ARIS MINING ANNOUNCES UPDATED MARMATO EXPANSION PFS INCLUDING 57% INCREASE IN GOLD MINERAL RESERVES TO 3.2 MOZ

Aris Mining Corporation (TSX: ARIS) (OTCQX: TPRFF) announces updated mineral resource and reserve estimates and a Preliminary Feasibility Study for the Marmato expansion project, effective June 30, 2022, which includes significant growth and refinement over the PFS completed in March 2020.

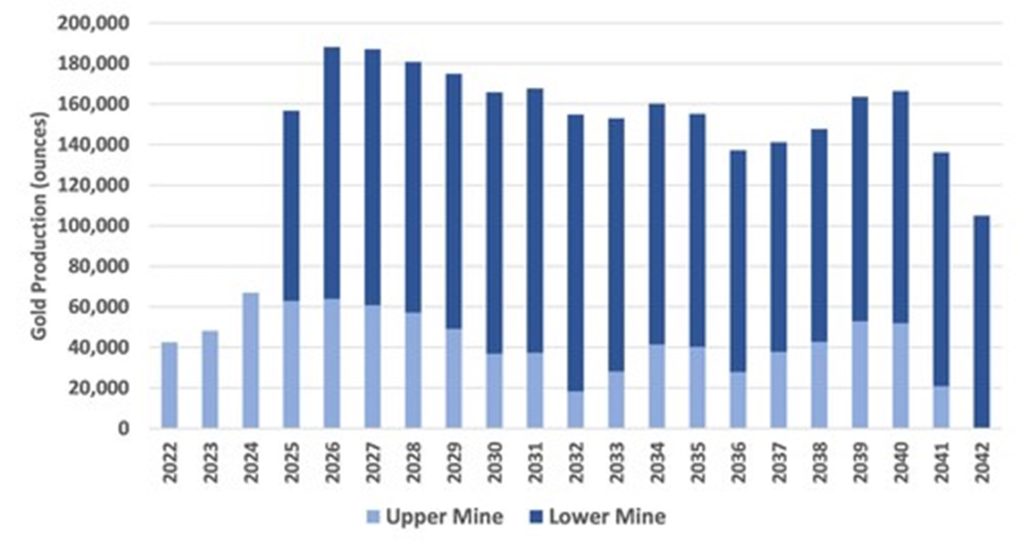

Neil Woodyer, CEO of Aris Mining, commented: “We are very pleased with the results of the 2022 PFS which includes an updated Marmato Lower Mine construction capital estimate of $280 million, that will be partially funded from $122 million of remaining committed stream financing, for a net construction funding amount of $158 million. Compared to the 2020 PFS, we have increased measured and indicated mineral resources by 47% to 6.0 million ounces of gold, the mineral reserves by 57% to 3.2 million ounces, and, at the base case $1,600 gold price, the project NPV5% is $341 million and the project IRR is 30%. Following construction of the new Lower Mine and based on the current mineral reserve, the Marmato mine is expected to deliver average production of 162,000 ounces per year over a nearly 20-year mine life at AISC of US$1,0031/oz, as shown in Figure 1.

“We are nearing completion of the process to amend the existing environmental permits at Marmato to facilitate the expansion, and we plan to quickly enter the construction phase of the Lower Mine expansion project. On November 3, 2022 the Marmato Plan de Trabajos y Obras or PTO was approved by the Agencia Nacional de Minería as a progressive step toward fully permitting the expansion project.”

| _____________ | |

| 1 | AISC ($ per oz sold) is a non-IFRS financial measure and does not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. Please refer to the Non-IFRS Measures section of the Company’s Management’s Discussion and Analysis for the three and nine months ended September 30, 2022, which is incorporated by reference into this press release, and is available on SEDAR at www.sedar.com, for full details. |

Highlights of the 2022 PFS for the Marmato Expansion

The Marmato expansion project includes the development of a new underground mine and 4,000 tonne per day (tpd) processing facility to add to the current 1,250 tpd Upper Mine. Total recovered gold ounces are estimated at 3.0 million. The deposit remains open at depth and along strike, and has a high expansion potential from future underground drilling programs. The construction capital is estimated at $280 million as detailed in Table 3, and the project economics presented in Table 1 are inclusive of the stream financing, where for upfront deposits of $53 million received and $122 million to be received during construction, Wheaton Precious Metals International purchases metals at reduced prices.

Table 1: 2022 PFS – Marmato Project Economics1

| Gold price (US$/oz) | $1,400 | $1,500 | $1,6002 | $1,700 | $1,800 |

| Project NPV @ 5% (after-tax) | $150 | $246 | $341 | $438 | $533 |

| Project IRR (after-tax) | 16.1 % | 22.8 % | 29.7 % | 37.1 % | 45.2 % |

| 1 | Project economics inclusive of precious metal streaming agreement with WPMI. In exchange for the upfront deposits of $175 million, WPMI purchases 10.5% of gold produced from the Marmato mine until 310,000 ounces of gold have been delivered, after which the volume reduces to 5.25% for the life of mine. WPMI will also purchase 100% of silver produced from the Marmato mine until 2.15 million ounces of silver have been delivered, after which the volume reduces to 50% for the life of mine. | ||||

| 2 | Base case assumption | ||||

Marmato Optimization and Project Management

Following the mineral resource estimate effective June 30, 2021 and announced in November 2021 that demonstrated significant growth over the previous MRE prepared for the 2020 PFS2, the Marmato mine has been thoroughly reviewed and the results have been incorporated into the 2022 PFS. The Company and its consultants are currently finalizing the 2022 PFS technical report in accordance with NI 43-101 and the Company expects to file the report on SEDAR and the Company’s website in November 2022.

| ___________ | |

| 2 | See the Qualified Person and Technical Disclosure section for a reference to the 2020 PFS |

Following cost and business risk studies, optimizations and updates were made to the overall development strategy including:

- Selecting a contractor-mining approach for the Lower Mine over the previous owner-operator approach, which enhances scalability and accelerates the development timeline while reducing initial capital requirements;

- Relocating the underground crusher to the surface and eliminating the underground conveyor systems, thereby improving operational flexibility with some increase in operating costs;

- Designing the dry-stack tailings facilities for the increased volumes realized from the extended mine life; and

- The cost estimates for the economic analysis now include annualized capital expenditures for the processing plant and other infrastructure, a distinction between fixed and variable costs, and better consideration for the effects of taxation and the stream financing.

Table 2 provides highlights of the 2022 PFS, and a comparison to the 2020 PFS, which includes an increased mine life of 20 years (previously 14 years) and life of mine gold production of 3.0 million ounces (previously 1.9 million ounces).

Table 2: 2022 PFS Highlights and Comparison to the 2020 PFS

| 2022 PFS | 2020 PFS | |

| Proven + probable gold mineral reserves

M+I gold mineral resources (inclusive of reserves) Inferred gold mineral resources |

31.3 Mt at 3.2 g/t for 3.2 Moz

61.5 Mt at 3.0 g/t for 6.0 Moz 35.6 Mt at 2.4 g/t for 2.8 Moz |

19.7 Mt at 3.2 g/t for 2.0 Moz

39.4 Mt at 3.2 g/t for 4.1 Moz 26.4 Mt at 2.6 g/t for 2.2 Moz |

| Mine life | 20 years | 14 years |

| Processing rates (tpd) | Upper Mine: 1,250

Lower Mine: 4,000 |

Upper Mine: 1,500

Lower Mine: 4,000 |

| Average LOM gold recovery | 94 % | 92 % |

| Total LOM gold production (koz) | 2,986 | 1,865 |

| Average annual production (koz/year) | 162 | 166 |

| AISC (US$/oz) | $1,003 | $880 |

| Construction capital (US$ million) (see Table 3) | $279.6 | $269.4 |

| Committed stream financing (US$ million)1 | $122.0 | $72.0 |

| Net construction capital (US$ million) | $157.6 | $197.4 |

| At base case prices of $1,600/oz gold and $19/oz silver | ||

| Free cash flow2 (US$ million)

NPV @ 5% (after-tax, US$ million) IRR (after-tax) |

$648

$341 29.7% |

N/A 3 |

| 1: Streaming financing commitment during the project construction period. In 2020, the stream commitment included two installments of $36 million each. In April 2022, the stream was amended to include three installments that total $122 million. | ||

| 2: Free cash flow is after-tax and includes construction capital and stream financing. | ||

| 3: The 2020 PFS was completed prior to completion of the stream financing, therefore, like-for-like comparison is not available | ||

Table 3 – Marmato Lower Mine Project Capital Cost Summary

| Category | Amount (US$ million) |

| Process plant | $92.9 |

| Mine development and infrastructure | 62.4 |

| Non process infrastructure | 42.1 |

| Owner’s costs, G&A, and other indirect | 45.3 |

| Paste plant | 18.4 |

| Tailings facility | 16.0 |

| Mining EPCM | 2.5 |

| Total capital cost including contingency | 279.6 |

| Committed stream financing1 | 122.0 |

| Net construction capital | $157.6 |

| 1: Includes three installments of $40 million, $40 million, and $42 million based on project completion milestones of 25%, 50% and 75%, respectively

|

|

The Upper Mine operations are supported by fully developed site infrastructure. Ore mined from the Upper Mine by conventional cut and fill and long hole stoping is processed in the existing 1,250 tpd processing facility using three stage crushing, ball mill grinding, gravity concentration, flotation, flotation and gravity concentrate regrind, cyanidation of the flotation and gravity concentrates, and Merrill Crowe precipitation and smelting to produce a gold-silver doré. Optimizations have been underway during 2022 to increase metallurgical recoveries and the processing rate to 1,250 tpd from 1,100 tpd.

The major new project facilities for the Lower Mine will include the mine portal, crusher, stockpiles, processing facility, two dry stack tailings storage facilities, mining services, accommodation, access roads, power and water management and distribution facilities, and office buildings. The overall timeline for project construction is estimated to be 2.5 years and Aris Mining plans to manage procurement and construction.

The new Lower Mine porphyry style mineralization will be mined using long hole stoping with paste backfill at a targeted mining rate of 4,000 tpd following a quick ramp up period. Ore will be hauled up a new decline to the new Lower Mine processing plant approximately three km by road from the Lower Mine. The new processing plant, designed by Ausenco Engineering, includes 4,000 tpd capacity two-stage crushing, semi-autogenous and ball mill grinding, gravity concentration, cyanidation of the gravity tailings, a carbon in pulp circuit, and electrowinning and refining to produce a gold-silver doré. Metal recoveries are estimated at 95.0% for gold and 57.0% for silver.

2022 Mineral Resource Estimate Update and Comparison to the 2020 PFS

The table below summarizes the updated MRE effective June 30, 2022 and a comparison to the 2020 MRE included in the 2020 PFS. The full break down of the 2022 MRE is provided after the comparison tables.

| Measured | Indicated | Measured & Indicated | Inferred | |||||||||

| Tonnes | Grade Au | Oz Au | Tonnes | Grade Au | Oz Au | Tonnes | Grade Au | Oz Au | Tonnes | Grade Au | Oz Au | |

| (Mt) | (g/t) | (koz) | (Mt) | (g/t) | (koz) | (Mt) | (g/t) | (koz) | (Mt) | (g/t) | (koz) | |

| 2022 MRE

2020 MRE |

2.8

2.1 |

6.0

5.6 |

545

387 |

58.7

37.3 |

2.9

3.1 |

5,452

3,699 |

61.5

39.4 |

3.0

3.2 |

5,997

4,086 |

35.6

26.4 |

2.4

2.6 |

2,787

2,172 |

| Change (koz, %) | +158

+41% |

+1,753

+47% |

+1,911

+47% |

+615

+28% |

||||||||

Notes: Mineral resource estimates were prepared under the supervision of, or were reviewed by, Pamela De Mark, P.Geo, Senior Vice President Technical Services of Aris Mining, who is a Qualified Person as defined by National Instrument NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. Mineral resource estimates are reported inclusive of mineral reserves. Totals may not add due to rounding. The 2022 MRE was estimated using a gold price of US$1,700 per ounce and the 2020 MRE was estimated using US$1,500 per ounce.

2022 Mineral Reserve Estimate Update and Comparison to the 2020 PFS

The table below summarizes the updated mineral reserve estimate effective June 30, 2022 and a comparison to the PFS mineral reserve estimate effective March 17, 2020. The full break down of the 2022 mineral reserve estimate is shown below this comparison table.

| Proven | Probable | Proven & Probable | |||||||

| Tonnes | Grade Au | Oz Au | Tonnes | Grade Au | Oz Au | Tonnes | Grade Au | Oz Au | |

| (kt) | (g/t) | (koz) | (kt) | (g/t) | (koz) | (kt) | (g/t) | (koz) | |

| 2022 MRE

2020 MRE |

2,196

802 |

4.3

5.1 |

304

133 |

29,082

18,898 |

3.1

3.1 |

2,874

1,888 |

31,277

19,700 |

3.2

3.2 |

3,178

2,021 |

| Change

(koz, %) |

+171

+129% |

+986

+52% |

+1,157

+57% |

||||||

Notes: The mineral reserve estimates were prepared under the supervision of, or were reviewed by, Pamela De Mark, P.Geo, Senior Vice President Technical Services of Aris Mining, who is a Qualified Person as defined by National Instrument NI 43-101. Totals may not add due to rounding. The 2022 mineral reserve was estimated using a gold price of US$1,500 per ounce and the 2020 mineral reserve was estimated using US$1,400 per ounce.

Marmato Mine Mineral Resources, effective June 30, 2022

| Area | Category | Tonnes (Mt) |

Grade Au (g/t) |

Grade Ag (g/t) |

Contained Au (koz) |

Contained Ag (koz) |

| Upper Mine | Measured | 2.8 | 6.04 | 27.8 | 545 | 2,509 |

| Indicated | 12.7 | 4.14 | 16.8 | 1,691 | 6,847 | |

| Measured + Indicated | 15.5 | 4.49 | 18.8 | 2,236 | 9,356 | |

| Inferred | 2.6 | 3.03 | 15.4 | 250 | 1,265 | |

| Lower Mine | Measured | 0.0 | 2.73 | 17.8 | 0 | 3 |

| Indicated | 46.0 | 2.54 | 3.3 | 3,761 | 4,912 | |

| Measured + Indicated | 46.0 | 2.54 | 3.3 | 3,761 | 4,914 | |

| Inferred | 33.1 | 2.39 | 2.3 | 2,537 | 2,418 | |

| Marmato Total | Measured | 2.8 | 6.04 | 27.8 | 545 | 2,512 |

| Indicated | 58.7 | 2.89 | 6.2 | 5,452 | 11,758 | |

| Measured + Indicated | 61.5 | 3.03 | 7.2 | 5,997 | 14,270 | |

| Inferred | 35.6 | 2.43 | 3.2 | 2,787 | 3,682 |

Notes:

- Measured and Indicated mineral resources are inclusive of mineral reserves.

- Mineral resources are not mineral reserves and have no demonstrated economic viability.

- The mineral resource estimate was prepared by Benjamin Parsons, MSc, of SRK, who is a Qualified Person as defined by National Instrument 43-101. Mr. Parsons has reviewed and verified the drilling, sampling, assaying, and QAQC protocols and results, and is of the opinion that the sample recovery, preparation, analyses, and security protocols used for the mineral resource estimate are reliable for that purpose.

- Totals may not add up due to rounding.

- Mineral resources are reported above a cut-off grade of 1.8 g/t Au for the Upper Mine and 1.3 g/t Au for the Lower Mine. The cut-off grades are based on a metal price of US$1,700 per ounce of gold, and gold recoveries of 90% for the Upper Mine and 95% for the Lower Mine.

- The Upper Mine is defined as the current operating mine levels above the 950 m elevation and the Lower Mine is defined as below the 950 m elevation.

- There are no known environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the mineral resources.

Marmato Mine Mineral Reserves, effective June 30, 2022

| Area | Category | Tonnes (kt) | Grade Au (g/t) |

Grade Ag (g/t) |

Contained Au (koz) |

Contained Ag (koz) |

| Upper Mine | Proven | 2,195.5 | 4.31 | 16.4 | 304 | 1,157 |

| Probable | 4,946.9 | 4.09 | 14.3 | 650 | 2,273 | |

| Proven + Probable | 7,142.3 | 4.16 | 14.9 | 954 | 3,431 | |

| Lower Mine | Proven | – | – | – | – | – |

| Probable | 24,135.0 | 2.87 | 3.5 | 2,224 | 2,707 | |

| Proven + Probable | 24,135.0 | 2.87 | 3.5 | 2,224 | 2,707 | |

| Marmato Total | Proven | 2,195.5 | 4.31 | 16.4 | 304 | 1,157 |

| Probable | 29,081.8 | 3.08 | 5.3 | 2,874 | 4,980 | |

| Proven + Probable | 31,277.3 | 3.16 | 6.1 | 3,178 | 6,138 |

Notes:

- The Upper Mine mineral reserve estimate was prepared by Anton Chan, BEng, M.Sc., P.Eng, MMSAQP and the Lower Mine mineral reserve estimate was prepared by Joanna Poeck, BEng Mining, SME-RM, MMSAQP, both of whom are Qualified Persons as defined by NI 43-101.

- All figures are rounded to reflect the relative accuracy of the estimate. Totals may not add up due to rounding. Mineral Resources are reported inclusive of the Mineral Reserves.

- Upper Mine mineral reserves are reported above a cut-off grade of 2.05 g/t Au and Lower Mine mineral reserves are reported above a cut-off grade of 1.62 g/t. The cut-off grades are based on a metal price of US$1,500 per ounce of gold, gold recoveries of 90% for the Upper Mine and 95% for the Lower Mine, and costs of US$89 per tonne for the Upper Mine and US$74.3 per tonne for the Lower Mine.

- There are no known environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the mineral reserves.

Qualified Person and Technical Disclosure

The technical information in this news release was reviewed and approved by Pamela De Mark, P.Geo, Senior Vice President, Technical Services of Aris Mining, who is a Qualified Person as defined by NI 43-101.

Scientific and technical information concerning the 2020 Marmato PFS is summarized, derived, or extracted from the Marmato Technical Report entitled “Revised NI 43-101 Technical Report Pre-Feasibility Study Marmato Project Colombia” dated September 18, 2020 with an effective date of March 17, 2020. The 2020 Marmato PFS was prepared by Ben Parsons, MSc, MAusIMM (CP), Eric J. Olin, MSc Metallurgy, MBA, SME-RM, MAusIMM, Fernando Rodrigues, BS Mining, MBA, MAusIMM, MMSAQP, Jeff Osborn, BEng Mining, MMSAQP, Joanna Poeck, BEng Mining, SME-RM, MMSAQP, Fredy Henriquez, MS Eng, SME, ISRM, Breese Burnley, P.E., Cristian A Pereira Farias, SME-RM, David Hoekstra, BS, PE, NCEES, SME-RM, David Bird, PG, SME-RM, Mark Allan Willow, MSc, CEM, SME-RM, and Tommaso Roberto Raponi, P.Eng, each of whom is independent of Aris Mining within the meaning of NI 43-101 and is a “Qualified Person” as such term is defined in NI 43-101.

About Aris Mining

Aris Mining is a Canadian company led by an executive team with a track record of creating value through building globally relevant mining companies. In Colombia, Aris Mining operates several high-grade underground mines at its Segovia Operations and the Marmato Mine, which together produced 230,000 ounces of gold in 2021. Aris Mining also operates the Soto Norte joint venture, where environmental licensing is advancing to develop a new underground gold, silver and copper mine. In Guyana, Aris Mining is advancing the Toroparu Project, a gold/copper project with expected average gold production of 225,000 per year over the life of mine. Aris Mining plans to pursue acquisition and other growth opportunities to unlock value creation from scale and diversification.

Aris Mining promotes the formalization of small-scale mining as this process enables all miners to operate in a legal, safe and responsible manner that protects them and the environment.

Figure 1: Marmato annual gold production by Upper Mine and Lower Mine – Note 1: Full year 2022 includes 14,830 ounces gold produced from the Upper Mine during the six-month period ended June 30, 2022 (CNW Group/Aris Mining Corporation)

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE