American Lithium Announces Positive Preliminary Economic Assessment for TLC, Base Case – After-tax NPV8% US$3.26 Billion & After-tax IRR of 27.5%

American Lithium Corp. (TSX-V:LI) (NASDAQ:AMLI) (Frankfurt:5LA1) is pleased to announce the results of its maiden Preliminary Economic Assessment for the Tonopah Lithium Claims project located in the Esmerelda lithium district northwest of Tonopah, Nevada. This independent PEA was completed jointly by DRA Global and Stantec Consulting Ltd. and demonstrates that the TLC project has the potential to become a substantial, long-life producer of low-cost lithium carbonate with the potential to produce either battery grade LCE or lithium hydroxide. The PEA base case envisions an initial 4.4 Million tonnes per annum processing throughput expanding to 8.8Mtpa. The PEA alternative case is identical, but with added production of high purity magnesium sulfate as a by-product over life of operations. Unless otherwise stated, all dollar figures are in US currency.

TLC PEA Highlights (Base Case – Ramp-up Production Li only production):

- Pre-tax Net Present Value 8% $3.64 billion at $20,000/tonne LCE

- After-tax NPV8% $3.26 billion at $20,000/t LCE

- Pre-tax Internal Rate of Return of 28.8%

- After-tax IRR of 27.5%

- PEA mine and processing plan produces 1.46 Mt LCE LOM over 40 years

- Pre-tax initial capital payback period 3.6 years; after-tax payback 3.8 years

- Average LOM annual pre-tax cash flow: $435 million; annual after tax cash flow: $396 million

- Initial Capital Costs estimated at $819 million

- Total Capex estimated at $1,431 million; Sustaining Capital estimated at $792 million

- Operating cost estimated at $7443/t LCE inclusive of power credits

Simon Clarke, CEO of American Lithium, states, “We are extremely pleased to announce a very robust maiden PEA for TLC. Our team has worked hard and spent considerable time getting an in-depth understanding of TLC mineralization and the best way to recover high purity lithium utilizing conventional processing methods with the latest techniques and best in class plant and equipment. A significant portion of the processing work has been done to pre-feasibility levels as we believe this will help us move quickly through the next phases of development. At 99.4% LCE purity, TLC offers the capability to produce either battery grade lithium carbonate or hydroxide with minimal additional refining.

In this PEA, we showcase a long mine-life utilizing only the highest-grade sections of the deposit, with the potential for additional production ramp-up and mine life utilizing our mid-grade and lower grade sections. Not only are the economics very strong for high purity lithium production, but TLC also has the potential to produce high purity magnesium sulfates as by-products for agriculture and other end uses. As shown in the PEA, even assuming conservative pricing, these by-products can add significant economic value. At the same time, we have focused our work on ensuring we continue to minimize environmental impacts and water usage in the mining, processing and production of lithium from TLC.”

TLC PEA Highlights (Alternate Case – Ramp-Up Production Li + Magnesium Sulfate production):

- Identical LCE production scenario, but with added LOM average production of 1,681,856 tpa of magnesium sulfate (“MgSO4” – monohydrate and heptahydrate) by-products;

- Pre-tax Net Present Value 8% $6.06 billion at $20,000/t LCE & $150/t MgSO4;

- After-tax NPV8% $5.16 billion at $20,000/t LCE & $150/t MgSO4;

- Pre-tax Internal Rate of Return of 38.6%

- After-tax IRR of 36.0%

- Pre-tax initial capital payback period 3.5 years; after-tax payback 3.7 years

- Average LOM pre-tax annual cash flow: $684 million; annual after tax cash flow: $591 million

- Initial Capital Costs estimated at $827 million

- Total Capex estimated at $1439 million; Sustaining Capital estimated at $763 million

- Operating cost estimated at $7443/t LCE inclusive of power credits

- Operating cost estimated at $817/t LCE, inclusive of power & MgSO4 credits

- PEA mine plan produces 1.46 Mt LCE and 64.9 Mt MgSO4 LOM over 40 years

Mine Life & Production

- Simple truck and shovel open pit mining of the shallow resource underpins the scalable, long-life, lithium project producing approximately 24,000 tpa LCE over Years 1-6 expanding to 48,000 tpa LCE production for Years 7-19 years when mining ceases. Rehandling of the >1,000 parts per million stockpile allows production to continue for Years 20-40.

- Average LOM Production of approximately 38,000 tpa LCE for 40 years.

- Targeted 1,400 ppm Li average feed grade pit-constrained resource supports mining for 19 years and processing >1,000 ppm Li stockpile for an additional 21 years.

- 1,400 ppm feed material beneficiation increases the head grade to leaching to 2,000 ppm Li.

- LOM Strip Ratio (Waste:Ore) of 0.93:1 with a maximum final pit depth of ~325-350’, well above the water table depth.

- Where possible progressive reclamation of mining areas is planned along with in-pit back-filling of waste rock and filtered tailings.

- Sulfuric acid leaching using industry standard techniques and flowsheet produces high purity lithium carbonate to enable the production of battery grade LCE or LiOH.

- PEA study estimates that for an additional $100M (Installed) Capex, and $406/t LCE Opex, a final conversion and refining processing step will enable the production of battery grade LiOH; or

- End users have the flexibility of acquiring high purity LCE from TLC and converting it themselves to whichever product is required.

- Magnesium sulphate (monohydrate) is an increasingly important fertilizer add-on product with a large and growing global market. High-purity hydrated products (heptahydrate & epsom salts) are used in the food, personal care and water quality industries.

Table 1 – TLC Project PEA Key Highlights

| Description | Units | Base Case | Alternate Case |

| LCE Selling Price | $/tonne | $20,000 | $20,000 |

| Life of Mine | years | 40 | 40 |

| Processing Rate P1 / P21 | ROM Mtpa | 4.4 / 8.8 | 4.4 / 8.8 |

| Average Throughput (LOM) | tpa | 8,112,415 | 8,112,415 |

| LCEProduced (average LOM)1 | tpa | 38,157 | 38,157 |

| P1 LCE Production (steady state) | tpa | 24,000 | 24,000 |

| P2 LCE Production (steady state) | tpa | 48,000 | 48,000 |

| LCE Produced (total LOM)1 | tonnes | 1,462,913 | 1,462,913 |

| Unit Operating Cost (OPEX) LOM2 | $/LCE tonne | 7,443 | 817 |

| MgSO4 Produced (average LOM)1 | tpa | n/a | 1,663,213 |

| MgSO4 Selling Price | $/tonne | n/a | 150 |

| Gross Revenue incl. Power & MgSO4 Credits | $ B | 29.7 | 39.4 |

| Capital Cost (CAPEX)3 P1 | $ M | 819 | 827 |

| Capital Cost (CAPEX)3 LOM | $ M | 1,431 | 1,439 |

| Sustaining Capital Costs (undiscounted) | $ M | 792 | 763 |

| Project Economics | |||

| Pre-tax: | |||

| Net Present Value (NPV) (8%) | U$ M | 3,642 | 6,056 |

| Internal Rate of Return (IRR) | % | 28.8 | 38.6 |

| Initial Payback Period (undiscounted) | years | 3.6 | 3.6 |

| Average Annual Cash Flow (LOM) | $ M | 435 | 684 |

| Cumulative Cash Flow (undiscounted) | $ M | 16,147 | 25,860 |

| After-tax:4 | |||

| Net Present Value (NPV)8%) Post-Tax | $ M | 3,261 | 5,157 |

| Internal Rate of Return (IRR) Post-Tax | % | 27.5 | 36.0 |

| Payback Period (undiscounted) | years | 3.8 | 3.7 |

| Average Annual Cash Flow (LOM) | $ M | 396 | 591 |

| Cumulative Cash Flow (undiscounted) | $ M | 14,617 | 22,219 |

Notes:

- Production: base case is 2 phases, 4.4Mtpa and 8.8Mtpa throughput; alternative case is identical, but with production of magnesium sulfate co-product over life of operations.

- Includes all operating expenditures with credit for excess power and revenue from MgSO4 production as offset to Unit LCE Opex, the estimate is expected to fall within an accuracy level of ±30%.

- Includes 10% contingency on process plant capital costs, 10% contingency is included in the tailings and infrastructure costs, and closure costs (LOM).

- Tax calculation estimates were completed by Mining Tax Plan LLP, and include Federal Taxes, all Nevada State taxes and royalties and Nye County Property tax estimates, and available producer tax credits.

Sensitivities

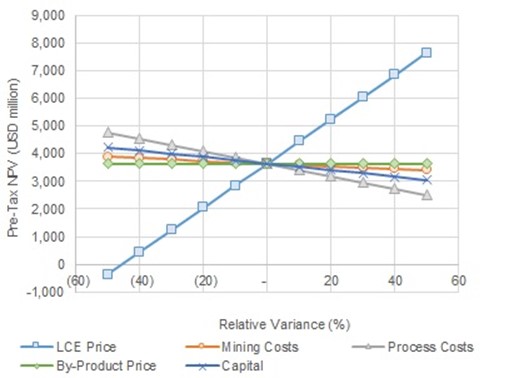

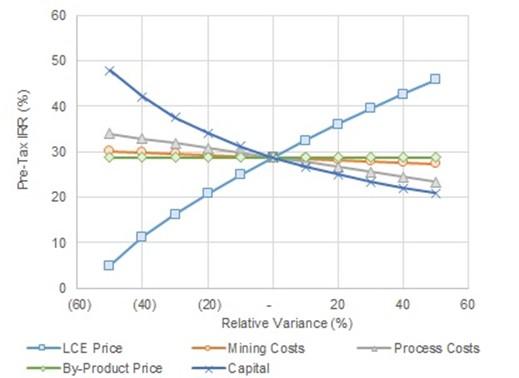

The project is most sensitive to LCE price and process costs, but relatively far less sensitive to capital costs and mining costs, in descending order of affect (see Table 2, and Figures 1 and 2, below).

Table 2 – TLC Project Metal Pricing NPV8% and IRR Sensitivity

| Sensitivity ($)/t | -30% | -20% | -10% | Base Case $20,000/t |

10% | 20% | 30% |

| Pre-tax NPV8% (millions) | $1,243 | $2,042 | $2,842 | $3,641 | $4,441 | $5,240 | $6,040 |

| Pre-tax IRR (%) | 16.3 | 20.7 | 24.9 | 28.8 | 32.5 | 36.0 | 39.4 |

Figure 1 – Base Case Pre-Tax NPV8 Sensitivity Graph

Figure 2 – Base Case Pre-Tax IRR Sensitivity Graph

Mining

Based on the analysis completed by Stantec, the TLC Project is highly amenable for development by conventional open pit truck and shovel operation. The Base Case and Alternative Case have identical LOM production plans and schedules.

Table 3 – Mining Rates

| Parameter | Unit | Value |

| Mine Production Life | Years | 40 (includes 2-year production ramp up)1 |

| Material mined | Mt | 607 |

| ROM head grade to beneficiation | ppm Li | 1400 |

| Head Grade to Leach | ppm Li | 2000 |

| Recovered LCE | LOM Mt | 1.41 |

| Waste | LOM Mt | 292.5 |

| Total Mineralize Material throughput | LOM Mt | 315.3 |

| Strip Ratio (LOM) | (tw:to) | 0.93 |

- 2 years construction, including 1 year Capitalized pre-production mining; 2-year production ramp-up with 75% nameplate in Year 2.

Table 4 – Detailed Capital Cost Estimates:

| Capital Costs | Phase 1 |

Phase 2 |

LOM |

| ($ millions) | |||

| Mining (pre-strip and capital) | 56.3 | – | 56.3 |

| Processing plant – Direct costs | 424.5 | 228.8 | 653.3 |

| Processing plant/mine – Infrastructure | 45.9 | sustaining | 45.9 |

| Tailings & bulk infrastructure1 | 49.8 | sustaining | 49.8 |

| Total Direct Costs | 576.5 | 228.8 | 805.3 |

| Total Indirect Costs (Process Plant)2 | 181.9 | 316.8 | 498.7 |

| Contingency (Process Plant)10% | 60.6 | 54.7 | 115.3 |

| Closure Costs (captured in sustaining) | – | – | 25 |

| TOTAL – Li Only Base Case | 819.0 | 600.3 | 1,431 |

| Added Plant Capex for MgSO4 Production | 23.8 | 23.8 | 47.6 |

| TOTAL – Li + MgSO4 (includes tailings savings) | 827.0 | 1,439 | |

| Sustaining Capital Costs – Li only | – | – | 765.5 |

| Sustaining Capital Costs – Li + MgSO4 | – | – | 735.9 |

- Tailings built in phases and included in P1 capital cost estimate and sustaining capital for remaining LOM

- Includes EPCM, spares, insurances, owners’ team.

Flat 24,000 t LCE Production Scenarios

As part of the PEA modeling and design work, DRA Global and Stantec were also requested to evaluate flat 24,000 t/year LCE production scenarios without any production ramp-up using the identical 1,400 ppm Li feed scenario. The flat scenarios both have 20 years of mining followed by processing of stockpiled material for Years 21 to 36.

The two additional scenarios are as follows:

- Case 3: Flat 24 kt/a LCE – Stand-alone Li-only production

- Case 4: Flat 24 kt/a LCE – Li and Magnesium Sulfate co-production

|

Table 5 – Capital and Operating Cost Estimates |

||||

| Case | Initial Capital (millions US$) |

LOM Capital (millions US$) |

US$/t LCE with power credit |

US$/t LCE with MgSO4 credit |

| Base Case | 819 | 1431 | 7429 | – |

| Alternate Case | 827 | 1439 | 7429 | 843 |

| Case 3 | 813 | 813 | 7543 | – |

| Case 4 | 822 | 822 | 7543 | 1,330 |

Table 6 – Financial Model Estimate Results Comparison

| Recovered LCE |

Recovered MgSO4 |

Pre-Tax Comparison |

||

| Case | t/a average | kt/a average | NPV (M US$) | IRR (%) |

| Base Case | 38,157 | 0 | $3,629 | 28.8% |

| Alternate Case | 38,157 | 1,681 | $6,030 | 38.6% |

| Case 3 | 21,930 | 0 | $2,136 | 27.5% |

| Case 4 | 21,930 | 909 | $3,592 | 38.2% |

Qualified Persons

Joan Kester, PG and Derek Loveday, P. Geo. of Stantec Consulting Ltd., Independent Qualified Persons as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, have prepared or supervised the preparation of, or have reviewed and approved, the scientific and technical data pertaining to the Mineral Resource estimates contained in this release.

Satjeet Pander, P.Eng. and Sean Ennis, P.Eng of Stantec Consulting Ltd., Independent Qualified Persons as defined by NI 43-101, have prepared or supervised the preparation of, or have reviewed and approved, the scientific and technical data pertaining to mining, mine scheduling, and tailings management contained in this release.

John Joseph Riordan, BSc, CEng, FAuslMM, MIChemE, RPEQ, of DRA Pacific (Pty) Ltd., and Valentine Eugene Coetzee, BEng, Meng, P.Eng. of DRA Projects SA Pty Ltd., Independent Qualified Persons as defined by NI 43-101, have prepared or supervised the preparation of, or have reviewed and approved the scientific and technical metallurgical information and financial modelling results contained in this news release.

Mr. Ted O’Connor, P.Geo., Executive Vice President of American Lithium, and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has also reviewed and approved the scientific and technical information contained in this news release.

In accordance with NI 43-101, the Company intends to file the completed technical report on the PEA under the Company’s profile on SEDAR (www.sedar.com) and on the Company’s website within 45 days from the date of this news release.

About DRA Global Limited (ASX: DRA | JSE: DRA), as lead engineer, is a diversified global engineering, project delivery and operations management group headquartered in Perth, Australia, with an impressive track record completing over 300 unique projects worldwide spanning more than three decades. Known for its collaborative approach and extensive experience in project development and delivery, as well as turnkey operations and maintenance services, DRA Global delivers optimal solutions that are tailored to meet clients’ needs. DRA Global, through its subsidiary, DRA Met-Chem, has a team of lithium process and metallurgical experts that identify the process requirements through flowsheet development and process equipment is selected to minimize costs and ensure plant efficiency.

About Stantec Consulting Ltd., a full-service engineering and consulting firm, has extensive experience in surface mineable stratiform deposits in North American and internationally. Stantec has been involved in the evaluation and design of several lithium projects with services spanning from environmental studies, geological modeling, resource and reserve estimates, mining engineering, hydrology and hydrogeology, geotechnical engineering, and tailings, waste, and water management facility design. The company specializes in helping mining companies to reach their net zero mining goals.

About Mining Tax Plan LLP. Mining Tax Plan LLC specializes in U.S. federal and state income taxation including foreign income taxation of precious metal, non-metallic ores, coal and quarry mining companies. They have extensive experience with extractive and natural resource industries and have provided consulting services to clients in such areas as mergers and acquisitions, corporate distributions, restructuring and foreign investment. In addition, they specialize in state mineral property and severance taxes in Alaska, Arizona, California, Colorado, Idaho, Montana, Nevada and Utah.

About American Lithium

American Lithium, a member of the TSX Venture 50, is actively engaged in the development of large-scale lithium projects within mining-friendly jurisdictions throughout the Americas. The Company is currently focused on enabling the shift to the new energy paradigm through the continued development of its strategically located TLC lithium claystone project in the richly mineralized Esmeralda lithium district in Nevada, as well as continuing to advance its Falchani lithium and Macusani uranium development-stage projects in southeastern Peru. Both Falchani and Macusani have been through robust preliminary economic assessments, exhibit strong significant expansion potential and enjoy strong community support. Pre-feasibility work has now commenced at Falchani.

MORE or "UNCATEGORIZED"

Great Pacific Gold Announces Closing of Upsized $16.9 Million Private Placement Financing Led by Canaccord Genuity Corp

Great Pacific Gold Corp. (TSX-V: GPAC) (OTCQX: FSXLF) (FSE: V3H)... READ MORE

Ridgeline Minerals Provides Assay Results and Drill Program Updates for the Big Blue and Atlas Projects

Big Blue highlights: 0.6 meters grading 0.7% Cu, 3,194 g/t Ag and... READ MORE

Goldshore Intersects 42.7m of 1.09 g/t Au at the Eastern QES Zone of the Moss Deposit

Goldshore Resources Inc. (TSX-V: GSHR) (OTCQB: GSHRF) (FSE: 8X00)... READ MORE

Dios Sells K2 to Azimut

Dios Exploration Inc. (TSX-V: DOS) is pleased to report it has e... READ MORE

Northisle Announces Near Surface Intercepts and Higher-Grade Intercepts at Depth at West Goodspeed on its North Island Project

Highlights: Recent drilling at West Goodspeed supports the presen... READ MORE