Ahead of the Herd & Under the Spotlight – Dylan Langille, VP Exploration, White Gold

Rick Mills, Editor/ Publisher, Ahead of the Herd:

Dylan, please give us your most recent background, how you become part of John Robins’ team on Great Bear, and just kind of walk us through that to the ending with Kinross.

Dylan Langille, VP Exploration, White Gold:

Prior to joining White Gold I was most recently involved with the Great Bear project. I joined that team back in January of 2019 on what was supposed to be a one-month contract.

A colleague had called me, said that they were getting a second drill rig at the Great Bear project and wanted to know if I’d like to come and log some core up in Red Lake for a month.

And then in May of that year we stepped back and drilled into the felsic volcanics, that was DNW-011, the discovery hole. I was fortunate enough to be the geologist in the core shack and logged that drill hole, so it was a really exciting moment and things kind of exploded from there.

We went from two drills to four to eight to 12 pretty quickly, it was something new for the Red Lake region, it changed how everybody looked at the geology, you didn’t need to look at just the Balmer aged rocks anymore, people started looking at the Confederation-aged rocks and that’s when the staking rush began.

From that point on we just continued doing step-out drilling, starting with 1 km spacing, dropping down to 500 meters, then 200 meters, and we realized the mineralization was continuous.

In February ‘22 that’s when Kinross came in and purchased us for $1.8 billion. I joined Kinross through acquisition and then I spent the latter three years managing and leading exploration, drilling over 300,000 meters and taking the deposit from just under 5 million ounces to 7Moz.

RM: When you were with Great Bear on the discovery did you advance from the core shack and get other responsibilities?

DL: Definitely, I went from logging core to managing databases and overseeing geologists, to designing, managing, and leading exploration— it was a phenomenal opportunity.

I was lucky enough to be involved early on, which presented a lot of unparalleled opportunity which accelerated my career quickly.

RM: And you were acquired — it’s a funny word — but you were acquired by Kinross from Great Bear when they bought it out and you went to work for Kinross. Can you explain your duties as you advanced three years with Kinross please?

DL: From that point on when I joined Kinross, I took on more of a leadership role, helping lead exploration efforts, designing and managing over 300,000 meters of drilling across the deposit. The goal became adding as many ounces as quickly as possible and showing how big the system was, so that’s what we did.

RM: I know you had several job offers, and you could’ve had your pick of some quality projects a little closer to home. Why White Gold, what about this company attracted you?

DL: That’s a great question. Ultimately when I made the decision to leave Red Lake, that project was going quickly from exploration and discovery into production, I had to make the decision if I wanted to go down the production geology route, or if I wanted to continue with junior exploration and discoveries.

Ultimately I decided that was what I wanted to do, I wanted to look for what I thought was a low-risk early-exploration opportunity with a high probability for discovery, and given my background — I’m an Ontario guy, spent a lot of years doing geology in Ontario — at first my focus was looking at projects in Ontario but I was also keeping my finger on the pulse in the Yukon.

I think it’s been an emerging jurisdiction over the last few years, I’d followed companies like Snowline (TSX.V:SGD) and Banyan (TSX.V:BYN), and there’s been a lot of excitement and buzz around the Yukon in general, so that became another jurisdiction I was looking to get involved with.

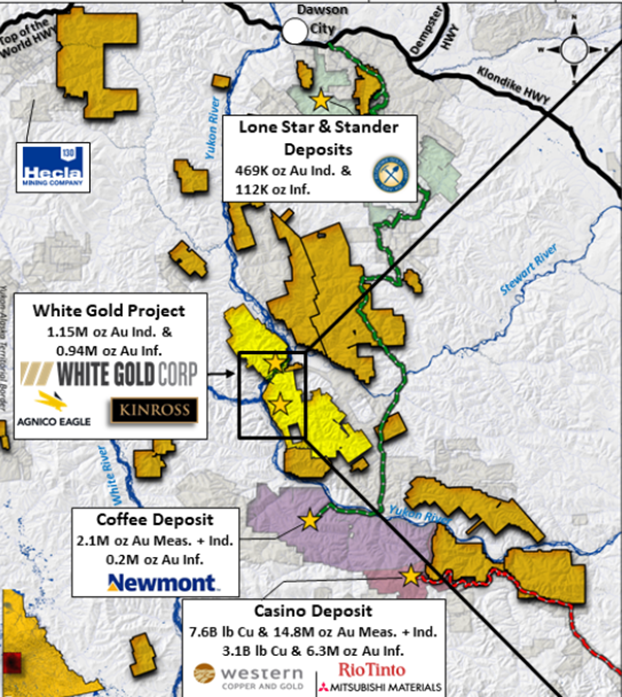

Then the White Gold opportunity presented itself to me, and the first thing that stood out with White Gold was just the sheer scale, the quality and the strategic positioning that they’ve got under their portfolio. They cover a huge portion of the Klondike Gold District and what I came to understand later was over the years, Shawn Ryan had looked at 80 to 90% of this jurisdiction, and hand-selected the properties that are now in the portfolio, so they were cherry-picked to be the best opportunities.

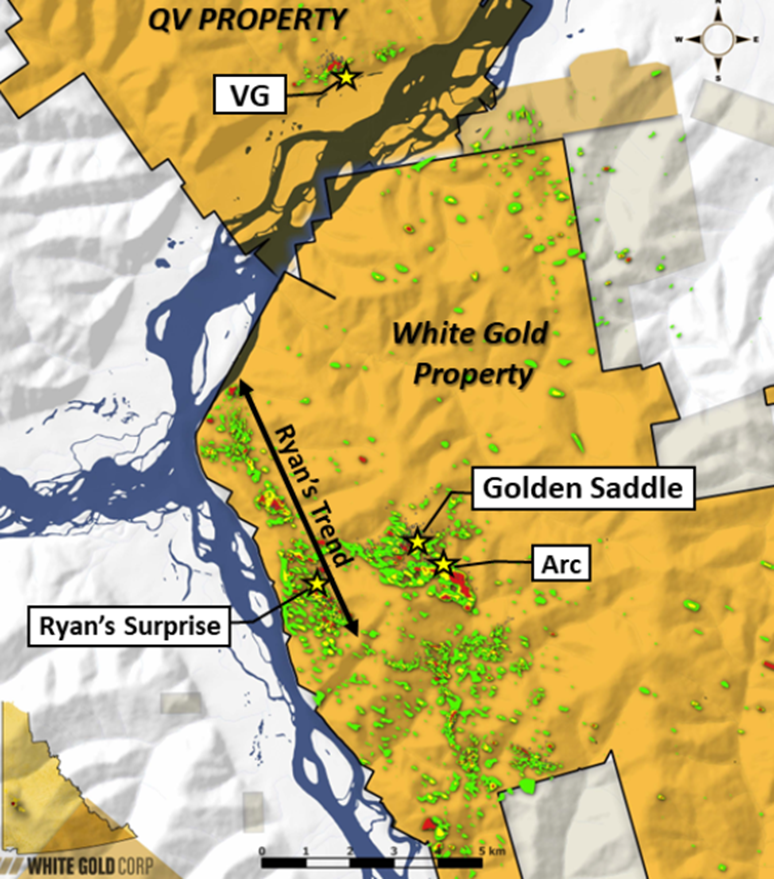

So, the initial thing that caught my eye was the claim package, the portfolio, but really what solidified the decision was the realization that they have a foundation, they have an existing deposit already in Golden Saddle, Arc, Ryan’s Surprise and VG, so that was kind of the second half to why I saw this as a really low-risk opportunity.

They already had the 2.3 million oz, they had been marketing it over the years as still being open at depth and along strike, there really hasn’t been an extreme amount of drilling into these deposits, so that’s what got me excited.

RM: You know the dedication it takes to find an ore body, you know how to turn it into a deposit, and you learned about growing it. It’s obvious that White Gold, the company, perfectly fits your experiences on the Great Bear Project.

DL: I had just spent three years on the Great Bear project growing a deposit, and I wanted to get a hold of the data of White Gold and see if that opportunity truly existed with Golden Saddle. To my surprise I started realizing that there is a lot of opportunity and potential here with this deposit.

That became my strategy along with CEO David D’Onofrio and the team, to say, “We really need to get back to drilling Golden Saddle, we need to take this thing off the shelf, we need to dust it off, we need to show its potential,” so that’s what we did this year and that’s the announcements you saw come out a few weeks ago.

RM: White Gold has put together a two-phase plan, let’s talk about that. Phase 1 is identifying critical metals potential like copper, moly, tungsten, antimony, bismuth on that selected land package we just talked about. You’re going to get at least 3 of these projects ready for drilling in 2026.

Phase 2 is drilling on the flagship Golden Saddle deposit with the goal of demonstrating the potential for two times the current 2.3Moz resource.

Tell us how you plan to accomplish this?

DL: Half of our program this year is focused on the critical metals stream, so we have three high-priority targets that we’re running IP surveys on to get high-resolution chargeability targets ready for drilling next year. Those three properties are Pedlar, Loonie and Nolan. All three of these properties have really nice soil geochemistry anomalies showing high values for either moly or tungsten or copper mixed with lead, bismuth, tellurium.

And these aren’t just small soil anomalies streaked across the map, these are broad 3-kilometer by 3-kilometer signatures that really present as potential for porphyry-style systems at depth, so that’s been the focus for the critical metals stream.

We want to highlight those targets and show that there’s something worthy of drilling. In particular of interest is the Pedlar property, because that sits just north, relatively close to the Casino project owned by Western Copper and Gold Corporation (TSX:WRN) so it’s very intriguing; we definitely look forward to drilling that one next year.

RM: And Phase II.

DL: The other half of our program this year is drilling at Golden Saddle. When I got a hold of the Golden Saddle database, when I started spinning it around in Leapfrog, I really wanted to identify whether or not there’s opportunity to grow this thing, and to my excitement not only is there very nice targets to drill and go after for future work, but there’s some really near-term low-hanging fruit that I think is going to add ounces to the resource model further to what we just put out the other day.

RM: Let’s get into that. You’re going to resample previously drilled holes, you’ve got drill core basically only for the felsic units, and this was all based on the understanding at the time, but you’ve got potential for mineralization in the mafic units of the hanging wall and the foot wall as well, don’t you?

DL: Yes, so one thing I realized early on, the team were going through all the previous drilling, and we started to notice that there was unsampled core, particularly in the mafic units but mostly in the hanging wall of the deposit. One thing we want to do is go back and take a look at that core, because there are instances in more recent drilling, in 2018-19 on Saddle where they did sample those intervals, and they ran good grades, stringing together back-to-back samples of 2 grams per tonne, 5 g/t, 1 g/t, so it makes a nice composite.

Maybe not all of these samples run high grade but we’re talking about a shallow open pit, so effectively that’s going to change a lot of your waste rock into ore, so it’s going to improve your economics and your strip ratio, and it’s just going to make this deposit a lot bigger and a lot more attractive.

RM: A high-grade breccia was identified in historic drilling, but nobody has chased that.

DL: It was identified in the past but the understanding and the interpretation on it is not pinned down. As you mentioned there’s some holes through it at the shallow depth like 100 to 150-meter vertical depth, but there’s only one hole that pierces through that foot wall breccia at depth, and then the next hole above it is about 250 meters away, so there’s a lot of opportunity there to infill that mineralization panel and that has become the focus of the 2025 exploration drilling.

RM: These zones are very close to the existing pit shell.

DL: Yes, they’re just outside the currently modeled pit shell, it wouldn’t surprise me if we successfully intercept similar grade, that 4 grams per tonne over 12 meters, that was the last hole to go through it, it could pull the pit lower and it might be incorporated into that pit resource as well. There’s some exciting opportunity there.

RM: It certainly sounds like there’s quite a few, we’re also looking at the potential for multiple parallel high-grade zones within the known footprint, is that correct?

DL: Potentially yes, I think the foot wall breccia is incorporated to some aspect, just not continuously because of the minimal nature of the drilling through the foot wall breccia. And then with the hanging wall I think as we go through this systematic resampling program, I think we’ll be able to improve those wireframes further and add more grade to that as well.

RM: Depth is open, and it looks like maybe the grade potentially increases as you get deeper.

DL: Yes, so one of my favorite things that I’ve interpreted about this is the good potential for a high-grade, tabular-like ore shoot to exist. If you look at the deposit and the broad mineralization envelope, it plunges to the north at about 55° and I think internal to that mineralization envelope there might be a high-grade plunge that plunges about 50° towards the west. If you look at some of the long sections that we’ve put out I show that as a target. There’s 200 meters between drill holes at depth that just skirted the highest-grade portion of the deposit I believe, so I think there’s some serious potential to expand that high-grade zone at depth.

RM: I know most of your higher-grade mineralization is in that Golden Saddle core, but you’ve got something here that maybe people aren’t really paying attention to. The Arc deposit is currently 300,000 oz but it’s only been drilled down to 80 meters. Am I correct in thinking that maybe there could be a pleasant surprise coming from the Arc deposit?

DL: Yes, certainly. Out of all the drilling that’s been done between the two deposits, a lot of it has focused on Golden Saddle. I think the Arc only has 7,000 meters of drilling, its broadly spaced drill holes separated by 125 meters and not really to depth; they didn’t do any follow-up drilling on depth.

RM: Well, it had poor recoveries, so go drill elsewhere till you get it sorted?

DL: Yes, so it appears. Historically the metallurgy came back at 30 to 40% but as you saw in the press release yesterday, additional test work has shown that with the change to the flow sheet we’ve got recoveries up to 80-85%.

That’s actually part of our program again this year in that we’re going to collect as much of that Arc core as possible and we’re going to get it over to our consultants to do some more lab testing because they believe like we do, that those recoveries can be improved quite significantly.

I think once you demonstrate that, and I’ve already got a plan together to hit that zone with another 7 or 8,000 meters of RC drilling and I think the potential is there if the grades are consistent to double that resource quite easily because it’s quite shallow right now.

RM: Arc has some leg to it.

DL: I would agree with you there. I think the growth from here is going to be very positive, we’ve seen 3 million oz as of yesterday and that’s with pretty early-stage work. I think once you go through this resampling program and we gear up towards a bigger drill program on this deposit next year, I think that’s where the big value’s going to show.

RM: Before we got the new mineral resource estimate, Clarus Securities put out a report.

Clarus says that back on August 6th WGO was trading for less than $30 an ounce, which is a massive 75% discount to your peers because Canadian developers are trading at an average of 6X NAV. So even using 3X, which is a 50% discount to the average, and this is coming from Clarus Securities remember, that would imply a $300 million market valuation for WGO.

Now even today at the current price of $0.48, that’s still 3X over current levels because as of close Friday the 22nd of August WGO has a market cap of $95.8 million, Clarus Securities thinks it should have been $300 million – they thought all this before the new Mineral Resource Estimate (MRE).

Here’s a quote: “Management believes remodeling alone could add 20 to 25% to the current resource without drilling a single hole.” We already talked about you were going to do some work on the modeling, and you just gave us the results.

Tell us about those.

DL: Yes, it ended up being a little bit more than a 25% increase and obviously that’s fantastic and it’s a real credit to the team.

Before my arrival they had really started picking apart the geology, reinterpreting the wireframes, improving the mineralized zones and the outcome was very positive. We realized the mineralization was a lot more continuous and we were able to add a lot more ounces.

I think one thing that people will notice in the resource update is we’ve added 680,000 oz or thereabouts, and maybe the grade came down a bit, but one positive thing to that is we’re going to go through and we’re going to resample this material in the pit.

I think you’re going to start to see that grade come back up again because there’s a lot of instances where there’s holes in the grade and the resource estimate just purely due to unsampled drill core, so I think that’s something that people can really look forward to when we put out the next update and we get through this program.

RM: For contained gold in Yukon projects, Snowline Gold’s Valley resource is the top, they’ve got 8 million oz inferred and indicated. Newmont’s (NYSE:NEM) Coffee project is in second place, they’ve got 2.4Moz of gold in M&I.

With the updated MRE, White Gold’s resource is 3 million ounces gold. 1.73moz indicated at 1.53 g/t, and 1.26moz inferred at 1.2 g/t.

It’s probably good to note here that Shawn Ryan discovered both the White Gold and Coffee deposits.

We also have something I haven’t seen emphasized by many, a consistent large high-grade core. We do stand out.

DL: Yes, 3 million ounces is the overall resource. If you look at the high-grade core of the Golden Saddle, if you take the 3-gram cut-off you’re looking at 700,000 oz indicated at a grade of 4.8 g/t, so that’s really high grade.

RM: To me that’s a US$2.34 billion extremely high-grade starter pit.

DL: It’s very exciting.

RM: You increased the indicated and inferred resources on your last MRE by 44% and 13.5%, respectively compared to the previous MRE. Now let’s be clear: what work does that not include?

DL: That does not include anything from our programs in 2025, so that doesn’t include the resampling that we’re going through right now, it doesn’t include any of the drilling that we’re going to do for this season, those are future additions that will come.

I think that the resampling alone will add a good increase to the resource estimate. And then this drilling will string together that breccia foot wall zone, which will add ounces as well.

RM: It is interesting, the company said 3-5 million ounces and without any of this year’s program you just hit 3 million ounces from 2.3m ozs.

DL: Yes, it’s quite phenomenal and like I said that’s credit to the team and the geos prior to my arrival. I think it’s a great first step towards the goal.

And it also demonstrates with this resampling program, that this is gold contained in quartz carbonate veins, structurally controlled, and it doesn’t exist just in the felsics, it exists in the mafics as well and I think if that shapes up that’s going to change the interpretation of this deposit.

RM: Those veins aren’t sitting in isolation.

DL: Yes, and I believe the system is bigger than what’s demonstrated right now by the drilling and the modeling.

RM: I want to switch tracks here for just a minute. Ahead of the Herd knew years ago that mined production of gold plateaued in 2016 and we’ve had no significant growth since. As a matter of fact, demand for gold has not been met by mine production for almost a decade. The demand for gold has been met by melting down jewelry and we reached peak mined gold a long time ago.

Do you think about stuff like that?

DL: I do yes, quite often. I’m not just a geologist working on deposits and for companies, I do also like to get involved with investments and track other opportunities and companies.

I find myself thinking about that quite frequently and I think gold has proven itself to stay above $3,000 and I think what we’ve seen over the last 12 to 18 months is a lot of the investment and the money has been going to those big producers because that’s where the money was to be made.

Gold is holding close to its highest price ever, so you want to produce as much gold as possible because it’s worth so much, but I think now that it’s been so sustainable I would hope, and I would think that you’ll start to see a lot more pressure on these major mining companies to restock reserves.

Because everybody knows reserves have been depleting quite quickly and I think that pressure is going to come, and I hope it comes because I think more exploration is needed.

RM: It’s always the majors that get the love first, but we’ve never seen anything like $3,300-$3500 gold, their profit margins aren’t just fantastic they’re unbelievable and they know their mining reserves are being depleted faster then ever before.

Mining’s a depletion business, each mine has a life and every year you deplete your main assets. You have to replace those if you want to stay in business, it’s a well-known fact at AOTH that the owners of the world’s future mines are junior resource companies and they’ve been severely underfunded for years.

As a matter of fact, White Gold itself has been funded internally and by Agnico Eagle, who is probably the premier gold miner in the world at this current time; they’re your partner. What do you think about working with Agnico? Do you talk to them? Do they work with you?

DL: Yes, they do. Just recently we had two Agnico guys up at site and me being new we had some good discussions on how we want to tackle Golden Saddle, and not just Golden Saddle but also the other properties in the portfolio, come up with a systematic strategy to make discoveries. So that relationship is definitely there and it’s a very positive one to have.

RM: Agnico Eagle recently bought a large chunk of shares in the company when Kinross exited its position in White Gold, I honestly don’t care why they did it, they’ve got their own reasons for doing things, and they sold at $0.29.

Now insiders, including Agnico Eagle, acquired a large part of that ownership and I believe Agnico Eagle increased their ownership to just slightly less than 20%, which was very well received by investors. That’s a very strong show of confidence by the world’s premier gold miner, isn’t it?

DL: Yes.

RM: Did you get to talk to Crescat Capital geologist Quinton Hennigh when he was up there?

DL: I did get to talk to Quinton, and we just had a phone call the other day.

RM: Ok, when Quinton went up there, he thought he was just coming up to see a typical orogenic gold deposit, you know big, low-grade classic, he got a surprise, a mega-shear?

DL: Well, it’s classified as an orogenic system structurally hosted. I think what Quinton saw was the scale of the deposit and what exists there. I think he was pleasantly surprised to see the core, the alteration, the mineralization, the brecciation and all the structures that are present definitely sparked his interest in the deposit.

And than you get to thinking about the database that Shawn Ryan and his team has put together, over 600,000 soil samples, there’s gold-in-soil anomalies that light up across the entire district.

I don’t doubt that there’s more discoveries to be made and that there’s likely some massive structure that’s feeding secondary or tertiary fault systems that’ll host these gold deposits, so it really is an exciting jurisdiction.

I think that it’s behind in terms of hard-rock exploration, and I think that’s why there’s so much potential here.

RM: You’re doing some regional exploration this year?

DL: We are, we’re doing a bit of mapping and prospecting but for this summer the focus really is Golden Saddle, and then those three critical metals properties.

RM: The regional setting, the Dawson Range, you’ve got an east-southeast trending mountain range, you’ve got several important mineral deposits and prospects, you’ve tied up a considerable amount of this range.

DL: Yes, I think the portfolio represents around 30% of that entire range and like I said earlier, it’s not because he only looked at 30%. Shawn looked at 80% to 90% so these properties that he kept, had the best anomalies and structures and reasons for deposits to exist on them.

RM: Well, when you got in there and you started looking at all the data it must have been better than Christmas for a geo.

DL: Yes, it’s admittedly a bit overwhelming because it’s a lot of data to look at, but that’s one of the exciting opportunities. This off-season we’re going to dive into all the surrounding properties and come up with a strategy.

We’re going to put these properties into a pipeline and we’re going to understand how to develop them in the most valuable way.

RM: Does that mean potentially joint venturing them off to other quality juniors or spin-out a newco, both?

DL: David has talked about this quite a bit, we’re going to take the critical metals properties and we’re going to divide them out and put them into a spin-co and that’s going to help us internally in terms of strategizing, but it’s also going to help investors focus on what they want to invest in.

RM: It’s a good idea, so that’s part of the macro plan for ’26, is there anything else? You’ve covered some of this stuff, but can you tell us, you’ve got all this property stuff going on right now, the Phase 1, the Phase 2, and you’re going to take that and this winter study it.

You’ve got a potential new-co spin out on the books for the critical metals, you’ve talked about a major drill program on Golden Saddle. Like, “let’s focus on Golden Saddle,” go in there and get it moving. Is there anything else you can tell us about your macro plans, and maybe bring it down to the micro a little bit for 2026?

DL: I haven’t spent too much time digging into the surrounding properties, I’ve looked high level at most of them and I think for people that have followed the story for the last few years, they’ve seen that the company has gone out to properties like Betty, they’ve gone out to JPR and Henderson, they’ve put drill holes into Betty that returned some really impressive grades, like 5 g/t over 20 meters, multiple 4 g/t over 50 meters, they’ve gone over to the Vertigo discovery on GPR, they took 4 g/t over 12 meters multiple times on that property, so the strategy is there, the success is there, it’s just a matter understanding the systems and then coming up with a strategy to truly expose the potential. But discoveries are being made.

RM: I’ve got a prediction for the rest of this year into next year, want to hear it?

DL: Sure, I’d love to.

RM: Ok, there’s going to be one major project and one mine sold in the Yukon in 2025. I think we have 100% surety that Victoria’s Eagle mine, that’s on their Brewery Creek project, I think PricewaterhouseCoopers is going to announce a buyer for that very soon.

And there are some serious rumors floating around that Newmont is going to finally pull the trigger, they’ve found a buyer and they’re going to sell their Coffee project. So that’s my prediction and that’s going to happen for 2025.

My prediction for 2026 is we’re going to have two major gold projects sold in the Yukon.

The first one is BYN, Banyan, and the second one is White Gold. I think by this time next year maybe a little later into the year you’re going to have more than enough info, it’s going to be good info, and I personally believe that you’re going to be taken out.

And the reason I’m looking at these two buyouts is because somebody’s going to come in and consolidate the camp where you guys are, and that means probably by the company that buys Coffee. And then over in the Tombstone, whoever buys the Eagle is going to consolidate and buy Banyan, and that’s how the majors are coming into the Yukon big time.

DL: I think that’s a justified prediction. I think once the Coffee domino falls, and maybe when some of this infrastructure starts breaking headway, I think the Yukon’s off to the races in terms of projects going through the next stage.

RM: That leads us to our last question, Dylan. What are the infrastructure plans, such as roads for the White Gold project? I know there’s some stuff that governments have got going, some more money’s going to be spent, can you explain that to us please?

DL: Yes, there’s two major roads that have been announced in our area, there’s the Northern Access Route from Dawson that runs south right along it through a lot of our other properties and then to Coffee, that’s the end goal.

And then there’s the Resource Gateway Road that comes up from the southeast and goes over to Casino. I think once those roads are established it does wonders for all these projects and makes it a lot more economic and realistic and more attractive to developers.

RM: That sounds very interesting and relates to my predictions.

DL: It does, the resources are there, Casino’s there, Coffee’s there, golds at all-time highs, the value is definitely sitting there, and I think they’re just waiting to be developed.

RM: Before we wrap this up is there anything you think we missed? Is there anything you want to add?

DL: I’ll close by saying that I think White Gold, and its portfolio of properties, is a really good opportunity in the Yukon. There’s a lot of work to be done for sure, and we’re going to start with what I think is the most value for everybody, Golden Saddle, Arc and the White property, but we’ll definitely be taking a look at those other gold targets and seeing how we can advance those as well.

RM: Great to talk with you Dylan. Thank you.

DL: Thank you, Rick.

Subscribe to AOTH’s free newsletter

Richard owns shares of White Gold (TSX-V:WGO) and Banyan Gold (TSX-V:BYN). WGO is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of WGO.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE