Abitibi Metals Extends B26 Mineralization & Increases Grade: Reports 3.65% CuEq Over 21.1m Within Interval of 1.55% CuEq Over 69.0m

Highlights:

- High Gold Credit & Increase in Block Model Grade:

-

- Hole 1274-17-269W3 – 3.65% CuEq (2.67% Cu, 1.14g/t Au) over 21.1 metres within 1.55% CuEq over 69.0 metres beginning at 932 metres depth

- One of strongest results intercepted in the western plunge to date, supporting the high-grade growth potential with a strong gold credit. This hole tested a 200m-by-200m gap in the drill grid, located 80m down-dip from 1274-17-260 which intercepted 2.56% CuEq over 10 metres within 1.26% CuEq over 28.5 metres. In comparison to historical hole 260, results from 269W3 support the grade and width increasing at depth.

- Up to 100m Step-Out Expansion: Drilling successfully intersected high-grade mineralization beyond the 2024 resource boundary, confirming growth potential of the B26 footprint:

- Hole 1274-17-269W1b – 3.41% CuEq over 10 metres within 1.12% CuEq over 37.6 metres beginning at 982.4 metres depth, in 40 metre step-out from 2024 resource boundary.

-

- Hole 1274-17-269W2b – 3.25% CuEq over 2 metres and 1.98% CuEq over 4 metres within 1.01% CuEq over 31 metres beginning at 1,140 metres depth, in 100 metre step-out

- Growth Confirmed: Both step-out holes intercepted economic-grade mineralization beyond the current block model (see Figures 1, 2 & 4), underscoring the success of Abitibi’s expansion strategy.

- Open at Depth: Results validate continuity of the western Cu-Au shoot at depth, with mineralization remaining open down-plunge and along strike for further expansion.

- Momentum Building: With 9,060 m of the 17,500 m Phase 3 drill program completed, additional assays are pending – positioning B26 for meaningful resource growth.

- Fully Funded: The Company is fully funded to Q1, 2027 and has budgeted approximately 25,000 additional metres for Phase 4 drilling, to be strategically deployed in 2026 based on ongoing exploration success

Abitibi Metals Corp. (CSE:AMQ) (OTCQB: AMQFF) (FSE: FW0) is pleased to announce it has received assay results from its Phase 3 drill program at the B26 Polymetallic Deposit. To date, a total of 9,060 meters has been drilled as part of the 17,500-meters Phase 3 drill program. The remaining 8,440 meters of drilling are set to be completed by the end of November. The Company currently owns 50% of the B26 Deposit and retains the option to earn an additional 30% from SOQUEM Inc. a subsidiary of Investissement Québec (see news release dated November 16, 2023).

“We are very pleased with the progress of the Phase 3 drill program,” said Jonathon Deluce, CEO of Abitibi Metals. “These results highlight two key wins for Abitibi Metals – step-out drilling continues to extend B26’s footprint beyond the current resource with excellent high-grade intercepts, while infill drilling is delivering higher grades that strengthen the core of the deposit. Together, this confirms both the growth potential and quality of B26 as we advance it toward becoming one of the most significant critical-minerals projects in the Abitibi. With an increasing flow of assay results expected through year-end, we look forward to keeping our shareholders updated as we continue to advance this robust project.”

To recap, Phase 3 is a fully funded drilling program designed around three strategic objectives:

- Expansion of High Grade: Drilling continues to expand higher-grade zones at B26, driving resource growth in the block model. Today’s excellent results, highlighted by hole 1274-17-269W3, confirm the strong momentum successfully achieved and previously announced and further demonstrates the strength of the mineralization. See news release dated June 24, 2025– Abitibi Metals Expands Mid-Level High-Grade Copper Zones at B26: 4.8% CuEq Over 4.1m within 63.2m at 1% CuEq;

- Expansion of Mineralized Trends: Extending open-ended mineralized trends beyond the current B26 block model is one of the primary goals of today’s drill results and the upcoming drilling is set to further demonstrate this growth potential;

- Unlocking Regional Potential: making new discoveries across Abitibi’s 3,328-hectare property is set to become the next focus in Q4 2025 and Q1 2026.

The results from these holes further validate the continuity of mineralization at depth along the down plunge of the western Cu-Au mineralized shoot within the current resource model of 11.3MT @ 2.13% Cu Eq (Indicated- 1.23% Cu, 1.27% Zn, 0.46 g/t Au and 31.9 g/t Ag) & 7.2MT @ 2.21% Cu Eq (Inferred – 1.56% Cu, 0.17% Zn, 0.87 g/t Au and 7.4 g/t Ag). The company anticipates these results to positively contribute to the expansion of its mineral resource base.

Table 1: Significant Intercepts from Phase 3

| Hole ID | From (m) | To (m) | Length (m) | CuEq (%) | Cu (%) | Au (g/t) | Ag (g/t) | Zn (%) |

| 1274-17-269W1b | 982.40 | 1020.00 | 37.60 | 1.12 | 1.01 | 0.12 | 1.94 | 0.01 |

| incl | 990.00 | 1000.00 | 10.00 | 3.41 | 3.04 | 0.39 | 5.20 | 0.02 |

| 1274-17-269W2b | 1140.00 | 1171.00 | 31.00 | 1.01 | 0.95 | 0.06 | 2.23 | 0.01 |

| incl | 1161.00 | 1163.00 | 2.00 | 3.25 | 3.10 | 0.14 | 4.55 | 0.01 |

| incl | 1167.00 | 1171.00 | 4.00 | 1.98 | 1.90 | 0.07 | 3.83 | 0.01 |

| 1274-17-269W3 | 932.00 | 1001.00 | 69.00 | 1.55 | 1.19 | 0.41 | 2.03 | 0.01 |

| incl | 963.20 | 966.00 | 2.80 | 4.54 | 4.29 | 0.25 | 6.08 | 0.02 |

| incl | 976.00 | 997.10 | 21.10 | 3.65 | 2.67 | 1.14 | 4.08 | 0.01 |

| 1274-25-367 | 500.00 | 502.00 | 2.00 | 1.91 | 1.61 | 0.30 | 8.70 | 0.01 |

| 1274-25-368 | 669.00 | 676.00 | 7.00 | 1.09 | 0.68 | 0.22 | 5.77 | 0.54 |

| incl | 672.90 | 674.95 | 2.05 | 3.45 | 2.22 | 0.72 | 16.89 | 1.48 |

Note 1: The intercepts above are not necessarily representative of the true width of mineralization. The local interpretation indicates core length corresponding generally to 40 to 70% of the mineralized lens’ true width.

Note 2: Copper equivalent values calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $2,500/ounce Au. Recovery factors were applied according to SGS CACGS-P2017-047 metallurgical test: 98.3% for copper, 90.0% for gold, 96.1% for zinc, 72.1% for silver.

Note 3: Intervals are generally composited starting with a 0.1% CuEq cut-off and between 0.6% CuEq cut-off grade for the “including” intervals, allowing for up to 3 consecutive samples below cut-off grade.

Discussion of Results:

The Phase 3 drill holes completed to date are returning robust intercepts in the down plunge extension of the western copper zone shoot. The copper zones have been intercepted at the predicted depths and consist in the typical chalcopyrite stringers associated with a dark chlorite alteration. Some quartz – iron carbonate – chalcopyrite veins are sometimes present within the zone. The western copper zone remains open laterally below 400 meters vertical and at depth. These initial results support continued focus in that area and adding more meterage.

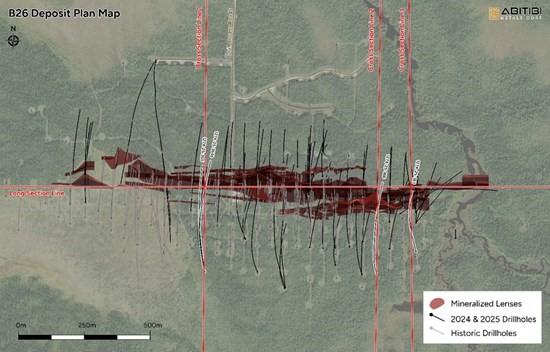

Figure 1: Plan Map

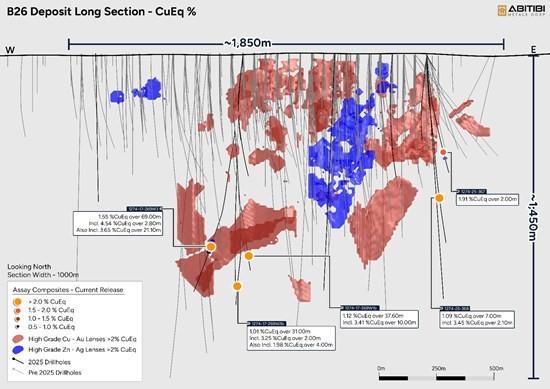

Figure 2: Longitudinal section looking north with Significant Results from Phase 3 drill program

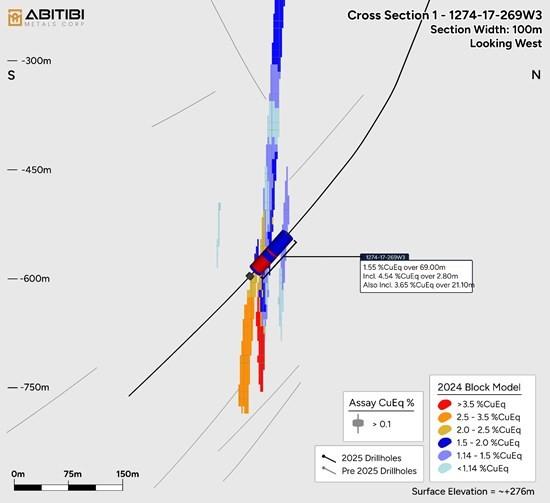

Figure 3: Drill Hole 1274-17-269W3 Cross section looking west – Mineralized intervals from 932 to 1001m

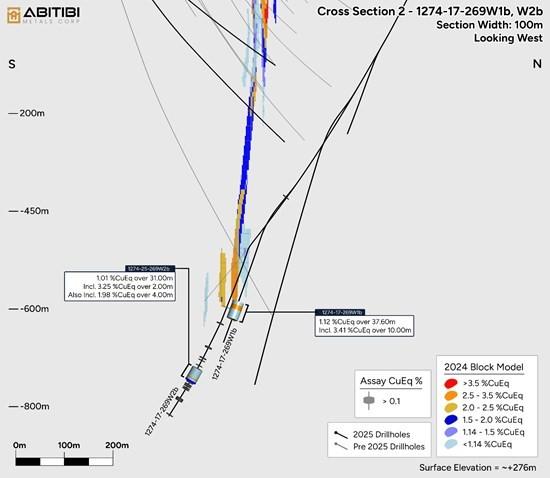

Figure 4: Drill Hole 1274-17-269W1b, 269W2b Cross section looking west – Mineralized intervals from 982.4 to 1020m and 1140 to 1171m.

Figure 5: Core picture 3.65% CuEq over 21.1 metres from 976 m to 997.1 m in hole 1274-17-269W3

Table 2: Phase 3 Drill Hole Information

| Hole ID | UTM East | UTM North | Elevation | Azimuth | Dip | Start (m) | End (m) | Reported |

| 1274-25-363 | 653350 | 5513165 | 270 | 345 | -65 | 0 | 486 | 06/24/2025 |

| 1274-25-364B | 652552 | 5513089 | 277 | 347 | -61 | 0 | 687 | 06/24/2025 |

| 1274-25-365 | 652552 | 5513089 | 277 | 349 | -51 | 0 | 555 | 06/24/2025 |

| 1274-25-366 | 653200 | 5513085 | 270 | 347 | -72 | 0 | 677 | 06/24/2025 |

| 1274-17-269W1b | 652506 | 5513872 | 276 | 170 | -50 | 726 | 1071 | 08/29/2025 |

| 1274-17-269W2b | 652506 | 5513872 | 276 | 181 | -73 | 882 | 1254 | 08/29/2025 |

| 1274-17-269W3 | 652506 | 5513872 | 276 | 178 | -60 | 348 | 1254 | 08/29/2025 |

| 1274-25-367 | 653348 | 5513096 | 270 | 14 | -61 | 0 | 623 | 08/29/2025 |

| 1274-25-368 | 653348 | 5513096 | 270 | 7 | -3 | 0 | 900 | 08/29/2025 |

Note 1: Numbers have been rounded to the nearest whole number in the table above

QAQC

The core logging and QAQC protocol program was run and supervised by the Company technical team. The drill core was split in half, sent to AGAT Laboratories Ltd. All sample preparation takes place in Val-d’Or, all fire assay takes place in Thunder Bay and all four acid digestion and multi element analysis takes place in Calgary. Prepared samples are fused using accepted fire assay techniques, cupelled and parted in nitric acid and hydrochloric acid. Sample splits of 30g are routinely used though 50g may also be used (AGAT Code 202 551). 0.2g of prepared samples are digested with a series of acids (HClO4, HF, HCL and HNO3) at a temperature of ~200oC until incipient dryness. It is then heated with HNO3 and HCl, then diluted to 12mL with de-ionized water. While very aggressive, the solubility of some elements can be dependent on the mineral species present and as such, data reported from the 4-Acid digestion should be considered as representing only the leachable portion of a particular analyte. Some elements show poor recovery due to volatilization (B, As, Hg). PerkinElmer 7300DV/8300DV ICP-OES and Agilent 5900 ICP-OES instruments are used in the analysis. Inter-Element Correction (IEC) techniques are used to correct for any spectral interferences. Blanks, sample replicates, duplicates, and internal reference materials (both aqueous and geochemical standards) are routinely used as part of AGAT Laboratories quality assurance program. AAS instruments are used in the analysis.

Qualified Person

Information contained in this press release was reviewed and approved by Louis Gariépy, P.Eng (OIQ #107538), VP Exploration of Abitibi Metals, who is a qualified person as defined under National Instrument 43-101, and responsible for the technical information provided in this news release.

About Abitibi Metals Corp:

Abitibi Metals Corp. is a Quebec-focused mineral acquisition and exploration company focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi’s portfolio of strategic properties provides target-rich diversification and includes the option to earn 80% of the high-grade B26 Polymetallic Deposit, which hosts a resource estimate1 of 11.3MT @ 2.13% Cu Eq (Ind- 1.23% Cu, 1.27% Zn, 0.46 g/t Au and 31.9 g/t Ag) & 7.2MT @ 2.21% Cu Eq (Inf – 1.56% Cu, 0.17% Zn, 0.87 g/t Au and 7.4 g/t Ag), and the Beschefer Gold Project, where historical drilling has identified 4 historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres (BE13-038) and 13.07 g/t gold over 8.75 metres (BE12-014) amongst four modeled zones.

About SOQUEM:

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec’s mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE