Ahead of the Herd & Under the Spotlight – Rick Mark, CEO Harvest Gold (TSX-V:HVG)

Rick Mills, Editor/ Publisher, Ahead of the Herd:

Rick, I think our readers would like to know a little bit more about you and how you came to be CEO of Harvest.

Rick Mark, President and CEO, Harvest Gold:

Well, I think we met probably 20 years ago, Rick, when I had begun my time with a group of guys who had a company called Rare Earth Metals, which became VMS Ventures. We were exploring in Manitoba at that time. During that early time, 20 years ago, people came to us with a shell company.

We looked at that and it became Pancontinental Uranium. In that same time frame, as I recall, Rick, we spun out the gold assets. I think Harvest Gold was a spin-out back then.

It shows you how long ago it was. And it was part of our group of companies early on. And so, at that point in the office, we had Pancontinental Uranium, Harvest Gold, and VMS Ventures.

After roughly two years the group decided I was best suited to be the CEO. I think that comes from my earlier history of being a high school principal. I’d also led curriculum projects for the province. My experience really was in running things. And I’d just spent ten years in the Public Company space, so I was ready for the role.

I’m comfortable talking to various audiences. In the case of these companies, its investors, its brokers, its geologists, so I’m comfortable in speaking to different groups as I got more educated about the complexities of business.

RM: What did you learn from all of this?

RMark: Ultimately, I learned that I needed really talented geologists with me, because I am not a geologist. I never pretend to be a geologist. I had also learned a good deal about the public reporting aspect of this, which told me you need a strong CFO, and you need a strong corporate secretary. The underpinnings of the company, if you will, are there.

You don’t want people to find out about your company through failures of the legal side or the corporate reporting side, and I think we’ve been able to manage that extremely well through the years, and around me over those years I’ve managed to keep a strong core of geologists.

Neil Richardson’s been with us since about 2007 or 2008 with VMS Ventures. He’s now the Vice President of Exploration for Hudbay Canada. He’s responsible for Canada, and he’s a guy that is still on our Technical Advisory Board, and one of my close confidants on anything to do with geology, and interestingly, Rick, you may remember this, Neil actually worked on Windfall in the early days, so the group, as you’ll see on our website, including Director Pat Donnelly, are just a powerhouse group of geologists.

So, over time I’ve honed my skills as a CEO, I understand my responsibility and built a very strong technical team that is willing to go along with me on these various adventures.

RMills: You briefly worked in BC and met Crescat Capital.

RMark: Yes, Harvest has had a recent life here in British Columbia, where we mounted a drill program in the Smithers area looking for near-surface gold. We encountered Crescat, who, as we all know now is our largest shareholder at 19.9%, and a very active and intelligent fund in this space.

Unfortunately, we didn’t find that near-surface gold, and then the last two years, we’ve been fighting hard to tell the story of these three great properties in Quebec, with this team that is the essence, the strength of Harvest, and with Crescat continuing to be our largest shareholder, to the point now, Rick, where after two years, we’ve just completed a drill financing.

We have an additional $500,000 closing from a large European investor, who will end up being somewhere around a 9.9% shareholder, and I consider that to be a great compliment to the team and the work that we’ve done. So that’s about a four-minute review of the last 20 years.

RMills: I’ve talked to Neil and a few of the other guys, and I was always impressed by the team. They’re a very smart, savvy, experienced bunch of guys, and I’m glad you’ve still got them. I like the continuity.

Can you give us a brief acquisition history and rundown on each of the projects and where we stand right now?

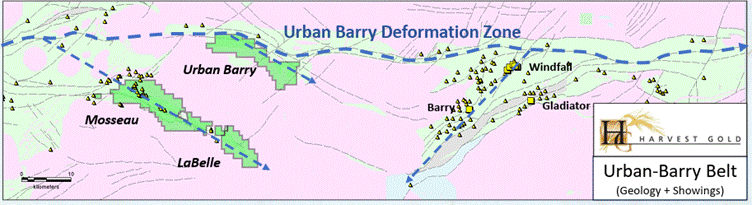

RMarK: Sure, a couple of years ago Daniel Rodriguez, who was CEO of EGR Exploration (TSX.V:EGR), talked to me about their Urban Barry property. The Urban Barry property was interesting because it has about 17 kilometers of the Urban Barry belt itself.

The deal was very reasonable. They were in a position where they were trying to raise money for their Detour West property, and this was a second property of theirs.

I immediately brought Neil in, and Neil really loved the cross-cutting structures on the Urban Barry Belt, on the major structure running east-west, he said, “Look, I think you should pick this up.”

So, I looked at it and thought, “Well, we can’t build a company just on that.” But Daniel Rodriguez said, “I know that a company called Vior who have spent about four years putting together a project called Mosseau which is very close to Urban Berry.” So, I took a look at Mosseau and I called Vior and met their CEO, Mark Fedosiewich

That was about the time you and I talked first talked about Harvest, two years ago in August. So, we met Daniel two years ago, April-May, made a small deal, and then began working on putting Mosseau into the project, and that took, between lawyer delays, various things, almost six months, and it was a year and a half ago, or perhaps a year and three quarters ago, when we got Mosseau. And Mosseau is the highlight flagship property because of the work that’s been done on it over many years.

And Vior took, and people may not be aware of this, Rick, Vior took four years to amalgamate the various properties inside Mosseau into one property. So, what we were able to get a hold of is the product of that work. We would not have had time as a small company to do that.

And so, we made a deal that I thought was reasonably fair with Vior. It’s a little bit loaded on the back end for their shares, which is fine with me. Companies dilute over time.

They’ve been excellent partners. We are up to speed with everything that we owe to Vior, and we’re getting ahead of it, as we’ll talk about. So that got us an opportunity, Rick, to own 100% of Vior’s Mosseau project.

RMills: You brought on Louis Martin, a French Canadian, to help with working in Quebec.

RMark: Yes, Pat Donnely introduced us to a gentleman called Louis Martin, who is really our chief geologist, our Quebec-based geologist, he’s a very important guy on our team and is really running the program around our team of advisors. He was on a meeting just this morning with three of our geologists, for example.

Louis was able to bring his Abitibi, Quebec and French-language experience that’s required to work in Quebec. And he knows all the players in the industry who are key to our success.

One day, Louis says to me, “You know, down to the south of Mosseau is unstaked ground.” And that is what we ended up staking and naming LaBelle. And on that now 100% owned property you see an extension of the structures that run right through Mosseau.

RMills: What is the Kiask River Mineralized Corridor and how important is it?

RMark: The Kiask River Mineralized Corridor is the major structure that runs through Mosseau all the way through LaBelle. By the way we have now flown La Belle, and the mag details are coming soon.

So, we now are in possession of about 50 kilometers of structures in the Urban Barry Belt area. The Mosseau, Urban Berry and LaBelle structures, as Quinton said famously in an interview with you in July, are the mirror image of the structure that holds the Windfall deposit and the other deposits on that side, which gave us great confidence.

So, we now have the opportunity to own 100% of 50 kilometers of what we consider to be a very important through-going structure in this area. And we’re now very large landholders in the Urban Barry Belt, surrounded, by the way, by Gold Fields (NYSE:GFI).

RMills: Tell us a little more on Vior and Osisko (TSX:OSK) and the Gold Fields’ move into the area. I think it’s important for our readers to know who we got Mosseau from, you wanted the pieces to build a company on, and you went to Vior.

RMark: Well, what’s important to the story is that Gold Fields arrived in the belt. They first began talking to Osisko Mining about Windfall and the properties that Osisko Mining owned in the Urban Barry Belt, I think a couple of years ago is safe to say, maybe longer. And they announced their intentions, I don’t know, a year and a half or so.

And then sometime perhaps nine months ago or so, perhaps a year by now, they made the deal and effectively valued Windfall and all the properties at $4 billion. And so that gave us instant credibility, as you can imagine. If you look at our website and one of my favorite images shows basically Gold Fields owning all of the Urban Barry Belt around us.

So, Gold Fields not only bought the Windfall deposit, but all of the exploration ground that Osisko Mining had built over a number of years in this area.

Now, what’s also interesting is that about January, a situation was set up between Osisko Mining and Vior. And it was what I would describe as a very friendly management takeover of Vior.

So, I guess the senior managers at Osisko Mining were looking for something to do. They talked to Vior and sure enough Vior said, “Well, why don’t you come and run our company?” And Mark Fedosiewich, the CEO of Vior at that point, was quite happy to move to the role of chairman. He had built Vior, done all that great work.

He was at a stage in his life where the move to chairman was excellent. And he knew as a very loyal shareholder that bringing in the Osisko Mining guys would give them all the credibility they could ever have with Osisko Mining’s experience and that’s including developing Windfall into a $4 billion asset. So, we now have partners in Vior who include the Osisko Mining senior management.

They know this belt. They know Mosseau. They know this area. And they’ve been assisting us by staking ground to the south and the north of Mosseau, for example, and including it in our deal.

We’ve got smart, experienced partners in Vior who are very comfortable I think with our team doing our job, which is to develop Mosseau.

So that’s the umbrella picture. It’s incredible, really. I loved the story when it was just Osisko Mining and Windfall, Rick, but for Gold Fields to come in and spend $4 billion to own the belt and the deposit and then to get the extra kiss of the ex Osisko Mining guys to be our Vior partners it’s just sort of this incredible story that from what we talked about two years ago, when we took on Urban Barry and we were discussing getting Mosseau into the fold.

I’m very proud of where we are today.

RMills: I think there’s been a couple of very, I’m going to call them brilliant moves. I’m not arm waving because things have worked out quite spectacularly for Harvest Gold and you’re the CEO. You can take a lot of the credit for it as well as the team that you’ve managed to put together and keep together.

Now, what I like is when Quinton Hennigh of Crescat said this was a mirror image of the Windfall; he meant a lot of the exploration and the cross-cutting structures and everything.

I look at this and I look at Harvest Gold and we might have a mirror image to a $4 billion project. I wrote my first article in August of ‘24 about what you had, what you were doing and what you put together over the last year since we had first talked about this.

I look at this and I think so much has changed in the junior market, you’re starting to see money flow down into the juniors. Give us a little bit of your take on how the market’s changed.

RMark: Well, you know, frankly, I think it’s over the last three months really the energy has changed.

And the gold price of $3,600, it certainly has helped the juniors getting financed and aggressively financed. So it’s really one of these deals, and you’ve been in the business long enough as I have, where you kind of have to hang in there until the next wave goes up on the shore because you’re still paddling out there beating the surf and trying to get to shore and trying to survive and, you know, whatever you can do to keep yourself afloat, literally.

I mean, we had to do a small bridge financing in April because this same European investor now stepping up, got spooked by the Trump tariffs in April, as a lot of people did. And so, I think there now is a market for good exploration stories, and we are a really, really good exploration story.

Of course, what we’re hoping for is exactly what you described. There’s a $4 billion asset sitting over there. Are we the mirror image? That’s a great question. We do have a through-going structure. We do have cross-cutting structures. We’ll find out.

RMills: The amount of work that has been done on Mosseau is limited, the amount of work done on the other two land packages is almost nil.

RMark: A lot of the property package has never been worked, some a bit, the little bit of drilling that has been done has not been deeper than 250 meters.

Nobody really knows anything about this yet. If you look at the drilling at Mosseau in the ‘80s, it was done by different companies. It was sporadic. It wasn’t ever done with today’s technology, and we were able to consolidate the data related to the historic work that had been done, which our team has done, ahead of our drilling.

I think we’re in a position now where juniors have a shot, and audience building is always a challenge. I think we’ve got people very experienced helping us with that.

Ultimately, results matter, and a commitment, Rick, by these bigger groups who aren’t going away. Crescat has money to keep financing us, which they’ve done every financing. This European group wants a position so they can continue to support us.

The two Quebec exploration funds, SIDEX and NQ Investimente have now invested and are supporting us, and they have the money to support us again. All of that is about relationship building, which started with my initial contacts with them, and then their time with our technical team. They need to have comfort at their management level and then at their technical level that we can handle the money; we can spend the money properly.

But in order for them to even talk to us, they have to say, “You have a chance,” and I think we do. One thing I’ll say is that the gentleman who runs NQ, beautiful guy, he says, “Rick, I look at all these northern opportunities because we’re looking for stories we can support in the north of Quebec, and there are no companies with properties, at least very few I’ll say, with the properties, the size that you have.”

So, we do have real estate. We do have sizeable real estate. We own it. All things going well here we’re going to put ourselves in a position very soon where we’ve confirmed 80% ownership of Mosseau, which is how the deal was built. Yeah, I’m happy that the market has caught up with us, and we did hang in there waiting for the wave, and I think we’re on shore now.

We’re going to announce a little bit more work with extra money we’ve raised, and I like where we are.

RMills: You can never predict what’s going to happen, but really this market cycle is no different than any others we’ve been through. The price of metals rise, the majors move, and it comes down into the mid-tiers, and then the juniors move.

Right now, there’s just a dribble coming through the dam to the juniors. It’s starting to pick up. Through the first six months of this year juniors were able to raise more financing than they did in all of 2024.

So that’s a really good sign. But when the floodgates really open there’s going to be a massive amount of money come into this sector and getting positioned in a lot of juniors right now is probably a smart move.

I didn’t play in BC with you, but I’m certainly on board with what you’re doing here in Quebec. I think we’re just getting started in this metal cycle.

What excites me about Harvest Gold is that you guys have projects that really could deliver substantial deposits. You’re not just running around writing press releases and, you know, take a sample here and take a sample there. You guys have got projects that could deliver long intercepts of some really good grades, and we could really build off just a little bit of success, and that’s what I like.

If you were a retail investor and you were looking at this, why would you invest in Harvest Gold?

RMark: Well, I think you’re making the point. I’ve said before, Rick, that in one of the bullish-type junior markets, if you say we’ve got 50 kilometers of strike length, we’re in the Abitibi, we’re in Quebec, we’re in a belt that’s now owned by Gold Fields, they’d be saying what’s the symbol? That’d be enough. Come on, that would be enough.

The interesting thing is that was enough for Crescat. If you look at Quinton’s initial comments on the structures, well, we heard the Osisko Mining guys called it through-going structures, which I like. The through-going structures of these properties.

Louis refers to them as strike lengths. I don’t say that. I mean that’s a pretty aggressive term.

All of that, in the right political jurisdiction, in the right geological environment, that is the Abitibi, you don’t need to know any more, Rick. Now, are the guys running the deal straight up or are they just promoters? I think we’ve proven we are serious to the market.

Do they have the technical team that can get to the answer if there is an answer? I think we’ve proven that to the market. And we also have supporting that technical team, Quinton and Crescat. You know, when I talk to Neil, he’s got a $50 million exploration budget for Canada every year, I’m talking to a guy who runs advanced drill programs. So yeah, I think we’re everything that one would say, “I’ve got to own this stock.”

You don’t own one junior stock. I mean, that’s great if you do and you love Harvest. But the guys that we’re talking to own hundreds of these things, or 20s and 30s or 80s of them. They do that because they know the odds of success are still long.

But we are putting together one of these great checklists where everything until drill results says the box is ticked. And I do think that’s the case. And then drill results are going to be interesting.

We know it takes a lot of time to find a deposit. So, it’ll be up to us to create a value proposition out of our drill results. And let people know that we are advancing these properties.

In a perfect world like with VMS Ventures, you get a drill result that shocks the world. Then you never need to market your company again because the entire world knows you’ve got a massive strike before literally the ink is dry, if you like. Now that is an old analogy on the press release.

So, we’ll see. We’ll see once we get drill results in, who we are in the next phase. We’re at work. We’ve got money in the bank. And now we can go about building this company and making discoveries.

RMills: I talked before about buying a handful of popcorn kernels and you throw them on the heat. You know some of them are going to pop. Some of them aren’t. And that’s why you have a basket.

But you still have to be a stock picker in picking the companies that you put in your bag of kernels. As a shareholder you should know that you’re getting the best projects, the lowest-risk profile, the lowest-cost exposure, and most of the money is going into the ground so that the exploration team can actually make discoveries, because true wealth in this sector is created at the end of the drill bit.

And what I like about Harvest Gold is you guys are going drilling and you’re not going to quit going drilling. I look at the money you’ve raised, I look at who’s backing you, I see the warrants to be exercised and I know the money is there and I know you’re going to spend it on drilling so for me I’m looking at staying in this company and see if we can build something and that’s where I want to be.

I don’t think there’s anything we missed here, Rick, is there anything that that you think we need to cover or maybe put a wrap on it here?

RMark: No, I think we talked about the things that matter.

RMills: It was great talking to you and thanks for your time.

RMark: Ok great job, appreciate it, Rick.

Subscribe to AOTH’s free newsletter

Richard owns shares of Harvest Gold (TSX.V:HVG). HVG is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of HVG

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE