Arizona Metals Intersects 20.1 m @ 3.6 g/t AuEq in Kay2 Zone at Kay Deposit

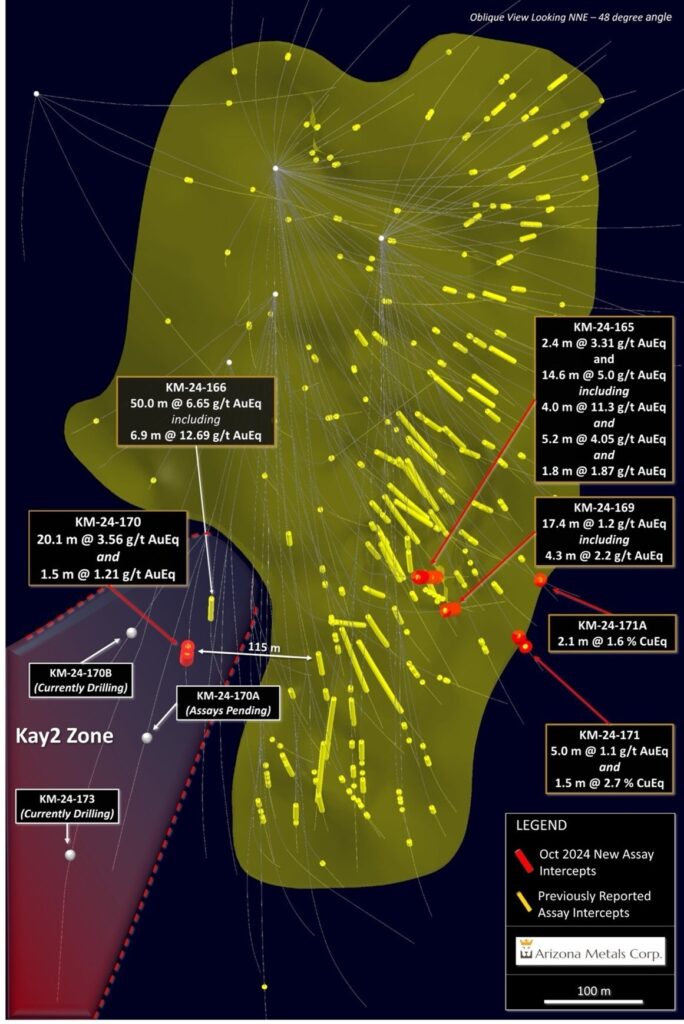

Arizona Metals Corp. (TSX: AMC) (OTCQX: AZMCF) is pleased to announce new drill results from the Kay2 Zone at the Kay deposit in Arizona. Drill hole KM-24-170 intersected 20.1 m grading 3.6 g/t AuEq, including 1.4 m @ 7.9 g/t AuEq. This drill hole is located approximately 60 m below hole KM-24-166, which intersected 50.0 m @ 6.7 g/t AuEq in what appears to be a new zone of mineralization in the Kay deposit (Figure 1). The new zone of mineralization, the Kay2 Zone, is located approximately 100 m north of previously drilled mineralization in the Kay deposit.

Figure 1. Oblique section looking northeast, displaying new drill holes reported in this release. See Table 1 for additional details. The true width of mineralization in this area is yet to be determined. See Table 1 for constituent elements, grades, metals prices and recovery assumptions used for AuEq g/t and CuEq % calculations. Analyzed Metal Equivalent calculations are reported for illustrative purposes only. (CNW Group/Arizona Metals Corp.)

Duncan Middlemiss, President and CEO of Arizona Metals, comments: “A second significant intersection in the Kay2 Zone is very encouraging as we continue to test the extents of mineralization in and around the Kay deposit. These recently drilled Kay2 holes will likely be included in our upcoming Mineral Resource Estimate which we plan to publish in H1 of 2025. Currently we have two rigs testing this new extension with plans to drill 6,300 meters at Kay2 and Kay in the first quarter of 2025.”

Four other drill holes at the Kay deposit returned favorable results.

- Hole KM-24-165 returned several intervals, the best of which is 14.6 m @ 5.0 g/t AuEq, including 4.0 m @ 11.3 g/t AuEq. This infill hole is in the core of the deposit, intended to fill a large gap south of hole KM-22-74 (39 m @ 4.2 g/t AuEq).

- Hole KM-24-169 intersected 17.4 m @ 1.2 g/t AuEq, including 4.3 m @ 2.2 g/t AuEq. Also located in the core of the deposit, this infill hole is located in a large gap south of hole KM-21-25B (numerous intervals, including 4.3 m @ 1.8% CuEq)

- Hole KM-24-171 drilled 5.0 m @ 1.1 g/t Au and 1.5 m@ 2.7% CuEq along the south edge of the deposit, stepping out ~35 m south of hole KM-24-143 (20.1 m@ 3.4% CuEq). Mineralization is open to the south in this portion of the deposit.

- Hole KM-24-171A intersected 2.1 m @ 1.6% CuEq in a branch hole that extended mineralization 25 m south of hole KM-21-35 (5.5 m @ 2.3% CuEq)

Three holes in the North Central target intersected both the Kay horizon and Pad 10 horizon: holes KM-24-164, 167, and 168 intersected anomalous Cu, Au, and Zn where expected within these mineralization horizons.

With the completion of recent drill holes, Arizona Metals has drilled a total of 124,000 meters on the property.

Table 1. Results of Phase 3 Drill Program at the Kay Project, Yavapai County, Arizona announced in this news release.

| Analyzed Grade | Analyzed Metal Equivalent |

Metal Equivalent | ||||||||||||

| Hole ID | From m |

To m | Length m |

Cu % |

Au g/t |

Zn % | Ag g/t |

Pb % |

CuEq % |

AuEq g/t |

ZnEq % |

CuEq % |

AuEq g/t |

ZnEq % |

| KM-24-164 | no significant assays | |||||||||||||

| KM-24-165 | 680.3 | 682.8 | 2.4 | 0.28 | 0.98 | 2.67 | 52.1 | 0.49 | 2.43 | 3.98 | 6.31 | 2.02 | 3.31 | 5.25 |

| KM-24-165 | 686.1 | 700.7 | 14.6 | 0.47 | 1.08 | 4.18 | 75.5 | 1.16 | 3.59 | 5.89 | 9.34 | 3.04 | 4.98 | 7.90 |

| including | 686.1 | 690.1 | 4.0 | 0.30 | 2.00 | 11.58 | 176.6 | 3.27 | 8.09 | 13.26 | 21.05 | 6.88 | 11.28 | 17.91 |

| KM-24-165 | 712.8 | 718.0 | 5.2 | 0.22 | 1.53 | 3.79 | 28.9 | 0.56 | 2.96 | 4.85 | 7.70 | 2.47 | 4.05 | 6.43 |

| KM-24-165 | 725.4 | 727.3 | 1.8 | 0.02 | 0.37 | 1.87 | 34.1 | 0.56 | 1.35 | 2.22 | 3.52 | 1.14 | 1.87 | 2.96 |

| KM-24-167 | no significant assays | |||||||||||||

| KM-24-168 | no significant assays | |||||||||||||

| KM-24-169 | 719.0 | 736.4 | 17.4 | 0.05 | 0.47 | 1.02 | 13.6 | 0.20 | 0.88 | 1.44 | 2.29 | 0.73 | 1.19 | 1.89 |

| including | 732.1 | 736.4 | 4.3 | 0.03 | 0.70 | 2.15 | 23.1 | 0.56 | 1.59 | 2.60 | 4.13 | 1.33 | 2.18 | 3.46 |

| KM-24-170 | 715.5 | 717.0 | 1.5 | 0.01 | 1.28 | 0.33 | 8.0 | 0.12 | 1.01 | 1.65 | 2.62 | 0.74 | 1.21 | 1.93 |

| KM-24-170 | 731.5 | 751.6 | 20.1 | 0.55 | 1.59 | 2.64 | 7.0 | 0.03 | 2.60 | 4.26 | 6.76 | 2.17 | 3.56 | 5.65 |

| including | 737.9 | 739.3 | 1.4 | 0.27 | 8.03 | 3.10 | 4.0 | 0.03 | 6.40 | 10.49 | 16.65 | 4.81 | 7.88 | 12.50 |

| KM-24-171 | 652.1 | 657.2 | 5.0 | 0.05 | 0.31 | 1.17 | 11.9 | 0.08 | 0.80 | 1.32 | 2.09 | 0.68 | 1.11 | 1.77 |

| KM-24-171 | 673.0 | 674.5 | 1.5 | 1.95 | 0.68 | 1.16 | 16.8 | 0.21 | 2.99 | 4.90 | 7.77 | 2.65 | 4.34 | 6.89 |

| KM-24-171A | 627.0 | 629.1 | 2.1 | 0.59 | 0.62 | 1.96 | 16.7 | 0.13 | 1.88 | 3.08 | 4.89 | 1.63 | 2.67 | 4.23 |

The true width of mineralization is estimated to be 50% to 99% of reported core width, with an average of 76%. (2) Assumptions used in USD for the copper and gold metal equivalent calculations were metal prices of $4.63/lb Copper, $1937/oz Gold, $25.20/oz Silver, $1.78/lb Zinc, and $1.02/lb Pb. Assumed metal recoveries (rec.), based on a preliminary review of historic data by SRK and ProcessIQ, were 93% for copper, 92% for zinc, 90% for lead, 72% silver, and 70% for gold. The following equation was used to calculate copper equivalence: CuEq = Copper (%) (93% rec.) + (Gold (g/t) x 0.61)(70% rec.) + (Silver (g/t) x 0.0079)(72% rec.) + (Zinc (%) x 0.3844)(92% rec.) + (Lead (%) x 0.2203)(90% rec.). The following equation was used to calculate gold equivalence: AuEq = Gold (g/t)(70% rec.) + (Copper (%) x 1.638)(93% rec.) + (Silver (g/t) x 0.01291)(72% rec.) + (Zinc (%) x 0.6299)(92% rec.) +(Lead (%) x 0.3609)(90% rec.). Analyzed metal equivalent calculations are reported for illustrative purposes only. The metal chosen for reporting on an equivalent basis is the one that contributes the most dollar value after accounting for assumed recoveries.

Corporate Update – Previously Proposed Spin-outs

The Board of Directors of the Company recently completed its 2025 strategy session, and as part of these discussions the Company has decided to no longer pursue the proposed spin-out transactions, which the Company had previously postponed in May of 2024. Management, after careful consideration and consultation with the Board of Directors, determined that at this time the proposed spin-out transactions are not in the best interest of the Company given the current stage of the Company’s development and current capital markets conditions.

Arizona Metals had previously announced its intention to seek shareholder approval for the spin-out of the Company’s Sugarloaf Peak Gold Project, and the spin-out of a to-be-created net smelter return royalty on the Company’s Kay Mine Project. Neither spin-out was voted on by shareholders or executed.

About Arizona Metals Corp

Arizona Metals Corp owns 100% of the Kay Project in Yavapai County, which is located on a 1669 acres of patented and BLM mining claims and193 acres of private land that are not subject to any royalties. An historic estimate by Exxon Minerals in 1982 reported a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.” The historic estimate at the Kay Deposit was reported by Exxon Minerals in 1982. (Fellows, M.L., 1982, Kay Mine massive sulphide deposit: Internal report prepared for Exxon Minerals Company)

The Kay Mine historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Kay Mine is a steeply dipping VMS deposit that has been defined from a depth of 60 m to at least 900 m. It is open for expansion on strike and at depth.

The Company also owns 100% of the Sugarloaf Peak Property, in La Paz County, which is located on 4,400 acres of BLM claims. Sugarloaf is a heap-leach, open-pit target and has a historic estimate of “100 million tons containing 1.5 million ounces gold” at a grade of 0.5 g/t (Dausinger, N.E., 1983, Phase 1 Drill Program and Evaluation of Gold-Silver Potential, Sugarloaf Peak Project, Quartzsite, Arizona: Report for Westworld Inc.)

The historic estimate at the Sugarloaf Peak Property was reported by Westworld Resources in 1983. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE