Altamira Gold Announces Maiden Mineral Resource Estimate for Maria Bonita Porphyry Gold Project, Cajueiro District, Brazil

Altamira Gold Corp.’s (TSX-V: ALTA) (FSE: T6UP) (OTC Pink: EQTRF) is pleased to announce the results of an independently assessed, maiden mineral resource estimate for the Maria Bonita porphyry gold deposit within the Cajueiro Project. Maria Bonita is a separate discovery, located 7km to the west of, and additional to, the Cajueiro Central Mineral Resource (previously reported under NI 43-101).

Highlights:

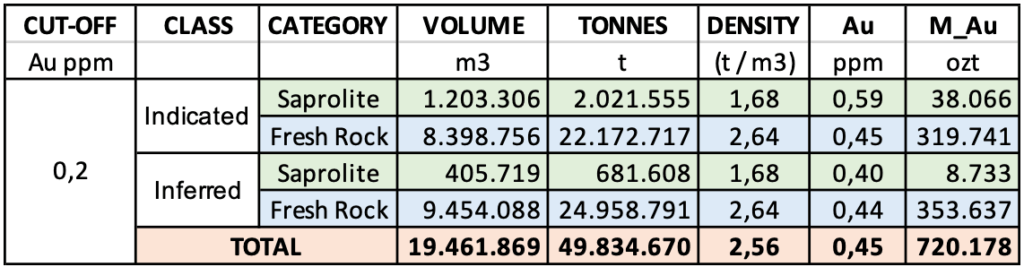

- The maiden open-pit resource consists of total Indicated Resources of 24.19Mt @ 0.46g/t gold (for a total of 357,800oz) and Total Inferred Resources of 25.64Mt @ 0.44g/t gold (for a total of 362,400oz). These resources include near-surface saprolite Indicated Resources of 2,02Mt @ 0.59g/t gold (for a total of 38,000oz) and Inferred Resources of 0.68t @ 0.40g/t gold (for a total of 8,700oz). These resources were calculated using a 0.2 g/t gold cut-off grade.

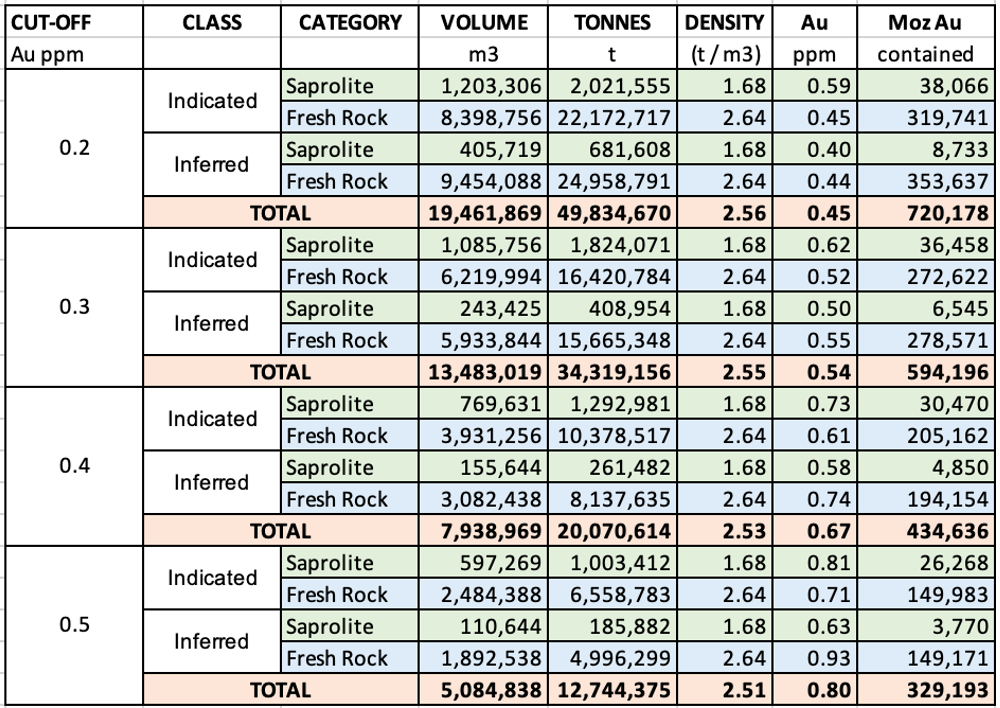

- A significant higher grade near-surface resource has also been identified and at a 0.5 g/t gold cut-off comprises Indicated Resources of 7.56Mt @ 0.72g/t gold (176,250oz) and Inferred Resources of 5.18Mt @ 0.92g/t gold (152,940oz).

- Mineralization extends to surface and the relative volume of waste to mineralized material within the optimised pit is 0.5:1. The deposit remains open to the west, south and at depth.

- Maria Bonita is the first of nine porphyry-gold targets that have been identified so far within the Cajueiro district and further drilling will be aimed at both expanding Maria Bonita and initial drill testing of the eight other targets.

CEO Mike Bennett commented; “We are thrilled with the maiden mineral resource estimate for our Maria Bonita project. This is a transformational step forward for the company and, together with the existing resources at Cajueiro, doubles Altamira’s Indicated and Inferred resource base. The mineralization at Maria Bonita is notably coherent and regular, with higher grades returned from near surface material. Coupled with our portfolio of nine drill-ready targets within the Cajueiro district, we now have an excellent opportunity to add to these resources through both the expansion of the defined mineral resources at both Maria Bonita and Cajueiro Central, and additional discoveries of porphyry-related mineralization in the district. We will be mobilising a drill rig shortly to continue testing of the extensions to the Maria Bonita mineralization and our district targets. We look forward to the continued delineation of the deposit and unlocking the potential of the other eight targets.”

CAJUEIRO PROJECT

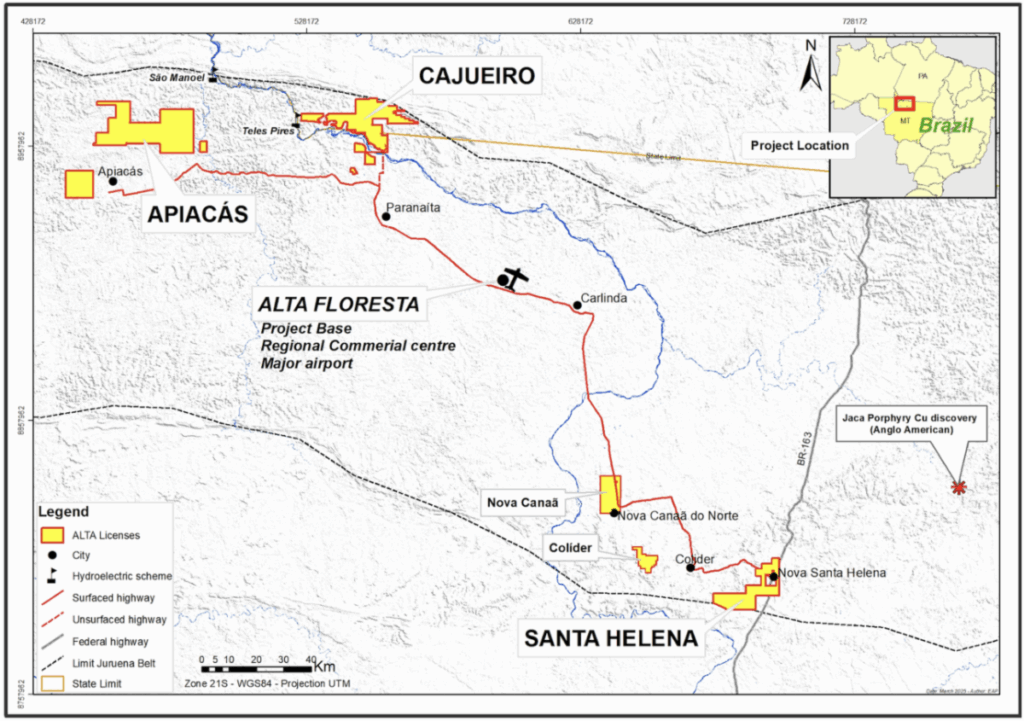

The Cajueiro project is located approximately 75km NW of the town of Alta Floresta in the state of Mato Grosso (Figure 1) in central western Brazil. The project is easily accessible by road, lies on open farmland and has grid power and a local water supply (Figure1).

Figure 1: Location of the Cajueiro, Apiacas and Santa Helena projects.

The maiden mineral resource estimate for Maria Bonita was completed by VMG Consultoria e Soluções Ltda of Belo Horizonte, Minas Gerais, Brazil under the direction of Volodymyr Myadzel PhD, MAIG. The estimate is based on drilling undertaken by Altamira between August 2022 and April 2024.

A total of thirty-one diamond drillholes (4,710m) have been completed at the Maria Bonita target. Of this total, twenty-nine drill holes were used to estimate the mineral resource (4,518m).

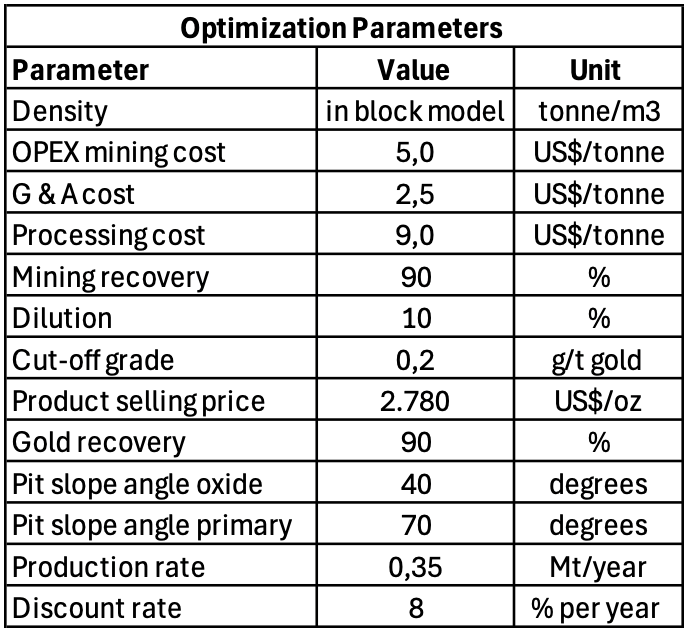

The parameters used to constrain a pit shell in the mineral resource estimate process are presented in Table 1. A gold price of US$2,780/oz was used.

The resource estimations are based on a block model interpolated by the Ordinary Kriging (OK) method, using Micromine software. The block model was created using wireframes and filled with blocks measuring 25 (X) by 25 (Y) by 10 (Z) metres. The radii and the orientation of the search ellipses were determined using standard variograms.

All Inferred Resources and Indicated Resources are defined in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (2014) (the “CIM Standards”). For the Indicated Resources, a wireframe that encompasses the area with a 50×50 and 50×100 metre regular drilling grid was created. For interpolation, an average of 3 holes and 8 composite samples were used. The other blocks were classified as Inferred Resources. The block model was validated in several ways: by running an Inverse Distance Weighted interpolation and comparing the results, and by comparing the means and standard deviations of the block grades to the composite data set.

Based on the geological disposition, an open pit mining configuration was used and, based on metallurgical testwork to date, an agitated leach gold recovery was assumed. Industry standard assumptions on unit costs and other parameters were applied.

*NI 43-101 Technical Report, Cajueiro Project, Mineral Resource Estimate: Global Resource Engineering, Denver Colorado USA, October 10, 2019; Authors K. Gunesch, PE; H. Samari, QP-MMSA; T. Harvey, QP-MMSA

Table 1: Maria Bonita independent Mineral Resource estimate parameters

Open-pit Indicated Resources are 24.19Mt @ 0.46g/t (for a total of 357,800oz) and Total Inferred Resources are 25.64Mt @ 0.44g/t (for a total of 362,400oz). These resources include near-surface saprolite Indicated resources of 2,02Mt @ 0.59g/t (for a total of 38,000oz) and Inferred Resources of 0.68t @ 0.40g/t (for a total of 8,700oz). These resources were calculated using a 0.2 g/t gold cut-off grade and were estimated for the volume of mineralized material drill tested to date. Of particular importance in the resource estimate is the uniform style of mineralization and the regular grade distribution.

- CIM Standards were followed for Mineral Resources.

- Mineral Resources are estimated at a cut-off grade of 0.20 g/t Au for open-pit fresh-rock mineralization, 0.20 g/t Au for saprolite.

- Mineral Resources are estimated using a long-term gold price of US$2,780 per ounce.

- Open pit Mineral Resources are reported within a conceptual open pit

- Bulk density is 1.68t/m3for saprolite and 2.64 t/m3 for fresh material based on site measurements on drill core

- Metallurgical recovery used is 90% for saprolite, and 90% for fresh rock.

- Numbers may not add due to rounding.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Table 2: Maria Bonita Mineral Resource at a 0.2g/t gold cut-off grade.

A significant higher grade near-surface resource has also been identified, and at a 0.5 g/t gold cut-off comprises total Indicated Resources of 7.56Mt @ 0.72g/t (for a total of 176,250oz) and Total Inferred Resources are 5.18Mt @ 0.92g/t (for a total of 152,940oz) – Table 3.

Table 3: Maria Bonita Mineral Resource sensitivity to gold cut-off grade.

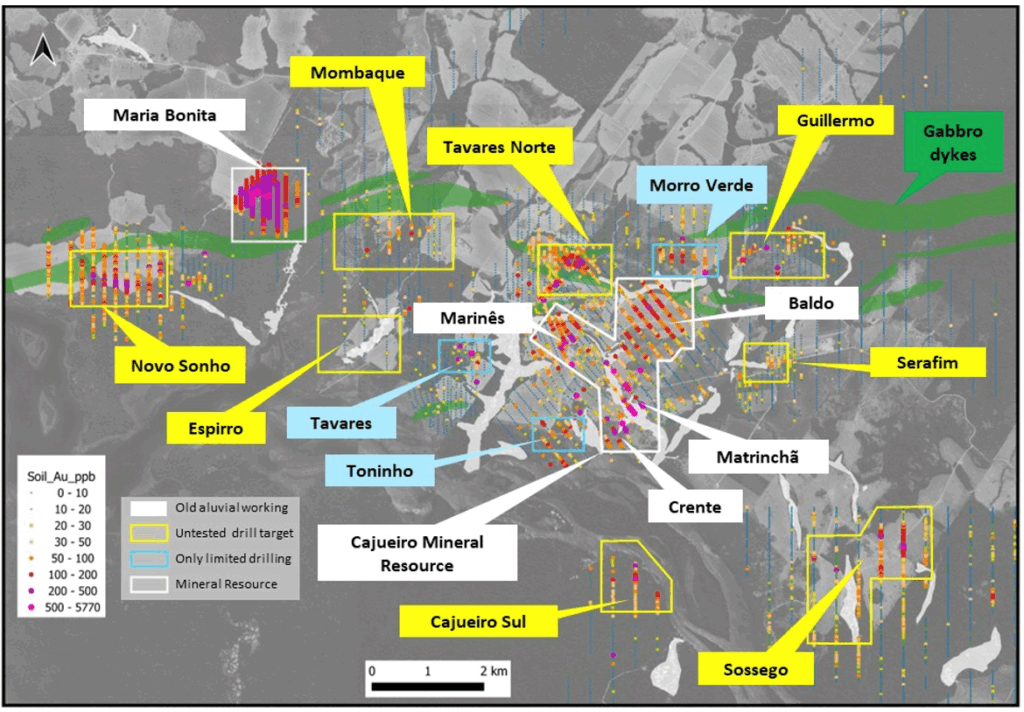

The Maria Bonita porphyry gold deposit is part of a district-scale, porphyry-related mineralizing event. There are currently eight additional porphyry gold targets over a strike of 12km east-west awaiting scout drill testing (Figure 2).

Figure 2: Maria Bonita maiden mineral resource, as described in this release, in relation to the Cajueiro Central mineral resource which comprises 185,000 ounces of gold in the Indicated category (5.66Mt @ 1.02 g/t) and an additional 515,000 ounces in the Inferred category (12.66Mt @ 1.26 g/t).Untested district drill targets are depicted by yellow labels.

Qualified Person

Volodymyr Myadzel, PhD, MAIG, a consultant to the Company as well as a Qualified Person as defined by National Instrument 43-101, supervised the preparation of the technical information in this news release.

Further details supporting the geological model, estimation procedure and block modeling will be available in a National Instrument 43-101 Technical Report authored by Volodymyr Myadzel, PhD, MAIG, of VMG Consultoria e Soluções Ltda of Belo Horizonte, Minas Gerais, Brazil. The report will be posted under the Altamira profile at www.sedarplus.ca within 45 days from the date of this news release.

About Altamira Gold Corp.

The Company is focused on the exploration and development of gold and copper projects within western central Brazil, strategically advancing six projects spanning over 100,000 hectares within the prolific Juruena Gold Belt—an area that has historically yielded over 6 million ounces of placer gold**. Leading the portfolio is the Cajueiro project, a highly prospective asset with an NI 43-101 compliant resource estimate of 185,000 ounces of gold in the Indicated category (5.66Mt @ 1.02 g/t) and an additional 515,000 ounces in the Inferred category (12.66Mt @ 1.26 g/t).

Ongoing exploration and fieldwork at Cajueiro indicate the presence of multiple porphyry gold systems, reinforcing its potential for district-scale development. These hard-rock gold sources align with historical alluvial gold production, highlighting the region’s exceptional gold endowment and scalability. With a rich geological setting and a track record of significant discoveries, the Company is well-positioned to unlock further value across its expansive land package.

*NI 43-101 Technical Report, Cajueiro Project, Mineral Resource Estimate: Global Resource Engineering, Denver Colorado USA, 10th October 2019; Authors K. Gunesch, PE; H. Samari, QP-MMSA; T. Harvey, QP-MMSA

** Juliani, C. et al; Gold in Paleoproterozoic (2.1 to 1.77 Ga) Continental Magmatic Arcs at the Tapajós and Juruena Mineral Provinces (Amazonian Craton,Brazil): A New Frontier for the Exploration of Epithermal–Porphyry and Related Deposits. Minerals 2021, 11, 714. https://doi.org/10.3390/min11070714

MORE or "UNCATEGORIZED"

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE