B2Gold Corp. Announces Acquisition of Sabina Gold & Silver Corp.

B2Gold Corp. (TSX: BTO) (NYSE MKT: BTG) (NSX: B2G) and Sabina Gold & Silver Corp are pleased to announce that the parties have entered into a definitive agreement pursuant to which B2Gold has agreed to acquire all of the issued and outstanding shares of Sabina.

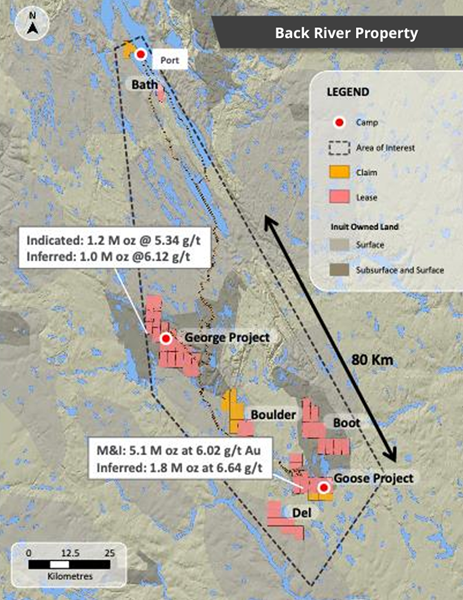

The Transaction will result in B2Gold acquiring Sabina’s 100% owned Back River Gold District located in Nunavut, Canada. The Back River Gold District consists of five mineral claims blocks along an 80 kilometre belt. The most advanced project in the district, Goose, is fully permitted, construction ready, and has been de-risked with significant infrastructure currently in place. B2Gold has strong northern construction expertise and experience to deliver the fully permitted Goose project and the financial resources to develop the significant gold resource endowment at the Back River Gold District into a large, long life mining complex.

Under the terms of the Transaction, B2Gold will issue 0.3867 of a common share of B2Gold for each Sabina common share held, representing consideration of C$1.87 per Sabina Share on a fully-diluted basis and a total equity value for Sabina of approximately C$1.1 billion based on the closing price of B2Gold on the Toronto Stock Exchange as of February 10, 2023. The consideration implies a premium of 45% to the 20-day volume weighted average prices of each of B2Gold and Sabina on the TSX as of February 10, 2023. Furthermore, the consideration implies a premium of 45% to the closing price of Sabina on the TSX as of February 2, 2023, the date the non-binding letter of intent was signed.

The Transaction will be implemented by way of a court-approved Plan of Arrangement under the Business Corporations Act (British Columbia) (the “Arrangement”). Upon completion of the Arrangement, existing B2Gold shareholders and former Sabina shareholders will own approximately 83% and 17%, respectively, of the outstanding B2Gold Shares.

Strategic Rationale for B2Gold

- Adds a high grade, fully permitted, construction ready gold project in Nunavut, Canada:

- A March 2021 Updated Feasibility Study on the Goose project outlined a 15-year life of mine, producing an average of 223,000 ounces of gold per year (average annual production of 287,000 ounces over first five years) from 3.6 million ounces of Mineral Reserves averaging 5.97 grams per tonne (g/t) gold.

- The Goose project has been significantly de-risked with 97% of procurement complete, pre-stripping having begun at the Echo pit, and 100% of plant site civil works completed.

- Will leverage B2Gold’s in-house construction and global logistics teams, with specific expertise in remote, cold weather environments (including winter ice road construction and operation) from constructing the Julietta and Kupol mines in Russia as part of B2Gold’s predecessor company, Bema Gold.

- Enhanced operational and geographic diversification by combining B2Gold’s stable production base with a high grade, advanced development asset in a Tier-1 mining jurisdiction:

- Scarcity of high grade, long life, construction ready gold development projects located in mining friendly jurisdictions with meaningful production scale.

- With an estimated average head grade of ~6.0 g/t gold, the Goose project ranks among the highest-grade undeveloped gold projects globally.

- B2Gold will have production and development assets spanning four continents and located in both established mining jurisdictions and high growth emerging economies, serving to mitigate collective operational and geopolitical risk.

- Significant untapped exploration potential across an 80 km belt:

- At the Goose project, all deposits (Goose, Echo, Umwelt, Llama, and Nuvuyak) are open along the eight kilometres of iron formation, providing considerable potential for mine life extension.

- At the George project (~50 km from the Goose project), over 20 km of iron formation (nearly triple the iron formation length of the Goose project) represents a highly prospective area to expand existing mineral resources.

- Over 40 targets have been identified at the George project for follow-up drilling.

- B2Gold is planning a significant exploration campaign for the district over the next few years.

- Opportunity to optimize the development of the Back River Gold District with a stronger balance sheet:

- Potential to increase production in first five years of the mine life through accelerated development of the underground mine at the Goose project.

- B2Gold to complete optimization studies on various project initiatives which could improve long-term economics by allocating more capital up-front.

- Immediately and meaningfully grows B2Gold’s attributable Mineral Reserves and Mineral Resources base:

- Attributable Proven & Probable Mineral Reserves increase by 66% to 9.0 million gold ounces.

- Attributable Measured & Indicated Mineral Resources increase by 52% to 18.5 million gold ounces.

- Attributable Inferred Mineral Resources increase by 63% to 7.4 million gold ounces.

- Leverages B2Gold’s strong financial position and robust free cash flow generation to develop the Back River Gold District, with the potential for long-term tax synergies:

- Upon completion of the Transaction, it is anticipated that B2Gold would develop the Back River Gold District without further equity dilution to B2Gold shareholders.

- Development of the district offers the potential for long-term tax benefits from B2Gold’s Canadian tax pools.

Clive Johnson, President and Chief Executive Officer of B2Gold said, “The acquisition of Sabina represents an exciting opportunity to develop the significant gold resource endowment at the Back River Gold District into a large, long life mining complex. B2Gold has strong construction expertise and experience to successfully develop the fully permitted Goose project and unlock considerable value for the shareholders of both Sabina and B2Gold. The Back River Gold District has multiple high-potential mineralized zones which remain open, and we are confident that the district has strong untapped upside with numerous avenues for resource growth.

Our extensive due diligence reinforced the scarcity of a gold district of the quality of Back River, as well as the excellent work that the Sabina team has completed to date in taking the asset from an exploration project to a near-term operating mine. We have great respect for what Sabina has achieved at Back River and look forward to working with their exceptional team moving forward.

We also look forward to building strong relationships with the Kitikmeot Inuit Association and commit to ensuring that the development of the gold district delivers sustainable benefits to the Kitikmeot communities and Nunavut, as B2Gold has done all over the world in the communities and jurisdictions in which we operate in.”

Benefits to Sabina Shareholders

- Immediate upfront premium of 45% to the to the 20-day VWAP of each of B2Gold and Sabina on the TSX as of February 10, 2023, and a premium of 45% to the closing price of Sabina on the TSX as of February 2, 2023, the date the non-binding letter of intent was signed.

- Ownership in a major gold producer with proven northern construction and operating capabilities, significantly reduces execution risk of the Goose project compared to a junior developer.

- Ongoing exposure to future value creating milestones at the Back River Gold District, and to Fekola, a cornerstone Tier 1 asset with significant free cash flow generation.

- Provides access to a strong, debt free balance sheet and robust cash flow generation to fund and optimize the development of the Back River Gold District.

- Enhanced institutional investor following, improved trading liquidity, and participation in a peer leading dividend yield.

Bruce McLeod, President and Chief Executive Officer of Sabina said, “We are tremendously proud of the work we have done to advance the first mine on what we believe will be a multi-generational mining district at Back River. The execution of the Goose project by Sabina did not come without risk to Sabina as a single asset, junior development company with capital constraints. With a two-year construction period until first gold production, we believe that additional value can be unlocked by participating as shareholders of a major gold producer with the northern experience and financial resources to optimize the Goose project and this prolific belt. Shareholders will also benefit from exposure to B2Gold’s continued growth and healthy dividends.

We would like to thank our land-owners, the Kitikmeot Inuit Association and the constituents of the Kitikmeot Region for all their support in advancing this project. I am confident that, when completed, this agreement means an ever-brighter future for the Back River Gold District. B2Gold will bring to Nunavut a wealth of international mining experience built upon a proven track record of project success.”

About the Back River Gold District

The Back River Gold District is located in southwestern Nunavut, Canada, approximately 520 km northeast of Yellowknife. The district comprises mining leases and claims covering approximately 58,374 hectares. There are five mineral claim blocks on the 80 km belt. The most advanced is the Goose project. The second most advanced is the George project, situated approximately 60 km northwest from the Goose project. There are three other underexplored claim blocks named Boot, Boulder, and Del. Significant infrastructure exists at the Goose project site along with the port facility at Bathurst Inlet.

In March 2021, an Updated Feasibility Study was published on the Goose project, outlining attractive operating metrics and robust economics, including:

- 18.7 million tonnes processed at an average grade of ~6.0 g/t gold over a 15-year mine life.

- Average metallurgical recoveries of 93.4%.

- Average annual production of 223,000 ounces of gold.

- First five years average of 287,000 ounces of gold, with peak production of 312,000 ounces in year three.

- Average cash costs of US$679 per ounce of gold and all-in sustaining costs of US$775 per ounce of gold.

- Initial capital costs of C$610 million with total life of mine sustaining capital costs of C$419 million.

- Payback of 2.3 years, with a post-tax IRR of ~28% and NPV5% of C$1.1 billion utilizing a gold price of US$1,600 per ounce and a C$:US$ exchange rate of 1.31.

The Goose project contains Measured & Indicated Mineral Resources of 5.1 million ounces of gold and Inferred Mineral Resources of 1.8 million ounces of gold. All deposits that comprise the existing Goose Mineral Resources remain open.

The George project contains Indicated Mineral Resources of 1.2 million ounces of gold and Inferred Mineral Resources of 1.1 million ounces of gold. All deposits that comprise the existing George Mineral Resources remain open.

Inuit Relations and Sustainability

Upon closing of the Transaction, B2Gold will continue to honour the Framework Agreement that Sabina signed with the Kitikmeot Inuit Association (“KIA”) outlining renewable 20-year benefit and land tenure agreements. B2Gold looks forward to continuing the positive and strong relationships with the community that Sabina has established through meaningful engagement.

B2Gold recognizes that respect and collaboration with the KIA is central to the license to operate in the district and will continue to prioritize developing the project in a manner that recognizes Indigenous input and concerns and brings long-term socio-economic benefits to the area. Consistent with how it develops all its projects around the world, B2Gold is committed to ensuring that its operations leave a lasting and positive legacy and to minimize environmental impacts.

The Back River Gold District is in an area conducive to wind power and B2Gold expects to fully assess the viability of building a renewable resources facility that supports B2Gold’s goal of reducing GHG emissions by 30% by 2030. B2Gold will also look to incorporate energy-efficient initiatives as it constructs the project, including evaluating electric and hydrogen fuel fleets.

Transaction Structure and Terms

Under the terms of the Transaction, B2Gold will acquire all the issued and outstanding Sabina Shares and Sabina shareholders will receive 0.3867 B2Gold Shares for each existing Sabina Share held. All outstanding Sabina stock options will be exchanged for B2Gold stock options based on the exchange ratio.

The Transaction will be carried out by way of a court-approved Arrangement under the Business Corporations Act (British Columbia) and will require approval by 66 2/3% of the votes cast by Sabina shareholders at a special meeting expected to be held in April 2023.

The B2Gold Board of Directors has unanimously approved the Transaction. The Sabina Board of Directors have unanimously approved the Transaction, with Sabina directors recommending that Sabina shareholders vote in favour of the Transaction.

Each of the directors and senior officers of Sabina, representing in aggregate approximately 1% of the issued and outstanding Sabina Shares, have entered into voting support agreements with B2Gold and have agreed to vote in favour of the Transaction at the special meeting of shareholders of Sabina to be held to consider the Transaction.

In addition to Sabina shareholder approval, the Transaction is subject to normal course regulatory approvals and the satisfaction of customary closing conditions. Subject to the satisfaction of these conditions, B2Gold and Sabina expect that the Transaction will be completed in the second quarter of 2023.

B2Gold and Sabina have provided representations and warranties customary for a transaction of this nature as well as customary interim period covenants regarding the operation of their respective businesses in the ordinary course. The Agreement also provides for customary deal-protection measures, including non-solicitation covenants on the part of Sabina and a right to match in favour of B2Gold. Sabina may, under certain circumstances, terminate the Agreement in favour of an unsolicited superior proposal, subject to a termination payment by Sabina to B2Gold.

Further information regarding the Transaction will be contained in an information circular that Sabina will prepare, file and mail in due course to its shareholders in connection with the Sabina special meeting.

Details regarding these and other terms of the transaction are set out in the Agreement, which will be available under each of B2Gold’s and Sabina’s profile on SEDAR at www.sedar.com.

None of the securities to be issued pursuant to the Agreement have been or will be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and any securities issued in the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Advisors and Counsel

B2Gold’s financial advisor is National Bank Financial, its Canadian legal counsel is Lawson Lundell LLP and its United States legal counsel is Dorsey & Whitney LLP.

Sabina’s financial advisors are BMO Capital Markets and Cormark Securities Inc., its Canadian legal counsel is Blake, Cassels & Graydon LLP and its United States legal counsel is Skadden, Arps Slate, Meagher & Flom LLP. Each of BMO Capital Markets and Cormark Securities Inc. has provided an oral opinion to the Board of Directors of Sabina that the consideration offered under the Transaction is fair, from a financial point of view, to the shareholders of Sabina.

Qualified Persons

Bill Lytle, Senior Vice President and Chief Operating Officer of B2Gold Corp. and Vincy Benjamin, Director, Engineering for Sabina Gold & Silver Corp., both qualified persons under NI 43-101, have approved the scientific and technical information related to operations matters contained in this news release.

Brian Scott, P. Geo., Vice President, Geology & Technical Services for B2Gold Corp. and Angus Campbell, Vice President, Exploration for Sabina Gold & Silver Corp., both qualified persons under NI 43-101, have approved the scientific and technical information related to exploration and mineral resource matters contained in this news release.

About B2Gold Corp.

B2Gold is a low-cost international senior gold producer headquartered in Vancouver, Canada. Founded in 2007, today, B2Gold has operating gold mines in Mali, Namibia and the Philippines and numerous exploration and development projects in various countries including Mali, Colombia, Finland and Uzbekistan. B2Gold forecasts total consolidated gold production of between 1,000,000 and 1,080,000 ounces in 2023.

About Sabina Gold & Silver Corp.

Sabina Gold & Silver Corp. is an emerging gold mining company that owns 100% of the district scale, advanced, high grade Back River Gold District in Nunavut, Canada.

Sabina filed an Updated Feasibility Study on its first project on the district, Goose, which presents a project that will produce ~223,000 ounces of gold a year (first five years average of 287,000 ounces a year with peak production of 312,000 ounces in year three) for ~15 years with a rapid payback of 2.3 years, with a post-tax IRR of ~28% and NPV5% of C$1.1 billion at a gold price of US$1,600 per ounce. See “National Instrument (NI) 43-101 Technical Report – 2021 Updated Feasibility Study for the Goose Project at the Back River Gold District, Nunavut, Canada” dated March 3, 2021.

The Goose project has received all major permits and authorizations for construction and operations.

Sabina is also very committed to its Inuit stakeholders, with Inuit employment and opportunities a focus. Sabina has signed a 20-year renewable land use agreement with the Kitikmeot Inuit Association and has committed to various sustainability initiatives under the agreement.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE