Abitibi Metals Drills 3.47% CuEq over 5.25 Metres Within 1.61% CuEq over 18.55 Metres at B26 Deposit

Abitibi Metals Corp. (CSE: AMQ) (OTCQB: AMQFF) (FSE: FW0) is pleased to announce additional assays from its Phase II drill program at the B26 Polymetallic Deposit and has received assays from 9 additional holes which are reported below. On November 16th, 2023, the Company entered into an option agreement on the B26 Polymetallic Deposit to earn 80% over 7 years from SOQUEM Inc., a subsidiary of Investissement Québec (see news release dated November 16, 2023).

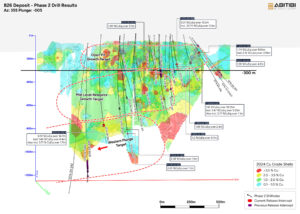

Jonathon Deluce, CEO of Abitibi Metals, commented, “We are pleased to report additional high-grade polymetallic mineralization across three key target areas at the B26 Deposit: (1) the Mid-Range Depth, (2) the Western Plunge, and (3) the Near Surface Growth Target. These results reinforce the strength of our exploration model and highlight the expansion potential of B26. With multiple mineralized intercepts extending beyond the current resource, we are well-positioned to continue unlocking value through our fully funded Phase III drill program and 2025 exploration plan.”

Figure 1: Phase II Drillholes with the Location of Significant Results (CNW Group/Abitibi Metals Corp.)

Drilling Summary:

The Company is currently still waiting for partial results from 1 hole for 91.5 meters (1274-24-358) and results from 5 full holes across 2,133 meters (1274-24-359/60/61/62/117 EXT). Once all assays have been released Abitibi Metals plans to announce its 2025 exploration program that will include a fully funded approximately 20,000-metre Phase III drilling campaign targeting resource expansion and potential new standalone discoveries outside the main B26 Deposit within the 3,328-hectare land package.

Out of the holes drilled and included in this release, 7 out of 9 yielded results with copper equivalent grades exceeding 1% over core lengths of 0.5 to 18 meters. Highlights from each target area include:

Mid-Range Depth: Drill holes were planned with two primary objectives: 1) to explore the western extension of VMS-related mineralized stringer zones and 2) to improve the understanding of how chalcopyrite stringer zones connect at depth. Specifically, holes 1274-24-351, 1274-24-353, and 1274-24-354 were drilled from a common starting point on section 652850E, each using different dip and azimuth angles to target areas beyond the currently known inferred mineral resources.

The best result was obtained from hole #354 with 4.18% CuEq over 0.5 metres starting at 544 metres, including 5.6 g/t gold. There was a second interval of 1.08% CuEq over 2.0 metres starting at 613 metres. Additionally, Hole # 354 encountered various styles of mineralization within the mid-level resource envelopes: 1) disseminated chalcopyrite, 2) chalcopyrite-pyrite concordant stringers and 3) ribbons, quartz-carbonate-sulfides stockworks. These mineralized zones were observed from 496 to 626 metres.

Hole #351 planned to a depth of 1,050 metres was stopped short at 771 metres due to an issue with the drill rig. This hole stopped short of the target and the Company plans to complete this hole during Phase 3. Results from hole #353 intersected mineralization composed of up to 20% chalcopyrite and 2% pyrite associated with quartz carbonate veining. Highlight intercepts include 0.77% CuEq over 3.05 metres beginning at 682.5 metres depth.

Holes #357 and #358 were drilled to test higher grade potential within gaps in drill coverage in the upper portions of the Mid-Range Growth Target Area. This objective was achieved as higher-grade mineralization was intersected in both holes with highlight intercepts of 1) 3.47% CuEq over 5.25 metres within 1.61% CuEq over 18.55 m (1274-24-357), and 2) 2.01% CuEq over 10.2 metres beginning at 263.7 metres depth, including 33.74% CuEq over 0.5 metres (1274-24-358). The interval is supported by a 20cm quartz-dolomite vein laced with native silver returning an initial grade of 5580 gram per tonne silver and 5.8 gram per tonne gold. The silver grade is considered preliminary and will require additional assaying with a methodology more suitable for coarse native silver mineralization (see pictures below).

The bulk of mineralization in both holes is in the form of chalcopyrite stringers (20-50%) over several centimeters, and upwards of 50% pyrite and 15% sphalerite in bands and veinlets that trend with the overall schistosity of the deposit.

Western Plunge: Holes 1274-24-350 and 1274-24-352 were planned to test large gaps in the drill grid within the Western Plunge Target and encountered a network of chalcopyrite bearing quartz veins controlled by shear zones and faults. This copper-gold system appears to follow known geological controls, offering expansion possibilities down plunge to the west within untested areas.

In hole #350, the main mineralized structure was intersected from 825 to 886 metres returning three metric intervals for 2.58 % CuEq over 1.5 metres starting at 837.5 metres and 1.1 % CuEq over 2.45 metres starting at 876 metres. When analyzing hole #352, the main mineralized structure was intersected from 802.5 to 855 metres in a sheared and fractured sericite alteration zone hosting chalcopyrite stringers. An interval of 0.91% CuEq over 16.7 metres was calculated starting from the hanging wall of mineralization including 1.46% CuEq over 8.4 metres (802.5 metres) corresponding to a vertical depth of 700 metres. A highlight interval of 3.71% CuEq over 1.7 metres can be isolated from 806.7 to 808.4 metres.

When interpreting current results, it is worth noting that assays from hole #352 solidify the resource model at that depth. In hole #350, the VMS contact was also intercepted about 800 metres west of the known mineralization. Metals concentrations are below reported cut off but represent a significant anomaly that will require a distinct exploration plan.

Eastern Satellite: Hole 356 was planned to intercept the Eastern Satellite zone at depth after crossing a north-south fault zone using a north-east drilling azimut. This hole was collared on section 653300E, the locus of a strong density of polymetallic stringer zone related to the VMS contact where a series of holes previously drilled in 2024 returned significant results (see DDH 1274-24-313, 320, 321 in previous press releases). Strong mineralized stringers were encountered before crossing a faulted dyke. Pyrite and sphalerite vary throughout but are present locally in concentrations as high as 15% and 30%, respectively. Highlight results include 1.74% CuEq over 9.65 metres beginning at 151.6 metres depth, including 2.12% CuEq over 3.95 metres starting at 151.6m.

Additional assays were also received from Hole 1274-24-355, which tested the up-dip extension of hole 1274-13-117 at a spacing of 35 metres, which had a notable previous highlight intercept of 2.32% CuEq over 89.5 metres in an area that had very limited drilling (see Release issued on January 30, 2025). New highlight assays received from this hole include 1.28% CuEq over 4.2 metres starting at 351 metres.

Table 1: Significant Intercepts

| Hole ID | From (m) | To (m) | Length (m) | CuEq (%) | Cu (%) | Au (g/t) | Ag (g/t) | Zn (%) |

| 1274-24-350 | 837.5 | 839 | 1.5 | 2.58 | 2.48 | 0.10 | 12.4 | 0.1 |

| And | 851 | 856 | 5 | 0.81 | 0.65 | 0.18 | 5.1 | 0.1 |

| And | 876 | 878.45 | 2.45 | 1.10 | 1.04 | 0.07 | 3.1 | 0.0 |

|

And |

925 | 927.2 | 2.2 | 0.81 | 0.43 | 0.63 | 2.2 | 0.0 |

| And | 951 | 953.1 | 2.1 | 0.73 | 0.69 | 0.03 | 4.0 | 0.0 |

| 1274-24-352 | 802 | 818.7 | 16.7 | 0.91 | 0.74 | 0.29 | 1.7 | 0.0 |

| incl | 802.5 | 810.9 | 8.4 | 1.46 | 1.18 | 0.48 | 2.4 | 0.0 |

| incl | 806.7 | 808.4 | 1.7 | 3.71 | 2.95 | 1.33 | 5.1 | 0.0 |

| And | 848.6 | 851.5 | 2.9 | 1.01 | 0.96 | 0.09 | 2.2 | 0.0 |

| And | 869.7 | 870.2 | 0.5 | 2.03 | 1.33 | 0.95 | 8.6 | 0.3 |

| 1274-24-353 | 682.5 | 685.55 | 3.05 | 0.77 | 0.74 | 0.03 | 2.4 | 0.0 |

| 1274-24-354 | 544 | 544.5 | 0.5 | 4.18 | 0.87 | 5.60 | 2.9 | 0.0 |

| And | 589.8 | 590.3 | 0.5 | 1.89 | 1.88 | 0.03 | 3.8 | 0.0 |

| And | 613 | 615 | 2 | 1.08 | 0.89 | 0.29 | 5.3 | 0.0 |

| 1274-24-3557 | 351 | 355.2 | 4.2 | 1.28 | 0.87 | 0.67 | 2.9 | 0.0 |

| 444.8 | 449.1 | 4.3 | 0.79 | 0.75 | 0.06 | 4.1 | 0.0 | |

| 1274-24-356 | 151.6 | 161.25 | 9.65 | 1.74 | 0.00 | 0.12 | 26.1 | 4.2 |

| incl | 151.6 | 155.55 | 3.95 | 2.12 | 0.00 | 0.25 | 27.3 | 5.1 |

| 1274-24-357 | 240.15 | 244.6 | 4.45 | 0.63 | 0.00 | 0.01 | 9.9 | 1.6 |

| And | 286.45 | 305 | 18.55 | 1.61 | 1.35 | 0.37 | 8.1 | 0.1 |

| incl | 287.75 | 293 | 5.25 | 3.47 | 2.78 | 1.04 | 18.9 | 0.1 |

| incl | 303.9 | 305 | 1.1 | 2.17 | 1.97 | 0.33 | 5.5 | 0.0 |

| 1274-24-3585 | 263.7 | 273.9 | 10.2 | 2.01 | 0.00 | 0.29 | 290.7 | 0.9 |

| incl | 268.05 | 269.05 | 0.5 | 33.74 | 0.04 | 5.80 | 5580.0 | 2.6 |

| And | 292.2 | 294.5 | 2.3 | 1.85 | 0.53 | 0.22 | 16.2 | 3.1 |

| And | 304.6 | 307.35 | 2.75 | 0.72 | 0.66 | 0.05 | 5.6 | 0.1 |

| And | 312.25 | 317.95 | 5.7 | 1.20 | 1.16 | 0.04 | 5.9 | 0.0 |

Note 1: The intercepts above are not necessarily representative of the true width of mineralization. The local interpretation indicates core length corresponding generally to 70 to 80% of the mineralized lens’ true width. (350, 351, 352, 353,354,357,358)

Note 2: The true thickness of holes 1274-24-355 & 356 is undefined. The thickness modelled could be between 10 and 15 metres.

Note 3: Copper equivalent values calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $1,800/ounce Au. Recovery factors were applied according to SGS CACGS-P2017-047 metallurgical test: 98.3% for copper, 90.0% for gold, 96.1% for zinc, 72.1% for silver.

Note 4: Intervals were calculated using a cut-off grade of 0.1% Cu Eq, which represents the visual limit of the mineralized system.

Note 5: For 1274-24-358, the Company has reported partial results received to date and will report the remainder (355.5-447m) once received & processed.

Note 6:1274-24-351 planned to a depth of 1,050 metres was stopped short at 771 due to an issue with the drill rig. The Company plans to complete this hole during Phase 3. Results received to date are not significant, however the target has yet to be reached.

Note 7: Results from 1274-24- 355 for 71.35 – 135m, 371-412m, and 532-543.35m were reported on January 30, 2025. Results listed in Table 1 complete the reporting on this hole.

Table 2: Drill Hole Information

| Drill hole number | UTM East | UTM North | Elevation | Azimuth | Dip | Length (m) |

| Drilled | ||||||

| 1274-24-350 | 652751 | 5513089 | 276 | 334 | -76 | 1097 |

| 1274-24-351 | 652854 | 5513027 | 276 | 338 | -74 | 771 |

| 1274-24-352 | 652552 | 5513100 | 276 | 340 | -74 | 973 |

| 1274-24-353 | 652856 | 5513030 | 276 | 344 | -60 | 783 |

| 1274-24-354 | 652856 | 5513030 | 276 | 353 | -49 | 663 |

| 1274-24-355 | 653302 | 5513400 | 268 | 90 | -50 | 564 |

| 1274-24-356 | 653290 | 5513309 | 268 | 57 | -53 | 483 |

| 1274-24-357 | 653250 | 5513177 | 276 | 90 | -55 | 405 |

| 1274-24-358 | 653149 | 5513204 | 276 | 11 | -63 | 446 |

Note 1: Numbers have been rounded to the nearest whole number in the table above.

QAQC

The core logging program was run by Explo-Logik in Val d’Or, Quebec. The drill core was split with half sent to AGAT Laboratories Ltd. and prepared in Val d’Or, Quebec. All samples are processed by fire assays on 50 gr with atomic absorption finish and by “four acids digestion” with ICP-OES finish, respectively, for gold and base metals. Samples returning a gold grade above 3 g/t are reprocessed by metallic screening with a cut at 106 µm. Material treated is split and assayed by fire assay with ICP-OES finish to extinction. A separate split is taken to assay separately mineralized intervals with target grades above 0.5% Cu using Na2O2 fusion and ICP-OES or ICP-MS finish. Samples preparation duplicates, varied standards, and blanks are inserted into the sample stream.

In the 2018 resource estimate, SGS recommended the QAQC protocol to explain the replicability for the four metals (Au-Cu-Ag-Zn). The Company has set up for this program a series of assaying protocols with the objective to control QAQC issues from the beginning of the project. As a result, samples are crushed finer with 95% of particles passing 1.7 mm and a large split of 1 kg is pulverized down to 106 µm (150 mesh). Other measures put in place include the automatic re-assaying of gold results above 3 g/t by metallic screening and the use of sodium peroxide fusion in mineralized intervals corresponding to a target grade above 0.5% Cu.

Qualified Person

Information contained in this press release was reviewed and approved by Martin Demers, P.Geo., OGQ No. 770, a qualified person as defined under National Instrument 43-101, and responsible for the technical information provided in this news release.

About Abitibi Metals Corp:

Abitibi Metals Corp. is a Quebec-focused mineral acquisition and exploration company focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi’s portfolio of strategic properties provides target-rich diversification and includes the option to earn 80% of the high-grade B26 Polymetallic Deposit, which hosts a resource estimate of 11.3MT @ 2.13% Cu Eq (Ind) & 7.2MT @ 2.21% Cu Eq (Inf), and the Beschefer Gold Project, where historical drilling has identified 4 historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres amongst four modeled zones.

About SOQUEM:

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec’s mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE