparent discrepancies between tonnes, grade, and contained metal content.

4 Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources estimated will be converted into mineral reserves. The quantity and grade of reported Inferred mineral resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred mineral resources as Indicated mineral resources. It is uncertain if further exploration will result in upgrading them to the Indicated mineral resources category.

The NW step out area contains resources of over 12 million ounces of AgEq which are excluded from the PEA. There is significant exploration potential to expand this zone such that it could become big enough to be included in future mining studies.

To generate the MRE, RESPEC was supplied with three-dimensional vein shapes by Blackrock. These vein shapes were used as geological controls to construct three-dimensional grade domains to constrain the estimate. Silver and gold mineral resources were modelled and estimated as follows:

- evaluate the drill data statistically;

- create tightly constrained low-, medium- and high-grade mineral-domain polygons for both silver and gold on sets of cross sections spaced at 50-metre intervals;

- use the mineral-domain polygons as a basis to create three-dimensional wireframes;

- code a block model to the silver and gold domains using the mineral-domain wireframes;

- analyze the modelled mineralization geostatistically to aid in the establishment of estimation and classification parameters; and

- interpolate grades into models comprised of 1.5(east-west) x 1.5(north-south) x 1.5(vertical)-metre blocks using the silver and gold mineral domains to explicitly constrain the grade estimations.

Drillhole assay samples were composited within the mineralized domains into 1.5-metre length composites. High-grade capping was completed on composite data and established using a statistical analysis for silver and gold. Silver was capped at 1,800 g/t, and gold was capped at 20 g/t.

Specific gravity test work was completed for 92 core samples. Results indicate an average density of 2.49 grams/cm for vein material and 2.36 grams/cm for wall rock.

RESPEC utilized Inverse Distance Cubed (ID) interpolation for the estimation to obtain a localizing effect in the mid- and high-grade domains, and an Inverse Distance Squared (ID) in the low-grade domains where mineralization is more diffuse. All estimates are based on a block dimension of 1.5-metre by 1.5-metre by 1.5-metre blocks.

The original deposit has been depleted by historical mining in the Victor area. Approximately 200,000 tonnes of material were removed from the Victor resource estimate. In the DPB area, no historical mining records were documented.

A cut off for the reported resource of 190 g/t AgEq was selected based an assumed mining costs for underground methods along with processing and G&A costs. At a 190 g/t AgEq cut off, the average grade of the inferred resource is 492.5 g/t AgEq.

The MRE was prepared under the supervision of Mr. Jeffrey Bickel, CPG, an employee of RESPEC, and he has reviewed and approved the technical contents relating to the MRE in this news release.

Mr. Bickel has reviewed the sampling, assaying, and security procedures used at Tonopah West and it is his opinion that they follow industry standard procedures and are adequate for the estimation of the current MRE.

Mr. Bickel completed audits of the database, performed a site visit, and reviewed quality assurance and quality control data. After performing their review, he considers the assay data to be adequate for the estimation of the current MRE.

Qualified Persons

The “Qualified Persons” (as defined by NI 43-101) who were responsible for the PEA and who have verified and approved the contents of this news release are Robert H. Todd, P.E., of Minetech, Jeffery Bickel, C.P.G (AIPG) of RESPEC Company, LLC, Travis Manning, P.E., QP of Kappes, Cassiday & Associates, Thomas H. Bagan, P.E., MBA, SME-RM, an independent consulting mining engineer and Richard DeLong, QP of Westland Engineering and Environmental Inc.

Blackrock’s exploration activities at Tonopah West are conducted and supervised by Mr. William Howald, Executive Chairman of Blackrock. Mr. William Howald, AIPG Certified Professional Geologist #11041, is a Qualified Person as defined under NI 43-101 standards. He has reviewed and approved the contents of this news release.

The Qualified Persons referenced in this news release are not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the PEA.

About Blackrock Silver Corp.

Backed by gold and silver ounces in the ground, Blackrock is a junior precious metal focused exploration and development company driven to add shareholder value. Anchored by a seasoned Board of Directors, the Company is focused on its 100% controlled Nevada portfolio of properties consisting of low-sulphidation, epithermal gold and silver mineralization located along the established Northern Nevada Rift in north-central Nevada and the Walker Lane trend in western Nevada.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE