ADYTON RESOURCES RECEIVES NON-BINDING LETTER OF INTENT (LOI) FOR THE PURCHASE OF GOLD CONCENTRATE FROM ITS WAPOLU PROJECT

Adyton Resources Corporation (TSX-V: ADY) is pleased to announce that it has received a Non-Binding LOI from Korean group Hyosung TNC Corporation on December 8, 2025 for the purchase of gold concentrate from its Wapolu Gold Project in Papua New Guinea.

HIGHLIGHTS

- Strong demand interest from concentrate traders: Adyton has attracted strong interest from global trading houses for concentrate from its Wapolu project, which is targeted to restart production in late 2026;

- Payable terms significantly improved: Adyton’s discussions with a range of traders indicate that payable terms for concentrates with the expected Wapolu specifications have materially improved, with an anticipated 15% improvement from terms previously provided and used in Adyton’s internal modelling;

- Significant project value uplift expected: Supported by a strong gold price environment, Adyton expects that should the improved payability terms be reflected in final sale and purchase agreements, there will be a significant and material enhancement to the value of the Wapolu and Gameta projects on Fergusson Island.

Tim Crossley, Chief Executive Officer, commented:

“This LOI is a very positive indicator for our Fergusson Island projects, highlighting robust demand for precious-metal concentrates. The material improvement in payable terms combined with the current strength in gold prices positions our Fergusson projects to generate strong cash flows.”

Gary Wang, Chief Executive Officer, EVIH, stated:

“This indicative concentrate pricing is very positive for our Fergusson Island projects and, combined with the strong gold price, provides us with strong motivation to accelerate all aspects of project permitting and development.” Project

Update

Adyton, together with its joint venture (JV) partner EVIH, is advancing the Wapolu project with a targeted production restart in late 2026. Current work streams are focusing on completing all precursor inputs to the submission of the Mining Lease (ML) application and the Conservation and Environment Protection Authority (CEPA) permit.

Background

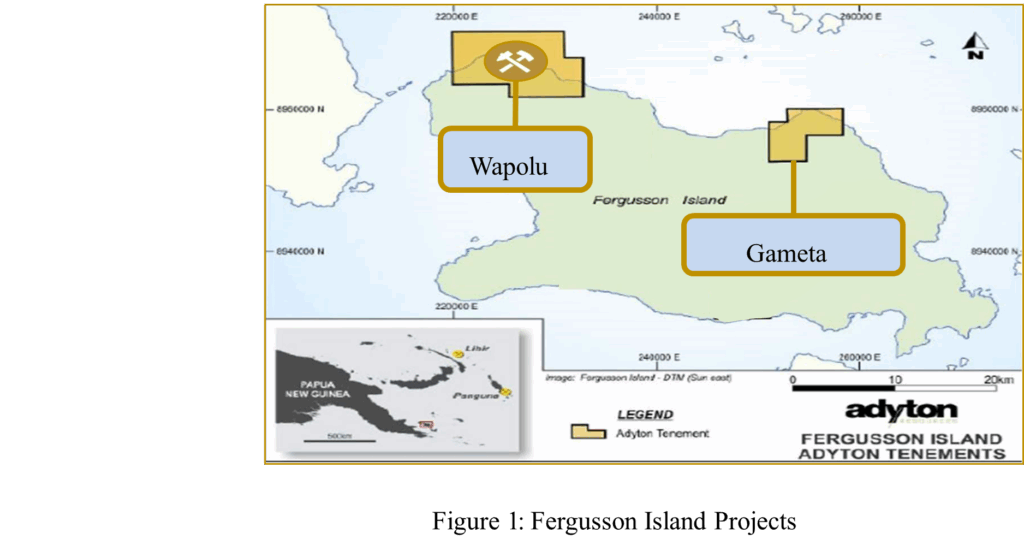

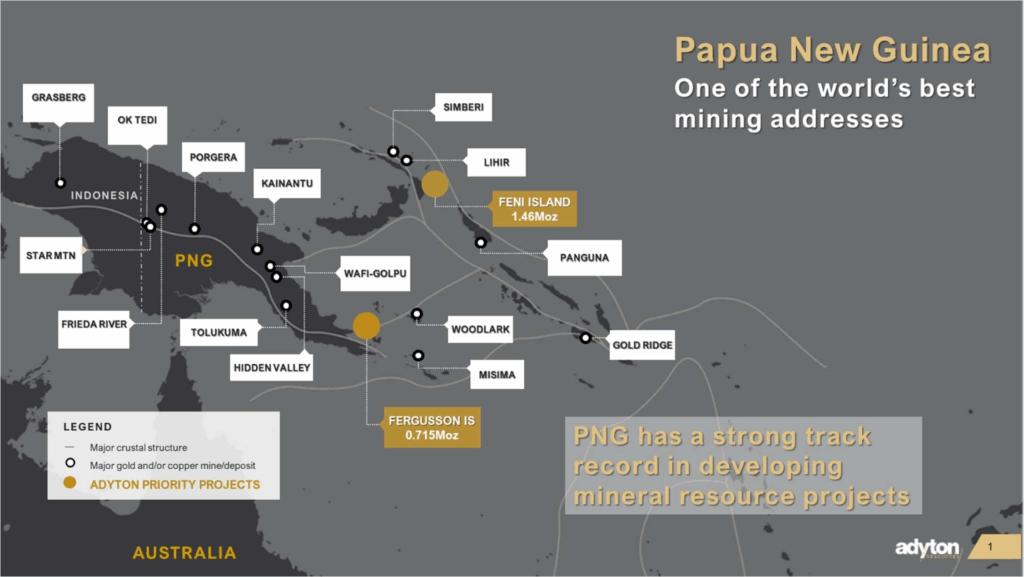

Adyton’s gold projects, held in JV with EVIH, are located on easily accessible islands in Papua New Guinea (PNG). The Gameta and Wapolu projects are situated on Fergusson Island in the Milne Bay province of PNG, which also hosts the Woodlark and Misima projects (refer to map of PNG deposits at the end of this document).

The Wapolu gold project (refer to Figure 1) is a proposed restart of the past-producing Wapolu mine which operated in the mid 1990’s, producing about 9,000oz of gold before shutting down due to low gold prices. The restart of Wapolu will be substantially easier than a green field project, being enabled by significant existing infrastructure such as airstrips, workshop and warehouse structures, basic wharf infrastructure and tailings impoundments.

The neighboring Gameta project is an advanced exploration asset being prepared to be taken into permitting and development, that lies approximately 30 km from Wapolu and has the benefit of being able to leverage some of the Wapolu infrastructure, such as the airstrip.

Resource Estimate

The existing Gameta and Wapolu Mineral Resource Estimate is highlighted in Table 1, with resources open at depth and along strike. The current drill programs at both Wapolu and Gameta are in part designed to test depth and strike extensions but also importantly to increase resource confidence to enable progression to establish reserve estimates and the Mining License (ML) application.

Table 1: Mineral Resource Estimates:

| Project | Indicated | Inferred | ||||

| Au Tonnes

(g/t) (million) |

Au

(koz) |

Au

(g/t) |

Tonnes

(million) |

Au

(koz) |

||

| Gameta exploration licence | 1.33 | 4.0 | 173 | 1.01 | 10.5 | 340 |

| Wapolu exploration licence | – | – | – | 1.06 | 5.8 | 200 |

| Fergusson Island Gold Project | 1.33 4.0 | 173 | 1.02 | 16.3 | 540 | |

Gameta and Wapolu resources at 0.5g/t gold cut-off [1]

ABOUT ADYTON RESOURCES CORPORATION

Adyton Resources Corporation is focused on the development of gold and copper resources in world class mineral jurisdictions. It currently has a portfolio of highly prospective mineral exploration projects in Papua New Guinea on which it is exploring to expand its identified gold Inferred and Indicated Mineral Resources and expand on its recent significant copper drill intercepts on the 100% owned Feni Island project. The Company’s mineral exploration projects are located on the Pacific Ring of Fire on easy to access island locations which hosts several globally significant copper and gold deposits including the Lihir gold mine and Panguna copper/gold mine on Bougainville Island, both neighboring projects to the Company’s Feni Island project.

Adyton has a total Mineral Resource Estimate inventory within its PNG portfolio of projects comprising indicated resources of 173,000 ounces gold and inferred resources of 2,000,000 ounces gold.

The Feni Island Project currently has a mineral resource prepared in accordance with NI 43-101 dated October 14, 2021, which has outlined an initial inferred mineral resource of 60.4 million tonnes at an average grade of 0.75 g/t Au, for contained gold of 1,460,000 ounces, assuming a cut-off grade of 0.5 g/t Au. See the NI 43-101 technical report entitled “NI 43-101 Technical Report on the Feni Gold-Copper Property, New Ireland Province, Papua New Guinea prepared for Adyton Resources by Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an independent mining consultant and “qualified person” as defined in NI 43-101,available under Adyton’s profile on SEDAR+ at www.sedarplus.ca. Mineral resources are not mineral reserves and have not demonstrated economic viability.

The Fergusson Island Project currently has a mineral resource prepared in accordance with NI 43-101 dated October 14, 2021, which outlined an indicated mineral resource of 4.0 million tonnes at an average grade of 1.33 g/t Au for contained gold of 173,000 ounces and an inferred mineral resource of 16.3 million tonnes at an average grade of 1.02 g/t Au for contained gold of 540,000 ounces. See the technical report entitled “NI 43-101 Technical Report on the Fergusson Gold Property, Milne Bay Province, Papua New Guinea” prepared for Adyton Resources by Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an independent mining consultant and “qualified person” as defined in NI 43-101,available under the Company’s profile on SEDAR+ at www.sedarplus.ca. Mineral resources are not mineral reserves and have not demonstrated economic viability.

Qualified Person

The scientific and technical information contained in this press release has been prepared, reviewed, and approved by Dr Chris Bowden, PhD, GCMEE, FAusIMM(CP), FSEG, the Chief Operating Officer and Chief Geologist of Adyton, who is a “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE