Arizona Metals Intersects 20.1 m at 3.4% CuEq (incl. 3.2 m at 14.9% CuEq) and 38.0 m at 1.4% CuEq (incl. 4.4 m at 7.1% CuEq) in Kay Mine Expansion Drilling

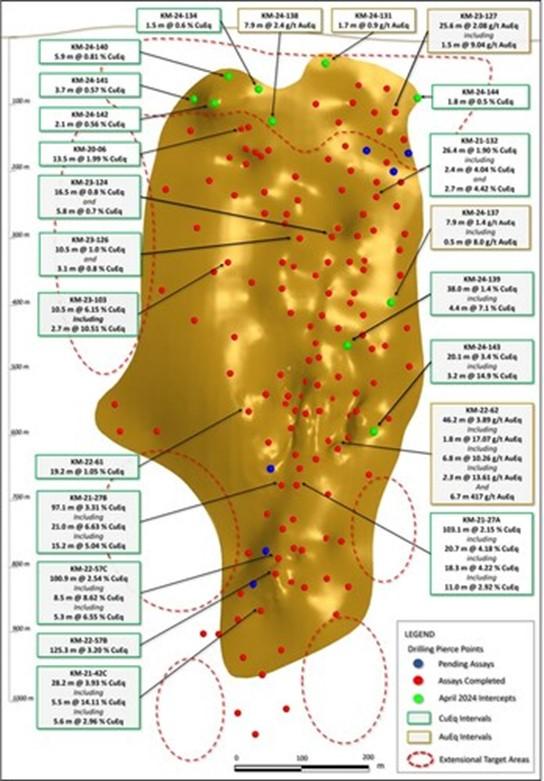

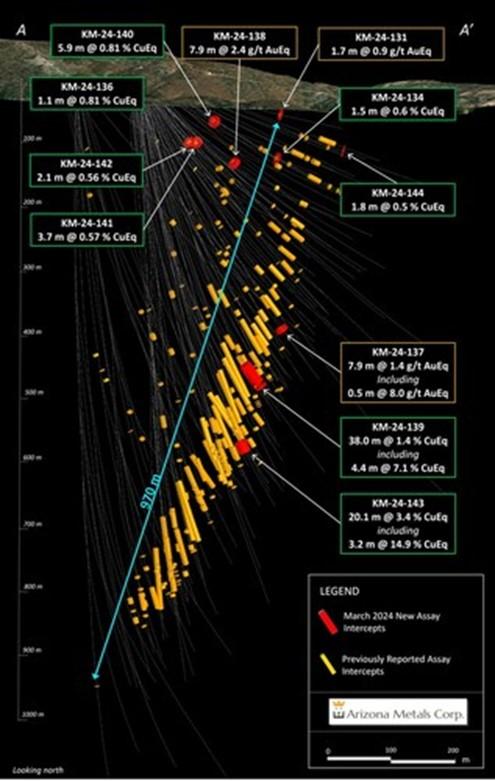

Arizona Metals Corp. (TSX: AMC) (OTCQX: AZMCF) is pleased to announce the latest drill results from the Kay Mine Project in Arizona. Eleven new drill holes at the Kay Mine Deposit continue to demonstrate the continuity and expansion potential of the deposit. Three holes on the southern edge of the deposit have encountered zones of high-grade copper-rich (holes KM-24-143 and KM-24-139) and gold-rich (hole KM-24-137) mineralization that are open for expansion.

Highlights of the recent drilling include:

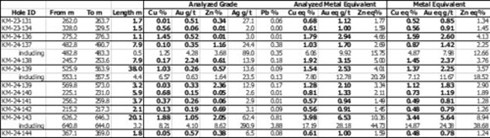

- Hole KM-24-143 intersected 20.1 m at 3.4% copper equivalent (CuEq), including 3.2 m at 14.9% CuEq, from a vertical depth of 590 m. This hole is on the southern edge of the deposit and showed excellent continuity in the 90-m gap between holes KM-21-35 (5.5 m at 2.3% CuEq) and KM-22-79 (7.9 m at 4% CuEq). Mineralization in this area is open for expansion to the south.

- Hole KM-24-139 returned 38.0 m at 1.4% CuEq, including 4.4 m at 7.1% CuEq, from a vertical depth of 450 m. This hole filled in a 70-100 meter gap among previous drill holes in this area, including KM-21-50 (53.1 m at 1.5% CuEq) and KM-20-10B (27.6 m at 2.0% CuEq).

- Hole KM-24-137 intersected 7.9 m at 1.4 g/t AuEq, including 0.5 m at 8.0 g/t AuEq. from a vertical depth of 360 m. This hole extended mineralization 55 m south of hole KM-20-14 (39.9 m at 2.5% CuEq) in the central portion of the deposit. Mineralization is open to the south in this area.

Marc Pais, CEO, commented, “These new drill results from the Kay Deposit continue to point to its expansion potential, with three holes encountering both high-grade copper-rich and gold-rich mineralization at the southern edge of the deposit. Future drill holes will target this area as part of the continuing Kay Mine resource definition program.

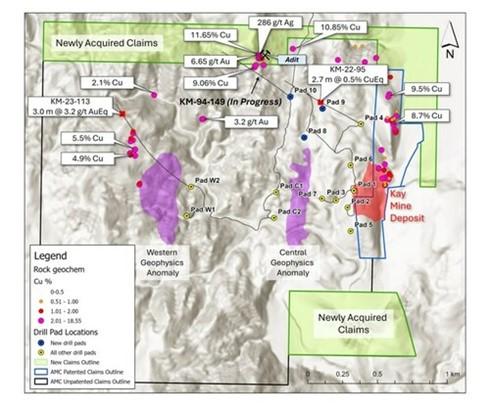

As disclosed in our news release of April 10th, 2024, we recently increased our land position at the Kay Project by 22% and through a rock sampling program, have identified a number of high priority exploration targets on these claims. Three newly-permitted drill pads will allow for testing of these targets as well as the northern strike extension of the Kay Deposit. Exploration drilling has commenced from pad 10 (see Figure 4) to test the first of a number of targets identified through a recently completed rock sampling program on the new claims.”

With the completion of recent drill holes, Arizona Metals has drilled a total of 106,000 meters on the Property. The Company is fully funded (with $31 million in cash as of Dec 31, 2023) to complete the remaining 53,000 m of the 76,000 m Phase 3 drill program.

Kay Deposit Shallow Drilling

The drill holes released today extend mineralization in the shallow portions of the Kay deposit approximately 70 meters upward toward surface, along a strike length of 335 meters.

KM-24-131

- 1.7 m at 0.9 g/t AuEq.

- Among the shallowest holes at Kay, KM-23-131 added mineralization 70 m above the previous drilling between the North and South Zones.

KM-24-134

- 1.5 m at 0.6% CuEq.

- Extends mineralization about 50 m upward above hole KM-20-03A (4.6 m at 4.8% CuEq).

KM-24-136

- 1.1 m at 1.6% CuEq.

- Extends mineralization about 50 m upward above hole KM-20-03A.

KM-24-138

- 7.9 m at 2.4 g/t AuEq.

- Hole KM-24-138 showed that mineralization continues southward from the Company’s earliest Kay drill holes, including KM-20-06 (13.5 m at 2.0% CuEq).

KM-24-140

- 5.9 m at 0.7% CuEq.

- Among the shallowest drill holes at Kay, KM-24-140 extended mineralization 80 m above hole KM-20-03 (2.7 m at 4.2% CuEq), to within 70 m of surface.

KM-24-141

- 3.7 m at 0.5% CuEq.

- This hole extended mineralization 40 m toward surface above hole KM-22-82 (2.4 m at 1.3% CuEq) along the northern edge of the Kay deposit.

KM-24-142

- 2.1 m at 0.5% CuEq

- This hole verified continuous mineralization in the 80-meter gap between holes KM-24-141 and KM-20-03 in the shallow portions of the Kay north zone.

KM-24-144

- 1.8 m at 0.5 % CuEq

- This hole is in the upper portions of the south zone, and extended mineralization 35 m south of KM-23-123 (28.1 m at 1% CuEq) and 30 m above KM-23-127 (25.6 m at 1.3% CuEq).

The true width of mineralization is estimated to be 50% to 99% of reported core width, with an average of 76%. (2) Assumptions used in USD for the copper and gold metal equivalent calculations were metal prices of $4.63/lb Copper, $1937/oz Gold, $25/oz Silver, $1.78/lb Zinc, and $1.02/lb Pb. Assumed metal recoveries (rec.), based on a preliminary review of historic data by SRK and ProcessIQ1, were 93% for copper, 92% for zinc, 90% for lead, 72% silver, and 70% for gold. The following equation was used to calculate copper equivalence: CuEq = Copper (%) (93% rec.) + (Gold (g/t) x 0.61)(72% rec.) + (Silver (g/t) x 0.0079)(72% rec.) + (Zinc (%) x 0.3844)(93% rec.) +(Lead (%) x 0.2203)(93% rec.). The following equation was used to calculate gold equivalence: AuEq = Gold (g/t)(72% rec.) + (Copper (%) x 1.638)(93% rec.) + (Silver (g/t) x 0.01291)(72% rec.) + (Zinc (%) x 0.6299)(93% rec.) +(Lead (%) x 0.3609)(93% rec.). Analyzed metal equivalent calculations are reported for illustrative purposes only. The metal chosen for reporting on an equivalent basis is the one that contributes the most dollar value after accounting for assumed recoveries.

Drilling Commenced to Test Newly-Staked High-Grade Targets

The Company has permitted three new dill pads (pads 8, 9, and 10 on Figure 1) allowing for additional testing of the northern extension of the Central Target. The drill pads also allow access to high-grade mineralization identified through rock sampling of the newly-staked claims, and extensions of mineralization identified at the Kay Deposit.

Mapping of the new claims identified an historic adit, approximately 100 feet in length. Sampling of this adit returned a number of high-grade samples of VMS mineralization, with grades including 11.7% copper, 9.1% copper, 6.7 g/t gold, and 286 g/t silver. The area of this adit can be reached from drill pad 10. The first drill hole from pad 10 has commenced, with a number of additional holes from pads 8, 9, and 10 being planned.

| _______________________________ |

| 1 SRK Consulting (Canada) Inc., March 2022, Updated Metallurgical Review, Kay Mine, Arizona. Report 3CA061.004 |

About Arizona Metals Corp

Arizona Metals Corp owns 100% of the Kay Mine Project in Yavapai County, which is located on a combination of patented and BLM claims totaling 1,300 acres that are not subject to any royalties. An historic estimate by Exxon Minerals in 1982 reported a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.” The historic estimate at the Kay Deposit was reported by Exxon Minerals in 1982. (Fellows, M.L., 1982, Kay Mine massive sulphide deposit: Internal report prepared for Exxon Minerals Company)

*The Kay Mine historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Kay Mine is a steeply dipping VMS deposit that has been defined from a depth of 60 m to at least 900 m. It is open for expansion on strike and at depth.

The Company also owns 100% of the Sugarloaf Peak Property, in La Paz County, which is located on 4,400 acres of BLM claims. Sugarloaf is a heap-leach, open-pit target and has a historic estimate of “100 million tons containing 1.5 million ounces gold” at a grade of 0.5 g/t (Dausinger, N.E., 1983, Phase 1 Drill Program and Evaluation of Gold-Silver Potential, Sugarloaf Peak Project, Quartzsite, Arizona: Report for Westworld Inc.)

The historic estimate at the Sugarloaf Peak Property was reported by Westworld Resources in 1983. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

Qualified Person and Quality Assurance/Quality Control

All of Arizona Metals’ drill sample assay results have been independently monitored through a quality assurance/quality control protocol which includes the insertion of blind standard reference materials and blanks at regular intervals. Logging and sampling were completed at Arizona Metals’ core handling facilities located in Phoenix and Black Canyon City, Arizona. Drill core was diamond sawn on site and half drill-core samples were securely transported to ALS Laboratories’ (“ALS”) sample preparation facility in Tucson, Arizona. Sample pulps were sent to ALS’s labs in Vancouver, Canada, for analysis.

Gold content was determined by fire assay of a 30-gram charge with ICP finish (ALS method Au-AA23). Silver and 32 other elements were analyzed by ICP methods with four-acid digestion (ALS method ME-ICP61a). Over-limit samples for Au, Ag, Cu, and Zn were determined by ore-grade analyses Au-GRA21, Ag-OG62, Cu-OG62, and Zn-OG62, respectively.

ALS Laboratories is independent of Arizona Metals Corp. and its Vancouver facility is ISO 17025 accredited. ALS also performed its own internal QA/QC procedures to assure the accuracy and integrity of results. Parameters for ALS’ internal and Arizona Metals’ external blind quality control samples were acceptable for the samples analyzed. Arizona Metals is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

The qualified person who reviewed and approved the technical disclosure in this release is David Smith, CPG, a qualified person as defined in National Instrument43-101–Standards of Disclosure for Mineral Projects. Mr. Smith supervised the preparation of the scientific and technical information that forms the basis for this news release and has reviewed and approved the disclosure herein. Mr. Smith is the Vice-President, Exploration of the Company. Mr. Smith supervised the drill program and verified the data disclosed, including sampling, analytical and QA/QC data, underlying the technical information in this news release, including reviewing the reports of ALS, methodologies, results, and all procedures undertaken for quality assurance and quality control in a manner consistent with industry practice, and all matters were consistent and accurate according to his professional judgement. There were no limitations on the verification process.

Figure 1. Long section looking east, displaying new drill holes reported in this release (labels highlighted yellow). See Tables 1-3 for additional details. The true width of mineralization in this area is yet to be determined. See Table 1 for constituent elements, grades, metals prices and recovery assumptions used for AuEq g/t and CuEq % calculations. Analyzed Metal Equivalent calculations are reported for illustrative purposes only. (CNW Group/Arizona Metals Corp.)

Figure 2. Cross-section view looking north at the Kay Deposit, showing assay intervals in drilling reported in this release. See Tables 1-3 for additional details. The true width of mineralization is estimated to be 50% to 99% of reported core width, with an average of 76%. (CNW Group/Arizona Metals Corp.)

Figure 3. Drill core from Hole KM-24-143, showing part the 3.2 m interval 640.8 m to 644 m which intersected 4.1 g/t gold, 8.2% copper, 8.6% zinc, and 291 g/t silver (for an equivalent grade after assumed recoveries of 14.9% CuEq). This is part of a broader interval of 20.1 m grading 3.4% CuEq. (CNW Group/Arizona Metals Corp.)

Figure 4. Map showing newly staked claims, 3 newly permitted drill pads, and highlights of recent rock sampling program. Hole KM-24-149 is in progress from pad 10 with planning underway for additional drill targets. (CNW Group/Arizona Metals Corp.)

Table 1. Results of Phase 3 Drill Program at the Kay Exploration Project, Yavapai County, Arizona announced in this news release. (CNW Group/Arizona Metals Corp.)

Table 2. Full results to date of Phase 2 and 3 Drill Program at the Kay Deposit, Yavapai County, Arizona. See Table 1 for width and metal equivalency notes. (CNW Group/Arizona Metals Corp.)

Table 3. Full results to date of Phase 2 and 3 Drill Program at the Kay Deposit, Yavapai County, Arizona. See Table 1 for width and metal equivalency notes. (CNW Group/Arizona Metals Corp.)

Table 4. Results of Phase 1 Drill Program at the Kay Deposit, Yavapai County, Arizona. See Table 1 for width and metal equivalency notes. (CNW Group/Arizona Metals Corp.)

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE