Americas Gold and Silver Reports Positive Q2 2025 Results and Provides Development Update on Operational Improvements and Projects Underway

Americas Gold and Silver Corporation (TSX: USA) (NYSE: USAS) a growing North American precious metals producer, reports consolidated financial and operational results for the quarter ended June 30, 2025.

This earnings release should be read in conjunction with the Company’s Management’s Discussion and Analysis, Financial Statements and Notes to Financial Statements for the corresponding period, which have been posted on the Americas Gold and Silver Corporation SEDAR+ profile at www.sedarplus.ca, and on its EDGAR profile at www.sec.gov, and which are also available on the Company’s website at www.americas-gold.com. All figures are in U.S. dollars unless otherwise noted.

Highlights

- Consolidated silver production increased 36% year-over-year and 54% quarter-over-quarter as the impact of operational improvements and efficiencies continues at the Galena Complex in Idaho while the positive development progress at the EC120 Project facilitated the batching of higher grade development ore through the mill.

- Consolidated silver production of 689,000 ounces was achieved during the quarter, or approximately 839,000 silver equivalent2 ounces, including 1.5 million pounds of zinc and 1.9 million pounds of lead.

- Increase in silver sales revenue due to higher realized prices. Consolidated revenue, including by product revenue, decreased to $27.0 million for Q2-2025 or 19% compared to $33.2 million for Q2-2024. The positive impact of higher silver production and realized silver price1 of $34.22/oz was offset by lower production and realized prices of zinc and & lead, as the Company continues development transitioning into the silver-copper EC120 Project which is predominantly higher grade silver and copper compared to San Rafael (higher zinc and lead) mined previously.

- Pre-production sales of EC120 silver-copper concentrate contributed $8.3 million to revenue during Q2-2025.

- Executed Senior secured term loan facility for funds of up to $100 million entered into with SAF Group (“SAF”) primarily to fund growth and development capital spending at the Galena Complex, with the first $50 million tranche of funds received in June.

- Successful metallurgical testwork results at the Galena Complex demonstrated over 90% antimony recovery. The Company commissioned SGS Canada Inc. to conduct flotation tests on the current mill feed. The test results on the tetrahedrite material indicated that a marketable concentrate may now be possible using modern metallurgical processes.

- The test results mark a key step toward establishing the Company as the only current antimony producer in the United States, potentially unlocking a new revenue stream from a strategic by-product, previously counted as a penalty element, of the Galena ore body.

- Multi-Metal Offtake Agreement for Galena Concentrates with Ocean Partners for treatment of up to 100% of the polymetallic concentrates from the Company’s Galena Complex at Teck Resources Limited’s (“Teck”) Trail Operations in Trail British Columbia. Guaranteeing processing capacity at a nearby smelter is critical as the Company executes its plans to significantly increase silver and by-product metal production over the next several years.

- Strong exploration results from the Galena Complex, highlighted by an intersection of 983 g/t over 3.4 metres in the new 034 vein, with an initial vein target of 1.2M-1.5M silver ounces. The Company is continuing its near mine exploration program to target new high-grade mining areas that provide near term mining potential.

- Cash and cash equivalents balance of $61.7 million and working capital1 of $10.4 million as at June 30, 2025 (working capital deficit of $28.7 million as at December 31, 2024).

- Cost of sales1,2 per silver equivalent ounce produced, cash costs1 and all-in sustaining costs1 per silver ounce produced averaged $27.99, $26.64 and $32.89, respectively, in Q2-2025.

- Net loss of $15.1 million for Q2-2025 during the revitalization of Galena (Q2-2024 net loss of $4.0 million), primarily due to the impact of increasing precious metal prices on metals-based liabilities, non-recurring non-cash corporate general and administrative expenses connected with the addition of key technical personnel and reconstitution of the Board, and lower net revenue from decreased base metals production of zinc and lead, as the Cosalá Operations transition to the silver-copper focused EC120 deposit. This was partially offset by lower interest and financing expense, and higher foreign exchange gain as well as very strong silver revenue performance as the company executes its strategy at Galena and Cosala.

- Adjusted earnings1 for Q2-2025 was a loss of $12.1 million (adjusted loss of $2.4 million for Q2-2024) and Adjusted EBITDA1 for Q2-2025 was a loss of $4.1 million (adjusted EBITDA income of $8.0 million for Q2-2024), or $0.02 and $0.01 per share, respectively, primarily due to non-recurring non-cash corporate general and administrative expenses, and lower net revenue from decreased base metals production of zinc and lead.

- Inclusion in the Solactive Global Silver Miners Index announced on May 1, 2025. Inclusion in this major silver index is an important milestone validating Americas position as a growing silver focused miner and increases exposure to large institutional investors.

Paul Andre Huet, Chairman and CEO, commented: “During the first half of 2025, we’ve made significant progress and investments into our strategy to deliver materially increased silver production and lower costs over the coming years. Our teams have been strengthened and aligned in executing our operational growth plan at Galena and the transition from the San Rafael Mine to the higher grade silver-copper EC120 Project at Cosalá. Our critical work in reviewing the current operations has progressed well, including studying multiple scenarios for operational adjustments, productivity improvements, cost reductions and material movement increases.

Securing the US$100 million debt facility in June represents a major milestone for the Company, providing us with the financial flexibility to implement and execute our growth strategy. The result is that we expect to realize incremental production increases and lower costs as we progress through a transformative investment year in 2025 setting us up with a much stronger operational platform to support continued sustained production growth at Galena.

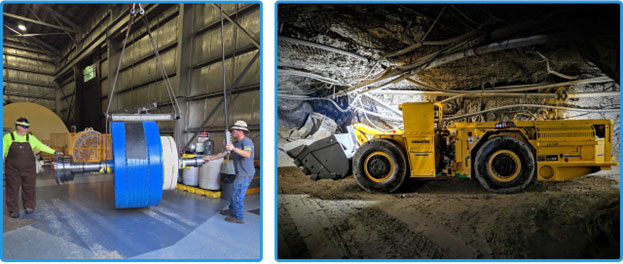

At Galena, numerous initiatives are underway that are designed to safely improve mining productivity. Key developments during the quarter include the expansion of the 55-179 decline to access multiple stopes, the successful development and mining of the first long-hole stope as well as the commissioning of new underground loaders and trucks to enhance productivity. Significant ventilation improvements were achieved with the completion of the first Alimak vent raise, while the development of a second Alimak raise is underway. Very significantly, components for the #3 shaft replacement hoist motor have arrived at site, with installation planned for Q4-2025 to materially boost hoisting capacity and debottleneck operations – a critical step in unlocking value at the mine.

We’re also very excited about the metallurgical testing completed on Galena concentrate that confirmed high recoveries of both antimony and copper, with modern processes enabling the potential extraction of antimony from the tetrahedrite. The test work is a key step in establishing Americas as the only current antimony producer in the U.S., unlocking a potential new revenue stream. Further testing is aimed at confirming the ability to produce saleable antimony products, leveraging historical precedents and enhancing Galena’s economic potential. Rounding out the metallurgical successes, we also secured a multi-metal offtake agreement with Ocean Partners at Teck’s Trail Operations in British Columbia. This guaranteed capacity not only secures the growth plan at Galena, it also turns several metals previously penalized (including copper and antimony) into potential revenue streams – a double benefit for our shareholders.

The Cosalá Operations are advancing well towards mining the higher-grade silver-copper EC120 orebody, where we are aiming to be in commercial production by the end of 2025. The team is mining concurrently at San Rafael during the development of EC120, with a focus on mining higher-grade silver areas in late Q3 and early Q4 2025. During the quarter we saw an early example of the positive impact EC120 will have on silver grades and we are looking forward to continuing this progress. In support of the ramp up efforts, we have also placed additional mobile fleet orders to improve operational efficiency as we enter the heart of the orebody in the years ahead – an exciting time for everyone at Americas.

I am also pleased to welcome Shirley In’t Veld to Americas Board of Directors. The addition of Shirley’s extensive experience as a senior executive and director in the mining, renewables and energy sectors to our team further strengthens our Board and is a strong endorsement of Americas position as growing silver producer. We look forward to benefiting from Shirley’s insights and guidance as we continue to grow and create value for our shareholders.

Overall, I am very pleased with our progress as we leverage the strength of our expanded and strengthened team as well as our bolstered balance sheet to build a strong foundation for our strategy to deliver sustained multi-year production growth, unlocking the massive potential across our asset base for all our stakeholders.”

Consolidated Production

Consolidated silver production of 689,000 ounces during Q2-2025 was higher than Q2-2024 production of 506,000 ounces (36% increase in silver production) due to higher grades at both operations, offset by slightly lower tonnage. At Cosalá, pre-production of EC120 silver-copper concentrate contributed to 211,000 ounces of silver production during Q2-2025. Production of both zinc and lead during the quarter were lower than in Q2-2024 due to lower tonnage of San Rafael ore processed as the Company develops and transitions into the silver-copper EC120 orebody.

Consolidated attributable cash costs and all-in sustaining costs for Q2-2025 were $26.64 per silver ounce and $32.89 per silver ounce, respectively. Cash costs per silver ounce increased during the quarter compared to the same period the year prior, primarily due to lower by-product credits as the Company focused on setting up for future growth.

Galena Complex

The Galena Complex produced 420,000 ounces of silver in Q2-2025 compared to 560,000 ounces of silver in Q2-2024 (25% decrease in silver production). The mine also produced 1.7 million pounds of lead in Q2-2025, compared to 3.0 million pounds of lead in Q2-2024 (44% decrease in lead production). During the period of operational improvements currently underway as part of the transition plan at the Galena Complex, as previously discussed, the Company anticipates potential short-term movements in by-product production levels while the focus on increasing mining rates of silver-copper ore and setting up key infrastructure in support of future growth is advanced. Cash costs per ounce of silver increased to $24.18 in Q2-2025 from $14.78 in Q2-2024, primarily due to modest increases in salaries and employee benefits at the operations inline with the Company’s strategy to attract and retain key technical personnel, and impact from decreased lead production resulting in lower by-product credits during the period.

During Q2-2025, the Company has continued to make significant advances at the Galena Complex and is on-track with its operational growth plan. Development plans are advancing well with efficiencies in muck handling and improved development rates being realized.

Cosalá Operations

Silver production increased in Q2-2025 to ~269,000 ounces of silver compared to ~170,000 ounces of silver in Q2-2024 (58% increase in silver production) primarily due to higher grades and silver recoveries offset by lower tonnages during the period. Higher portion of the mill feed came from pre-production of the EC120 Project which has higher silver grades and silver recoveries based on its minerology. Lower milled tonnage from the San Rafael Main Central orebody caused base metals production to decrease to 1.5 million pounds of zinc and 0.2 million pounds of lead in Q2-2025, compared to 8.9 million pounds of zinc, and 2.6 million pounds of lead in Q2-2024. Silver production is expected to increase steadily as the development into EC120 Project progresses and EC120 continues to batch higher development grade ore through the mill. The Cosalá Operations increased capital spending on the EC120 Project, expending $2.9 million during Q2-2025 ($1.0 million during Q1-2025). The EC120 Project contributed 211,000 ounces of silver production in Q2-2025 (375,000 ounces of silver production project-to-date) as the Cosalá Operations milled and sold silver-copper concentrate during the EC120 Project’s development phase, contributed $8.3 million to net revenue during Q2-2025. Cash costs per silver ounce increased during Q2-2025 to $30.48 per ounce from $7.75 per ounce in Q2-2024 due primarily to decreased zinc and lead production resulting in lower by-product credits during the period.

Board of Directors Strengthened with Appointment of Shirley In’t Veld

The Company is pleased to announce the appointment of Shirley In’t Veld to its Board of Directors effective immediately.

Ms. In’t Veld brings extensive depth of knowledge and experience to the Americas Board, having served over 30 years in board and senior management positions in the mining, renewables and energy sectors. She is currently a Director of Westgold Resources Limited and Develop Global Limited. Ms. In’t Veld was formerly a Director Karora Resources Inc., NBN Co. Limited (National Broadband Network Co.), Northern Star Resources Limited, Perth Airport, DUET Group, Asciano Limited and Alcoa of Australia Limited. Ms. In’t Veld was also the Managing Director of Verve Energy (2007 – 2012) and, previously, served 10 years in senior roles at Alcoa of Australia Limited, WMC Resources Ltd, Bond Corporation and BankWest Perth.

Share Consolidation

Americas is also pleased to announce, as previously authorized by its shareholders on June 24 and subsequently approved by its Board of Directors (the “Board”) on August 6, 2025, the Company intends to file articles of amendment on or about August 21, 2025, implementing a consolidation of its outstanding common shares on the basis as finally determined by the Board of one (1) post-consolidation common share for every two point five (2.5) pre-consolidation common shares (the “Consolidation”). The Consolidation has been conditionally approved by the TSX and is subject to NYSE American approval. Americas will issue a further news release providing the date, expected in the next 10 days, on which the Company’s common shares will commence trading on a post-consolidation basis on each of the TSX and NYSE American. The exercise price or conversion price, as applicable, and the number of common shares issuable, as applicable, under any of the Company’s outstanding convertible or share-based securities such as warrants, stock options and restricted share units, performance share units and deferred share units, as applicable, will be proportionately adjusted upon completion of the Consolidation in accordance with their respective terms. The CUSIP and ISIN numbers of the post-consolidation common shares will also change upon the completion of the Consolidation.

About Americas Gold and Silver Corporation

Americas Gold & Silver is a growing precious metals mining company with multiple assets in North America. In December 2024, Americas increased its ownership in the Galena Complex (Idaho, USA) from 60% to 100% in a transaction with Eric Sprott, solidifying its position as a silver-focused producer. Americas also owns and operates the Cosalá Operations in Sinaloa, Mexico. Eric Sprott is the Company’s largest shareholder, holding an approximate 20% interest. Americas has a proven and experienced management team led by Paul Huet, is fully funded to execute its growth plans, and focused on becoming one of the top North American silver plays, with an objective of over 80% of its revenue to be generated from silver by the end of 2025.

Figure 1 – Galena New Equipment Deliveries: New hoist motor shown on left and new underground loader shown on right. Photo Credit: Americas Gold and Silver Corp.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE