Aura Announces Q4 2024 Production Results, Achieving 2024 Guidance

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) announces Q4 2024 preliminary production results from the Company’s four operating mines: Aranzazu, Apoena, Minosa (San Andres), and Almas. Total production in Q4 2024 reached 66,473 gold equivalent ounces1, 1% below the third quarter of 2024 and stable when compared to the same period last year at constant metal prices. The quarter’s highlights included Almas, which set another production record, achieving an 11% increase over the previous quarter and surpassing the annual guidance. Minosa also stood out by exceeding its annual guidance.

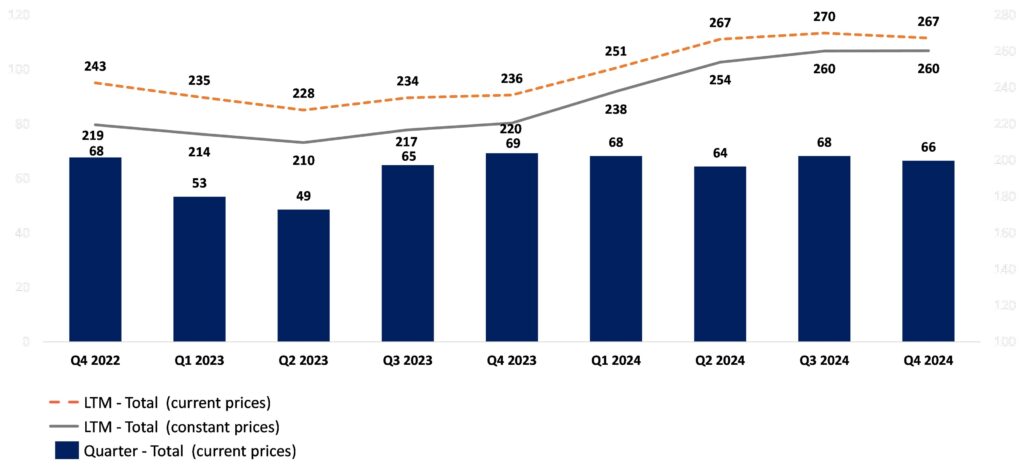

Total production for 2024 reached 267,232 GEO at current prices, a 13% increase when compared to 2023 at current prices and 18% increase when compared at constant prices. At guidance metal prices, production achieved 276,305 GEO, placing it at the upper end of the consolidated production guidance range of 244,000 to 292,000 GEO for the year.

Q4 2024 Highlights:

- At Aranzazu, production reached 23,379 GEO, once again stable, both when compared to Q3 2024 and when compared to Q4 2023, at constant prices, reflecting continued operational stability and adherence to mine sequencing in the quarter. For the full year of 2024, Aranzazu’s production reached 97,558 GEO at current prices. During 2024, the variation in metal prices significantly influenced GEO conversion, particularly due to an increase of approximately 34% in gold price compared to the levels used to define the year’s production guidance. For the guidance projection ending 2024, the Company considered the following prices: Copper at $3.95/lb, Gold at $1,988/oz, and Silver at $24.17/oz. When applying these same price levels to the annual production at Aranzazu, the total production for the year reached 106,631 GEO, aligning with the upper range of the Guidance of 94,000 to 108,000 GEO.

- At Minosa (San Andres), production totaled 19,294 GEO, reflecting a 7% decrease over the previous quarter, primarily caused by the expected rainfall during the period, particularly in November and December, but still consistently above 19,000 ounces as achieved during all quarters during the year. When compared to the same quarter last year, production increased by 8%, due to an increase of 9% in grades between quarters. For the full year of 2024, production reached 78,372 GEO, a 19% increase compared to 2023, exceeding the 2024 Guidance range of 60,000 to 75,000 GEO.

- At Almas, production reached 16,679 GEO, representing an increase of 11% compared to the previous quarter, and 74% when compared to the same period last year. This growth was primarily driven by an increase in ore mined and stable grades during the period, both aligned with the mine production plan, as well as an increase in ore feed to the plant, consistent with the plant’s expansion plan. This quarter, once again, reflects continuous improvements in production and efficiency resulting from the contractor replacement in Q2 2024. For the full year of 2024, despite the challenges of replacing the contractor during the second quarter, production totaled 54,129 GEO, exceeding the upper end of the 2024 guidance range of 45,000 to 53,000 GEO.

- At Apoena (EPP), production was 7,121 GEO, down 11% from Q3 2024 and 53% from Q4 2023. This drop was due to lower ore grades caused by delays in getting permits for the Nosde pit expansion, which was vital for accessing higher-grade ore. Aura expects these permits in early 2025. The delay meant lower grades and that 2024’s total production was 37,173 GEO, a 19% decrease from 2023, below the 46,000 to 56,000 GEO guidance.

Rodrigo Barbosa, Aura’s President and CEO commented, “We ended 2024 at the upper end of our production guidance with 267,000 GEO at current prices, marking a 13% increase from the previous year. The quick and effective contractor change at Almas allowed us not only to recover from the Q2 production dip but also to surpass our yearly targets. Alongside Almas, improvements in Honduras exceeded expectations, and Aranzazu maintained its consistent output. This robust performance ensured we met our guidance, despite setbacks at Apoena due to delays in obtaining environmental permits for accessing higher-grade ore, which we plan to start mining in 2025. Also in 2024, we made significant progress on the Borborema construction, staying on schedule and aiming for ramp-up by the end of Q1 2025. We’ve also acquired a new world class project for development in Guatemala. Overall, in 2024 we not only increased our production in line with our long-term strategy but also demonstrated that with our expansion and upcoming operations, we’ll experience less production volatility. This lays the groundwork for executing our growth strategy and significantly enhancing our valuation multiple.”

1 Gold equivalent ounces, or GEO, is calculated by converting the production of silver, copper and gold into gold using a ratio of the prices of these metals to that of gold. The prices used to determine the gold equivalent ounces are based on the weighted average price of gold, silver and copper realized from sales at the Aranzazu Complex during the relevant period.

Production Results and Guidance 2024 Achievement

Preliminary GEO1,2,3 production volume for the three and twelve months ended December 31, 2024 at both current prices and constant prices, compared to the previous quarter and the same period in the previous year is presented below:

| Q4 2024 | Q3 2024 | Q4 2023 | % change vs. Q3 2024 |

% change vs. Q4 2023 |

2024 | 2023 | % change vs. 2023 |

|

| Ounces produced (GEO1) | ||||||||

| Aranzazu | 23,379 | 24,486 | 26,532 | -5% | -12% | 97,558 | 106,120 | -8% |

| Minosa (San Andres) | 19,294 | 20,750 | 17,854 | -7% | 8% | 78,372 | 65,927 | 19% |

| Almas | 16,679 | 14,975 | 9,591 | 11% | 74% | 54,129 | 17,805 | 204% |

| Apoena (EPP) Mines | 7,121 | 8,035 | 15,217 | -11% | -53% | 37,173 | 46,006 | -19% |

| Total GEO produced – current prices | 66,473 | 68,246 | 69,194 | -3% | -4% | 267,232 | 235,858 | 13% |

| Total GEO produced – constant prices | 66,473 | 67,103 | 66,274 | -1% | 0% | 267,232 | 226,840 | 18% |

| [1] Includes ounces produced and which were capitalized for projects at pre-commercial production stages. | ||||||||

The table below shows production by each type of metal at Aranzazu. Production increased in Q4 2024 for Gold and Silver, and decreased for Copper, and was in line with the Company’s expectations.

| Q4 2024 | Q3 2024 | Q4 2023 | % change vs. Q3 2024 |

% change vs. Q4 2023 |

2024 | 2023 | % change vs. 2023 |

|

| Gold Production (oz) | 6,987 | 6,898 | 7,061 | 1% | -1% | 26,578 | 27,549 | -4% |

| Silver Production (oz) | 146,187 | 137,414 | 130,370 | 6% | 12% | 539,532 | 507,144 | 6% |

| Copper Production (klbs) | 9,413 | 9,511 | 9,606 | -1% | -2% | 36,988 | 36,684 | 1% |

| Total GEO produced – current prices | 23,379 | 24,486 | 26,532 | -5% | -12% | 97,558 | 106,120 | -8% |

| Total GEO produced – constant prices | 23,379 | 23,344 | 23,612 | 0% | -1% | 97,558 | 97,102 | 0% |

1 The total may not add due to rounding.

2 For quarterly constant prices, applies the metal sale prices in Aranzazu realized during Q4 2024 to the previous quarters in all operations, being: Copper price = US$4.15/lb; Gold Price = US$2,663/oz; Silver Price = US$31.47/oz.

3 For yearly constant prices, applies the metal sale prices in Aranzazu realized during 2024 to the previous year, being: Copper price = US$4.17/lb; Gold Price = US$2,406/oz; Silver Price = US$28,60/oz.

Preliminary GEO1,2 production volume for the year ended December 31, 2024, at both current prices and Guidance prices, along with the Guidance ranges, compared to the previous quarter and the same period in the previous year is presented below:

| 2024 | |||

| Ounces produced (GEO1) | Current Prices | Guidance Prices | Guidance Range |

| Aranzazu | 97,558 | 106,631 | 94,000 – 108,000 |

| Minosa (San Andres) | 78,372 | 78,372 | 60,000 – 75,000 |

| Almas | 54,129 | 54,129 | 45,000 – 53,000 |

| Apoena (EPP) Mines | 37,173 | 37,173 | 46,000 – 56,000 |

| 267,232 | 276,305 | 244,000 – 292,000 | |

The chart below displays the consolidated quarterly GEO production measured at current and constant prices since Q4 2022, as well as the last twelve months at the end of each reporting period:

Consolidated GEO Production per Quarter and LTM

(000’s GEO, current and constant prices as reported)

1 The total may not add due to rounding.

2 Applies the metal sale prices in Aranzazu realized during Q4 2024 to the previous quarters in all operations, being: Copper price = US$4.15/lb; Gold Price = US$2,663/oz; Silver Price = US$31.47/oz.

Qualified Person

The scientific and technical information contained within this news release has been reviewed and approved by Farshid Ghazanfari, P.Geo. Mineral resources and Geology Director for Aura Minerals Inc. and serve as the Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production company focused on operating and developing gold and base metal projects in the Americas. The Company has 4 operating mines including the Aranzazu copper-gold-silver mine in Mexico, the Apoena (EPP) and Almas gold mines in Brazil, and the Minosa (San Andres) mine in Honduras. The Company’s development projects include Borborema and Matupá both in Brazil. Aura has unmatched exploration potential owning over 630,000 hectares of mineral rights and is currently advancing multiple near-mine and regional targets along with the Carajas (Serra da Estrela) copper project in the prolific Carajás region of Brazil.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE