Aldebaran PEA for the Altar Project Reports 48 Year Mine Life, After Tax NPV (8%) of US$2 Billion, and 20.5% IRR

Aldebaran Resources Inc. (TSX-V: ALDE) (OTCQX: ADBRF) is pleased to announce the results of a Preliminary Economic Assessment, prepared in accordance with National Instrument 43-101 standards, for the Altar copper-gold project located in San Juan, Argentina. The base case scenario utilizes a 60,000 tonnes per day concentrator, processing mineralized material from both open pit and underground sources. The results of the PEA are reported on a 100% basis, while Aldebaran owns an 80% interest in the project, with the remaining 20% held by Sibanye-Stillwater Ltd.

All dollar amounts referenced herein are in US dollars unless otherwise noted.

HIGHLIGHTS

Long life operation with significant production:

- 48-year mine life, including 3 years of construction

- First 20 years1: Average annual production of 121,445 tonnes copper equivalent2

- 108,579 tonnes copper, 43,199 ounces of gold, and 570,217 ounces of silver

- First 30 years1: Average annual production of 116,294 tonnes CuEq

- 105,897 tonnes Cu, 33,866 ounces of Au, and 557,239 ounces of Ag

- LOM: Average annual production of 101,413 tonnes CuEq

- 92,891 tonnes Cu, 27,020 ounces of Au, and 525,192 ounces of Ag

Robust economics with leverage to commodity prices:

- Using base-case metal prices of $4.35/lb Cu, $2,500/oz Au, and $27/oz Ag, the project has an after-tax NPV (8%) of $2.0 billion, an IRR of 20.5% and a payback period of 4 years

- Total LOM gross revenue of $44.7 billion (before TC/RCs, payabilities and transport) and total LOM free cash flow of $10.7 billion

- Using spot prices of $5.00/lb Cu, $3,963/oz Au, and $47/oz Ag, the project has an after-tax NPV (8%) of $3.34 billion and an IRR of 28.0%4

Attractive capital intensity:

- Initial capex for the project is $1.59 billion

- Upfront capital is minimized by taking a staged approach to the tailings storage facility and underground construction

- Capital intensity of $15,713/t of average annual CuEq metal produced3

- NPV @ 8% / Initial Capex ratio of 1.27x

Competitive cost profile:

- Cash Costs (C1) of $1.71/lb payable Cu for the first 20 years1, $1.87/lb payable Cu for the first 30 years1, and $2.02/lb payable Cu for the LOM

- All in Sustaining Costs (“AISC”) of $2.25/lb payable Cu for the first 20 years1, $2.42/lb payable Cu for the first 30 years1, and $2.59/lb payable Cu for the LOM

Combined Open Pit and Underground Operation:

- Production from the open pit pays back the initial capital, while development of the underground is ongoing

- Underground mining pulls forward better grade mineralization earlier in the mine life, to increase production and generate cash flow

- ~80% of the resources (by tonnage) in the mine plan are categorized as Measured and Indicated, with the remaining ~20% categorized as Inferred

John Black, Chief Executive Officer of Aldebaran, commented: “This PEA confirms that the Altar project has the potential to become a long-life, high-quality copper operation capable of generating substantial production and cash flow. Our objective was to define a mine plan that delivers a minimum of 100,000 tonnes of CuEq per year, while maintaining a compact operational footprint and a disciplined approach to capital. The results of this study clearly achieve those objectives and demonstrate that Altar is a technically and economically robust project. This PEA represents a major milestone for the Company and provides the foundation for our upcoming application for inclusion under Argentina’s RIGI investment framework. With the political environment in Argentina shifting toward pro-business and pro-development policies—as underscored by the recent mid-term election results—the timing for advancing a project of Altar’s scale could not be better. The country is positioning itself to emerge as a significant copper producer at a time when global demand for the metal continues to rise. In addition to the base case concentrator scenario, our collaboration with Nuton, a Rio Tinto venture, demonstrates Nuton® Technology as a potentially viable processing alternative at Altar. Utilizing Nuton® Technology, life-of-mine capital expenditure and operating costs were reduced, leading to higher life-of-mine free cash flow. When you combine the economic results with the ESG benefits of Nuton’s sulphide leaching technology, the Nuton case is quite compelling and warrants further evaluation. The next 12 to 18 months will be transformative for the Company, with multiple key catalysts—including a resource update, completion of the PFS, and the proposed Centauri Minerals spin-out—positioning us to unlock significant value for our shareholders.”

Kevin B. Heather, Chief Geological Officer of Aldebaran, commented: “The PEA represents a significant milestone for the Altar project. In addition to achieving the goals John stated above, we were also focused on maximizing NPV and IRR, hence we elected to move forward with a mine plan that included a combination of open-pit and underground block caving. The block cave, commencing production after the open pit pays back the initial capital, allows us to pull forward higher-grade material in the mine plan and to maintain constant CuEq production numbers, while keeping throughput at 60,000 tpd. Moreover, it keeps the overall footprint of the operation smaller, which is a key consideration for development projects. Our approach to capital expenditures was to stage capital outlays where possible, to ensure initial capital expenditures were kept manageable. Where possible, capital was paid out of cash flow to present a more prudent and attractive development opportunity. We will now begin to shift our focus to the PFS, which will be the next step in de-risking the Altar project. To that end, our 2025/2026 field program is now underway, with most of the work focused on collecting the additional data necessary for the upcoming PFS. This includes additional infill drilling, geotechnical drilling, lab-based geotechnical stress and strain test work, Acid Based Accounting (ABA) test work, environmental monitoring, water wells, water balance studies, community engagement, and more. While this work is ongoing, we will also be exploring several opportunities that we have identified that could potentially unlock additional value from the Altar Project.”

PEA Overview

When available, readers are encouraged to read the PEA in the Company’s technical report prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects in its entirety, including all qualifications, assumptions and exclusions that relate to the PEA and mineral resource model. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

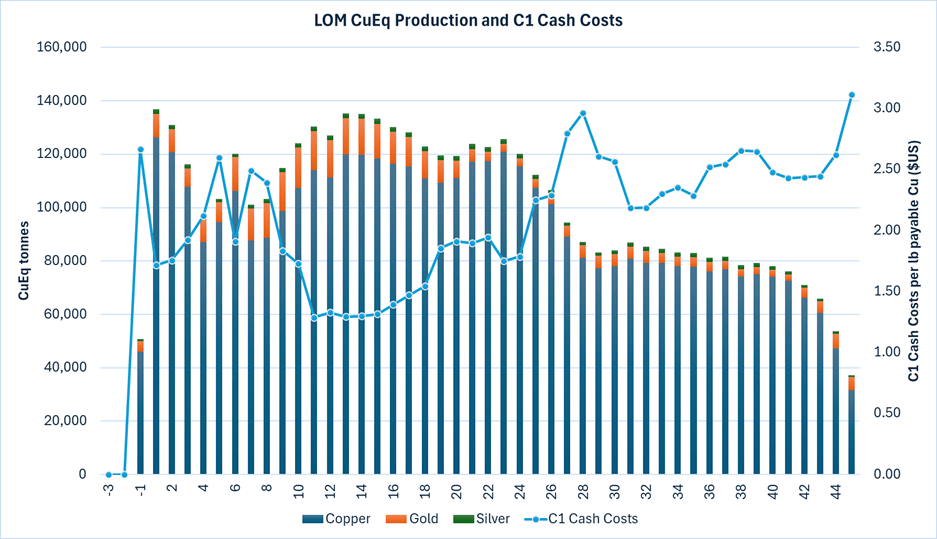

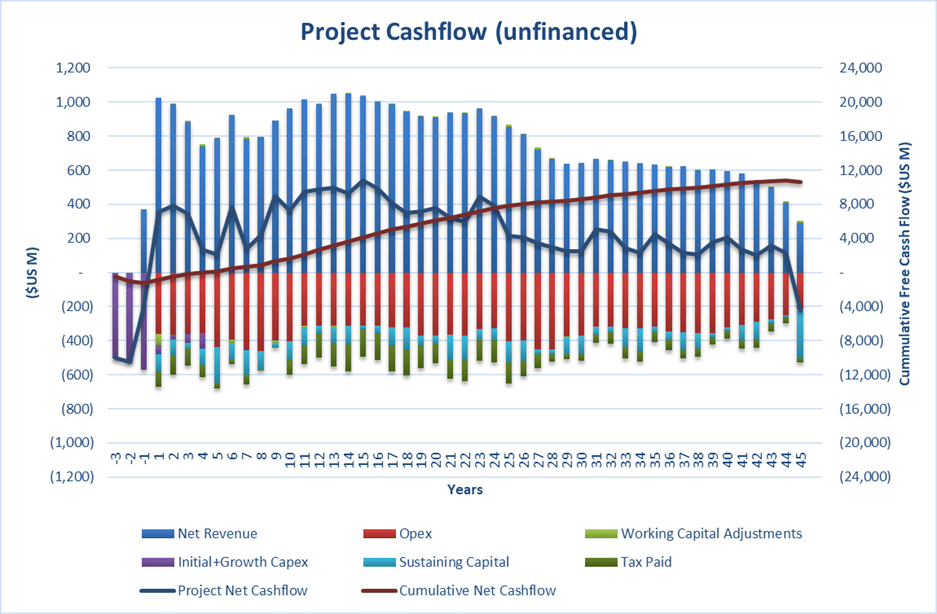

The PEA envisions a combination of open-pit and underground mining, followed by processing via a conventional copper flotation circuit having a nameplate processing capacity of 60,000 tonnes per day. This results in a mine life of 48 years with an average annual production of 102,742 CuEq tonnes for LOM, 116,539 tonnes CuEq for the first 30 years, and 121,748 CuEq tonnes for the first 20 years. Table 1 presents key operating and financial highlights from the PEA, using base study case assumptions of $4.35/lb Cu, $2,500/oz Au and $27/oz Ag. Figure 1 displays annual CuEq production for the LOM, while Figure 2 displays projected cash flows.

| Table 1. PEA Summary | |||

| Metric | Unit | Base Case | |

| Mine Life (including construction) | Years | 48 | |

| After Tax NPV – 8% | M USD | 2,009 | |

| IRR (after tax) | % | 20.5% | |

| Payback | Years | 4 | |

| Averal annual production (LOM) | tonnes CuEq | 101,413 | |

| Averal annual production (LOM) | M lbs CuEq | 224 | |

| Averal annual production (years 1-30) | tonnes CuEq | 116,294 | |

| Averal annual production (years 1-30) | M lbs CuEq | 256 | |

| Averal annual production (years 1-20) | tonnes CuEq | 121,445 | |

| Averal annual production (years 1-20) | M lbs CuEq | 268 | |

| LOM Gross Revenue5 | M USD | 44,738 | |

| LOM Free Cash Flow | M USD | 10,632 | |

| Initial capital | M USD | 1,593 | |

| Capital Intensity | USD/tonne CuEq | 15,713 | |

| NPV/Initial Capex | Ratio | 1.27 | |

| Construction Period | Years | 3 | |

| LOM capital | M USD | 5,651 | |

| C1 Cash Costs (LOM) | USD/lb Cu Payable | 2.02 | |

| C1 Cash Costs (years 1-30) | USD/lb Cu Payable | 1.87 | |

| C1 Cash Costs (years 1-20) | USD/lb Cu Payable | 1.71 | |

| AISC (LOM) | USD/lb Cu Payable | 2.59 | |

| AISC (years 1-30) | USD/lb Cu Payable | 2.42 | |

| AISC (years 1-20) | USD/lb Cu Payable | 2.25 | |

| Throughput | tonnes per day | 60,000 | |

| LOM Cu Recovery | % | 87.76% | |

| LOM Au Recovery | % | 57.00% | |

| LOM Ag Recovery | % | 50.00% | |

| LOM Open pit strip ratio | waste/mineralized | 1.53 | |

| LOM Open pit mineralized tonnes mined | M tonnes | 223 | |

| LOM Open pit Cu grade | % | 0.44% | |

| LOM Open pit Au grade | g/t | 0.07 | |

| LOM Open pit Ag grade | g/t | 1.18 | |

| LOM Block cave mineralized tonnes mined | M tonnes | 768 | |

| LOM Block cave Cu grade | % | 0.50% | |

| LOM Block cave Au grade | g/t | 0.07 | |

| LOM Block cave Ag grade | g/t | 1.61 | |

| LOM Recovered Cu | M lbs | 9,420 | |

| LOM Recovered Au | M Oz’s | 1.24 | |

| LOM Recovered Ag | M Oz’s | 24.16 | |

Figure 1 – LOM CuEq Production and C1 Cash Costs

Figure 2 – Project Cash Flows

Mineral Resource Estimate

On November 25, 2024, the Company announced an updated mineral resource estimate for the Altar project (see Table 2). The PEA is based on the MRE; however, the PEA production profile is based on a subset of the MRE, utilizing different metal prices, operating costs, and mining methods.

| Table 2. 2024 Altar Resource Estimate – $13.99 NSR Cut-off (0.24% CuEq) | ||||||||||

| Average Grade | Contained Metal | |||||||||

| Material Type |

Category | Tonnes (000’s) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Mo (ppm) |

As (ppm) |

Cu (M lbs) |

Au (M Ozs) |

Ag (M Ozs) |

| Supergene | Measured | 121,884 | 0.55 | 0.08 | 1.07 | 21 | 289 | 1,475 | 0.3 | 4.2 |

| Indicated | 80,007 | 0.36 | 0.06 | 0.93 | 19 | 123 | 639 | 0.2 | 2.4 | |

| Total M&I | 201,891 | 0.47 | 0.07 | 1.01 | 20 | 223 | 2,114 | 0.5 | 6.6 | |

| Inferred | 24,850 | 0.46 | 0.07 | 1.01 | 19 | 213 | 251 | 0.1 | 0.8 | |

| Mixed | Measured | 109,510 | 0.38 | 0.07 | 1.22 | 23 | 192 | 913 | 0.2 | 4.3 |

| Indicated | 19,208 | 0.32 | 0.06 | 1.11 | 23 | 139 | 136 | 0.0 | 0.7 | |

| Total M&I | 128,718 | 0.37 | 0.07 | 1.20 | 23 | 184 | 1,049 | 0.3 | 5.0 | |

| Inferred | 1,386 | 0.29 | 0.07 | 1.00 | 13 | 111 | 9 | 0.0 | 0.0 | |

| Hypogene | Measured | 549,385 | 0.41 | 0.10 | 0.98 | 20 | 120 | 4,966 | 1.7 | 17.3 |

| Indicated | 1,517,339 | 0.42 | 0.05 | 1.33 | 54 | 114 | 13,882 | 2.6 | 64.9 | |

| Total M&I | 2,066,724 | 0.41 | 0.07 | 1.24 | 45 | 116 | 18,848 | 4.3 | 82.2 | |

| Inferred | 1,189,513 | 0.37 | 0.04 | 1.26 | 46 | 96 | 9,572 | 1.6 | 48.2 | |

| Total | Measured | 780,779 | 0.43 | 0.09 | 1.03 | 21 | 156 | 7,354 | 2.3 | 25.8 |

| Indicated | 1,616,554 | 0.41 | 0.05 | 1.31 | 52 | 115 | 14,657 | 2.8 | 68.0 | |

| Total M&I | 2,397,333 | 0.42 | 0.07 | 1.22 | 42 | 128 | 22,011 | 5.1 | 93.8 | |

| Inferred | 1,215,749 | 0.37 | 0.04 | 1.25 | 45 | 98 | 9,832 | 1.7 | 49.0 | |

Notes:

Copper Contribution:

Gold Contribution:

Silver Contribution:

|

||||||||||

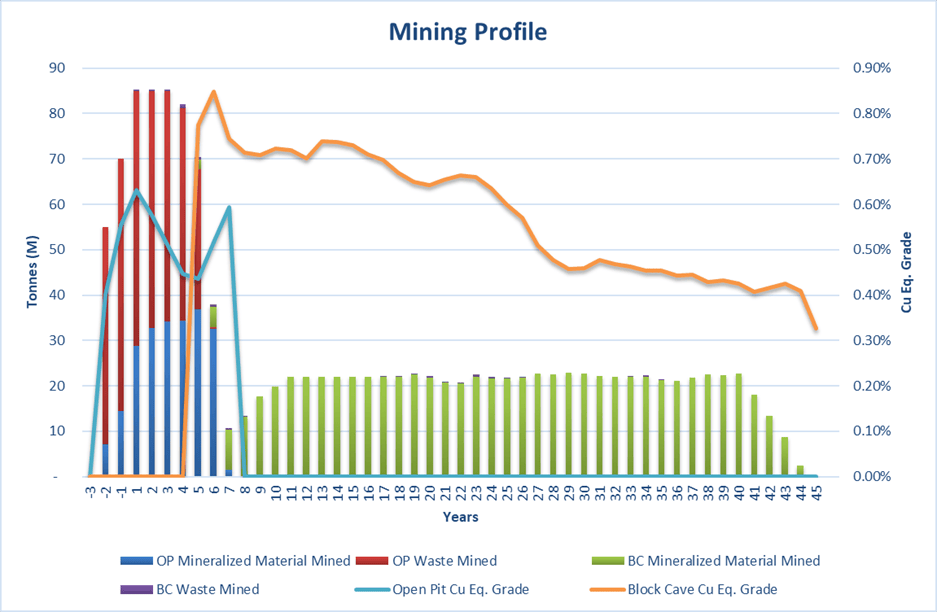

Mining

The proposed mining method is divided into open-pit mining for the near-surface part of the deposit and underground caving for the deeper parts. The open pit will use well-known truck and shovel operations with 12.5-m bench intervals. Haul trucks will be used for hauling mineralized material to the crushing plant and long-term stockpile facilities. Waste rock will be hauled to the closest waste rock storage facility. Underground operations will handle material in bulk using well established block caving methods. Open-pit mining will occur during the first 9 years of operation (in the Altar Central area), while underground development is underway. The mining profile for the project can be seen in Figure 3.

Open pit mining operations will use a smaller-scale equipment fleet that includes 8 m3 hydraulic excavators and 100t capacity SANY haul trucks to allow for narrower bench phases and haul roads, steeper pit slopes, which will facilitate getting into the better-grade, highest-margin mineralization sooner. Underground block cave mining will occur in three areas: Altar East, Altar United, and Altar Central (beneath the open pit). Each underground cave is divided into two lifts, an upper and lower, which will be sequenced as follows: Altar East Upper, Altar United Upper, Altar Central Upper, Altar East Lower, Altar United Lower and Altar Central Lower. Underground access to the block caving mining areas will be through a portal and conveyor drift from the south of the proposed pit (twin declines). To develop the first block cave lift at Altar East, two 3000 m declines are required plus associated development beneath the cave lift.

Figure 3. Mining profile for the LOM

Processing

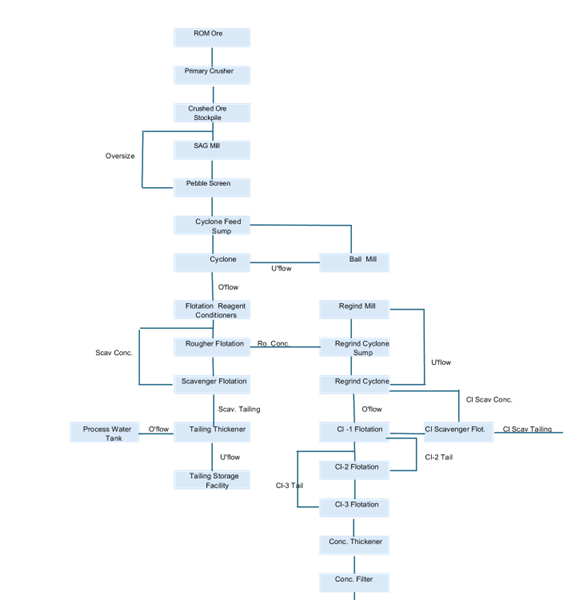

Extensive metallurgical test work has demonstrated that the contained copper and gold can be effectively recovered in a traditional flotation concentrator that would produce a single gold-bearing copper concentrate using industry-accepted technologies. The flowsheet includes primary crushing followed by grinding in a SAG (semi-autogenous grinding) mill/ball mill grinding circuit, rougher flotation, regrinding of the rougher concentrate and three stages of cleaner flotation. The concentrator would be constructed with a capacity to process 60,000 tpd and operated on a 365 day/year, 24 hour/day schedule. A simplified process flowsheet can be seen in Figure 4. LOM average recoveries for Cu, Au and Ag are 87.76%, 57% and 50% respectively. The grade of the concentrate produced is 26% for the LOM. Arsenic in the concentrate is expected to range from 0.5% to 2.2%. Aldebaran hired the CRU Group, a global leader in commodity research and market analysis, to complete a study analyzing the placement of arsenic-bearing concentrates into the marketplace, which showed that blending capacity for arsenic-bearing copper concentrates worldwide has increased materially in recent years, and penalties paid for arsenic-bearing concentrates have decreased substantially. The PEA utilizes CRU’s view on arsenic penalties.

Figure 4. Processing Circuit

Capital and Operating Costs

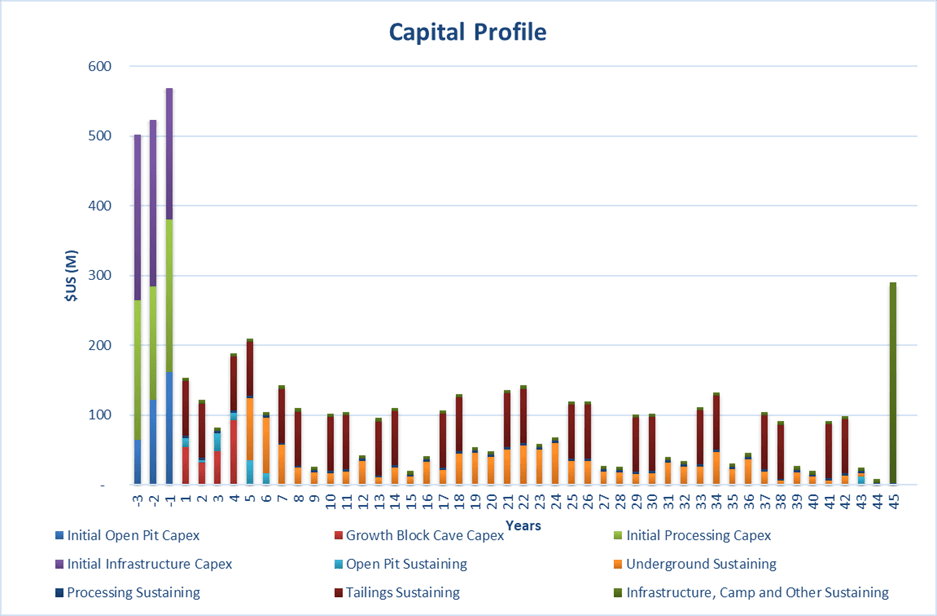

The capital cost estimate prepared for the PEA includes an installation cost associated with the site infrastructure, open pit mine and concentrator plant, a growth capital associated with the installation of the block caving underground mining operation, and the sustaining capital associated with the production plan. The LOM summary of capital is presented in Table 3, while the capital profile for the LOM is presented in Figure 5.

| Table 3. Altar Capital Cost Summary | |||

| Type | Unit | Cost | |

| Initial Open Pit Capex | M USD | 350 | |

| Initial Processing Capex | M USD | 579 | |

| Initial Infrastructure Capex | M USD | 665 | |

| Total Initial Capex | M USD | 1,593 | |

| Growth UG Capex | M USD | 227 | |

| Total Initial + Growth Capex | M USD | 1,821 | |

| Sustaining Capital | M USD | 3,830 | |

| Total LOM Capital | M USD | 5,651 | |

Figure 5. Capital Profile for the LOM

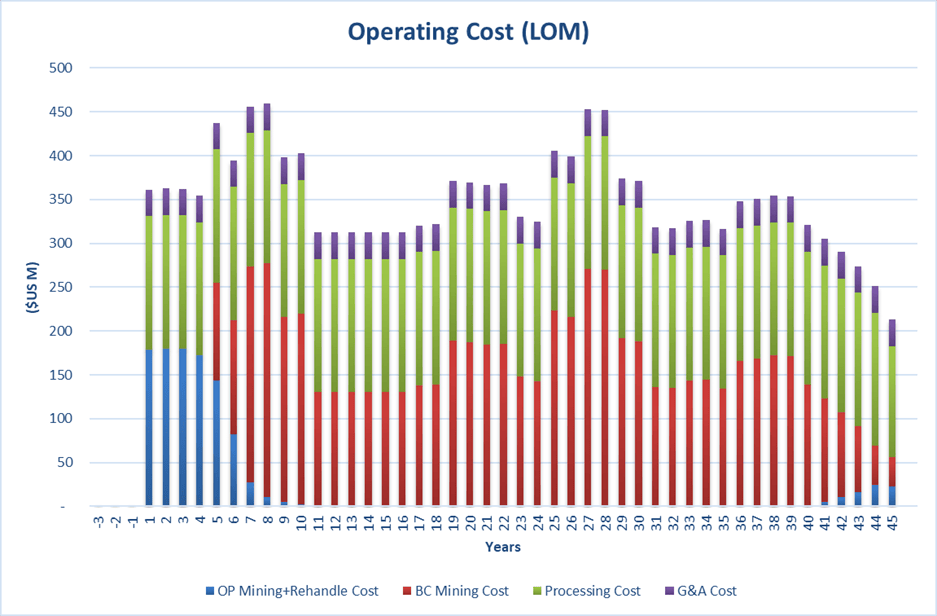

Operating costs were estimated for the open pit mining operation, block caving mining operation, the concentrator processing operation, and G&A. A summary of the estimated operating costs is presented in Table 4. The buildup of LOM C1 cash costs and AISC can be found in Tables 5 and 6, while operating costs by year can be found in Figure 6.

| Table 4. Altar Operating Cost Summary | ||

| Type | Unit | Cost |

| Open Pit Mining Cost | $/t mined | 2.35 |

| Block Cave Mining Cost | $/t mined | 8.42 |

| Processing Cost | $t milled | 6.93 |

| G&A Cost | $t milled | 1.38 |

| Total Operating Cost | M USD | 15,690 |

| Table 5. Altar C1 Cash Costs | ||||

| Item | Unit | M USD | USD/ lb Cu Payable | |

| Open Pit Mining Cost | M USD | 1,208 | 0.13 | |

| Block Cave Mining Cost | M USD | 6,523 | 0.72 | |

| Processing Cost | M USD | 6,866 | 0.76 | |

| G&A Cost | M USD | 1,388 | 0.15 | |

| As Penalty | M USD | 288 | 0.03 | |

| Treatment Charges (TC) | M USD | 1,150 | 0.13 | |

| Cu Refining Charges (RC) | M USD | 634 | 0.07 | |

| Freight Charges (FC) | M USD | 2,257 | 0.25 | |

| Less: Au By-Product Credits | M USD | -1,798 | -0.20 | |

| Less: Ag By-Product Credits | M USD | -221 | -0.02 | |

| C1 Cost | $US/lb Payable Cu | 18,296 | 2.02 | |

| Table 6. Altar AISC | ||||

| Item | Unit | M USD | USD/ lb Cu Payable | |

| Open Pit Mining Cost | M USD | 1,208 | 0.13 | |

| Block Cave Mining Cost | M USD | 6,523 | 0.72 | |

| Processing Cost | M USD | 6,866 | 0.76 | |

| G&A Cost | M USD | 1,388 | 0.15 | |

| As Penalty | M USD | 288 | 0.03 | |

| Treatment Charges (TC) | M USD | 1,150 | 0.13 | |

| Cu Refining Charges (RC) | M USD | 634 | 0.07 | |

| Freight Charges (FC) | M USD | 2,257 | 0.25 | |

| Less: Au By-Product Credits | M USD | -1,798 | -0.20 | |

| Less: Ag By-Product Credits | M USD | -221 | -0.02 | |

| San Juan Mine Mouth Tax | M USD | 972 | 0.11 | |

| Total Royalties | M USD | 393 | 0.04 | |

| Total Sustaining Capex | M USD | 3,830 | 0.42 | |

| AISC | $US/lb Payable Cu | 23,492 | 2.59 | |

Figure 6. Operating Cost by Year

Infrastructure

The Altar project includes on-site infrastructure such as earthworks development, crushing and process plant facilities as well as ancillary buildings such as camp, warehouses and workshops, on-site roads, water management systems, and site electrical power facilities.

Off-site infrastructure includes a site access road, plant roads, water supply, power supply (power transmission line), two waste rock storage areas, the tailings storage facility, and surface water management structures.

Water use for the project assumes use of surface runoff water, pit dewatering wells, water supply wells within 25 km from the concentrator, with additional water supplied from surface sources.

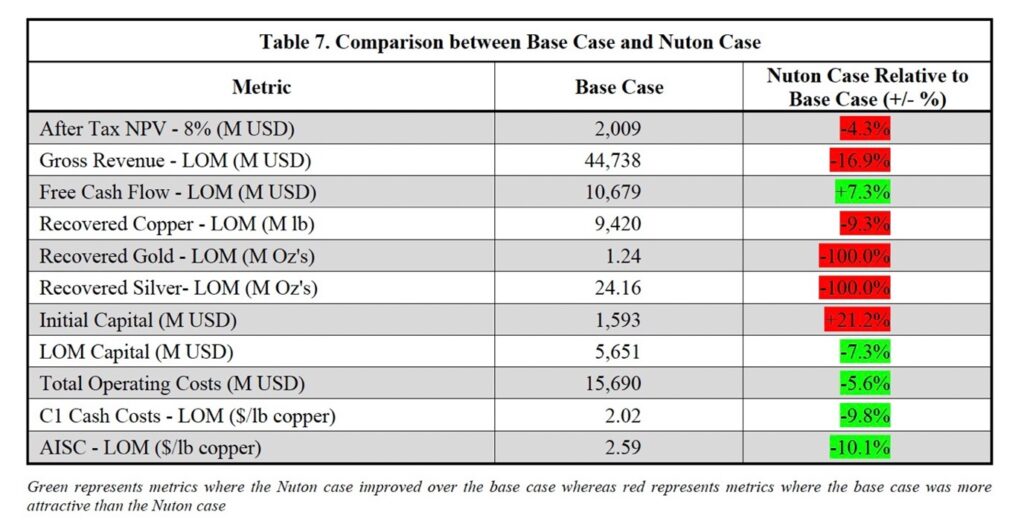

Nuton, a Rio Tinto venture, Scenario

On November 7, 2024, Aldebaran announced that it had entered an agreement with Nuton Holdings ltd. whereby Aldebaran would grant Nuton the option to acquire a 20% stake in the Altar project (see Company press release dated November 7, 2024). As part of that agreement, Aldebaran agreed to include a case in the PEA (“Nuton Case”) utilizing the Nuton® Technology, a suite of proprietary sulphide leaching technologies, as a potential alternative to the base case concentrator scenario reported above (“Base Case”). Nuton® Technology provides the potential to leach both primary and secondary sulphides, providing an alternative processing option for the Altar project. In addition, the Nuton Case provides significant other benefits, such as eliminating the need for a tailings dam, providing a smaller environmental footprint, lower overall energy consumption and lower water consumption than conventional sulphide mineralization treatment processes. Moreover, producing copper cathode on site would eliminate downstream treatment and refining costs, deleterious elements’ penalties, simplify logistics and would provide a finished product at site saleable to the market.

As a result of the work completed in the Phase 1 Nuton® Technology test work program (see Company press release dated November 7, 2024, for details), Nuton has estimated ultimate copper extraction and copper recovery after a 450-day leach cycle for each material type at Altar. The results of this analysis estimate copper extraction from hypogene, mixed and supergene material at 86%, 88% and 91%, respectively. Nuton applies a discount factor of 92% to allow for inherent inefficiencies in the scale up to a commercial heap leach and has, therefore, estimated copper recoveries from hypogene, mixed and supergene material at 79%, 81% and 84%, respectively.

The Nuton Case in the PEA utilizes the same mine plan as the Base Case, due to the use of an overall elevated cutoff grade for both cases; however, it utilizes Nuton® Technology, a bio-leach heap leaching process targeting the leaching of primary and secondary copper sulfide minerals and has been designed to process 60,000 tpd, matching the Base Case throughput. Material will be crushed and processed using a conventional lined heap leach pad and combined with a standard SX/EW facility will produce saleable copper cathode onsite. Aldebaran currently does not have a commercial agreement with Nuton to deploy Nuton® Technology at Altar and there is no guarantee an agreement will come to fruition. For comparative purposes, the Nuton Case does not include project costs associated with licensing and Nuton® Technology services at the Altar Project.

To demonstrate the Nuton Case, the variance percentage relative to the Base Case is included here for selected key production and financial metrics. The results of the Nuton Case can be found in Table 7. Measurable contributors to capital spend include a Tailings Storage Facility (TSF) for the Base Case and a Heap Leach Pad (HLP) for the Nuton Case. The Nuton case shows higher initial capital requirements due to the need for more infrastructure from the start-up (e.g. full-sized ponds) compared to a TSF. However, LOM capex in the Nuton Case is lower, as TSF requires higher sustaining capex to reach final capacity. Additionally, at this time, precious metals such as gold and silver cannot be recovered with Nuton® Technology, whereas they are recovered in the Base Case. Timing of capital and revenue from copper equivalent reduces the NPV for the Nuton Case, but lower total capital and lower operating C1 and AISC costs allow for a higher Free Cash Flow in the Nuton Case.

Opportunities

Several opportunities to potentially unlock additional value remain to be evaluated, including:

- Installation of a molybdenum circuit in the later years of the mine when higher-grade molybdenum is encountered in the lower block caves

- Additional metallurgy to potentially improve copper recoveries

- Combined concentrator and Nuton® Technology scenario

- Processing of concentrate on-site rather than shipping to a smelter

- Filtered tailings storage

- Producing a pyrite concentrate from the pyrite-rich waste rock, that could be used in the Nuton Case

- Upsizing the daily production rate and copper output with better metal prices

Next Steps

- The 2025/2026 field season is underway, with four drill rigs currently being mobilized to site

- Additional infill drilling to convert inferred resources to the measured and indicated categories

- Preparation to apply for inclusion under Argentina’s RIGI benefits

- Produce an updated mineral resource estimate based on the infill drilling completed in 2024-2025 and the to-be-completed 2025-2026 infill drilling (resource conversion)

- Geotechnical drilling within the PEA open pit and underground block caves

- Geotechnical drilling within the PEA tailings storage facility

- Lab-based geotechnical stress and strain test work

- Acid Based Accounting (ABA) test work

- Drilling additional water wells and conducting additional pump tests for water balance studies

- Continue environmental monitoring studies

Study Notes

Aldebaran retained SRK Consulting Inc. as lead consultants, with Knight Piesold as a subcontractor.

The PEA is preliminary in nature, as it includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not Mineral Reserves and do not have demonstrated economic viability.

Qualified Person

The scientific and technical data contained in this news release has been reviewed and approved by Dr. Kevin B. Heather, B.Sc. (Hons), M.Sc, Ph.D, FAusIMM, FGS, Chief Geological Officer and director of Aldebaran, who serves as the qualified person (QP) under the definitions of National Instrument 43-101.

Notes

- Assumes commercial production begins in year 1 after 3 years of construction. 20- and 30-year averages calculated starting in year 1.

- CuEq calculated in the PEA study using $4.35/lb Cu, $2,500/oz Au and $27/oz Ag and is reported utilizing recoveries of 87.76% for Cu, 57% for Au, and 50% for Ag

- Capital intensity calculated as initial capex divided by LOM average annual CuEq production.

- LME copper price, gold and silver price as of market close on October 27, 2025. The NPV calculation using spot prices was not part of the PEA report and was calculated by Aldebaran using the financial model provided by SRK.

- Before TC/RCs, payabilities and transport.

About Aldebaran Resources Inc.

Aldebaran is a mineral exploration company that was spun out of Regulus Resources Inc. in 2018 and has the same core management team. Aldebaran holds an 80% interest in the Altar copper-gold project in San Juan Province, Argentina. The Altar project hosts multiple porphyry copper-gold deposits with potential for additional discoveries. Altar forms part of a cluster of world-class porphyry copper deposits which includes Los Pelambres (Antofagasta Minerals), El Pachón (Glencore), and Los Azules (McEwen Copper). In November 2024 the Company announced an updated mineral resource estimate for Altar, prepared by Independent Mining Consultants Inc. and based on the drilling completed up to and including the 2023-24 field season (independent technical report prepared by Independent Mining Consultants Inc., Tucson, Arizona, titled “Technical Report, Estimated Mineral Resources, Altar Project, San Juan Province, Argentina”, dated December 31, 2024 – see news release dated November 25, 2024).

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE